TIDMLBE

RNS Number : 4186B

Longboat Energy PLC

10 June 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, TO ANY US PERSONS OR INTO THE UNITED

STATES, AUSTRALIA, THE REPUBLIC OF IRELAND, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN, OR ANY OTHER JURISDICTION, OR TO ANY PERSON, WHERE

TO DO SO WOULD CONSTITUTE A VIOLATION OF APPLICABLE LAW OR

REGULATION OF SUCH JURISDICTION.

This announcement is not an admission document or a prospectus

and does not constitute or form part of an offer to sell or issue

or a solicitation of an offer to subscribe for or buy any

securities nor should it be relied upon in connection with any

contract or commitment whatsoever. Investors should not purchase or

subscribe for any transferable securities referred to in this

announcement except in compliance with applicable securities laws

on the basis of the information in the admission document (the

"Admission Document") to be published by Longboat Energy plc in

connection with the placing and subscription of ordinary shares in

the Company (the "New Ordinary Shares"), the admission of such New

Ordinary Shares to trading on AIM, a market operated by London

Stock Exchange Plc ("AIM") ("Admission") and the re-admission of

the Company's entire issued and to be issued ordinary share capital

to trading on AIM ("Re-Admission"). Before any purchase of shares,

persons viewing this announcement should ensure that they fully

understand and accept the risks which will be set out in the

Admission Document when published. Copies of the Admission Document

will, following publication, be available during normal business

hours on any day (except Saturdays, Sundays and public holidays)

from the registered office of the Company and on the Company's

website.

10 June 2021

Longboat Energy plc

("Longboat Energy", "Longboat" or the "Company")

Farm-Ins to High Impact Drilling Programme,

Fundraising Result and Publication of Admission Document

Further to its announcement on 1 June 2021, Longboat Energy is

pleased to announce it has successfully raised gross proceeds of

GBP35 million by means of a conditional placing and subscription

for New Ordinary Shares (the "Fundraising"). The Fundraising was

completed at a price of 75 pence per share (the "Fundraising

Price"). The Fundraising represents 467% of the Company's existing

ordinary share capital, or 46,666,666 New Ordinary Shares in total

(45,213,332 Placing Shares, 1,453,334 Subscription Shares). The

Fundraising Price is equal to a 6.8% discount to the closing

mid-market price on 31 May 2021 (being the business day prior to

the date on which trading in the Company's shares was

suspended).

The Company also announces that it has executed farm-in

agreements with Equinor Energy AS ("Equinor") and Spirit Energy

Norway AS ("Spirit") with a third transaction anticipated to be

executed imminently (collectively the "Farm-Ins" or the

"Transactions"). As part of the financing of the Transactions,

Longboat has also executed a NOK 600 million (GBP52 million)

Exploration Finance Facility ("EFF") with SpareBank 1 SR-Bank ASA

and ING Bank N.V.

Together, the Fundraising and EFF will enable Longboat to pursue

a significant, near-term, low-risk exploration drilling programme

on the Norwegian Continental Shelf across seven wells targeting net

mean prospective resource potential of 104 MMboe and an additional

220 MMboe of upside and follow-on prospectivity. The first well in

the programme is expected to spud in Q3 2021. A full list of the

licences and working interests to be acquired are detailed below.

The cost of the carry element of the Transactions is fully eligible

for the Norwegian tax refund system reducing the net cost to

Longboat to $7.8 million on a post-tax basis ($35 million pre-tax)

.

The Transactions are classified as a reverse takeover pursuant

to the AIM Rules for Companies. Completion of the Farm-Ins and

Fundraising are subject to approval by Longboat's shareholders at a

general meeting to be convened on 28 June 2021 (the "General

Meeting").

The Company expects to publish the Admission Document, which

includes a circular and notice of General Meeting, later today.

Accordingly, following publication of the Admission Document,

trading in the Company's existing ordinary shares (the "Existing

Ordinary Shares") on AIM is expected to be restored from 7.30 a.m.

on 11 June 2021.

The Company will release further announcements as and when

appropriate.

Helge Hammer, Chief Executive of Longboat, commented:

" The Board of Longboat is delighted by the support we have

received from new and existing shareholders. Securing these

Farm-Ins will enable us to pursue a significant, near-term,

low-risk exploration drilling programme. We can now look forward to

a busy period of almost continuous drilling and frequent catalysts

during the next 18 months.

"Our ambition remains to build Longboat in to a full-cycle,

North Sea E&P company."

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act 2018

("UK MAR").

For the purposes of UK MAR, the person responsible for arranging

for the release of this announcement on behalf of Longboat is

Julian Riddick, Company Secretary.

Ends

Enquiries:

Longboat Energy

Helge Hammer, Chief Executive Officer via FTI

Jon Cooper, Chief Financial Officer

Nick Ingrassia, Corporate Development

Director

Stifel Nicolaus Europe Limited (Nominated Adviser, Joint Bookrunner

and Broker)

Callum Stewart Tel: +44 20 7710 7600

Jason Grossman

Simon Mensley

Ashton Clanfield

DNB Markets, a part of DNB Bank ASA (Joint Bookrunner)

Halvor Teslo demand@dnb.no

Christoffer Gundersen

Aksel Thue

FTI Consulting (PR adviser)

Ben Brewerton Tel: +44 20 3727 1000

Sara Powell longboatenergy@fticonsulting.com

Background and Reasons for the Farm-Ins

Longboat Energy was established by the ex-Faroe Petroleum Plc

("Faroe") management team to create a full-cycle North Sea E&P

company through value accretive M&A and low-risk, near-field

exploration. The management team has a proven track record of

delivering value to shareholders through exploration success,

accretive acquisitions and farm-ins, and a demonstrated ability to

monetise discoveries through sales and asset swaps. At Faroe, the

team grew reserves from 19 MMboe to 98 MMboe between 2013 and 2018,

a compounded annual growth rate of approximately 39%. The team

monetised numerous assets through development and active portfolio

management, including asset swaps and sell downs. Faroe Petroleum

was sold to DNO ASA in January 2019, providing a Total Shareholder

Return of 129% to investors from the previous equity fundraise.

The Farm-Ins provide the Company with a hand-picked portfolio

and material drilling programme, including seven attractive

exploration wells over the next 18 months and further appraisal

drilling likely on success.

Net mean prospective resources across the licences are estimated

by ERC Equipoise ("ERCE") at 104 MMboe with total upside potential

of 324 MMboe(1) . The Company has created a portfolio with an

attractive risk and reward balance, with the chance of success for

each well in the 22-55% range for all-but-one high-impact

prospect.

The prospects are gas weighted and are all located in close

proximity to existing infrastructure, with an overlap between

exploration partners and infrastructure owners, providing a

portfolio with a clear low-cost route to monetisation and

low-carbon drilling and development opportunities, well aligned to

Longboat's ESG targets which includes a corporate 'Net Zero' on a

Scope 1 and 2 basis by 2050.

As a result of the Farm-Ins, the Company has applied for

qualification as a licence holder of oil and gas assets on the

Norwegian Continental Shelf. The Company currently expects to have

approvals in place before 30 September 2021, but notes that this

remains subject to completion of the Farm-Ins and final Norwegian

government approvals.

Summary of the Transactions

Licence Prospect Longboat Gross Attributable Geological Pre-tax Expected

Working Prospective Chance Well Cost Drilling

Interest Resources of Success(2) Gross/Net Date(3)

(MMboe)(1) ($million)(3)

--------------- --------- ------------------- -------------- ---------------

Equinor

Egyptian

PL939 Vulture 15 % 103 25% $31/5 Q3-21

---------------- --------------- --------- ------------------- -------------- --------------- ----------

PL901 Rødhette 20 % 41 41% $35/7 Q3-21

---------------- --------------- --------- ------------------- -------------- --------------- ----------

PL1060 Ginny 9 % 41 27% $25/2 Q3-21

---------------- --------------- --------- ------------------- -------------- --------------- ----------

PL1060 Hermine 9% 27 22% incl above Q3-21

---------------- --------------- --------- ------------------- -------------- --------------- ----------

PL906 Mugnetind 20 % 24 51% $33/7 Q4-21

---------------- --------------- --------- ------------------- -------------- --------------- ----------

PL1049(4) Cambozola 5 % 159 15% $64/16 Q2-22

---------------- --------------- --------- ------------------- -------------- --------------- ----------

PL1017 Copernicus 10% 254 26% $38/4 Q2/3-22

---------------- --------------- --------- ------------------- -------------- --------------- ----------

Spirit

PL1049(4) Cambozola 20 % 159 15% $64/16 Q2-22

---------------- --------------- --------- ------------------- -------------- --------------- ----------

Transaction 3

To Be Announced D 10% 36 55% $31/3 Q4-21

---------------- --------------- --------- ------------------- -------------- --------------- ----------

Source: ERC Equipoise Competent Persons Report. The geological

chance of success (GCOS) is an estimate of the probability that

drilling the prospect would result in a discovery as defined

under SPE PRMS. In the case of Prospective Resources, there is

no certainty that hydrocarbons will be discovered, nor if discovered

will it be commercially viable to produce any portion of the

resources.

Notes :

1 ERC Equipoise estimates, using a conversion factor of 5,600

scf/stb

2 ERC Equipoise estimates

3 Longboat management/operator estimates

4 Transaction also includes the extension licence PL1049B

A copy of the full ERC Equipoise Competent Persons Report can be

found in the Admission Document to be published on the Company's

website ( www.longboatenergy.com ) shortly.

Standard: Estimates of reserves and resources have been prepared

in accordance with the June 2018 Petroleum Resources Management

System ("PRMS") as the standard for classification and reporting

with an effective date of 31 December 2020.

The Fundraising

The Fundraising comprises the Placing and the Subscription:

The Placing

The Company has conditionally raised gross proceeds of

approximately GBP34 million (before commission and expenses) by the

placing of 45,213,332 New Ordinary Shares ("Placing Shares") at the

Fundraising Price pursuant to the terms of a placing agreement

dated 9 June 2021 between, among others, the Company, Stifel

Nicolaus Europe Limited and DNB Markets (the "Placing") , which is

conditional upon, amongst other matters, the shareholders passing

the resolutions at the General Meeting, each of the agreements

relating to the Farm-Ins having been entered into and not having

lapsed or been terminated prior to Admission and the EFF having

become unconditional in all respects save for Admission, and on

Admission occurring on or by 30 June 2021 (or such later date as

the Joint Bookrunners and the Company may agree, but in any event

not later than 9 July 2021). The Placing Shares allotted pursuant

to the Placing will (following issue) rank pari passu in all

respects with the Existing Ordinary Shares.

The Placing Shares are not being offered generally in the UK or

elsewhere and no applications have or will be accepted other than

under the terms of the placing agreement entered into on today's

date between, among others, the Company and the Joint Bookrunners,

and the terms and conditions of the Placing set out in the

Admission Document. It is expected that the proceeds of the Placing

due to the Company will be received by it on or soon after

Admission.

The Subscription

The Company has conditionally raised gross proceeds of

approximately GBP1 million through the subscription for 1,453,334

New Ordinary Shares ("Subscription Shares") at the Fundraising

Price pursuant to the terms of subscription letters dated 9 June

2021 between the Company and certain directors of the Company

("Directors") (the "Subscription"). The Subscription, which is not

underwritten, is conditional on, inter alia, Admission occurring on

or before 8.00 a.m. on 9 July 2021.

The Subscription Shares are in registered form and will be free

from restrictions on transfer and freely transferable. The

Subscription Shares will represent approximately 2.6 per cent. of

the Company's share capital as enlarged by the Fundraising

("Enlarged Share Capital") on Admission. The Subscription Shares

are not being offered generally in the UK or elsewhere. It is

expected that the proceeds of the Subscription due to the Company

will be received by it soon after Admission.

Admission

Application will be made for the Placing Shares and the

Subscription Shares to be admitted to trading on AIM. It is

expected that Admission will become effective and that dealings in

the Enlarged Share Capital will commence at 8.00 a.m. on 30 June

2021.

Following Admission, the Company's issued ordinary share capital

will consist of 56,666,666 o rdinary shares, with the right to one

vote each. The Company will hold no ordinary shares in treasury.

Therefore, the total number of ordinary shares and voting rights in

the Company will be 56,666,666 . With effect from Admission, this

figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Director shareholdings

Certain Directors have each subscribed for Subscription Shares

pursuant to the Subscription. As at 9 June 2021 (being the latest

practicable date prior to the date of this announcement) and, as

expected to be immediately following Admission, the interests of

each such Director in the issued share capital of the Company are

as follows:

Immediately following

As at 10 June 2021 Admission

Number of Percentage Number of Percentage

Existing of Existing Subscription Number of of Enlarged

Ordinary Ordinary Shares subscribed ordinary Share Capital

Name Shares held Shares held for shares held held

Graham Stewart 150,000 1.50% 200,000 350,000 0.62%

Helge Hammer* 300,000 3.00% 506,667 806,666 1.42%

Jonathan Cooper 125,000 1.25% 200,000 325,000 0.57%

Nicholas Ingrassia - - 160,000 160,000 0.28%

Jorunn Saetre 25,000 0.25% 26,667 51,666 0.09%

Brent Cheshire - -

Katherine Roe - -

* Held indirectly via Hammer Investering AS

Footnotes

1. Including operator P10 un-risked estimates of follow on

prospect

2. Year-to-date as announced by NPD based on geological success

rates

3. As reported by DNO in H1 2019 financial results

4. As calculated by Longboat Energy management

Related Party Transactions

The participation in the Subscription of certain Directors and

related parties, as stated above, constitute related party

transactions for the purposes of the AIM Rules for Companies (the

"AIM Rules"). The Directors who are independent of the related

party transaction, being Brent Cheshire and Katherine Roe, having

consulted with Stifel, the Company's nominated adviser for the

purposes of the AIM Rules, considers the terms of participation of

Graham Stewart, Helge Hammer, Jonathan Cooper, Nicholas Ingrassia,

Jorunn Seatre, Blackacre Trust No 1 and Blackacre Trust No 2 in the

Subscription to be fair and reasonable insofar as shareholders are

concerned.

The participation in the Placing of BlackRock , a substantial

shareholder of the Company, constitutes a related party transaction

for the purposes of the AIM Rules. The Directors, having consulted

with Stifel, the Company's nominated adviser for the purposes of

the AIM Rules, consider the terms of participation of BlackRock in

the Placing to be fair and reasonable insofar as shareholders are

concerned.

Review by Qualified Person

The technical information in this release has been reviewed by

Helge Hammer, Chief Executive Officer, who is a qualified person

for the purposes of the AIM Guidance Note for Mining, Oil and Gas

Companies. Mr Hammer is a petroleum engineer with more than 30

years' experience in the oil and gas industry. He holds a degree in

Petroleum Engineering from NTH University in Trondheim and an MSc

in Economics from the Institut Français du Pétrole in Paris.

Glossary

"1U" denotes the unrisked low estimate qualifying

as Prospective Resources

"2U" denotes the unrisked best estimate qualifying

as Prospective Resources

"2P Reserves" or "Proved those additional reserves which analysis

plus Probable Reserves" of geoscience and engineering data indicate

are less likely to be recovered than Proved

Reserves but more certain to be recovered

than Possible Reserves. It is equally likely

that actual remaining quantities recovered

will be greater than or less than the sum

of the estimated Proved plus 2P. In this

context, when probabilistic methods are

used, there should be at least a 50% probability

that the actual quantities recovered will

equal or exceed the 2P estimate

"3U" denotes the unrisked high estimate qualifying

as Prospective Resources

"Bcf" billion cubic feet

"boe" barrels of oil equivalent

"boepd" barrels of oil equivalent per day

"CO(2) " carbon dioxide

"ESG" environmental, social, governance

"EFF" exploration finance facility

"GCoS" geological chance of success

"kboepd" thousand barrels of oil equivalent per day

"MMboe" Million barrels of oil equivalent

"Mmstb" million stock tank barrels

"NCS" Norwegian Continental Shelf

"NPD" Norwegian Petroleum Directorate

"P10" the quantity for which there is a 10% probability

that the quantities actually recovered will

equal or exceed the estimate

"PRMS" SPE Petroleum Resources Management System

2018

"Possible Reserves" those additional reserves which analysis

of geoscience and engineering data suggest

are less likely to be recoverable than Probable

Reserves. The total quantities ultimately

recovered from the project have a low probability

to exceed the sum of Proved plus Probable

plus Possible Reserves, which is equivalent

to the high estimate scenario. In this context,

when probabilistic methods are used, there

should be at least a 10 per cent. probability

that the actual quantities recovered will

equal or exceed the 3P estimate

"Prospective Resources" those quantities of petroleum which are

estimated, on a given date, to be potentially

recoverable from undiscovered accumulations

"Proved Reserves" those quantities of petroleum, which, by

analysis of geoscience and engineering data,

can be estimated with reasonable certainty

to be commercially recoverable, from a given

date forward, from known reservoirs and

under defined economic conditions, operating

methods, and government regulations. If

deterministic methods are used, the term

reasonable certainty is intended to express

a high degree of confidence that the quantities

will be recovered. If probabilistic methods

are used, there should be at least a 90

per cent. probability that the quantities

actually recovered will equal or exceed

the estimate

"Total Shareholder share price return generated at a relevant

Return" measurement date above the starting market

share price, taking into account dividends

paid in the period

Notification of Deal Forms of each PDMR can be found below. This

announcement is made in accordance with Article 19 of the EU Market

Abuse Regulation 596/2014.

1. Details of the person discharging managerial responsibilities/persons closely associated

--- -----------------------------------------------------------------------------------------------------------------

a) Name Graham Stewart

--- -------------------------------------------------------- -------------------------------------------------------

2. Reason for notification

--- -----------------------------------------------------------------------------------------------------------------

a) Position/Status Chairman

--- -------------------------------------------------------- -------------------------------------------------------

b) Initial notification/amendment Initial notification

--- -------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

--- -----------------------------------------------------------------------------------------------------------------

a) Name Longboat Energy plc

--- -------------------------------------------------------- -------------------------------------------------------

b) LEI 213800D1D587TB36ST68

--- -------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary Shares of GBP0.10 each in the capital of

instrument and identification code Longboat Energy plc ISIN: GB00BKFW2482

--- -------------------------------------------------------- -------------------------------------------------------

b) Nature of transaction Subscription for new Ordinary Shares

--- -------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ------------------------

GBP0.75 200,000 Ordinary Shares

--------- ------------------------

--- -------------------------------------------------------- -------------------------------------------------------

d) Aggregated Information n/a

--- -------------------------------------------------------- -------------------------------------------------------

e) Date of transaction 9 June 2021

--- -------------------------------------------------------- -------------------------------------------------------

f) Place of transaction XOFF

--- -------------------------------------------------------- -------------------------------------------------------

1. Details of the person discharging managerial responsibilities/persons closely associated

--- -----------------------------------------------------------------------------------------------------------------

a) Name Helge Hammer

--- -------------------------------------------------------- -------------------------------------------------------

2. Reason for notification

--- -----------------------------------------------------------------------------------------------------------------

a) Position/Status CEO

--- -------------------------------------------------------- -------------------------------------------------------

b) Initial notification/amendment Initial notification

--- -------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

--- -----------------------------------------------------------------------------------------------------------------

a) Name Longboat Energy plc

--- -------------------------------------------------------- -------------------------------------------------------

b) LEI 213800D1D587TB36ST68

--- -------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary Shares of GBP0.10 each in the capital of

instrument and identification code Longboat Energy plc ISIN: GB00BKFW2482

--- -------------------------------------------------------- -------------------------------------------------------

b) Nature of transaction Subscription for new Ordinary Shares

--- -------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ------------------------

GBP0.75 506,667 Ordinary Shares

--------- ------------------------

--- -------------------------------------------------------- -------------------------------------------------------

d) Aggregated Information n/a

--- -------------------------------------------------------- -------------------------------------------------------

e) Date of transaction 9 June 2021

--- -------------------------------------------------------- -------------------------------------------------------

f) Place of transaction XOFF

--- -------------------------------------------------------- -------------------------------------------------------

1. Details of the person discharging managerial responsibilities/persons closely associated

--- -----------------------------------------------------------------------------------------------------------------

a) Name Jonathan Cooper

--- -------------------------------------------------------- -------------------------------------------------------

2. Reason for notification

--- -----------------------------------------------------------------------------------------------------------------

a) Position/Status CFO

--- -------------------------------------------------------- -------------------------------------------------------

b) Initial notification/amendment Initial notification

--- -------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

--- -----------------------------------------------------------------------------------------------------------------

a) Name Longboat Energy plc

--- -------------------------------------------------------- -------------------------------------------------------

b) LEI 213800D1D587TB36ST68

--- -------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary Shares of GBP0.10 each in the capital of

instrument and identification code Longboat Energy plc ISIN: GB00BKFW2482

--- -------------------------------------------------------- -------------------------------------------------------

b) Nature of transaction Subscription for new Ordinary Shares

--- -------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ------------------------

GBP0.75 200,000 Ordinary Shares

--------- ------------------------

--- -------------------------------------------------------- -------------------------------------------------------

d) Aggregated Information n/a

--- -------------------------------------------------------- -------------------------------------------------------

e) Date of transaction 9 June 2021

--- -------------------------------------------------------- -------------------------------------------------------

f) Place of transaction XOFF

--- -------------------------------------------------------- -------------------------------------------------------

1. Details of the person discharging managerial responsibilities/persons closely associated

--- -----------------------------------------------------------------------------------------------------------------

a) Name Nicholas Ingrassia

--- -------------------------------------------------------- -------------------------------------------------------

2. Reason for notification

--- -----------------------------------------------------------------------------------------------------------------

a) Position/Status Corporate Development Director

--- -------------------------------------------------------- -------------------------------------------------------

b) Initial notification/amendment Initial notification

--- -------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

--- -----------------------------------------------------------------------------------------------------------------

a) Name Longboat Energy plc

--- -------------------------------------------------------- -------------------------------------------------------

b) LEI 213800D1D587TB36ST68

--- -------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary Shares of GBP0.10 each in the capital of

instrument and identification code Longboat Energy plc ISIN: GB00BKFW2482

--- -------------------------------------------------------- -------------------------------------------------------

b) Nature of transaction Subscription for new Ordinary Shares

--- -------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ------------------------

GBP0.75 160,000 Ordinary Shares

--------- ------------------------

--- -------------------------------------------------------- -------------------------------------------------------

d) Aggregated Information n/a

--- -------------------------------------------------------- -------------------------------------------------------

e) Date of transaction 9 June 2021

--- -------------------------------------------------------- -------------------------------------------------------

f) Place of transaction XOFF

--- -------------------------------------------------------- -------------------------------------------------------

1. Details of the person discharging managerial responsibilities/persons closely associated

--- -----------------------------------------------------------------------------------------------------------------

a) Name Jorunn Saetre

--- -------------------------------------------------------- -------------------------------------------------------

2. Reason for notification

--- -----------------------------------------------------------------------------------------------------------------

a) Position/Status Non Executive Director

--- -------------------------------------------------------- -------------------------------------------------------

b) Initial notification/amendment Initial notification

--- -------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

--- -----------------------------------------------------------------------------------------------------------------

a) Name Longboat Energy plc

--- -------------------------------------------------------- -------------------------------------------------------

b) LEI 213800D1D587TB36ST68

--- -------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary Shares of GBP0.10 each in the capital of

instrument and identification code Longboat Energy plc ISIN: GB00BKFW2482

--- -------------------------------------------------------- -------------------------------------------------------

b) Nature of transaction Subscription for new Ordinary Shares

--- -------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- -----------------------

GBP0.75 26,667 Ordinary Shares

--------- -----------------------

--- -------------------------------------------------------- -------------------------------------------------------

d) Aggregated Information n/a

--- -------------------------------------------------------- -------------------------------------------------------

e) Date of transaction 9 June 2021

--- -------------------------------------------------------- -------------------------------------------------------

f) Place of transaction XOFF

--- -------------------------------------------------------- -------------------------------------------------------

1. Details of the person discharging managerial responsibilities/persons closely associated

--- -----------------------------------------------------------------------------------------------------------------

a) Name Julian Riddick

--- -------------------------------------------------------- -------------------------------------------------------

2. Reason for notification

--- -----------------------------------------------------------------------------------------------------------------

a) Position/Status Company Secretary

--- -------------------------------------------------------- -------------------------------------------------------

b) Initial notification/amendment Initial notification

--- -------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

--- -----------------------------------------------------------------------------------------------------------------

a) Name Longboat Energy plc

--- -------------------------------------------------------- -------------------------------------------------------

b) LEI 213800D1D587TB36ST68

--- -------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary Shares of GBP0.10 each in the capital of

instrument and identification code Longboat Energy plc ISIN: GB00BKFW2482

--- -------------------------------------------------------- -------------------------------------------------------

b) Nature of transaction Subscription for new Ordinary Shares

--- -------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ------------------------

GBP0.75 160,000 Ordinary Shares

--------- ------------------------

--- -------------------------------------------------------- -------------------------------------------------------

d) Aggregated Information n/a

--- -------------------------------------------------------- -------------------------------------------------------

e) Date of transaction 9 June 2021

--- -------------------------------------------------------- -------------------------------------------------------

f) Place of transaction XOFF

--- -------------------------------------------------------- -------------------------------------------------------

IMPORTANT INFORMATION

This announcement does not constitute, or form part of, any

offer or invitation to sell or issue, or any solicitation of any

offer to purchase or subscribe for any securities in the United

States, Australia, Japan or the Republic of South Africa or in any

other jurisdiction in which such offer or solicitation is unlawful,

prior to registration, exemption from registration or qualification

under the securities laws of any jurisdiction. The distribution of

this announcement and other information in connection with the

Fundraising, Admission and Re-Admission in certain jurisdictions

may be restricted by law and persons into whose possession this

announcement, any document or other information referred to herein

comes should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction. Neither this announcement nor any part of it nor the

fact of its distribution shall form the basis of or be relied on in

connection with or act as an inducement to enter into any contract

or commitment whatsoever.

Stifel Nicolaus Europe Limited ("Stifel"), which is authorised

and regulated in the United Kingdom by the Financial Conduct

Authority, is acting for the Company as Financial Adviser,

Nominated Adviser, Broker and Joint Bookrunner in connection with

the Fundraising, Admission and Re-Admission, and will not be

responsible to any other person for providing the protections

afforded to customers of Stifel or advising any other person in

connection with the Fundraising, Admission and Re-Admission.

Stifel's responsibilities as the Company's Nominated Adviser under

the AIM Rules for Companies and the AIM Rules for Nominated

Advisers will be owed solely to the London Stock Exchange and not

to the Company, the directors or to any other person in respect of

such person's decision to subscribe for or acquire ordinary shares.

Apart from the responsibilities and liabilities, if any, which may

be imposed on Stifel by the Financial Services and Markets Act

2000, as amended or the regulatory regime established under it,

Stifel does not accept any responsibility whatsoever for the

contents of this announcement, and no representation or warranty,

express or implied, is made by Stifel with respect to the accuracy

or completeness of this announcement or any part of it and no

responsibility or liability whatsoever is accepted by Stifel for

the accuracy of any information or opinions contained in this

announcement or for the omission of any material information from

this announcement.

DNB Markets, a part of DNB Bank ASA ("DNB"), which is authorised

and regulated in Norway by the Financial Supervisory Authority of

Norway, is acting for the Company as Joint Bookrunner in connection

with the Fundraising and Admission , and will not be responsible to

any other person for providing the protections afforded to

customers of DNB or advising any other person in connection with

the Fundraising and Admission. DNB does not accept any

responsibility whatsoever for the contents of this announcement,

and no representation or warranty, express or implied, is made by

DNB with respect to the accuracy or completeness of this

announcement or any part of it and no responsibility or liability

whatsoever is accepted by DNB for the accuracy of any information

or opinions contained in this announcement or for the omission of

any material information from this announcement.

This announcement is only addressed to and directed at: (a)

persons in member states of the European Economic Area who are

"qualified investors" within the meaning of Article 2(e) of

Regulation (EU) 2017/1129 (together with any implementing measure

in such member states, the "EEA Prospectus Regulation"); (b)

persons in the United Kingdom who are "qualified investors" within

the meaning of the UK version of the EEA Prospectus Regulation (the

"UK Prospectus Regulation"), which forms part of UK law by virtue

of the European Union (Withdrawal) Act 2018 (the "EUWA"), and who

are persons who: (i) have professional experience in matters

relating to investments and are "investment professionals" within

the meaning of Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (as amended) (the

"Order"); or (ii) are persons falling within Article 49(2)(a) to

(d) ("high net worth companies, unincorporated associations, etc.")

of the Order; or (c) persons to whom it is otherwise lawful to

distribute it (all such persons together being referred to as

"Relevant Persons"). It is not directed at and may not be acted or

relied on by anyone other than a Relevant Person. Persons who do

not fall within the de nition of "Relevant Persons" above should

not rely on this announcement, nor take any action upon it.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. No public offering of securities is being made in

the United States. The ordinary shares of the Company have not been

and will not be registered under the United States Securities Act

of 1933, as amended (the "Securities Act"), or with any securities

regulatory authority of any state or other jurisdiction of the

United States, and may not be offered, sold, resold, pledged,

delivered, assigned or otherwise transferred, directly or

indirectly, into or within the United States, or to or for the

account or benefit of a US Person (as defined in Regulation S

promulgated under the Securities Act) except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. The Company has not been and,

after applying the proceeds from the Fundraising, will not be

registered under the Investment Company Act of 1940, as amended

(the "Investment Company Act"), and as such investors in the New

Ordinary Shares will not be entitled to the benefits of the

Investment Company Act. No offer, purchase, sale or transfer of the

New Ordinary Shares may be made except under circumstances which

will not result in the Company being required to register as an

investment company under the Investment Company Act.

The New Ordinary Shares have not been approved or disapproved by

the United States Securities and Exchange Commission, any state

securities commission in the United States or any other regulatory

authority in the United States, nor have any of the foregoing

authorities passed upon or endorsed the merit of the offer of the

New Ordinary Shares or the accuracy or adequacy of this document.

Any representation to the contrary is a criminal offence in the

United States.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this announcement are based on

certain factors and assumptions, including the directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by applicable law or regulation, the Company undertakes no

obligation to release publicly the results of any revisions to any

forward-looking statements in this announcement that may occur due

to any change in the directors' expectations or to reflect events

or circumstances after the date of this announcement.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFEVRTIAIIL

(END) Dow Jones Newswires

June 10, 2021 02:00 ET (06:00 GMT)

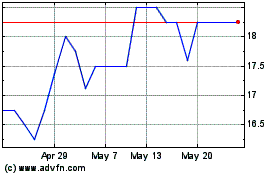

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024