Form 8 (OPD) Liberty PLC - Amendment

May 28 2010 - 9:17AM

UK Regulatory

TIDMLBE

RNS Number : 7453M

BlueGem Capital Partners LLP

28 May 2010

+---------------------------------------------------------------------------+

| Press Announcement |

+---------------------------------------------------------------------------+

| For immediate release |

+---------------------------------------------------------------------------+

| 28 May 2010 |

+---------------------------------------------------------------------------+

| Company |

+---------------------------------------------------------------------------+

| BLUEGEM GAMMA LIMITED |

+---------------------------------------------------------------------------+

| |

+---------------------------------------------------------------------------+

| Title |

+---------------------------------------------------------------------------+

| AMENDED PUBLIC OPENING POSITION DISCLOSURE BY A PARTY TO AN OFFER |

| Rules 8.1 and 8.2 of the Takeover Code (the "Code") |

| |

| 2.(c) - Corrects details disclosed previously |

+---------------------------------------------------------------------------+

+--+-------------------------------+-----------+

| 1.| KEY INFORMATION | |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (a)| Identity of the party to the | BLUEGEM |

| | offer making the disclosure: | GAMMA |

| | | LIMITED |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (b)| Owner or controller of | |

| | interests and short positions | |

| | disclosed, if different from | |

| | 1(a): | |

| | The naming of nominee or | |

| | vehicle companies is | |

| | insufficient | |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (c)| Name of offeror/offeree in | LIBERTY |

| | relation to whose relevant | PLC |

| | securities this form relates: | |

| | Use a separate form for each | |

| | party to the offer | |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (d)| Is the party to the offer | OFFEROR |

| | making the disclosure the | |

| | offeror or the offeree? | |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (e)| Date position held: | 19 MAY |

| | | 2010 |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (f)| Has the party previously | NO |

| | disclosed, or is it today | |

| | disclosing, under the Code in | |

| | respect of any other party to | |

| | this offer? | |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| 2.| POSITIONS OF THE PARTY TO THE | |

| | OFFER MAKING THE DISCLOSURE | |

+--+-------------------------------+-----------+

| | | |

+--+-------------------------------+-----------+

| (a)| Interests and short positions | |

| | in the relevant securities of | |

| | the offeror or offeree to | |

| | which the disclosure relates | |

+--+-------------------------------+-----------+

+--+----------------+---------+--+---------+---+

| Class of | | |

| relevant | | |

| security: | | |

+-------------------+------------+-------------+

| | Interests | Short |

| | | positions |

+-------------------+------------+-------------+

| | Number |% | Number |% |

+-------------------+---------+--+---------+---+

| (1)| Relevant | NIL | | NIL | |

| | securities | | | | |

| | owned and/or | | | | |

| | controlled: | | | | |

+--+----------------+---------+--+---------+---+

| (2)| Derivatives | NIL | | NIL | |

| | (other than | | | | |

| | options): | | | | |

+--+----------------+---------+--+---------+---+

| (3)| Options and | NIL | | NIL | |

| | agreements to | | | | |

| | purchase/sell: | | | | |

+--+----------------+---------+--+---------+---+

| | TOTAL: | | | | |

+--+----------------+---------+--+---------+---+

+----------------------------------------------+

| All interests and all short positions should |

| be disclosed. |

+----------------------------------------------+

| |

+----------------------------------------------+

| Details of any open derivative or option |

| positions, or agreements to purchase or sell |

| relevant securities, should be given on a |

| Supplemental Form 8 (Open Positions). |

+----------------------------------------------+

| |

+----------------------------------------------+

| Details of any securities borrowing and |

| lending positions or financial collateral |

| arrangements should be disclosed on a |

| Supplemental Form 8 (SBL). |

+----------------------------------------------+

+--+---------------------------------+--------+

| (b)| Rights to subscribe for new | |

| | securities | |

+--+---------------------------------+--------+

| | | |

+--+---------------------------------+--------+

| | Class of relevant security in | NONE |

| | relation to which subscription | |

| | right exists: | |

+--+---------------------------------+--------+

| | | |

+--+---------------------------------+--------+

| | Details, including nature of | N/A |

| | the rights concerned and | |

| | relevant percentages: | |

+--+---------------------------------+--------+

+----------------------------------------------+

| If there are positions or rights to |

| subscribe to disclose in more than one class |

| of relevant securities of the offeror or |

| offeree named in 1(c), copy table 2(a) or |

| (b) (as appropriate) for each additional |

| class of relevant security. |

+----------------------------------------------+

+--+---------------------------------+--------+

| (c)| Irrevocable commitments and | |

| | letters of intent | |

+--+---------------------------------+--------+

+----------------------------------------------+

| Details of any irrevocable commitments or |

| letters of intent procured by the party to |

| the offer making the disclosure or any |

| person acting in concert with it (see Note 3 |

| on Rule 2.11 of the Code): |

+----------------------------------------------+

| |

+----------------------------------------------+

| Summary of principal terms of Liberty Offer |

| Irrevocables |

+----------------------------------------------+

| |

+----------------------------------------------+

| BlueGem has received hard irrevocable |

| undertakings as follows: |

+----------------------------------------------+

+-----------------------------+------------+--------+

| MWB Retail Stores | 15,440,432 | 68.3% |

| Shareholder Limited | | |

+-----------------------------+------------+--------+

| Cartesian Partners LP | 2,359,177 | 10.4% |

+-----------------------------+------------+--------+

| Principle Capital | 1,693,541 | 7.5% |

| Investments Limited | | |

+-----------------------------+------------+--------+

| MWB Management Services | 6,977 | 0.0% |

| Limited | | |

+-----------------------------+------------+--------+

| | | |

+-----------------------------+------------+--------+

| Total hard irrevocables | 19,500,127 | 86.3% |

+-----------------------------+------------+--------+

| | | |

+-----------------------------+------------+--------+

| Amendment: The previous announcement dated |

| 19 May 2010 incorrectly stated the number of |

| MWB Retail Stores Shareholder Limited shares |

| as 15,440,412 and the number of MWB |

| Management Services Limited shares as 6,997. |

| This amendment does not change either the |

| total number of MWB shares for which |

| irrevocable undertakings have been received |

| nor the total number of hard irrevocables. |

+-----------------------------+------------+--------+

+----------------------------------------------+

| Each person who has entered into a hard |

| irrevocable undertaking has undertaken (on |

| its own behalf and on behalf of its |

| associates) inter alia not to (i) sell, |

| transfer, charge, encumber, grant any option |

| over or otherwise dispose of any interest in |

| any ordinary shares such person holds in |

| Liberty; (ii) accept any other offer in |

| respect of its ordinary shares in Liberty; |

| (iii) purchase, sell or otherwise deal in |

| ordinary shares in Liberty or any interest |

| therein; (iv) requisition any shareholder |

| meeting of Liberty; or (v) agree to do any |

| of the things described in (i) or (ii) |

| above. |

+----------------------------------------------+

| |

+----------------------------------------------+

| Such persons have further undertaken inter |

| alia to accept or procure the acceptance of |

| the Proposed Offer in respect of their |

| ordinary shares in Liberty and not to |

| withdraw or procure the withdrawal of such |

| acceptance. |

+----------------------------------------------+

| |

+----------------------------------------------+

| From the time that a Proposed Offer is |

| announced to the time that a Proposed Offer |

| becomes wholly unconditional, lapses or is |

| withdrawn, such persons have undertaken to |

| exercise votes (and or any other rights) |

| attaching to their ordinary shares in |

| Liberty in accordance with BlueGem's |

| directions in relation to the passing or |

| proposal of any resolution necessary to |

| implement the Proposed Offer or which, if |

| passed, might result in any condition of the |

| Proposed Offer not being fulfilled or which |

| might impede or frustrate the Proposed |

| Offer. |

+----------------------------------------------+

| |

+----------------------------------------------+

| The undertakings provided by MWB, MWB Retail |

| Stores Shareholder Limited and MWB |

| Management Services Limited are conditional |

| on the sale by MWB of the Relevant Liberty |

| Shares pursuant to the Proposed Offer being |

| approved by shareholders of MWB at a general |

| meeting of the shareholders of MWB. |

+----------------------------------------------+

| |

+----------------------------------------------+

| The undertakings shall also lapse and shall |

| cease to be binding if the Proposed Offer is |

| not formally announced by 8 June 2010; or if |

| after the Proposed Offer is announced the |

| Panel on Takeovers and Mergers consents to |

| BlueGem not making the offer or an event |

| occurs which means that BlueGem is no longer |

| required by the Takeover Code to proceed |

| with the Offer; or if the offer document and |

| associated form of acceptance in respect of |

| the Proposed Offer is not posted within 28 |

| days of the formal announcement of the |

| Proposed Offer; or if the Proposed Offer |

| once formally announced lapses or is |

| withdrawn in accordance with the Takeover |

| Code. |

+----------------------------------------------+

| |

+----------------------------------------------+

| In addition, the directors of Liberty have |

| undertaken inter alia (i) to recommend the |

| Proposed Offer to the shareholders of |

| Liberty; (ii) not to solicit, initiate or |

| encourage any other person to make an offer |

| for Liberty; and (iii) except where required |

| by his duties as a director of Liberty or |

| under the Takeover Code, and in any event |

| only in response to an unsolicited approach, |

| not to enter into or continue discussions or |

| agreements with, or provide any information |

| to any person considering making such an |

| offer or otherwise take any action which |

| might be prejudicial to the outcome of the |

| Proposed Offer. |

+----------------------------------------------+

| |

+----------------------------------------------+

| Capitalised terms above are as defined in |

| the 2.4 announcement dated 7 May 2010. |

+----------------------------------------------+

+--+-------------------------------------------+

| 3.| POSITIONS OF PERSONS ACTING IN CONCERT |

| | WITH THE PARTY TO THE OFFER MAKING THE |

| | DISCLOSURE |

+--+-------------------------------------------+

+----------------------------------------------+

| Details of any interests, short positions |

| and rights to subscribe of any person acting |

| in concert with the party to the offer |

| making the disclosure: |

+----------------------------------------------+

| N/A |

+----------------------------------------------+

| |

+----------------------------------------------+

| If there are positions or rights to |

| subscribe to disclose in more than one class |

| of relevant securities of the offeror or |

| offeree named in 1(c), copy table 3 for each |

| additional class of relevant security. |

+----------------------------------------------+

| |

+----------------------------------------------+

| Details of any open derivative or option |

| positions, or agreements to purchase or sell |

| relevant securities, should be given on a |

| Supplemental Form 8 (Open Positions). |

+----------------------------------------------+

| |

+----------------------------------------------+

| Details of any securities borrowing and |

| lending positions or financial collateral |

| arrangements should be disclosed on a |

| Supplemental Form 8 (SBL). |

+----------------------------------------------+

+--+-------------------------------------------+

| 4.| OTHER INFORMATION |

+--+-------------------------------------------+

| | |

+--+-------------------------------------------+

| (a)| Indemnity and other dealing arrangements |

+--+-------------------------------------------+

+----------------------------------------------+

| Details of any indemnity or option |

| arrangement, or any agreement or |

| understanding, formal or informal, relating |

| to relevant securities which may be an |

| inducement to deal or refrain from dealing |

| entered into by the party to the offer |

| making the disclosure or any person acting |

| in concert with it: |

| If there are no such agreements, |

| arrangements or understandings, state "none" |

+----------------------------------------------+

| NONE |

+----------------------------------------------+

+--+-------------------------------------------+

| (b)| Agreements, arrangements or |

| | understandings relating to options or |

| | derivatives |

+--+-------------------------------------------+

+----------------------------------------------+

| Details of any agreement, arrangement or |

| understanding, formal or informal, between |

| the party to the offer making the |

| disclosure, or any person acting in concert |

| with it, and any other person relating to: |

| (i) the voting rights of any relevant |

| securities under any option; or |

| (ii) the voting rights or future |

| acquisition or disposal of any relevant |

| securities to which any derivative is |

| referenced: |

| If there are no such agreements, |

| arrangements or understandings, state "none" |

+----------------------------------------------+

| NONE |

+----------------------------------------------+

+--+-------------------------------------------+

| (c)| Attachments |

+--+-------------------------------------------+

+----------------------------------------------+

| Are any Supplemental Forms attached? |

+----------------------------------------------+

+--------------------------------+---------------+

| Supplemental Form 8 (Open | NO |

| Positions) | |

+--------------------------------+---------------+

| Supplemental Form 8 (SBL) | NO |

+--------------------------------+---------------+

| | |

+--------------------------------+---------------+

| Date of disclosure: | 27 MAY 2010 |

+--------------------------------+---------------+

| | |

+--------------------------------+---------------+

| Contact name: | MARCO |

| | ANATRIELLO |

+--------------------------------+---------------+

| | |

+--------------------------------+---------------+

| Telephone number: | 020 7647 9714 |

+--------------------------------+---------------+

+---------------------------------------------------------------------------+

| Public disclosures under Rule 8 of the Code must be made to a Regulatory |

| Information Service and must also be emailed to the Takeover Panel at |

| monitoring@disclosure.org.uk. The Panel's Market Surveillance Unit is |

| available for consultation in relation to the Code's dealing disclosure |

| requirements on +44 (0)20 7638 0129. |

+---------------------------------------------------------------------------+

| |

+---------------------------------------------------------------------------+

| The Code can be viewed on the Panel's website at |

| www.thetakeoverpanel.org.uk. |

+---------------------------------------------------------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

FEEBXGDUXBDBGGI

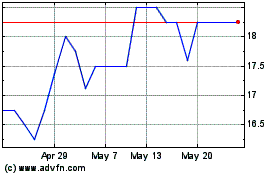

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024