TIDMMWB TIDMLBE

RNS Number : 7426M

MWB Group Holdings PLC

28 May 2010

For Immediate Release

28 May 2010

MWB GROUP HOLDINGS PLC ("MWB" or the "Company")

PROPOSED DISPOSAL OF THE GROUP'S ENTIRE SHAREHOLDING IN LIBERTY PLC

MWB today announces that it has received 51.47 per cent. irrevocable

undertakings to vote in favour of the resolution to approve the proposed sale of

the Group's entire 68.3 per cent. shareholding in Liberty for a total price

equivalent to GBP28.7 million in cash.

MWB acquired its investment in Liberty Plc (the "Liberty Shareholding") in July

2000, since when the Liberty Shares have been admitted to trading on AIM. The

Liberty Shareholding represents 68.3 per cent. of the issued share capital of

Liberty and as such Liberty is a subsidiary of MWB. In July 2009, the Liberty

Board announced that it was undertaking a review with the aim of identifying

ways in which the Liberty business could be developed and expanded. As a result

of this review, the Liberty Board, in conjunction with its financial advisers,

considered a number of different strategies that were proposed to Liberty.

On 19 May 2010, the Liberty Board and BlueGem Gamma Limited ("BGL") announced

that they had agreed the terms of a recommended offer to be made by BGL

consisting of 141.8 pence in cash for each Liberty Ordinary Share (the "Offer

Price") valuing the issued ordinary share capital at GBP32.0 million, together

with payment of the Special Dividend of 44.2 pence for each Liberty Ordinary

Share amounting to GBP10.0 million, which in total equate to the Aggregate Price

of GBP42.0 million payable to Liberty Shareholders.

As the Disposal is of sufficient size to that of MWB to constitute a Class 1

transaction under the Listing Rules, it requires the prior approval of

shareholders. A circular to shareholders of MWB containing details of the

Disposal ("Circular") has been published and is expected to be posted to

shareholders today. A General Meeting to approve the Disposal is expected to be

held at 11.00 a.m. on 21 June 2010.

Highlights

· Aggregate Offer Price of GBP42.0 million equivalent to GBP28.7 million in

cash to MWB

· Irrevocable undertakings from MWB Shareholders to vote in favour of

Disposal totalling 51.47% already received

Shareholders may be aware of recent announcements and press comment concerning a

possible offer for the Liberty Ordinary Shares from Pyrrho, a shareholder in

MWB. The Board can confirm that, despite the impression that certain

Shareholders may have gained, no formal offer for the Liberty Ordinary Shares

has been made by Pyrrho.

The Company has received irrevocable undertakings to vote in favour of the

ordinary resolution to be put to shareholders of the Company at the General

Meeting to approve the Disposal, from shareholders holding 51.47% of the

Company's issued share capital. The Directors have given irrevocable

undertakings amounting to 15.8% of the Company's issued share capital (such

amount being included in the 51.47% total above). These irrevocable undertakings

exceed the majority of 50 per cent. required to pass the Resolution.

The Disposal will enable the Group to realise the inherent value in the Liberty

Shareholding in cash and so to continue the Group's strategy of realising the

value of the Group's businesses through sales in connection with the Group's

Cash Distribution Programme.

The Circular relating to the Disposal has been approved by the UK Listing

Authority and will shortly be available for inspection at their Document Viewing

Facility, situated at The Financial Services Authority, 25 The North Colonnade,

Canary Wharf, London E14 5HS. The Circular will also be available at the

registered office of the Company and at the offices of Dechert LLP, 160 Queen

Victoria Street, London EC4V 4QQ during normal business hours on any weekday

(Saturdays, Sundays and public holidays excepted) from the date of the

publication of the Circular until the General Meeting. The circular will also be

available on the Company's website, www.mwb.co.uk

Terms used in this announcement but not defined shall have the same meanings

given to them in the Circular.

For further information, please contact:

+-----------------------------------------+---------------------+

| MWB Group Holdings Plc | +44 (0) 20 7706 |

| Richard Balfour-Lynn, Chief Executive | 2121 |

| Jag Singh, Finance Director | |

| | |

+-----------------------------------------+---------------------+

| Panmure Gordon (Financial Adviser and | +44 (0) 20 7459 |

| Broker) | 3600 |

| Hugh Morgan | |

| Adam Pollock | |

| | |

+-----------------------------------------+---------------------+

| Baron Phillips Associates (Financial PR | +44 (0) 20 7920 |

| Adviser) | 3161 |

| Baron Phillips | |

+-----------------------------------------+---------------------+

This announcement has been issued by, and is the sole responsibility of, the

Company. No representation or warranty, express or implied, is made or given by,

or on behalf of, the Company or Panmure Gordon (UK) Limited ("Panmure Gordon")

or any of their affiliates, parent undertakings, subsidiary undertakings or

subsidiaries of their parent undertakings or any of their respective directors,

officers, employees or advisers or any other person as to the accuracy or

completeness or fairness of the information or opinions contained in this

announcement and no responsibility or liability is accepted by any of them for

any such information or opinions or for any errors or omissions.

Panmure Gordon, which is authorised and regulated by the Financial Services

Authority, is acting exclusively for the Company and for no one else in

connection with the Disposal and is not advising any other person and

accordingly will not be responsible to anyone other than the Company for

providing the protections afforded to the customers of Panmure Gordon or for

providing advice in relation to the contents of this announcement or any

transaction, arrangement or other matter described in this announcement.

The distribution of this announcement into jurisdictions other than the United

Kingdom may be restricted by law. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such jurisdiction.

The information in this announcement may not be forwarded or distributed to any

other person and may not be reproduced in any manner whatsoever. Any forwarding,

distribution, reproduction, or disclosure of this information in whole or in

part is unauthorised. Failure to comply with this directive may result in a

violation of applicable laws of relevant jurisdictions.

This announcement contains a number of forward looking statements relating to

MWB and Liberty with respect to, amongst others, the following: financial

conditions; results of operations; economic conditions in which MWB and Liberty

operates; the businesses of MWB and Liberty; future benefits of the Disposal;

and management plans and objectives. The Company considers any statements that

are not historical facts as "forward looking statements". They relate to events

and trends that are subject to risks, uncertainties and assumptions that could

cause the actual results and financial position of MWB and Liberty to differ

materially from the information presented in the relevant forward looking

statement. When used in this announcement the words "estimate", "project",

"intend", "aim", "anticipate", "believe", "expect", "should", and similar

expressions, as they relate to MWB and Liberty or the management of either of

them, are intended to identify such forward looking statements. Readers are

cautioned not to place undue reliance on these forward looking statements which

speak only as at the date of this announcement. Neither the Company nor any

member of the Group including Liberty undertakes any obligation to update

publicly or revise any of the forward looking statements, whether as a result of

new information, future events or otherwise, save in respect of any requirement

under applicable laws and regulations, the Listing Rules, the Prospectus Rules,

and the Disclosure and Transparency Rules.

MWB GROUP HOLDINGS PLC

PROPOSED DISPOSAL OF THE GROUP'S ENTIRE SHAREHOLDING IN LIBERTY PLC

1. Introduction

On 12 March 2010, Liberty, MWB's 68.3 per cent. owned subsidiary, announced that

it had received approaches which may or may not lead to an offer being made for

Liberty. On 7 May 2010, BlueGem Capital Partners LLP, on behalf of BlueGem L.P.,

issued an announcement under the Code that it was in discussions with the

Liberty Board about the possibility of making an offer for the Liberty Ordinary

Shares at the Aggregate Price.

Shareholders may be aware of recent announcements and press comment concerning a

possible offer for the Liberty Ordinary Shares from Pyrrho, a shareholder in

MWB. The Board can confirm that, despite the impression that certain

Shareholders may have gained, no formal offer for the Liberty Ordinary Shares

has been made by Pyrrho. Furthermore, in light of the irrevocable undertakings

obtained by BlueGem L.P., and in the absence of the Offer lapsing, the Board

does not consider there is any realistic prospect of any formal offer for the

Liberty Ordinary Shares being made successfully by Pyrrho or any other third

party. Further details of the approach by Pyrrho and the reasons for the

unanimous rejection of that approach by the Liberty Board and the Board are

included in paragraph 2 below entitled "Background to the Disposal".

On 19 May 2010, the Liberty Board and BGL announced that they had agreed the

terms of a recommended cash offer to be made by BGL for the Liberty Ordinary

Shares at the Offer Price, together with payment of the Special Dividend, which

in total equate to the Aggregate Price. The Offer is being made by BGL in

accordance with the Code. As part of the negotiations which led to BGL

announcing the Offer, the MWB Parties have given the Irrevocable Undertakings to

BGL to accept the Offer in relation to the Liberty Shareholding. The Irrevocable

Undertakings were given by the MWB Parties subject to approval of the Disposal

by Shareholders.

The Disposal is of sufficient size relative to that of the Group to constitute a

Class 1 transaction for MWB under the Listing Rules, and therefore requires the

prior approval of Shareholders.

The aggregate price receivable by MWB in respect of the Offer (including MWB's

proportion of the Special Dividend, amounting to GBP6.8 million payable in

conjunction with the Offer) will amount to a total cash receipt by MWB as a

result of the Offer of GBP28.7 million.

2. Background to the Disposal

MWB has held the Liberty Shareholding since July 2000 and since then the Liberty

Shares have been admitted to trading on AIM. At the time of acquisition by MWB

of the Liberty Shareholding, stock market conditions were considerably more

favourable to small companies than is currently the case. Throughout the period

from MWB's acquisition of the Liberty Shareholding, Liberty has continued to be

loss making and substantially cash flow negative, requiring MWB management

involvement and direction. In order to part fund Liberty's losses and capital

requirements, MWB also provided the Inter Group Debt to Liberty, which amounted

to GBP14.7 million immediately prior to its repayment on 11 May 2010.

In February 2009, Liberty launched its Renaissance of Liberty after substantial

financial and management investment provided by MWB. This was the next step in

establishing Liberty as a popular and avant-garde British luxury brand. The

Renaissance continues to be successful, and in the year ended 31 December 2009

Liberty revenues grew by 20 per cent. compared with 2008, resulting in a

positive EBITDA (after brand expenditure and reorganisation costs) of GBP0.1

million for the year ended 31 December 2009 and a reduced post-tax loss after

depreciation and interest for Liberty of GBP5.15 million. The success of the

Renaissance has continued in 2010 and in the four months ended 30 April 2010,

Liberty's total revenue increased by 40 per cent. over the same period in 2009,

as referred to in the MWB interim management statement issued on 12 May 2010.

In July 2009, the Liberty Board announced that it was undertaking a review with

the aim of identifying ways in which the Liberty business could be developed and

expanded. As a result of this review, the Liberty Board, in conjunction with its

financial advisers, considered a number of different strategies that were

proposed to Liberty. On 12 March 2010, the Liberty Board announced that it had

received approaches which may or may not lead to an offer for Liberty.

Discussions with BlueGem Capital Partners LLP, on behalf of BlueGem L.P. (the

holding entity of BGL), about the possibility of an offer for the Liberty

Ordinary Shares commenced in February 2010, and since then BlueGem L.P. has

undertaken over four months of extensive due diligence on Liberty.

On 15 March 2010, the Liberty Board announced that it had agreed terms to sell

the Tudor Building to the Tudor Building Purchaser for a sale price of GBP41.5

million in cash. Shareholders approved the Tudor Building Sale at a general

meeting of the Company which was held on 10 May 2010 and completion of the Tudor

Building Sale took place on 11 May 2010. The sale price of GBP41.5 million, less

a retention of GBP0.3 million by the Tudor Building Purchaser, represents a

surplus, before expenses, of GBP10.95 million or 36 per cent. over the book

value of the Tudor Building of GBP30.25 million at 31 December 2009. Since

completion of the Tudor Building Sale, Liberty has continued, and will continue,

to occupy and carry on its retail operations at the Tudor Building pursuant to

the Liberty Lease, at an initial annual rent of GBP2.1 million, with five-yearly

fixed upward rent reviews.

On 6 May 2010, Pyrrho made a proposal to the Liberty Board about a possible

offer for Liberty at an offer price of 185 pence per Liberty Ordinary Share

(including a special dividend). Pyrrho's proposal was fully considered that day

by both the Liberty Board and the Board, both of which boards subsequently

resolved to proceed with the proposed offer by BlueGem L.P., the holding entity

of BGL. BlueGem L.P.'s proposed offer was the highest of the two possible

offers; BlueGem L.P. had already undertaken over four months of extensive due

diligence on Liberty and therefore its proposal was fully researched; and

BlueGem L.P. had committed to declare its offer unconditional if acceptances in

respect of not less than 86.27 per cent. of Liberty Ordinary Shares were

received. As irrevocable undertakings to accept the offer proposed by BlueGem

L.P. had already been obtained or promised in respect of 86.27 per cent. of the

Liberty Ordinary Shares, this gave the Liberty Board and the Board a high degree

of certainty that the offer proposed by BlueGem L.P. would succeed. In addition,

if the Liberty Board had not agreed to proceed with the offer proposed by

BlueGem L.P., that offer would have been withdrawn by BlueGem L.P. and Liberty

would have become liable to pay an inducement fee of GBP0.3 million pursuant to

the inducement fee agreement entered into between Liberty and BlueGem Capital

Partners LLP. The offer proposed by BGL had the approval of the trustees of the

Liberty Pension Scheme which was required owing to the deficit in the Liberty

Pension Scheme and agreement had been reached with the trustees for a special

contribution to be made by Liberty to the Liberty Pension Scheme.

On 7 May 2010, BlueGem Capital Partners LLP, on behalf of BlueGem L.P., issued

an announcement under the Code that it was in discussions with the Liberty Board

about the possibility of making an offer for the Liberty Ordinary Shares at the

Aggregate Price.

On 14 May 2010, Pyrrho issued an announcement under the Code that it wished to

make an offer for the share capital of Liberty at a higher price than that

announced by BlueGem L.P. on 7 May 2010 However, by this stage irrevocable

undertakings to accept the offer proposed by BGL had already been obtained, as

referred to above, and the Liberty Board and the Board continue to believe that

the offer made by BGL is in the best interests of Liberty Shareholders and

Shareholders respectively.

On 19 May 2010, the Liberty Board and BGL announced under the Code a recommended

cash offer to be made by BGL for the Liberty Ordinary Shares, being the Offer.

As a small quoted company on AIM, Liberty has suffered from share illiquidity

and limited institutional interest in its shares. The Liberty Board has worked

hard to restructure Liberty and revive its fortunes within the confines of the

public arena. It also now considers that Liberty's long term strategy has better

prospects of being delivered as a private company with a backer with a strong

retail focus, and one which would be willing to commit the substantial sums of

capital required to take Liberty to the next stage of its development. The

Liberty Board considers that BGL possesses these characteristics.

The Board believes that it is now in Shareholders' best interests to dispose of

the Liberty Shareholding at what the Directors believe, in conjunction with

receipt of the Group's proportionate share of the Special Dividend, is an

attractive price.

Since implementation of the Cash Distribution Programme in May 2002, the Board's

strategy has been to mature and enhance the value of the Group's businesses.

Upon the businesses reaching maturity, the strategy has been to realise their

value through sales and, after repayment of debt, to return realised cash or

cash equivalents to Shareholders. These broad strategic aims remain in place

today.

The Disposal will enable the Group to realise the inherent value in the Liberty

Shareholding in cash and so to continue the Group's strategy of realising the

value of the Group's businesses through sales in connection with the Cash

Distribution Programme.

3. Principal terms and conditions of the Disposal

The Offer is being made in accordance with the Code on terms and conditions

which are customary for offers made under the Code. The Aggregate Price will be

paid in cash. In accordance with the terms of the Code, BGL's financial adviser,

has confirmed that it is satisfied that the necessary financial resources are

available to BGL to satisfy acceptance of the Offer in full. The Offer has been

made in conjunction with the Special Dividend which the Liberty Board has

resolved to be paid to Liberty Shareholders within seven days after the Offer

becomes or is declared unconditional in all respects.

BlueGem L.P. has undertaken to provide agreed funding to ensure that Liberty has

the necessary cash available to it to pay the Special Dividend.

Together with the Special Dividend, the Offer would result in total receipts by

Liberty Shareholders of GBP42.0 million (being the Aggregate Price). Of this

amount, the Offer Price is 141.8 pence per Liberty Ordinary Share and the

Special Dividend resolved by the Liberty Board to be paid in conjunction with

the Offer is 44.2 pence per Liberty Ordinary Share.

The consideration has been structured in this way to give Liberty Shareholders

the benefit of the surplus cash in Liberty resulting from the Tudor Building

Sale, as more fully described in the Tudor Building Circular.

In addition, the holders of options over Liberty Ordinary Shares have agreed to

surrender all of their options over an aggregate of 1,930,000 Liberty Ordinary

Shares in return for a gross cash payment equal to 21.8 pence per Liberty

Ordinary Share (or GBP0.4 million in total) from BGL and an additional amount

equal to 44.2 pence per Liberty Ordinary Share (or GBP0.9 million in total) from

Liberty. These arrangements put the option holders in the position they would

have been in had they exercised their options and participated in the Offer as a

Liberty Shareholder. Payments under these agreements are conditional upon the

Offer being declared unconditional in all respects.

In the Tudor Building Circular, MWB stated that following completion of the

Tudor Building Sale, Liberty intended to pay a special dividend. The amount

which could be paid as a dividend in the event that the Offer does not complete

would need to reflect the ongoing cash requirements and growth plans of Liberty

as an independent business and so would be likely to be materially less than the

Special Dividend which will be paid in conjunction with the Offer if the Offer

is completed.

The Liberty Board, which has received advice from Liberty's financial adviser,

Cavendish Corporate Finance LLP, considers the terms of the Offer, taking into

account the Special Dividend, to be fair and reasonable. On this basis, the

Liberty Board has unanimously recommended that Liberty Shareholders accept the

Offer.

The aggregate amount receivable by Liberty Shareholders pursuant to the Offer,

including the Special Dividend payable by Liberty to Liberty Shareholders,

represents a multiple of 26.9 times Liberty's Pro Forma EBITDA.

The Aggregate Price represents a discount of 32.4 per cent. to the closing

middle market quotation for a Liberty Ordinary Share of 275 pence on 11 March

2010, being the last practicable date before Liberty Board made the announcement

that it had received approaches which may or may not lead to an offer being made

for Liberty on 12 March 2010. The Aggregate Price represents a discount of 39.5

per cent. to the closing middle market quotation for a Liberty Ordinary Share of

307.5 pence on 6 May 2010, being the last practicable date before the

announcement made by the Liberty Board that BlueGem Capital Partners LLP, on

behalf of BlueGem L.P., was in discussions with the Liberty Board about the

possibility of making an offer for the ordinary share capital of Liberty. The

Aggregate Price represents a discount of 16.4 per cent. to the closing middle

market quotation for a Liberty Ordinary Share of 222.5 pence on 18 May 2010,

being the last practicable date before the announcement of the Offer.

The Liberty Ordinary Shares have, for a number of years, been highly illiquid on

AIM, with very limited trading volumes. In the opinion of the Board, and after

receiving appropriate financial advice, the underlying economic value of Liberty

is lower than the quoted price of the Liberty Ordinary Shares. Consequently, a

sale of any substantial number of Liberty Ordinary Shares on the market would

not, in the opinion of the Board, realise a value per share that was materially

higher than the Aggregate Price.

The Offer is subject to valid acceptances of the Offer in respect of not less

than 86.27 per cent. (or such lesser percentage as BGL may decide) of the

Liberty Shares to which it relates being received (and not, where permitted,

withdrawn) by no later than 1.00 p.m. on 22 June 2010 (or such later time(s)

and/or date(s) as BGL may, subject to the rules of the Code, or with the consent

of the Panel, decide).

BGL is a newly formed company wholly owned by BlueGem L.P., a private equity

fund formed at the end of 2006. BlueGem L.P. has received capital commitments of

over EUR200 million from investors, of which approximately 40 per cent. has been

invested at the date of this announcement. BlueGem L.P. makes private equity

investments in mid-market companies, mainly in the UK and Italy, and its team

has considerable experience in making investments in the retail sector.

4. Composition, receipt and use of proceeds derived from the Tudor Building Sale

and the Disposal

As referred to in the Tudor Building Circular, out of the proceeds of the Tudor

Building Sale of GBP41.5 million and, after the retention by the Tudor Building

Purchaser of GBP0.3 million pursuant to the Tudor Building Sale Agreement,

Liberty has discharged the amounts set out in (i) and (ii) below and will

discharge the amounts set out in (iii) and (iv) below:-

(i) repayment of the Liberty Bank Debt of GBP14.0 million;

(ii) repayment of the Inter Group Debt of GBP14.7 million;

(iii) the costs of the Tudor Building Sale incurred by Liberty estimated at

GBP0.7 million; and

(iv) the payment of accrued dividends to holders of preference shares in Liberty

of GBP0.2 million.

Thereafter, it is estimated by the Liberty Board that there will be GBP11.6

million of surplus cash proceeds out of the proceeds of the Tudor Building Sale

that will be available in Liberty for the benefit of Liberty Shareholders.

The Tudor Building Circular also referred to discussions with the trustees of

the Liberty Pension Scheme, concerning a possible contribution to the Pension

Scheme out of the proceeds of the Tudor Building Sale, to reduce the deficit in

the Liberty Pension Scheme. Since the date of the Tudor Building Circular,

Liberty has concluded these discussions, and as a result a contribution of

GBP2.0 million has been agreed to be made by Liberty to the Liberty Pension

Scheme out of the proceeds of the Tudor Building Sale to reduce the deficit in

the Pension Scheme. This payment is due to be made on or before 31 May 2010.

Thereafter, and after adjusting for certain working capital items in the

ordinary course as agreed between Liberty and BGL, the net surplus cash proceeds

available in Liberty as a result of the Tudor Building Sale total GBP10.5

million.

Under the terms of the Offer, MWB will receive 141.8 pence for each Liberty

Ordinary Share held by MWB, and accordingly MWB will receive GBP21.9 million for

the Liberty Shareholding at Completion. The Liberty Board has also resolved to

pay the Special Dividend totalling GBP10.0 million to Liberty Shareholders,

which reflects the level of distributable reserves available within Liberty

after completion of the Tudor Building Sale and costs incurred by Liberty in

relation to the Offer of GBP2.1 million. The Group has a 68.3 per cent. interest

in Liberty and accordingly GBP6.8 million of the Special Dividend would be

receivable by MWB.

Taking into account the proceeds receivable by MWB from the Offer and the

Special Dividend referred to above, and repayment of the Inter Group Debt, and

after deducting costs of GBP0.7 million incurred by MWB in undertaking the

Disposal, MWB will receive GBP42.7 million on Completion. These proceeds are

proposed by the Board to be used by MWB as follows:-

(i) the repayment of GBP21.0 million of the MWB Bank Debt, which is secured in

part on the Liberty Shareholding (and which will not be available to be

redrawn), which at the date of this announcement totals GBP53.0 million and

which is expected to remain unchanged at Completion;

(ii) the retention of GBP21.2 million in cash or the use of such amount for the

repayment of part of the revolving element of the MWB Bank Debt after the

repayment referred to in (i) above, thereby reducing overall net debt of the

Group, but preserving the flexibility of the Group to redraw these funds, if

required, for further expansion or for general working capital of the Group; and

(iii) the purchase of GBP0.5 million of the Loan Stock, thereby reducing the

principal amount of Loan Stock outstanding from GBP22.5 million to GBP22.0

million.

Group Net Debt at 31 December 2009 totalled GBP362.8 million as included in the

2009 Group Financial Statements. Subsequent to the Disposal, pro forma Group net

debt would amount to GBP289.7 million. This comprises net debt at 31 December

2009 in the 2009 Group Financial Statements adjusted for the major transactions

undertaken by the Group since 31 December 2009, being receipt by the Group of

the net proceeds from the Placing of GBP23.0 million, receipt by the Group

(including Liberty) of the net proceeds from the Tudor Building Sale of GBP40.1

million and receipt by the Continuing Group from the disposal of the Liberty

Shareholding net of costs, of GBP26.5 million, less the cash within Liberty

divested as a result of the Disposal of GBP16.5 million. Pro forma net assets

calculated on the same basis would increase from GBP176.2 million as set out in

the 2009 Group Financial Statements, to GBP202.8 million.

Pro forma gearing calculated by reference to the pro forma net debt of GBP289.7

million referred to above and pro forma net assets of GBP202.8 million referred

to above, would amount to 143 per cent., in comparison to 206 per cent. at 31

December 2009.

Under the Cash Distribution Programme, the Board's strategy has been to use the

proceeds from sales of Group assets initially in the repayment of debt and

thereafter to return surplus realised cash or cash equivalents to Shareholders.

Awards under the Incentive Scheme may be made only once Gross Cash Returns to

Shareholders following completion of the Placing in January 2010 exceed GBP49.2

million, being 30 pence per Unit (which was the issue price per Unit under the

Placing). No Gross Cash Returns to Shareholders have yet been made since the

revised rules of the Incentive Scheme were approved by Shareholders in January

2010. In order to enhance Shareholders' interests in the Group, in the same way

that the Board used the net proceeds from the Placing and the repayment of the

Inter Group Debt following the Tudor Building Sale to repay Group net debt, the

Board proposes to use all the net proceeds receivable from the Disposal to repay

Group net debt in the manner referred to above. Accordingly, distributions to

Shareholders in accordance with the Cash Distribution Programme are not proposed

to take place at this stage as a result of these transactions and therefore no

payment would be due to participants in the Incentive Scheme. The Board

considers that the Group will be significantly strengthened from a financial

perspective as a result of these transactions, thus improving the future returns

expected to be achievable by Shareholders under the Cash Distribution Programme.

5. Current operations of Liberty

Liberty, which was established by the Liberty family in 1875, is a retail

emporium whose business is principally located in the West End of London.

Liberty retails fashion, beauty and home collections from five floors of the

Tudor Building and operates a wholesale business through Liberty Art

Fabrics. The core of the Liberty strategy is the creation of a global luxury

brand across four distinct business activities, each based on a common heritage

and shared support functions.

The principal activity of Liberty is the operation of the Liberty flagship store

on Great Marlborough Street, which has in recent years undergone a period of

significant financial investment, culminating in completion of the 'Renaissance

of Liberty' which was launched in February 2009. The Liberty flagship store

carries menswear, womenswear, shoes, jewellery, accessories and home interiors

amongst other categories. The store also carries collections by renowned

designers and is positioned at the upper end of the luxury market. With the

refurbished Liberty flagship store having opened in February 2009, Operating

Revenue from the store and transactional website increased in 2009 to GBP37.3

million, an increase of 18 per cent. over the revenue of GBP31.5 million in

2008, and Liberty recorded positive EBITDA during this period. Given the current

economic climate, the Liberty Board considers this to be a strong performance

and a good barometer with which to measure the prospects going forward. In the

year ended 31 December 2009, the Liberty flagship store and the transactional

website contributed 63 per cent. to Liberty's total revenues.

In July 2008, Liberty launched its transactional website, which has developed

rapidly since then. The Liberty Board considers that the response to Liberty's

products indicates that there is significant potential for this part of its

business.

Liberty Art Fabrics supplies fashion and design fabrics and prints to global

fashion brands and designers, such as Nike, Balmain and Junya Watanabe. In the

year ended 31 December 2009, the Liberty Art Fabrics business contributed 36 per

cent. of Liberty's total revenues.

Liberty of London, Liberty's in-house studio, develops fashion accessories for

men and women which are sold in Liberty's three core areas of operation referred

to above. In the year ended 31 December 2009, the Liberty of London business

contributed 1 per cent. of Liberty's total revenues.

Revenue increased by 40 per cent. during the four months ended 30 April 2010,

compared to the same period in 2009, driven by growth across the key areas of

Liberty's business, namely fabrics division, the flagship store and the internet

business. Revenue for the four months ended 30 April 2010 totalled GBP26.0

million, an increase from GBP18.5 million in the comparative four months to 30

April 2009.

6. Financial effects of the Disposal on the Group

Consolidated statement of financial condition

On the assumption that the Disposal completes as planned, Liberty will cease to

be a member of the Group with effect from Completion. As a result, Liberty's

assets and liabilities will no longer feature in the consolidated statement of

financial position of the Group from Completion.

At 31 December 2009, the consolidated statement of financial position of the

Group contained total assets attributable to Liberty of GBP73.7 million, total

liabilities attributable to Liberty of GBP36.2 million and resultant net assets

attributable to Liberty of GBP37.5 million. Capital expenditure incurred by

Liberty during the year ended 31 December 2009 totalled GBP2.8 million and

depreciation during the same period totalled GBP2.3 million.

On the assumption that the Disposal completes as planned, not only will the

above items no longer feature in the consolidated statement of financial

position of the Group, but net indebtedness will be reduced as a result of the

net proceeds receivable by the Group from the Disposal.

The Disposal is expected to realise a surplus attributable to Shareholders of

GBP4.0 million over the book value of the Liberty Shareholding of GBP28.8

million included in the 2009 Group Financial Statements.

Consolidated income statement

On the assumption that the Disposal completes as planned, Liberty will cease to

be a member of the Group with effect from Completion. As a result, Liberty's

trading and operating results will no longer feature in the consolidated income

statement of the Group from Completion.

For the year ended 31 December 2009, the results of Liberty included in the 2009

Group Financial Statements amounted to revenue of GBP60.8 million, EBITDA of

GBP0.1 million, negative earnings before interest and taxation of GBP2.7 million

and a pre-tax loss of GBP3.4 million.

On the assumption that the Disposal completes as planned, not only will the

above items no longer feature in the consolidated income statement of the Group,

but net finance costs would decrease to reflect the reduction in net

indebtedness arising from the net proceeds received by the Group from the

Disposal.

Equity Attributable to Shareholders

As a result of the Placing and the Tudor Building Sale, referred to in the

Prospectus and the Tudor Building Circular respectively, net assets of the Group

increased from GBP176.2 million at 31 December 2009 to GBP210.7 million. As a

result of these two transactions, Equity Attributable to Shareholders increased

from GBP104.5 million to GBP135.9 million, while Equity Attributable to

Shareholders in pence per Unit reduced from 144 pence to 83 pence per Unit,

principally reflecting the dilution arising from the Placing.

Following receipt by the Group of the net proceeds from the Disposal, and after

elimination of the Liberty assets and liabilities that are included in the 2009

Group Financial Statements, Equity Attributable to Shareholders will increase as

a result of the Disposal from GBP135.9 million to GBP139.9 million.

This increase in Equity Attributable to Shareholders of GBP4.0 million amounts

to an additional 2 pence per Unit attributable to Shareholders. This will be in

addition to the Equity Attributable to Shareholders at 31st December 2009 after

the Placing and the Tudor Building Sale referred to above of 83 pence per Unit.

As a result, pro forma Equity Attributable to Shareholders after completion of

the Disposal amounts to 85 pence per Unit. This shows the effect of the

increased net assets available to the Group as a result of the Disposal by

reference to the consolidated statement of financial position of the Company at

31 December 2009, after reflecting the effects of the Placing and the Tudor

Building Sale on the net assets of the Group in the manner referred to above.

Pro forma impact on MWB's audited net profit for the year ended 31 December 2009

The impact on the audited Group loss after tax for the year ended 31 December

2009 on the basis that this was prepared as if the Placing, the Tudor Building

Sale and the Disposal had taken effect on 1 January 2009 would have been as

follows:-

1. Net finance costs would decrease to reflect the reduction of debt arising

from the net proceeds of the Placing, the Tudor Building Sale and the Disposal;

2. The results of Liberty included in the 2009 Group Financial Statements, being

revenue of GBP60.8 million, EBITDA of GBP0.1 million, negative earnings before

interest and taxation of GBP2.7. million and a pre-tax loss of GBP3.4 million

would have been excluded from the results of the Group;

3. Rental costs in Liberty would increase by GBP2.1 million to reflect the sale

of the Liberty Tudor Building;

4. Depreciation charged at Liberty would decrease by GBP2.3 million to reflect

the Tudor Building Sale; and

5. The above four adjustments relating to the Placing, the Tudor Building Sale

and the Disposal would have the effect of reducing the taxation charge for the

year by GBP0.7 million.

7. 2009 Results and current trading

Detailed commentary on the Group's current trading and prospects is included in

the 2009 Group Financial Statements which were posted to Shareholders on 6 May

2010.

Equity Attributable to Shareholders reduced from GBP125.9 million or 174p per

share at 31 December 2008, to GBP104.5 million or 144p per share at 31 December

2009, principally reflecting retained losses for the year and the effective

portion of changes in fair value of cash flow hedges. After taking account of

the Placing that was completed in January 2010, Equity Attributable to

Shareholders at 31 December 2009 totalled GBP129.1 million, or 79p per share,

reflecting the issue price of the New Units of 30p per Unit. The Group's

property values stabilised during the year ended 31 December 2009, resulting in

a reduction in values during the year of only GBP2.1 million, in comparison to a

reduction of GBP79.2 million during the year ended 31 December 2008.

The Malmaison and Hotel du Vin trading results were steady during the year ended

31 December 2009 despite challenging market conditions, producing EBITDA of

GBP26.4 million, in comparison to GBP25.9 million in the previous year. Liberty

produced record levels of revenue of GBP60.8 million, being 20 per cent. higher

than those for the year ended 31 December 2008. At Business Exchange, EBITDA

declined 46 per cent. to GBP9.8 million, reflecting lower returns at centres

acquired from the MLS group while they are brought up to Group standards, and

aggressive pricing from the conventional property market.

Overall, the loss before tax of the Group increased to GBP15.4 million from

GBP9.9 million during the year ended 31 December 2008, reflecting the above

factors and high interest costs. The latter have been reduced going forward as a

result of the proceeds received from the Placing announced by the Company in

December 2009 and completion of the Tudor Building Sale, and would be reduced

further on completion of the Disposal.

On 12 May 2010, the Company issued its interim management statement covering the

period from 1 January 2010 to 12 May 2010, extracts of which are summarised

below.

Trading at Malmaison and Hotel du Vin performed in line with expectations in the

three months ended 31 March 2010, achieving its budgeted EBITDA despite revenues

in January 2010 being severely affected by the adverse weather conditions across

the country. While revenue generation remained challenging, Malmaison and Hotel

du Vin delivered year on year rate growth which, combined with strong cost

control, delivered the budgeted profit for the three months ended 31 March 2010.

The start of the second quarter of 2010 was adversely affected by the

unprecedented standstill in air travel throughout the UK and much of Northern

Europe. However, the outlook for the remainder of the quarter remains positive.

The average room rate for Hotel du Vin during April 2010 was GBP112, compared to

GBP111 for the year ended 31 December 2009, while Malmaison's average room rate

was GBP101 in April 2010, an increase from GBP99 for the year ended 31 December

2009.

Business Exchange continued to see signs of recovery in terms of rate stability

and occupancy growth. Over the four months ended 30 April 2010, demand from the

corporate market improved, especially in the City where occupancy remains

strong. The management at Business Exchange has continued to focus on cost

control and driving yield where possible as well as capitalising on revenue

opportunities in the market. Although demand during the four months ended 30

April 2010 remained broadly constant, Business Exchange's revenue conversion

levels improved, resulting in the volume of deals increasing, albeit for smaller

workstation requirements. As a result, occupancy at Business Exchange's leased

centres remained firm at similar levels to the occupancy level of 82 per cent.

For the year ended 31 December 2009. Revenue per available workstation and

revenue per occupied workstation improved slightly from GBP6,180 and GBP7,545

respectively at 31 December 2009.

At Liberty, revenue increased by 40 per cent. during the four months ended 30

April 2010, compared to the same period in 2009, driven by growth across the key

areas of Liberty's business, namely fabrics division, the flagship store and the

internet business. Revenue for the four months ended 30 April 2010 totalled

GBP26.0 million, an increase from GBP18.5 million in the comparative four months

to 30 April 2009.

Since the Company issued its interim management statement on 12 May 2010,

revenue generation in Malmaison and Hotel duVin has been 4 per cent. lower than

in the same period in 2009. However, continued strong cost control by management

has ensured that operating profit has been slightly higher than that achieved in

the same period in 2009. After increased financing costs, this has resulted in a

slightly increased loss before tax in Malmaison and Hotel du Vin for the period.

In Business Exchange, the market has remained challenging, and management has

concentrated on maintaining occupancy, although this has had some adverse effect

on average rate achieved. At the operating profit and pre-tax line, the results

are lower in Business Exchange than for the same period last year. This is due

to the additional costs arising from the integration of centres acquired from

the MLS group of companies during 2009 and the opening of new centres in

Knightsbridge and Paddington, all of which were referred to in the 2009 Group

Financial Statements. At Liberty, the increase in revenue generation in

comparison to the same period in 2009, has continued.

8. General Meeting

The Disposal is conditional upon Shareholders' approval being obtained at the

General Meeting to be held at the offices of Dechert LLP, 160 Queen Victoria

Street, London EC4V 4QQ at 11.00 a.m. on 21 June 2010 at which the Resolution

will be proposed to approve the Disposal.

To approve the Disposal, a majority of not less than 50 per cent. of those

voting in person or by proxy must vote in favour of the Resolution (unless a

poll is demanded, in which case, a majority of not less than 50 per cent. of the

votes cast in person or by proxy must be in favour of the Resolution).

9. Irrevocable undertakings

The Directors and persons connected with them have given irrevocable

undertakings to the Company and BGL to vote in favour of the Resolution to be

proposed at the General Meeting (and to procure that such action is taken by the

relevant registered holders) in respect of their beneficial holdings totalling

25,880,014 Units, representing 15.78 per cent. of the existing Units at the date

of this announcement.

In addition, certain other Shareholders have given irrevocable undertakings to

the Company and BGL to vote in favour of the Resolution to be proposed at the

General Meeting (and to procure that such action is taken by the relevant

registered holders) in respect of their beneficial holdings totaling 58,542,992

Units, representing 35.69 per cent. of the existing Units at the date of this

announcement.

In total, therefore, the Company and BGL have received irrevocable undertakings

to vote in favour of the Resolution to be proposed at the General Meeting in

respect of beneficial holdings totaling 84,423,006 Units, representing 51.47 per

cent of the existing Units at the date of this announcement. The total amount of

beneficial holdings to which these irrevocable undertakings relate exceeds the

majority of not less than 50 per cent. of those voting in person or by proxy (or

if a poll is demanded a majority of not less than 50 per cent. of the votes cast

in person or by proxy) required to pass the Resolution.

10. Recommendation

The Board considers that the Disposal is in the best interests of the Company

and the Shareholders as a whole. The Board has received financial advice from

Panmure Gordon on the Disposal. In giving its financial advice to the Board,

Panmure Gordon has relied on the Board's commercial assessment of the Disposal.

Accordingly, the Board recommends that Shareholders vote in favour of the

Resolution to be proposed at the General Meeting, as the Directors intend to do

in respect of their own holdings totalling 25,880,014 Units, representing 15.78

per cent. of the existing Units.

Appendix

Senior Management of Liberty

The senior management of Liberty consists of the following persons:

+----------------------------------+-----+--------------------+

| Name | Age | Job title |

| | | |

+----------------------------------+-----+--------------------+

| Geoffroy de La Bourdonnaye | 53 | Chief Executive of |

| | | Liberty |

+----------------------------------+-----+--------------------+

| Paul Harris | 40 | Finance Director |

| | | of Liberty |

+----------------------------------+-----+--------------------+

Geoffroy de La Bourdonnaye, MBA INSEAD, BA EM Lyons and HEC Montreal

Geoffroy de La Bourdonnaye joined Liberty in July 2007 from LVMH where he had

served four years as President of the Christian Lacroix house. Before joining

LVMH, Geoffroy held general management, retail and marketing positions at

l'Oreal, PepsiCo and The Walt Disney Company. In his 13 years at Disney, he was

successively in charge of the Consumer Products division for Europe and of the

60 stores and supply chain operations of Disneyland Resort Paris. Geoffroy is a

board member of the Research Centre for Fashion at Central St Martins College of

Arts and Design in London and he also teaches at IFM, the Paris-based fashion

management school.

Paul Harris, BA (Hons), ACMA

Paul Harris was appointed Finance Director of Liberty in April 2008, having been

its Financial Controller since joining Liberty in July 2006. Paul has spent most

of the past eleven years working in the retail sector. This included five years

with Selfridges & Co where he was part of the team that oversaw the opening of

both the Manchester and Birmingham city centre stores and two years as a retail

financial analyst at Selfridges' Trafford Centre. Before joining Liberty, he was

finance manager for Kurt Geiger where he was responsible for group budgeting as

well as chairing the capital committee which assessed and recommended capital

investment projects.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISKKFDNBBKDKPB

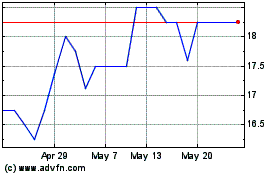

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024