TIDMGUN

RNS Number : 5575I

Gunsynd PLC

19 April 2022

Gunsynd plc

("Gunsynd", or "the Company")

Interim Results for the six months ended 31 January 2022

Chairman's Statement

I am pleased to report the interim results for the six months

ended 31 January 2022.

Review of Investments

Low 6 Limited ("Low6")

Low6 completed US$5 million financing during January and

February 2022 supported by existing shareholders, together with new

sophisticated North American investors. As announced on 2 February

2022, Low6 entered into a binding letter of agreement with 1319735

B.C. Ltd. ("735"), a British Columbian corporation with a view to

undertaking a transaction that would result in a reverse takeover

of 735 by Low6 while at the same time pursuing a listing of the

combined entity on the TSX Venture Exchange.

Gunsynd holds 6,667 shares (for approximately GBP200,000)

together with a GBP65,000 convertible loan note.

The key growth drivers for new business in the coming years is

Low6's iGaming white label technology platform and this has already

helped Low6 achieve a major new business milestone. Low6 has won a

seven-figure contract to become the official supplier of "free to

play" games for an iGaming provider for the next two years, with an

option to extend for a third.

Rincon Resources Pty Ltd ("Rincon")

Gunsynd holds 8.9 million shares representing approximately 17%

of Rincon's issued share capital.

Rincon is a Western Australian ("WA") focussed gold and base

metals exploration company quoted on the ASX. It holds the rights

to three highly prospective gold and copper projects in WA, with a

main focus on the South Telfer Project, covering 50,000-hectares in

Paterson province.

During the period, the 5,000m Phase 2 reverse circulation ("RC")

and diamond drilling ("DD") programme at Hasties has recommenced.

DD drilling is set to test the 'Hasties Deeps' target area, 300m

below surface. The Phase 2 drilling programme initially commenced

in December 2021, with 7 RC holes completed for 1,476m.

Approximately 3,000m remains to be drilled, including up to 8 RC

and 2 DD holes.

Eagle Mountain Mining Limited ("Eagle Mountain")

Gunsynd holds 2.5 million shares in Eagle Mountain representing

approximately 1% of its issued share capital.

Eagle Mountain Mining Limited (ASX:EM2), is a copper focused

exploration and development company with a key objective of

becoming a low emission producer at its high-grade Oracle Ridge

project in Arizona, USA, to supply the rapidly growing green energy

market.

During the period, the Eagle Mountain updated its JORC Mineral

Resource Estimate ("MRE") for the Oracle Ridge Copper Project.

Using a 1.0% Cu cut-off grade, the company delivered an updated

figure of 17.0 Mt grading 1.48% Cu, 15.09g/t Ag and 0.17g/t Au for

251,000t of contained copper, 8.2Moz of silver and 93Koz of gold.

Compared to the previous MRE, contained copper increased by 36%

with a 39% increase in tonnes. Furthermore, since the MRE cut-off

date, a further 60 holes have been completed that were not included

in the resource.

Eagle Mountain continues to be well funded following completion

of a AUD$16m equity financing in early April 2022.

Rogue Baron Limited ("Rogue Baron")

Rogue Baron PLC (AQSE: SHNJ) is a leading company in the premium

spirit sector which listed on the Access segment of the AQSE Growth

Market on 12 March 2021. Gunsynd currently holds 21,543,563

ordinary shares in Rogue Baron, representing approximately 24% of

its issued share capital. Gunsynd also retains a balance of

GBP111,464 of Convertible Loan Notes consisting of accrued

interest.

Rogue Baron's flagship Shinju Whisky won two medals in October

2021 including a double gold with a perfect score of 100 when voted

best whisky at the 2021 Sante' International Spirit Competition.

During the period Rogue Baron closed down the smaller of its two

Washington DC bars to concentrate on the new and much larger venue

(De Rhum Spot). In November Shinju won another gold medal, this

time at the prestigious John Barleycorn awards.

In April 2022, Rogue Baron announced it had secured new

distribution deals in both the UK and Spain for Shinju.

Charger Metals Limited ("Charger")

Gunsynd currently holds 3,000,000 shares in Charger representing

approximately 6% of Charger's issued share capital, of which

1,200,000 shares are subject to an escrow period of 24 months

following its IPO on 7 July 2021.

Charger is a Western Australian ("WA") focussed base metals

(Ni,Cu,Co-PGE) and lithium exploration company which currently

holds three highly prospective projects in WA and the Northern

Territory ("NT") in Australia. Charger has an 85% interest in the

Coates North Project and 70% interest in the adjacent Coates

Ni-Cu-Co-PGE Project (WA), 70% interest in the Lake Johnson Lithium

and Gold Project (WA) and 70% interest in the Bynoe Lithium and

Gold Project (NT).

In March 2022, Charger announced its drilling schedule for the

Coates North Project and the Coates Ni-Cu-Co-Au-PGE Project

(together "Coates Project"), located 65km northeast of Perth,

Western Australia. The Coates Project contains a mafic intrusive

complex within the Jimperding Metamorphic Belt, which also hosts

the 17Moz PdEq Julimar - Gonneville nickel-copper-PGE Project owned

by Chalice Mining Ltd (ASX: CHN) and located 28km NW of the Coates

Project. Charger announced in April 2022 that it expects the maiden

drill programme to commence shortly at the Coates Project, with

five diamond core drill holes planned to test conductor targets for

economic mineralisation.

First Tin Limited ("First Tin") Formerly Anglo Saxony Mining

Limited ("ASM")

In March 2021, Gunsynd invested GBP125,000 in ASM, a now public

tin development and exploration company, as part of a wider GBP6m

funding round. In April 2022, Gunsynd invested a further GBP75,000

in the IPO of First Tin which was part of a GBP20,000,000 IPO

fundraise.

First Tin, a tin development company with advanced, low capex

projects in Germany and Australia, commenced trading of its

ordinary shares to trading on the Main Market of the London Stock

Exchange on 8 April 2022, with the TIDM 1SN.

First Tin plans to establish sustainable tin production and

processing from the Tellerhäuser Mine in Saxony, Germany. The

Tellerhäuser Mine has a 50-year mining licence granted in 2020 with

final permitting well advanced.

Pacific Nickel Limited ("Pacific Nickel")

During the period Pacific Nickel made good progress on its two

tenements in the Solomon Islands. In October 2021 it announced an

initial JORC resources estimate for its Jejevo licence. In

September it commenced stage two infill drilling at its Kolosori

tenement. In October 2021 it announced that 90 infill holes had

been drilled as part of the second stage 151-hole drill programme

designed to increase the confidence of the existing mineral

resource estimate of 5.89Mt at 1.55% Ni at 1.2% Ni cut off and that

discussions with potential Direct Ship Ore ("DSO") off-take

partners had commenced.

Pacific Nickel successfully raised AUD$5.25m in October 2021 to

advance both its Solomon Islands projects. In November 2021, it

announced both assay results from 27 drill holes at Kolosori and an

executive summary of a scoping study for its Kolosori DSO project.

In December 2021, Pacific Nickel announced that it had initiated an

early works programme. This programme was successfully completed in

March 2022. Finally in April 2022, Pacific Nickel advised it had

received a number of proposals with respect to offtake agreements

for its Kolosori project and that its mining lease application was

under consideration by the Solomon Islands government.

Oscillate plc ("Oscillate")

Oscillate is an investment company listed on the AQSE Growth

Market Exchange with the ticker, AQSE: MUSH. In April 2021, Gunsynd

invested GBP200,000 into Oscillate being 10 million shares at 2p

representing circa 4.5% of Oscillate. Other than a change at board

level, very little has happened since the year end.

Oyster Oil and Gas Limited ("Oyster")

Gunsynd has a holding valued at GBP130k, and there has been no

material change since year end. The rising oil price gives the

Company confidence of restoring value. Gunsynd will update the

market as and when material developments occur.

Overview

All of our investments are minority investments. Whilst we may

offer advice to management of investee companies in this regard,

they can, and sometimes do, ignore such advice. Similarly, private

companies don't have the disclosure requirements of public

companies and are under no obligation to keep us regularly updated.

It should be noted that the Company does not operate its investment

projects/companies on a day-to-day basis and whilst the Board looks

to structure investments in a format where Gunsynd can obtain a

high level of oversight (including at board level) and use legal

agreements to provide control mechanisms to protect the Company's

investments, there is a risk that the operator does not meet

deadlines or budgets, fails to pursue the appropriate strategy,

does not adhere to the legal agreements in place or does not

provide accurate or sufficient information to Gunsynd. Decisions

are ultimately made by investee companies and not by Gunsynd.

The level of administrative costs in the year can fluctuate

significantly depending on the level of costs in the Company and

can fluctuate significantly depending on the level of activity,

both with regard to the due diligence work carried out on

investments and disposals, and in managing pr oject

investments.

Finance Review

The Company's loss for the period was GBP310,000 (31 January

2021: GBP1,032,000 profit). The realised and unrealised market

valuation on financial investments for the period was a loss of

GBP56,000 (31 January 2021: GBP1,280,000 gain).

The Company had net assets at 31 January 2022 of GBP5,993,000

(31 January 2021: GBP4,848,000) including cash balances of

GBP1,082,000 (31 January 2021: GBP1,000,000).

Outlook

We previously stated "Debate lingers over whether the effects

are a temporary hiccup or the harbinger of structural changes. We

are far from convinced that the current inflation level is just a

blip, hence our positioning towards gold and copper." We stand by

that. The policy response by politicians the world over to Covid

has now clearly been shown to have been vastly overdone. With

governments lacking the courage to curtail spending and with

central banks very aware that sustained interest rate increases may

well cause a recession and possibly even a sovereign debt crisis,

we believe that on the balance of probabilities the base case is

for inflation to remain higher than in recent years and commodity

prices to remain elevated for at least the medium term if not

longer. Whilst at the junior resource company level in the UK there

is clearly a disconnect between commodity and share prices, history

tells us that at some stage reversion to mean will occur i.e.

either share prices go up or commodity prices will fall. We believe

the former is more likely than the latter.

As a well known investor once said "Price is what you pay, and

value is what you get".

The Board continues to look at investments in line with its

investment policy as highlighted on its website. Such investment(s)

may or may not lead to a reverse takeover.

The Board would like to take this opportunity to thank

shareholders for their continued support.

Hamish Harris

Chairman

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information, please contact:

Gunsynd plc:

Hamish Harris / Peter Ruse +44 (0) 78 7958 4153

Cairn Financial Advisers LLP

James Caithie / Liam Murray / James Western +44 (0) 20 7213 0880

Peterhouse Capital Limited

Lucy Williams +44 (0) 20 7469 0936

The interim results will be available electronically on the

Company's website: www.gunsynd.com .

Gunsynd plc

Interim statement of comprehensive income - unaudited

For the six months ended 31 January 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 January 31 January 31 July

2022 2021 2021

GBP'000 GBP'000 GBP'000

Unrealised (loss)/gain on financial

investments (170) 1,166 2,371

Realised gain on financial investments 114 114 236

------------ ------------ ---------

(56) 1,280 2,607

Administrative and other costs (254) (252) (523)

Impairment of financial investments - - (130)

Write down of convertible loan

notes - - (2)

Share based payment charge - (25) (24)

Other income - - 26

Finance income - 29 58

(Loss)/profit before tax (310) 1,032 2,012

Taxation

------------ ------------ ---------

(Loss)/profit for the period (310) 1,032 2,012

------------ ------------ ---------

(Loss)/profit for the period and

total comprehensive (loss)/profit

attributable to equity shareholders (310) 1,032 2,012

------------ ------------ ---------

Other comprehensive (expenditure)/income - - -

for the period net of tax

Total comprehensive (expenditure)/income

for the period (310) 1,032 2,012

------------ ------------ ---------

(Loss)/ earnings per ordinary

share

Basic (0.069) 0.341 0.558

Diluted (0.069) 0.256 0.428

Gunsynd plc

Interim statement of financial position - unaudited

As at 31 January 2022

Unaudited Unaudited Audited

At 31 January At 31 January At 31 July

2022 2021 2021

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Financial investments 4,817 3,704 5,124

Trade and other receivables - 49 -

--------------- --------------- ------------

Total non-current assets 4,817 3,753 5,124

--------------- --------------- ------------

Current assets

Trade and other receivables 156 185 174

Cash and cash equivalents 1,082 1,000 1,071

--------------- --------------- ------------

Total current assets 1,238 1,185 1,245

Total assets 6,055 4,938 6,369

--------------- --------------- ------------

LIABILITIES

Current liabilities

Trade and other payables (62) (90) (66)

--------------- --------------- ------------

Total current liabilities (62) (90) (66)

--------------- --------------- ------------

Total liabilities (62) (90) (66)

--------------- --------------- ------------

Net assets 5,993 4,848 6,303

--------------- --------------- ------------

EQUITY

Equity attributable to equity

holders of the company

Ordinary share capital 382 332 382

Deferred share capital 2,299 2,299 2,299

Share premium reserve 13,459 13,033 13,459

Share-based payments reserve 131 216 131

Retained earnings (10,278) (11,032) (9,968)

--------------- --------------- ------------

Total equity 5,993 4,848 6,303

--------------- --------------- ------------

Gunsynd plc

Interim statement of changes in equity - unaudited

For the six months ended 31 January 2022

Ordinary Deferred Share Share Retained Total

Share share Premium Based earnings

Capital capital Payment

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited (restated)

--------- --------- --------- --------- ---------- --------

At 31 July 2020 216 2,299 11,828 192 (12,065) 2,470

--------- --------- --------- --------- ---------- --------

Profit for the six month

period ended 31 January

2021 - - - - 1,032 1,032

--------- --------- --------- --------- ---------- --------

Total comprehensive income

for the period - - - - 1,032 1,032

Issue of share capital 116 - 1,261 - - 1,377

Share issue costs - - (56) - - (56)

Share options issued - - - 25 - 25

Share options lapsed - - - (1) 1 -

At 31 January 2021 332 2,299 13,033 216 (11,032) 4,848

--------- --------- --------- --------- ---------- --------

Audited

At 31 July 2020 216 2,299 11,828 192 (12,065) 2,470

--------- --------- --------- --------- ---------- --------

Profit for the year - - - - 2,012 2,012

--------- --------- --------- --------- ---------- --------

Total comprehensive income

for the year - - - - 2,012 2,012

Transactions with owners:

Issue of share capital 166 - 1,690 - - 1,856

Share issue costs - - (59) - - (59)

Share options issued - - - 24 - 24

Share options lapsed - - - (84) 84 -

Transfer within Equity - - - (1) 1 -

At 31 July 2021 382 2,299 13,459 131 (9,968) 6,303

--------- --------- --------- --------- ---------- --------

Unaudited

--------- --------- --------- --------- ---------- --------

At 31 July 2021 382 2,299 13,459 131 (9,968) 6,303

--------- --------- --------- --------- ---------- --------

Loss for the six month

period ended 31 January

2022 - - - - (310) (310)

--------- --------- --------- --------- ---------- --------

Total comprehensive expenditure

for the period - - - - (310) (310)

At 31 January 2022 382 2,299 13,459 131 (10,278) 5,993

--------- --------- --------- --------- ---------- --------

Gunsynd plc

Interim statement of cash flows - unaudited

For the six months ended 31 January 2022

Unaudited Unaudited Audited

Six months ended Six months ended Year

31 January 2022 31 January 2021 ended

31 July

2021

GBP'000 GBP'000 GBP'000

------------------ ------------------ ---------

Cash flows from operating activities

(Loss)/profit after tax (310) 1,032 2,012

Finance income net of finance costs - (29) (58)

Unrealised (gain)/loss on revaluation of financial investments 170 (1,166) (2,371)

Realised (gain)/loss on sale of financial investments (114) (114) (236)

Share based payments - 25 24

Impairment provision - - 130

Write down of convertible loan notes - - 2

Foreign exchange movements - - 3

Operating cash flow before changes in working capital (254) (252) (519)

Movement in trade and other receivables 18 1 7

Movement in trade and other payables (4) (8) (32)

Cash flow from operations (240) (259) (519)

Tax received - - -

------------------ ------------------ ---------

Net cash flows from operating activities (240) (259) (519)

Cash flow from investing activities

Payments for financial investments (44) (1,396) (2,143)

Disposal proceeds from sale of financial investments 295 ` 1,042

Repayment of loans to investee company - - 62

Unsecured loans to investee company - (25) (6)

Net cash flow from investing activities 251 (900) (1,045)

Cash flows from financing activities

Proceeds on issuing of ordinary shares - 1,377 1,856

Cost of issue of ordinary shares - (56) (59)

------------------ ------------------ ---------

Net cash flow from financing activities - 1,321 1,797

Net increase/(decrease) in cash and cash equivalents 11 162 233

Cash and cash equivalents at start of period 1,071 838 838

Cash and cash equivalents at end of period 1,082 1,000 1,071

------------------ ------------------ ---------

Notes to the interim report

For the six months ended 31 January 2022

1 Basis of preparation

As permitted IAS 34, 'Interim Financial Reporting' has not been

applied to these half-yearly results. The financial information of

the Company for the six months ended 31 January 2022 have been

prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards,

International Accounting Standards and Interpretations

(collectively "IFRS") issued by the International Accounting

Standards Board ("IASB") as adopted by the European Union ("adopted

IFRS") and are in accordance with IFRS as issued by the IASB. The

condensed interim financial information has been prepared using the

accounting policies which will be applied in the Company's

statutory financial statements for the year ending 31 July

2021.

The financial information shown in this publication is unaudited

and does not constitute statutory accounts as defined in Section

434 of the Companies Act 2006. The comparative figures for the

financial year ended 31 July 2021 have been derived from the

statutory accounts for 2021. The statutory accounts have been

delivered to the Registrar of Companies. The auditors have reported

on those accounts; their report was unqualified and did not contain

statements under the section 498(2) or 498(3) of the Companies Act

2006.

2 Earnings per share

The calculation of the loss per share is based on the loss

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 January 31 January 31 July

2022 2021 2021

GBP'000 GBP'000 GBP'000

(Loss)/profit on ordinary activities

after tax (310) 1,032 2,012

Weighted average number of ordinary

shares for the purposes of basic

(loss)/earnings per share (millions) 449.80 302.58 362.57

Weighted average number of ordinary

shares for the purposes of diluted

(loss)/earnings per share (millions) 543.76 403.95 470.73

Basic (loss)/earnings per share

(expressed in pence) (0.069) 0.341 0.558

Diluted (loss)/earnings per share

(expressed in pence) (0.069) 0.256 0.428

However, due to losses incurred in the half year there is no

dilutive effect from the potential exercise of the share options in

existence.

3 Events after the end of the reporting period

4. Financial Information

The Board of Directors approved this interim report on 14 April

2022.

A copy of this report can be obtained from our website at

www.gunsynd.com

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGMDKLLGZZG

(END) Dow Jones Newswires

April 19, 2022 02:02 ET (06:02 GMT)

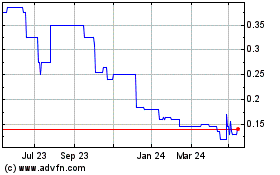

Gunsynd (LSE:GUN)

Historical Stock Chart

From May 2024 to Jun 2024

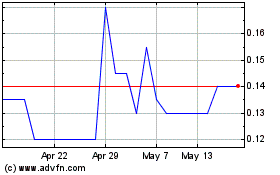

Gunsynd (LSE:GUN)

Historical Stock Chart

From Jun 2023 to Jun 2024