TIDMGUN

RNS Number : 5638A

Gunsynd PLC

30 September 2020

Gunsynd plc

("Gunsynd" or the "Company")

New Investment - Angold Resources Ltd

Gunsynd Plc (AIM: GUN, AQSE: GUN) is pleased to announce that it

has invested C$100,000 (approximately GBP58,000) into the gold

exploration company Federal Gold Corp (to be renamed Angold

Resources Ltd subject to completion of a reverse takeover as

detailed below ("Angold" or the "Issuer")). This investment

complements the Company's recent investment in gold and copper

explorer Rincon Resources as announced on 22 and 23 June 2020.

Subject to a number of conditions, including receipt of

regulatory consents, TSX Exchange approval and completion of a

fundraising as further described below and in which Gunsynd is

participating, the Issuer will complete a reverse takeover (the

"RTO") of ZTR Acquisition Corp (ZTR.H:APH) ("ZTR"), whereby ZTR

will acquire all of the issued and outstanding share capital of the

Issuer. The 35,187,000 existing shares in the Issuer will be

exchanged for common shares of ZTR (the "Exchange Shares") on a

one-for-one basis.

ZTR is the former company Oyster Oil and Gas Ltd which was moved

to the NEX Board of the TSX Venture Exchange in June 2019 and in

which Gunsynd currently holds 462,500 shares. The RTO price of

C$0.40c values the existing Gunsynd holding of ZTR shares at

C$185,000 (approximately GBP107,000).

The Issuer is a widely-held private company which controls the

rights to the Uchi, Iron Butte, Dorado and Cordillera mineral

exploration projects located in the Province of Ontario, the State

of Nevada and the Republic of Chile, respectively. Following

completion, it is anticipated that exploration and development of

the Uchi and Dorado projects will be its primary focus. The

following selected financial information is taken from the

unaudited financial statements of Federal Gold Corp for the

three-month period ended July 31, 2020:

Total Assets C$232,720

Total Liabilities C$127,277

----------

Net Loss C$5,150

----------

Dorado Property (Chile)

The Dorado property is located in the Maricunga region of Chile,

approximately 135 km east of Copiapo. The property, which covers an

area of 1,600 hectares is reported to feature a significant but

poorly defined gold-rich porphyry system which outcrops at surface.

Additionally, the property is reported to be host to significant

zones of hydrothermal alteration at surface which have not been

explored or drilled.

Iron Butte Property (Nevada)

The Iron Butte Property is located 60 km south of Battle

Mountain, Nevada. The property, which covers an area of

approximately 200 hectares, features a well-defined bulk-tonnage

epithermal gold and silver system which outcrops at surface.

Federal Gold has an option to acquire the property by making a

series of staged cash and share payments totalling US$1,572,750

over six years and arranging for the issuance of 187,500 common

shares of the Company to the optionholder.

Uchi Property (Ontario)

The Uchi property is located approximately 80 km east of Red

Lake, Ontario in the Birch-Uchi greenstone belt. The western

portion of the property is adjacent to the past-producing South Bay

Cu-Zn-Ag mine. The eastern portion of the property is adjacent to

the past-producing Uchi Au mine. The property, which covers an area

of 5,232 hectares represents a regional exploration opportunity in

a greenstone belt with known zones of significant mineralization,

but which remains relatively underexplored.

Cordillera (Chile)

The Cordillera property is located in the Maricunga region of

Chile, approximately 100 km east of Copiapo. The property, which

covers an area of approximately 1,680 hectares, is located 7 km

south of the Maricunga Mine, formerly operated by Kinross, and 3 km

north of the Caspiche Deposit, now being developed by the Norte

Abierto Joint Venture between Barrick and Newmont. The Cordillera

property is an early stage property prospective for porphyry gold

and epithermal gold style mineralization which has not been

adequately explored.

The investment was executed on the following terms:

Subscription for 250,000 ordinary shares at C$0.40c for a total

consideration of C$100,000 (approximately GBP58,000) as part of a

proposed capital raising of up to C$8,000,000.

As a result, conditional on completion of the fundraising and

RTO, Gunsynd will hold 712,500 ordinary shares in Angold. A further

announcement will be made in due course.

Peter Ruse, a director of Gunsynd, commented: "We are pleased to

announce this investment into Angold Resources, an investment and

transaction that we hope will resurrect value from a holding that

had been largely written off. Angold represents an attractive entry

into two core projects situated in the two very mining friendly

jurisdictions of Chile and Nevada, USA."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

The Directors of Gunsynd accept responsibility for this

announcement.

For further information please contact:

Gunsynd plc

Hamish Harris / Peter Ruse +44 (0) 78 7958 4153

Cairn Financial Advisers LLP

James Caithie / Liam Murray /

Mark Rogers +44 (0) 20 7213 0880

Peterhouse Capital Limited

Lucy Williams +44 (0) 20 7469 0936

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCWPUWUBUPUUQU

(END) Dow Jones Newswires

September 30, 2020 02:04 ET (06:04 GMT)

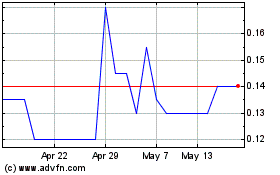

Gunsynd (LSE:GUN)

Historical Stock Chart

From May 2024 to Jun 2024

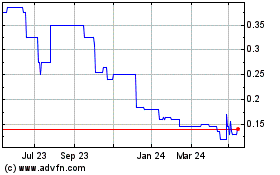

Gunsynd (LSE:GUN)

Historical Stock Chart

From Jun 2023 to Jun 2024