TIDMGUN

RNS Number : 9992K

Gunsynd PLC

27 April 2020

Gunsynd plc

("Gunsynd", or "the Company")

Interim Results for the six months ended 31 January 2020

Chairman's Statement

I am pleased to report the interim results for the six months

ended 31 January 2020.

Review of Investments

Human Brands Inc. ("HB")

Human Brands is a private company which owns, licenses, and

markets a portfolio of liquor brands. Its two key products are an

aged tequila (Copa Imperial Tequila) and a Japanese Whiskey (Shinju

Whiskey). On 27 January 2020, the Company announced that it had

rolled up its existing investments in Human Brands into a new

GBP378,575 convertible loan note.

A number of distribution deals have recently been signed for

Shinju, extending its distribution to include Florida, California

and New Jersey, in addition to Maryland/DC, Massachusetts and New

York.

Human Brands has entered into conditional agreements with the

owners of the Santo Coyote restaurant in Guadalajara to develop two

new bar/restaurants in conjunction with Santo Coyote management. In

addition, Human Brands has conditionally taken a minority stake in

a new bar (Santo Cantina), within the Santa Coyote restaurant, the

consideration for which will be settled in a cash and shares. Human

Brands' Armero tequila brand will be heavily promoted on the menu

at these locations and Shinju will also be available. These

agreements are on hold for now due to the COVID-19 situation in

Mexico.

Whilst numerous states in the US have gone into lockdown this

looks like ending sooner rather than later. The lockdown has

impacted Human Brands particularly with respect to its bar in

Washington DC which has had to shut temporarily.

As announced on 10 December 2019, Human Brands intends to

re-domicile its business from the US to the UK and change its name

to Rogue Baron Ltd and then raise further funds. This process is

still ongoing and has been impacted by the effects of COVID-19 on

confidence and markets.

United Oil and Gas Plc ("UOG")

UOG is an independent oil & gas company established in 2015

by a former Tullow Oil team. Its strategy is to acquire assets

where the management team's experience can drive near-term activity

and unlock previously untapped value.

In September 2019, UOG was awarded four blocks in a North Sea

licensing round which follows on from UOG signing a non-binding

Heads of Terms on an agreement to sell North Sea blocks 15/18d and

15/19b to Anasuria Hibiscus UK Limited for a headline consideration

of up to US$5 million.

Prior to that, UOG announced a c onditional acquisition by UOG

of Rockhopper Egypt Pty Ltd ("Rockhopper Egypt") for US$16

million.

Following the announcement on 20 December 2019, issued pursuant

to media reports in Egypt, ASH-2, which was drilled to a total

depth of 4,030m in the Alem El Buieb (AEB) Formation, has been

completed to allow selective production from both an upper and

lower reservoir interval. The upper and lower intervals were tested

separately at maximum gross rates of 7,027 and 3,851 boepd

respectively.

ASH-2 came on stream on 2 January 2020 and has been consistently

producing at over 3,000 boepd (660 boepd net to Rockhopper's 22%

interest) on a 32/64" choke. The well will continue to be monitored

over the coming months, and during this period, the interpretation

of the test data and the longer-term planning for the ASH

field-development will continue with the joint venture partners and

Egyptian General Petroleum Corporation ('EGPC'). They are currently

drilling the first well in the 2020 infill programme (El Salmiya 5)

with an update due on this shortly.

Since ASH-2 came on stream, gross production from the Abu Sennan

licence has averaged c. 8,000 boepd, which equates to c. 1,760

boepd net to Rockhopper's 22% interest. On April 2 it was announced

that gross production in Egypt was 8,400 boepd (1,850 net to

UOG)

20% of United's net production is gas which is sold under a

fixed price contract that is relatively insensitive to oil-price

changes.

In response to COVID-19, UOG has deferred Italian capex, reduced

its Egyptian infill campaign from 4 to 2 wells, cut admin

expenditure and looked at divestment plans for selected non-core

assets.

Gunsynd currently holds 1.93 million shares in UOG which is a

holding of approximately 0.3%

Sunshine Minerals Limited ("Sunshine")

The Company has an 18.2% interest in Sunshine Minerals, a

company with nickel interests in the Solomon Islands.

On 2 December 2019, Sunshine announced that an ASX listed

company, Malachite Resources ("Malachite"), had entered into a

conditional share subscription agreement with Sunshine to acquire a

15% stake. The Company understands that Malachite continues to

undertake due diligence on the transaction including site visits

and analysis of the relevant drilling data.

On 20 December 2019, the Company announced a dispute between

Axiom Mining Limited ("Axiom") and the Mines and Minerals Board of

the Solomon Islands ("MMERE") relating to certain of Sunshine's

assets was still ongoing. The Company notes that the Solomon

Islands government purportedly cancelled Axiom's foreign investor

certificates for alleged failure to complete surveys and hold a

provincial business licence.

Gunsynd's interest in Sunshine Minerals Limited is likely to be

diluted by certain consultants' fees owed being paid in equity, and

the Malachite share subscription if it were to proceed. Malachite

Resources has now held its AGM which was needed in order to allow

the conversion of certain debts to equity.

Kolosori Nickel Limited ("Kolosori")

On 4 December 2019, the Company announced it had purchased a

7.67% stake in Kolosori, which owns 80% of the nickel prospecting

licence PL05/19 over the Kolosori Prospect in the Solomon Islands,

for consideration of GBP45,000. Gunsynd also had an option to

acquire a larger stake but did not take this up. Kolosori has been

in talks with a party regarding the financing of a work programme

but no binding agreement has been reached.

Oyster Oil and Gas Limited ("Oyster") now ZTR Acquisition

Corporation ("ZTR")

On 29 November 2019, the Company announced it had entered into a

binding term sheet with Sajawin Pty Ltd ("Sajawin") to

conditionally sell the Oyster Madagascar licence for circa

GBP260,000 subject to various conditions.

The Production Sharing Contract for Blocks 1-4 in the Republic

of Djibouti are not included in the above transaction and will be

transferred to a party of Subco's choosing before completion of the

sale to Sajawin. Oyster remains in discussions with the Djibouti

government over these blocks and given the current circumstances

with respect to oil prices and the effect of COVID-19 on capital

markets it is possible that some or all of the blocks will be

relinquished.

Sajawin continues to undertake the necessary work to meet the

conditions precedent to conclude this deal.

As notified on 2 July 2019 Oyster has reached an "in principle"

agreement with the Government of Madagascar for a two-year

extension to the current exploration phase, however this has still

yet to be formally documented. As such the conditions precedent for

the deal have yet to be met, given this and the current oil price

Gunsynd is in discussions with Sajawin regarding extending the long

stop date on the transaction.

Brazil Tungsten Holdings Limited ("BTHL")

On 7 February 2020, the Company announced that it had been

notified by BTHL, a company in which it has a 6.18% interest, that

BTHL had very constrained working capital and that, in order to

continue with its operations, it would need to undertake a deep

discounted rights issue, which would lead to a significant dilution

in Gynsynd's shareholding or alternatively that BTHL would place

itself into administration which would reduce Gunsynd's interest to

nil. The rights issue was not taken up by shareholders and as a

result BTHL are in discussion with lawyers over the best way to

wind the company up. There will be likely to be no money

distributed to shareholders after liquidation.

The Company has since written down its investment in BTHL by

GBP400,000 to nil.

All of our investments are minority investments. Whilst we may

offer advice to management of investee companies, they can and

sometimes do ignore such advice. Similarly, private companies don't

have the disclosure requirements of public companies and are under

no obligation to keep us constantly updated. Decisions are

ultimately made by investee companies not by the Company.

Finance Review

The Company's loss for the period was GBP642,000 (31 January

2019: GBP248,000 loss). The increase in loss from last year is

attributable to the GBP400,000 impairment expense for the period in

relation to the Company's investment in BTHL. The market valuation

gain for "available for sale" assets was a loss of GBP13,000 (31

January 2019: GBP178,000 loss).

The Company had net assets at 31 January 2020 of GBP1,721,000 (

31 January 2019 : GBP2,175,000) including cash balances of

GBP225,000 ( 31 January 2019 : GBP543,000).

Outlook

The outbreak of the coronavirus and subsequent government

actions have had an extraordinarily negative economic impact which

has been reflected on global stock exchanges. The panic selling has

seen dramatic falls in share prices. However, in recent days there

seems to be a shift towards optimism as parts of Europe are talking

of partially ending their lockdowns. Hopefully this sentiment will

flow through to the markets. Historically alcohol has been regarded

as recession proof which gives us grounds for some confidence even

if the economy enters a prolonged recession which we obviously hope

it won't.

Over the past quarter the board of Gunsynd has been actively

conducting due diligence on a number of early stage exploration

opportunities in the Australian precious metals sector. With the

current gold price reaching record highs of 1,800 USD/oz ($2,800

AUD/oz equivalent) early stage exploration has a strong tail-wind

of risk capital willing to invest in in this sector. Due diligence

is ongoing and the board hopes to secure an attractive exposure in

this space in the short to medium term.

Gunsynd maintains a low fixed cost structure and with no large

General and Administration expenses and this will continue through

volatile and uncertain conditions across global markets.

The Board would like to take this opportunity to thank

shareholders for their continued support.

Hamish Harris

Chairman

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Gunsynd plc:

Hamish Harris +44 (0) 20 7440 0640

Nominated Adviser / AQSE Corporate Adviser:

Cairn Financial Advisers LLP

James Caithie / Liam Murray +44 (0) 20 7213 0880

Joint Broker:

Peterhouse Corporate Finance

Lucy Williams +44 (0) 20 7469 0930

The interim results will be available electronically on the

Company's website: www.gunsynd.com .

Gunsynd plc

Interim statement of comprehensive income - unaudited

For the six months ended 31 January 2020

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

31 January 31 January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

Unrealised (loss) on available

for sale assets (13) (178) (224)

Realised Profit on available for

sale assets (2) 56 35

------------ ------------ ------------

(15) (122) (189)

Administrative and other costs (208) (139) (347)

Share of associate losses (34) - (6)

Impairment of financial investments (400) - (100)

Other income - - 50

Finance income 15 13 34

Loss before tax (642) (248) (558)

Taxation - - -

------------ ------------ ------------

Loss for the period (642) (248) (558)

------------ ------------ ------------

Loss for the period and total

comprehensive loss attributable

to equity shareholders (642) (248) (558)

------------ ------------ ------------

Other comprehensive income/(expenditure) - - -

for the period net of tax

Total comprehensive income/(expenditure)

for the period (642) (248) (558)

------------ ------------ ------------

Loss per ordinary share

Basic (0.010) (0.005) (0.011)

Diluted (0.010) (0.005) (0.011)

Gunsynd plc

Interim statement of financial position - unaudited

As at 31 January 2019

Unaudited Unaudited Audited

At 31 January At 31 January At 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Available for sale investments 876 1,592 1,238

Investment in associate 315 - 350

--------------- --------------- ------------

Total non-current assets 1,191 1,592 1,588

--------------- --------------- ------------

Current assets

Trade and other receivables 372 207 333

Cash and cash equivalents 225 543 568

--------------- --------------- ------------

Total current assets 597 750 901

Total assets 1,788 2,342 2,489

--------------- --------------- ------------

LIABILITIES

Current liabilities

Trade and other payables (67) (167) (126)

--------------- --------------- ------------

Total current liabilities (67) (167) (126)

--------------- --------------- ------------

Total liabilities (67) (167) (126)

--------------- --------------- ------------

Net assets 1,721 2,175 2,363

--------------- --------------- ------------

EQUITY

Equity attributable to equity

holders of the company

Ordinary share capital 633 489 633

Deferred share capital 1,729 1,729 1,729

Share premium reserve 10,890 10,536 10,890

Share-based payments reserve 205 205 205

Retained earnings (11,736) (10,784) (11,094)

--------------- --------------- ------------

Total equity 1,721 2,175 2,363

--------------- --------------- ------------

Gunsynd plc

Interim statement of changes in equity - unaudited

For the six months ended 31 January 2019

Ordinary Deferred Share Share Retained Total

Share share Premium Based earnings

Capital capital Payment

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited

At 1 August 2018 489 1,729 10,536 234 (10,565) 2,423

Loss for the six month period

ended 31 January 2018 - - - - (248) (248)

--------- --------- --------- --------- ---------- --------

Total comprehensive loss - - - - (248) (248)

Transactions with owners:

Share options lapsed - - - (29) 29 -

--------- --------- --------- --------- ---------- --------

At 31 January 2019 489 1,729 10,536 205 (10,784) 2,175

--------- --------- --------- --------- ---------- --------

Audited

At 1 August 2018 489 1,729 10,536 234 (10,565) 2,423

Loss for the year - - - - (558) (558)

--------- --------- --------- --------- ---------- --------

Total comprehensive loss - - - - (558) (558)

Transactions with owners:

Issue of share capital 144 - 393 - - 537

Share issue costs - - (39) - - (39)

Share options lapsed - - - (29) 29 -

At 31 July 2019 633 1,729 10,890 205 (11,094) 2,363

--------- --------- --------- --------- ---------- --------

Unaudited

At 1 August 2019

Loss for the six month period

ended 31 January 2019 - - - - (642) (642)

--------- --------- --------- --------- ---------- --------

Total comprehensive loss - - - - (642) (642)

At 31 January 2020 633 1,729 10,890 205 (11,736) 1,721

--------- --------- --------- --------- ---------- --------

Gunsynd plc

Interim statement of cash flows - unaudited

For the six months ended 31 January 2019

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

31 January 2020 31 January 2019 31 July 2019

GBP'000 GBP'000 GBP'000

------------------ ------------------ --------------

Cash flows from operating activities

(Loss)/profit after tax (642) (248) (558)

Finance income net of finance costs (15) (13) (34)

Unrealised Revaluation of AFS assets 13 178 224

(Loss)/profit on sale of AFS Asset 3 (56) (35)

Share of associate loss 34 - 6

Impairment provision 400 - 100

Operating cash outflow before changes in working capital (207) (139) (295)

Movement in trade and other receivables (23) 89 79

Movement in trade and other payables (59) (141) (182)

Cash flow from operations (289) (191) (400)

Tax received - - -

------------------ ------------------ --------------

Net cash flows used in operating activities (289) (191) (400)

Cash flow from investing activities

Payments for investments in AFS assets (87) (100) (358)

Disposal proceeds from sale of AFS asset 48 497 600

Unsecured loans to investee company (15) - (109)

Net cash outflow from investing activities (54) 397 133

Cash flows from financing activities

Proceeds on issuing of ordinary shares - - 537

Cost of issue of ordinary shares - - (39)

------------------ ------------------ --------------

Net cash inflow from financing activities - - 498

Net (decrease)/increase in cash and cash equivalents (343) 206 231

Cash and cash equivalents at start of period 568 337 337

Cash and cash equivalents at end of period 225 543 568

------------------ ------------------ --------------

Notes to the interim report

For the six months ended 31 January 2019

1 Basis of preparation

As permitted IAS 34, 'Interim Financial Reporting' has not been

applied to these half-yearly results. The financial information of

the Company for the six months ended 31 January 2020 have been

prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards,

International Accounting Standards and Interpretations

(collectively "IFRS") issued by the International Accounting

Standards Board ("IASB") as adopted by the European Union ("adopted

IFRS") and are in accordance with IFRS as issued by the IASB. The

condensed interim financial information has been prepared using the

accounting policies which will be applied in the Company's

statutory financial statements for the year ending 31 July

2019.

The financial information shown in this publication is unaudited

and does not constitute statutory accounts as defined in Section

434 of the Companies Act 2006. The comparative figures for the

financial year ended 31 July 2019 have been derived from the

statutory accounts for 2019. The statutory accounts have been

delivered to the Registrar of Companies. The auditors have reported

on those accounts; their report was unqualified and did not contain

statements under the section 498(2) or 498(3) of the Companies Act

2006.

2 Loss per share

The calculation of the loss per share is based on the loss

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

31 January 31 January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

Loss on ordinary activities after

tax (642) (248) (558)

Weighted average number of ordinary

shares for the purposes of basic

earnings/(loss) per share (millions) 6,334.3 4,882.9 5,082.7

Weighted average number of ordinary

shares for the purposes of diluted

earnings/(loss) per share (millions) 6,675.9 5,224.6 5,424.4

Basic (loss)/ earnings per share

(expressed in pence) (0.010) (0.005) (0.011)

Diluted (loss)/ earnings per share

(expressed in pence) (0.010) (0.005) (0.011)

However, due to losses incurred in the year there is no dilutive

effect from the potential exercise of the share options in

existence.

3 Events after the end of the reporting period

None noted.

4. Financial Information

The Board of Directors approved this interim report on 27 April

2020.

A copy of this report can be obtained from our website at

www.gunsynd.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR ZZGZDZNKGGZM

(END) Dow Jones Newswires

April 27, 2020 08:30 ET (12:30 GMT)

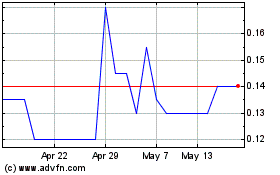

Gunsynd (LSE:GUN)

Historical Stock Chart

From May 2024 to Jun 2024

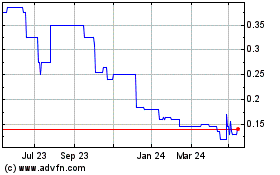

Gunsynd (LSE:GUN)

Historical Stock Chart

From Jun 2023 to Jun 2024