TIDMDPP

RNS Number : 5393A

DP Poland PLC

27 March 2017

DP Poland PLC ("DP Poland" or the "Company")

Final results for the full year to 31 December 2016.

Accelerated store roll-out and strong like-for-likes drive sales

volume and improved contributions from corporate stores and

commissary

DP Poland, through its wholly owned subsidiary DP Polska S.A.,

has the exclusive right to develop, operate and sub-franchise

Domino's Pizza stores in Poland. There are currently 39 Domino's

Pizza stores in 14 Polish cities, 16 corporately managed and 23

sub-franchised.

Highlights

-- 39 stores open to-date, 4 stores already opened in 2017

-- 6 stores currently under construction

-- Expecting to cross the 50 stores mark during 2017

-- System Sales(1) up +62% (PLN) 2016 on 2015

-- Like-for-like(2) System Sales (PLN) up +27%

-- 17 consecutive quarters of double digit like-for-like System

Sales growth, Q4 2012 - Q4 2016

-- Total corporate store EBITDA up +76% at +1.76m PLN

(+GBP329k(3) ) 2016 vs +1.00m PLN (+GBP173k(4) ) 2015

-- Top 3 corporate stores averaged +468k PLN (+GBP88k(3) )

EBITDA each in 2016 vs +332k PLN (+GBP58k(4) ) each in 2015

-- Top store delivered +536k PLN (+GBP100k(3) ) EBITDA

-- Commissary gross profit5 up +155% at +1.71m PLN (+GBP321k(3)

) vs +673k PLN (+GBP117k(4) ) in 2015

-- Group EBITDA(6) losses marginally reduced (GBP1.58m)(3) 2016 vs (GBP1.63m)(4) 2015

-- Second commissary on plan to open Summer 2017 taking total

commissary capacity to c.150 stores

-- Double digit like-for-like System Sales growth January-February 16%

o March like-for-likes on track to be 20%+

Peter Shaw, Chief Executive of DP Poland said:

"Our accelerated store roll-out plan and strong like-for-like

performance drove sales volume and improved contributions from

corporate stores and commissary. We will continue to drive sales

volume growth through 2017 and anticipate Group EBITDA losses

further reduced for YE 2017.

During 2017 we expect to cross the 50 store mark, which will be

a key milestone for Domino's Pizza in Poland, as we extend our

footprint and seek further economies of scale in this market of

38.5 million people."

27 March 2017

(1) System Sales - total retail sales including sales from

corporate and sub-franchised stores

(2) Like-for-like growth in PLN, matching trading periods for

the same stores between 1 January and 31

December, 2016 and 1 January and 31 December, 2015

(3) Exchange rate average for 2016 GBP1:PLN 5.3391

(4) Exchange rate average for 2015 GBP1:PLN 5.7657

(5) Sales minus variable costs

(6) Excluding non-cash items, non-recurring items and store

pre-opening expenses

This announcement contains inside information for the purposes

of the Market Abuse Regulation.

Enquiries:

DP Poland PLC

Peter Shaw, Chief Executive

www.dppoland.com 020 3393 6954

Peel Hunt LLP

Adrian Trimmings / George

Sellar 020 7418 8900

Chairman's Statement

2016 was a year of robust System Sales(1) growth, driven by

strong like-for-likes(2) and the roll-out of new stores to more

towns and cities. This growth in System Sales enhanced both store

EBITDA and commissary gross profit(5) , albeit in the context of a

marginally reduced Group EBITDA(6) loss. The growth in commissary

gross profit is particularly driven by the addition of new

sub-franchised stores and the growth in sub-franchised store sales,

through the provision of dough balls, ingredients, boxes and other

items to sub-franchisees, plus sales royalties.

Today we have 8 sub-franchise partners, 6 more than we had this

time last year and we expect to welcome more in the coming year.

The addition of more sub-franchisees is further confirmation of the

potential of the Polish market, as more individuals commit to

building their own Domino's businesses in a country of 38.5 million

people. Today over half of our estate is sub-franchised, compared

to less than one third this time last year. The mix of corporately

managed and sub-franchised stores will vary as we build out over

the coming years, but we expect sub-franchised stores to be a key

growth engine in the medium to longer term.

We work closely with our sub-franchisees to create strong sales

and marketing programmes, to run in tandem with those of our

corporate stores. Local store marketing (LSM) lies at the heart of

Domino's marketing, communicating to our customers and potential

customers through menus, leaflets and other activities. LSM is

supported by various media, including digital, out-of-home poster

campaigns and radio. As our store estate grows and our ability to

deliver to more customers increases we can foresee the introduction

of national television advertising; we believe this will mark a

further step change to the performance of the Domino's business in

Poland.

Our most mature corporate stores continue to deliver robust

growth, alongside our newer stores, with both sales and Store

EBITDA significantly ahead in 2016 over 2015. The growing traction

of the Domino's brand in Poland is founded on the satisfaction of a

loyal and growing customer base at each store, through our offer of

great service, great product and great value.

While expansion requires resource, with strengthened real estate

and store opening teams and extended commissary capacity, the

growing store contribution to marketing and the economies of scale

in procurement will further strengthen the positive feedback cycle

inherent to revenue growth. As we progress through this growth

phase, to establish a national presence, we expect the reduction in

Group EBITDA losses, compared to the growth in revenues, to

rebalance as we approach critical mass in stores numbers and System

Sales. With that rebalancing there will come an inflection point

when the relative costs of running a high growth business steadily

reduce in proportion to the growth in revenues and improvements in

Group EBITDA.

Our fund raising of GBP3.2m gross in October 2016 was strongly

supported by our investors and enables us to maintain the pace in

the opening of corporate stores and in certain cases to support our

own managers, through loans, to acquire their own stores.

Supporting in-house talent in this way is a success model that is

tried and tested across the Domino's system worldwide, in tandem

with encouraging and supporting third parties to sub-franchise the

Domino's brand.

The opportunity for Domino's in Poland is founded on the size of

the population - the eighth largest in Europe - and the evident

appetite for the Domino's offer of high quality pizza, delivered

fast and hot to the door. Delivering against that opportunity

requires a mix of careful management, energy and determination

which I believe is ably demonstrated by our team; I would like to

take this opportunity to thank both them and our sub-franchisees

for delivering a strong performance in 2016.

In 2017 we remain focused on building out the store estate to

achieve critical mass and to establish Domino's Pizza as a national

brand in Poland.

Nicholas Donaldson

Non-Executive Chairman

24 March 2017

Chief Executive's Review

Group performance

Group EBITDA(6) losses marginally improved 2016 (GBP1.58m(3) )

on 2015 (GBP1.63m(4) ) at average exchange rates for 2016 and

2015.

At constant exchange rates (GBP1: 5.34PLN, the 2016 average)

Group EBITDA(6) losses, improved by 8%, 2016 on 2015.

As described in the Finance Director's Report below, the Group

loss for the period of (GBP2,493,401(3) ) 2016, at actual exchange

rates increased by 14%, mainly due to the increases in

depreciation, amortisation and impairment and share based

payments.

Investment in the real estate and store opening teams reduced

the positive impact of the growth in store EBITDA and commissary

gross profit on Group EBITDA. As revenues continue to grow we

expect them to outstrip growth in Direct Costs (including the new

commissary) and S,G&A and for the benefits to show in

improvement in Group EBITDA for YE 2017 and beyond.

Store performance

2016 delivered a strong store performance in both

like-for-like(2) sales and sales from stores that were opened

during the year.

Like-for-like System Sales(1) were up +27% 2016 on 2015.

2016 closed with our 17(th) consecutive quarter of double digit

like-for-like System Sales growth.

Like-for-like store performance was driven by a combination of

successful sales and marketing activity and, we believe, increasing

traction of the Domino's brand with existing and prospective

customers, overlaid on a bouyant consumer economy.

Total System Sales were up +62% (PLN) 2016 on 2015.

Total Corporate Store EBITDA 2016 was +1.76m PLN (+GBP329k(3) )

vs +1.0m PLN (+GBP173k(4) ) in 2015, growth of +76%.

Total Corporate Store EBITDA performance benefited from

improvement in the cost of goods, in part due to commodity

deflation in the first part of the year and in part due to growing

volumes benefiting commissary procurement. In contrast, higher

store labour costs had some impact on store EBITDA in the second

part of the year. The upward pressure on store labour was impacted

both by the introduction of a minimum wage and its subsequent

increase and by a drop in unemployment, impacting wage levels. On

the plus side, in the macroeconomic context, lower unemployment and

increased wages feed through to increased disposable income and a

higher propensity to purchase.

We are very encouraged that our top 3 corporate stores averaged

+468kPLN (+GBP88k(3) ) EBITDA each in 2016 vs +332kPLN (+GBP58k(4)

) each in 2015. Our top store delivered +536kPLN (+GBP100k(3) )

EBITDA.

New store sales growth was driven by the opening of 12 stores in

2016.

Store roll-out

12 stores were opened in 2016, 8 sub-franchised and 4 corporate,

ending the year with 35 stores.

The table below shows store openings and sales of stores to

sub-franchisees in 2016

Stores 1 Jan 2016 Opened Sold to Closed 31 Dec 2016

franchisees

------------ ----------- ------- ------------- ------- ------------

Corporate 15 4 -6 0 13

------------ ----------- ------- ------------- ------- ------------

Franchised 8 8 +6 0 22

------------ ----------- ------- ------------- ------- ------------

Total 23 12 0 0 35

------------ ----------- ------- ------------- ------- ------------

In 2017 to-date we have opened 4 stores, of which 3 are

corporate stores and 1 sub-franchised. We currently have 39 stores

in operation.

We started 2016 with Domino's stores in 4 cities; we ended the

year with stores in 10 towns/cities and today there are stores in

14 towns/cities. The overall performance of our new stores is

encouraging, with inevitable variations in performance between

individual stores.

In Warsaw we have started to split the delivery areas of some of

our more mature stores, as the sales of those stores are healthy

enough to share part of their delivery areas. The reason for

splitting delivery areas with the opening of a second store is to

serve our customers even better with even faster delivery times.

The better we serve our customers with fast delivery the more

likely they are to repeat their purchase with us and the combined

sales and EBITDA of 2 stores will exceed the sales of the original

store.

Sub-franchisees

We finished the year with 8 sub-franchise partners, who are

operating 23 stores out of a total of 39 stores open to-date. We

have witnessed a swing from a predominantly corporately managed

estate in 2015 to a predominantly sub-franchised estate today.

While we expect this mix to vary as new stores are opened, we

believe that sub-franchise store openings will be a very important

engine of our store-rollout.

Our sub-franchisees are a mix of former Domino's Pizza area

managers and third parties who have come from outside the Domino's

system.

Commissary

The performance of our commissary in 2016 was marked by a step

change increase in sales to stores as System Sales grew by 62%

(PLN). Commissary gross profit5 increased by 155% to +1.71m PLN

(+GBP321k(3) ) in 2016, from +673k PLN (+GBP117k(4) ) in 2015.

The high proportion of sub-franchised stores positively impacted

commissary gross profit as we retain a proportion of sales

royalties and are able to add margin to the sales of goods to

sub-franchised stores, while still offering sub-franchisees highly

competitive prices compared to those achievable in the open market.

These goods include dough balls, ingredients, boxes and

services.

Our ability to procure high quality goods cost effectively

improves as our sales volumes grow. 2016 was marked by commodity

deflation for much of the year, although by the fourth quarter we

saw prices of certain commodities, such as cheese and meat, start

to increase.

In the summer of 2017 we will have finished the construction of

our second commissary which will give us the production and

warehousing capacity to open an additional c.100 stores. Together

with our current commissary will take our commissary capacity to up

to c.150 stores, dependent on store sales volumes.

The opening of our second commissary will have an impact on

Direct Costs, nevertheless, this capacity is required and the new

commissary's more central location, on the outskirts of the city of

ód , will benefit distribution costs to many of our stores that are

not in the vicinity of Warsaw or to the east of Warsaw.

Marketing

We continue to invest in marketing at both the store and

town/city level. Digital marketing is an important component for us

as are the more traditional media of direct marketing, out-of-home

posters and radio. Return on investment is a critical metric in our

choice of marketing spend; as our experience of marketing Domino's

in Poland grows so does our efficiency of spend on media.

The growth in our store estate will lead to more opportunities

to market to our existing and prospective customers. As we expand

our national coverage of stores the prospect of national television

advertising becomes more realistic, both in terms of the efficiency

of media spend and the availability of Domino's Pizza to potential

customers.

With the growth in our online sales - we saw 71% of delivery

orders made online in 2016, compared to 67% in 2015 - we see the

benefits of a closer relationship with our customers. Our online

interface is tailored to the way our consumers wish to use it, be

that through our app or our responsive website which adapts to the

format of the device that our consumers decide to use. By the same

token we are able to tailor our offers and their timing to suit our

customers

Innovation

We regularly introduce new pizza recipes to delight our

customers. In 2016 we launched two stuffed crust options: Cheesy

Crust and Hot Dog Crust, following in the footsteps of other

Domino's Pizza markets. These crust types can be ordered to

supplement any of our pizza recipes.

New pizza recipes introduced last year included Italian

Meatballs, Tuna Light and Big Meat.

Product innovation will continue to play an important part in

attracting new customers and delighting our existing customers.

October fundraising

In October, 2016 we raised GBP3.2m before expenses, c.GBP3m net,

in order to support our continued roll-out of store openings, with

an additional 20 stores, increasing our target to 100 stores open

by YE 2020. This fund raising was well supported by our existing

investors and new investors, resulting in a placing price discount

to the prior-day closing price of only 1.3%.

Outlook and current trading

Our like-for-like System Sales were 16% Jan-Feb 2017; while

lower than the exceptional like-for-likes in 2016, due to strong

comparables, we anticipate our like-for-like performance for the

full year 2017 to be stronger. March 2017 like-for-likes are on

track to be 20%+.

We had 35 stores open at the beginning of 2017 and we expect to

push through the 50 store mark this year. 4 stores were opened by

early February 2017 and we have 6 further stores under

construction. While we expect the majority of these store openings

to be corporate stores, a number of our existing sub-franchisees

have committed to open stores in 2017 and we anticipate new

sub-franchisees opening stores during the year.

The Polish economy continues to deliver healthy consumer

spending and we expect this consumer behaviour to continue through

2017, supported by falling unemployment and growing wage levels,

which in turn boost disposable incomes. On the cost front the

reduction in unemployment has impacted labour rates, but we

continue to respond with competitive rates and a supportive working

environment, retaining and attracting the talent that we need. We

saw some inflation in food prices in the fourth quarter of 2016,

following the deflation that we experienced in the first half of

the year, but so far the increases have not been dramatic. Our

management of pricing is designed to minimise the impact of such

commodity price increases.

2017 will be the year when we expect to push through the 50

store mark, a key milestone. The growth in store numbers and

positive like-for-likes will deliver growing economies of scale and

growing store EBITDA and commissary gross profit, positively

impacting Group EBITDA losses for YE 2017.

Peter Shaw

Chief Executive

24 March 2017

Finance Director's Review

Overview

In 2016 we achieved our 17(th) consecutive quarter of double

digit like-for-like(2) System Sales(1) growth; through improved

corporate store EBITDA and commissary gross profit5. Total

corporate store EBITDA grew +75% (PLN) and commissary gross profit

grew

+155% (PLN). Growth of System Sales in 2016 was supported by

Local Store Marketing and digital media, radio and billboards,

carefully planned against specific Return on Marketing Investment

criteria. The loss for the year was in line with expectations at

(GBP2,493,401(3) ).

While the Polish economy in 2016 experienced deflation, we

experienced some inflation in food and wages in Q4 2016, following

deflation in those goods earlier in the year. From the broader

macro-economic viewpoint wage inflation translates to an increase

in internal consumption, which should in-turn stimulate demand and

growth in our System Sales. We have been managing those

inflationary pressures through pricing management and enhanced

procurement through volume growth.

In 2016 we decided to invest in store expansion and to

accelerate store openings. We opened 12 new stores and added 6 more

towns/ cities. In the period January-March 2017 we added 4 new

stores in 4 new towns/cities; today there are 39 Domino's Pizza

stores in 14 towns/cities. We expect to reach the 50 store mark

during this year.

Selling, General and Administrative expenses (S,G&A)

In 2016 Selling, General and Administrative expenses (S,G&A)

were 29% of System Sales, a 15 percentage points improvement

against 2015 (44% in 2015), both measured using the actual average

exchange rates for 2016 and 2015.

The opening of new stores in new towns and cities requires

investment in the store expansion team and additional area managers

to oversee both corporate and sub-franchised store performance. As

we open more stores these additional costs will become

proportionately less significant and the overall impact of

S,G&A on Group EBITDA will continue to reduce.

As our national coverage of stores grows the prospect of

national television advertising becomes more realistic, both in

terms of the efficiency of media spend and the availability of

Domino's Pizza to potential consumers.

Direct costs

In preparation for further store openings and continuing growth

in System Sales we will be extending our commissary capacity in

2017 with the construction of a new facility on the outskirts of ód

, a large city in the centre of Poland with excellent access to the

motorway network. We have approached this investment with the same

capital light model that we applied to our Warsaw facility. This

additional commissary capacity will impact our Direct Costs through

additional rent and operating costs, production labour and

warehousing labour. As System Sales grow the impact of this

additional commissary capacity on Direct Costs will be

proportionately less marked and the benefits of lower production

costs and warehouse product handling costs will be seen in further

improved corporate store EBITDA and commissary gross profit.

The opening of new stores in new towns and cities results in

higher distribution costs, which in turn will become proportionally

less significant as those costs are spread across towns and cities

with growing store penetrations. The opening of our second

commissary in the centre of Poland will reduce distribution

expenses with stores located in the west, north and south of

Poland. The current commissary in Warsaw will service Warsaw and

stores located to the east.

Store count

Stores 1 Jan Opened Sold Closed 31 Dec

2016 to franchisees 2016

------------ ------ ------- ---------------- ------- -------

Corporate 15 4 -6 0 13

------------ ------ ------- ---------------- ------- -------

Franchised 8 8 +6 0 22

------------ ------ ------- ---------------- ------- -------

Total 23 12 0 0 35

------------ ------ ------- ---------------- ------- -------

4 stores have been opened in 4 new towns and cities since 1

January 2017, totalling 39 stores to-date.

Sales Key Performance Indicators

62% growth in System Sales (PLN) was supported by 27% growth in

like-for-like System Sales (PLN) and the opening of 12 new stores

in 2016. 27% like-for-like System Sales growth comprises a mix of

24% like-for-like System order count growth and a 3% growth in

average net check. Delivery System Sales ordered online are

growing, however newly opened stores need time to build online

customers and that will dilute the System average.

2016 2015 Change

%

-------------------------- ----------- ----------- -------

System Sales PLN 38,531,225 23,714,687 +62%

-------------------------- ----------- ----------- -------

System Sales* GBP 7,216,802 4,441,701 +62%

-------------------------- ----------- ----------- -------

L-F-L System Sales (PLN) +27% +16%

-------------------------- ----------- ----------- -------

L-F-L System order count +24% +14%

-------------------------- ----------- ----------- -------

Delivery System Sales

ordered online +71% +67%

-------------------------- ----------- ----------- -------

*Constant exchange rate of GBP1: 5.3391 PLN

Group performance

97% growth of Group Revenue at a constant exchange rate of GBP1:

5.3391 PLN is derivative of 62% growth of System Sales, opening 8

sub-franchised stores and selling 6 corporate stores to

sub-franchisees.

Group Revenue & 2016 2015 Change %

EBITDA

----------------- ------------ ------------ ---------

Revenue PLN 40,346,077 20,515,866 +97%

----------------- ------------ ------------ ---------

Revenue* GBP 7,556,719 3,842,570 +97%

----------------- ------------ ------------ ---------

Group EBITDA(6)

* GBP (1,579,565) (1,713,241) +8%

----------------- ------------ ------------ ---------

*Constant exchange rate of GBP1: 5.3391 PLN

The Group Income statement at actual average exchange rate for

2016 and 2015 was impacted by GBP weakening against the PLN by 7%

in 2016.

Group Revenue & 2016 2015 Change %

EBITDA

----------------- ------------ ------------ ---------

Revenue PLN 40,346,077 20,515,866 +97%

----------------- ------------ ------------ ---------

Revenue GBP 7,556,719 3,558,261 +112%

----------------- ------------ ------------ ---------

Group EBITDA(6)

GBP (1,579,565) (1,625,267) +3%

----------------- ------------ ------------ ---------

Actual average exchange rates for 2016 and 2015

Group Loss for the period

Group EBITDA(6) at actual average exchange rates for 2016 and

2015, improved by GBP45,702 (GBP133,676 improvement at constant

exchange rate of GBP1: 5.3391 PLN) against the prior year. The

Group loss for the year at actual average exchange rates for 2016

and 2015 increased by GBP300,138 against 2015, mainly due to the

effect of non-cash expenses as follows: the depreciation,

amortisation and impairment charge increased by GBP118,560 and the

share based payments charge increased by GBP137,931.

Group Loss for 2016 2015 Change %

the period

--------------------- ------------ ------------ ---------

Loss for the period

GBP (2,493,401) (2,193,263) -14%

--------------------- ------------ ------------ ---------

Actual average exchange rates for 2016 and 2015

Exchange rates

PLN : GBP1 2016 2015 Change %

------------------ ------- ------- ---------

Income Statement 5.3391 5.7657 -7%

------------------ ------- ------- ---------

Balance Sheet 5.1437 5.8011 -11%

------------------ ------- ------- ---------

Financial Statements for our Polish subsidiary DP Polska S.A.

are denominated in PLN and translated to GBP. Under IFRS accounting

standards the Income Statement for the Group has been converted

from PLN at the average annual exchange rate applicable to PLN

against GBP. The balance sheet has been converted from PLN to GBP

at the 31 December 2016 exchange rate applicable to PLN against

GBP. In 2016 the PLN strengthened against GBP and impacted numbers

presented at 2016 and 2015 rates accordingly.

Cash position

Cash reduced by 10% from 1 January 2016, with the net cash at

31(st) December 2016 being GBP6.3m. The Company raised

approximately GBP3 million after expenses in October through the

placing of 6,667,000 new Ordinary Shares at 48 pence per share. The

net proceeds of the Placing are expected to provide the Company

with the funds required to open an additional 20 stores, with the

target of 100 stores open by 2020.

The Company has spent GBP3.7 million covering Group losses and

store CAPEX and to finance sub-franchisee store openings. The store

opening costs are repaid by sub-franchisees over a period of 3 to

10 years.

1 January Cash movement 31 December

2016 2016

-------------- ---------- -------------- ------------

Cash in bank 6,987,503 (679,243) 6,308,260

-------------- ---------- -------------- ------------

Actual exchange rates for 2016 and 2015

Macro situation in Poland

In 2016 we saw GDP growth combined with continued deflation.

However, in Q4 2016 we experienced inflation of food and wages. GDP

growth was supported by growth in Internal Consumption. The 3 Month

Warsaw Interbank Offered Rate is virtually unchanged.

Macro KPI 2016 2015

------------------------- ------- -------

Real GDP growth

(% growth)(7) 2.5 3.5

------------------------- ------- -------

Inflation (% growth)(8) -0.7 -0.9

------------------------- ------- -------

31 Dec 31 Dec

2016 2015

------------------------- ------- -------

Interest rate (%)(9) 1.7300 1.7200

------------------------- ------- -------

Maciej Jania

Finance Director

24 March 2017

(1) System Sales - total retail sales including sales from

corporate and sub-franchised stores

(2) Like-for-like growth in PLN, matching trading periods for

the same stores between 1 January and 31

December, 2016 and 1 January and 31 December, 2015

(3) Exchange rate average for 2016 GBP1: 5.3391 PLN

(4) Exchange rate average for 2015 GBP1: 5.7657 PLN

(5) Sales minus variable costs

(6) Excluding non-cash items, non-recurring items and store

pre-opening expenses

(7) source:

http://www.euromonitor.com/poland/country-factfile#

(8) source:

http://www.euromonitor.com/poland/country-factfile#

(9) 3M WIBOR at 30(th) of December; source: www.money.pl

FINANCIAL STATEMENTS

--------------------------------------- ----------- -----------

Group Income Statement

for the year ended 31 December 2016

2016 2015

GBP GBP

Revenue 7,556,718 3,558,261

Direct Costs (7,022,673) (3,367,684)

Selling, general and administrative

expenses - excluding:

store pre-opening expenses,

depreciation, amortisation and

share based payments (2,113,610) (1,815,844)

GROUP EBITDA - excluding non-cash

items, non-recurring items and

store pre-opening expenses (1,579,565) (1,625,267)

----------------------------------------- ----------- -----------

Store pre-opening

expenses (47,850) (20,165)

Other non-cash and

non-recurring items (99,302) (73,944)

Finance income 65,116 46,464

Finance costs (12,478) (4,519)

Foreign exchange

(losses) / gains (7,915) 39,084

Depreciation, amortisation

and impairment (458,722) (340,162)

Share based

payments (352,685) (214,754)

Loss before

taxation (2,493,401) (2,193,263)

------------------------------------------ ----------- -----------

Taxation - -

Loss for the

period (2,493,401) (2,193,263)

------------------------------------------ ----------- -----------

(2.01

Loss per share Basic (1.93 p) p)

(2.01

Diluted (1.93 p) p)

All of the loss for the year is attributable to

the owners of the Parent Company.

Group Statement

of comprehensive income

for the year ended 31 December

2016

2016 2015

GBP GBP

----------------------------------------- ----------- -----------

Loss for the period (2,493,401) (2,193,263)

Currency translation differences 618,614 (218,117)

Other comprehensive expense for the

period, net of tax to be reclassified

to profit or loss in subsequent periods 618,614 (218,117)

--------------------------------------------- ----------- -----------

Total comprehensive income for the

period (1,874,787) (2,411,380)

------------------------------------------- ----------- -----------

All of the comprehensive expense for the year

is attributable to the owners of the Parent Company.

Group Balance Sheet

at 31 December 2016

2016 2015

GBP GBP

------------------------------ --------- ------------ ------------

Non-current assets

Intangible assets 442,764 251,697

Property, plant and equipment 2,765,748 2,053,207

Trade and other receivables 1,217,231 287,351

------------------------------- --------- ------------ ------------

4,425,743 2,592,255

Current assets

Inventories 271,525 116,668

Trade and other receivables 1,818,425 1,040,702

Cash and cash equivalents 6,308,260 6,987,503

-------------------------------------------- ------------ ------------

8,398,210 8,144,873

Total assets 12,823,953 10,737,128

-------------------------------------------- ------------ ------------

Current liabilities

Trade and other payables (1,218,991) (853,209)

Borrowings (73,007) (34,416)

Provisions (37,294) (35,274)

-------------------------------------------- ------------ ------------

(1,329,292) (922,899)

---------------------------------------- ------------ ------------

Non-current liabilities

Provisions (50,532) (39,899)

Borrowings (234,276) (97,801)

-------------------------------------------- ------------ ------------

(284,808) (137,700)

Total liabilities (1,614,100) (1,060,599)

-------------------------------------------- ------------ ------------

Net assets 11,209,853 9,676,529

-------------------------------------------- ------------ ------------

Equity

Called up share capital 684,576 651,241

Share premium account 26,878,887 23,856,796

Capital reserve - own shares (50,463) (56,361)

Retained earnings (16,116,724) (13,970,110)

Currency translation reserve (186,423) (805,037)

------------------------------- --------- ------------ ------------

Total equity 11,209,853 9,676,529

-------------------------------------------- ------------ ------------

The financial statements were approved by the

Board of Directors and authorised for issue on

24 March 2017 and were signed on its behalf by:

Peter Shaw Maciej Jania

Direc

Director tor

Group Statement of Cash Flows

for the year ended

31 December 2016

2016 2015

GBP GBP

--------------------------------------- ----------- -----------

Cash flows from operating

activities

Loss before taxation

for the period (2,493,401) (2,193,263)

Adjustments for:

Finance income (65,116) (46,464)

Finance costs 12,478 4,519

Depreciation, amortisation

and impairment 458,722 340,162

Share based payments

expense 352,685 214,754

---------------------------------------- ----------- -----------

Operating cash flows before movement

in working capital (1,734,632) (1,680,292)

(Increase)/decrease

in inventories (134,825) (22,103)

(Increase)/decrease in trade

and other receivables (254,038) (532,689)

Increase in trade

and other payables 461,664 314,941

Increase in provisions 50,532 -

------------------------------------------- ----------- -----------

Cash generated from

operations (1,611,299) (1,920,143)

Taxation paid - -

Net cash from operating

activities (1,611,299) (1,920,143)

Cash flows from investing

activities

Payments to acquire software (25,114) (6,433)

Payments to acquire property, plant

and equipment (1,714,215) (814,485)

Payments to acquire intangible

fixed assets (23,699) (15,895)

Lease deposits net amount repaid

/ (advanced) (62,052) (45,203)

Proceeds from disposal of property

plant and equipment 698,882 140,864

Decrease/(increase) in loans

to sub-franchisees (1,214,743) 28,091

Interest received 36,745 46,464

Net cash used in

investing activities (2,304,196) (666,597)

Cash flows from financing

activities

Net proceeds from issue

of ordinary share capital 3,055,426 5,205,180

Interest paid (12,478) (4,519)

------------------------------------------- ----------- -----------

Net cash from financing

activities 3,042,948 5,200,661

Net increase/(decrease) in cash

and cash equivalents (872,547) 2,613,921

Exchange differences

on cash balances 193,304 (92,845)

Cash and cash equivalents at beginning

of period 6,987,503 4,466,427

Cash and cash equivalents at end

of period 6,308,260 6,987,503

------------------------------------------ ----------- -----------

The principal non-cash transaction was the acquisition

of property, plant and equipment under finance

lease agreements as disclosed in note 21.

Group Statement of Changes in Equity

for the year ended

31 December 2016

Share Currency Capital

reserve

Share premium Retained translation -

capital account earnings reserve own shares Total

GBP GBP GBP GBP GBP GBP

----------------------- ------- ---------- ------------ ----------- ---------- -----------

At 31 December

2014 477,190 18,825,667 (11,991,601) (586,920) (56,361) 6,667,975

Shares issued 174,051 5,325,949 - - - 5,500,000

Expenses of share

issue - (294,820) - - - (294,820)

Share based payments - - 214,754 - - 214,754

Shares acquired

by EBT - - - - - -

Translation difference - - - (218,117) - (218,117)

Loss for the period - - (2,193,263) - - (2,193,263)

----------------------- ------- ---------- ------------ ----------- ---------- -----------

At 31 December

2015 651,241 23,856,796 (13,970,110) (805,037) (56,361) 9,676,529

Shares issued 33,335 3,166,825 - - - 3,200,160

Expenses of share

issue - (144,734) - - - (144,734)

Share based payments - - 352,685 - - 352,685

Shares transferred

out

of EBT - - (5,898) - 5,898 -

Translation difference - - - 618,614 - 618,614

Loss for the period - - (2,493,401) - - (2,493,401)

At 31 December

2016 684,576 26,878,887 (16,116,724) (186,423) (50,463) 11,209,853

----------------------- ------- ---------- ------------ ----------- ---------- -----------

1. ACCOUNTING POLICIES

Basis of preparation

The financial statements have been prepared

on the historical cost basis, with the exception

of certain financial instruments and share based

payments. The consolidated and Company financial

statements of DP Poland plc have been prepared

in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European

Union, IFRIC Interpretations and the Companies

Act 2006 applicable to Companies reporting under

IFRS. The financial statements have been prepared

in accordance with IFRS and IFRIC interpretations

issued and effective or issued and early adopted

as at the time of preparing these statements

(March 2017). The preparation of financial statements

in accordance with IFRS requires the use of

certain critical accounting estimates. It also

requires management to exercise judgement in

the process of applying the Company's accounting

policies.

2. SEGMENTAL REPORTING

The Board monitors the performance of the corporate

stores and the commissary operations separately

and therefore those are considered to be the Group's

two operating segments. Corporate store sales

comprise sales to the public. Commissary operations

comprise sales to sub-franchisees of food, services

and fixtures and equipment. Commissary operations

also include the receipt of royalty income from

sub-franchisees. The Board monitors the performance

of the two segments based on their contribution

towards Group EBITDA - excluding non-cash items,

non-recurring items and store pre-opening expenses.

In accordance with IFRS 8, the segmental analysis

presented reflects the information used by the

Board. No separate balance sheets are prepared

for the two operating segments and therefore no

analysis of segment assets and liabilities is

presented.

Operating Segment EBITDA

contribution

2016 2015

GBP GBP

---------------------------------- ----------- -----------

Corporate stores 328,906 173,490

Commissary gross

profit 321,171 116,762

Unallocated expenses (2,229,642) (1,915,519)

------------------------------------- ----------- -----------

GROUP EBITDA - excluding non-cash

items, non-recurring items and

store pre-opening expenses (1,579,565) (1,625,267)

------------------------------------- ----------- -----------

3. LOSS BEFORE TAXATION

This is stated after

charging

2016 2015

GBP GBP

--------------------------- ---------------------------- ------- -------

Auditors and

their

associates' - audit of company and

remuneration group financial statements 30,400 22,500

- tax compliance

services 1,400 1,400

- remuneration

Directors' emoluments and fees 352,974 329,288

Amortisation of intangible

fixed assets 64,173 63,523

Depreciation of property,

plant and equipment 394,549 256,708

Impairment of property,

plant and equipment - 19,931

Operating lease - land and

rentals buildings 476,928 624,272

and after crediting

Operating lease income

from sub-franchisees 263,191 166,019

Foreign exchange

gains /(losses) (7,915) 39,084

4. OTHER NON-CASH AND NON-RECURRING

ITEMS

2016 2015

GBP GBP

------------------------------------- -------- --------

Provision for additional

VAT payable (50,532) -

Other non-cash and

non-recurring items (48,770) (73,944)

(99,302) (73,944)

------------------------------------- -------- --------

Non-recurring

Items

Non-recurring items include items which are not

sufficiently large to be classified as exceptional,

but in the opinion of the Directors, are not part

of the underlying trading performance of the Group.

The provision for additional VAT payable has been

recognised following the reversal of a previous

ruling by the Polish VAT authorities.

5. TAXATION

2016 2015

GBP GBP

---------------------------------------- ----------- -----------

Current tax - -

Total tax charge

in income statement - -

----------------------------------------- ----------- -----------

The tax on the Group's loss before tax differs

from the theoretical amount that would arise using

the tax rate applicable to profits of the consolidated

entities as follows:

2016 2015

GBP GBP

---------------------------------------- ----------- -----------

Loss before

tax (2,493,401) (2,193,263)

Tax credit calculated

at applicable rate of

19% (473,746) (416,720)

Income taxable but not recognised

in financial statements 20,536 19,017

Income not subject

to tax (2,487) (2,303)

Expenses not deductible

for tax purposes 74,338 63,447

Tax losses for which no deferred income

tax asset was recognised 381,359 336,559

Total tax charge

in income statement - -

----------------------------------------- ----------- -----------

The Directors have reviewed the tax rates applicable

in the different tax jurisdictions in which the

Group operates. They have concluded that a tax

rate of 19% represents the overall tax rate applicable

to the Group.

6. LOSS PER

SHARE

The loss per ordinary share has been calculated

as follows:

2016 2016 2015 2015

GBP GBP

Weighted Profit Weighted Profit

average / (loss) average / (loss)

number after number after

of shares tax of shares tax

------------ -------- ----------- ----------- ----------- -----------

Basic 128,931,485 (2,493,401) 109,369,484 (2,193,263)

Diluted 128,931,485 (2,493,401) 109,369,484 (2,193,263)

--------------------- ----------- ----------- ----------- -----------

The weighted average number of shares for the

year excludes those shares in the Company held

by the employee benefit trust. At 31st December

2016 the basic and diluted loss per share is the

same, as the vesting of JOSS, SIP or share option

awards would reduce the loss per share and is,

therefore, anti-dilutive.

7. INTANGIBLE ASSETS

Franchise

fees Capitalised

and intellectual Software loan Total

property

rights discount

Group GBP GBP GBP GBP

--------------------- ---------------- -------- ----------- --------

Cost:

At 31 December 2014 334,955 187,557 - 522,512

Foreign currency

difference (17,684) (9,885) - (27,569)

Additions 15,895 6,433 - 22,328

Disposals - (399) - (399)

At 31 December 2015 333,166 183,706 - 516,872

Foreign currency

difference 43,480 24,255 - 67,735

Additions 23,699 25,114 178,269 227,082

Disposals - (4,668) - (4,668)

At 31 December 2016 400,345 228,407 178,269 807,021

----------------------- ---------------- -------- ----------- --------

Amortisation

At 31 December 2014 114,815 98,597 - 213,412

Foreign currency

difference (6,256) (5,338) - (11,594)

Amortisation charged

for the year 37,187 26,336 - 63,523

Disposals - (166) - (166)

At 31 December 2015 145,746 119,429 - 265,175

Foreign currency

difference 19,850 16,236 - 36,086

Amortisation charged

for the year 32,192 26,756 5,225 64,173

Disposals - (1,177) (1,177)

At 31 December 2016 197,788 161,244 5,225 364,257

----------------------- ---------------- -------- ----------- --------

Net book value:

At 31 December 2016 202,557 67,163 173,044 442,764

----------------------- ---------------- -------- ----------- --------

At 31 December 2015 187,420 64,277 - 251,697

Franchise fees consisting of the cost of purchasing

the Master Franchise Agreement (MFA) from Domino's

Pizza Overseas Franchising B.V. have been capitalised

and are written off over the term of the MFA.

The difference between the present value of loans

to sub-franchisees recognised and the cash advanced

has been capitalised as an intangible asset and

are amortised over the life of a new franchise

agreement of 10 years. The amortisation of intangible

fixed assets is included within administrative

expenses in the Income Statement.

8. PROPERTY, PLANT AND

EQUIPMENT

Fixtures Assets

fittings

Leasehold and under

property equipment construction Total

Group GBP GBP GBP GBP

---------------------------- --------- --------- ------------ -----------

Cost:

At 31 December 2014 1,517,251 1,212,582 76,581 2,806,414

Foreign currency difference (80,511) (65,027) (4,717) (150,255)

Additions 353,225 103,316 396,961 853,502

Transfers (257,197) (107,339) (14,273) (378,809)

Disposals 42,220 226,564 (268,784) -

At 31 December 2015 1,574,988 1,370,096 185,768 3,130,852

Foreign currency difference 226,639 349,204 (158,605) 417,238

Additions 581,957 336,619 605,016 1,523,592

Disposals (679,424) (394,242) - (1,073,666)

Transfers 78,037 496,304 (574,341) -

At 31 December 2016 1,782,197 2,157,981 57,838 3,998,016

------------------------------ --------- --------- ------------ -----------

Depreciation:

At 31 December 2014 638,061 458,960 - 1,097,021

Foreign currency difference (32,994) (24,843) - (57,837)

Depreciation charged for

the year 76,769 179,939 - 256,708

Impairment 19,931 - - 19,931

Disposals (180,142) (58,036) - (238,178)

At 31 December 2015 521,625 556,020 - 1,077,645

Foreign currency difference (26,465) 164,815 - 138,350

Depreciation charged for

the year 178,035 216,514 - 394,549

Disposals (248,843) (129,433) - (378,276)

At 31 December 2016 424,352 807,916 - 1,232,268

------------------------------ --------- --------- ------------ -----------

Net book value:

At 31 December 2016 1,357,845 1,350,065 57,838 2,765,748

------------------------------ --------- --------- ------------ -----------

At 31 December 2015 1,053,363 814,076 185,768 2,053,207

9. SHARE CAPITAL

2016 2015

GBP GBP

------------------------- ----------- ------- ------- -------------

Called up, allotted

and fully paid:

136,915,112 (2015: Ordinary shares

130,248,112 ) of 0.5 pence each 684,576 651,241

--------------------------- ---------------------- ------- -------------

Movement in share capital

during the period

Nominal

Number value Consideration

GBP GBP

------------------------- ----------- ------- ------- -------------

At 31 December

2014 95,437,986 477,190 20,907,874

Placing 07 July

2015 34,810,126 174,051 5,500,000

At 31 December

2015 130,248,112 651,241 26,407,874

Placing 05 October

2016 6,667,000 33,335 3,200,160

At 31 December

2016 136,915,112 684,576 29,608,034

------------------------- ----------- ------- ------- -------------

10. ANNUAL GENERAL MEETING

The Annual General Meeting of DP Poland plc will

be held at the Offices of Peel Hunt, 120 London

Wall, London EC2Y 5ET on 5 May 2017 at 11.00 a,m,

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BCGDXGGDBGRL

(END) Dow Jones Newswires

March 27, 2017 02:00 ET (06:00 GMT)

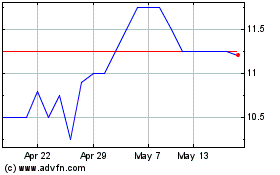

Dp Poland (LSE:DPP)

Historical Stock Chart

From May 2024 to Jun 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jun 2023 to Jun 2024