TIDMALTN

30 April 2019

Altyn Plc

("Altyn" or the "Company")

Results for the year ended 31 December 2018

Altyn Plc (LSE:ALTN) an exploration and development company, is

pleased to announce its results for the year ended 31 December

2018.

Highlights

Underground development & exploration

-- Additional shaft work was done to provide an additional exit to the

surface from the decline in order to reduce the haulage

distance, and

increase productivity in 2019.

-- Operational exploration was carried out carried out at ore bodies no.

1, 2, and 3-8.

-- Further safety works were performed at the transport portal, and

safety works carried out on the ventilation system.

-- Extensive exploration drilling carried out was carried out in ore ore

bodies No 2 and 3-8 in the period.

-- Test production was carried out at Karasuyskoye with 500t of ore

extracted from, the site TerenSai, a ore body identified in

the

exploration area

Financial highlights

-- Turnover decreased in the year to US$19.4m (2017: US$21.6m).

-- 14,990oz of gold sold (2017: 16,747oz), an decrease of 1,757oz.

-- Average gold price achieved (including silver as a by- product),

US$1,292oz, (2017: US$1,293oz).

-- Adjusted EBITDA (Earnings before interest, tax, depreciation and

amortisation and excluding impairment) of US$0.9m (2017:

US$3.7m).

-- In April 2019 the Company obtained a loan from a Kazakh based bank of

US$1m, and is in continuing talks with the bank to raise further

funds

for capital development.

-- In February 2018 the Company converted US$9.7m of the US$10m bond

issued to African Resources into 233,333,333 new ordinary

shares. It

is the intention to convert the remaining shares and interest

into

ordinary shares.

Operational highlights

-- Gold poured 15,282oz, (2017: 16,717oz) a 8.58% decrease year-on-year,

the decrease in production was a result of the lower grade

obtained

from the mixed ore - the ore processed was similar to last year

at

348,000t ( 2017: 333,000t)

-- Underground gold grade 1.95g/t, (2017: 2.08g/t).

-- Operating cash cost US$865/oz, (2017: US$774/oz).

-- Gold recovery rate 83.23% (2017: 83.54%)

For further information please contact:

Altyn PlcRajinder Basra, CFO +44 (0) 207 932 2456

VSA Capital (Corporate Broker)Andrew Monk / Andrew Raca +44 (0)

203 005 5000

CHAIRMAN'S STATEMENT

Dear shareholders,

Following positive progress made on several financing options

during the year, these, initiatives were ultimately abandoned owing

to unappealing terms. The company has now embarked on sourcing new

alternatives, which resulted in securing an initial loan of US$1m

from a Kazakh Bank. Negotiations are ongoing with the lender to

secure a further US$13m needed for additional mining equipment.

In the interim, the major shareholder remains committed to the

business and matched the bank's disbursement by providing a similar

amount in order to purchase a low haulage dumper. This initiative,

alongside other developmental work, is expected to increase the

monthly run rate of production to approximately 40,000t in

2019.

Operational performance has satisfactory given the

circumstances. Production increased slightly, mining grade declined

and the company maintained a tight grip on operational expenses.

The effects cost improvements were, however, clouded by one-off

exceptional items.

At this stage the core focus is to attain a positive resolution

on financing which should trigger a significant turnaround in

profitability. A strong operational gearing given a lean cost base,

expected increase in volumes (60-70kt per month) and associated

improvement in grades should result in improved results over the

coming periods.

Kanat AssaubayevChairman30 April 2019

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

After reconsidering and weighing funding options the company

entered into discussions with a Kazakhstan based bank in order to

raise the necessary finance to take the project forward.

The proceeds of an initial loan taken out coupled with an

injection of funds from the majority shareholder, are being used in

the short term to purchase equipment to increase production from

the current levels to approximately 40,000t per month. The expected

increase in production is planned to take place towards the end of

Q2 2019.

While there were savings on internal costs, the effect of these

were clouded by some restructuring and duplication of costs as the

Company moved development work from internal resources to an

external contractor leading to a higher cost of production during

the year.

Current developments

The following was achieved with regards to the underground mine

in the year:

-- There has been no further development of the decline which was taken

down to 150masl in the prior year. There is adequate access to

a

number of ore bodies at this level. In the current mining plan

for

2019 there is sufficient mineable ore for the planned

production.

A cross cut was completed of the transport decline no.2, which

was

done from two side 250masl and 320masl. This decreased the

haulage

distance, provided a second exit to the mine surface.

During the year extensive maintenance and safety works were

carried out including additional ventilation works, maintenance

of

the tunnels and exit portal.

-- Ore bodies that were prepared for production in 2017 ore bodies 3-8 at

levels 250masl to 150masl were excavated during 2018. The

average

grade extracted from this ore body was between 2.37g/t -2.10g/t.

These

were excavated together with ore bodies No. 1 between levels

320masl

and 285masl, which produced an initial grade of 2.01, and ore

body 11

between 195masl and 185masl which produced a grade of

1.86g/t.

-- Refurbishment of the processing plant and the preparation of the ore

bodies were completed to a large extent in the prior year.

Necessary

maintenance was carried out in 2018 but the capital program was

kept

to a minimum in order to preserve cash flows.

-- During the year the Company placed an order for an additional LHD

Caterpillar (Ioad-haul- dumper) at a cost of US$0.7m, which

will

increase the total number of underground LHDs to 3. This is

expected

to increase the supply of feedstock to the processing plant

to

approximately 40,000t per month. Advance payments have also been

made

for an additional truck to be also delivered in May 2019 at a

similar

cost. The Company is also expecting to purchase a further

haulage

trucks towards the end of the year.

During the year the Company has continued to develop its

exploration site at Karasuyskoye, spending approximately US$1.6m.

These costs were capitalized in line with accounting policy. Test

production was achieved with 500t of ore processed from TerenSai

(one of the contract areas in Karasuskoye). A mine and

beneficiation plant plans have been designed, and initial

procedures drawn up to start resources exploitation in 2021- 2022.

The initial capex requirements have been incorporated into the

budget.

Looking forward

-- The plan for 2019 is to reduce the amount of development work in

relation to the decline as the Company has achieved sufficient

ore

bodies. The intention is to move the decline down to 140masl in

2019

to access the predicted higher grade ore of 3.43g/t at ore body

11.

-- The ore extraction will be undertaken from ore bodies 11 as noted

above, and also ore bodies 3-8. The expected grade from these

ore body

in 2019 is expected to produce an average grade of 2.41g/t.

This

together with the feed stock from the additional equipment

results in

the expectation that production and output will increase in

2019.

-- Karasuyskoye exploration will continue as planned with an expected

additional spending of US$1.7m in 2019. Exploration effort will

be

principally concentrated on the TeranSai site which has produced

very

promising results.

Capital requirements

Future development plans are dependent on raising further

funding. Limited short term funding has been obtained that will

enable the Company to increase production and turnover in 2019. It

is in negotiations to obtain debt finance that will substantially

meet a large part of the capex requirement. Once the equipment is

in place and production is rising, additional funding is expected

to come from the Group's internal cash flow generation, and as a

backstop from the principal shareholder to fund the expansion. The

expectation as it currently stands is that the increased funding

will be in place in Q3 2019.

Projected capital expenditures

underground operations

Total 2019 2020 2021

US$m US$m US$m US$m

Prospect drilling 3.3 0.3 1.5 1.5

Underground development 5.6 2.0 1.6 2.0

Infrastructure 3.4 - 3.4 -

Ore handling facilities 21.9 6.0 13.6 2.3

Karasuyskoye - exploration 4.9 1.7 1.6 1.6

Total 47.4 11.7 26.2 9.8

Sekisovskoye operational update

The 2018 operational performance of the Company's Sekisovskoye

gold mine during versus the prior year is shown in the tables. The

attached mining map shows the grades and ore that were extracted

during the year as well as the corresponding extraction plans for

2019. The 2018 range of underground ore grade varied between

1.86g/t to 2.37g/t. For 2019 grades are expected to increase as ore

extraction moves to lower depths. As such 2019 grade is expected to

average at 2.41g/t with a range of a high 3.43g/t for ore body 11

to a low of 2.01 for ore bodies 3-8.

The recovery rate remained stable at 83.23%(2017: 83.54%). No

significant changes are expected in this regard and no further

upgrades to the plant are currently anticipated.

The budgets going forward are based on a stable gold price in of

US$1,250. No significant changes are expected in the cost structure

and no significant write-offs are expected to occur in 2019.

Mining - underground

2018 2017

Ore mined T 278,883 287,389

Gold grade g/t 1.95 2.08

Silver grade g/t 2.92 2.80

Contained gold oz 17,482 19,243

Contained silver oz 26,110 25,909

Mining - processing

2018 2017

Crushing T 340,091 332,502

Milling T 348,169 332,947

Gold grade g/t 1.68 1.88

Silver grade g/t 2.50 2.56

Gold recovery % 83.23 83.54

Silver recovery % 74.37 73.85

Contained gold oz 18,367 20,040

Contained silver oz 27,986 27,138

Gold poured oz 15,282 16,717

Silver poured oz 20,794 19,989

MARKET REVIEW AND SHARE PRICE PERFORMANCE

Commentary

On a positive note the fundamentals are good. The gold price has

been stable and is expected to be in a similar range in the future

with some commentators predicting an upward trend, moving up to

US$1,400.

As the Company earns its revenue in US Dollars a strengthening

Dollar is seen as good for the Company as its principal costs are

in Tenge. The only significant liabilities in Dollars are the

loans, however the principal loans are not due for repayment until

2021. Again the predictions are that the Dollar will strengthen

against the Tenge in the future, slowly moving from its current

range of KZT380 towards KZT400 and beyond.

The share price of the Company has been trading again at a low

level, the Directors are aware this is a reflection of the Company

not moving to the next stage of operations.

The share price has seen a steady decline from April 2018 to

April 2019 from 1.4p to its current value of 0.57p. The Directors

are aware this is underperforming all significant benchmarks. The

principal driver to the share price will be an increase in

production and profitability.

The principal shareholder has committed funds in April 2019 and

the Company has obtained a loan of US$1m. This has been used to

order new equipment which will come on stream in May 2019. This

will start to increase production to the 40,000t target. The

Directors are confident that further significant funding can be

obtained in the near future to further increase production.

FINANCIAL PERFORMANCE

Key performance indicators (KPIs)

Annual gold poured (oz)15,282oz201815,2822017 16,7172016

10,970

Revenue (US$m)US$19.4m201819.42017 21.62016 15.9

Operating cash production cost (US$oz)US$865oz20188652017

7742016 832

Adjusted EBITDA (US$m)US$0.9m20180.92017 3.692016 0.3

Net assets (US$m)US$34.9m201834.92017 33.22016 34.0

The gold poured decreased from 16,717oz to 15,282oz from the

prior year, reflecting the lower overall gold grade achieved of

1.68g/t (2017: 1.88g/t). This as in the prior year was due to ore

being mined from the underground workings being diluted with lower

grade stockpiled ore. In addition the underground ore itself is not

being extracted in an manner to maximise the grade, and being

diluted with lower grade ore. This process is expected to continue

until new equipment and targeted ore production can be achieved. As

the Company is continuing to use the low grade ore, part of the

provision made against the stockpile in prior periods, has been

reversed amounting to US$383,000 (2017: US$374,000).

The total cash cost of production, which includes administrative

costs but excludes depreciation and provisions, amounted to

US$1,235/oz, (2017: US$1,075oz). The operating cash cost amounts to

US$865/oz (2017: US$774/oz). This is based on the above but

excluding administrative expenses. The cash cost of production has

risen as direct consequence of the lower grade and production. In

addition there have been additional costs with the restructuring of

the internal labour force being replaced by the subcontracted

contractors. The Company's aim is still to reduce the long term

cash cost of sales down to the range of US$540.

The Group has reported a loss of US$4.0m before tax (2017:

US$1.9m), with a gross profit of US$2.5m (2017: US$4.2m). The

operating loss is US$2.5m (2017: loss US$484,00). The principal

drivers behind the loss are the restructuring costs of closing down

a number of operational departments in Sekisovskoye included within

cost of sales. In addition, significant write offs of irrecoverable

VAT and other penalties. These are included within administrative

costs and amounted to US$2m and are not expected to reoccur in the

following year.

The EBITDA is US$0.9m, after adjusting the operating loss of

US$2.9m (2017: US$0.48m) for depreciation of US$3.95m (2017:

US$4.5m), and impairment gain of US$0.6m (2017: US$0.4m). A

positive EBITDA, however lower than the one budgeted.

During 2018, the Company sold 14,990oz of gold (2017 16,747oz).

The average price achieved per oz in 2018 was US$1,292 similar to

last year, which achieved an average price of US$1,293. The prices

are budgeted to stay at similar levels in 2018, and there are no

changes anticipated to the sales offtake agreement currently in

place to the Kazakh national refinery.

The current cash position and anticipated trading is sufficient

for the budgeted capex (with limited expansion), and budgeted

production for the next year to increase with the new equipment

ordered in May 2019. The principal shareholders have agreed to

provide monetary support as necessary, in order to provide any

short term financing that may be required.

Cash at year-end was US$105,000 (2017: US$704,000). Resources

are sufficient to meet the current working capital requirements.

The cash was lower in 2018 as a number of payables outstanding were

settled prior to the year end. The Company generated a positive

EBITDA which is expected to increase next year as one off costs are

avoided. Financing commitments are expected to be met from the cash

generation of the Company. Principal financing commitments are

payment of interest on the US$2m convertible loan and repayment of

short term borrowings from the bank, in total these are expected to

amount to approximately US$1m.In 2018 as in 2017 the principal

shareholders have agreed to defer any loan repayments, until funds

allow.

Until further financing is obtained no significant additional

purchasing of equipment is budgeted to be made. A limited capex

program is in place for 2019. This will increase output from the

current levels to an expected run rate of 40,000t per month. The

budgeted capex does include further development of the Karasuyskoye

site in 2019, which is seen as a valuable resource.

The consolidated net assets of the Company are US$34.9m (2017:

US$33.2m), the change from the prior year is essentially a result

of the conversion of the bond liability into equity.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

year ended 31 December 2018

Notes 2018 2017

US$000 US$000

Revenue 3 19,366 21,649

Cost of sales (16,871) (17,470)

Gross profit 2,495 4,179

Administrative expenses (5,543) (5,037)

Impairments - reversed 562 374

Operating loss (2,486) (484)

Foreign exchange (196) (52)

Finance expense (1,283) (1,381)

Loss before taxation (3,965) (1,917)

Taxation charge (323) (12)

Loss attributable to equity (4,288) (1,929)

holders of the parent

Loss per ordinary share

Basic & diluted 4 (0.17c) (0.08c)

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

year ended 31 December 2018

2018 2017

US$000 US$000

Loss for the year (4,288) (1,929)

Currency translation differences arising (5,712) 98

on translations of foreign

operations items that may be reclassified

to profit or loss

Currency translation differences 2,560 1,088

arising on translations

of foreign operations relating to taxation

Total comprehensive loss attributable (7,440) (743)

to equity holders of the parent

The accompanying notes are an integral part of these financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

year ended 31 December 2018

Company number 5048549 Notes 2018 2017

US$000 US$000

Non-current assets

Intangible assets 5 12,338 11,881

Property, plant and equipment 6 28,391 35,163

Trade and other receivables 1,303 1,476

Deferred tax asset 7,999 6,928

Restricted cash 28 14

50,059 55,462

Current assets

Inventories 1,297 1,713

Trade and other receivables 3,081 2,531

Cash and cash equivalents 105 704

4,483 4,948

Total assets 54,542 60,410

Current liabilities

Trade and other payables (7,846) (7,822)

Other financial liabilities (122) (399)

Provisions (94) (112)

Borrowings (1,218) (724)

(9,280) (9,057)

Net current liabilities (4,797) (4,109)

Non-current liabilities

VAT payable (1,383) -

Other payables (644) (160)

Provisions (4,412) (4,512)

Convertible bonds (3,963) (12,496)

Borrowings - (937)

(10,402) (18,105)

Total liabilities (19,682) (27,162)

Net assets 34,860 33,248

Equity

Called-up share capital 4,054 3,886

Share premium 151,470 141,918

Merger reserve (282) (282)

Other reserve 333 333

Currency translation reserve (47,770) (44,618)

Accumulated losses (72,945) (67,989)

Total equity 34,860 33,248

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

year ended 31 December 2018

Note Share Share Merger Currency Other Accumulated Total

capital premium reserve translation reserve losses US$000

US$000 US$000 US$000 reserve US$000 US$000

US$000

1 3,886 141,918 (282) (45,804) 333 (66,060) 33,991

January

2017

Loss for (1,929) (1,929)

the year

Other - - - 1,186 - - 1,186

comprehensive

income

Total - - - 1,186 - (1,929) (743)

comprehensive

loss

31 3,886 141,918 (282) (44,618) 333 (67,989) 33,248

December

2017

Loss for (4,288) (4,288)

the year

Other - - - (3,152) - - (3,152)

comprehensive

loss

Total - - - (3,152) - (4,288) (7,440)

comprehensive

loss

Conversion 168 9,552 - - - (668) 9,052

of bond

into

shares

31 4,054 151,470 (282) (47,770) 333 (72,945) 34,860

December

2018

Group Reserves Description

Share capital Amount of the contributions

made by shareholders

in return for the issue of shares.

Share premium Amount subscribed for share capital

in excess of nominal value.

Merger reserve Reserve created on application of merger

accounting under a previous GAAP.

Currency translation reserve Gains/losses arising on re-translating

the net assets

of overseas operations in to US Dollars.

Other reserve Amount of proceeds on issue of convertible

debt relating to the equity component.

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF CASHFLOWS

year ended 31 December 2018

Notes 2018 2017

US$000 US$000

Net cash inflow from operating activities 940 5,107

Investing activities

Purchase of property, plant and equipment (1,108) (2,252)

Disposals of property, plant and machinery 264

Exploration costs - (439)

Net cash used in investing activities (844) (2,691)

Financing activities

Loans received 151 724

Loans repaid (550) (4,331)

Interest repaid (160) (341)

Net outflow from financing activities (559) (3,948)

Decrease in cash and cash equivalents (463) (1,532)

Foreign currency translation (136) -

Cash and cash equivalents 704 2,236

at beginning of the year

Cash and cash equivalents at end of the year 105 704

The accompanying notes are an integral part of these

consolidated financial statements.

NOTES TO THE FINANCIAL STATEMENTS

year ended 31 December 2018

1General information

Altyn Plc (the "Company") is a Company incorporated in England

and Wales under the Companies Act 2006.

The financial information set out above for the years ended 31

December 2018 and 31 December 2017 does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006, but

is derived from those accounts. Whilst the financial information

included in this announcement has been compiled in accordance with

International Financial Reporting Standards ("IFRS") (as adopted by

the European Union), this announcement itself does not contain

sufficient financial information to comply with IFRS. A copy of the

statutory accounts for 2017 has been delivered to the Registrar of

Companies and those for 2018 will be submitted for approval by

shareholders at the Annual General Meeting. The full audited

financial statements for the years end 31 December 2018 and 31

December 2017 do comply with IFRS.

2Going concern

To progress the mine to the full projected capacity the Company

requires further funding, which the Company is endeavoring to put

in place. It has received preliminary indication of funding to be

made available by a Kazakh based bank. In March 2019 as part of the

process an initial US$1m was advanced by the bank to purchase

equipment and spares, The Company is in the process of finalising a

larger loan with the bank. In addition the major shareholder has

provided funds in April 2019 to purchase further equipment in order

to increase production.

The Company is continuing to develop its underground mine,

production is continuing at a steady pace with gold sold in the

current year of 14,990 oz. The Group made a loss before tax in the

current year of US$4.0m (2017 loss: US$1.9m) however it generated a

positive EBITDA. Cash funding from operations has reduced due to

limited capital expenditures during the year. This also contributed

a lower production levels. Production and revenues are expected to

increase as capital expenditure is made from the loans made into

the Company in April 2019.

The Directors have reviewed the cash flows for 15 months from

the date of approval of the financial statements based on the

projected trading. The Directors are confident that should the fund

raising as noted above, not be provided in the expected timeframe

the Company will be able to adapt its operational plans such that

it continues to operate.

Furthermore the major shareholder has confirmed their intention

to provide further funding to enable the Company to continue its

planned operations for at least twelve months from the date of

approval of the financial statements.

On this basis the Directors have therefore concluded that it is

appropriate to prepare the financial statements on a going concern

basis .

3Revenue

An analysis of the Company's revenue is as follows:

2018 2017

US$000 US$000

Sale of gold and silver 19,030 21,294

Other sales 336 355

19,366 21,649

Included in revenues from sale of gold and silver are revenues

of US$19,030,000 (2017: US$21,294,000) which arose from sales of

precious metals to one customer based Kazakhstan. Other sales

amounted to US$336,000 (2017 US$355,000), and related to sale of

machinery and consumables.

4Loss per ordinary share

The calculation of basic and diluted earnings per share from

continuing operations is based upon the retained loss from

continuing operations for the financial year of US$4.3m (2017: loss

of US$1.9m).

The weighted average number of ordinary shares for calculating

the basic loss in 2018 and 2017 is shown below. As the Company was

loss making in 2018, the impact of the potential ordinary shares

outstanding from the conversion of the Convertible loan notes would

be anti-dilutive, and as such the basic and diluted earnings per

share are the same.

2018 2017

Basic and diluted 2,552,972,267 2,334,342,130

5Intangible assets

Karasuyskoye Exploration and US$000

geological data evaluation costs

Cost

1 January 2017 11,345 718 12,063

Translation difference 79 - 79

Transfers - 157 157

Additions - 1,430 1,430

Amortisation capitalized - 1,021 1,021

31 December 2017 11,424 3,326 14,750

& 1 January 2018

Translation difference (1,535) (113) (1,648)

Additions - 1,605 1,605

Amortisation capitalized - 1,101 1,101

31 December 2018 9,889 5,919 15,808

Amortisation

1 January 2017 1,799 - 1,799

Charge for the year 1,021 - 1,021

Translation difference 49 - 49

31 December 2017 2,869 - 2,869

& 1 January 2018

Charge for the year 1,101 - 1,101

Translation difference (500) - (500)

31 December 2018 3,470 - 3,470

Net book value

1 January 2017 9,546 718 10,264

31 December 2017 8,555 3,326 11,881

31 December 2018 6,419 5,919 12,338

The intangible assets relate to the historic geological

information pertaining to the Karasuyskoye ore fields. The ore

fields are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye. The Company obtained

a contract for exploration and evaluation on the site in May 2017

from the Kazakh authorities. The contract is valid for a period of

6 years, which is a right to extend for a minimum period of 4

years.

The value of the geological data purchased is in the opinion of

the Directors the value that would have been incurred if the

drilling had been undertaken by a third party (or internally).

During the year there has been extensive exploratory drilling, a

pre- feasibility study was carried out and samples taken from a

test production site, which confirmed the expected grades. The

directors consider that no impairment is required taking into

account the exploration and planned production in the future. The

write off of the geological data over the period of the licence to

May 2026 is appropriate. The costs amortised are capitalised in

line with the Company's accounting policy within the subsidiary TOO

GMK Altyn MM LLP, there are no impairment indicators.

6Property, plant and equipment

Mining Freehold, Equipment, Plant, Assets under Total

properties land and fixtures and machinery and construction US$000

and leases buildings fittings vehicles US$000

US$000 US$000 US$000 US$000

Cost

1 January 2017 11,351 24,241 12,189 5,825 4,155 57,761

Additions 1,196 38 399 283 686 2,602

Disposals - (15) (257) (53) (133) (458)

Transfers (157) - - - - (157)

Transfers to (1,513) 2,465 (829) 2,469 (2,651) (59)

inventories

Currency (34) 22 44 4 49 85

translation

adjustment

31 December 10,843 26,751 11,546 8,528 2,106 59,774

2017

& 1 January

2018

Additions 2,940 2 124 24 721 3,811

Disposals/provision - (1) (563) (2,620) - (3,184)

Transfers - 1,494 41 - (1,661) (126)

Currency (2,053) (3,765) (1,447) (885) (188) (8,338)

translation

adjustment

31 December 11,730 24,481 9,701 5,047 978 51,937

2018

Accumulated

depreciation

1 January 2017 2,262 5,100 9,584 3,499 - 20,445

Charge for 222 2,498 1,452 336 - 4,508

the year

Disposals - (15) (208) (40) - (263)

Transfers (180) (290) (1,871) 2,282 - (59)

Currency 2 (33) 6 5 - (20)

translation

adjustment

31 December 2,306 7,260 8,963 6,082 - 24,611

2017

& 1 January

2018

Charge for 251 2,242 1,133 275 - 3,901

the year

Disposals - (1) (356) (1,085) - (1,442)

Currency (337) (1,210) (1,239) (738) - (3,524)

translation

adjustment

31 December 2,220 8,291 8,501 4,534 - 23,546

2018

Net book value

1 January 2017 9,089 19,141 2,605 2,326 4,155 37,316

31 December 8,537 19,491 2,583 2,446 2,106 35,163

2017

31 December 9,510 16,190 1,200 513 978 28,391

2018

Capitalised cost of mining property and leases are amortised

over the life of the licence from commencement of production on a

unit of production basis. This basis uses the ratio of production

in the period compared to the mineral reserves at the end of the

period. Mineral reserves estimates are based on a number of

underlying assumptions, which are inherently uncertain. Mineral

reserves estimates take into consideration estimates by independent

geological consultants. However, the amount of mineral that will

ultimately be recovered cannot be known until the end of the life

of the mine.

Any changes in reserve estimates are, for amortisation purposes,

treated on a prospective basis. The recovery of the capitalised

cost of the Company's property, plant and equipment is dependent on

the development of the underground mine.

The Directors are required to consider whether the non-current

assets comprising, mineral properties leases, plant and equipment

have suffered any impairment. The recoverable amount is determined

based on value in use calculations. The use of this method requires

the estimation of future cash flows and the choice of a discount

rate in order to calculate the present value of the cash flows. The

directors considered entity specific factors such as available

finance, cost of production, grades achievable, and sales price.

The directors have concluded that no adjustment is required for

impairment.

7Availability of accounts

The audited Annual Report and Financial Statements for the 12

months ended 31 December 2018 and notice of AGM will shortly be

sent to shareholders and published at: www.altyn.uk.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20190430006208/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

May 01, 2019 02:00 ET (06:00 GMT)

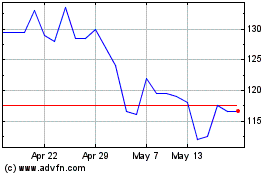

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024