TIDMALTN

RNS Number : 7650D

Altyn PLC

28 April 2017

Altyn Plc

("Altyn" or the "Company")

Results for the year ended 31 December 2016

Altyn Plc (LSE:ALTN) an exploration and development company, is

pleased to announce its results for the year ended 31 December

2016.

Highlights

Underground development

-- During the year the first transport decline was taken from

250masl (metres above sea level) to 200masl. The decline will now

stop at this level.

-- Second transport decline was taken from the 250masl and is

currently being developed to 225masl.

-- Completion of works on the second decline from 250masl to the

bottom of the open pit at 320masl.

-- Access portal, for the second transport decline was completed during H2 2016.

-- Ventilation shafts and ancillary services for the mine works were completed.

-- Tailings dam 4 was completed in January 2017. It covers an

area of 190,000sqm and has the capacity to absorb 1m tonnes of

tailings, and will have an operational capacity of 2-3 years on the

basis of the planned production increases.

-- Capital investment of US$5.6m (2015: US$9.6m) which includes 30 tonne haulage trucks and new load-haul-dumper (LHD), used to fill the underground trucks with ore. The principal operational fleet is to be further enhanced with an additional 30 tonne haulage truck in 2017 and an additional LHD, to be purchased in 2017.

Financial Highlights

-- Debt raising of US$12m through the issue of convertible

bonds, (2015: US$5.1m equity raising) and US$1.66m through

unsecured loans.

-- Turnover decreased in the year to US$15.9m (2016: US$24.1m).

-- 12,602oz of gold sold (2015: 20,890oz), a reduction of 8,288oz.

-- Average gold price achieved (including silver as a

by-product), US$1,259oz, (2015: US$1,173oz).

-- Adjusted EBITDA (Earnings before interest, tax, depreciation

and amortisation excluding impairment) of US$260,000 (2015:

negative US$2.3m).

Operational Highlights

-- Gold poured 10,970oz, (2015: 15,534oz) a 29.4% decrease

year-on-year, due to the continuing development of the second

transport decline that resulted in a lower production in the

year.

-- Underground gold grade 2.70g/t, (2015: 2.55g/t).

-- Operating cash cost US$846/oz, (2015: US$837/oz).

-- Gold recovery rate 80.20% (2015:76.04%) the improvement is in

line with expectations as the higher grade ore is processed.

Neil Herbert, Director of Altyn Plc commented:

"The 2016 annual results are in line with expectations,

production declined as resources were switched to develop the

second decline and infrastructure in order to access the high grade

underground ore. With the solid platform developed in 2016, we look

forward to progressing the underground mine in 2017, with rising

production and profitability."

For further information please contact:

Altyn Plc

Rajinder Basra, CFO +44 (0) 207 932 2456

VSA Capital (Corporate Broker)

Andrew Monk / Andrew Raca +44 (0) 203 005 5000

Blytheweigh (Financial PR)

Tim Blythe/Camilla Horsfall +44 (0) 207 138 3204

Information on the Company

Altyn is a gold mining, exploration and development group based

in Kazakhstan. Whilst the Company was initially established to

exclusively develop and operate the Sekisovskoye gold and silver

mine in the East Kazakhstan Region, it is now actively targeting

additional gold mining opportunities in Kazakhstan. This includes

the adjacent prospective Karasuyskoye Ore Fields, on which Altyn

was recently awarded the tender to perform further confirmatory

testing in order to gain the sub-soil user licence.

The Company holds a 100 per cent shareholding in DTOO GRP

Baurgold (Formerly DTOO Gornorudnoe Predpriatie Sekisovskoye )

which holds a subsoil use contract in relation to the Sekisovskoye

deposit, covering a total area of 0.855km(2). The subsoil use

contract for Sekisovskoye is valid until 2020 and the Company

currently intends to seek to extend the contract in accordance with

its terms. The Company also holds a 100 per cent shareholding in

TOO GMK Altyn MM (formerly TOO Altai Ken-Bayitu), which owns and

operates the processing plant at the Sekisovskoye deposit. The

Sekisovskoye deposit is located at the village of Sekisovskoye,

approximately 40km north of the town of Ust-Kamenogorsk, the

capital city of the East Kazakhstan Region. The current operation

is focused on mining the near-vertical deposits which extend to the

surface below the open pits which have been previously mined.

The Company intends that the Sekisovskoye deposit shall become a

selective-mining underground operation. As at 31 May 2014, the

Company's proven and probable reserves consisted of 2.67moz of gold

and 3.52moz of silver and the Company's measured, indicated,

inferred resources consisted of 5.14moz of gold, and 3.52moz of

silver, in each case as classified in accordance with JORC.

Chairman's Statement

Dear shareholders,

The focus in 2016 as in the prior year has been on moving the

underground project forward as efficiently as possible but aiming

to maintain our working capital requirements, and ensure our loan

commitments are met.

In relation to the latter the Company currently has a bank loan

with EBRD, the capital amount outstanding as at the date of this

report is US$1.79m. During the year the Company raised US$12m

through the issue of convertible bonds with a coupon rate of 10%.

The proceeds include US$2m from institutional investors and US$10m

from its major shareholder. Additionally, a total of US$1.7m was

raised in the form of 13% unsecured loans from the major

shareholder. The funds raised were used to finance working capital

commitments, repay the loan commitments as noted above, in addition

to acquiring the capital assets in the year.

In order to continue with the underground development plans and

move towards the targeted production levels the Company needs to

raise further funds for capital investment in the underground

development. As part of the process of engaging with potential

investors the Company has instructed brokers and external

consultants to actively market the company. We will keep

shareholders updated as the financing progresses.

The Company has made significant progress utilising the funding

so far, and the transition to the underground mine is progressing

well, albeit with a delay from the original anticipated schedule of

approximately 9 months. The underground ore mined in H1 2016 was

28,824mt and in H2 71,939mt. The Company has now moved to a monthly

run rate of 29,000t in 2017, with the anticipation to increasing

this toward the target of 40-45,000t during 2017.

The gold price is still favourable and stable and has been

trading in the range of US$1,200/oz -US$1,300oz. As interest rates

rise it is expected that the current price may be put under

downward pressure. However, based on the Company's revenue and cost

assumptions the profits going forward are still very

favourable.

In summary we have now developed the platform to move forward.

The forthcoming years, will see the fortunes of the Company change

as production increases and we move towards our target of 100,000oz

of gold a year.

Finally, may I once again thank all our employees and our

Management team for their hard work and also thank our shareholders

for their continued support, as we look forward to a challenging

and exciting year ahead for Altyn.

Kanat Assaubayev

Chairman

Chief Executive Officer's Report

Overview

The management team have had a successful year in advancing the

development of the underground mine. The exercise was time

consuming and technically difficult in a number of areas leading to

a delay from the planned time table, essentially pushing the

development back by approximately 9 months from that initially

envisaged.

MAP OF UNDERGROUND MINE SOWING DECLINES

Current developments

To summarise the following progress was achieved in the

development of the underground mine in the year, building a solid

platform for production growth going forward:

-- Development of the first decline which was taken from the

250masl down to 200masl, this gave access to ore body 11. The first

decline will now be terminated at this level and the second decline

will be used in the future to access the ore bodies. Development of

the second decline has significantly reduced the haulage distance

to the underground tracks. The decline was taken from the 250masl

up to the 320masl to give access to the bottom of the open pit, and

a transport portal was constructed. It is also currently in the

process of being further developed to 225masl giving access to a

number of ore bodies at this level.

-- Ore bodies were prepared for production including ore body 10

and also ore body 5, the latter was originally expected to be

producing ore in H2 2016, however the delay pushed this back to Q1

2017.

-- The current production in Q1 2017 is being taken from ore

body 5 that typically has ore grades on average of 3.5g/t. Although

the actual grade achieved in the Q1 was 2.56 g/t this is mainly a

dilution issue that is expected to be settled in the 2nd half of

the year achieving the targeted average gold grade for the

year.

-- The extraction from the sides of the open pit has revealed

veins of ore with very high grades of gold in excess of 6g/t, as

well as free gold.

-- Completion of tailings dam 4 allows for approximately 1

million tonnes of tailings to be absorbed. Tailings dam 4 will have

a life of approximately 2-3 years, taking into account our plan to

raise production. It is expected that after this period the paste

plant will be constructed, thereafter allowing the tailings to be

backfilled into the underground mine.

-- Sourcing, purchasing and commissioning of plant and equipment

during the year. Key items were the load-haul dumper CAT R1300 and

the 3 Sandvik UG trucks TH430 which can carry 30 tonnes each. These

are replacing the existing 15 tonne trucks which have been retained

for possible deployment in Karasuyskoye. Another 30 tonne UG truck

is to be ordered in the near term. Also in addition to the above a

low haul dumper was delivered in late March 2017 and is now being

used in the operations.

Looking forward

-- The second decline is to be developed to 225masl as noted

above, and this is expected to be completed by June 2017, giving

access to the ore bodies at this level which will then be prepared

for production. Ore body 11 contains on average higher grade ore up

to 4.5g/t, and will be mined in H2 2017.

-- Further drilling and preparatory works will be undertaken at

ore bodies 2-10 at the 250masl in order to prepare them for ore

production.

-- The extraction of the very high grade ore that is being mined

from the sides of the open pit is being further refined by applying

higher concentrations of cyanide, in three smaller intensive

leaching tanks which have been set up. The recovery rates will be

further enhanced in the future by the purchase of gravitational

circuits, as cash flow permits.

Capital requirements

An update to the current projected development capital

requirements is given in the table below.

Total 2017 2018 2019 2020

------------------------- ------ ----- ----- ----- -----

US$m US$m US$m US$m US$m

Prospect drilling 4.0 0.9 0.1 1.5 1.5

------------------------- ------ ----- ----- ----- -----

Underground development 3.5 1.4 0.4 0.8 0.9

------------------------- ------ ----- ----- ----- -----

Infrastructure 1.2 1.2 - - -

------------------------- ------ ----- ----- ----- -----

Ore handling facilities 16.8 10.2 4.6 2.0 -

------------------------- ------ ----- ----- ----- -----

Process plant

& paste plant 12.0 - 12.0 - -

------------------------- ------ ----- ----- ----- -----

Contingency 3.3 0.6 2.3 0.3 0.1

------------------------- ------ ----- ----- ----- -----

Total 40.8 14.3 19.4 4.6 2.5

------------------------- ------ ----- ----- ----- -----

Of the total amount shown above the external funding requirement

is in the region of US$20m-US$30m. The Company is currently in

discussion with a number of interested parties, in order to raise

the necessary funding.

Sekisovskoye operational update

In the year to December 2016, the mine has been operating at a

very low capacity and the current year low level of production has

to be seen as a necessary step in order to achieve the Company's

long term goal. During H1 2016 this dropped to 3,694oz of gold

produced but since then production has been rising as the

underground mine is developed.

The key performance statistics show that the underground grades

are improving as direct access is gained to the ore bodies and

recovery rates are now moving to the target goal of above 80%.

Indeed, in Q1 2017 the recoveries have increased, albeit the grades

have remained at the 2.5-2.6g. The grades are expected to improve

as the higher grade ore bodies are accessed and there is less

developmental ore delivered to the processing plant

The operational performance of the Company' Sekisovskoye gold

mine during 2016 against the prior year is shown in the tables

below.

Mining - open

pit

--------------- ----- -------- --------

2016 2015

--------------- ----- -------- --------

Ore mined T 107,586 339,111

--------------- ----- -------- --------

Gold grade g/t 0.91 1.06

--------------- ----- -------- --------

Silver grade g/t 1.60 2.03

--------------- ----- -------- --------

Contained

gold oz 3,065 11,595

--------------- ----- -------- --------

Contained

silver oz 5,361 22,139

--------------- ----- -------- --------

Mining - underground

---------------------- ----- -------- -------

2016 2015

---------------------- ----- -------- -------

Ore mined T 100,763 79,276

---------------------- ----- -------- -------

Gold grade g/t 2.70 2.55

---------------------- ----- -------- -------

Silver grade g/t 3.76 3.7

---------------------- ----- -------- -------

Contained

gold oz 8,757 6,492

---------------------- ----- -------- -------

Contained

silver oz 12,182 9,441

---------------------- ----- -------- -------

Mining processing

------------------- ----- -------- --------

2016 2015

------------------- ----- -------- --------

Crushing T 258,206 570,949

------------------- ----- -------- --------

Milling T 262,546 566,664

------------------- ----- -------- --------

Gold grade g/t 1.66 1.12

------------------- ----- -------- --------

Silver grade g/t 2.88 2.25

------------------- ----- -------- --------

Gold recovery % 80.20 76.04

------------------- ----- -------- --------

Silver recovery % 73.45 64.91

------------------- ----- -------- --------

Contained

gold oz 13,679 20,428

------------------- ----- -------- --------

Contained

silver oz 22,491 40,994

------------------- ----- -------- --------

Gold poured oz 10,970 15,534

------------------- ----- -------- --------

Silver poured oz 16,519 26,608

------------------- ----- -------- --------

Total gold production for 2016 was only 10,970oz, and was lower

than that initially budgeted. The result reflects the winding down

and closure of the open pit mine at Sekisovskoye, as the Company's

efforts were focused on increasing its underground development. Of

this amount 3,694oz were produced in H1 and 7,276oz in H2, the

increase in production is encouraging. The production is expected

to build in 2017 such that it is expected to achieve a run rate of

40,000oz of gold per annum in the latter part of the year.

As expected the gold recoveries have increased and are now in

excess of 80% as production is switched to the higher grade ore.

The increase is expected to continue as the composition of the ore

processed is not expected to be so variable in grade. In addition

to this the operational upgrades made in the prior year in the

processing plant have also made a difference in uplifting the

recoveries achieved. In the current year the processed ore was a

mixture of lower grade ore from the open pit and the developmental

ore from the higher grade underground ore bodies. The open pit ore

grade was 0.91 at a very low level and was only used in order to

keep the plant operational. In the current year the low grade

stockpiles have been fully impaired as they are no longer

considered to be economically viable to process.

Financial performance review 2016

In terms of production and revenue generation this is

anticipated to be the low point of the Company's performance. The

production performance was a direct result of the continuing

underground mine development which led to delays and interruptions

to production. In addition the use of low grade ore from that

remaining in the open pit led to the low levels of grade and

recovery rates, and was principally used to maintain the operation

of the processing plant.

As anticipated the grades and recovery are improving and all the

main elements are in place to increase production in the

forthcoming year. The second decline is now moving towards 200masl

and a number of ore bodies are accessible and are being prepared

for production. As noted previously further investment will be

required in order to advance the second decline to minus 50masl

which is the current development plan, and to conduct further

exploratory drilling.

The current KPI's are to a large extent not a valid comparable

to prior years, as production was being maintained at the

processing plant to keep it operational during developmental works.

In particular the production cash cost is very high given the low

level of production and will decrease incrementally as the

production rises with the targeted average cash cost of US$540.

The current cash position and anticipated trading is sufficient

for the budgeted capex (with no expansion), and budgeted production

for the next year, but to further develop the mine additional

investment is required. In the prior year one of the principal

factors affecting the results for the year was the devaluation of

the Kazakh Tenge against the US Dollar The US Dollar has stabilised

against the Kazakh Tenge and is in the range of KZT300-320, and

gold is trading in the range of US$1,200-1,300. Both are expected

to be in similar ranges in the forthcoming year.

The Company has reported a net loss of US$6.4m (2015: US$10.2m),

with a gross profit of US$2.3m (2015: US$4.3m) and an operating

loss of US$4.1m (2015: US$4.8m).

During 2016, Sekisovskoye poured 10,970oz of gold

(2015:15,534oz). A total of 12,602oz (2015:20,890oz) were sold in

2016 at an average price of US$1,259oz (2015: US$1,151oz). Revenue

totalled US$15.9m (2015: US$24.1m) and was lower than 2015 as the

Company focused its efforts on developing the underground

development. The principal purchaser of the gold dore was Kazakh

state refinery as in the prior year.

The total cash cost of production, which includes administrative

costs but excludes depreciation and provisions, amounted to

US$1,238/oz, (2015: US$1,263oz). The operating cash cost amounts to

US$832/oz (2014: US$837/oz). This is based on the cost of sales

excluding depreciation and administrative expenses, and

impairments. The earnings before interest, tax and depreciation,

(Adjusted EBITDA), excluding exceptional items, amounted to a

positive US$260,000, (2015: negative (US$2.3m)).

Depreciation of US$3.1m (2015: US$4.2m). The lower level of

deprecation is a reflection of the decreased charge for mining

properties, reflecting the lower production in the year. In 2016,

the amortisation charge of US$553,000 (2015: US$852,000) relates to

the geological data asset for Karasuyskoye ore field purchased in

2013. As the Company has been awarded a subsoil contract in May

2016 US$322,000 of the amortisation charge has been capitalised to

the exploration and evaluation asset in line with the Group's

accounting policy.

The Group has reported Net cash outflow from operating

activities of US$2.9m (2015: net inflow of US$8.2m). The effect of

lower production was partially offset by a higher average gold

price.

Purchase of property plant and equipment of US$4.9m (2015:

US$9.6m). The Company has been conserving cash where possible in

order to preserve working capital until such point as the funding

is in place to further develop the mine.

Cash at year-end was US$2.2m (2015: US$1.1m). During the year,

the Company raised US$12m via convertible bonds and US$1.7m in the

form of unsecured loans. The Company is currently in negotiations

to raise further funds, and will update shareholders as matters

progress, however available cash resources are sufficient to meet

the current working capital requirements.

The Company's principal debts are that owed to The European Bank

for Reconstruction (EBRD), and the convertible loan notes issued in

the year. The EBRD loan is set to be paid over the remaining two

equal quarterly instalments of US$833,000. In relation to the

convertible bonds they are not expected to impact the cash flow,

(other than the interest payments), until maturity in 2021, at

which point they may be converted into shares. African Resources

Limited have agreed to delay the payment of the outstanding

interest payable on their loans in order to aid the cash flow of

the Company.

The consolidated net assets of the Company are US$34.0m (2015:

US$38.4m).

In summary the Company has progressed well on a developmental

level on its limited funding, and managed to continue the mine

development as well as maintain production albeit at low levels.

2017 is looking encouraging and mining and production is moving

towards the targeted production levels set for the high grade

underground mine.

Consolidated statement of profit or loss

Year ended 31 December 2016

Notes 2016 2015

US$000 US$000

---------------------------------- ------------- ---------------- ---------------

Revenue 3 15,867 24,054

Costs of sales (13,554) (19,763)

---------------------------------- ------------- ---------------- ---------------

Gross profit 2,313 (5,352) 4,291

Administrative expenses (1,107) (9,762)

Impairment-other - -

Impairment reversed 674

---------------------------------- ------------- ---------------- ---------------

Operation Loss Foreign exchange

loss (4,146) (4,797)

Finance expense 283 (5,718)

(2,215) (1,235)

---------------------------------- ------------- ---------------- ---------------

Loss profit before taxation (6,078) (11,750)

Taxation credit (278) 1,532

---------------------------------- ------------- ---------------- ---------------

Loss attributable to equity

holders of the parent (6,356) (10,218)

---------------------------------- ------------- ---------------- ---------------

Profit per ordinary share

Basic & Diluted 4 (0.3c) (0.4c)

---------------------------------- ------------- ---------------- ---------------

Consolidated statement of profit or loss and other comprehensive

income

Year ended 31 December 2016

2016 2015

US$000 US$000

-------------------------------------------- -------------- -------------

Loss for the year (6,356) (10,218)

-------------------------------------------- -------------- -------------

Currency translation differences

arising on translations of foreign

operations items that may be reclassified

to profit or loss 747 (34,577)

Currency translation differences

arising on translation of foreign

operations relating to taxation 866 4,574

Total comprehensive loss attributable

to equity holders of the parent (4,743) (40,221)

-------------------------------------------- -------------- -------------

Consolidated statement of financial position

Year ended 31 December 2016

Notes 2016 2015

US$000 US$000

Company number 5048549

------------------------------------ ------- ----------------------- ----------------

Non-current assets Intangible

assets

Property, plant and equipment

Inventory 5 10,264 9,887

Trade and other receivables

Deferred tax asset Restricted

cash 6 37,316 35,134

- 604

1,100 1,337

5,855 5,145

139 137

------------------------------------ ------- ----------------------- ----------------

54,674 52,244

Current assets Inventories

Trade and other receivables

Cash and cash equivalents 1,366 3,223

3,096 2,649

2,236 1,084

------------------------------------ ------- ----------------------- ----------------

6,698 6,956

Total assets 61,372 59,200

------------------------------------ ------- ----------------------- ----------------

Current Liabilities (5,877) (9,298)

Trade and other payables (461) (297)

Other financial liabilities

Current tax payable Provisions (11) (191)

Borrowings (190) (247)

(4,439) (6,676)

------------------------------------ ------- ----------------------- ----------------

(10,978) (16,709)

------------------------------------ ------- ----------------------- ----------------

Net current assets/(liabilities) (4,280) (9,753)

------------------------------------ ------- ----------------------- ----------------

Non-current liabilities

Other financial liabilities (254) (537)

Other contract liabilities (190) -

Provisions (3,978) (3,553)

Convertible bonds (11,281) -

Borrowings (700) -

------------------------------------ ------- ----------------------- ----------------

(16,403) (4,090)

Total liabilities (27,381) (20,799)

------------------------------------ ------- ----------------------- ----------------

Net assets 33,991 38,401

------------------------------------ ------- ----------------------- ----------------

Equity 3,886 3,886

Called-up share capital

Share premium Merger reserve 141,918 141,918

Other reserve (282) (282)

Currency translation reserve

Accumulated losses 333 -

(45,804) (47,417)

(66,060) (59,704)

------------------------------------ ------- ----------------------- ----------------

Total equity 33,991 38,401

------------------------------------ ------- ----------------------- ----------------

Consolidated statement of changes in equity

Year ended 31 December 2016

Currency

Share Share Merger translation Other Accumulat-

Capital Premium Reserve reserve reserve ed Losses Total

US$000 US$000 US$000 US$000 US$000 US$000 US$000

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

1 January 2015 3,702 137,234 (282) (17,414) - (49,486) 73,754

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Loss for the year - - - - - (10,218) (10,218)

Other comprehensive

loss - - - (30,003) - (30,003)

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Total comprehensive

loss - - - (30,003) - (10,218) (40,221)

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Shares issued on

conversion of loan 184 4,968 - - - - 5,152

notes

Issue costs - (284) - - - - (284)

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

31 December 2015 3,886 141,918 (282) (47,417) - (59,704) 38,401

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Loss for the year - - - - - (6,356) (6,356)

Other comprehensive

income - - - 1,613 - - 1,613

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Total comprehensive

loss - - - 1,613 - (6,356) (4,743)

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Equity components

of loans received - - - - 333 - 333

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

31 December 2016 3,886 141,918 (282) (45,804) 333 (66,060) 33,991

---------------------- -------------- --------------- ------------ -------------------- -------- ------------- ----------------

Consolidated statement of changes in cashflows

Year ended 31 December 2016

2016 2015

US$000 US$000

------------------------------------------ --------------------------- --------------

Net cash (outflow)/inflow from

operating activities (2,918) 8,183

------------------------------------------ --------------------------- --------------

Investing activities

Purchase of property, plant and

equipment (4,898) (9,639)

Payment of costs associated with

provisions (396) -

------------------------------------------ --------------------------- --------------

Net cash used in investing activities (5,294) (9,639)

Financing activities 5,152

Proceeds on issue of shares Issue

costs - (284)

Loans received - -

Borrowings and Interest paid 13,661 (3,990)

(4,193)

------------------------------------------ --------------------------- --------------

Net cash inflow from financing

activities 9,468 878

------------------------------------------ --------------------------- --------------

Increase/ (decrease) in cash

and cash equivalents 1,256 (578)

------------------------------------------ --------------------------- --------------

Foreign currency translation (104) (22)

------------------------------------------ --------------------------- --------------

Cash and cash equivalents at

beginning of the year 1,084 1,684

------------------------------------------ --------------------------- --------------

Cash and cash equivalents at

the end of the year 2,236 1,084

------------------------------------------ --------------------------- --------------

Notes

1. General information

Altyn Plc (the "Company") is a Company incorporated in England

and Wales under the Companies Act 2006.

The financial information set out above for the years ended 31

December 2016 and 31 December 2015 does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006, but

is derived from those accounts. Whilst the financial information

included in this announcement has been compiled in accordance with

International Financial Reporting Standards ("IFRS") (as adopted by

the European Union), this announcement itself does not contain

sufficient financial information to comply with IFRS. A copy of the

statutory accounts for 2015 has been delivered to the Registrar of

Companies and those for 2016 will be submitted for approval by

shareholders at the Annual General Meeting. The full audited

financial statements for the years end 31 December 2016 and 31

December 2015 do comply with IFRS.

2. Going concern

The Group has made good progress in the year in moving forward

the development of the underground mine, but the anticipated

progress was delayed by 9 months from the planned timetable. To

progress the mine to the full projected capacity the Group does

require further funding, which the Group is actively seeking to

raise.

However based on the current level of capital investment made it

is expected that the mine will increase gold production

significantly in the current year. This will enable the Group to

meet its continuing obligations as they fall due. In particular,

the Group's obligations under its loan agreements to EBRD and its

bond holders. The EBRD loan outstanding amounts to US$1.79m as at

the date of this report and is payable by quarterly instalments of

US$833,000. In order to aid the cash flow African Resources Limited

who account for US$10m of the convertible loan debt with a coupon

rate of 10%, have agreed to defer the interest due until such time

as cash flow permits payment. It should also be noted that during

the year the Assaubayev family made available a loan of US$1.66m in

order to provide working capital during the transition phase.

The Group has reviewed the cash flows for 12 months based on the

projected trading. Based on the information available the Directors

are confident that the Group will be able to continue to trade, in

the unlikely event that the loan is requested for repayment earlier

than scheduled.

As noted above the Directors anticipate that, whilst the Group

may seek to raise further finance in the future, it now has access

to sufficient funding for its immediate needs. The Group expects to

have sufficient cash flow from its forecast production to finance

its ongoing operational requirements and to, at least in part, fund

the minimum future capital requirements of the Group. Should the

funding be delayed or additional funding is required to cover any

unforeseen production shortfalls and additional working capital

requirements arising from the move to the underground operations or

in the event that the EBRD loan is requested for payment earlier

than expected, the major shareholder has confirmed their intention

to provide further funding to enable to Group to continue its

planned operations for at least twelve months from the date of the

approval of the financial statements.

On this basis the Directors have therefore concluded that it is

appropriate to prepare the financial statements on a going concern

basis.

3. Revenue

An analysis of the Company's revenues is as follows:

2016 2015

$000 $000

-------------------------- -------------------------------------- --------------------

Sale of gold and silver 15,867 24,054

-------------------------- -------------------------------------- --------------------

Included in revenues from sale of gold and silver are revenues

of US$15,862,000 (2014: US$24,017,000) which arose from sales to

the Company's largest customer which is based in Kazakhstan.

4. Loss per ordinary share

The calculation of basic and diluted earnings per share from

continuing operations is based upon the retained loss from

continuing operations for the financial year of US$6.4m (2015: loss

of US$10.2m)

The weighted average number of ordinary shares for calculating

the basic loss in 2016 and 2015 is shown below. As the Company was

loss making in 2016, the impact of the potential ordinary shares

outstanding from the conversion of the Convertible loan notes would

be anti-dilutive, and as such the basic and diluted earnings per

share are the same.

2016 2015

-------------------- ------------- -------------

Basic and diluted 2,334,342,130 2,298,284,596

-------------------- ------------- -------------

5. Intangible assets

Karasuyskoye Exploration

geological and evaluation

data costs US$000

Cost

1 January 2015 20,736 - 20,736

Translation difference (9,597) - (9,597)

31 December 2015 & 11,139 - 11,139

1 January 2016

Additions - 396 396

Translation difference 206 - 206

Amortisation capitalised - 322 322

31 December 2016 11,345 718 12,063

Amortisation

1 January 2015 1,296 - 1,296

Charge for the year 852 - 852

Translation difference (896) - (896)

31 December 2015 & 1,252 - 1,252

1 January 2016

Charge for the year 553 - 553

Translation difference (6) - (6)

31 December 2016 1,799 - 1,799

Net Book Value

1 January 2015 19,440 - 19,440

31 December 2015 9,887 - 9,887

31 December 2016 9,546 718 10,264

=========================== ============================== ================================================ ============================

The intangible assets relate to the historic geological

information pertaining to the Karasuyskoye ore fields. The ore

fields are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye. The Company obtained

a contract for exploration and evaluation on the site in May 2016

from the Kazakh authorities. The contract is valid for a period of

6 years.

The value of the geological data purchased is in the opinion of

the Directors the value that would have been incurred if the

drilling had been undertaken by a third party (or internally). They

took the view that a 20 year write off is appropriate in relation

to the absorption of the cost given the current development of the

site.

6. Property, plant and equipment

Mining properties Freehold, Equipment Plant,

and leases US$000 land and fixtures machinery Assets

buildings and and under Total

US$000 fittings vehicles construction US$000

US$000 US$000 US$000

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

Cost 16,541 15,434 18,852 8,041 29,414

1 January 2015 Additions

Disposals Transfers 104 1,210 1,782 92 6,451 88,282

Currency translation adjustment (863) - (288) (8) (21) 9,639

- - - - - (1,180)

(7,392) (7,564) (9,245) (3,751) (16,425) -

(44,377)

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

31 December 2015 & 1 January

2016 Additions 8,390 9,080 11,101 4,374 19,419 52,364

Disposals Transfers - 217 1,056 1,376 2,891 5,540

Transfers to inventories - - (663) - (1) (664)

Currency translation adjustment - 14,788 505 - (18,487) (3,194)

2,817 - - - - 2,817

144 156 190 75 333 898

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

31 December 2016 11,351 24,241 12,189 5,825 4,155 57,761

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

Accumulated depreciation 3,432 6,046 12,768 4,798 - 27,044

1 January 2015 Charge for

the year Disposals -425 1,136 1,840 823 - 4,224

Currency translation adjustment - (1,736) - - (81) - (81)

(3,193) (6,550) (2,479) - (13,958)

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

31 December 2015 & 1 January

2016 Charge for the year 2,121 3,989 8,058 3,061 - 17,229

Disposals 102 1,016 1,573 376 - 3,067

Transfers - - (216) - - (216)

Currency translation adjustment - - - - - -

39 95 169 62 365

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

31 December 2016 2,262 5,100 9,584 3,499 - 20,445

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

Net book value

1 January 2015 13,109 9,388 6,084 3,243 29,414 61,238

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

31 December 2015 6,269 5,091 3,043 1,312 19,419 35,134

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

31 December 2016 9,089 19,140 2,605 2,327 4,155 37,316

------------------------------------ --------------------------------------------- -------------------- ------------------ ------------------------ ----------------------- ----------------

Capitalised cost of mining property and leases are amortised

over the life of the licence from commencement of production on a

unit of production basis. This basis uses the ratio of production

in the period compared to the mineral reserves at the end of the

period plus production in the period. Mineral reserves estimates

are based on a number of underlying assumptions which are

inherently uncertain. Mineral reserves estimates take into

consideration estimates by independent geological consultants.

However, the amount of mineral that will ultimately be recovered

cannot be known until the end of the life of the mine. Any changes

in reserve estimates are, for amortisation purposes, treated on a

prospective basis. The recovery of the capitalised cost of the

Company's property, plant and equipment is dependent on the

development of the underground mine.

Under the terms of the loan agreement with the European Bank for

Reconstruction and Development (EBRD), the Company and its

subsidiaries should have pledged certain assets as security for the

loan that was entered into.

The Directors are required to consider whether the non-current

assets comprising, mineral properties leases, plant and equipment

have suffered any impairment. The recoverable amount is determined

based on value in use calculations. The use of this method requires

the estimation of future cash flows and the choice of a discount

rate in order to calculate the present value of the cash flows. The

directors have concluded that no adjustment is required for

impairment.

7. Availability of accounts

The audited Annual Report and Financial Statements for the 12

months ended 31 December 2016 and notice of AGM will shortly be

sent to shareholders and published at: www.altyn.uk

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR OKFDBPBKDOQB

(END) Dow Jones Newswires

April 28, 2017 11:43 ET (15:43 GMT)

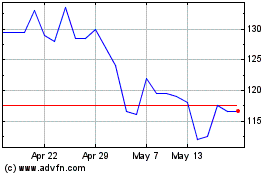

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024