TIDMGBGR

RNS Number : 9213L

GoldBridges Global Resources PLC

30 April 2015

30 April 2015

GoldBridges Global Resources Plc

("GoldBridges" or the "Company")

Audited results for the year ended 31 December 2014

GoldBridges, the open pit and underground gold mining and

development company, is pleased to announce the release of its

audited results.

Highlights

Company Highlights

-- Competent Person's Report published on Sekisovskoye,

including updated JORC resource and reserve statement - validates

both ore body and underground development strategy;

-- JORC ore reserves of 2.26Moz, JORC mineral resources (indicated and inferred) of 5.14Moz;

-- Admission to Main Market of London Stock Exchange by Standard Listing in December 2014

-- Post period end: awarded tender to perform further

confirmatory testing to gain sub-soil user licence to the adjacent

Karasuyskoye Ore Fields;

-- Successful resolution in relation to the recovery of monies

from the Akmola Gold investment, US$2.7m received.

-- Successfully completed Placings, raising net proceeds of

US$22.7m in 2014 and a further US$5.1m in April 2015, to further

develop the Company's strategic plans and provide additional

working capital;

Financial Highlights

-- 2014 Revenue of US$35.2m (2013: US$42.4m), reflecting lower gold prices;

-- 2014 gold sales of 27,959oz (2013: 29,712oz);

-- Finished gold stocks increased to 7,307oz (2013: 2,024oz);

-- Average gold price achieved (including silver as a

by-product), US$1,258/oz (2013: US$1,427/oz);

-- Reduction in administrative expenses to US$8.2m (2013:

US$16.5m), due to efficiency and organisational savings instigated

in 2013;

-- 2014 adjusted EBITDA of positive US$5.3m (2013: negative US$0.59m).

Operational Highlights

-- Gold poured 32,994oz, (2013: 30,669oz) a 7.5% increase ;

-- 2014 Average gold grade of 1.71g/t, (2013: 1.61g/t) ;

-- Operating cash cost decreased to US$834/oz (2013:US$903/oz);

-- Gold recovery rate of 83.3% (2013:84.3%) is expected to

improve as more higher grade ore is processed;

-- 2014 capital expenditure paid of US$26.0m (2013: US$7.4m).

Aidar Assaubayev, CEO of GoldBridges, commented:

"2014 was a significant year for GoldBridges, with our move to

the main market a reflection of the considerable progress we have

made in the last two years. We also delivered a robust operational

and financial performance during 2014. From a technical

perspective, we had a very productive year in delivering our

completed independent competent person's report, which demonstrated

significantly increased JORC reserves and resources and our plan

for further development of the Sekisovskoye underground mine. We

look forward to providing updates on our progress in that regard as

the year progresses."

For further information please contact:

GoldBridges Global Resources Plc

Louise Wrathall

+44 (0) 207 932 2456

Strand Hanson (Financial Adviser and Joint Broker)

Andrew Emmott / James Spinney / Ritchie Balmer

+44 (0) 207 409 3494

Cantor Fitzgerald Europe (Joint Broker)

Stewart Dickson / Jeremy Stephenson

+44 (0) 207 894 7000

Bell Pottinger (Financial PR)

Daniel Thole / Marianna Bowes / Richard Crowley

+44 (0) 203 772 2500

Information on the Company

GoldBridges is a gold mining, exploration and development group

based in Kazakhstan. Whilst the Company was initially established

to exclusively develop and operate the Sekisovskoye gold and silver

mine in the East Kazakhstan Region, it is now actively targeting

additional gold mining opportunities in Kazakhstan. This includes

the adjacent prospective Karasuyskoye Ore Fields, on which

GoldBridges was recently awarded the tender to perform further

confirmatory testing in order to gain the sub-soil user

licence.

The Company holds a 100 per cent shareholding in DTOO

Gornorudnoe Predpriatie Sekisovskoye ("DGPS") which holds a subsoil

use contract in relation to the Sekisovskoye deposit, covering a

total area of 0.855km(2). The subsoil use contract for Sekisovskoye

is valid until 2020 and the Company currently intends to seek to

extend the contract in accordance with its terms. The Company also

holds a 100 per cent shareholding in DTOO Altai Ken-Bayitu LLP

which owns and operates the processing plant at the Sekisovskoye

deposit. The Sekisovskoye deposit is located at the village of

Sekisovka, approximately 40km north of the town of Ust-Kamenogorsk,

the capital city of the East Kazakhstan Region. The current

operation is focused on mining two open pits where the

near-vertical deposits extend to the surface. The open pits are

nearing their end of life in 2015, and the Company is developing an

underground extension to exploit the deposits to depth.

The Company intends that the Sekisovskoye deposit shall become a

selective-mining underground operation. As at 31 May 2014, the

Company's proven and probable reserves consisted of 2.3Moz of gold

and 3.0Moz of silver, and the Company's measured, indicated and

inferred resources consisted of 5.1Moz of gold and 3.5Moz of

silver, in each case as classified in accordance with JORC.

In the year ended 31 December 2014, the Company's consolidated

revenue was US$35.2 million and its EBITDA was US$5.3 million.

Chairman's Statement

I am pleased to report that the plans for the future development

of the Sekisovskoye mine are now well developed, with significant

milestones achieved in 2014, including the publication of a

Competent Persons Report (CPR) with updated reserves and resources

in November. This was followed by the Company's shares being

admitted to dealing on the standard segment of the London Stock

Exchange in December, increasing the profile and attractiveness of

GoldBridges to investors, both current and future, as well as

increasing the profile and reputation of the Company in

Kazakhstan.

The Sekisovskoye CPR was seen as a key component forming the

basis of building investor confidence and underpinning any future

funding requirements that the Company is seeking in order to fulfil

its development plans. At present, underground production is being

carried out in addition to open-pit mining, although it has now

been decided that it makes economic sense to phase out the open pit

mining during Q3 2015. At this point, all production will be from

the underground mine, with feed to the processing plant being

complemented by the use of existing ore stockpiles. The detailed

development plans and funding options are currently being finalised

and will lead to an increase in the production capacity of the

underground workings. During the year, a significant part of the

funding raised from the Placings undertaken in January and February

2014 which raised cash resources of $22.7m was used to enhance and

develop the current underground operations. Further funding of

US$5.0m was raised in April 2015 to provide interim funding for

working capital and to progress the development of the underground

mine.

Gold poured for the full year increased by 7.5% to 32,994 ounces

(2013: 30,669 oz), with an increasing amount being delivered from

the underground operations. During the year, the increased level of

activity was slowed by the flow of work during the processing plant

improvements as well as by future development work. Our 2014 gold

sales amounted to 27,959 ounces (2013: 29,712 ounces), a decrease

of 1,753 ounces. However, there was an increase in the inventories

of finished goods which increased by 5,283oz to 7,307oz at the year

end. The significant difference from the prior year has been in the

price of gold, with an average market price of gold in 2014 of

US$1,198 per ounce, compared to an average market price in 2013 of

US$1,418 per ounce, a 15% reduction.

This has had an inevitable impact on profitability, particularly

in the second half of the year, with the gold price finishing the

year at US$1,183 per ounce. The actual average price the Company

achieved (including silver as a by-product was US$1,258 per ounce

(2013: US$1,427). The current consensus is that gold will trade at

an average between US$1,200 and US$1,235 per ounce throughout

2015.

Given the economic model currently being developed by the

Company, we feel that the Company has sufficient headroom in

profitability to cope with any further downward pressure on gold

prices.

As reported last year, the Company acquired the geological data

in relation to the Karasuyskoye Ore Fields, located adjacent to the

current operations at Sekisovskoye. The Company successfully

obtained the necessary permits to exploit the site and conduct

further testing to validate the initial resource estimates. The

Company is expecting to conclude testing and obtain the sub-soil

user licence for the area in 12-18 months following the completion

of further testing.

I am also pleased to report that the final material legacy issue

was resolved in 2014, resulting in the Company receiving US$2.27m,

being the total amount claimed (which includes interest and costs).

This amount related to the settlement of an outstanding claim made

against Akmola Gold LLP for the return of funds invested by the

previous management in the project.

2015 will be a year of transition and development for the

Company with the Sekisovskoye operation starting on the road to

achieving its full potential, and the development of the

Karasuyskoye project providing a future stepping stone for greater

growth in the Company's fortunes.

Finally, may I thank all our employees and our management team

for their hard work and our shareholders, for their continued

support.

Kanat Assaubayev

Chairman

Chief Executive Officer and Operational Review

We are pleased to report a solid performance in 2014, against

the backdrop of falling gold prices. We have taken significant

steps forward this year in planning and development in relation to

the efficient exploitation of the higher grade underground reserves

at Sekisovskoye, which is a key factor in delivering significant

shareholder value in the future.

During 2014, our operational performance at Sekisovskoye was

robust and, importantly, the proportion of ore from the underground

mine increased, as did the grade of ore mined from the underground

operations. This bodes well as we continue with the transition from

open pit to a solely underground gold mine. In this regard, our

technical consultants, Venmyn Deloitte, completed our Sekisovskoye

Competent Persons Report ('CPR'). This comprised JORC compliant

reserves and resources, financial assumptions and valuation

scenarios for our development project. We also made positive

progress in receiving permits for the Karasuyskoye Ore Fields and,

in 2015, we announced that we had been successful in receiving

permits for further testing which will lead to a subsoil user

licence in the near future.

Sekisovskoye Gold Mine - Our Operational Track Record

The operational performance of the Company's Sekisovskoye gold

mine during 2014, against the prior year and against budget, is

provided below. The key operational statistics of the mine

operation are as follows:

Mining - Open-pit

----------------- --------

2014 2013

----------------- --------

Ore mined T 570,991 705,257

----------------- --------

Gold grade g/t 1.26 1.39

----------------- --------

Silver grade g/t 1.89 2.49

----------------- --------

Contained gold oz. 23,050 31,621

----------------- --------

Contained silver oz. 34,620 56,387

----------------- --------

Mining - Underground

------- -------

2014 2013

------- -------

Ore mined T 82,045 63,572

------- -------

Gold grade g/t 2.96 3.50

------- -------

Silver grade g/t 4.05 5.27

------- -------

Contained gold oz. 7,807 7,157

------- -------

Contained silver oz. 10,680 11,139

------- -------

Mining - Enriched ore

------- -----

2014 2013

------- -----

Ore mined T 34,000 -

------- -----

Gold grade g/t 4.16 -

------- -----

Silver grade g/t 5.72 -

------- -----

Contained gold oz. 4,547 -

------- -----

Contained silver oz. 6,253 -

------- -----

Mineral processing Budget

Budget Actual - % Actual

-------------- -------- ------------------- --------

2014 2014 2014 2013

-------------- -------- ------------------- --------

Crushing T 735,000 726,427 98 700,421

-------------- -------- ------------------- --------

Milling T 735,000 728,620 99 701,361

-------------- -------- ------------------- --------

Gold grade g/t 1.3 1.71 131 1.61

-------------- -------- ------------------- --------

Silver grade g/t 2.19 2.37 108 2.16

-------------- -------- ------------------- --------

Contained gold oz. 30,720 39,798 130 36,388

-------------- -------- ------------------- --------

Contained silver oz. 51,752 55,603 107 48,782

-------------- -------- ------------------- --------

Gold recovery per cent. 83 83.3 100 84.3

-------------- -------- ------------------- --------

Silver recovery per cent. 74 74.4 101 71.6

-------------- -------- ------------------- --------

Gold poured oz. n/a 32,994 n/a 30,669

-------------- -------- ------------------- --------

Silver poured oz. n/a 41,390 n/a 34,902

-------------- -------- ------------------- --------

In 2014, 25.3% of the total 30,857 oz of contained gold in the

ore was mined from the underground operation. The average gold

grade from the underground mine during 2014 was 2.96g/t which is

expected to rise as higher grade ore is accessed through continued

underground development. The higher percentage of underground ore

helped to increase the average grade from 1.61g/t in 2013 to

1.71g/t in the current year. Recovery fell from 84.3% in 2013 to

83.3% in 2014. However, it is expected to improve as the higher

grade ore is processed and is budgeted to be in the region of

84%.

The Sekisovskoye JORC probable reserve gold grade, as reported

in the Competent Person's Report released to the market on 17

November 2014, is 4.09g/t. The Company is increasing the mined

grade towards the reserve grade. At present the mining operations

are gradually moving towards the main ore body from the lower grade

peripheral ore.

During the year, the Company increased the number of employees

working in the underground mine and, additional mining equipment

was purchased to increase the future contributions of ore

production from the underground mine. This is expected to provide a

greater contribution as the scale of the operation is expanded.

During the period, a preliminary review of the gold processing

plant was conducted that highlighted opportunities to improve the

performance of the plant and detailed investigations will be

initiated to determine how these may be implemented.

Sekisovskoye Independent CPR - laying the foundations for our

underground development plans

In Q4 2013, mining consultants Venmyn Deloitte commenced work on

a Competent Person's Report ("CPR") which was to estimate JORC

compliant resources and reserves for Sekisovskoye, as well as

providing cost and valuation scenarios for the underground

development project. This work was completed in Q4 2014 and has

enabled us to set out our future plans for this development

project.

The Company has used the information obtained in the CPR to

develop its plans in relation to the expansion of underground

operations at Sekisovskoye. At present, it is exploring two options

in relation to the development of the underground mine. These are

(a) a shaft based approach as documented in the CPR and (b) a

development based approach, with the expansion of the existing

decline and a secondary decline being strategically built to

significantly increase the quantity of ore mined in an economically

efficient way. Both approaches are expected to result in a similar

net present value of future cash flows. However, the essential

difference will be in the timings of cash flows needed to fund the

capital expenditure for the mine development.

Underground gold mining particularly, in Australia, has advanced

in the use of the decline approach which is popular with a large

number of mining companies. In this regard, the Company is in

discussions with an international contract mining firm with

extensive experience in the industry in relation to costings and

assistance in developing a mining plan to assess the feasibility of

developing the underground mine using this approach.

The CPR estimated probable ore reserves of 2.26Moz from 17.25Mt

at 4.09g/t Au from surface (approximately 350m above sea level) to

400m below sea level. The previous ore reserve estimate in 2011 was

for 0.27Moz of gold.

Mineral resources (both indicated and inferred) now total

5.14Moz - an increase from 1.8Moz in 2011. Additional exploration

results of 3.3Moz were also identified which, with further

drilling, may be upgraded to mineral resources. These resource and

exploration result estimates were based on an extensive drilling

programme which represents more than 170,000m of drilling.

Increasing future gold production

The current Sekisovskoye mine has a conventional carbon-in-leach

(CIL) gold recovery plant with a processing capacity of

0.85Mt/year. A small incremental processing plant expansion is

planned to be completed by 2018, which will increase throughput

from 0.85Mt/year to 1Mt/year. The expansion will be through

debottlenecking of existing equipment and the addition of some new

equipment to support the upgrade.

Through accessing the higher grade ore reserves in the

underground mine, which are estimated at 4.09g/t, against the 2014

average grade delivered to the mill of 1.81g/t Au, utilising the

full processing plant capacity and incrementally increasing it, the

Company is well placed to increase its annual gold production to in

excess of 100,000oz by 2018 under the current plans.

From 2015 onwards, the processing plant is expected to produce a

gold doré with an overall gold recovery of 84% and an associated

silver recovery of 75%. This is commensurate with the metallurgical

test work that has been undertaken and is broadly in line with

operational performance to date. Over the life of the mine,

Sekisovskoye is expected to produce 1.89Moz of gold, with total

associated silver production of 2.72Moz.

The CPR financial outcomes based on the JORC compliant Probable

Reserve, the initial capital investment and forecast operating

costs indicate a robust project for the underground mine

development at Sekisovskoye. The Net Present Value (after tax),

using a discount rate of 9.3% and a prevailing gold price at that

time of US$1,273/oz, was estimated at US$286.7m, with a 64.4% IRR.

Additional financial modelling has confirmed the project remains

viable at gold prices which are significantly below current prices,

as demonstrated in the following table. Importantly, this table

demonstrates that the project remains NPV positive under low gold

price scenarios.

Gold Silver

price price

(US$/oz.) (US$/oz.) NPV (US$m)

----------- ----------- -----------

750 15 55.2

----------- ----------- -----------

900 17 135.2

----------- ----------- -----------

1050 18 203.2

----------- ----------- -----------

1200 19 257.8

----------- ----------- -----------

1273 19.7 286.7

----------- ----------- -----------

1300 20 295.6

----------- ----------- -----------

1400 21 325.5

----------- ----------- -----------

The upside opportunity at the Sekisovskoye Mine is related to

further exploration drilling to upgrade the existing multimillion

ounce gold exploration targets to Mineral Resources and to

potentially upgrade the existing Mineral Resources to Ore Reserves.

This may justify a further expansion of the processing plant or an

increase in the mine life. The option of a feasibility study for a

2Mtpa mine in the future, producing more than 200,000oz per year of

gold is being considered, based on the increase in the overall

resource and the large volume of prospective exploration targets

identified.

Karasuyskoye - our long term development plan

In 2013, GoldBridges reported that it had acquired a very

extensive technical database that covered the Karasuyskoye Ore

Fields area, a land package of 198km(2) adjacent to

Sekisovskoye.

We are pleased to report that during 2014 we made significant

progress in terms of obtaining drilling permits for Karasuyskoye

and in January 2015, were given further rights to perform

confirmatory drilling. This is expected to lead to the award of a

licence and contract for the subsoil rights by the relevant

authorities in Kazakhstan. The final subsoil licence terms and

conditions, including the new financial incentives now offered

specifically to GoldBridges through the state programme on forced

industrial-innovative development (SFIID), are expected to be

finalised in the near term. These additional terms are expected to

include investment incentives and tax reductions as previously

announced.

The data acquired indicates that there are several mineralised

zones and leads the Company to believe that Karasuyskoye has the

potential to contain significant gold resources. The Company is to

commence validation work of this geological data. This work will

facilitate the preparation of an independent CPR to international

standards, and the Company will work on this programme throughout

2015-16.

On completion of the CPR, the Company envisages progressing

towards mining within the Karasuyskoye Ore Fields, primarily using

cash generated from existing operations There is also the potential

to use the Company's existing open pit assets once Karasuyskoye

becomes operational.

Move to Main Market

In December 2014, we moved our listing from AIM to the Main

Market of the London Stock Exchange with a Standard Listing. The

progression to the Main Market is a natural step in the Company's

growth cycle as a quality Kazakh company and demonstrates our

alignment with and commitment to the London Investor base. The move

also reflects our focus on meeting best practise corporate

governance standards.

Looking to 2015

2015 will be a busy year for the Company as it plans to make

significant progress to lay the foundations for its growth. The

Company is close to finalising its approach in relation to the

funding, and the technical approach to be taken to develop the

Sekisovskoye mine and shareholders will be updated in due course.

Given the robust economics of the project the Company is positive

of remaining profitable against an uncertain future gold price.

The Company is very positive about the future potential of the

Karasuyskoye project and will be progressing this asset in parallel

to Sekisovskoye. The Company will keep shareholders informed of the

exploration and appraisal progress on this asset during the course

of the year.

Financial performance review 2014

During 2014, Sekisovskoye poured 32,994oz of gold (2013:

30,669oz). A total of 27,959oz (2013: 29,712oz) were sold in 2014

at an average price of US$1,198 (2013: US$1,418) per ounce. Revenue

totalled US$35.2m (2013: US$42.4m) and was lower than 2013 due to

both reduced gold sales and the lower gold price. In addition, the

Company sold obsolete and surplus parts for a total of US$1.1m, and

this amount is included within other income. There were no other

material items of revenue.

The total cash cost of production, which includes administrative

costs but excludes depreciation and provisions, amounts to

US$1,084/oz (2013: US$1,309/oz). The operating cash cost amounts to

US$834/oz (2013: US$903/oz). Additional cost saving measures are

being put in place to further reduce the costs, however, the major

impact will be the higher grade ore being accessed in the future

that is expected to lead to higher revenues and a decrease in the

unit cash costs.

The 2014 earnings before interest, tax, depreciation and

amortisation (EBITDA), excluding exceptional items, amounted to

US$5.3m. This is in marked contrast to the prior year with cash

being absorbed by the operations of US$0.6m. With the further cost

savings filtering through next year, and an increase in production

from the underground reserves, EBITDA is anticipated to further

improve during the current year.

The Company's administrative expenses have reduced markedly from

US$16.5m in 2013 to US$8.2m in 2014, and the Directors are

committed to keeping administration expenses as low as possible.

2013 administrative expenses were impacted by exceptional costs

principally related to the acquisition of the Karasuyskoye Ore

Fields.

Depreciation of US$5.4m (2013: US$5.2m) is broadly in line with

2013. In 2014 amortisation is US$1.0m (2013 US$0.3m) and this

relates to amortising the value of Karasuyskoye data purchased in

2013 ahead of the final terms of the subsoil user licence.

The income statement reflects a write-back of previously

impaired low grade ore stockpiles of US$284,000 (2013: US$ nil).

This reflects the operational aim to blend this material with

higher grade underground ore to operate the processing plant at

capacity.

The exceptional items include the following:

- Legal fees of US$0.7m associated with the move from AIM to the

Main Market of the London Stock Exchange.

- Write back of impairments of a net positive US$1.0m includes a

positive contribution from the company recouping funds from the

aborted Akmola transaction of US$2.27m, less other smaller

impairments made this year against receivables.

The Company has reported a net loss of US$0.3m (2013: net profit

US$2.3m as restated), with a gross profit of US$7.2m (2013:

US$10.3m) and an operating profit of US$0.8m (2013: US$3.1m). This

includes a taxation benefit of US$1.6m.

GoldBridges has reported net cash inflow from operating

activities of US$5.6m. This was lower than the US$7.1m reported in

2013 due to lower gold sales, which is largely a timing issue, and

a considerably lower average gold price.

Purchase of property plant and equipment of US$26.0m (2013:

US$7.5m) reflects GoldBridges increased capital spend on the

migration of operations from open pit to a solely underground mine.

Directors expect a similar or higher investing cash outflow again

in 2015.

Cash at year end was US$1.7m. Cash at 31 December 2013 was

US$2.1m, although the Company placed US$23.2m in equity during the

course of 2014, which was largely spent on the capex during the

year. Post period end, in April 2015, GoldBridges announced that it

had raised gross proceeds of approximately US$5.1m through a

subscription of 123,000,000 new Ordinary Shares at a price of 2.8

pence per share. The net proceeds of the Subscription will be used

for general working capital purposes, and will form part of the

funding to enable the Company to develop the underground mine at

Sekisovskoye in accordance with the Company's business plan.

The Company's principal debt is that owed to The European Bank

for Reconstruction (EBRD). The loan is set to be paid by twelve

equal quarterly instalments, and repayments commenced in January

2015.

The net assets of the Company are US$73.8m (2013: US$59.9m as

restated) and the increase arises principally from the investment

in the underground development project.

Consolidated statement of profit or loss

Year ended 31 December 2014

Notes 2014 Restated

US$000 2013

US$000

-------------------------------------- ------ ---------- ----------

Revenue 5 35,177 42,395

Costs of sales (27,969) (32,076)

-------------------------------------- ------ ---------- ----------

Gross profit 7,208 10,319

Other operating income 1,141 -

Administrative expenses (8,233) (16,475)

Tailing dam leak 330 9,252

Listing expenses (702) -

Impairments (1,214) -

Impairment reserved - Akmola LLP 2,227 -

-------------------------------------- ------ ---------- ----------

Operating Profit 757 3,096

Finance income 7 1

Foreign exchange loss (1,418) (413)

Finance expense (331) (771)

-------------------------------------- ------ ---------- ----------

(Loss)/profit before taxation (985) 1,913

Taxation credit 730 358

-------------------------------------- ------ ---------- ----------

(Loss)/profit attributable to equity

holders of the parent (255) 2,271

-------------------------------------- ------ ---------- ----------

Profit per ordinary share

-------------------------------------- ------ ---------- ----------

Basic & Diluted 6 (0.01)c 0.23c

-------------------------------------- ------ ---------- ----------

Consolidated statement of profit or loss and other comprehensive

income

Year ended 31 December 2014

2014 2013

US$000 US$000

------------------------------------------------ -------- --------

(Loss)/profit for the year (255) 2,271

------------------------------------------------ -------- --------

Currency translation differences arising on

items that may be reclassified to profit or

loss in accordance with IAS 1 (9,310) (763)

------------------------------------------------ -------- --------

Currency translation differences arising on 737 -

translations of foreign tax

------------------------------------------------ -------- --------

Total comprehensive (loss(/income attributable

to equity holders of the parent (8,828) 1,508

------------------------------------------------ -------- --------

Consolidated statement of financial position

Year ended 31 December 2014

Restated

2014 2013

Company number 5048549 Notes US$000 US$000

----------------------------------- -------- ----------- -----------

Non-current assets

Intangible assets 7 19,440 27,157

Property, plant and equipment 8 61,238 45,866

Trade and other receivables 2,553 381

Deferred tax asset 2,407 1,145

Restricted cash 260 301

----------------------------------- -------- ----------- -----------

85,898 74,850

----------------------------------- -------- ----------- -----------

Current assets

Inventories 10,882 9,354

Trade and other receivables 10,260 5,446

Cash and cash equivalents 1,684 2,067

----------------------------------- -------- ----------- -----------

22,826 16,867

----------------------------------- -------- ----------- -----------

Total assets 108,724 91,717

----------------------------------- -------- ----------- -----------

Current Liabilities

Trade and other payables (15,725) (11,512)

Other financial liabilities (326) (239)

Current tax payable (475) (558)

Provisions (335) (647)

Borrowings (3,333) (894)

----------------------------------- -------- ----------- -----------

(20,194) (13,850)

----------------------------------- -------- ----------- -----------

Net current assets ( liabilities) 2,632 3,017

----------------------------------- -------- ----------- -----------

Non-current liabilities

Other financial liabilities (709) (1,287)

Provisions (7,400) (6,705)

Borrowings (6,667) (10,000)

----------------------------------- -------- ----------- -----------

(14,776) (17,992)

----------------------------------- -------- ----------- -----------

Total liabilities (34,970) (31,842)

----------------------------------- -------- ----------- -----------

Net assets 73,754 59,875

----------------------------------- -------- ----------- -----------

Equity

Called-up share capital 3,702 2,635

Share premium 137,234 115,594

Merger reserve (282) (282)

Currency translation reserve (17,414) (8,841)

Accumulated losses (49,486) (49,231)

----------------------------------- -------- ----------- -----------

Total equity 73,754 59,875

----------------------------------- -------- ----------- -----------

Consolidated statement of changes in equity

Year ended 31 December 2014

Notes Share Share Merger Currency Accumulated Total

Capital Premium Reserve Translation Losses US$000

US$000 US$000 US$000 reserve US$000

US$000

---------------------- --------- ---------- ---------- ---------- -------------- -------------- ---------

1 January 2013

- restated 1,684 88,245 (282) (8,078) (51,502) 30,067

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Profit of the

year - restated - - - - 2,271 2,271

Other comprehensive

loss - - - (763) - (763)

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Total comprehensive

profit - (763) (49,231) 1,508

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Shares issued

on conversion 951 27,590 - - - 28,541

of loan notes

Issue costs - (241) - - - (241)

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

31 December 2013

- restated 2,635 115,594 (282) (8,841) (49,231) 59,875

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Loss for the

year - - - - (255) (255)

Other comprehensive

loss - - - (8,573) - (9,310)

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Total comprehensive

loss - - - (8,573) (255) (8,828)

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Share issued 1,067 22,095 - - - 23,162

Issued costs - (455) - - - (455)

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

31 December 2014 3,702 137,234 (282) (17,414) (49,486) 73,754

--------------------------------- ---------- ---------- ---------- -------------- -------------- ---------

Consolidated statement of changes in cashflows

Year ended 31 December 2014

Note 2014 2013

US$000 US$000

---------------------------------------------- ------ ----------- ----------

Net cash inflow from operating activities 5,601 7,141

------------------------------------------------------ ----------- ----------

Investing activities

Interest received 7 1

Purchase of property, plant and equipment (25,989) (7,471)

Restricted cash (6) -

Payment of costs associated with provisions (651) -

------------------------------------------------------ ----------- ----------

Net cash used in investing activities (26,639) (7,470)

Financing activities -

Proceeds on issue of shares 23,162 (241)

Issue costs (455) 894

Loan from related party (1,043) (924)

Interest paid (750)

------------------------------------------------------ ----------- ----------

Net cash used in investing activities 20,914 (271)

------------------------------------------------------ ----------- ----------

Decrease in cash and cash equivalents (124) (600)

------------------------------------------------------ ----------- ----------

Foreign currency translation (259) 163

------------------------------------------------------ ----------- ----------

Cash and cash equivalents at beginning

of the year 2,067 2,504

------------------------------------------------------ ----------- ----------

Cash and cash equivalents at the end

of the year 1,684 2,067

------------------------------------------------------ ----------- ----------

Notes

1. General information

GoldBridges Global Resources Plc (the "Company") is a Company

incorporated in England and Wales under the Companies Act 2006.

The financial information set out above for the years ended 31

December 2014 and 31 December 2013 does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006, but

is derived from those accounts. Whilst the financial information

included in this announcement has been compiled in accordance with

International Financial Reporting Standards ("IFRS") (as adopted by

the European Union), this announcement itself does not contain

sufficient financial information to comply with IFRS. A copy of the

statutory accounts for 2013 has been delivered to the Registrar of

Companies and those for 2014 will be submitted for approval by

shareholders at the Annual General Meeting. The full audited

financial statements for the years end 31 December 2014 and 31

December 2013 do comply with IFRS.

2. Auditors opinion

The auditor has issued an unqualified opinion in respect of the

financial statements which does not contain any statements under

the Companies Act 2006, Section 498(2) or Section 498(3).

3. Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") in force at

the reporting date and their interpretations issued by the

International Accounting Standards Board ("IASB") as adopted for

use within the European Union. The consolidated financial

statements have also been prepared in accordance with those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS.

It is not anticipated that the adoption in the future of the new

or revised standards or interpretations that have been issued by

the International Accounting Standards Board but are not yet

effective will have a material impact on the Group's earnings or

shareholders' funds. The Company has not adopted any new standards

in advance of the effective dates.

4. Going concern

The Company will continue to generate its gold production from

its open pit until production ceases in August 2015, and from this

point all gold will be generated from the underground operations at

Sekisovskoye. The underground operations are continuing to provide

an increasing amount of high grade ore which is expected to

increase in volume and grade in the year. The ore has been mined

through the deepening of the transport decline giving access ore

bodies #11 and #3. In addition, in the current year development

work was also undertaken to give access to ore body #8 and this

provides additional ore production capacity in 2015.

On 20 April 2015 the Company completed a successful share

placing raising gross proceeds of GBP3.4m, (equivalent to US$5.0m).

This provides additional working capital to the Company, and also

provides the further capital required to progress the underground

project developments.

The Directors anticipate that, whilst the Company may seek to

raise further finance in the future, it now has access to

sufficient funding for its immediate needs.

The Company expects to have sufficient cash flow from its

forecast production to finance its ongoing operational requirements

and to, at least in part, fund the future capital requirements of

the Company. The Directors are confident that further sources of

funding can be acquired in the timescales required to meet the

future funding requirements as necessary.

On this basis the Directors have therefore concluded that it is

appropriate to prepare the financial statements on a going concern

basis.

5. Revenue

Continuing operations 2014 2013

$000 $000

------------------------- ------- -------

Sale of gold and silver 35,177 42,395

------------------------- ------- -------

Included in revenues from sale of gold and silver are revenues

of US$35,177,000 which arose from sales to the Group's largest

customer. All of the sales in the prior year related to a different

but single customer.

6. Loss per ordinary share

The calculation of basic and diluted loss per share is based

upon the retained loss from continuing operations for the financial

year of US$255,000 (2013: profit of US$2,271,000 as restated).

The weighted average number of ordinary shares for calculating

the basic profit/(loss) in 2014 and 2013 is shown below. There were

no potential ordinary shares outstanding at the reporting date

(2013: Nil) and as such basic and diluted earnings are the

same.

2014 2013

------------------- -------------- --------------

Basic and diluted 2,125,781,253 1,003,707,088

------------------- -------------- --------------

7. Intangible assets

Total

ussooo

======================= ==============

Cost

1 January 2013 -

Additions 27,500

Adjustments* (2,532)

Currency translation

adjustment (4,232)

============================ ==============

31 December 2014 20,736

============================ ==============

Amoritisation

1 January 2013 -

Charge for the year 343

31 December 2013 343

============================ ==============

Charge for the year 1,023

Translation difference (70)

============================ ==============

31 December 2014 1,296

============================ ==============

Net book value

1 January 2013 -

======================= ==============

31 December 2013 27,157

============================ ==============

31 December 2014 19,440

============================ ==============

*The adjustment relates to the recovery of VAT reclaimable on

the purchase price of the geological data.

The intangible assets relate to the historic geological

information pertaining to the Karasuyskoye ore fields. The ore

fields are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye

In January 2015, GoldBridges had been awarded the subsoil user

rights to Karasuyskoye by the Ministry of Investments and

Development in Kazakhstan The final subsoil contract terms and

conditions, including the new financial incentives offered

specifically to GoldBridges through the state programme on forced

industrial-innovative development (SFIID), has been not awarded

however the subsoil user rights awarded gives the Company a

pre-emptive right to obtain the subsoil contract The subsoil user

rights allows the Company to perform further exploration work in

order to complete a work programme which will needs to be submitted

to the authorities for approval.

The Ministry requires 12 to 18 months from date of issue of the

subsoil user rights to perform due diligence checks on the

information provided by the Company during the tendering process

and to prepare the terms of the subsoil contract including any

grants, tax reliefs, environmental protection requirements etc.

Management believes that the final contract will be awarded based

on ongoing consultation with the Ministry, compliance with local

legal and tax regulations and the submission of an appropriate

mining plan.

8. Property, plant and equipment

Freehold, Plant, Restated

Mining land and Equipment, machinery assets

proper fixtures under

lies and

and leases buildings fittings and vehicles construction Total

ussooo ussooo ussooo US000 ussooo ussooo

============== ================== =============== =============== =============== =============== ==============

Cost

1 January

2013* 10,401 16,980 15,165 7,352 13,259 63,157

Additions 468 11 1,234 966 8,079 10.758

Disposals (119) (142) (8) (8) (277)

Currency

translation

adjustment (187) (378) (330) (178) (397) (1,470)

============== ================== =============== =============== =============== =============== ==============

1 January

2014 10,682 16,494 15,927 8,132 20,933 72,168

Additions 131 58 5,31 2 1,302 22,040 28,843

(1.71

Disposals (563) (1,017) (131) 1)

Transfers 7,211 2,028 1,400 (339) (10,300)

Currency

translation

adjustment (1,483) (2,583) (2,770) (1,054) (3,128) (11,018)

============== ================== =============== =============== =============== =============== ==============

31 December

2014 16,541 15,434 18,852 8,041 29,414 88,282

============== ================== =============== =============== =============== =============== ==============

Accumu lated

depreciation

1 January

2013* 2,983 3,937 10,335 4.323 - 21,578

Charge for the

year 647 1,683 2,030 864 - 5,224

Disposals (5) (91) (30) - (126)

Currency

translation

adjustment (78) (114) (100) (82) - (374)

-------------- ------------------ =============== =============== =============== --------------- --------------

1 January

2014 3,552 5,501 12,174 5,075 - 26,302

============== ================== =============== =============== =============== =============== ==============

Charge for the

year 432 1,478 2,575 865 - 5.350

Disposals (60) (988) 574 - (474)

Currency

translation

adjustment (552) (873) (993) (1,716) - (4,134)

============== ================== =============== =============== =============== =============== ==============

31 December

2014 3,432 6,046 12,768 4,798 - 27,044

============== ================== =============== =============== =============== =============== ==============

Net book

value

1 January

2013 7,418 13,043 4,830 3,029 13,259 41,579

============== ================== =============== =============== =============== =============== ==============

31 December

2013 7,130 10,993 3.753 3,057 20,933 45,866

============== ================== =============== =============== =============== =============== ==============

31 December

2014 13,109 9,388 6,084 3,243 29,414 61,238

============== ================== =============== =============== =============== =============== ==============

*The comparative cost and depreciation figures have been

restated to reflect assets that have been fully depreciated and the

capitalisation of interest

Capitalised cost of mining property and leases are amortised

over the life of the licence from commencement of production on a

unit of production basis. This basis uses the ratio of production

in the period compared to the mineral reserves at the end of the

period plus production in the period Mineral reserves estimates are

based on a number of underlying assumptions which are inherently

uncertain. Mineral reserves estimates take into consideration

estimates by independent geological consultants. However, the

amount of mineral that will ultimately be recovered cannot be known

until the end of the life of the mine Any changes in reserve

estimates are, for amortisation purposes, treated on a prospective

basis. The recovery of the capitalised cost of the Company's

property, plant and equipment is dependent on the development of

the underground mine. Included within mining properties is an

amount of US$750,000 and associated foreign exchange of US$ l50,000

relating to interest that has been capitalised (2013: US$744,000,

201 2: US$765,000)

Under the terms of the loan agreement with the European Bank for

Reconstruction and Development (EBRD), the Company and its

subsidiaries has pledged certain assets as security for the loan

that was entered into.

The Directors are required to consider whether the non-current

assets comprising, mineral properties leases, plant and equipment

have suffered any impairment. The recoverable amount is determined

based on value in use calculations. The use of this method requires

the estimation of future cash flows and the choice of a discount

rate in order to calculate the present value of the cash flows. The

Directors have concluded that no adjustment is required for

impairment.

Additions to assets under construction include US$2,112,000 to

reflect the change in estimates relating to abandonment and

restoration provision.

9. Availability of accounts

The audited Annual Report and Financial Statements for the 12

months ended 31 December 2014 and notice of AGM will shortly be

sent to shareholders and published at: www.goldbridgesplc.com .

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BUGDSXXXBGUG

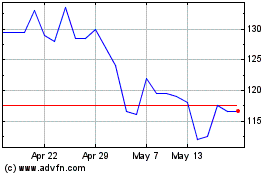

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024