TIDMGBGR

RNS Number : 0213T

GoldBridges Global Resources PLC

30 September 2014

GOLDBRIDGES GLOBAL RESOURCES PLC

Interim report - six months to 30 June 2014

GoldBridges Global Resources Plc ("GoldBridges" or the

"Company"), the AIM quoted gold mining and development group,

announces its unaudited results for the six months to 30 June

2014.

Highlights:

Production

- H1 2014 gold production from Sekisovskoye was 12,694 ounces

("oz") at an average grade of 1.42 grammes / tonne ("g/t"),

compared to 12,673 oz in H1 2013 at an average grade of 1.45

g/t;

- Significant reduction in total production cost to US$11.6m (H1 2013: US$15.9m) and administrative cost to US$3.3m (H1 2013: US$6.2m);

- Significant decrease in unit cash costs to US$744 / oz (H1 2013: US$1,055 / oz);

Financial

- Decline in revenue for the period to US$16.7m (H1 2013:

US$20m), reflecting the recent decline in the global price of

gold;

- This lower gold price was offset to some extent by the

government imposed devaluation of the Kazakh Tenge by approximately

20 per cent. in February 2014;

- Operating profit of US$3.3m in H1 2014, a significant

turnaround from a loss of US$2.1m in H1 2013;

- Leading to an EPS of US$0.19/share, up from a loss of US$0.24/share in H1 2013;

- Equity capital raisings in excess of US$22m during the period;

- Cash balances of US$18.5m as at 30 June 2014 (H1 2013 US$1.3m);

Strategic

- The licence and permit applications in relation to the

Karasuyskoye Ore Fields ("Karasuyskoye") are continuing;

- As part of the completion of the Karasuyskoye purchase, the

Group is entitled to a VAT refund of 453m Tenge (approximately

US$2.5m at closing exchange rates) which will aid future cash flow.

This is expected to be set off against VAT liabilities arising over

a period of approximately two years;

- The Group is expected to benefit from participation in the

Kazakhstan government's initiative on industrial development

and;

- The Sekisovskoye CPR was being finalised in Q3 and is expected

to be released in Q4 2014.

Aidar Assaubayev, CEO of GoldBridges Global Resources Plc

commented:

"We are very pleased with our 2014 interim results. The

reorganisation and cost cutting measures that we have taken have

had a positive effect on our operations. This, in combination with

the weaker Kazakh Tenge, has resulted in the reporting of a profit

for the six months to June 2014. The Group is now well positioned

to move forward to exploit its opportunities, both in developing

the underground mine at Sekisovskoye and the ore fields at

Karasuyskoye, once the necessary permits have been obtained".

For further information please contact:

GoldBridges Global Resources Plc +44 (0) 207 932

Louise Wrathall 2456

Strand Hanson (Nomad and Joint Broker)

Andrew Emmott +44 (0) 207 409

Ritchie Balmer 3494

+44 (0) 203 540

1720

Peat & Co. (Joint Broker) +44 (0) 203 540

John Beaumont, COO and Head of Research 1723

Blytheweigh (Financial PR)

Tim Blythe

Halimah Hussain +44 (0) 207 138

Camilla Horsfall 3204

GOLDBRIDGES GLOBAL RESOURCES PLC

Chief Executive's review

Review of 2014 to date

I am delighted to update you on the positive progress that we

have made during H1 2014. In the reported period, the Group has

benefited from the rationalisation and reorganisational measures

that were put in place over the last year. We have continued with

our efforts to upgrade the gold processing plant, have raised

capital in excess of US$22m through two equity placings and have

been endorsed by the Kazakhstan government for our inclusion in the

State Programme on Forced Industrial-Innovative development

(SPFIID) for the Sekisovskoye development.

We have produced 12,694oz of gold during the six months to June

2014, which was in line with our output during H1 2013. This result

is extremely pleasing given that our costs have reduced from an

average of US$1,055/oz in H1 2013 to US$744/oz during H1 2014. This

is primarily due to cost saving measures that the Group has put in

place, coupled with the approximate 20 per cent. government imposed

devaluation of the local currency, the Kazakh Tenge.

In terms of production, although the open pit remains the

primary source of ore, the Group's main focus in H1 2014 was the

continuing objective of increasing the tonnage of ore produced from

the underground mine development. The ultimate aim is to develop

the capacity for 'bulk' production from the mining stopes with the

development drifts currently being mined to give access to the ore

stopes.

We have continued to upgrade the gold processing plant and, in

the 6 months up to 30 June 2014, additional crushing equipment has

been installed allowing the ball mills to receive a finer feed and

increase the productivity of the grinding system. Additional

debottlenecking is required to increase the capacity of the plant

with the ultimate goal being 1 million tonnes per annum ("Mtpa"),

and this remains work in progress.

The open pit mine, previously consisting of two pits, has

reduced to a single pit as the higher grade ore from the north is

now virtually depleted except for a small amount of remnant ore

that will be selectively mined as it becomes available. The

remaining open pit operations during the rest of 2014 will be from

the central pit. With increasing underground production the fall in

grade from the open pit operations should be more than compensated

for by the higher grade ore from the underground mine in the longer

term.

During the six months, there have been two successful capital

raisings and we thank our shareholders for their support and belief

in our business. In total, we raised approximately US$22.1m through

a placing in early January of 97,972,000 new Ordinary Shares at a

price of 1.975 pence per Ordinary Share, and then through a second

placing in February of 550,000,000 shares at a price of 2.175 pence

per Ordinary Share. The net proceeds of both placings have been

used further the development of the underground mine at

Sekisovskoye and for general working capital purposes.

The Group's Sekisovskoye underground development will benefit

from inclusion in the State Programme On Forced

Industrial-Innovative Development ("SPFIID"). Currently a report on

the project is being prepared, which will then be presented to the

Kazakhstan State Commission of Modernisation, headed by the Prime

Minister of Kazakhstan, for final approval. The SPFIID initiative

targets the modernisation of the Kazakhstan economy and pledges

state support to selected projects by providing financing

incentives such as grants and low interest loans, infrastructure

development and policies to fast track these strategic projects.

Following final approval, the Kazakhstan government will expand

existing infrastructure supporting the Sekisovskoye project

including electricity and transportation networks. These works will

run in tandem with the Group's own development plans. We will

update the market further once the final approval is granted.

GOLDBRIDGES GLOBAL RESOURCES PLC

Chief Executive's review (continued)

Outlook

During Q3 2014, international mining consultants Venmyn Deloitte

were finalising their independent competent persons report ("CPR")

on the Sekisovskoye underground mine, it is now expected to be

released in Q4 2014. The CPR will contain an updated JORC compliant

reserve and resource estimate based on the historical drilling and

the most recent drilling programme completed in early 2014. This

report should pave the way for increased development of the

underground resources and reserves at Sekisovskoye and higher gold

production in the future.

As a result of internal [staff] changes at the government

departments that are responsible for issuing the appropriate

licences and permits, the Group's timeline for obtaining the

various approvals needed for the development of Karasuyskoye has

been extended beyond initial expectations. The Group is however now

pleased to announce that the licence application is proceeding

without any further delay and the Directors hope to provide a

positive progress report in the near future.

In terms of gold production, we look forward to higher output in

H2 2014 and remain confident that we will meet our production

targets for the year.

GOLDBRIDGES GLOBAL RESOURCES PLC

Operations report

Mining activity

Overview H1 2014

Mining operations in the first half of 2014 performed to

expectations. The activities continued to be focused on the open

pit operation with 317,085 tonnes of ore mined during the period,

which was the primary source of material for the processing plant.

The northern pit is now virtually depleted of ore except for some

remnant material that will be selectively mined in the future.

During the reporting period and in the future, open pit mining will

focus on the lower grade central pit.

During the six months to 30 June the contribution of underground

ore increased significantly, with 26,157 tonnes of the higher grade

ore being mined. It must be noted that a large portion of this ore

was as result of the development work to gain access to the mining

stopes. A higher grade of ore will be generated from the actual

mining stopes.

The processing plant feed experienced a slight decrease in the

gold grade to 1.42 g/t, as compared to 1.45 g/t in H1 2013, due to

the depletion of ore from the open cast northern pit and the higher

than expected quantities of development ore from the underground

mine.

H1 2014 H1 2013

Total ore mined, open pit (t) 317,085 374,448

Total ore mined, underground (t) 26,157 5,739

Total ore milled (t) 333,490 329,104

Open pit gold grade (g/t) 1.32 1.42

Underground gold grade (g/t) 2.97 5.60

Average gold grade (g/t) 1.42 1.45

Average silver grade (g/t) 2.15 1.94

Gold recovery (%) 83.4 82.8

Gold produced (oz) 12,694 12,673

Silver produced (oz) 17,380 15,524

The focus on reducing costs and improving efficiencies has

helped decrease production costs in H1 2014 to US$744/oz from

US$1,055/oz in H1 2013. Substantial savings have been achieved by

restructuring the costs related to supervision and labour and,

this, together with investments in equipment and machinery during

2013 and 2014 has increased the efficiency and reliability of the

operation. Management continues to focus on further cost

savings.

Open Pit Mining

In total, 317,085t of ore was produced from the central and

north pits during H1 2014 as compared to 374,448t of ore in H1

2013. In future and until the depletion of the open pit in 2016,

all ore will come from the lower grade central pit. Some ore

remains in the north pit and it will be selectively mined with

smaller equipment if required. The waste generated from open pit

mining activities is used as foundation material for the tailings

dams and, as such, waste generated during the reporting period was

used to complete the construction of Tailings Dam 4 and commence

Tailings Dam 5. Once complete, Tailings Dam 5 is expected to have

capacity for some 17 years from 2015 onwards to support the

underground mining operation. The plan is to complete all tailings

dams by 2016 so that when the open pit mine ceases all civil

engineering infrastructure tasks onsite will be complete.

GOLDBRIDGES GLOBAL RESOURCES PLC

Operations report (continued)

Gold Processing Plant

Gold recovery rate at the processing plant improved to 83.4 per

cent in H1 2014 from 82.8 per cent in H1 2013. This was driven by

efficiency and optimisation measures even with the slightly lower

gold grade in the plant feed. This improvement in the gold recovery

rate follows the installation and commissioning of the high

capacity tailings and recycling water pumps, new heat-exchange

elution units and a second elution column plus the seventh CIL tank

in late 2013. In addition to this, new crushing equipment is being

commissioned in H2 2014 and more debottlenecking of the plant is

planned with the aim of further improving recoveries and

throughput.

The increased gold recovery rates are a positive indicator for

the future productivity of the plant, when the source material

consists of only underground ore. This is forecast to be the case

by 2016, when the production life of the open pit comes to an end.

Test work to date using 100 per cent underground ore indicates gold

recovery at approximately 84 per cent.

The Underground Mine

The management team is committed to the development of the

underground mine which, in combination with the processing plant

upgrades which are underway, should result in long term increased

gold production for GoldBridges. The quantity of ore is steadily

increasing, however during the move to access the higher grade ore,

the grades will initially be variable as some of the development

work transverses low grade ore zones.

The Group's development plans will include appraising the costs

and benefits of using our own team as compared to employing a

contractor for the underground mine development. This aim is to

ensure that developmental progress of the underground mine

progresses as required by the mine plan to access the high grade

underground stopes prior to the depletion of the open pit ore. This

is seen as a key objective for the success of the Sekisovskoye

Underground Development Project during the transition from the open

pit to the underground.

During H1 2014, the underground ore was sourced from the decline

where horizontal developments are being made to access the future

mining stopes. This work provides relatively small quantities of

ore when compared to the future bulk mining of the stopes. However

all the development ore processed is within the mineralised part of

the ore body.

GOLDBRIDGES GLOBAL RESOURCES PLC

Operations report (continued)

Exploration Drilling

During H1 2014, 94 diamond drill holes were drilled for a total

of 7,230m. H1 2014 exploration drilling had considerable success in

confirming the vertical extension of the ore body. Initially, all

drilling had been terminated at the -400masl level, approximately

725m from surface. The 6 holes that were drilled along the ore body

from the -400masl level, targeted the -800masl level with the

intention of confirming gold mineralization continuity. The

drilling was a success and these deeper holes will now form part of

the updated JORC resource estimate.

GOLDBRIDGES GLOBAL RESOURCES PLC

Operations report (continued)

Financial

Sekisovskoye poured 12,694 ounces of gold in H1 2014 (H1

2013:12,673). Gold sold during the period amounted to 12,479 ounces

(H1 2013: 12,694) at an average price of US$1,337 per ounce H1

2013: US$1,554). The average price of sales achieved includes

revenues generated from silver sales in the period, which are

treated as incidental to gold production. During 2014 the Group

also sold spare parts and other consumables for US$1.2m (2013: US$

Nil).

There have been significant savings in both production costs and

administrative costs.

The cash cost (cost of sales excluding depreciation and

provisions) for the period was US$744 per ounce (H1 2013:

US$1,055). The decrease in the cost of production is due to a

number of factors the principal ones are described below:

During H1 2014, due to a change in government legislation in

relation to metal sales, the Group sold all production to the state

refiner. The price as in the prior period is still fixed in terms

of US Dollars, however all amounts are paid to the Group in Kazakh

Tenge (being the principal cost base of the Kazakh based

Companies). The Group has benefited from the devaluation of the

Kazakh Tenge to the US Dollar, decreasing the costs denominated in

Kazakh Tenge by approximately 20% from last year in currency terms.

In addition, the switch to the Kazakh based refiner has led to

substantial savings in transportation and security costs from the

prior period when the gold was shipped to Switzerland. Further cost

savings have been achieved from the Group performing a greater part

of the mining works in house and therefore dispensing with a number

of contractors. This has not only led to a decrease in contractor

cost but a saving in material component costs that were previously

being purchased via the contractors.

Administration costs in the six months to 30 June 2014 amounted

to US$3.3m (H1 2013: US$6.2m). The savings are a product of cost

cutting measures now being fully reflected in the current period

and as a result of savings made from Karasuyskoye related costs

that were incurred in the prior period, and which are not

recurring. Expenses amounting to US$2.6m were incurred in the prior

year to 31 December 2013 in negotiating and securing the

Karasuyskoye deal.

There is expected to be a positive impact on cash flow in future

periods as the Group will be able to recover approximately US$3m in

relation to the VAT attributable to the purchase of Karasuyskoye

geological data. This has now been reflected in note 3 by a

consequent reduction of the purchase price to the net amount paid

to purchase the geological information. Recovery will be obtained

by off-setting this amount against future VAT liabilities that

would have been payable by Sekisovskoye.

The Company has retained a strong cash position with US$18.5m at

the balance sheet date. Cash generated from operations was a

negative US$0.8m and in large part was due to the repayment of

creditors of approximately US$5m. Creditors in total have increased

from US$11.5m to US$19.4m, however US$12.9m relates to the purchase

of assets and as such are not reflected as part of operating

activities. If these are adjusted for, the actual creditors have

decreased from US$11.5m to US$6.5m i.e. a reduction of US$5m. The

payment in relation to the asset purchases has been agreed to be

made over an extended period and will not have an impact on the

liquidity of the Group.

Capital expenditure totalled US$18.5m in H1 2014 (H1 2013:

US$3.7m). The main item of capital expenditure was the development

of the underground mine, and associated equipment.

The increase in trade and other receivables is principally due

to the recognition of the VAT as mentioned above on the

Karasuyskoye asset which is expected to be recovered in full over a

period of approximately two years.

GOLDBRIDGES GLOBAL RESOURCES PLC

Operations report (continued)

Financial (continued)

The Group has recognised deferred tax assets and in total these

amount to US$2.1m (H1 2013: US$1.1m) in relation to both trading

subsidiary companies in Kazakhstan on the basis that both are

expected to generate chargeable profits in future periods.

Aidar Assaubayev

Chief Executive Officer

30 September 2014

INDEPENDENT REVIEW REPORT

FOR THE PERIOD ENDED 30 JUNE 2014

INDEPENDENT REVIEW REPORT TO GOLDBRIDGES GLOBAL RESOURCES

PLC

Introduction

We have been engaged by the Company to review the consolidated

financial information in the interim financial report for the six

months ended 30 June 2014 which comprise the Consolidated Income

Statement, the Consolidated Statement of Comprehensive Income, the

Consolidated Statement of Changes in Equity, the Consolidated

Statement of Financial Position, the Consolidated Statement of Cash

Flows and the related notes.

We have read the other information contained in the interim

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the consolidated

financial information.

Directors' responsibilities

The interim financial report, including the financial

information contained therein, is the responsibility of and has

been approved by the directors. The directors are responsible for

preparing the interim financial report in accordance with the rules

of the London Stock Exchange for companies trading securities on

the Alternative Investment Market which require that the interim

financial report be presented and prepared in a form consistent

with that which will be adopted in the Company's annual accounts

having regard to the accounting standards applicable to such annual

accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the consolidated financial information in the interim financial

report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on the Alternative Investment Market and for no other purpose. No

person is entitled to rely on this report unless such a person is a

person entitled to rely upon this report by virtue of and for the

purpose of our terms of engagement or has been expressly authorised

to do so by our prior written consent. Save as above, we do not

accept responsibility for this report to any other person or for

any other purpose and we hereby expressly disclaim any and all such

liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the consolidated financial information in

the interim financial report for the six months ended 30 June 2014

is not prepared, in all material respects, in accordance with the

rules of the London Stock Exchange for companies trading securities

on the Alternative Investment Market.

Emphasis of Matter - Carrying value of Intangible Assets

In forming our review conclusion, which is not modified, we have

considered the adequacy of the disclosures in note 3 to the

financial statements concerning the outcome of the licence

application at Karasuyskoye. During 2013, the Group acquired the

geological data at Karasuyskoye for $27.5m and has applied for but

not yet been granted a mining licence over this area. In the event

that the licence is granted to another party, the Group would need

to negotiate the sale of the data to the successful applicant which

may be at a lower value than the carrying value. The ultimate

outcome of this matter cannot presently be determined.

BDO LLP

Chartered Accountants and Registered Auditors

London

United Kingdom

30 September 2014

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated income statement

Six months

Six months ended Year ended

ended 30 June 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

Note US$'000 US$'000 US$'000

======================== ====== ================= ============= =============

Revenue 16,683 20,014 42,395

Cost of sales (11,593) (15,877) (32,076)

Gross profit 5,090 4,137 10,319

Other operating

income 7 1,162 - -

Administrative

expenses (3,286) (6,223) (16,475)

Tailings dam

leak 300 - 9,252

Operating profit/(loss) 3,266 (2,086) 3,096

Finance income 4 1 1

Foreign exchange

(loss)/gain (368) 192 (413)

Finance Expense (229) (365) (1,515)

Profit/(loss)

before taxation 2,673 (2,258) 1,169

Taxation

credit/(charge) 1,173 (79) 358

------------------------ ------ ----------------- ------------- -------------

Profit/(loss)

attributable

to equity shareholders 3,846 (2,337) 1,527

======================== ====== ================= ============= =============

Profit/(loss)

per ordinary

share

Basic & diluted

(US cent) 2 0.19 (0.24) 0.15

The notes on pages 17 to 23 form part

of this financial information

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated statement of comprehensive

income

Six months Six months Year ended

ended 30 June ended 30 31 December

2014 June 2013 2013

(unaudited) (unaudited) (audited)

US$000 US$000 US$000

-------------------------------------------------- ----------------- ------------- -------------

Profit/(loss) for the

period/year 3,846 (2,337) 1,527

Currency translation differences

arising on translations

of foreign operations

items which will or may

be reclassified to profit

or loss (6,295) (1,001) (763)

Total comprehensive income/(loss)

for the period/year attributable

to equity shareholders (2,449) (3,338) 764

-------------------------------------------------- ----------------- ------------- -------------

The notes on pages 17 to 23 form part of this financial

information

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated statement of financial position

Six months

ended 30 Six months Year ended

June ended 30 31 December

2014 June 2013 2013

Notes (unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

---------------------------------- ------ ------------ ------------ -------------

Non-current assets

Intangible asset 3 23,633 - 27,157

Property, plant and

equipment 4 52,721 42,052 44,357

Trade and other

receivables 3,040 485 381

Deferred tax asset 2,059 344 1,145

Restricted cash 253 306 301

---------------------------------- ------ ------------ ------------ -------------

81,706 43,187 73,341

---------------------------------- ------ ------------ ------------ -------------

Current assets

Inventories 6,913 10,449 9,354

Trade and other

receivables 8,475 11,798 5,446

Cash and cash equivalents 18,514 1,264 2,067

---------------------------------- ------ ------------ ------------ -------------

33,902 23,511 16,867

---------------------------------- ------ ------------ ------------ -------------

Total assets 115,608 66,698 90,208

Current liabilities

Current tax payable (470) - (558)

Trade and other

payables (19,352) (11,903) (11,512)

Other financial

liabilities (351) (229) (239)

Provisions (363) (10,714) (647)

Borrowings (1,666) (10,000) (894)

---------------------------------- ------ ------------ ------------ -------------

(22,202) (32,846) (13,850)

---------------------------------- ------ ------------ ------------ -------------

Net current assets/(liabilities) 11,700 (9,335) 3,017

Non-current liabilities

Other financial

liabilities (963) (1,322) (1,287)

Provisions (5,486) (6,566) (6,705)

Borrowings (8,333) - (10,000)

---------------------------------- ------ ------------ ------------ -------------

(14,782) (7,888) (17,992)

---------------------------------- ------ ------------ ------------ -------------

Total liabilities (36,984) (40,734) (31,842)

---------------------------------- ------ ------------ ------------ -------------

Net assets 78,624 25,964 58,366

---------------------------------- ------ ------------ ------------ -------------

Equity

Called-up share

capital 5 3,702 1,684 2,635

Share premium 137,234 88,245 115,594

Merger reserve (282) (282) (282)

Currency translation

reserve (15,136) (9,079) (8,841)

Accumulated loss (46,894) (54,604) (50,740)

---------------------------------- ------ ------------ ------------ -------------

Total equity 78,624 25,964 58,366

---------------------------------- ------ ------------ ------------ -------------

The financial information was approved and authorised for issue

by the Board of Directors on 30 September 2014 and was signed on

its behalf by:

Aidar Assaubayev

Chief Executive Officer

The notes on pages 17 to 23 form part of this financial

information

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated Statement of changes

in equity

For the six months ended 30 June

2014

Share Share Merger Cumulative Retained Total

capital premium reserve translation deficit

reserve

Unaudited US$'000 US$'000 US'000 US$'000 US$'000 US$'000

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

At 1 January

2014 2,635 115,594 (282) (8,841) (50,740) 58,366

Profit for the

period - - - - 3,846 3,846

Exchange

differences

on

translating

foreign

operations - - - (6,295) - (6,295)

Total

comprehensive

loss for the

period - - - (6,295) 3,846 (2,449)

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

Shares issued 1,067 22,094 - - - 23,161

Issue costs - (454) - - - (454)

At 30 June

2014 3,702 137,234 (282) (15,136) (46,894) 78,624

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

For the six months ended 30 June

2013

Share Share Merger Cumulative Retained Total

capital premium reserve translation deficit

reserve

Unaudited US$'000 US$'000 US'000 US$'000 US$'000 US$'000

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

At 1 January

2013 1,684 88,245 (282) (8,078) (52,267) 29,302

Loss for the

period - - - - (2,337) (2,337)

Exchange

differences

on

translating

foreign

operations - - - (1,001) - (1,001)

Total

comprehensive

loss for the

period - - - (1,001) (2,337) (3,338)

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

At 30 June

2013 1,684 88,245 (282) (9,079) (54,604) 25,964

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

For the year ended 31 December

2013

Share Share Merger Cumulative Retained Total

capital premium reserve translation deficit

reserve

Audited $'000 $'000 $'000 $'000 $'000 $'000

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

At 1 January

2013 1,684 88,245 (282) (8,078) (52,267) 29,302

Profit for the

year - - - - 1,527 1,527

Exchange

differences

on

translating

foreign

operations - - - (763) - (763)

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

Total

comprehensive

income for

the year - - - (763) 1,527 764

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

Shares issued 951 27,590 - - - 28,541

Issue costs - (241) - - - (241)

At 31 December

2013 2,635 115,594 (282) (8,841) (50,740) 58,366

--------------- ---------------- ------------------ ---------------- ------------------ ------------------ --------

The notes on pages 17 to 23 form part of this financial

information

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated cash flow statement

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

Note US$'000 US$'000 US$'000

Net cash (outflow)/inflow

from operating

activities 8 (833) 2,845 7,304

--------------------------- ----- --------------- --------------- -------------

Investing activities

Interest received - - 1

Proceeds on

disposals of

property, plant

and equipment 577 29 -

Purchase of

property, plant

and equipment (5,639) (3,720) (7,471)

Prepayment for

non-current

assets - (65) -

Restricted cash - (78) -

Net cash used

in investing

activities (5,062) (3,834) (7,470)

Financing activities

Proceeds on

issue of shares 23,162 - -

Share issue

costs (455) - (241)

Loan from related

party - - 894

Interest paid (365) (362) (924)

Net cash flow

from financing

activities 22,342 (362) (271)

--------------------------- ----- --------------- --------------- -------------

Increase/(Decrease)

in cash and

cash equivalents 16,447 (1,351) (437)

Cash and cash

equivalents

at the beginning

of the year 2,067 2,504 2,504

Effect of foreign

exchange rate

movements - 111 -

Cash and cash

equivalents

at the end of

the period 18,514 1,264 2,067

--------------------------- ----- --------------- --------------- -------------

The notes on pages 17 to 23 form part of this financial

information

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information

1. Basis of preparation

GoldBridges Global Resources Plc is registered and domiciled in

England and Wales.

The interim financial results for the period ended 30 June 2014

are unaudited. The financial information contained within this

report does not constitute statutory accounts as defined by Section

434(3) of the Companies Act 2006.

This interim financial information of the Company and its

subsidiaries ("the Group") for the six months ended 30 June 2014

has been prepared on a basis consistent with the accounting

policies set out in the Group's consolidated annual financial

statements for the year ended 31 December 2013. It has not been

audited, does not include all of the information required for full

annual financial statements, and should be read in conjunction with

the Group's consolidated annual financial statements for the year

ended 31 December 2013. The 2013 annual report and accounts, as

filed with the Registrar of Companies, received an unqualified

opinion from the auditors, but did draw attention to the carrying

value of the intangible assets by way of emphasis, it did not

contain a statement under section 498 (2) or 498 (3) of the

Companies Act 2006.. As permitted, the Group has chosen not to

adopt IAS 34 'Interim Financial Reporting'.

The financial information is presented in US Dollars and has

been prepared under the historical cost convention.

The same accounting policies, presentation and method of

computation are followed in this consolidated financial information

as were applied in the Group's latest annual financial statements

except that in the current financial year, the Group has adopted a

number of revised Standards and Interpretations. However, none of

these have had a material impact on the Group.

In addition, the IASB has issued a number of IFRS and IFRIC

amendments or interpretations since the last annual report was

published. It is not expected that any of these will have a

material impact on the Group.

Going concern

The Group's operations are cash generative and the current cash

position is sufficient to cover ongoing operating and

administrative expenditure for the next 12 months.

During the period the Company secured an additional US$22m

equity investment. The Directors consider this together with income

from the Group's producing assets to be sufficient to cover the

expenses of running the Group's business for the foreseeable

future. They have therefore adopted the going concern basis in the

preparation of these financial statements.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

2. Profit/(loss) per ordinary share

Basic profit/(loss) per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

The calculation of basic and diluted earnings per share is based

upon the retained profit for the financial.

The weighted average number of ordinary shares for calculating

the basic profit/(loss) per share and diluted loss per share for

the period are as follows:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2014 June 2012 2013

(unaudited) (unaudited) (audited)

2,038,802,240 979,721,513 1,003,707,088

-------------- ------------ --------------

3,846 (2,337) 1,527

-------------- ------------ --------------

The basic weighted average number of ordinary shares in issue

during the period

The profit/(loss) for the period attributable to equity

shareholders (US$'000s)

There are no dilutive instruments.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

3. Intangible assets

US$'000

------------------------- -------

Cost

------------------------- -------

1 January 2013 -

------------------------- -------

Additions -

------------------------- -------

30 June 2013 -

------------------------- -------

Additions 27,500

------------------------- -------

31 December 2013 27,500

------------------------- -------

Adjustments* (2,946)

------------------------- -------

30 June 2014 24,554

------------------------- -------

Accumulated amortisation

------------------------- -------

1 January 2013 -

------------------------- -------

Charge for the period -

------------------------- -------

30 June 2013 -

------------------------- -------

Charge for the period 343

------------------------- -------

31 December 2013 343

------------------------- -------

Charge for the period 578

------------------------- -------

30 June 2014 921

------------------------- -------

30 June 2013 -

------------------------- -------

31 December 2013 27,157

------------------------- -------

30 June 2014 23,633

------------------------- -------

The intangible asset relates to the historic geological

information pertaining to the Karasuyskoye ore fields, purchased by

the Group in 2013.

The value of the geological data purchased is in the opinion of

the Directors the value that would have been incurred if the

drilling had been undertaken by a third party (or internally). The

Directors have taken the view that a 20 year write off is

appropriate in relation to the absorption of the cost. The Group is

in the process of obtaining the mining rights in relation to the

area covered by the data.

However, the licencing tender process has not yet been completed

and there is no guarantee that the licence will be granted. In the

event that the licence is not granted, the Group would seek to

negotiate a disposal of the asset to the successful licence

applicant.

* The adjustment relates to the recovery of VAT reclaimable on

the purchase price of the geological data, as agreed with the tax

authorities in Kazakhstan in the current period. The VAT is

recoverable by way of set off against the VAT liabilities accruing

on a quarterly basis by Sekisovskoye, full recovery is expected

over a period of approximately two years.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

4. Property, plant and equipment

Equipment,

Mining Freehold fixtures Plant,

properties land and and machinery Assets under

and leases buildings fittings and vehicles construction Total

US$000 US$000 US$000 US$000 US$000 US$000

------------------------------------------------------- ---------- ---------------- --------------- -----------

Cost

1 January 2013 10,401 16,980 15,165 7,352 12,494 62,392

Additions 141 - 926 692 1,961 3,720

Disposals - (36) (22) - - (58)

Currency translation

adjustment (46) (105) (102) (51) (97) (401)

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

30 June 2013 10,496 16,839 15,967 7,993 14,358 65,653

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

Additions 327 11 308 274 5,374 6,294

Disposals - (83) (120) (8) (8) (219)

Currency translation

adjustment (141) (273) (228) (127) (300) (1,069)

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

31 December 2013 10,682 16,494 15,927 8,132 19,424 70,659

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

Additions 603 - 4,456 - 13,471 18,530

Disposals - (569) (59) - - (628)

Currency translation

adjustment (1,537) (2,714) (2,796) (1,040) (3,503) (11,590)

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

30 June 2014 9,748 13,211 17,528 7,092 29,392 76,971

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

Accumulated depreciation

1 January 2013 2,983 3,937 10,335 4,323 - 21,578

Charge for the period 300 828 428 616 - 2,172

Disposals - - - - - -

Currency translation

adjustment (21) (26) (34) (68) - (149)

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

30 June 2013 3,262 4,739 10,729 4,871 - 23,601

Charge for the period 347 858 1,602 248 - 3,055

Disposals - (5) (91) (30) - (126)

Currency translation

adjustment (57) (91) (66) (14) - (228)

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

31 December 2013 3,552 5,501 12,174 5,075 - 26,302

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

Charge for the period 280 618 999 364 - 2,261

Disposals - (62) - - - (62)

Currency translation

adjustment (573) (897) (1,960) (821) - (4,251)

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

30 June 2014 3,259 5,160 11,213 4,618 - 24,250

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

Net Book Values

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

1 January 2013 7,418 13,043 4,830 3,029 12,494 40,814

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

30 June 2013 7,234 12,100 5,238 3,122 14,358 42,052

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

31 December 2013 7,130 10,993 3,753 3,057 19,424 44,357

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

30 June 2014 6,489 8,051 6,315 2,474 29,392 52,721

------------------------------- ------- ------------- ---------- ---------------- --------------- -----------

The additions in the period principally relate the continuing

works associated with the underground mine in relation to

development of the declines, ventilation shafts and other

associated works.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

5. Share capital

Number US$000

1 January 2013 979,721,513 1,684

Issued during the year

Conversion of convertible

loan notes 583,648,617 951

31 December 2013 1,563,370,130 2,635

Issued during the year

Share placement 647,972,000 1,067

30 June 2014 2,211,342,130 3,702

---------------------------------- ------------------------- ------------

On 10 January 2014 there was a placing of 97,972,000 new

Ordinary Shares at a price of 1.975 pence per Ordinary Share. On 28

February 2014 there was a placing of 550,000,000 shares at a price

of 2.175 pence per Ordinary Share. The net proceeds of both

placings will be used for general working capital purposes and will

form part of the funding to enable the Company to develop the

underground mine at Sekisovskoye.

6. Reserves

A description and purpose of reserves is given below:

Reserve Description and purpose

Share capital Amount of the contributions made

by shareholders in return for

the issue of shares.

Share premium Amount subscribed for share capital

in excess of nominal value.

Merger Reserve Reserve created on application

of merger accounting under a previous

GAAP.

Currency translation Gains/losses arising on re-translating

reserve the net assets of overseas operations

into US Dollars.

Other reserves Fair value of share options granted

net of amounts transferred to

retained earnings on exercise

or lapse of options.

Accumulated Cumulative net gains and losses

losses recognised in the consolidate

statement of financial position.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

7. Related party transactions

Remuneration of key management personnel

The remuneration of the Directors, who are the key management

personnel of the Group, is set out below in aggregate for each of

the categories specified in IAS 24 - "Related Party

Disclosures".

Six months Six months Year to

ended 30 ended 30 December

June 2014 June 2013 2013

US$ US$ US$

Short term employee

benefits 135,165 195,311 292,612

Other - 16,637 16,637

-------------------------- ------------------------ ----------- -----------

135,165 211,948 309,249

Social security costs 7,581 19,915 19,915

-------------------------- ------------------------ ----------- -----------

142,746 231,863 329,164

------------------------- ------------------------ ----------- -----------

During the period ended 30 June 2014, US$Nil (H1 2013:US$Nil, YE

2013:US$7,974) has been accrued to Ellenkay Gold Ltd for the

provision of services by Ken Crichton.

During the year the following transactions were connected with

the Company's controlled by the Assaubayev family:

- An interest free loan was made to GoldBridges Global Resources

Plc, by Amrita Investments Limited to pay certain creditors in the

year ended 31 December 2013. This amounted to US$149,000 and was

repaid during the current period.

- An amount of 138m Tenge paid during the year ended 2013 by

Asia Mining Group ("AMG"), has been offset against total sales to

AMG of US$1.2m (being 202m Tenge) during the period. The sale by

the Group of parts and consumables were on normal commercial

terms.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

8. Notes to the cash flow statement

Net cash(outflow)/inflow from operating activities

Six months Six months Year ended

ended ended ended

30 June 30 June 31 December

2014 (unaudited) 2013 (unaudited) 2013

US$000's US$000's (audited)

US $000's

------------------

Profit/(loss) before taxation 2,673 (2,258) 1,169

Adjusted for:

Finance income (4) (1) (1)

Finance expense 229 365 1,515

Depreciation of tangible fixed

assets 2,261 2,172 5,224

Amortisation of intangibles 578 - 343

Change in provisions (284) (43) (9,252)

Decrease in inventories 2,441 2,930 4,025

Increase in trade and other

receivables (3,224) (7,637) (1,594)

Decrease in other financial

liabilities (182) (10) (36)

(Decrease)/increase in trade

and other payables (5,610) 8,076 5,208

(Profit)/loss on disposal of

property, plant and equipment (17) 7 151

Foreign currency translation 306 (756) 576

-------------------------------------- ------------------

Cash inflow from operations (833) 2,845 7,328

Income taxes paid - - (24)

-------------------------------------- ------------------

(833) 2,845 7,304

------------------------------ ------ ------------------ ------------------ ----------------

9. Events after the balance sheet date

There were no significant transactions after the reporting

date.

GOLDBRIDGES GLOBAL RESOURCES PLC

Company information

Directors Kanat Assaubayev Chairman

Aidar Assaubayev Chief executive officer

Ken Crichton Executive director

Ashar Qureshi Non-executive director

William Trew Non-executive director

Alain Balian Non-executive director

Secretary Rajinder Basra

Registered office and number Company number : 05048549

28 Eccleston Square

London

SW1V 1NZ

Telephone: +44 208 932

2455

Web www.goldbridgesplc.com

Kazakhstan office 10 Novostroyevskaya

Sekisovskoye Village

Kazakhstan

Telephone: +7 (0) 72331 27927 Fax: +7 (0)

72331 27933

Nominated adviser and joint Strand Hanson Limited

broker

26 Mount Row

Mayfair

London W1K 3SQ

Telephone: +44 (0) 20 7409

3494

Joint broker Peat & Co

108 Piccadilly

London

W1J 7NW

Telephone: +44 (0) 20 3540

1720

GOLDBRIDGES GLOBAL RESOURCES PLC

Company information (continued)

BDO LLP

Auditors 55 Baker Street, London

W1U 7EU

BDO Kazakhstanaudit, LLP

56 "A", micro region 6 Almaty city, 050036

KAZAKHSTAN

Lawyers Gowlings (UK) LLP

15th Floor

Old Broad Street

London

EC2N 1AR

Registrars Neville Registrars

18 Laurel Lane

Halesowen

West Midlands B63 3DA

Telephone: +44 (0) 121 585 1131

Bankers NatWest Bank plc

London City Commercial Business Centre

7th Floor, 280 Bishopsgate

London

EC2M 4RB

LTG Bank AG

Herrengasse 12

FL-9490, Vaduz

Principal of Liechtenstein

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFFLADIIVIS

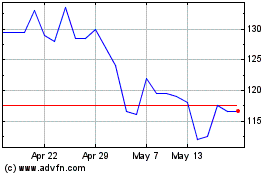

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024