TIDMGBGR

RNS Number : 7978J

GoldBridges Global Resources PLC

17 June 2014

17 June 2014

GoldBridges Global Resources plc

('GoldBridges', the 'Company' or the 'Group')

Preliminary results for the year ended 31 December 2013

GoldBridges Global Resources plc (LSE: GBGR), the gold mining

and development group, today announces its preliminary results for

the year ended 31 December 2013.

Highlights:

-- Gold poured during the year 30,669oz, (2012: 22,470oz) a

36.5% increase; gold grade 1.61g/t, (2012: 1.37g/t);

-- Gold recovery rate 84.3% (2012: 80.4%);

-- Operating cash cost per ounce down from last year US$903 (2012: US$1,046);

-- Positive contribution from underground mining which

recommenced production in June 2013 of 7,157oz (2012: 3,347oz) at

an average grade of 3.5g/t (2012: 2.75g/t);

-- Purchase of the geological data for the Karasuyskoye ore

fields estimated to contain resources of 9Moz of gold and 16Moz of

silver;

-- Positive contribution from underground mining which

recommenced production in June 2013 of 7,157oz (2012: 3,347oz) at

an average grade of 3.5g/t (2012: 2.75g/t);

-- Successful resolution against the additional fines and costs

imposed as a result of the tailings dam 3 incident in 2011,

resulting in a write back of provisions of US$9.3m;

-- The Company has successfully completed two placings post-year

end, raising gross proceeds of US$23m (GBP13.89m) to further

develop Group strategic plans and to provide additional

-- A strengthening of the Board of Directors coupled with a new

dynamic management team focused on growing Group turnover and

profitability working capital.

The accounts for the year ended 31 December 2013 will shortly be

available at the Company's website, http://www.goldbridgesplc.com/,

in accordance with AIM Rule 20.

Commenting, Aidar Assaubayev, Chief Executive, Goldbridges,

said:

"I am delighted to report that the operation at Sekisovskoye

continues to make positive progress, and that the Company has

delivered over and above the ambitious target that we set

ourselves.

"GoldBridges has been focused on growing production, improving

operational performance, as well researching additional growth

opportunities to enhance the current asset base to provide a solid

platform and deliver the best results for our shareholders.

"During the next quarter we will continue to develop the mine

and I look forward to updating the market with our progress."

For further information please visit www.goldbridgesplc.com or

contact:

GoldBridges Global Resources Plc +44 (0) 20 7932

Rajinder Basra (CFO) 2456

Strand Hanson Limited (Nomad, Financial Adviser

and Joint Broker) +44 (0) 20 7409

Andrew Emmott / James Spinney / Ritchie Balmer 3494

Peat & Co. (Joint Broker) +44 (0) 20 3540

John Beaumont, COO and Head of Research 1720

Blytheweigh (Financial PR) +44 (0) 20 7138

Tim Blythe / Camilla Horsfall / Halimah Hussain 3204

Chief Executive's Statement

I am delighted to present to you an update on the positive

progress during the year, and am also delighted to welcome on to

the board, Kanat Assauybayev, Ken Crichton and Alain Balian who

bring a wealth of experience and expertise to GoldBridges Global

Resources plc.

Over the last 12 months, the Company has been in the process of

implementing the recommendations that arose out of its strategic

review of the management and operations of the business. The

detailed review was principally conducted in 2012 and has been

implemented during the course of 2013. As a consequence there was a

commitment of time, energy and costs involved to see the process

through, and we are now confident that the Group is on the right

track to achieve profitability and growth. As part of this process

it was decided to change the name to GoldBridges Global Resources

plc, which was finalised in January 2014.

The operation at Sekisovskoye has performed well during the

year, with the additional input of ore from the underground

workings delivering an increase in gold production to a total of

30,669 oz in 2013 (22,471 oz in 2012). The original plan was to

phase out open pit production at Sekisovskoye in 2015, however this

winding down is currently being re-appraised with a view to extend

the open pit workings for a further two years. Plans as to the

timing and further development of the underground mining shafts to

accelerate the exploitation of the underground resource are

expected to be finalised soon.

In 2013, the opportunity arose to acquire the geological data in

relation to the Karasuyskoye Ore Fields, which appears to offer

significant potential, both in terms of resource base and location.

The resource, according to internal estimates, contains 9 million

ounces of gold and 16 million ounces of silver, and the location is

adjacent to the Group's current operations at Sekisovskoye. The

Group is currently in discussions with government authorities to

obtain the necessary licences and permits to exploit the site and

conduct further testing to validate the initial resource

estimates.

The funding to acquire the Karasuyskoye site was obtained from a

convertible loan note placed with African Resources Limited for

$27.5m, which was subsequently converted into shares in the Company

in December 2013. African Resources Limited also participated in

the placing in February 2014. In total the two placings post year

end raised GBP13.89m (equivalent to US$23m at year end exchange

rates). This funding will be used to provide a platform for growth

and additional working capital. We were grateful for the support of

our existing shareholders and to the new shareholders who

participated in the placings.

I am confident that 2014 will continue to be a positive year for

GoldBridges against the backdrop of changing economic and market

conditions. Indeed on a positive note the 20% devaluation of the

Kazakh Tenge announced in February 2014 is expected to have a

beneficial effect on the Group and the impact is currently being

assessed. The gold price has been volatile in the year given the

changing market conditions, with an opening price of US$1,650/oz at

the start of the year and a closing price of US$1,200/oz. The price

has since recovered and gold is currently trading in the

US$1,300/oz range. The consensus outlook is that gold will trade in

the range of US$1,100/oz to US$1,400/oz in the current year, based

on a stable economic (and political) climate with a gradual

increase in economic growth. The Group will continue its approach

of concentrating on the exploitation of higher grade underground in

order to keep operating costs as low as possible, as a buffer

against further downward gold price movements.

Finally, may I thank all our employees and management team for

their hard work and also thank our shareholders for their continued

support.

Aidar Assaubayev

Chief Executive Officer

Operational Review

The Group was focused during 2013 on growing production,

improving operational performance and researching new business

opportunities to complement and enhance the current asset base of

the Group. Open pit operations were complimented by increasing

production of ore from the underground higher grade resource. This

combined with the greater efficiencies achieved in recovery rates

has led in part to the increased group operating profit achieved in

the year. Following on from the review conducted in 2012, a number

of practical and pragmatic measures were put into place to achieve

efficiencies in the operations of the Group. During 2013, the Board

of Directors was strengthened by the appointment of a further three

Directors.

The Group had three main objectives in 2013, the first was to

accelerate the exploitation of the underground resource at

Sekisovskoye. Diamond drilling was accelerated in the underground

resource and these findings were used to access the resource level

indicated by the underground ore body. Internal reviews estimated

the gold resource at a total of 6moz of high grade ore. Venmyn

Deloitte a South African based consultancy, are currently working

on an independent Competent Persons Report (CPR) to verify these

estimates.

The second principal aim in the year was to implement the

operational review of the Group developed in 2012, and to deal with

and finalise the legacy issues inherited from the previous

management. These included the resolution of fines and

rehabilitation works incurred as a result of failure of the

tailings dam 3 in 2011, and recovery of monies due in relation to

the abortive acquisition of Akmola Gold LLP.

The third was to focus on new investment opportunities, in

particular, one that would utilise the current asset and skills

base of the Group in the most effective manner. The ideal fit was

found with the Karasuyskoye Ore Fields that sit adjacent to the

Group's current operating mine at Sekisovskoye. The initial

purchase of the geological data amounting to US$27.5m was funded by

the issue of a convertible bond by African Resources Limited (the

Group's principal Shareholder) which was subsequently converted

into shares in the Company in December 2013. Additional costs

incurred in relation to the negotiation and professional costs were

funded by the Group and amounted to US$2.6m.

Mineral Resources

The independent CPR is being prepared by Venmyn Deloitte and

work commenced in Q4 2013. Venmyn Deloitte ('Venmyn') is a wholly

owned subsidiary of Deloitte Touche Tohmatsu Limited, (part of the

Deloitte global services group), and is experienced in the

preparation of mineral resource reports. Based on the Group's

internal investigations the Directors' are confident that Venmyn's

report will provide positive confirmation of their internal

assessments. The management have been providing detailed

information as requested by Venmyn and are expecting the report to

be finalised in Q3 2014.

Sekisovskoye Operations and underground mine development

The key operational statistics of the mine operation are as

follows:

Mining - Open-cast mining

Actual 2013 Actual 2012

------------------ ----- ------------ ------------

Ore mined T 705,257 616,776

------------------ ----- ------------ ------------

Gold grade g/t 1.39 1.26

------------------ ----- ------------ ------------

Silver grade g/t 2.49 2.38

------------------ ----- ------------ ------------

Contained gold oz 31,621 24,915

------------------ ----- ------------ ------------

Contained silver oz 56,387 45,987

------------------ ----- ------------ ------------

Waste mined T 2,144,656 2,766,119

------------------ ----- ------------ ------------

Mining - Underground

Actual 2013 Actual 2012

------------------ ----- ------------ ------------

Ore mined T 63,572 37,867

------------------ ----- ------------ ------------

Gold grade g/t 3.50 2.75

------------------ ----- ------------ ------------

Silver grade g/t 5.27 3.62

------------------ ----- ------------ ------------

Contained gold oz 7,157 3,347

------------------ ----- ------------ ------------

Contained silver oz 11,139 4,397

------------------ ----- ------------ ------------

Waste mined T 128,006 109,570

------------------ ----- ------------ ------------

Mineral processing

Budget 2013 Actual 2013 Budget (% Actual 2012

2013)

------------------ ----- ------------ ------------ ---------- ------------

Crushing T 770,000 700,421 91.96 625,227

------------------ ----- ------------ ------------ ---------- ------------

Milling T 770,000 701,361 91.09 628,731

------------------ ----- ------------ ------------ ---------- ------------

Gold grade g/t 1.49 1.61 108.5 1.37

------------------ ----- ------------ ------------ ---------- ------------

Silver grade g/t 2.00 2.16 108.0 1.93

------------------ ----- ------------ ------------ ---------- ------------

Contained gold oz 30,295 36,388 120.1 27,803

------------------ ----- ------------ ------------ ---------- ------------

Contained silver oz 42,110 48,782 115.84 39,045

------------------ ----- ------------ ------------ ---------- ------------

Gold recovery % 82 84.3 102.8 80.4

------------------ ----- ------------ ------------ ---------- ------------

Silver recovery % 70 71.6 102.3 69.7

------------------ ----- ------------ ------------ ---------- ------------

Gold poured oz n/a 30,669 n/a 22,470

------------------ ----- ------------ ------------ ---------- ------------

Silver poured oz n/a 34,902 n/a 27,198

------------------ ----- ------------ ------------ ---------- ------------

Mining activity - open pit mine

A review was undertaken of the open pit mine to include the

mining methods, the infrastructure and the closure plan in relation

to winding down of mining activity.

Technical improvements were made to the explosive techniques

employed and improvements made to the road infrastructure to enable

a more efficient extraction and delivery of the ore to the

stockpile.

The Group also reconsidered the plan in relation to the

continued operation of the open pit operation, which was initially

considered for closure in Q2 2015. It was decided given the ore

reserves remaining that it would make economic sense to expand and

deepen the open pit operations. Based on the assessment made this

will increase the reserves that the open pit will produce by an

additional 64,000/oz, increasing the operational life of the open

pit to the end of 2017.

In addition to the usual mining works, the construction and

expansion of the tailings dams is continuing, these are on plan for

completion by 2015.

Mining activity - underground

Underground works were recommenced in April 2013, with mining

restarting in June, with a steady growth in production throughout

the year. During 2013, 63,500T of ore was excavated, the management

are expecting a significant improvement on this during 2014.

In 2013, in addition to resource extraction, a great deal of

preparatory work was carried out in order to gain further access to

ore bodies #3 and #11. This necessitated further exploratory

drilling that was conducted by both the Company's work force and

sub-contracted companies. As part of the plan developed in 2012

planned improvements to the infrastructure were also completed.

The principal works associated with underground mining in the

year were:

Mining and extraction of ore was from six mining levels in 2012,

ranging from +358mrl to +305mrl. In 2013 the work has continued to

develop further horizon extraction levels down to +250mrl. Once

this is fully completed there will be 170,000T of extractable ore

available. Of this amount 48,000T is ready for mining

extraction.

The diamond drilling programme to identify and enhance the

estimate of resources was deemed by management to be a key priority

in 2013. Resources were targeted at increasing the level of

drilling undertaken with subcontractors aiding the Company's own

staff to achieve impressive results in the year. By the end of the

year in excess of 53,800m of drilling had been achieved with

drilling conducted from the +250mrl level. The drilling is

continuing with a further 28,000m of drilling to be undertaken from

the 0mrl to -400mrl.

During 2013, in excess of 2,000 linear metres of tunnels were

developed for the transport decline, shafts and haulage entry

points, which necessitated the extraction of 45,200m(3) of waste in

the year. The works also included the necessary electrical works,

explosive magazines and ventilation works associated with the

tunnel development.

Underground - capex development

Based on detailed studies, two underground shafts are to be

constructed to a depth of 1000m which will be used to extract the

ore in the most commercially efficient manner. The estimated

capital expenditure for development of the shafts, equipment and

further working capital is expected to be in the region of US$130m.

This will be principally expended during the first three years of

the shafts construction. The amount required for the mine

development will be a combination of monies raised from external

capital sources with the balance of the funding coming from the

Group's internally generated cash flows.

Based on the current plans, the construction is expected to

commence in 2015, with construction of both shafts taking in the

region of 24 months. During this period the current transport

declines will be used to access the ore from underground.

The life of the mine of 22 years is based on the following

assumptions underlying the project economics of the model, gold

production of 100,000T of high grade ore per annum, this level of

production is to be achieved within 2 years of the shafts

completion. The model is based on a production cost in the region

of US$560/oz. The relatively low level is based on the switch to

higher grade underground ore from the current open pit source,

giving greater productivity from a smaller ore input into the

processing plant. Given these parameters and based on a price for

gold at 1,200/oz, the free cash flow over the project life is

expected to be in the region of US$1 billion.

Mineral processing

The performance against budget is shown in the table on page

above. The shortfall identified in ore processing was due to the

following:

-- Production problems in the ore crushing and sorting plant due

to plant failures. In Q4 these issues were resolved.

-- The supply of ore from underground was lower in Q4 due to

maintenance work, which resulted in a supply of ore being reduced

in that period.

The principal improvements highlighted in the year were as a

result of the following factors:

-- Production procedures have been enhanced resulting in the

mills being redesigned which has resulted in improving the quality

of ore being processed.

-- The quality of the underground ore is of better quality as it

can be ground to a finer paste, compared with the open pit ore. The

smaller granules have a positive effect on the sorption of

dissolved gold from the slurry. Thin sludges act as a sorbent and

lower gold recovery from activated carbon. In testing using solely

underground ore, the recovery rate achieved was an impressive 91.3%

for gold and 95.4% for silver.

-- The increase in the recovery rates of the ore being processed

is in part a direct consequence of the increase of underground ore

utilised.

-- The Group is in collaboration with independent research

companies in order to understand and obtain greater production

efficiencies, with particular emphasis on the quality of the ore

being extracted from underground resources. Preliminary studies

indicate potential increase in the recovery rates by an additional

1%.

Resolution of legacy issues

Tailings Dam

During 2012 the Irtysh Ecology department of the Ministry of the

Environment appealed through the courts and argued that a higher

level of fines and obligations as currently imposed should be

levied on the Company. This amounted to US$9.4M (being

1,429,000,000 Tenge) and was based on the agreement that the

environmental damage could not be directly measured and an indirect

measure of calculating the damage should be used. In March 2014

this argument was rejected on the basis that the damage was indeed

measurable reliably through the direct method and as such the court

action was dismissed. Indeed the court commented that the costs

already paid had exceeded the previous estimate agreed with the

department of 700,214,000 Tenge, and ordered the department to meet

the legal costs of the court amounting to 137,000 Tenge. Although

the department does have the right to appeal within 6 months of the

judgement given in March 2014 the Directors are of the opinion that

the possibility of this is remote. The provision in relation to the

finalisation of works to complete the outstanding rehabilitation

measures has been adjusted accordingly resulting in a write back of

the provision of US$9.3m.

The remainder of the rehabilitation works which amounts to

US$330,000 will be completed in 2014 to the satisfaction of the

Kazakh authorities.

Akmola Gold

In 2013, the Group successfully sued Akmola Gold for settlement

of US$2m which was due for payment in December 2013 as agreed

between the parties. The amount of US$2m related to the partial

repayment of amounts advanced to Akmola as part of the abortive

acquisition by GoldBridges in 2012.

Judgement was obtained in 2013, which was confirmed in 2013

which imposes a lien on the assets of Akmola Gold such that no

disposal of the assets of Akmola can take place without the consent

of Goldbridges. The Group are currently in negotiations with Akmola

in relation to crystallising the amount due. Due to the

uncertainties surrounding the issue a full provision has been

maintained against the amount due in relation to the recoverability

of this amount in the financial statements.

Acquisitions

Karasuyskoye Ore Fields

GoldBridges entered into an information transfer and sale

agreement with Hydrogeology LLP ("Hydrogeology") (the "Information

Transfer and Sale Agreement") to acquire certain historical

geological information pertaining to the Karasuyskoye Ore Fields

which are located adjacent to the Company's current operations in

Kazakhstan. The Directors are excited with the potential that the

site offers in relation to the potential revenues to be generated

and see it as a perfect fit for the current operations,

particularly in light of the expected termination of open pit

operations at Sekisovskoye.

The Karasuyskoye Ore Fields are an advanced exploration project

covering an area of approximately 198 km(2) . Exploration drilling

and testing by Hydrogeology and GoldBridges technical teams,

indicates estimated resources of approximately nine million ounces

of gold at 3g/t, and in excess of sixteen million ounces of

silver.

The Company expects initially to use the information acquired as

the basis for an application for the extension of its existing

mining licenses, to cover the Karasuyskoye Ore Fields, from the

Ministry of Industry and New Technologies (MINT). Assuming this

extension is granted, and following the completion of limited

additional verification work, the Company then expects to engage

Venmyn, to complete a JORC-compliant CPR on the Karasuyskoye Ore

Fields. The Group is currently awaiting notification from MINT and

expects to receive notification in the short term.

Following the completion of the CPR, the Company expects to

announce its strategy for bringing the Karasuyskoye Ore Fields into

production using the cash generated by its existing operations.

Initially, this is expected to involve the utilisation of the

Company's existing mining fleet and processing facilities, while

the Company completes its medium-term investment programme to

expand both fleet and plant.

The total consideration payable under the transaction was

US$27.5 million (approximately GBP17.25 million), which was

satisfied by the issue of a convertible bond to African Resources

Limited (a principal shareholder).

Financial performance review

Sekisovskoye poured 30,669 (2012: 22,470), ounces of gold in

2013. Due to timings in the shipping and selling of the gold poured

to the refiner, a total of 29,712 (2012: 24,800) ounces were sold

in 2013 at an average price of US$1,426 (2012: US$1,563) per ounce.

There were no other material items of revenue.

The total cash cost of production (which includes administrative

costs but excludes depreciation and provisions) amounts to

US$1,309/oz, (2012: US$1,428/oz). The operating cash cost amounts

to US$903/oz (2012: US$1,046/oz), this is based on the cost of

production excluding depreciation and administrative expenses.

Further cost savings measures are being put in place to further

reduce the costs.

Adjusted EBITDA for the year of negative US$0.5m (excluding the

movements in the tailings dam provision) showed a marked turnaround

reflecting improved operating cost control under the new management

resulting in improved gross profits and despite an increase in

administrative costs (explained in more detail below). In 2012,

EBITDA before the tailings dam provision movement and Akmola

impairment was a loss of US$2.3m. On the same basis, (excluding

depreciation adjustment) the Group reported an operating loss of

US$6.0m, compared with a loss of US$6.7m in 2012.

Administrative costs amount to US$16.5m (2012: US$9.5m),

(excluding provisions) the overall increase in the year amounts to

US$7m, the increase is due to a number of factors. The increase in

costs can be split into the following three principal areas:

firstly costs associated with the acquisition of the Karasuyskoye

Ore Fields; secondly costs associated with the termination and

closure of contracts not being continued with by the current

management; and finally costs related to the potential expansion

and development of the business.

Significant expenses were incurred in relation to negotiating

and securing the Karasuyskoye contract of approximately US$2.6m.

These costs did not meet capitalisation criteria and were exposed

as incurred.

Secondly the Group has incurred costs in relation to terminating

staff and other contracts in order to rationalise costs in the

future and provide more efficient or competitive services as

necessary. The Directors estimate the costs in relation to these

matters amounts to approximately US$1m. The effect of the

efficiency measures have not been fully reflected in the results of

the year, as additional costs were incurred as a result of

repositioning services and terminating/renewing contracts. The

Directors are confident that there will be marked reduction in

these costs in the forthcoming year.

The third factor resulting in the increase in administrative

cost is as result of the Company building a platform for future

growth, with the development of the underground mine and the

expansion of the asset base with the acquisition of the

Karasuyskoye Ore Fields. Staff numbers have increased by 59,

resulting in an increase in payroll cost of US$1.2m.

Finance expenses amount to US$1.5m of which US$407,000 relates

to interest that was accrued in relation to the convertible bond

issued during the year in order to finance the acquisition of the

geological data of the Karasuyskoye Ore Field. The balance of the

finance expense relates to the payment of interest to the European

Bank for Reconstruction (EBRD), see note 10.

The Group had cash balances at 31 December 2013 of US$12m (2012:

US$2.5m), The cash balances were significantly enhanced with the

monies raised in the two share placings post year end raising an

additional US$23m. The net assets of the Group are US$58.6m (2012:

US$29.3m), the significant increase in net assets arises

principally from the acquisition of the Karasuyskoye Ore Fields,

which was ultimately purchased by the issue of shares in the

Company on the conversion of the convertible bond issued to African

Resources Limited.

Operating cash flow was also considerably improved in 2013,

showing a net cash inflow from operating activities of US$7,304m

compared with an outflow of US$(9,981) in 2012, as a result of the

increased EBITDA and careful working capital management under the

new management. In addition, operating cash flows reflected cash

receipts in respect of pre-paid sales amounting to US$2.2m and

which will recognised in the income statement in 2014.

Going concern

The Group's operations are cash generative and the current cash

position is sufficient to cover ongoing operating and

administrative expenditure for the next 12 months.

As part of the strategic plan the Group are planning to build

two underground shafts in order to exploit the underground

resources in a more cost effective approach. The project is due to

commence in 2015, and at present the detailed planning is being

undertaken.

On 10 January 2014 and 28 February 2014 the Company completed

two successful share placings raising gross proceeds of US$23

million (GBP13.89 million). This provides additional working

capital to the Group and also provides the initial capital required

to progress the Group's capital enhancement plans.

The Directors anticipate that whilst the Group may seek to raise

further finance in the future, it now has access to sufficient

funding for its immediate needs. The Group expects to have

sufficient cash flow from its forecast production to finance its

ongoing operational requirements and to, at least in part, fund the

future capital requirements of the Group.

On this basis the Directors have therefore concluded that it is

appropriate to prepare the financial statements on a going concern

basis.

Audit opinion

The auditors have not qualified the audit report but have

referred to the importance of the valuation of the Karasuyskoye ore

fields, the emphasis of matter paragraph from the audit report is

reproduced below, see note 9.

In forming our opinion on the financial statements, which is not

modified, we have considered the adequacy of the disclosures in the

notes to the financial statements concerning the outcome of the

licence application at Karasuyskoye. During the year the Group

acquired the geological data at Karasuyskoye for US$27.5 million

and has applied for but not yet been granted a mining licence over

this area. In the event that the licence is granted to another

party, the Group would need to negotiate the sale of the data to

the successful applicant which may be at a lower value than the

carrying value. The ultimate outcome of this matter cannot

presently be determined.

Consolidated statement of profit or loss

year ended 31 December 2013

Reclassified

Notes 2013 US$000 2012 US$000

------------------------------------- ----- ---------------------- --------------------

Revenue 42,395 38,913

Cost of sales (32,076) (30,519)

Impairment of inventory 3 - (5,638)

------------------------------------- ----- ---------------------- --------------------

Gross profit 10,319 2,756

Administrative expenses (16,475) (9,464)

Impairment - Akmola investment - (3,553)

Tailings dam leak 9,252 (10,261)

Operating profit/(loss) 3,096 (20,522)

Finance income 1 244

Foreign exchange loss (413) (240)

Finance expense (1,515) (885)

------------------------------------- ----- ---------------------- --------------------

Profit/(loss) before taxation 1,169 (21,403)

Taxation credit/(charge) 5 358 (740)

Profit/(loss) attributable to equity

holders of the parent 1,527 (22,143)

------------------------------------- ----- ---------------------- --------------------

Profit/(loss) per ordinary share

------------------------------------- ----- ---------------------- --------------------

Basic & Diluted 0.15c (2.36)c

------------------------------------- ----- ---------------------- --------------------

Consolidated statement of profit or loss and other comprehensive

income

year ended 31 December 2013

2013 2012

US$000 US$000

--------------------------------------------------------- ------ --------

Profit/(loss) for the year 1,527 (22,143)

Currency translation differences arising on translations

of foreign operations items which will or may be

reclassified to profit or loss (763) (1,257)

--------------------------------------------------------- ------ --------

Total comprehensive income/(loss) attributable to

equity holders of the parent 764 (23,400)

--------------------------------------------------------- ------ --------

Consolidated statement of financial position

year ended 31 December 2013

Company number 5048549 Notes 2013 US$000 2012 US$000

Non-current assets

Intangible assets 27,157 -

Property, plant and equipment 8 44,357 40,814

Trade and other receivables 381 421

Deferred tax asset 1,145 556

Restricted cash 301 384

-------------------------------- ----- --------------------- ------------------

73,341 42,175

-------------------------------- ----- --------------------- ------------------

Current assets

Inventories 9,354 13,379

Trade and other receivables 5,446 4,288

Cash and cash equivalents 2,067 2,504

-------------------------------- ----- --------------------- ------------------

16,867 20,171

-------------------------------- ----- --------------------- ------------------

Total Assets 90,208 62,346

-------------------------------- ----- --------------------- ------------------

Current Liabilities

Trade and other payables (11,512) (3,762)

Other financial liabilities (239) (229)

Current tax payable (558) (332)

Provisions (647) (10,774)

Borrowings (894) (10,065)

-------------------------------- ----- --------------------- ------------------

(13,850) (25,162)

-------------------------------- ----- --------------------- ------------------

Net current assets/liabilities 3,017 (4,991)

-------------------------------- ----- --------------------- ------------------

Non-current liabilities

Other financial liabilities (1,287) (1,333)

Provisions (6,705) (6,549)

Borrowings (10,000) -

-------------------------------- ----- --------------------- ------------------

(17,992) (7,882)

-------------------------------- ----- --------------------- ------------------

Total liabilities (31,842) (33,044)

-------------------------------- ----- --------------------- ------------------

Net assets 58,366 29,302

-------------------------------- ----- --------------------- ------------------

Equity

Share capital 2,635 1,684

Share premium 115,594 88,245

Merger reserve (282) (282)

Currency translation reserve (8,841) (8,078)

Accumulated losses (50,740) (52,267)

-------------------------------- ----- --------------------- ------------------

Total equity 58,366 29,302

-------------------------------- ----- --------------------- ------------------

Consolidated statement of changes in equity

year ended 31 December 2013

Currency

Share Share Merger Other Translation Accumulated

Capital Premium Reserve Reserves Reserve Losses Total

US$000 US$000 US$000 US$000 US$000 US$000 US$000

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

1 January 2012 1,310 76,914 (282) 535 (6,821) (30,659) 40,997

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Loss for the

year - - - - - (22,143) (22,143)

Other

comprehensive

loss - - - - (1,257) - (1,257)

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Total

comprehensive

loss - - - - (1,257) (22,143) (23,400)

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Lapsed share

options - - - (535) - 535 -

Shares issued

(note

26) 374 11,862 - - - - 12,236

Issue costs - (531) - - - - (531)

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

31 December

2012 1,684 88,245 (282) - (8,078) (52,267) 29,302

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Profit for the

year - - - - - 1,527 1,527

Other

comprehensive

loss - - - - (763) - (763)

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Total

comprehensive

loss - - - - (763) 1,527 764

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Shares issued

on conversion

of loan notes

(note

26) 951 27,590 - - - - 28,541

Issue costs - (241) - - - - (241)

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

31 December

2013 2,635 115,594 (282) - (8,841) (50,740) 58,366

---------------- ------------ --------------- -------- -------------- -------------- -------------- -----------

Consolidated statement of cashflows

year ended 31 December 2013 Notes 2013 US$000 2012 US$000

------------------------------------------- ------ ---------------------- ------------------

Net cash inflow/(outflow) from operating

activities 7,304 (9,941)

--------------------------------------------------- ---------------------- ------------------

Investing activities

Interest received 1 31

Proceeds on disposal of property, plant

and equipment - 416

Purchase of property, plant and equipment (7,471) (10,469)

Akmola Gold advances and prepayment

fees - (656)

Proceeds from Ognevka liquidation - 1,500

Restricted cash - (145)

--------------------------------------------------- ---------------------- ------------------

Net cash used in investing activities (7,470) (9,323)

--------------------------------------------------- ---------------------- ------------------

Financing activities

Proceeds on issue of shares - 12,236

Issue costs (241) (531)

Drawdown of bank loans - 10,065

Loan from related party 894 -

Interest paid (924) (765)

Repayment of bank loans - (1,000)

--------------------------------------------------- ---------------------- ------------------

Net cash inflow from financing activities (271) 20,005

--------------------------------------------------- ---------------------- ------------------

Increase in cash and cash equivalents (437) 741

--------------------------------------------------- ---------------------- ------------------

Cash and cash equivalents at beginning

of the year 2,504 1,763

--------------------------------------------------- ---------------------- ------------------

Cash and cash equivalents at end of

the year 2,067 2,504

--------------------------------------------------- ---------------------- ------------------

Notes

1. General information

GoldBridges Global Resources Plc (the "Company") is a Company

incorporated in England and Wales under the Companies Act 2006. In

January 2014 the Company changed its name from Hambledon Mining PLC

to Goldbridges Global Resources PLC. The address of its registered

office, and place of business of the Company and the subsidiaries

(the "Group") is set out within the Company information on page 49

of this annual report. The principal activities of the Group and

Company are set out on page 13 and, the strategic review within

this annual report.

2. Basis of preparation of financial information

The financial information set out above, which was approved by

the Board on 16 June 2014, has been compiled in accordance with

International Financial Reporting Standards ("IFRS"), but does not

contain sufficient information to comply with IFRS. The Company

expects to distribute its full financial statements that comply

with IFRS in June 2014.

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 31 December 2013

but is extracted from those accounts. The Company's statutory

accounts for the year ended 31 December 2013 will be filed with the

Registrar of Companies following the Company's annual general

meeting. The independent auditors' report on those accounts was

unqualified, but did draw attention to a matter by way of emphasis

without qualifying those accounts, it did not contain any statement

under section 498(2) or (3) of the Companies Act 2006.

The financial statements have been prepared under the historical

cost convention. The accounting policies are consistent with those

adopted and disclosed in the Group's annual financial statements

for the year ended 31 December 2012.

The Directors have elected to present for the first time the

Company's financial statements in US Dollars in order to make them

comparable to the Group financial statements and the financial

statements of its peers. This is a change from prior years when the

financial statements were presented in Pound Sterling. The change

represents a change in accounting policy and has been applied

retrospectively.

The comparative figures between cost of sales and administrative

expenses have been re-analysed as the Directors are of the opinion

that this gives a fairer and more comparable presentation of the

results.

Copies of the Company's audited statutory accounts for the

period ended 31 December 2013 will be available at the company's

website at www.goldbridgesplc.com, promptly after the release of

this preliminary announcement and a printed version will be

dispatched to shareholders shortly. The Board approved this

announcement on 16 June 2014.

3. Revenue

Continuing operations 2013 2012

$000 $000

------------------------- ------- -------

Sale of gold and silver 42,395 38,913

------------------------- ------- -------

Included in revenues from sale of gold and silver are revenues

of US$42,395,000 (2012: US$38,769,000) which arose from sales to

the Group's largest customer.

4. Tailings dam leak

A Provision was set up in order to provide for the cost

associated with the Tailings Dam leak and an update is provided

below:

Provision Paid in Change in Currency Provision

b/f 2013 Translation c/Fwd

$000 $000 Provision

------------------------- --------- ------- ---------- ------------------- ---------------

Environmental and social

obligations 1,071 (771) 46 (16) 330

Fines and penalties 9,400 - (9,298) (102) -

------------------------- --------- ------- ---------- ------------------- ---------------

10,471 (771) (9,252) (118) 330

------------------------- --------- ------- ---------- ------------------- ---------------

Background

In 2011, tailings dam 3 utilised by a Group company in

Sekisovskoye for its mining operations suffered an industrial water

leak. This resulted in pollution of the environment principally to

the Sekisovka river and its surrounding environment. It was

estimated by an independent ecological company that the damage to

the environment amounted to the equivalent of US$3.8m, (being

700,214,000 Tenge). A direct action plan was presented to the

department responsible being, Irtysh Ecology department of the

Ministry of the Environment.

In addition the Group paid US$3.9 million in penalties in 2012

and completed substantially all the measures on environment

rehabilitation to make good the local environment.

The Group is committed to the development of improved waste

handling facilities to prevent a reoccurrence of the tailings dam

incident the costs of which were already included in its

infrastructure development plan.

As at January 2014, 13 out of 19 planned environmental recovery

activities were completed, their total cost was US$5.3m (being

815,747,000 Tenge). The total cost of unfinished actions is

US$330,000 (being 51,067,072 Tenge). This was confirmed by an

independent expert, who further concluded that no further remedial

action is required, subject to completion of the agreed plan.

In addition, during 2012 the Irtysh Ecology department of the

Ministry of the Environment appealed through the courts and argued

that a higher level of fines and obligations as currently imposed

should be levied on the Company. This amounted to US$9.4M (being

1,429,000,000 Tenge). This was based on the argument that the

environmental damage could not be directly measured and an indirect

measure of calculating the damage should be used. This argument was

rejected on appeal in March 2014 and as a consequence the fine was

cancelled. Further details are provided on page 5 of the Strategic

report.

As a result of the tailings dam leak, the Group has also

contracted with the Government of the Republic of Kazakhstan to

spend an additional US$4.1 million on the construction of a paste

plant which is not included in the provision but is set out in note

29 - "Commitments and contingencies". Of this amount a total of

US$266,937 has already been incurred prior to 31 December 2013. The

Company has until the end of 2015 to fulfil this obligation.

5. Taxation

2012 2012

--------------------------------------- ----- ----

$000 $000

--------------------------------------- ----- ----

Current taxation 250 332

Deferred taxation (608) 408

--------------------------------------- ----- ----

Total taxation charge/(benefit) (358) 740

--------------------------------------- ----- ----

The current taxation charge for the year ended 31 December 2013

arose in one of the Group's subsidiaries in Kazakhstan which

recognised taxable profits for the year and had utilised all its

brought forward tax losses from previous years.

6. Dividends

The Directors do not recommend a dividend for the year (2012:

nil) and the loss for the year has been added to accumulated

losses.

7. Loss per ordinary share

The calculation of basic and diluted earnings per share is based

on profit for the financial year of US$1,527,000 (2012: loss of

US$22,143,000).

The weighted average number of ordinary shares for calculating

the basic profit/(loss) in 2013 and 2012 is shown below. There were

no potential ordinary shares outstanding at the reporting date

(2012: Nil) and as such the basic and diluted earnings per share

are the same.

2013 2012

Basic and diluted 1,003,707,844 938,491,844

8. Post reporting date events

Equity raising

On 10 January 2014 the Company completed a placing raising

GBP1.93m (US$3.2m), through a placing of 97,972.000 new shares at a

price of 1.975 pence per share. In addition on 28 February 2014 the

Company raised gross proceeds of GBP11.96m (US$19.8m), through a

placing of 550,000,000 shares at a price of 2.175 pence per share.

The total number of shares following the placing of the shares is

2,211,342,130.

Tailings dam fine

During 2012 the Irtysh Ecology department of the Ministry of the

Environment appealed through the courts and argued that a higher

level of fines and obligations then currently imposed should be

levied on the Company. This amounted to US$9.4M (being

1,429,000,000 Tenge). This was based on the fact that the

environmental damage could not be directly measured and an indirect

measure of calculating the damage should be used. In March 2014

this argument was rejected by the courts on the basis that the

damage was indeed measurable reliably through the direct method and

as such the court action was dismissed. Indeed the court commented

that the costs already paid exceeded the previous estimate agreed

with the department of 700,214,000 Tenge, and ordered the

department to meet the legal costs of the court amounting to

137,000 Tenge. Although the department does have the right to

appeal within 6 months of the judgement the Directors are of the

opinion that the possibility of this is remote. The provision in

relation to the finalisation of works to complete the outstanding

rehabilitation measures has been adjusted accordingly resulting in

a write back of the provision of US$9.3m.

Akmola

In late 2013, subsequent to the termination of the proposed

Akmola Gold acquisition, the Company successfully sued Akmola Gold

for US$2,000,000, the amount it had previously advanced, and it

agreed to be repaid by 1 December 2013. In February 2014 The Appeal

Board of Astana upheld the decision made by the Specialised

Interregional Economic Court of Astana in favour of the Company.

The Company at present has a lien over the assets of Akmola Gold

LLP and will take all appropriate measures for enforcement of the

court decision.

Currency devaluation

On 11 February 2014 the Republic of Kazakhstan National Bank

declared a 20% devaluation of Tenge. The National Bank expects a

new exchange rate to be around 300 Tenge per British Pound. The

management are of the opinion this will have a positive impact on

the Group as all revenues are generated in US dollars. They are

currently quantifying the impact.

9 Intangible Assets

2013 US$ '000

------------------ --------------

Cost

------------------ --------------

1 January 2013 -

------------------ --------------

Additions 27,500

------------------ --------------

31 December 2013 27,500

------------------ --------------

Amortisation

------------------ --------------

1 January 2013 -

------------------ --------------

Charge 343

------------------ --------------

31 December 2013 343

------------------ --------------

31 December 2012 -

------------------ --------------

31 December 2013 27,157

------------------ --------------

The intangible assets relate to the historic geological

information pertaining to the Karasuyskoye ore fields. The ore

fields are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye. The consideration

was satisfied by the issue of an unsecured convertible loan note of

GBP17,250,000 to African Resources Limited, which made the payment

to Hydrogeology LLP to acquire the asset on behalf of the Group.

The loan note was subsequently converted into ordinary shares in

the company.

The value of the geological data purchased is, in the opinion of

the Directors, the value that would have been incurred if the

drilling had been undertaken by a third party (or internally). The

Directors have determined that the value of this assets should be

amortised over 20 years.

The Group is in the process of obtaining the mining rights in

relation to the area covered by the data. However, the licensing

tender process has not yet commenced and there is no guarantee that

the licence will be granted. In the event the licence is not

granted to the Group, the Company would seek to negotiate a

disposal of the asset to the successful licence applicant.

In addition to the cost capitalised significant expenses

amounting to US$2.6m were incurred in 2013 in relation to

negotiating and securing the Karasuyskoye contract. These costs did

not meet capitalisation criteria and were expensed as incurred.

10. Notice of Annual General Meeting

The AGM will be held at the offices of BDO LLP, 55 Baker Street,

London W1U 7EU on Monday 30 June 2014 at 11.15am. The notice of

meeting and resolutions were issued on 6 June 2014 and are

available on the Company's website www.goldbridgesplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFASAWFLSEEM

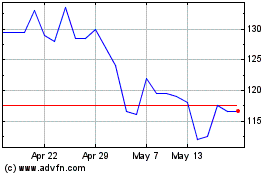

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024