Publication of Circular (717525)

August 24 2018 - 12:22PM

UK Regulatory

Dow Jones received a payment from EQS/DGAP to publish this press

release.

AEW UK REIT plc (AEWU)

Publication of Circular

24-Aug-2018 / 17:21 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, TO

U.S. PERSONS OR INTO OR IN THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR

SOUTH AFRICA.

AEW UK REIT plc

(the "Company)

24 August 2018

Publication of Circular

AEW UK REIT plc has today posted a circular to Shareholders (the "Circular")

convening a General Meeting to be held at The Cavendish Hotel, 81 Jermyn

Street, St. James', London SW1Y 6JF at 12.15 p.m. on 12 September 2018 at

which resolutions will be put to Shareholders to approve: (i) the adoption

of New Articles to permit the issuance of C Shares; and (ii) the issue of up

to 250 million Ordinary Shares and/or 250 million C Shares and the

disapplication of associated pre-emption rights in connection with a

potential new twelve month share issuance programme (together the

"Proposals"). Full details of the Proposals are set out in the Circular, a

copy of which will shortly be available on the Company's website at

www.aewukreit.com.

Background

The Company was launched in May 2015, raising gross proceeds of GBP100.5

million on IPO. Since then, a further 51,058,251 Ordinary Shares have been

issued at a premium to the NAV per Ordinary Share. As at 30 June 2018, the

fair value independent valuation of the Company's portfolio was GBP191.95

million, following the part sale of Pearl Assurance House, Nottingham. The

NAV was GBP149.14 million or 98.40 pence per Ordinary Share and EPRA earnings

per Ordinary Share for the quarter to 30 June 2018 was 2.04 pence per

Ordinary Share, in line with the Company's target annual dividend of 8.00

pence per Ordinary Share.

At 30 June 2018, the Company held GBP6.72 million cash for investment and has

declared dividends of 22.83 pence per Ordinary Share since launch.

AEW UK Investment Management LLP, the Company's investment manager,

continues to see a strong pipeline of potential opportunities generated by

its network of contacts across the UK commercial property market.

Accordingly, the Directors believe it is now appropriate to seek Shareholder

approval such that on the occurrence of suitable market conditions the

Company will be in a position to raise capital. Any such fundraising will

only be carried out when the Directors consider that it is in the best

interests of Shareholders and the Company as a whole. Relevant factors in

making such a determination will include net asset performance, share price

rating, investment pipeline and perceived investor demand.

Adoption of New Articles, Disapplication of Pre-emption Rights and Approval

of the Issue of Shares

In order to mitigate the risk of any cash drag to existing Shareholders, and

to ensure that the NAV attributable to the existing Ordinary Shares is not

diluted by the expenses associated with any new Share Issuance Programme,

the Directors believe it is prudent to have the ability to issue C Shares

under any potential Share Issuance Programme. Any new Ordinary Shares will

only be issued pursuant to the potential Share Issuance Programme at prices

greater than the latest published NAV per Ordinary Share.

In order to issue, on a non-pre-emptive basis, C Shares pursuant to the

potential Share Issuance Programme, the new articles are required to be

adopted (incorporating the rights of the new C Shares) and the Directors

also require specific authority from Shareholders. Therefore, the Company is

seeking Shareholder authority to: (i) adopt the new articles; and (ii) issue

and disapply associated statutory pre-emption rights for 250 million

Ordinary Shares and/or 250 million C Shares in connection with any new Share

Issuance Programme until the earlier of the close of such new Share Issuance

Programme and 30 June 2020.

Any issue of Shares using the above authorities will be subject to the

Company having a live Share Issuance Programme and, accordingly, the

Directors currently intend to publish a new prospectus in due course.

Expected Timetable of Principal Events

Latest time and date for the 12.15 p.m. on 10 September

return of the Form of Proxy 2018

General Meeting 12.15 p.m. on 12 September

2018 (or as soon thereafter as

the annual general meeting of

the Company convened for the

same date has concluded)

All references to times in this announcement are to London time unless

otherwise stated. Any changes to the expected timetable will be notified by

the Company through a Regulatory Information Service.

Terms used and not defined in this announcement shall have the meaning given

in the Circular. A copy of the Circular has also been submitted to the

National Storage Mechanism and will shortly be available for inspection at

www.morningstar.co.uk/uk/nsm.

Enquiries:

AEW UK

Mark Burton +44(0) 1392 477500

Alex Short alex.short@eu.aew.com

+44(0) 207 016 4880

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Liberum Capital

Gillian Martin +44(0) 20 3100 2000

Christopher Britton +44(0) 20 3100 2226

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477500

www.aewukreit.com [1]

ISIN: GB00BWD24154

Category Code: MSCH

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 5922

EQS News ID: 717525

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=c9b6404682d7efd026577394ecbedab5&application_id=717525&site_id=vwd_london&application_name=news

(END) Dow Jones Newswires

August 24, 2018 12:22 ET (16:22 GMT)

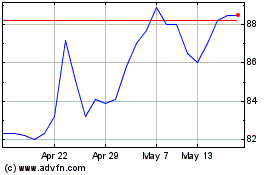

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2024 to Jun 2024

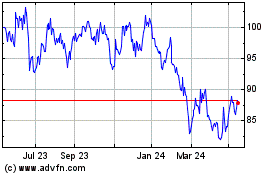

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2023 to Jun 2024