UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

December 31, 2008

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file number:

000-49746

VISCOUNT SYSTEMS, INC.

(Name of registrant as specified in its charter)

|

NEVADA

|

88-0498181

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

|

|

|

4585 Tillicum Street, Burnaby, British Columbia,

Canada

|

V5J 5K9

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Issuer’s telephone number:

|

(604) 327-9446

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the

Act:

|

None

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the

Act:

|

Common Stock, $.001 per share

|

|

|

(Title of class)

|

Check whether the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act.

Yes [

] No [X]

Check whether the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Exchange Act.

Yes [

] No [X]

Check whether the registrant (1) filed all reports required to

be filed by Section 13 or 15(d) of the Exchange Act

during the past 12

months (or for such shorter period that the registrant was required to file such

reports), and (2)

has been subject to such filing requirements for the past

90 days. Yes [X] No [ ]

Check if there is no disclosure of delinquent filers in response

to Item 405 of Regulation S-B contained in this form,

and no disclosure will

be contained, to the best of the registrant’s knowledge, in definitive proxy or

information

statements incorporated by reference in Part III of this Form

10-K or any amendment to this Form 10-K. [X]

Check whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller

reporting company.

See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company”

in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

|

Accelerated

filer

[ ]

|

|

Non-accelerated filer [ ]

|

(Do not check if a smaller

reporting company)

|

Smaller reporting company [

X

]

|

Check whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

State issuer’s revenues for its most recent fiscal year:

$4,189,608 ($5,102,434 in Canadian dollars converted at an

exchange rate of

US$0.8211/CDN$ 1.000) .

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by

reference to the price at

which the common equity was sold, or the average bid and asked price of such

common

equity, as of the last business day of the registrant’s most recently

completed second fiscal quarter: $3,746,663 as at

June 30, 2008.

State the number of shares outstanding of each of the issuer’s

classes of common equity, as of the latest practicable

date: 17,841,250 shares of common stock as at March 20, 2009.

2

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the Annual

Meeting of Stockholders are incorporated by reference into

Part III of this

Form 10-K, which Proxy Statement is to be filed within 120 days after the end of

the Registrant's fiscal

year ended December 31, 2008.

Transitional Small Business Disclosure Format (Check one): Yes

[ ] No [X]

3

Form 10-K

Table of Contents

1

FORM 10-K

VISCOUNT SYSTEMS, INC.

PART I.

FORWARD-LOOKING STATEMENTS

ALL STATEMENTS IN THIS DISCUSSION THAT ARE NOT HISTORICAL ARE

FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF SECTION 21E OF THE SECURITIES

EXCHANGE ACT OF 1934, AS AMENDED. STATEMENTS PRECEDED BY, FOLLOWED BY OR THAT

OTHERWISE INCLUDE THE WORDS "BELIEVES", "EXPECTS", "ANTICIPATES", "INTENDS",

"PROJECTS", "ESTIMATES", "PLANS", "MAY INCREASE", "MAY FLUCTUATE" AND SIMILAR

EXPRESSIONS OR FUTURE OR CONDITIONAL VERBS SUCH AS "SHOULD", "WOULD", "MAY" AND

"COULD" ARE GENERALLY FORWARD-LOOKING IN NATURE AND NOT HISTORICAL FACTS. THESE

FORWARD-LOOKING STATEMENTS WERE BASED ON VARIOUS FACTORS AND WERE DERIVED

UTILIZING NUMEROUS IMPORTANT ASSUMPTIONS AND OTHER IMPORTANT FACTORS THAT COULD

CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN THE FORWARD-LOOKING

STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE THE INFORMATION CONCERNING OUR

FUTURE FINANCIAL PERFORMANCE, BUSINESS STRATEGY, PROJECTED PLANS AND OBJECTIVES.

THESE FACTORS INCLUDE, AMONG OTHERS, THE FACTORS SET FORTH BELOW UNDER THE

HEADING "RISK FACTORS." ALTHOUGH WE BELIEVE THAT THE EXPECTATIONS REFLECTED IN

THE FORWARD-LOOKING STATEMENTS ARE REASONABLE, WE CANNOT GUARANTEE FUTURE

RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS. MOST OF THESE FACTORS

ARE DIFFICULT TO PREDICT ACCURATELY AND ARE GENERALLY BEYOND OUR CONTROL. WE ARE

UNDER NO OBLIGATION TO PUBLICLY UPDATE ANY OF THE FORWARD-LOOKING STATEMENTS TO

REFLECT EVENTS OR CIRCUMSTANCES AFTER THE DATE HEREOF OR TO REFLECT THE

OCCURRENCE OF UNANTICIPATED EVENTS. READERS ARE CAUTIONED NOT TO PLACE UNDUE

RELIANCE ON THESE FORWARD-LOOKING STATEMENTS. REFERENCES IN THIS FORM 10-K,

UNLESS ANOTHER DATE IS STATED, ARE TO DECEMBER 31, 2007. AS USED HEREIN, THE

"COMPANY," "VISCOUNT," "WE," "US," "OUR" AND WORDS OF SIMILAR MEANING REFER TO

VISCOUNT SYSTEMS, INC.

Currency of Financial Information and Exchange Rate Table

We maintain our books of account in Canadian dollars and

references to dollar amounts herein are to the lawful currency of Canada unless

otherwise indicated.

The following table sets forth, for the periods indicated,

certain exchange rates based on the noon buying rate in New York City for cable

transfers in Canadian dollars. Such rates are the number of Canadian dollars per

one (1) U.S. dollar and are the inverse of rates quoted by the Federal Reserve

Bank of New York for U.S. dollars per CDN$1.00. On February 12, 2008, the

exchange rate was US$1.00 per CDN$1.2248. The high and low exchange rates for

each month during the previous six months were as follows:

|

|

High

|

Low

|

|

February 2009

|

1.2250

|

1.2160

|

|

January 2009

|

1.2765

|

1.1761

|

|

December 2008

|

1.3008

|

1.1872

|

|

November 2008

|

1.2952

|

1.1477

|

|

October 2008

|

1.2995

|

1.0585

|

|

September 2008

|

1.0821

|

1.0298

|

2

The following table sets out the exchange rate information as

at each of the years ended December 31, 2008 and 2007.

|

|

Year Ended December 31

|

|

|

|

|

|

|

2008

|

2007

|

|

Rate at end of Period

|

1.2180

|

0.9913

|

|

Average Rate during Period

|

1.0660

|

1.0748

|

|

Low

|

0.9711

|

1.1030

|

|

High

|

1.3008

|

0.8419

|

Item 1. BUSINESS

GENERAL

We are a manufacturer, developer and service provider of access

control security products. In 2008, commercial sales of our MESH product line

continued to impact our total sales. MESH (Multimedia Embedded Security Hub) was

a new technology developed by Viscount that converged voice (intercom, emergency

communications), data (access control, elevator control, alarm) and some video

to provide increased security at a reduced cost of hardware, cabling and

installation and with simplified database management.

In addition to MESH, our current access control and security

product lines include the following: Enterphone 2000, a building intercom;

Entercheck, a card access system; RadioClik and InfraClik, radio frequency and

infrared remote controls; Elektra, liquid crystal display intercom panels;

EmerPhone, emergency telephone entry systems; and various accessories. We also

have a service division that provides service for the Enterphone 2000. We

currently have 1,630 service agreements in place.

Our website address is

www.viscount.com

. All periodic

and current reports are available, free of charge, on our website as soon as

reasonably practicable after such material is electronically filed with, or

furnished to, the U.S. Securities and Exchange Commission. Electronic or paper

copies of our filings are also available, free of charge, upon request.

BUSINESS OVERVIEW

We design, manufacture and service access control and security

products, including intercom and door access control systems and emergency

communications systems. These systems use telecommunications wiring to control

access to buildings and other facilities for security purposes. While much of

our current revenues are derived from sales of the Enterphone technology and

related security products, sales from our MESH product line continues to impact

and provide a significant source of revenues. Service sales from our existing

1,630 service agreements also continue to provide a significant source of

revenues.

MESH is now our leading sales product, accounting for 51.5% of

total sales for the year ended December 31, 2008. MESH technology is based on a

proprietary software platform that can be used for a variety of security and

access control applications as well as communication functions. The technology

represents a departure from traditional access control and security systems.

Traditional systems use controllers that have a capacity to control from 1 to 8

access points per controller. A building access system using the MESH technology

can control several hundred points of access from a single remote hardware and

software platform. The technology also allows several previously independent

building control systems to be hosted on a single hardware and software

platform. Our proprietary MESH software is designed to be modular, permitting

additional applications to be added as modules, each operating other building

and area control systems and high technology requirements.

Enterphone continued to provide a consistent source of revenue,

accounting for 17.7% of total sales for the year ended December 31, 2008.

Enterphone is a building access control system that uses a building’s internal

phone wiring thereby avoiding use of telephone utility services. Our products

include access control panels that use the

3

Enterphone technology. Our control panels are typically

installed at entrances to apartment buildings, government facilities, and other

buildings and facilities where security concerns require access control systems.

The control panels are sold in various formats and with varying features and

capabilities. Our Enterphone technology control panels are sold through an

established distribution network, and can be found installed in approximately

35,000 buildings throughout North America. We also package and sell access

control and security products that are complementary to our Enterphone product,

including card access systems, radio frequency remote controls, intercom

monitors and closed circuit cameras.

COMPANY HISTORY

Our current business is operated primarily through our wholly

owned subsidiary Viscount Communication and Control Systems Inc. The business of

our subsidiary began operations in 1969 as a manufacturer of video switching

equipment. In 1970, the business was acquired by B.C. Telecom Inc. (BC Tel),

which was acquired by Telus Corporation in 1999. BC Tel was the telephone

utility for British Columbia, Canada controlled by GTE Corporation (now Verizon

Communications Inc.). Under BC Tel, the business operated as an electronics

research laboratory and manufacturing facility. Among the products manufactured

were central office telephone test equipment, telephone demarcation blocks, and

a satellite based kiosk system used to provide information at airports and other

public facilities. Responsibility for the manufacture of the Enterphone system

was transferred into the business in 1984 from BC Tel. BC Tel contracted to sell

the business in 1997 to Blue Mountain Technologies Inc., a company that

purchases and installs our products. Blue Mountain Technologies Inc.

simultaneously assigned its contractual rights to acquire all of the business

assets, except for certain leasehold interests, to our subsidiary, Viscount

Communication. BC Tel consented to the assignment and accordingly the business

was acquired by our subsidiary, Viscount Communication and Control Systems

Inc.

We were incorporated on May 24, 2001 under the laws of the

State of Nevada under the name OMW4 Corp. Our subsidiary, Viscount Communication

was incorporated in 1997 under the laws of British Columbia, Canada, for the

purposes of carrying on our present access control business. We acquired all of

the issued and outstanding shares in the capital of Viscount Communication on

July 27, 2001, in exchange for 10,000,000 shares of our common stock, thereby

making it our wholly owned subsidiary. As a result of the acquisition, the

former shareholders of Viscount Communication obtained a controlling interest in

OMW4 Corp. In connection with the acquisition, we changed our name to Viscount

Systems Inc. effective August 27, 2001.

In 2003, we acquired certain inventory and 2,165 service

agreements from Telus Corporation. The service agreements related to the

maintenance Enterphone installations throughout Western Canada. The inventory

was comprised of various products and components for installation and repair of

these Enterphone installations. Enterphone is a specialized telephone switch

used to provide intercom and access control functions in buildings. It was

originally developed by BC Tel in 1965. Mirroring the increased security

awareness in buildings over the past few years, we have been providing a more

comprehensive package of complementary products. Products packaged, using third

party technologies for this purpose, include card access systems, radio

frequency remote controls, intercom display panels and closed circuit cameras.

The MESH product line, which has been under development since

1998, is an integrated platform for building access control and management. MESH

continues to be the focus of our corporate development.

INDUSTRY OVERVIEW

We compete in the building intercom and access control systems

industry. The intercom and access control industry is sometimes referred to as a

segment of the low voltage systems industry. Our intercom and access control

systems are designed to automate the control of access to buildings or other

restricted access areas. Intercom systems and access control systems are

complementary; however they can also be used independently depending on user

requirements. For example, most modern residential apartment or condominium

buildings have an intercom system for visitors wishing to communicate with

residents. Residents, on the other hand, are issued access cards that can be

used in conjunction with card readers installed beside doors or elevators in

order to gain access.

4

Access control systems provide two functions for a building.

Building tenants use access cards and readers that control access through doors,

gates or elevators, while visitors use telephone intercoms to be granted

admission by a building occupant or manager. The systems also provide

sophisticated alarm functions such as identifying doors left open or forced

entry. The sophistication of systems ranges from controlling a single door where

records are kept manually, to large enterprise systems covering hundreds of

buildings from a dedicated security facility.

The building control industry has traditionally been highly segmented

based on function. This has meant that makers of heating/ventilation and air-conditioning

systems and security card access systems essentially manufacture input/output

systems, while intercom makers manufacture voice systems, and security camera

makers manufacture closed circuit video systems. Stated otherwise, audio, video,

environment and access control systems are traditionally all separate building

control systems that are independently controlled. There has been strong convergence

of technologies in the computer and telephone related industries based on digital

standards; however the building control industry has not as yet undergone a

similar convergence of technologies. Traditionally, where systems need to be

compatible, the industry has relied on integration instead of convergence. Integration

is the use of a host computer to tie separate and distinct systems, typically

from different manufacturers, together on a common software platform. Convergence,

in the case of building control systems, is the provision of a new service that

is designed to operate multiple systems using homogenous control parameters.

Convergence is generally considered preferable to integration, as fewer distinct

systems means lower operational and maintenance costs.

Along with certain other industry participants, we have turned

to current high-technology solutions in order to reduce costs of ownership of

security systems, while improving functionality. We have developed new system

platforms that will permit convergence of the control of various building

functions, such as access control, intercom, closed circuit television, and

heating/ventilation and air-conditioning. These systems can be operated on a

single commercially available host server and can operate using standard

communications techniques. As a result of using a single full service system to

replace the three or more separate dedicated systems, each requiring its own

host server, the overall cost of ownership of a security and control system has

been reduced.

Access Control Systems Technology

The access control industry has traditionally used a technology

known as Wiegand. Approximately 90% of the world’s installed access systems are

based on Wiegand technology. Today, these systems are commonly found in

residential, commercial and industrial buildings in the form of access control

cards and card readers. Wiegand was initially developed in 1970 by Senso

Engineering as an access card technology. The card technology uses a special

patented process whereby wires are imbedded in a plastic access card to encode

its data. When passed through a magnetic field generated by a card reader, the

card generated a signal which is received and interpreted by the card reader. If

the signal is recognized, the reader will transmit the information to a host

controller to activate a switch, which for example purposes, may release a lock

or open an elevator to permit building access to the cardholder. A host

controller is essentially computer hardware that is programmed to receive

information from the card reader in order to permit access to a building.

Wiegand technology has established itself as the industry standard as it is

viewed as being reliable and difficult to counterfeit the access cards.

Other products that use the Wiegand principals for access

control are magnetic strip cards and radio frequency cards. These products

function similarly by providing a card reader with a signal that the reader

interprets and transmits to a host controller in order to grant or deny

access.

Wiegand access control technology requires card readers that

are connected to a host controller. Each host controller can operate between 1

to 8 doors. Accordingly, a building with a large number of controlled access

points could require a large number of host controllers, resulting in greater

hardware costs. Host controllers can in turn be connected to a central server

that monitors the host controllers and collects information on access point

usage.

The underlying technology that operates these traditional

access control systems is approximately 30 years old. The readers are considered

“dumb” readers as they simply receive information from the access card and

transmit it to a host controller. The host controller processes the information

in order to determine whether to grant or deny access. If access is granted, the

host controller then transmits a signal to activate a switch to open the access

point where the reader is located. This is a simple input/output type relay

system which requires a separate host controller for approximately every eight

access points.

5

As a result of the limitations and hardware requirements of the

traditional access control systems, some security industry manufacturers are

developing and marketing “intelligent” access control and communications

systems. Intelligent systems allow several previously independent building

control systems, such as intercom, access control, video, and climate control,

to be controlled by a single server. These systems are based on software

designed to control hundreds of readers from a single computer server, combined

with “smart chips” installed in readers at each control point. Smart chips are

programmable computer chips that permit access card readers to grant or deny

access without the need to relay a signal to and from a central host controller.

Smart chips can be programmed to perform tasks for a diverse range of building

control systems, such as fire alarm systems, heating/ventilation and air

conditioning, and building access and elevator controls. As the smart chip is

programmed to make its own decisions on a given application, this reduces the

load on the central host computer. The host computer accordingly performs

primarily a monitoring and information collection function.

We are participating in this advance in the access control

industry with our proprietary MESH intelligent access control and communication

technology system. We believe that intelligent systems, including smart chip

readers and cards will replace reliance on systems based on Wiegand technology.

PRODUCTS

We are a manufacturer, developer, reseller and service provider

of intercom and access control systems based on telephone, new and traditional

access card and reader technologies. Our intercom and access control systems are

installed throughout North America for various applications including:

condominium/apartment building access and intercom; residential intercom; gated

home/community access and intercom; seniors/government housing access, tracking

and intercom; elevator access and tracking; garage or perimeter gate control,

and emergency communications.

For the year ended December 31, 2008, approximately 20% of

total sales of our products and services were generated in the United States,

and 80% in Canada. This represents a change from 2007, where sales to the United

States and Canada were 23% and 77%, respectively. The change is in part due to

increased sales of products and services in Canada as a result of our

acquisition of service agreements and inventory from Telus Corporation.

Information on our existing products can be viewed on our website at

www.viscount.com

.

Our Enterphone Access Control Products

Historically, our principal product was the Enterphone intercom

and access control system. Enterphone is our patented building entry control

system that uses a building’s internal phone wiring to allow access control for

tenants and intercom and access control between visitors and tenants. The use of

a building’s internal phone wiring by our Enterphone system provides an option

to using telephone company wiring, thereby bypassing monthly telephone charges.

It also does not require tenants to pay for an individual phone line to operate

their intercom and door access system and is not affected by interruptions in

telephone company service. This makes our Enterphone system distinct from other

“dial-up” telephone entry systems that use telephone company lines. Sales of our

products based on the Enterphone system account for approximately 18% of our

total sales in fiscal 2008. This is down from approximately 30% in fiscal 2007,

due in part to the development of other sources of sales, including Enterphone

maintenance contracts, new product lines, and our OEM product lines.

Our Enterphone system is sold as a central control panel which

is installed in a building’s telephone control room. The control panel connects

an intercom panel located at an entrance to the building with the telephone of

building tenants. A visitor wishing to gain access to the building dials a 1 to

4 digit number at the entrance panel. The call is directed from the entrance

panel, through the common control equipment and up to the tenant’s telephone.

The tenant hears a unique ring and can unlock the entrance door by pressing a

number on the telephone’s numeric keypad. The tenant does not need to rent a

telephone line from the telephone company. Each control panel can process

connections to as many as 840 suites.

We also manufacture electronic entry access panels that can

operate using either our Enterphone system, or dial-up telephone company lines.

Our panels are manufactured in various sizes and with various features in order

to accommodate varying purposes and building types. For example, we manufacture

panels that provide intercom and access control from 1 suite to up to 1000

suites; or panels that provide on-screen name search capabilities; or panels

6

that are streamlined in shape or small in size. All panels that

we manufacture incorporate the Enterphone technology, however most panels can

also be installed to use telephone company lines.

Our Enterphone panels can also be combined with other

technologies such as access tracking and control, closed circuit monitors,

infrared and radio frequency remotes, and Wiegand cards and card readers. We

purchase these technologies from other manufacturers and resell them under our

brand names. Most of the products that we resell can be integrated into our

Enterphone access control system.

Our MESH Access Control System

Overview

MESH is a software based building management system designed to

replace traditional systems that are more hardware intensive. We continue to

develop this technology that was started in 1998. MESH was pre-commercially

released in late 2003.

MESH is a software platform that communicates with a network of

“intelligent” input/output devices, such as card readers or building environment

sensors. As such, the “intelligence” of the system can be said to be distributed

among the input/output devices. This is contrasted with the traditional access

control industry, which uses “dumb” readers that require information to be

processed at a central host computer. An “intelligent” reader or input/output

device uses a pre-programmed “smart chip” which allows it to process information

on its own, and does not require the host computer to make action decisions,

such as to grant or deny access to a door or to activate air-conditioning. The

use of “intelligent” devices accordingly reduces the load on the host computer

which allows the host computer to allocate its resources to a greater number and

diversity of tasks. The networked distribution of “intelligent” devices also

means reduced cost resulting from reduced hardware requirements, easier training

of control system operators, and the use of commercially available host computer

hardware and communication techniques. Initially, we will apply the MESH

technology for access control system purposes.

The conceptual basis for MESH is simple. Virtually every low

voltage building technology, except building access, has evolved using

“intelligent” addressable network devices. This includes fire alarms and

heating/ventilation and air-conditioning. An addressable network is one in which

devices can constantly communicate with a host server controller or can be

polled for information. For example, if a smoke detector on a non-addressable

fire alarm system fails, a fire in that location may go undetected since there

is no way to identify the failure without actually testing the device. In

contrast, the “smart chip” in an addressable smoke detector may be able to

notify the fire panel of a problem immediately and call for service. Access

control systems, however, continue to be based on a 30-year-old standard called

Wiegand. The limitations of this standard continue to plague the industry due to

the slow data transmission speed (9600 baud) between the reader and the host

controller, the high cost and quantity of specialized and dedicated hardware,

and the inability of the host computer to process voice or video signals. For

example, buildings requiring elevator access control have traditionally required

a significant amount of expensive dedicated hardware. The MESH network with

“intelligent” readers can accomplish these functions without dedicated hardware,

resulting in cost reductions, both in terms of the actual hardware required and

the labor, cable and conduit costs associated with installation.

The MESH system bypasses the need for specialized and dedicated

hardware. Instead, MESH provides a software-based platform that operates on an

industrial computer server connected to “intelligent” readers transmitting data

at high speed rates of up to 156,000 baud, while simultaneously running voice

and video applications. The benefits and functionality derived from this

approach can be significant.

MESH Structure

The MESH network consists of a main control computer server

communicating with a series of “intelligent” readers, panels, and input/output

devices. The key to the technology is the “smart chip” we use, known as the

MPNode computer chip, a programmable chip. We purchase the MPNode chips and

program them to perform certain functions upon detecting certain data. For

access control applications, the chip is installed into a card reader. When data

from an access card is received by the card reader, the chip processes the data

and makes a decision to grant or deny access. Information on the transaction is

passed along to the host computer for data storage and analysis

7

purposes. Traditional Wiegand style card readers require an

intermediate controller for every two or three reading devices. An intermediate

controller is connected between the host computer and the group of readers

controlled by it. In contrast, the MESH systems allows “intelligent” readers to

be installed in series, or daisy-chain fashion, without the need for

intermediate controllers. Small interface modules are used instead to maintain

data flow. This reduces hardware costs as only one host computer is

required.

MESH panels, located at entrance doors for visitor access, can

operate independently or as slaves off the MESH server. The basic MESH panel

that we have commercially released is a full color screen industrial computer.

Panels may be located at entrance doors for visitor access or can be on-site

managed by security guards as they manage the MESH network. The slave/master

architecture of MESH panels reduces cost, simplifies programming, and improves

data base management.

In designing MESH, much consideration has been made of the many

dissimilar applications requiring a MESH network. In cases where building

control is accomplished with on-site security and concierge staff, limited MESH

hardware or possibly only software may be needed to perform the required

functions. For example, MESH software may be sold as a simple visitor tracking

system for commercial or gated residential sites.

In general, MESH has been designed to allow simple

installations to be performed by small independent alarm contractors. However,

provision has also been made for direct involvement by our staff in large campus

wide and enterprise wide installations.

MESH has many additional benefits, both in terms of building

security and particularly relative to the legacy Wiegand protocol. It is our

belief that addressable networks pose a serious threat to the continued use of

the Wiegand format.

MESH is a modular product, meaning that the software can

accommodate add-on features or upgraded features. We have developed various

modules for our MESH technology, and we intend to develop further modules which

will be released in a series of phases. Some of these product enhancement

modules are described below:

-

MESH Photo-badging software is being designed to allow digital

photo-imaging of individuals accessing a building, which can be stored in a

database. This module is currently in development.

-

The MESH server provides new opportunities to host video on the unified

platform with voice and data. This product enhancement would represent an

entirely new concept in the security industry.

-

The nature of the MESH server makes MESH telephony products inherently

Internet enabled. Future MESH appliances may include the MESH television line,

which allows residents to view visitors at the door. MESH panels will be able

to connect to web enabled set top boxes being promoted as part of the web TV

market. MESH may be able to connect to videoconferencing telephones that would

compete in the large offshore video intercom business but at a fraction of the

cost by saving on conduit and cable.

-

The distributed intelligence of MESH makes the product suited to the

growing emergency call/nurse call industry.

-

MESH networks are built on a proprietary architecture platform which is

functional to integrate with any existing automation network.

-

A new and emerging market segment tracks not just people, but equipment. A

typical application is the embedding of anti-theft chips in computers, which

integrate with card reader systems.

-

MESH to be a fully Internet Protocal enabled system.

8

Our other products

Our next generation of Enterphone systems, called Enterphone X,

“EPX”, was released during the second quarter of 2008. EPX has replaced EP2000.

EPX, also a no phone line system like EP2000, is the next generation of

Enterphone. EPX is more cost effective because it requires less assembly and

material input costs. EPX improves compatibility with MESH and other newer

telephony technologies.

The Enterphone 2000 design dates back to 1990 and the

architecture has created complications for both manufacturing and installation.

The new universal controller eliminates the need for Viscount to manufacture and

carry inventory for 10 different circuit boards. Overall, EPX reduces cost,

produces higher margins, and improves our ability to market MESH.

Our other products include RadioClick and InfraClick. These are

remote control access control products for doors and parking gates. They are

sold separately or as complementary to our Enterphone, Entercheck and MESH

systems. We also manufacture and sell EmerPhone, an intercom system that is sold

in elevator phone, emergency phone and entry phone applications.

OTHER SERVICES

In addition to sales of our Enterphone, MESH and OEM products,

we also service approximately 1,630 existing Enterphone installations within

Western Canada.

PRODUCTION

Viscount has facilities for circuit board manufacture and

mechanical assembly. We use a range of processes to produce our products. Some

products including Enterphone, Infraclik, and Axess are completely manufactured

in-house. MESH and Emerphone use outsourced circuit boards with final assembly

and software installed at Viscount. Some access control, card readers, Elektra

panels, Infraclik and various product accessories are purchased from other

manufacturers and resold under our brand-names. We maintain full facilities to

assemble through-hole circuit boards and limited facilities for assembling

surface mount circuits. We have a policy of supporting old products as long as

parts are available for servicing and replacement. We have designed EPX to be

backwards compatible with the 2000 series to improve the longevity and

serviceability of both products.

The MESH software platform is loaded on standard industrial

computer chassis. We are not developing hardware internally for MESH, since the

required hardware controllers are commercially available at quality and price

levels that make internal development uneconomical. In addition, by using

off-the-shelf components, we improve our time to market, eliminate hardware

debugging and increase our ability to be technologically flexible in the future.

We are primarily executing final mechanical assembly of the MESH systems.

RESEARCH AND DEVELOPMENT

Our research and development continues to be focused on

enhancing MESH. A number of these enhancements were identified in the “MESH

Structure” and “Our other products” section of this document. Specific custom

MESH applications are being considered, evaluated and implemented. An example of

this process would be considering built-in badging printers and a virtual

concierge. We estimate that our expenditures in connection with research and

development during the last two fiscal years totaled $644,565.

MARKET AND MARKETING

The Market

The intercom and access control market is serviced by a number

of large and small competitors. Our traditional products compete in a mature

market place that largely uses the 30 year old Wiegand technology. We believe

that there currently exists an opportunity in the building and access control

market for innovative products that use current technologies to reduce user

costs. We have positioned our MESH technology to take advantage of this

opportunity.

9

The access control market can generally be described as the

market for any equipment used to control passage through a door, gate or other

portal. A portion of this market is comprised of mechanical and electronic door

locks that typically control access through single doors. Many of the single

door systems have been engineered for low security levels for customers who do

not desire a full access control host. The access control market that we compete

in involves computerized access control systems that typically control access

through multiple access points, such as our Enterphone system. MESH was designed

to present a new technology to this computerized market niche. In particular, in

large high-rises with a full MESH system, individual tenants may use the MESH

server to control access to one or two doors.

Our traditional market for our Enterphone product was apartment

and condominium buildings. While the market for telephone entry type systems

amounts to about US$100 million, in the past 10 years there has been a strong

trend towards increased building security resulting in much more sophisticated

integrated installations. For example, in 1990, a typical condominium building

would be equipped with an intercom to admit visitors. Today, a typical new

building installation includes telephone entry, card access, closed circuit

cameras, individual burglar alarms and panic stations. This puts pressure on

manufacturers to provide a comprehensive package and represents an opportunity

for significant revenue growth per system. MESH is our first in-house product

that addresses these multiple requirements. The modular nature of MESH also

provides us with an excellent opportunity to design additional products on the

MESH platform to provide enhanced options for a comprehensive building security

package.

In addition to apartment entrances, MESH is also designed to

provide access control for the rapidly growing gated community market. Monitor

style directory panels are also used in thousands of commercial high-rises. The

MESH panel provides features previously unavailable for this market. The overall

effect of these system advances has enhanced our core business, while allowing

us to find applications where the new features expand the traditional market for

such systems.

We are targeting upgrades and retrofits to existing apartments

and various government agencies that use traditional telephone wire intercom

access control systems. New construction projects are also part of our MESH

installation market. The low hardware costs and increased functionality of the

MESH system continue to be marketed to building management companies, along

with its turnkey installation as a replacement to existing access control systems

for most modern buildings.

While complete MESH networks will typically be installed, the

modular nature of MESH allows additional segmentation based on product

application and end-user need. The nature and scope of a MESH installation

depends on the level of security required, the product alternatives, the number

of buildings, and the level of system management required. The nature and scope

of an installation can be described in terms of a user spectrum ranging from

price sensitive users to users requiring enhanced services. At one end of this

spectrum is price. For these applications MESH has been competing with

traditional Wiegand systems. We believe the cost reduction aspects of MESH has

provided us with a competitive advantage over traditional Wiegand systems. For

example, a typical condominium developer does not manage a building after

construction. Therefore, the developer is looking for a very affordable,

reliable access control system. Unless a more sophisticated product will help

sell suites, the developer tends to keep the system simple. At the middle of the

spectrum are customers who will adopt MESH mainly due to system benefits. For a

commercial high-rise this may be the flexibility derived from a new user profile

approach MESH uses for programming. On the enhanced service end of the spectrum

we find customers who need to develop a much closer relationship due to the

level of sophistication of their needs. At this level, we anticipate additional

revenue opportunities for custom programming, data mining and hosting, and

direct installations for national accounts.

While the core function is controlling access/egress, through

the planned development of various MESH technology modules, we have been

actively targeting all of these segments. For example, a MESH add-on module can

be developed to provide an asset tracking system to prevent computer theft. The

inherent alarm functions of MESH allow it to be used as an integrated

theft/burglar alarm system for large facilities. The MESH telephony video

capture function will allow government agencies to track alcohol and drug

problem tenants of controlled housing complexes or other regulatory monitoring

functions. Finally, MESH, along with our EmerPhone, can function to combat

vandalism and to secure parking lots.

10

We rank controlling access/egress and securing parking

facilities as the primary concerns of our traditional core multi-residential

business.

Distribution Plan

We currently have approximately 500 dealers for our existing

products throughout North America. When our existing business was acquired from

BC Tel, we relied primarily on exclusive and semi-exclusive dealers in certain

major metropolitan areas. Our distribution network is not static and we are

constantly seeking additional sales channels. In October and November of 2003,

we signed a distributor deal with Tri Ed, the security distribution subsidiary

of Tyco. The agreement placed our security products in 27 Canadian and U.S. Tyco

branches, including Denver, Dallas, Phoenix, Seattle and six locations in

California.

As previously noted MESH can serve several different markets

and the type of dealer serving each may vary. Simple installations may be

performed by small independent dealers, but as the overall scope of the project

increases, the technical ability of the dealer becomes increasingly important.

At the extreme, our employees may be directly involved with the customer in

designing, installing and servicing the product. In other cases, our personnel

may be involved on a co-op basis with large national security, building

automation and heating/ventilation and air-conditioning contractors.

These distribution deals, along with our existing dealer base,

gave us immediate access to the largest networks of dealers in the US, Canada

and Mexico.

During the past year, we have been targeting our existing

markets for the sale of our MESH technology, as well as targeting the

international marketplace. Internationally, we have sold MESH in China, India,

France, and New Zealand. MESH is designed to accommodate foreign languages with

minimal modifications to the software. This is in contrast to other products of

its type which require a heavy software investment to provide alternative

language software. With MESH, the core software can be applied in all languages

with only the on screen text displays needing to be translated. Translation can

be accomplished using commercially available translation software.

MESH Marketing Strategy

We have been using our established distribution channels, as

well as new distribution channels to access our target markets for the MESH

technology. As a unique technology, however, end-users as well as dealers must

be educated about MESH benefits. It is our experience that a stronger initial

emphasis on end-user decision-makers and large national system integrators will

be the most effective in developing the MESH market.

Advertising

Our products are advertised on an ongoing basis in various

print publications, which we will continue to do. We have been testing new

publications on a regular basis to evaluate response, sales and readership. All

leads are followed up and magazines are rated based on a dollar sales per

advertising dollar spent ratio. While the sales cycle is sometimes fairly long,

this approach has given us a very accurate measure of the effectiveness of

various publications and individual ads.

Trade Shows

During 2008, we reduced our participation at tradeshows to

reduce costs. During 2009, we will consider attending certain tradeshows that

will provide increased exposure for MESH.

Direct Marketing

We continued educating customers about our MESH technology by

holding MESH training seminars throughout the U.S. and at hour head office.

11

Pricing Strategy

Our system provides features never before available in a

building control security system. The MESH technology is built on an

architecture which can reduce user costs significantly. The modular nature of

the technology amplifies this effect the larger the system becomes.

With a unique product and a position of product leadership, we

have devised a strategy of building market share. This strategy involves selling

MESH at reasonable 50-60% margins. With the telephony component, we have been

targeting a price which provides MESH panels at a price that is competitive with

similar products, but with newer enhanced features.

COMPETITION

Competitive Summary

The security and building control industry is undergoing a

rapid period of consolidation. Large multi-national companies are integrating

vertically by acquiring equipment providers to build house brands. Recent

examples are the purchase of Cardkey by Johnson Controls, Guardall by Chubb and

ADI/Northern Computers by Honeywell. The access control industry is very

segmented with no company having a dominant market position. Canada has

approximately six access control product manufacturers, while the U.S. has at

least fifty. There is a certain amount of vertical integration in the business

and several large multinational companies own their own house brands. Many

branches of these multinational companies often have their own brand preferences

and buy outside their internal distribution channels.

Almost all manufacturers build control hosts based on Wiegand

technology. Due to these limitations, most research and development is focused

on cost reducing hardware and making the control hosts more network capable. In

all cases, the manufacturer using traditional Wiegand technology are limited

from 1 to 8 doors per host.

Competitive Threats

We have a strong dealer and distribution plan in place and MESH

has positioned us in a market dominated by much larger players. The higher

security MESH applications are also somewhat outside of our traditional scope of

business and therefore, we are rapidly trying to develop a market for MESH and

in the process, educating users of MESH through our training seminars. We

believe that our marketing strategies and training seminars will provide

benefits that will help us achieve market share that will allow us to be

competitive. There is no guarantee that we will be able to successfully compete

against our larger competitors.

While MESH is still a new product in an established growing

market, technological change can be met with resistance. Some buyers are nervous

about new products, and new protocols even more so. Most buyers are familiar

with the benefits of addressable fire alarms and we have marketed MESH from this

point of view; that is to stress the inevitability of all access control systems

evolving this way.

A key concern is the ability of competitors to imitate the

product and the ability of large imitators to more easily commercialize their

product. We have estimated that we still have a three-year market lead.

Fortunately, the wide range of MESH software applications should provide us with

an ongoing lead, as long as we are aggressive with research and development.

INTELLECTUAL PROPERTY

We will rely on a combination of non-disclosure and other

contractual agreements, and technical measures to protect the confidential

information, know-how, and proprietary rights relating to our Enterphone, MESH

and other Viscount products. We have contractual rights with respect to

registered North American trademark and trade name for Enterphone (word alone).

We are still considering registering North American tradenames for MESH.

12

We have registered active Internet domain names for

www.viscount.com

,

www.enterphone.net

, and www.enterphone.org.

Our standard employment agreements and license agreements

contain provisions that protect the confidentiality of our proprietary property.

All our employees and sales agents are required to sign these agreements prior

to their employment or engagement.

To date we have not received notification that our services or

products infringe the proprietary rights of third parties. Third parties could

however make such claims of infringement in the future. We cannot be certain

that others will not develop substantially equivalent or superseding proprietary

technology, or that equivalent services will not be marketed in competition with

our services, thereby substantially reducing the value of our proprietary

rights. Furthermore, there can be no assurance that any confidentiality

agreements between us and our employees or any license agreements will provide

meaningful protection for our proprietary information in the event of any

unauthorized use or disclosure of such proprietary information.

GOVERNMENT REGULATIONS

Some of our products are still under government regulation. The

Enterphone is an interposition technology which in U.S. states can only be

installed where the local public service commission has designated the original

point of entry of a building as the demarcation point between the telephone

company and building owner’s responsibility. Conversely, it can also be

installed where the telephone company has given consent to allow Enterphone

to share the telephone backbone.

The history of government deregulation for us mainly relates to

the demarcation point in a building. Until government deregulation came to the

access control industry, Enterphone type systems could only be installed by

telephone companies.

After the break-up each regional telephone company began to

make its own decisions. As a result of this, Chicago, New York, and Boston

became strong markets for the Enterphone. Another result of government

deregulation was that many telephone companies withdrew from the access control

systems industry, which resulted in our using direct dealers in those

regions.

OUR SOURCES OF REVENUES

The majority of the Company’s revenues were derived from

the MESH and Enterphone product lines. In fiscal 2008, MESH sales represented

52% of total revenue, while Enterphone product sales represented 18% of total

revenue. The balance of the Company’s revenues were derived from service

agreements, and other products such as access tracking and control, closed circuit

monitors, infrared and radio frequency remotes.

EMPLOYEES

Viscount employs twenty five staff at its production facility

and head office located in Burnaby, British Columbia, Canada.

Item 1A. RISK FACTORS

You should carefully consider the following risk factors and

other information in this annual report and in our filings with the Securities

and Exchange Commission when you evaluate our business and the forward-looking

statements that we make in this annual report.

13

We cannot be certain that the market will accept our new

MESH™ technology as necessary to generate an economically viable level of sales.

We may not be successful at achieving a profitable level of sales of our MESH

technology.

Our ability to achieve significant growth is largely contingent

upon the success of our MESH technology. The building access control industry is

currently based upon well established and reliable technology that our MESH™

technology is designed to replace. Our technology has only recently been

available commercially and as a consequence we have little data on which to

establish a track record of market acceptance and sales. It is too soon to

determine whether we will be able to gain a significant level of commercial

acceptance of our MESH™ product. If we are unsuccessful at marketing and selling

our MESH™ modules in sufficient quantities, we may not be able to achieve

significant or sustained growth, and as a result the value of an investment in

our common stock may decrease.

Other companies with greater resources than we have are

currently developing or have commercially available products that use similar

technology to our MESH™ product, and we may lose potential market share as a

result.

Our MESH™ access control product is based on intelligent access

modules, which use commercially available programmable microchip technology. Due

to increasing availability and decreasing price of programmable microchips, the

development and commercialization of “intelligent” access control systems is not

unique to us. There are other companies that have developed or are developing

similar products that use intelligent cards and card readers that will be

competing with us in the access control industry. These competitors may have

substantially greater financial, technical, marketing, and management resources

than we have. Our ability to compete successfully will depend on several factors

including timing of taking our MESH product to market and our ability to educate

and use existing sales channels and develop new sales channels. To the extent

that our requirement for additional financing may cause delays in the marketing

of our MESH product, this may provide some of our better funded competitors with

a competitive advantage in their ability to access the markets before us. To the

extent that our competitors have more resources to market products based on

similar technology, we may lose market share which would decrease the value of

an investment in our common stock, or may cause the value of an investment in

our common stock to decrease.

The loss or unavailability of Stephen Pineau, our

President, Principal Executive Officer, and Principal Financial Officer for an

extended period of time could adversely affect our business operations and

prospects.

Our success depends, to a significant degree, upon the effort

and skill of Stephen Pineau, our president and principal executive officer. We

do not maintain key man insurance on Mr. Pineau. Due to his knowledge of our

operations and products, the loss, incapacity, or unavailability of Mr. Pineau

could have a material adverse effect on the business, financial condition or

results of our operations, which would likely result in a decrease in the value

of an investment in our common stock.

Because our common stock trades at prices below US$5.00

per share, and because we are not listed on a national exchange, there are

additional regulations imposed on broker-dealers trading in our shares that may

make it more difficult for you to resell our shares.

Because of rules that apply to shares with a market price of

less than US$5.00 per share, known as the “penny stock rules”, investors in this

offering will find it more difficult to sell their securities. The penny stock

rules currently apply to trades in our shares. These rules in most cases require

a broker-dealer to deliver a standardized risk disclosure document to a

potential purchaser of the securities, along with additional information

including current bid and offer quotations, the compensation of the

broker-dealer and its salesperson in the transaction, monthly account statements

showing the market value of each penny stock held in the customer’s account, and

to make a special written determination that the penny stock is a suitable

investment for the purchaser and receive the purchaser’s written agreement to

the transaction.

14

Our directors and officers hold approximately 47% of our

common stock and acting together may have the ability to control management and

affairs of Viscount and to deter changes in control.

Our directors and officers collectively hold approximately 47%

of our current issued and outstanding voting shares. As a result, such persons,

acting together, may have the ability to control most matters submitted to our

stockholders for approval, including the election and removal of directors, and

to control the management and affairs of Viscount. In addition, our Articles of

Incorporation include provisions that management can use to retain control over

Viscount. Accordingly, such concentration of ownership, coupled with management

friendly anti-takeover provisions, may have the effect of delaying, deferring or

preventing a change in control of Viscount, impeding a merger, consolidation,

takeover or other business combination or discouraging a potential acquirer from

making a tender offer or otherwise attempting to obtain control of us, which

limits the ability of our stockholders to participate in opportunities that may

increase the value of their stock.

Item 2. DESCRIPTION OF PROPERTY

PROPERTY

Our executive office and central factory is located in Burnaby,

British Columbia, where we currently lease 12,040 square feet. We lease this

space under an industry standard operating lease with a term expiring May 31,

2010, renewable at the option of Viscount. Current monthly lease obligations are

$10,921. We believe that our current facilities are adequate and are suitable

for our current use, and that suitable additional facilities will be available,

when needed, upon commercially reasonable terms. Our facilities are adequately

insured against perils in a manner consistent with industry practice.

Item 3. LEGAL PROCEEDINGS

The Company was named as the sole defendant in litigation for

wrongful dismissal that involves a former employee. The Company filed a defense

to this claim and is actively defending its position. At this time, the

likelihood of the outcome is not determinable and no provision has been made for

the claim in the accounts.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

PART II.

|

Item 5.

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED

STOCKHOLDER

MATTERS AND PURCHASES OF EQUITY SECURITIES

|

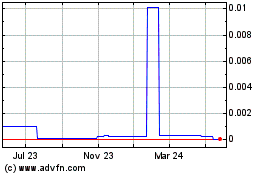

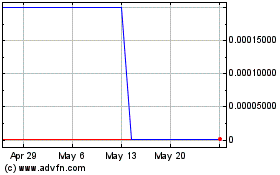

Trades in our common shares are quoted on the Over-the-Counter

Bulletin Board (OTC Bulletin Board) which is a quotation service administered by

the Financial Industry Regulatory Authority (FINRA). Our trading symbol on this

service is “VSYS”.

The OTC Bulletin Board has a limited and sporadic trading

market and does not constitute an established trading market. Our shares began

trading on February 12, 2002. The following table sets forth the range of high

and low price information of the common shares as reported on the OTC Bulletin

Board for the last two fiscal years and the subsequent period ending February

12, 2009. The price information available reflects inter-dealer prices, without

retail mark-up, mark-down or commission and may not represent actual

transactions.

15

|

|

|

High (U.S. $)

|

Low (U.S. $)

|

|

2009

|

First Quarter

(through February 12, 2009)

|

$0.08

|

$0.07

|

|

2008

|

Fourth Quarter

|

0.13

|

0.06

|

|

|

Third Quarter

|

0.22

|

0.12

|

|

|

Second Quarter

|

0.45

|

0.21

|

|

|

First Quarter

|

0.43

|

0.29

|

|

2007

|

Fourth Quarter

|

0.51

|

0.34

|

|

|

Third Quarter

|

0.49

|

0.38

|

|

|

Second Quarter

|

0.49

|

0.22

|

|

|

First Quarter

|

0.35

|

0.22

|

As of January 2, 2009 there were 39 holders of record of our

common stock, holding a total of 17,841,250 shares, and an unknown number of

beneficial holders.

We have not declared any dividends in the last two fiscal

years.

The following table sets forth information respecting our

compensation plans as at December 31, 2008, under which shares of our common

stock are authorized to be issued.

Plan Category

|

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(a)

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

|

Number of securities

remaining

available for

future issuance under

equity

compensation

plans (excluding

securities reflected

in

column (a))

(c)

|

|

Equity compensation plans approved by security holders

|

3,363,800

|

US$0.30

|

0

|

|

Equity compensation plans not approved by security holders

|

N/a

|

N/a

|

N/a

|

|

Total

|

3,363,800

|

US$0.30

|

0

|

Item 6. SELECTED FINANCIAL DATA

Not applicable.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF

OPERATION

The following discusses our financial condition and results of

operations based upon our consolidated financial statements which have been

prepared in conformity with accounting principles generally accepted in the

United States of America. It should be read in conjunction with our financial

statements and the notes thereto included elsewhere herein. All dollar amounts

are in Canadian dollars unless otherwise noted.

RESULTS OF OPERATIONS

Sales revenues for the years ended December 31, 2008 and 2007

were $5,102,434 and $4,970,967, respectively, an increase of $131,467 or 2.7% .

The increase in sales for the year ended December 31, 2008 resulted from

increased sales of our MESH system and continued steady sales of our legacy

Enterphone 2000 system. MESH sales for the years ended December 31, 2008 and

2007 were $2,627,308 and $1,875,469, respectively, an increase of $751,839 or

40.1% . MESH sales for the year ended December 31, 2008 were 51.5% of total

sales, as compared to 37.7% of total sales for the year ended December 31, 2007.

MESH is a convergent technology developed by Viscount that increases security at

a reduced cost of hardware, cabling and installation, and with simplified

database management.

16

Enterphone 2000 sales for the years ended December 31, 2008 and

2007 were $902,663 and $1,469,011, respectively, a decrease of $566,348 or 38.6%

. Enterphone 2000 sales for the year ended December 31, 2008 were 18% of total

sales, as compared to 30% of total sales for the year ended December 31, 2007.

As an old technology, Enterphone sales have been dropping for several years and

negating much of our MESH growth. MESH EPX is the replacement for our old

Enterphone system. MESH EPX is the next generation of Enterphone systems but

with features that are compatible with high speed internet and other newer

technologies. With MESH EPX, we can anticipate recovering our lost Enterphone

revenue while continuing to increase our MESH business.

We also provide Enterphone support and maintenance services

pursuant to service contracts that were assigned to us from Telus Corporation in

2003. Sales from the 1,630 existing service contracts continue to be steady. On

average, each service contract represents ongoing revenues of approximately $33

per month, inclusive of parts and labor. Typical customers include strata

management and building owners as well as various residential, business and

industrial users of Enterphone access control and security systems. During the

twelve months ended December 31, 2008, customer service contracts and new

equipment sales generated aggregate sales revenues of $1,638,913, as compared to

$1,516,485 for the year ended December 31, 2007, an increase of $122,428 or 8.1%

. These two comparative years are consistent. These sales included MESH sales by

the service division.

The intangible assets held by the Company are comprised

primarily of service agreements for our product known as “Enterphone 2000”. The

number of service agreements held by the Company decreased from 1,664 at

December 31, 2007 to 1,645, 1,634, 1,638, and 1,630 at March 31, June 30,

September 30, and December 31, 2008, respectively. During the four quarters of

2008, the Company performed a test for impairment in accordance with Statement

of Financial Accounting Standards No. 142, “Goodwill and Other Intangible

Assets” (“SFAS 142”) and evaluated the status of service agreements. Management

determined that no charge for impairment was required but the continuing

reduction in the number of service contracts held, indicated that the intangible

asset should be deemed to have a definitive life based on the provisions of SFAS

142. Accordingly, the Company continued to amortize the cost of the service

agreements on a straight-line basis over an estimated useful life of 10 years,

which became effective as of April 1, 2005. At December 31, 2008, the cost of

the service agreements, net of accumulated amortization, was $130,576.

The cost of sales as a percentage of sales was 40.6% for the

year ended December 31, 2008, as compared with the cost of sales as a percentage

of sales of 43.6% for the year ended December 31, 2007. Costs of sales as a

percentage of sales had remained consistent due to management’s commitment of

reviewing input costs regularly. Our policy of managing cost of sales remains

the same. We are continuously focusing on controlling costs, by using multiple

suppliers to ensure that the best and most inexpensive raw materials are used in

our products.

Gross profit for the year ended December 31, 2008 was

$3,032,238, as compared to $2,803,278 for the year ended December 31, 2007, an

increase of $228,960 or 8.2% . This increase corresponds with the increased

sales revenues and consistent cost of sales percentage for the year ended

December 31, 2008.

Selling, general and administrative expenses were $2,722,946

and $3,059,721 for the years ended December 31, 2008 and 2007, respectively, a

decrease of $336,755or 11.0% . This decrease was due to decreases in variable

costs such as advertising, travel, tradeshow and various office expenses. As a

percentage of sales, selling, general and administrative expenses were 53.4% and

61.6% for the years ended December 31, 2008 and 2007, respectively.

Research and development costs were $331,737 for the year ended

December 31, 2008, as compared to $312,827 for the year ended December 31, 2007.

Research and development costs increased by $18,910 or 6.1% . Research and

development costs remained consistent.

Loss before income tax for the year ended December 31, 2008 was

$(86,364), as compared to loss before income tax of $(623,570) for the year

ended December 31, 2007. This was a decrease in loss of $537,206. The decrease

in net loss during the year ended December 31, 2008 was the result of decreased

variable costs such as advertising, tradeshow, traveling, and various office

expenses.

LIQUIDITY AND CAPITAL RESOURCES

Cash decreased as of December 31, 2008, as compared to December

31, 2007. At December 31, 2008, cash totaled $255,172, as compared with the cash

of $111,173 at December 31, 2007. This represented an increase of $143,999.

17

We have a bank credit facility available for an operating loan

of up to a maximum of $500,000 at the prime lending rate plus 1.0% . Amounts

drawn are repayable on demand. At December 31, 2008, $57,775 was drawn on this

facility. The facility is secured by substantially all of our assets under a

general security agreement.

On April 16, 2007, the Company completed a private placement of

1,677,550 units at a price of US$0.16 per unit for gross proceeds of US$268,408.

Each unit consists of one common share and one warrant. Each warrant is

exercisable at a price of US$0.25 per share until April 16, 2012 to acquire an

additional share of common stock.

At December 31, 2008, working capital was $301,036, as compared

to a working capital of $349,734 at December 31, 2007. Working capital has

decreased by $48,698. The current ratio at December 31, 2008 was 1.28 to 1.0, as

compared with 1.31 to 1.0 at December 31, 2007.

The accounts receivable turnover ratio for year ended December

31, 2008 was 61 days, as compared to 63 days for the year ended December 31,

2007, a decrease of 2 days. This decrease was due to better follow up and

monitoring of slower paying accounts on a monthly basis by management. The

accounts receivable reserve was $336,776 at December 31, 2008, as compared to

$223,390 for the year ended December 31, 2007, an increase of $113,386. The

reserve was increased to be conservative in recognizing some of the slower

paying accounts. Management continues to recognize and remove older doubtful

customer accounts from the accounts receivable sub-ledger, as well as more

regular follow-up on certain customer accounts to improve the collection

process. There had been no significant or material business conditions that

would warrant additional increases to the reserve at this time.

For the year ended December 31, 2008, there were no capital

expenditures other than the purchase of equipment.

To date, we have not invested in derivative securities or any

other financial instruments that involve a high level of complexity or risk. We

expect that in the future, any excess cash will continue to be invested in high

credit quality, interest-bearing securities.

We will likely require additional funds to support the

development and marketing of our new MESH product. There can be no assurance

that additional financing will be available on acceptable terms, if at all. If

adequate funds are not available, we may be unable to develop or enhance our

products, take advantage of future opportunities, respond to competitive

pressures, and may have to curtail operations.

There are no legal or practical restrictions on the ability to

transfer funds between parent and subsidiary companies.

We do not have any material commitments for capital

expenditures as of December 31, 2008.

There are no known trends or uncertainties that will have a

material impact on revenues.

Related Party Transactions

In February of 2008, Stephen Pineau, president of Viscount,

loaned the Company $100,000. The loan bears interest at 9.5% per annum, is

unsecured and has no fixed terms of repayment.

In April of 2007 we sold 1,677,550 units at a price of $0.16

per unit, with each unit consisting of one share in the common stock of Viscount

one share purchase warrant, for aggregate proceeds of $268,408. A total of

815,000 of the units were purchased by Stephen Pineau, president of Viscount.

Critical Accounting Policies:

The Company’s discussion and analysis of its financial

condition and results of operations, including the discussion on liquidity and

capital resources, are based upon the Company’s financial statements, which have

been prepared in accordance with accounting principles generally accepted in the

United States. The preparation of these financial statements requires the

Company to make estimates and judgments that affect the reported amounts of

assets, liabilities, revenues and expenses, and related disclosure of contingent