THE RESERVE PETROLEUM COMPANY

6801 N. Broadway Ext. Suite 300

Oklahoma City, Oklahoma 73116-9092

SECURTIES AND EXCHANGE COMMISSION

Washington DC

Dear Sir:

Forwarded herewith is the Proxy Statement, Form of Proxy and Notice of Annual Meeting of the Stockholders, to be held on May 19, 2009. The proxy material will be mailed to the Stockholders on or about April 17, 2009.

Preliminary proxy material was not filed because the only matter to be acted upon is the election of the board of directors.

|

|

Very truly yours,

|

|

|

|

|

|

THE RESERVE PETROLEUM COMPANY

|

|

|

|

|

Date: April 17, 2009

|

/s/ James L. Tyler

|

|

|

|

|

|

James L. Tyler

|

|

|

2

nd

Vice President

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant

T

Filed by a Party other than the Registrant

o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

T

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to § 240.14a-12

|

THE RESERVE PETROLEUM COMPANY

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:_______________

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:_______________

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):_______________

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:_______________

|

|

|

(5)

|

Total fee paid:_______________

|

|

o

|

Fee paid previously with preliminary materials.

|

o

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

(1)

|

Amount Previously Paid:_______________

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:_______________

|

|

|

(3)

|

Filing Party:_______________

|

|

|

(4)

|

Date Filed: ________________

|

THE RESERVE PETROLEUM COMPANY

Notice of 2009

Annual Meeting

and

Proxy Statement

THE RESERVE PETROLEUM COMPANY

6801 N. Broadway Ext, Suite 300

Oklahoma City, Oklahoma 73116-9092

April 17, 2009

Dear Stockholder:

On behalf of the Board of Directors, it is my pleasure to invite you to attend the 2009 Annual Meeting of Stockholders of The Reserve Petroleum Company on Tuesday, May 19, 2009, at 3:00 p.m. local time, in Oklahoma City, Oklahoma. Information about the Annual Meeting is presented in the following pages.

The Annual Meeting will begin with a discussion and vote on the matters set forth in the accompanying Notice of 2009 Annual Meeting of Stockholders and Proxy Statement, followed by a discussion on any other business matters that are properly brought before the Annual Meeting.

Your vote is very important. We encourage you to read the Proxy Statement and vote your shares as soon as possible. Whether or not you plan to attend, you can be sure your shares are represented at the Annual Meeting by promptly completing, signing, dating and returning your Proxy Card in the enclosed envelope.

If you will need special assistance at the Annual Meeting because of a disability, please contact James L. Tyler, 2

nd

Vice President, at (405) 848-7551.

Thank you for your continued support of The Reserve Petroleum Company. We look forward to seeing you on May 19

th

.

Sincerely,

/s/ Mason McLain

Mason McLain

Chairman of the Board and

Chief Executive Officer

TABLE

OF CONTENTS

|

|

|

iii

|

|

|

|

1

|

|

|

|

|

1

|

|

|

|

|

1

|

|

|

|

|

1

|

|

|

|

|

2

|

|

|

|

|

6

|

|

|

|

|

7

|

|

|

|

|

9

|

|

|

|

|

10

|

|

|

|

|

10

|

|

|

|

|

11

|

|

|

|

|

11

|

|

|

|

|

12

|

THE RESERVE PETROLEUM COMPANY

6801 N. Broadway, Suite 300

Oklahoma City, Oklahoma 73116-9092

NOTICE

OF 2009 ANNUAL MEETING OF STOCKHOLDERS

The 2009 Annual Meeting of Stockholders of The Reserve Petroleum Company (the “Company”) will be held on Tuesday, May 19, 2009, at 3:00 p.m. local time, at the offices of the Company at 6801 N. Broadway Ext, Suite 300, Oklahoma City, Oklahoma for the following purposes:

|

|

1.

|

Electing nine (9) directors to serve for the next year and until their successors are elected and qualified.

|

|

|

2.

|

Transacting such other business as may properly be brought before the Annual Meeting or any adjournment thereof.

|

The Board of Directors has fixed the close of business on April 13, 2009 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting of Stockholders.

STOCKHOLDERS ARE URGED TO VOTE, SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED PROXY CARD IN THE ENCLOSED PREPAID ENVELOPE

.

It is desirable

that

as many stockholders as possible be represented at the Annual Meeting. Consequently, whether or not you now plan to attend in person, please vote, sign, date and return the enclosed Proxy Card. If you attend the Annual Meeting, you may vote your shares in person even though you have previously signed and returned your Proxy Card.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

|

s/ Mason McLain

|

|

|

|

|

|

|

|

|

Mason McLain,

|

|

|

Chief Executive Officer

|

PROXY

STATEMENT

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of The Reserve Petroleum Company (“Company”, “we”, “our” or “us”) for the 2009 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the principal executive offices of the

Company, 6801 N. Broadway Ext, Oklahoma City, Oklahoma 73116-9092, on Tuesday, May 19, 2009, at 3:00 p.m. local time, or any adjournment thereof. This Proxy Statement and Proxy Card are first being sent to the stockholders on or about April 17, 2009. The proxy will be voted at the Annual Meeting if the signer of the Proxy Card was a stockholder of record on April 13, 2009 (the “Record Date”).

SOLICITATION

OF PROXIES

The Company will bear the costs of solicitation, which are estimated to be approximately $31,750, of which amount approximately $22,500 has been spent to date. Solicitation of proxies may be made by personal interview, mail, telephone or telegram by Directors, officers, and regular employees of the Company. Copies

of proxy material and of the Company’s 2008 Annual Report on Form 10-K may also be supplied to holders of record, as well as to brokers, dealers, banks and voting trustees, or their nominees, for the purpose of soliciting proxies from the beneficial owners, and the Company will reimburse such holders for their reasonable forwarding expenses.

VOTING

RIGHTS AND OUTSTANDING SHARES

Voting rights are vested exclusively in the holders of the Company’s common stock, par value $.50 per share, with each share entitled to one (1) vote on each matter coming before the Annual Meeting. Only stockholders of record at the close of business on the Record Date will be entitled to receive notice of and to vote

at the Annual Meeting. On the Record Date, there were 162,148.64 shares of common stock of the Company outstanding and entitled to be voted.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock of the Company entitled to vote is necessary to constitute a quorum at the Annual Meeting. The shares represented by any and all proxies received by the Company will be counted towards a quorum, notwithstanding that any

such proxies contain thereon an abstention or a broker non-vote. Notwithstanding the Record Date specified above, the Company’s stock transfer books will not be closed and shares may be transferred subsequent to the Record Date. However, all votes must be cast in the names of the stockholders of record on the Record Date.

All votes will be tabulated by the Inspector of Election appointed for the Annual Meeting, who will separately tabulate affirmative votes, abstentions and broker non-votes. The election of the nominees to the Board requires the affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and

entitled to vote, provided a quorum is present. Proxies specifying “withheld authority to vote” will have the same effect as a vote “against” the nominees, while a broker non-vote will have no effect.

If sufficient shares are not present to provide a quorum on May 19

th

, the Annual Meeting, after the lapse of at least half an hour, will be adjourned by those present or represented and entitled to vote. Those stockholders entitled to receive notice

of and to vote at the Annual Meeting will be sent written notice of an adjournment meeting to be held with a quorum of those present in person or by proxy at such meeting. Under the Restated Bylaws of the Company, any number of stockholders, in person or by proxy, will constitute a quorum at the adjournment meeting.

A list of the stockholders entitled to vote at the Annual Meeting will be available for inspection during ordinary business hours at the offices of the Company for a period of ten (10) days preceding the Annual Meeting and at the Annual Meeting for purposes relating to the Annual Meeting.

You can ensure that your shares are voted at the Annual Meeting by submitting your instructions by completing, signing, dating and returning the enclosed Proxy Card in the envelope provided. Submitting your instructions by Proxy Card will not affect your right to attend the Annual Meeting and vote. A stockholder who

gives a proxy may revoke it at any time before it is exercised by voting in person at the Annual Meeting, by delivering a subsequent proxy, or by notifying James L. Tyler, the Inspector of Election, in writing of such revocation.

A stockholder of record on the Record Date may vote in one of the following ways:

|

|

·

|

by completing and mailing the Proxy Card; or

|

|

|

·

|

by written ballot at the Annual Meeting.

|

Your shares will be voted as you indicate on your Proxy Card. If you return your Proxy Card, but you do not indicate your voting preferences, the proxies will vote your shares FOR the nominees for Directors and in their discretion for such other matters as may come before the Annual Meeting.

If your shares are held in a brokerage account in your broker’s name (this is called street name), you should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee. Your shares should be voted by your broker or nominee as you have directed.

The Company will pass out written ballots to anyone who wants to vote at the Annual Meeting.

For additional information concerning the manner of proxy solicitation and voting, please see “Additional Information” beginning on page 12 of this Proxy Statement.

INFORMATION

RELATING TO DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS

Directors and Director Nominees

The nine (9) persons named below are nominees for election as Directors of the Company to serve until the next annual meeting of stockholders and until their respective successors are elected and qualified. If any nominee is unable to serve, which the Company has no reason to expect, the persons named in the accompanying

Proxy Card intend to vote for the balance of those named and, if they deem it advisable, for a substitute nominee. Each nominee is currently a Director and each has served continuously as a Director since the date of his first election or appointment to the Board. The Board had determined that the following Directors are independent, as independence is defined in Rule 4200(a)(15) of the NASDAQ listing standards: Jerry Crow, Marvin E. Harris, William M. (Bill) Smith and Doug Fuller.

The Board recommends a vote FOR each nominee for Director set forth below.

The following information and the information set forth in “Executive Officers” pertains to each person’s (i) age as of April 13, 2009, (ii) principal occupations for at least the past five years, and (iii) directorships in other companies.

|

Name

|

|

Age

|

|

Position/Office Held

With Company

|

|

Position Held Continuously

Since

|

|

Mason McLain (1)

|

|

82

|

|

Chief Executive Officer (CEO)

|

|

May 3, 1955

|

|

Robert T. McLain (1)

|

|

79

|

|

None

|

|

May 2, 1972

|

|

Robert L. Savage

|

|

61

|

|

None

|

|

May 6, 1975

|

|

Jerry L. Crow (1)

|

|

72

|

|

None (Retired December 31, 2003)

|

|

May 4, 1982

|

|

Marvin E. Harris, Jr.

|

|

57

|

|

None

|

|

May 7,

1991

|

|

William M. (Bill) Smith

|

|

50

|

|

None

|

|

May 5, 1998

|

|

Doug Fuller

|

|

51

|

|

None

|

|

May 2, 2000

|

|

Cameron R. McLain

|

|

50

|

|

President/ Exploration Manager

|

|

May 9, 1989

|

|

Kyle L. McLain

|

|

54

|

|

Executive Vice President/

Production Manager

|

|

May 12, 1984

|

___________________________________

(1) Member of Executive Committee

Executive Officers

The persons named below are the executive officers of the Company:

|

Name

|

|

Age

|

|

Position/Office Held

With Company

|

|

Office Held Continuously

Since

|

|

Mason McLain

|

|

81

|

|

CEO

|

|

May 6, 1969

|

|

Cameron R. McLain

|

|

50

|

|

President

|

|

May 20, 2008

|

|

Kyle L. McLain

|

|

54

|

|

Executive Vice President

|

|

May 20, 2008

|

|

James L. Tyler

|

|

60

|

|

2nd Vice President,

Secretary/Treasurer

|

|

January 1, 2004

|

Mason McLain, Director and CEO, and Robert T. McLain, Director, are brothers. Cameron R. McLain, Director and President, and Kyle L. McLain, Director and Executive Vice President, are sons of Mason McLain.

Mason McLain,

currently serving as CEO of the Company, served as President from May 6, 1969 until May 20, 2008 when he relinquished that title. He had previously served as 1

st

Vice President since

May 3, 1966, and as 2

nd

Vice President since May 6, 1958. Mr. McLain devotes substantially all of his time to the affairs of the Company, although he is permitted to and does devote part of his time and efforts to the activities of affiliated and family organizations. These organizations are Mesquite Minerals, Inc. (formerly Royalty Pooling Company), Mid-American Oil Company, Lochbuie Holding Company and Lochbuie

Limited Partnership, all of which are engaged in varying aspects of the oil and gas industry. Mr. McLain holds a Bachelors degree in Petroleum Engineering from the University of Oklahoma. Mr. McLain is also a director of Webber Investment Company, Mid-American Oil Company, Mesquite Minerals, Inc. and Lochbuie Holding Company.

Cameron R. McLain

was elected President of the Company on May 20, 2008. He also serves as Exploration Manager and has served in that capacity continuously since his employment on May 9, 1982. Mr. McLain devotes substantially all of his time to Company affairs;

however, he devotes a part of his time and efforts to the activities of affiliated organizations. Mr. McLain was previously employed from May, 1980 to May 1982 as a Southern Oklahoma exploration geologist for Cities Service Oil and Gas Company. Mr. McLain has a Bachelor of Science degree in Geology from the University of Oklahoma and a Master of Business Administration degree from Oklahoma City University. Mr. McLain is also a director of Mid-American Oil Company and Mesquite

Minerals, Inc.

Kyle McLain

was elected Executive Vice President on May 20, 2008. He also serves as Production Manager and has served in that capacity continuously since his employment on May 12, 1984. Mr. McLain devotes substantially all of his time to the affairs of the Company,

although he spends a part of his time and efforts on the activities of affiliated organizations. Mr. McLain was previously employed as a reservoir engineer for Gulf Oil Corporation from May, 1980 to May, 1984. Mr. McLain has a Bachelor of Science degree in Petroleum Engineering from the University of Oklahoma. Mr. McLain is also a director of Mid-American Oil Company and Mesquite Minerals, Inc.

Robert T. McLain

served as 1

st

Vice President of the Company from May 4, 1976 until he retired May 20, 2008. Prior to that date, he was Secretary-Treasurer of the Company from May 2, 1972. He

is Chairman of the Board of the Mull Corporation. He had previously served as Chairman and Chief Executive Officer of Bunte

¢

Candies, Inc. from 1972 to 1991. Mr. McLain holds a Bachelor of Science degree in Business Administration and a Bachelor of Law degree from the University of Oklahoma. Mr. McLain is also a director of Mid-American Oil Company, Mesquite Minerals, Inc. and Lochbuie Holding Company.

Robert L. Savage

is President of Leonard Securities, Inc., a NASD Broker Dealer, which he formed. He is also President of Leonard Agency, Inc. and Leonard Investment Advisors, Inc. He was Vice President with Century Investment Group, Inc., from May, 1994 to October,

1997. He was previously employed as an Account Executive with Park Avenue Securities, Inc. from January, 1989 to May 1994. Mr. Savage has a Bachelors degree in Business Administration from Trinity University, San Antonio, Texas, and a Master of Business Administration degree from Southern Methodist University, Dallas, Texas.

Jerry L. Crow

was employed by the Company from April 7, 1976, until he retired December 31, 2003. He served as Secretary-Treasurer and 2

nd

Vice President during his employment. Mr.

Crow holds a Bachelors and Masters degree in Business Administration from West Texas A&M University and is a Certified Public Accountant in both Texas and Oklahoma. Mr. Crow is also a director of Mid-American Oil Company and Mesquite Minerals, Inc.

Marvin E. Harris, Jr.

is President of Tetron Software, a computer software company which he formed on January 3, 1994. Until that date he had been employed as President of RDA Services, Inc., a computer software company, since April 15, 1991. He was previously

employed by Intel Corporation from 1984 until his resignation in 1991. Mr. Harris holds a Bachelor of Science degree from the University of Alabama, a Master of Science degree from the University of Alabama in Birmingham and a Master of Business Administration degree from Southern Methodist University.

William M. (Bill) Smith

is the owner of W.M. Smith Energy, LLC, a geological consulting company which he formed January 1, 2008. Until that date he had served as Manager of Geology at Bracken Operating, LLC since 1994, and was also a part owner. He joined Bracken Exploration

Co. as an Exploration Geologist in 1981, and became Vice President of Geology until 1986. In 1986, he assisted in forming Bracken Energy Company, for whom he was an employee and a part owner. Mr. Smith earned a Bachelor of Science degree in Geology from the University of Oklahoma in 1980 and was employed by Samedan Oil Corporation from 1980 through 1981.

Doug Fuller

has been employed as Membership Director with Leadership Oklahoma since May 7, 2007. He was previously employed as Sr. Vice President, Director of Business Banking for Western Oklahoma, with the Bank of Oklahoma from 1992 until May 2007. Before that,

he was Executive Vice President, Manager of Commercial Lending, Private Banking and Special Assets with Founders Bank. Mr. Fuller has a Bachelor of Business Administration degree in Finance from the University of Oklahoma and a Masters of Business Administration degree from Oklahoma City University.

James L. Tyler

was employed by the Company on August 1, 2003, and was elected 2nd Vice President and Secretary-Treasurer effective January 1, 2004 to replace Jerry L. Crow. Mr. Tyler devotes substantially all of his time to the affairs of the Company, although he devotes

a part of his time and efforts to the activities of the affiliated organizations. Mr. Tyler was previously employed as Vice-President, Controller for Grace Petroleum Corporation from May, 1979 to May, 1994 and Controller for MCNIC Oil & Gas, Inc. from June, 1994 to April, 1999. From May, 1999 until March, 2003, he was employed as Controller for Express Ranches and Accounting Manager for Bison Drilling Company. Mr. Tyler holds a Bachelor of Science degree in Accounting from

the University of Central Oklahoma, Edmond, Oklahoma and is a Certified Public Accountant in Oklahoma.

Certain Relationships and Related Transactions

The Company is affiliated by common management and ownership with Mesquite Minerals, Inc., (“Mesquite”), Mid-American Oil Company (“Mid-American”), Lochbuie Limited Partnership (“LLTD”) and Lochbuie Holding Company (“LHC”). The Company also owns interests in certain producing and

non-producing oil and gas properties as tenants in common with Mesquite, Mid-American and LLTD. Mason McLain, Director and officer of the Company, is a director of Mesquite and Mid-American. Jerry Crow and Robert T. McLain, Directors of the Company, are directors of Mesquite and Mid-American. Kyle McLain and Cameron R. McLain are sons of Mason McLain, who is a more than 5% owner of the Company, and are Directors and officers of the Company. Both are directors

and officers of Mesquite and Mid-American. Mason McLain and Robert T. McLain, who are brothers, each own an approximate 32% limited partner interest in LLTD and a 33.33% ownership in LHC, Mason McLain is president of LHC, the general partner of LLTD. Robert T. McLain is not an employee of any of the above entities, and devotes only a small amount of time conducting their business.

The above named officers and Directors as a group beneficially own approximately 30% of the common stock of the Company, approximately 32% of the common stock of Mesquite, and approximately 17% of the common stock of Mid-American. These three corporations each have only one class of stock outstanding. Item 8, “Notes

to Financial Statements,” Note 12 to the Company’s Form 10-K for the fiscal year ended December 31, 2008 includes additional disclosures regarding these relationships. See “Additional Information”.

Robert L. Savage, a Director, is also the President of Leonard Securities, Inc. (“LSI”). LSI manages the Company’s portfolio of “Trading Securities” and this asset was listed in the Company’s December 31, 2008 balance sheet at $218,228, which represents the year-end market price of the securities in the

portfolio. The $218,228 represents securities with a cost of $311,034 less a market write-down of $92,806. LSI earned $7,614 in broker commissions and fees on the securities bought and sold in 2008. Realized gains (net of losses) on the securities sold totaled $51,333 in 2008.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth information regarding the only persons known by the Company to be beneficial owners of more than 5% of the Company’s common stock as of April 13, 2009:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of

Beneficial Owner

|

|

Amount & Nature of Beneficial

Ownership

|

|

|

Percent of

Class (3)

|

|

|

|

|

|

|

|

|

|

|

Mason McLain (1) (2)

|

|

15,970

|

(4)

|

|

|

9.85

|

|

|

|

6801 N. Broadway, Suite 300

|

|

|

|

|

|

|

|

|

|

Oklahoma City, OK 73116-9092

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert T. McLain (1) (2)

|

|

12,149

|

(5)

|

|

|

7.49

|

|

|

|

6403 N. Grand, #203

|

|

|

|

|

|

|

|

|

|

Oklahoma City OK 73116

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Norma Moe (1) (2)

|

|

11,949

|

(6)

|

|

|

7.37

|

|

|

|

3100 Brush Creek Road

|

|

|

|

|

|

|

|

|

|

Oklahoma City OK 73120

|

|

|

|

|

|

|

|

|

___________________________________

|

|

(1)

|

Mason McLain, Robert T. McLain and Norma Moe are siblings.

|

|

|

(2)

|

Lochbuie Holding Company (“LHC”) is an “S” Corporation and owns 2,352 shares of common stock. Each sibling owns one-third of LHC.

|

|

|

(3)

|

Calculations of percent of class are based on the number of shares of common stock outstanding as of April 13, 2009, excluding shares held by or for the Company.

|

|

|

(4)

|

15,186 owned directly; 784 shares owned indirectly by LHC.

|

|

|

(5)

|

8,032 owned directly; 3,333 owned by wife; 784 shares owned indirectly by LHC.

|

|

|

(6)

|

11,165 owned directly; 784 shares owned indirectly by LHC.

|

Security Ownership of Management

The following table sets forth information regarding the Company’s common stock beneficially owned by its executive officers and Directors as of April 13, 2009:

|

Name

|

|

Title of

Class

|

|

|

Amount & Nature of

Beneficial Ownership

|

|

|

Percent

of Class

|

|

|

Mason McLain

|

|

Common

|

|

|

|

15,970

|

|

(1)

|

|

|

9.85

|

|

|

|

Robert T. McLain

|

|

Common

|

|

|

|

12,149

|

|

(2)

|

|

|

7.49

|

|

|

|

Robert L. Savage

|

|

Common

|

|

|

|

1,269

|

|

Owned Directly

|

|

|

.78

|

|

|

|

Jerry L. Crow

|

|

Common

|

|

|

|

5,379

|

|

Owned Directly

|

|

|

3.32

|

|

|

|

Cameron R. McLain

|

|

Common

|

|

|

|

6,785

|

|

Owned Directly

|

|

|

4.18

|

|

|

|

Kyle L. McLain

|

|

Common

|

|

|

|

6,785

|

|

Owned Directly

|

|

|

4.18

|

|

|

|

All Directors

|

|

|

|

|

|

48,337

|

|

|

|

|

29.80

|

|

|

|

All Directors and Executive Officers as a Group (10 persons)

|

|

|

|

|

|

48,337

|

|

|

|

|

29.80

|

|

|

___________________________________

|

|

(1)

|

15,186 owned directly; 784 shares owned indirectly by LHC

|

|

|

(2)

|

8,032 owned directly; 3,333 owned by wife; 784 shares owned indirectly by LHC.

|

INFORMATION

RELATING TO THE BOARD OF DIRECTORS AND COMMITTEES

Meetings

The Board held three meetings during the Company’s fiscal year ended December 31, 2008. All Directors were present at all meetings, except on May 20, 2008, when William M. (Bill) Smith was absent. It is the Board’s policy that Directors should attend the Company’s annual meeting of stockholders. Last

year, all Directors except William M. (Bill) Smith attended the annual meeting of stockholders.

Committees

In General

.

The Company does not have standing audit and compensation committees of the Board, or committees performing similar functions. The Company is a small business issuer

whose securities are not quoted on NASDAQ or listed on any exchange. The Company’s stock is traded by private transactions or over the counter. Over the counter bid information is quoted in the Pink Sheet Electronics Quotation Service, in the Pink Sheets OTC Market Report, and in the OTC Bulletin Board under the symbol “RSRV”.

Audit Committee

.

The Company does not have a separately-designated standing Audit Committee. The entire Board acts as the Company’s Audit Committee. The Board

has determined that Mr. Crow is an “audit committee financial expert” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K.

Nominating Committee

.

The Board has adopted the Company’s Statement of Governance Principles and Nominating Committee Charter. Minimum qualifications for Director Nominees

are detailed in the Statement of Governance Principles along with procedures for stockholders to recommend Director candidates for consideration by the Nominating Committee. These two documents can be viewed on the SEC website as Appendix A and B to the Company’s 2006 Proxy Statement. See “Additional Information”. The Company will provide a copy of these documents to any person without charge, upon written request addressed to the Company’s Secretary.

The Board has designated a Nominating Committee which consists of Mason McLain, Doug Fuller and Bill Smith. Both Mr. Fuller and Mr. Smith are “independent” as defined in Rule 4200(a)(15) of the NASDAQ listing standards. The Nominating Committee makes recommendations to the Board regarding individuals for

nomination as Director and, in addition, may consider other matters relating to corporate governance. The Nominating Committee met once in March, 2009 and recommended that the current Directors be nominated to serve another one year term on the Board. In addition, they reviewed the Company’s Statement of Governance Principles and decided no changes were currently needed.

The Nominating Committee evaluates qualified nominees for Director using the same process regardless of whether the nominee is recommended by an officer, Director or stockholder.

Director Compensation

Directors, whether employees or non-employees, are compensated on a per meeting basis and only for those Board meetings attended. The amount of compensation is set by a vote of the Directors at each Board meeting. In the year ended December 31, 2008, the Directors were compensated in the amount of $1,000 for each of

the meetings attended. All committee meetings are held just prior to the Board meetings or by telephone conference and Directors or officers of the Company who are also Directors receive no additional compensation for committee meetings.

The Company provides no stock or stock option awards compensation, non-equity incentive compensation or deferred compensation to any of our Directors.

For information concerning compensation paid to employee Directors in the year ended December 31, 2008, please see the footnotes to the Summary Compensation Table. The following table provides information relating to total compensation amounts paid to non-employee Directors:

Director Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Year

|

|

Fees Earned or

Paid in Cash (1)

|

|

Total

|

|

|

William M. (Bill) Smith

|

|

2008

|

|

$

|

2,000

|

|

|

$

|

2,000

|

|

|

|

Each other director (2)

|

|

2008

|

|

$

|

3,000

|

|

|

$

|

3,000

|

|

|

___________________________________

|

|

(1)

|

Amounts represent fees for attending Board meetings during the year at $1,000 per meeting.

|

|

|

(2)

|

Robert T. McLain, Robert Savage, Jerry Crow, Marvin E. Harris and Doug Fuller.

|

EXECUTIVE

COMPENSATION

Overview

As indicated earlier, the Company does not have a standing compensation committee of the Board or a committee performing a similar function. We are a smaller reporting company whose securities are not quoted on NASDAQ or listed on any exchange. The Company has a total of only eight employees, four of whom are classified as executive officers.

Non-employee Directors’ compensation was discussed in the previous section.

Compensation Philosophy and Objectives

Because we are so small, our compensation philosophy and objectives are to provide compensation that is fair and reasonable for all employees at a competitive level that will allow us to attract and retain qualified personnel necessary to operate the Company at the most efficient level possible. At the same time, we strive to comply with

all the operational and financial rules and regulations required of any public company and specifically those relating to the oil and gas exploration and production (E&P) industry. In addition, we try to maintain compensation at a level that is competitive with other companies in this industry. Our philosophy and objectives for compensation of executive officers are no different from the other employees.

Compensation levels for all employees, including executive officers, are reviewed annually in early November by the Chief Executive Officer, President and Executive Vice President. This review process includes reviews of salary and wage surveys primarily for the oil and gas E&P industry and informal performance evaluations provided

by supervisors. Compensation levels for the next fiscal year are determined during this review process and presented to the entire Board for approval at its meeting on the third Tuesday in November each year.

Elements of Compensation

Elements of our executive compensation and benefits package are as follows:

|

|

·

|

a bonus equal to one, two or three month’s base salary, paid in early December each year, and

|

|

|

·

|

Company sponsored employee benefits, such as life and health insurance benefits and a qualified 401(k) savings plan

|

These elements of compensation are no different than those provided to all of our employees.

The Company provides no incentive bonus compensation, stock or stock option awards compensation, non-equity incentive compensation or deferred compensation to the executive officers or to any of our other employees.

The following table sets forth summary information regarding the compensation paid to the principal executive officer and the two other highest paid executive officers.

Summary Compensation Table

|

Name and

Principal Position

|

|

Year

|

|

|

Salary (1)

|

|

|

Bonus

|

|

|

All Other

Compensation

|

|

|

Total

|

|

Mason McLain

|

|

2008

|

|

|

$

|

79,800

|

|

|

|

$

|

19,950

|

|

|

|

$

|

8,985

|

(2)

|

|

|

$

|

108,735

|

|

|

Chief Executive Officer

|

|

2007

|

|

|

$

|

71,904

|

|

|

|

$

|

11,984

|

|

|

|

$

|

8,033

|

(2)

|

|

|

$

|

91,921

|

|

|

Cameron R. McLain

|

|

2008

|

|

|

$

|

109,200

|

|

|

|

$

|

27,300

|

|

|

|

$

|

11,190

|

(3)

|

|

|

$

|

147,690

|

|

|

President

|

|

2007

|

|

|

$

|

98,868

|

|

|

|

$

|

16,478

|

|

|

|

$

|

9,921

|

(3)

|

|

|

$

|

125,267

|

|

|

Kyle McLain

|

|

2008

|

|

|

$

|

109,200

|

|

|

|

$

|

27,300

|

|

|

|

$

|

11,190

|

(3)

|

|

|

$

|

147,690

|

|

|

Executive Vice President

|

|

2007

|

|

|

$

|

98,868

|

|

|

|

$

|

16,478

|

|

|

|

$

|

9,921

|

(3)

|

|

|

$

|

125,267

|

|

___________________________________

|

|

(1)

|

Includes amounts earned but deferred at the election of each officer pursuant to our 401(k) employee savings plan.

|

|

|

(2)

|

Includes Director Fees of $3,000 paid in 2008 and 2007 and matching contributions made under our

401(k) employee savings plan in the amounts of $5,985 and $5,033 for 2008 and 2007 respectively.

|

|

|

|

(3)

|

Includes Director Fees of $3,000 paid in 2008 and 2007 and matching contributions made under our 401(k) employee savings plan in the amounts of $8,190 and $6,921 for 2008 and 2007 respectively.

|

CODE

OF ETHICS FOR SENIOR OFFICERS

The Company has adopted a Code of Ethics for Senior Officers (the “Code of Ethics”) that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions meeting the criteria set forth in Item 406 of Regulation S-K. The Company

will provide to any person without charge, upon written request addressed to the Company’s Secretary, a copy of the Code of Ethics. This document can also be viewed at the SEC website as Exhibit 14 to the Company’s 2005 Form 10-KSB. See “Additional Information”.

INFORMATION

REGARDING COMMUNICATIONS WITH AUDITORS

As required by Securities and Exchange Commission Regulation S-K, Item 407(d)(3)(i), the Board has:

|

|

1.

|

Reviewed and discussed the audited financial statements of the Company for the year ended December 31, 2008 with management.

|

|

|

2.

|

Discussed with Eide Bailly, LLP the matters that are required to be discussed by Statement on Auditing Standards No. 114 (

The Auditor's Communication With Those Charged With Governance

)

,

as adopted by the Public Company Accounting Oversight Board (the “PCAOB”).

|

|

|

3.

|

Received the written disclosures and the letter from Eide Bailly, LLP required by applicable requirements of the PCAOB regarding Eide Bailly’s communications with the Board concerning independence and has discussed with Eide Bailly the independent accountant’s independence.

|

Based on the above noted review and discussions, the Board approved the inclusion of the Company’s audited financial statements, for and as of the fiscal year ended December 31, 2008, in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008, for filing with the Securities and Exchange Commission.

The Members of the Board are Mason McLain, Robert T. McLain, Robert L. Savage, Jerry L. Crow, Marvin E. Harris, Jr., William M. Smith, Doug Fuller, Cameron McLain and Kyle McLain.

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers, directors and persons beneficially owning more than 10% of the Company’s stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission and with the Company. Based solely on a review

of the Forms 3 and 4 and any amendments thereto furnished to the Company and written representations from the executive officers and Directors, the Company believes that all of these persons complied with their Section 16(a) filing obligations.

INDEPENDENT

PUBLIC ACCOUNTANTS

In General

Our independent accountant, Murrell, Hall, McIntosh & Co., PLLP, merged with Eide Bailly, LLP effective August 1, 2008. Murrell, Hall, McIntosh & Co., PLLP had served as the Company’s independent accountant for the years ended December 31, 2005, 2006 and 2007.

For the year 2009, the executive officers will recommend to the Board that it approve Eide Bailly, LLP as the Company’s independent accountant. Eide Bailly, LLP served in that capacity for the year ended December 31, 2008, as discussed above.

Representatives of Eide Bailly, LLP are not expected to be at the Annual Meeting. However, if questions arise which require their comments, arrangements have been made to solicit their response.

Audit Fees

The aggregate fees billed for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2008 and the reviews of the financial statements included in the Company’s Form 10-Qs for the year totaled $54,157. Of this amount, Murrell, Hall, McIntosh & Co.,

PLLP billed $10,050 for their review of the financial statements included in our Form 10-Qs for the quarters ended March 31, 2008 and June 30, 2008. The remaining $44,107 was billed by Eide Bailly, LLP for the services rendered subsequent to the merger discussed above. Out of pocket and administrative costs of $1,787 are included in the amount billed by Eide Bailly, LLP.

The aggregate fees billed for professional services by Murrell, Hall, McIntosh, & Co., PLLP for the fiscal year ended December 31, 2007 totaled $50,000.

Audit – Related Fees

No fees were billed for audit related services rendered by either Eide Bailly, LLP or Murrell, Hall, McIntosh & Co., PLLP for either 2008 or 2007.

Tax Fees

The aggregate fees billed for tax services rendered by Murrell, Hall, McIntosh & Co., PLLP were $9,500 for 2008 and $9,500 for 2007. All such fees were for Federal and state income tax return preparation.

All Other Fees

None

ADDITIONAL

INFORMATION

Communications Between Stockholders and the Board

The Board has designated Mr. Harris to be the independent Director to receive communications from stockholders seeking to communicate directly with the Company’s independent Directors. Anyone who has a concern about the Company’s conduct, or about the Company’s accounting, internal accounting controls or auditing

matters, may communicate that concern directly to the Company’s Secretary. Those communications may be confidential or anonymous. All such concerns will be forwarded to Mr. Harris for review. The Board is committed to good governance practices.

Deadline for Stockholders for Inclusion in Next Year’s Proxy Statement

Stockholder proposals intended to be presented at the 2010 Annual Meeting of Stockholders, which is scheduled for May 18, 2010, and included in the Company’s proxy statement and form of proxy relating to that meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 must be received in writing by the Company at the

Company’s principal executive offices by Friday, December 18, 2009. Proposals should be addressed to James L. Tyler, Secretary, The Reserve Petroleum Company, 6801 N. Broadway Ext, Suite 300, Oklahoma City, Oklahoma 73116-9092.

Other Stockholder Proposals for Presentation at Next Year’s Annual Meeting

For any stockholder proposal that is not submitted to the Company for inclusion in next year’s proxy statement, but is instead sought to be presented by the stockholder directly at the 2010 Annual Meeting, Rule 14a-4(c) under the Securities Exchange Act of 1934 permits management to vote proxies in its discretion if the Company: (1) receives

written notice of the proposal before the close of business on Thursday, March 4, 2010, and advises stockholders in the 2010 Proxy Statement about the nature of the matter and how management intends to vote on the matter, or (2) does not receive written notice of the proposal before the close of business on Thursday, March 4, 2010. Notices of intention to present proposals at the 2010 Annual Meeting should be addressed to James L. Tyler, Secretary, The Reserve Petroleum Company, 6801 N. Broadway

Ext, Suite 300, Oklahoma City, Oklahoma 73116-9092.

Voting Securities

Stockholders of record at the close of business on April 13, 2009, will be eligible to vote at the Annual Meeting. The voting securities of the Company consist of its $0.50 par value common stock, of which 162,148.64 shares were outstanding on April 13, 2009. Each share outstanding on the Record Date

will be entitled to one vote. Treasury shares are not voted. Individual votes of stockholders are kept private, except as appropriate to meet legal requirements. Access to proxies and other individual stockholder voting records is limited to the Inspector of Election and certain employees of the Company and its agents who must acknowledge in writing their responsibility to comply with this policy of confidentiality.

Vote Required for Approval

The election of a nominee to the Board requires the affirmative vote of a majority of the shares of common stock represented at the Annual Meeting in person or by proxy. All other matters also require the affirmative vote of a majority of the shares of common stock voted at the Annual Meeting in person or by proxy. Abstentions,

if any, will not be counted as votes cast. Therefore, they will have no effect on the outcome of the other matters to be voted on at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial holder does not have discretionary voting power and does not receive voting instructions from the beneficial owner. Broker non-votes will not be treated as shares present and entitled to vote on a voting matter and will have no effect on the outcome of the

vote.

Manner for Voting Proxies

The shares represented by all valid proxies received by mail will be voted in the manner specified. Where specific choices are not indicated, the shares represented by all valid proxies received will be voted for the nominees for Director named in this Proxy Statement. Should any matter not described above be

properly presented at the Annual Meeting, the person or persons named in the Proxy Card will vote in accordance with their judgment.

Other Matters to be Presented

The Board knows of no other matters which may be presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, including any adjournment or adjournments thereof, proxies received in response to this solicitation will be voted upon such matters in the discretion of the person or persons named in

the Proxy Card.

Electronic Access to Proxy Statement and Annual Report

A copy of the Company’s 2008 Annual Report on Form 10-K will be furnished without charge to stockholders beneficially or of record at the close of business on April 13, 2009, on request to James L. Tyler, Secretary, at (405) 848-7551 Ext. 303. This Proxy Statement and the Company’s 2008 Annual Report on

Form 10-K are also available on the website

http://materials.proxyvote.com/761102

.

THE RESERVE PETROLEUM COMPANY

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

May 19, 2009

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

KNOW ALL MEN BY THESE PRESENTS:

That the undersigned holder(s) of common stock of The Reserve Petroleum Company, a Delaware corporation, does hereby constitute and appoint Cameron R. McLain and Kyle McLain as true and lawful attorneys and proxies for the undersigned, each with full power of substitution and revocation, to vote for and in the name, place and stead of the

undersigned at the 2009 Annual Meeting of Stockholders of the Company to be held at 6801 N. Broadway, Suite 300, Oklahoma City, Oklahoma, on Tuesday, May 19, 2009, at 3:00 p.m., local time, and any adjournment thereof, all of the stock of the Company which the undersigned would be entitled to vote if then personally present, hereby revoking any Proxy heretofore given.

This Proxy will confer discretionary authority to vote upon matters incidental to the conduct of the Annual Meeting, matters not known to management prior to the date of the Proxy Statement which are presented to the meeting and the approval of the form of minutes of the 2008 Annual Stockholders’ Meeting.

Election of Directors

|

VOTE FOR

|

|

WITHHOLD

AUTHORITY TO VOTE

|

|

NOMINEE

|

|

()

|

|

()

|

|

Mason McLain

|

|

()

|

|

()

|

|

Cameron R. McLain

|

|

()

|

|

()

|

|

Kyle McLain

|

|

()

|

|

()

|

|

Robert T. McLain

|

|

()

|

|

()

|

|

Jerry L. Crow

|

|

()

|

|

()

|

|

Robert L. Savage

|

|

()

|

|

()

|

|

Marvin E. Harris, Jr.

|

|

()

|

|

()

|

|

William M. (Bill) Smith

|

|

()

|

|

()

|

|

Doug Fuller

|

(Continued and to be signed on other side)

(Continued from other side)

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE NOMINEES.

This Proxy may be revoked at any time before the authority granted therein is exercised; otherwise, it shall remain in full force and effect.

IN WITNESS WHEREOF the undersigned has executed this Proxy on the ____day of _______________2009.

|

|

|

|

|

|

Signature

|

|

|

|

|

|

|

|

Signature if held jointly

|

|

|

|

|

|

|

|

Address

|

|

Please sign your name(s) exactly as it appears on your stock certificate and return this Proxy Card promptly in the enclosed prepaid envelope to save the Company additional mailing expense. Executors, administrators, trustees, guardians and others signing in a representative capacity please give their full titles. When shares

are held by joint tenants both should sign. If a corporation, please sign full corporate name by the President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

Must arrive in this office by May 18, 2009 to be counted.

14

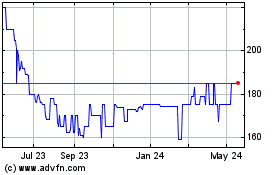

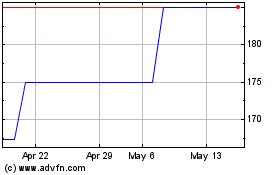

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From May 2024 to Jun 2024

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Jun 2023 to Jun 2024