Amended Statement of Beneficial Ownership (sc 13d/a)

August 17 2017 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

(Amendment No. 1)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

|

Indoor Harvest Corp

|

|

(Name of Company)

|

|

Common Stock, par value $0.001 per share

|

|

(Title of Class of Securities)

|

|

Richard Friedman, Esq.

Sheppard Mullin Richter & Hampton LLP

30 Rockefeller Plaza

New York, NY 10112

|

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

|

|

August 9, 2017

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box.

o

Note:

Six copies of this statement, including all exhibits, should be filed with the Commission. See Rule 13d-1(a) for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Securities Exchange Act (the “Act”) but shall be subject to all other provisions of the Act (however see the Notes).

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Chad Sykes

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐

|

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

OO

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

2,174,000(1)

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

2,174,000(1)

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,174,000(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.92%

(2)

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

(1)

|

On August 9, 2017, the Reporting Person returned 2,500,000 shares of the Issuer's common stock which shares were canceled and returned to the unissued and authorized shares of common stock of the Issuer.

|

|

|

|

|

(2)

|

Based upon 16,823,352 shares of common stock of the Issuer issued and outstanding as of August 17, 2017.

|

Item 1. Security and Company.

The title and class of equity securities to which this Schedule 13D relates is common stock, par value $0.001 per share (“Common Stock”), of Indoor Harvest Corp, a Texas corporation (the “Company”). The address of the Company’s principal executive office is 5300 East Freeway, Suite A, Houston, Texas 77020.

Item 2. Identity and Background.

|

(a)

|

This Schedule 13D is being filed by

Chad Sykes (the “Reporting Person).

|

|

|

|

|

(b)

|

The Reporting Person’s address is 14830 Forest Lodge Drive, Houston, Texas 77020.

|

|

|

|

|

(c)

|

The Reporting Person, is Chief of Cultivation for Alamo CBD, LLC located at 8518 Pegasus Drive, Selma, Texas 78154. The Reporting Person is responsible for managing operations related to cultivation at Alamo CBD, LLC.

|

|

|

|

|

(d)

|

During the past five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors).

|

|

|

|

|

(e)

|

During the past five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

|

|

(f)

|

United States.

|

Item 3. Source and Amount of Funds and Other Consideration.

All of the shares of Common Stock beneficially held by the Reporting Person were paid as set forth in Item 4 below.

Item 4. Purpose of Transaction.

The Reporting Person acquired the securities as follows: In March of 2012, the Company issued 2,153,600 shares of common stock to the Reporting Person in exchange for equipment and valued the share issuance at $0.01 per share. This transaction was valued based upon the cost of the equipment acquired by the owner and contributed to the Company as this was the most readily determinable value on the date of issuance. In March of 2012, the Company issued 2,470,400 shares of common stock to the Reporting Person to liquidate a liability for prior advances and valued the share issuance at $0.01 per share. This transaction was valued based upon the cost of the supplies and services acquired by the owner and contributed to the Company as this was the most readily determinable value on the date of issuance.

On August 9, 2017, the Reporting Person canceled and returned to the unissued and authorized shares of the Company, 2,500,000 shares of the Company’s common stock.

Although the Reporting Person has no specific plan or proposal to acquire or dispose of the Common Stock, consistent with its investment purpose, the Reporting Person at any time and from time to time may acquire additional Common Stock or dispose of any or all of its Common Stock depending upon an ongoing evaluation of the investment in the Common Stock, prevailing market conditions, other investment opportunities, liquidity requirements of the Reporting Person, and/or other investment considerations. The purpose of the acquisitions of the Common Stock was for investment as well as acquiring control of the Issuer upon formation.

The Reporting Person has no other plans or proposals which relate to, or would result in, any of the matters referred to in paragraphs (a) through (j), inclusive, of the instructions to Item 4 of Schedule 13D. The Reporting Person may, at any time and from time to time, review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto. Plans with respect to the Company are disclosed in the Company’s filings with the Securities and Exchange Commission.

Item 5. Interest in Securities of the Company.

|

(a)

|

The Reporting Person is the beneficial owner of 2,174,000 shares of Common Stock of the Company, representing approximately 12.92% of the total issued and outstanding shares of Common Stock, based upon 16,823,352 shares of Common Stock issued and outstanding as of August 17, 2017.

|

|

|

|

|

(b)

|

The Reporting Person may be deemed to hold sole voting and dispositive power over 2,174,000 shares of Common Stock. The Reporting Person does not hold shared voting and dispositive power over any securities of the Company.

|

|

|

|

|

(c)

|

On August 9, 2017, the Reporting Person canceled and returned to the unissued and authorized shares of the Company, 2,500,000 shares of the Company’s Common Stock.

|

|

|

|

|

(d)

|

Not applicable.

|

|

|

|

|

(e)

|

Not applicable.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Company.

None.

Item 7. Materials to be Filed as Exhibits.

None.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this Schedule 13D is true, complete and correct.

|

Dated: August 17, 2017

|

|

/s/ Chad Sykes

|

|

|

|

|

Chad Sykes

|

|

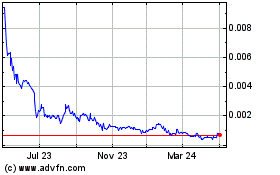

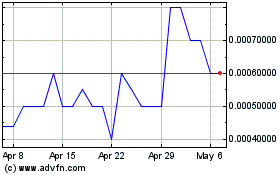

Indoor Harvest (PK) (USOTC:INQD)

Historical Stock Chart

From May 2024 to Jun 2024

Indoor Harvest (PK) (USOTC:INQD)

Historical Stock Chart

From Jun 2023 to Jun 2024