Brazil's Embraer Seeks to Raise $500 Million from Overseas Bonds Issue - Source

June 12 2012 - 10:49AM

Dow Jones News

Brazilian aircraft manufacturer Embraer S.A. (ERJ, EMBR3.BR) is

planning to raise $500 million from an overseas bonds issue, a

person close to the transaction said Tuesday.

Earlier Tuesday, the company announced it hired Citigroup, Banco

Itau BBA and Morgan Stanley to coordinate the operation.

The company said it will use the proceeds to finance its working

capital.

"After positive news from Europe over the weekend, local

companies saw a window of opportunity right now to tap the debt

market with demand for their bonds," said the person, who declined

to be named for this article.

In addition, Latin America's biggest bank by assets, Brazil's

state-run Banco do Brasil S.A. (BDORY, BBAS3.BR), also is tapping

the international bond market in order to raise $500 million.

Global markets cheered the weekend deal to recapitalize Spain's

banking sector, which has been weighed down by bad loans doled out

during the country's real estate boom. The European Union will loan

Spain up to $125 billion, with the final tally set to be disclosed

by independent auditors later this month. The deal eliminates, for

the moment, a key pressure point in the ongoing European financial

crisis.

Write to Rogerio Jelmayer at rogerio.jelmayer@dowjones.com

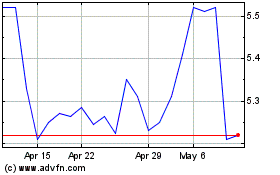

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Jun 2024 to Jul 2024

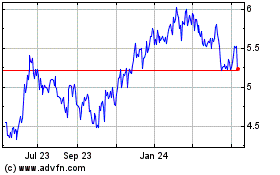

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Jul 2023 to Jul 2024