Abacus to Close $3.0 Million Unit Offering

March 02 2012 - 4:00PM

Marketwired Canada

Abacus Mining & Exploration Corporation (TSX VENTURE:AME) ("Abacus" or the

"Company") is pleased to report that the previously announced non-brokered

private placement has been increased to approximately $3.0 million in units of

the Company ("Units").

Each Unit carries a price of $0.22 per Unit and consists of one common share and

one-half of a common share purchase warrant. Each full warrant will be

exercisable to purchase one common share at a price of $0.32 per common share

for twelve months from the date of closing of the financing, which is expected

to occur on or about March 9, 2012. The securities issued will be subject to a

four month hold period under Canadian securities laws. Fees may be payable on a

portion of the financing. The financing is subject to regulatory approval.

Proceeds from the financing will be used to continue to advance the Company's

interest in the Ajax copper-gold project located near Kamloops, B.C., a joint

venture with global copper producer KGHM Polska Miedz S.A., and for general

corporate and working capital purposes.

On Behalf of the Board,

ABACUS MINING AND EXPLORATION CORPORATION

James D. Excell, President & CEO

Donna Yoshimatsu, Director, Investor Relations

About Abacus

Abacus is a mineral exploration and mine development company with a feasibility

stage copper-gold project located in the Ajax Mining Camp near Kamloops, B.C.

The Ajax copper-gold project is a joint venture between Abacus Mining &

Exploration Corp. and KGHM Polska Miedz S.A. ("KGHM") through KGHM Ajax Mining

Inc. ("KGHM Ajax") currently owned 49% by Abacus and 51% by KGHM.

On December 21, 2011 Abacus announced robust feasibility study results

supporting production of a total of 2.5 billion lbs of copper and 2.28 million

ozs of gold in concentrate, or an average of approximately 109 million lbs of

copper and 99,000 ozs of gold annually, over a 23 year mine life. The proposed

mine plan envisages a conventional open pit operation processing 60,000 tonnes

per day or 21.9 million tonnes per year of ore. (see Report titled "Ajax

Copper/Gold Project - Kamloops, British Columbia Feasibility Study Technical

Report" by Wardrop (a Tetra Tech Company) dated January 6, 2012 ("FS"))

Pursuant to the Joint Venture Shareholders' Agreement among Abacus, KGHM and

KGHM Ajax, KGHM has 90 days to acquire a further 29% in KGHM Ajax for cash

consideration equal to 29% of the proven and probable copper equivalent reserves

as defined in the FS, to a maximum of US$35 million, towards use by Abacus for

its share of project capital. In the event that KGHM chooses not to increase its

interest in the joint venture, Abacus then has 90 days to elect to purchase

KGHM's 51% interest for US$37 million, and 90 days thereafter to close on this

purchase. Should Abacus choose not to purchase KGHM's interest in its entirety,

Abacus' interest in the joint venture can be increased to 51% by paying

approximately US$1.5 million to KGHM.

Forward-Looking Information

This release includes certain statements that are deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address events or developments that Abacus expects to occur, are

forward-looking statements. Forward-looking statements are statements that are

not historical facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or conditions

"will", "would", "may", "could" or "should" occur. Although the Company believes

the expectations expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of future performance

and actual results may differ materially from those in the forward-looking

statements. Factors that could cause the actual results to differ materially

from those in forward-looking statements include changes to commodity prices,

mine and metallurgical recovery, operating and capital costs,foreign exchange

rates, ability to obtain required permits on a timely basis, exploitation and

exploration successes, continued availability of capital and financing, and

general economic, market or business conditions. Investors are cautioned that

any such statements are not guarantees of future performance and actual results

or developments may differ materially from those projected in the

forward-looking statements. Forward-looking statements are based on the beliefs,

estimates and opinions of the Company's management on the date the statements

are made. Except as required by applicable securities laws, the Company

undertakes no obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors, should

change.

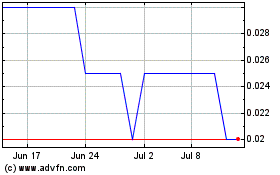

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024