Abacus Files Ajax Copper-Gold Project Feasibility Study Technical Report

January 10 2012 - 8:00AM

Marketwired Canada

Abacus Mining & Exploration Corporation (TSX VENTURE:AME) ("Abacus") is pleased

to announce that further to its news release of December 21, 2011, the Ajax

Project Feasibility Study Technical Report has been filed under AME's profile on

SEDAR at www.sedar.com and on AME's website at www.amemining.com.

The NI 43-101 compliant independent Feasibility Study supports a 60,000 tonne

per day conventional milling plant, producing a copper-gold concentrate

containing 25% Cu and 18 g/t Au. The Study was led by Tetra Tech WEI (Wardrop)

in conjunction with a team of globally recognized consultants.

The previously announced highlights of the Ajax Project include:

Base Case Highlights: (all economic figures in US$)

-- Total proven and probable mineral reserves of 3 billion lbs Cu and 2.7

million ozs Au at 0.27% Cu and 0.17 g/t Au based on $2.50 Cu and $1,085

Au

-- 23 year mine life at a processing rate of 60,000 t/d or 21.9 million t/a

at a LOM stripping ratio of 2.4:1

-- LOM production of 2.5 billion lbs Cu and 2.28 million ozs Au in

concentrate

-- Initial capital costs of $795 million, including contingency of $87

million

-- Cash cost per lb of copper of $1.28 net of gold credits

The base case of the pre-tax economic model has an internal rate of return (IRR)

of 14.5% and a net present value (NPV) of US$416 million at an 8% discount rate,

with payback of the initial capital of 7.8 years. The following table shows the

leverage to increases in metal prices from the base case scenario.

---------------------------------------------------------------------------

Base Case Alternate Case Alternate Case

Scenario Scenario1 Scenario2

---------------------------------------------------------------------------

Cu US$/lb $2.75 $3.00 $ 3.50

---------------------------------------------------------------------------

Au US$/oz $1,085 $1,300 $1,700

---------------------------------------------------------------------------

Exchange Rate (US$:C$) 0.92 0.94 0.98

---------------------------------------------------------------------------

Pre-tax Internal Rate of

Return 14.5% 19.5% 30.3%

---------------------------------------------------------------------------

Cash Cost per lb Cu (net of

gold credits) $1.28 $1.11 $0.79

---------------------------------------------------------------------------

Pre-Tax Net Present Value

(8% discount rate) $416 million $818 million $1,601 million

---------------------------------------------------------------------------

Payback Years 7.8 3.8 2.2

---------------------------------------------------------------------------

Joint Venture Next Steps

Abacus delivered the final Feasibility Study to KGHM in late December 2011 in

accordance with the provisions of the Joint Venture Shareholders' Agreement of

October 12, 2010. KGHM will have 90 days to acquire a further 29% in the Joint

Venture company for a cash consideration equal to 29% of the Proven and Probable

copper equivalent reserve in the FS, to a maximum of US$35 million, towards use

by Abacus for its share of project capital.

In the event that KGHM chooses not to increase its interest in the joint

venture, Abacus then has 90 days to elect to purchase KGHM's 51% interest for

US$37 million, and 90 days thereafter to close on this purchase. Should Abacus

choose not to purchase KGHM's interest in its entirety, Abacus' interest in the

Joint Venture can be increased to 51% by paying approximately US$1.5 million to

KGHM.

The technical information in this news release has been reviewed and approved by

Dave Laudrum, P.Geo., Abacus's Chief Geologist and qualified person for the Ajax

Project within the meaning of National Instrument 43-101.

On Behalf of the Board,

ABACUS MINING AND EXPLORATION CORPORATION

James D. Excell, President & CEO

Donna Yoshimatsu, Director, Investor Relations

About Abacus

Abacus Mining is a mineral exploration and mine development company with a

feasibility stage copper-gold project located in the Ajax Mining Camp southwest

of Kamloops, B.C. The Ajax copper-gold project is a joint venture between Abacus

Mining & Exploration and KGHM Polska Miedz through KGHM Ajax Mining Inc. owned

49% by Abacus and 51% by KGHM. The December 2011 feasibility study confirms a

proven and probable reserve of approximately 3 billion lbs copper and 2.7

million ozs gold supporting an average annual production of 109 million lbs

copper and 99,000 oz gold over 23 years at a rate of 60,000 tonnes per day. The

environmental review and permitting process was initiated in early 2011 with the

submission of the Project Description, a copy of which is available on the

Company's website and www.eao.gov.bc.ca.

Forward-Looking Information

This release includes certain statements that are deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address events or developments that Abacus Mining and Exploration

Corp. (the "Company") expects to occur, are forward-looking statements.

Forward-looking statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects", "plans",

"anticipates", "believes", "intends", "estimates", "projects", "potential" and

similar expressions, or that events or conditions "will", "would", "may",

"could" or "should" occur. Although the Company believes the expectations

expressed in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual

results may differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially from those in

forward-looking statements include changes to commodity prices, mine and

metallurgical recovery, operating and capital costs,foreign exchange rate, and

ability to obtain required permits on a timely basis including permission from

Kinder Morgan to have access to the pipeline right-of-way, exploitation and

exploration successes, and continued availability of capital and financing, and

general economic, market or business conditions. Investors are cautioned that

any such statements are not guarantees of future performance and actual results

or developments may differ materially from those projected in the

forward-looking statements. Forward-looking statements are based on the beliefs,

estimates and opinions of the Company's management on the date the statements

are made. Except as required by applicable securities laws, the Company

undertakes no obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors, should

change.

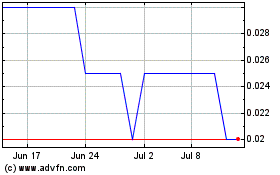

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024