Abacus Files Final Prospectus

December 21 2009 - 7:01AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES.

Abacus Mining & Exploration Corporation (the "Company" or "Abacus") (TSX

VENTURE:AME) is pleased to announce that it has filed a final prospectus in each

of the Provinces of Canada, other than Quebec, in connection with an offering of

18,882,500 units (the "Units") and 11,900,000 flow-through common shares (the

"Flow-through Shares"), on a best efforts basis, at a price of C$0.20 per Unit

and C$0.25 per Flow-through Share for aggregate gross proceeds to the Company of

C$6,751,500 (the "Offering"). The Offering is being conducted through a

syndicate of agents ("Agents") co-led by Haywood Securities Inc. and Canaccord

Financial Ltd.

Each Unit will consist of one common share in the capital of the Company (a

"Common Share") and one transferable common share purchase warrant (each, a

"Warrant"). Each Warrant will entitle the holder to acquire one Common Share at

a price per Common Share of C$0.30 for a period of 36 months following the

closing date of the Offering. In addition, the Company has granted the Agents an

over-allotment option (the "Option") to increase the size of the Offering by 15%

on the same terms. The Option may be exercised, in whole or in part, at any time

up to the closing date of the Offering. The Company has agreed to pay the Agents

a 7.0% cash commission as well as compensation options entitling the Agents to

purchase that number of Units of the Company equal to 6.0% of the aggregate

number of Units and Flow-through Shares sold under the Offering at an exercise

price of C$0.20 per Unit for a period of 36 months following the closing date of

the Offering. The Offering is expected to close no later than December 31, 2009.

The gross proceeds from the sale of Flow-through Shares will be used to incur

Canadian Exploration Expenses (as defined under the Income Tax Act (Canada)) at

the Company's Afton-Ajax project. The net proceeds from the sale of Units will

be used for working capital and general corporate purposes, including advancing

the pre-feasibility study on the Ajax project.

The Offering is subject to the receipt of all necessary approvals, including the

approval of the TSX Venture Exchange.

The Units and Flow-through Shares have not been, nor will they be, registered

under the United States Securities Act of 1933, as amended, and may not be

offered or sold within the United States, or to or for the account or benefit

of, U.S. persons without registration or pursuant to an applicable exemption

from U.S. registration requirements.

This press release does not constitute an offer to sell, nor is it a

solicitation of an offer to buy, securities.

About the Company

Abacus is an exploration and development company with a 43-101 compliant

positive preliminary economic assessment report (announced June 22, 2009) for

its Ajax copper/gold project located 10 kilometres southwest of Kamloops,

British Columbia. The report contemplates a 60,000 tonne per day operation

producing an average 106 million pounds of copper and 99,400 ounces of gold in

concentrate annually. Sensitivity analyses approximating metal prices (US$2.75

per pound copper and US$1,000 per ounce gold) in the assessment indicate a NPV

of $1.2 billion discounted 8% over a 23 year mine life, with an IRR of 31.3%,

cash costs of $0.90 per pound copper, and payback of 2.3 years. The Ajax

extension remains open along strike and at depth. Mineral resources that are not

mineral reserves do not have demonstrated economic viability.

Eco Tech Laboratory Ltd. of Kamloops, B.C., will complete all of Abacus'

analytical work on the project. A quality-control program, using specific

standards and blank samples is in place. Robert G. Friesen, P.Geo., the

Company's Senior Geologist, is the Qualified Person responsible for the design

and conduct of the work performed.

On Behalf of the Board

ABACUS MINING & EXPLORATION CORPORATION

Doug Fulcher, President and Chief Executive Officer

Forward-Looking Information

This release includes certain statements that may be deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address events or developments that Abacus Mining and Exploration

Corporation (the "Company") expects to occur, are forward-looking statements.

Forward-looking statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects", "plans",

"anticipates", "believes", "intends", "estimates", "projects", "potential" and

similar expressions, or that events or conditions "will", "would", "may",

"could" or "should" occur. Although the Company believes the expectations

expressed in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual

results may differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially from those in

forward-looking statements include market prices, exploitation and exploration

successes, and continued availability of capital and financing, and general

economic, market or business conditions. Investors are cautioned that any such

statements are not guarantees of future performance and actual results or

developments may differ materially from those projected in the forward-looking

statements. Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made. Except

as required by applicable securities laws, the Company undertakes no obligation

to update these forward-looking statements in the event that management's

beliefs, estimates or opinions, or other factors, should change.

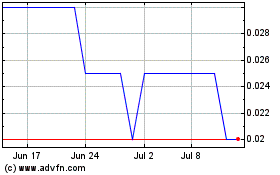

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024