International Tower Hill Mines Files 2011 Audited Annual Financial Statements and NI 43-101 Technical Report

August 29 2011 - 4:30PM

Marketwired Canada

International Tower Hill Mines Ltd. ("ITH" or the "Company") (TSX:ITH)(NYSE

Amex:THM)(FRANKFURT:IW9) announces that it has filed its audited financial

statements, associated management discussion and analysis, Annual Information

Form and Annual Report on Form 40F for the year ended May 31, 2011 on August 29,

2011. The Company has also filed a National Instrument 43-101 Report dated

August 26, 2011 containing its latest Preliminary Economic Assessment (PEA) and

Resource Estimate on SEDAR. All of these documents will be available for viewing

on SEDAR and EDGAR on Tuesday, August 30, 2011.

Clarification on August 23, 2011 News Release

The Company also wishes to clarify capital expenditure figures included in press

release NR11-14 dated August 23, 2011. An updated PEA completed on the Company's

Livengood Gold Project has estimated an initial capital cost of $1.61 Billion,

which includes $323 Million in contingency but does not include sustaining

capital costs estimated to be $585 Million. The Life of Mine capital

expenditures for the Livengood project is therefore estimated to be $2.19

Billion over a 23-year mine life (see Table 1 below). All other figures were

highlighted in the news release and the full PEA report will be available for

viewing on the SEDAR website on Tuesday, August 30, 2011.

Table 1: Expected Capital Costs

----------------------------------------------------------------------------

Items Capital Costs (millions)

----------------------------------------------------------------------------

Mining $ 271.4

----------------------------------------------------------------------------

Processing Plant $ 499.8

----------------------------------------------------------------------------

Infrastructure and Tailing Management $ 203.9

----------------------------------------------------------------------------

Other (Owners' cost, EPCM, Indirect costs etc.) $ 315.9

----------------------------------------------------------------------------

Contingency $ 323.0

----------------------------------------------------------------------------

Total Initial CAPEX $ 1,613.8

----------------------------------------------------------------------------

Sustaining Capital (over 23 years) $ 585

----------------------------------------------------------------------------

Total Life of Mine CAPEX $ 2,198.8

----------------------------------------------------------------------------

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class

Livengood Gold Project accessible by paved highway 70 miles north of Fairbanks,

Alaska. In 2011 ITH is focused on the rapid advancement of the Livengood project

into a compelling potential development scenario while it continues to expand

its current resource and explore its 145 km2 district for new deposits.

On behalf of International Tower Hill Mines Ltd.

James J. Komadina, Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking

information (collectively, "forward-looking statements") within the meaning of

applicable Canadian and US securities legislation. All statements, other than

statements of historical fact, included herein including, without limitation,

statements regarding the anticipated content, commencement, completion and cost

of exploration programs, anticipated exploration program results and the timing

thereof, the discovery and delineation of mineral deposits/resources/reserves,

the potential for the expansion of the estimated resources at Livengood, the

potential for any production at the Livengood project, the potential for higher

grade mineralization to form the basis for initial surface mining phases in any

extraction scenario, the potential low strip ratio of the Livengood deposit

being amenable for low cost surface mining techniques that could support a high

production rate and economies of scale, the potential to optimize currently

anticipated Livengood mineralization treatment options, the timing of the

completion of the pre-feasibility study for Livengood, the potential for a

production decision to be made, the potential commencement of any development of

a mine at Livengood following a production decision, business and financing

plans and business trends, are forward-looking statements. Information

concerning mineral resource estimates and the preliminary economic analysis

thereof also may be deemed to be forward-looking statements in that it reflects

a prediction of the mineralization that would be encountered, and the results of

mining it, if a mineral deposit were developed and mined. Although the Company

believes that such statements are reasonable, it can give no assurance that such

expectations will prove to be correct.

Forward-looking statements are typically identified by words such as: believe,

expect, anticipate, intend, estimate, postulate, proposed, planned, potential

and similar expressions, or are those, which, by their nature, refer to future

events. The Company cautions investors that any forward-looking statements by

the Company are not guarantees of future results or performance, and that actual

results may differ materially from those in forward looking statements as a

result of various factors, including, but not limited to, variations in the

nature, quality and quantity of any mineral deposits that may be located,

variations in the market price of any mineral products the Company may produce

or plan to produce, the inability of the Company to obtain any necessary

permits, consents or authorizations required for its activities, the inability

of the Company to produce minerals from its properties successfully or

profitably, to continue its projected growth, to raise the necessary capital or

to be fully able to implement its business strategies, and other risks and

uncertainties disclosed in the Company's Annual Information Form filed with

certain securities commissions in Canada and the Company's annual report on Form

40-F filed with the United States Securities and Exchange Commission (the

"SEC"), and other information released by the Company and filed with the

appropriate regulatory agencies. All of the Company's Canadian public disclosure

filings may be accessed via www.sedar.com and its United States public

disclosure filings may be accessed via www.sec.gov, and readers are urged to

review these materials, including the technical reports filed with respect to

the Company's Livengood property.

This press release is not, and is not to be construed in any way as, an offer to

buy or sell securities in the United States.

NR11-15

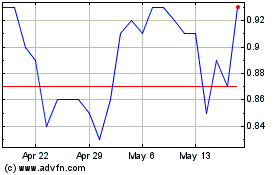

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From May 2024 to Jun 2024

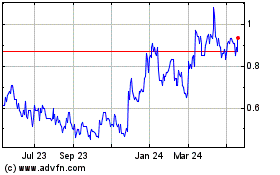

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jun 2023 to Jun 2024