Canadian Banc Recovery Corp.: Regular Monthly Dividend Declaration for Class A and Preferred Share

December 20 2010 - 8:00AM

Marketwired Canada

Canadian Banc Recovery Corp (formerly Prime Rate Plus Corp) ("The Company")

declares its regular monthly distribution of $0.06250 (5.00% annualized) for

each Class A share which reflects the distribution policy of prime rate in

Canada (3.00% as at December 15, 2010) plus 2% annually. The Company also

declares its regular monthly distribution of $0.04167 (5.00% annualized) for

each Preferred share which reflects the distribution policy of prime rate plus

0.75% annually. An annual Class A and Preferred share payment of 5.00% is the

minimum payment as per the prospectus. Distributions are payable January 10,

2011 to shareholders on record as of December 31, 2010.

Since inception Class A shareholders have received a total of $5.05 per share

and Preferred shareholders have received a total of $3.15 per share inclusive of

this distribution, for a combined total of $8.20 per share.

The Company invests in a portfolio of six publicly traded Canadian Banks as

follows: Bank of Montreal, Canadian Imperial Bank of Commerce, National Bank of

Canada, Royal Bank of Canada, Bank of Nova Scotia, Toronto- Dominion Bank.

Shares held within the portfolio are expected to range between 5-20% in weight

but may vary at any time. To generate additional returns above the dividend

income earned on the portfolio, The Company will engage in a selective covered

call writing program.

Distribution Details:

Class A Share (BK) $0.06250

Preferred Share (BK.PR.A) $0.04167

Ex-Dividend Date: December 29, 2010

Record Date: December 31, 2010

Payable Date: January 10, 2011

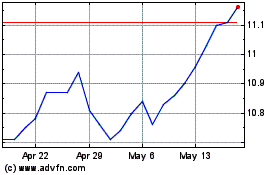

Canadian Banc (TSX:BK)

Historical Stock Chart

From May 2024 to Jun 2024

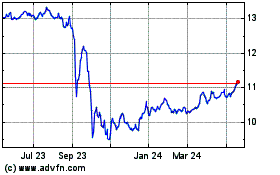

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jun 2023 to Jun 2024