0001828248

false

0001828248

2023-08-01

2023-08-01

0001828248

CVII:UnitsEachConsistingOfOneShareOfClassCommonStock0.0001ParValueAndOnefifthOfOneWarrantMember

2023-08-01

2023-08-01

0001828248

us-gaap:CommonClassAMember

2023-08-01

2023-08-01

0001828248

us-gaap:WarrantMember

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 1, 2023

CHURCHILL CAPITAL CORP VII

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40051 |

85-3420354 |

(State

or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS

Employer

Identification No.) |

640 Fifth Avenue, 12th Floor

New York, NY 10019

(Address of principal

executive offices, including zip code)

Registrant’s telephone number,

including area code: (212) 380-7500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| |

| |

| |

x | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| |

| |

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| |

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-fifth of one warrant |

|

CVII.U |

|

New York Stock Exchange |

| |

|

|

|

|

| Shares of Class A common stock |

|

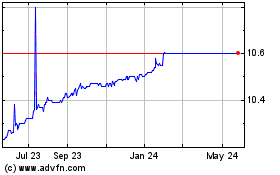

CVII |

|

New York Stock Exchange |

| |

|

|

|

|

| Warrants |

|

CVII WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On August 1,

2023, Churchill Capital Corp VII (“CCVII”) and CorpAcq Holdings Limited,

a private limited company incorporated under the laws of England and Wales (“CorpAcq”)

issued a press release (the “Press Release”) announcing the entry by

CCVII into a definitive agreement with respect to a business combination (together with the other transactions contemplated thereby,

the “Transactions”) with CorpAcq. The Press Release is attached hereto

as Exhibit 99.1 and incorporated by reference herein.

Attached as

Exhibit 99.2 and incorporated by reference herein is an investor presentation, dated August 2023, that will be used by CCVII with

respect to the Transactions.

Additional Information and Where to Find It

In connection with the Transactions, CorpAcq or CCVII (or an affiliate

of CorpAcq) is expected to file a registration statement on Form F-4 or any other applicable form (the “Registration Statement”)

with the Securities and Exchange Commission (“SEC”), which will include preliminary and definitive proxy statements

to be distributed to CCVII’s shareholders in connection with CCVII’s solicitation for proxies for the vote by CCVII’s

shareholders in connection with the Transactions and other matters to be described in the Registration Statement, as well as the prospectus

relating to the offer of the securities to be issued to CCVII’s shareholders in connection with the completion of the Transactions.

After the Registration Statement has been filed and declared effective, CCVII will mail a definitive proxy statement/prospectus and other

relevant documents to its shareholders as of the record date established for voting on the Transactions. This communication does not contain

all the information that should be considered concerning the Transactions and is not intended to form the basis of any investment decision

or any other decision in respect of the Transactions. Before making any voting or other investment decisions, CCVII’s shareholders

and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus statement and any amendments

thereto and, once available, the definitive proxy statement/prospectus, in connection with CCVII’s solicitation of proxies for its

special meeting of shareholders to be held to approve, among other things, the Transactions, as well as other documents filed with the

SEC by CCVII in connection with the Transactions, as these documents will contain important information about CorpAcq, CCVII and the Transactions.

Shareholders may obtain a copy of the preliminary or definitive proxy statement/prospectus, once available, as well as other documents

filed by CCVII with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to Churchill

Capital Corp VII at 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Forward-Looking Statements

This Current Report includes “forward looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation

Reform Act of 1995. Forward looking statements may be identified by the use of words such as “estimate,”

“plan,” “project,” “forecast,” “intend,” “will,” “expect,”

“anticipate,” “believe,” “seek,” “target,” “continue,”

“could,” “may,” “might,” “possible,” “potential,” “predict”

or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

CCVII and CorpAcq have based these forward looking statements on each of its current expectations and projections about future

events. These forward looking statements include, but are not limited to, statements regarding estimates and forecasts of financial

and operational metrics. These statements are based on various assumptions, whether or not identified in this communication, and on

the current expectations of CorpAcq’s and CCVII’s management and are not predictions of actual performance. Nothing in

this communication should be regarded as a representation by any person that the forward looking statements set forth herein will be

achieved or that any of the contemplated results of such forward looking statements will be achieved. These forward looking

statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor

as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are

difficult or impossible to predict and may materially differ from assumptions. Many actual events and circumstances are beyond the

control of CCVII and CorpAcq. These forward looking statements are subject to known and unknown risks, uncertainties and assumptions

about CCVII and CorpAcq that may cause each of its actual results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or achievements expressed or implied by such forward looking

statements. Such risks and uncertainties include changes in domestic and foreign business changes in the competitive environment in

which CorpAcq operates; CorpAcq's ability to manage its growth prospects, meet its operational and financial targets, and execute

its strategy; the impact of any economic disruptions, decreased market demand and other macroeconomic factors, including the effect

of the COVID 19 pandemic, to CorpAcq's business, projected results of operations, financial performance or other financial metrics;

expectations as to future growth in demand for CorpAcq's products and services; CorpAcq's ability to maintain and develop its IT

systems or data storage, including the security of its product offering, or anticipate, manage or adopt technological advances

within its industry; CorpAcq's reliance on its senior management team and key employees; risks related to liquidity, capital

resources and capital expenditures; failure to comply with applicable laws and regulations or changes in the regulatory environment

in which CorpAcq operates; the outcome of any potential litigation, government and regulatory proceedings, investigations and

inquiries that CorpAcq may face; the inability of the parties to successfully or timely consummate the Transactions, including the

risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could

adversely affect the combined company or the expected benefits of the Transactions or that the approval of the shareholders of CCVII

is not obtained; the risk that shareholders of CCVII could elect to have their shares redeemed by CCVII, thus leaving the combined

company insufficient cash to complete the Transactions or grow its business; the outcome of any legal proceedings that may be

instituted against CorpAcq or CCVII following announcement of the Transactions; failure to realize the anticipated benefits of the

Transactions; risks relating to the uncertainty of the projected financial information with respect to CorpAcq; the effects of

competition; changes in applicable laws or regulations; the ability of CorpAcq to manage expenses and recruit and retain key

employees; the ability of CCVII or the combined company to issue equity or equity linked securities in connection with the

Transactions or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and

inquiries; the impact of the global COVID 19 pandemic or any future pandemic on CorpAcq, CCVII, the combined company’s

projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks; those factors

discussed in CCVII’s Quarterly Reports filed by CCVII with the SEC on Form 10-Q and the Annual Reports filed by CCVII with the

SEC on Form 10-K, in each case, under the heading “Risk Factors,” and other documents filed, or to be filed, with the

SEC by CCVII. If any of these risks materialize or CorpAcq’s or CCVII’s assumptions prove incorrect, actual results

could differ materially from the results implied by these forward looking statements. There may be additional risks that neither

CorpAcq nor CCVII presently know or that CorpAcq and CCVII currently believe are immaterial that could also cause actual results to

differ materially from those contained in the forward looking statements. In addition, forward looking statements reflect

CorpAcq’s and CCVII’s expectations, plans or forecasts of future events and views as of the date of this communication.

CorpAcq and CCVII anticipate that subsequent events and developments will cause CorpAcq’s and CCVII’s assessments to

change. However, while CorpAcq and CCVII may elect to update these forward looking statements at some point in the future, CorpAcq

and CCVII specifically disclaim any obligation to do so. These forward looking statements should not be relied upon as representing

CorpAcq and CCVII’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance

should not be placed upon the forward looking statements. An investment in CorpAcq or CCVII is not an investment in any of

CorpAcq’s or CCVII’s founders’ or sponsors’ past investments or companies or any funds affiliated with any

of the foregoing. The historical results of these investments are not indicative of future performance of CorpAcq or CCVII, which

may differ materially from the performance of past investments, companies or affiliated funds.

No Offer or Solicitation

This Current Report does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a proxy statement or solicitation of a proxy,

a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or

exemptions therefrom.

Participants in the Solicitation

CorpAcq, CCVII, Churchill Sponsor VII LLC and their directors and

executive officers may be deemed participants in the solicitation of proxies from CCVII’s shareholders with respect to the Transactions.

A list of the names of CCVII’s directors and executive officers and a description of their interests in CCVII is set forth in CCVII’s

filings with the SEC (including CCVII’s prospectus related to its initial public offering filed with the SEC on February 16, 2021

and Annual Reports filed by CCVII with the SEC on Form 10-K) and are available free of charge at the SEC’s website located at www.sec.gov,

or by directing a written request to Churchill Capital Corp VII at 640 Fifth Avenue, 12th Floor, New York, NY 10019. Additional information

regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the

definitive proxy statement/prospectus when it becomes available. Shareholders, potential investors and other interested persons should

read the definitive proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

You may obtain free copies of these documents from the sources indicated above.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 1, 2023

| |

Churchill Capital Corp VII |

| |

|

| |

By: |

/s/ Jay Taragin |

| |

|

Name: |

Jay Taragin |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

CorpAcq to Go Public via Business Combination

with Churchill Capital Corp VII

CorpAcq is a corporate compounder and preferred

acquirer of founder-led small and medium-sized enterprises in the UK anchored by a diversified portfolio of 41 stable and profitable businesses

Transaction is expected to provide CorpAcq with

capital to optimize its balance sheet and the opportunity to fund accelerated growth and scale with a broader acquisition pipeline

CorpAcq has grown revenue at an annual rate

of 16% and adjusted EBITDA1 of 17%

over the last 4 years including average organic revenue growth of 4% and subsidiary-level profit growth of 7%, respectively

Transaction implies an initial enterprise value

of approximately $1.58 billion, providing an attractive entry point for Churchill VII’s shareholders at approximately 10x current

year adjusted EBITDA

CorpAcq intends to initiate a dividend policy

from closing targeting an attractive dividend yield that will be supported by free cash flow from current operations

ALTRINCHAM, England and NEW YORK August 1, 2023

– CorpAcq Holdings Limited (“CorpAcq”), a corporate compounder with a proven track record of acquiring and supporting

founder-led businesses, and Churchill Capital Corp VII (“Churchill VII”) (NYSE: CVII), a special purpose acquisition company,

announced today that they have entered into a definitive agreement for a business combination (the “transaction”). The transaction

values CorpAcq at a pro forma enterprise value of approximately $1.58 billion and is expected to provide CorpAcq with up to $592 million

in the cash held in Churchill VII’s trust account (assuming no redemptions), which will help facilitate advancing CorpAcq’s

strategy and accelerating its growth initiatives. Upon closing of the transaction, the combined company (the “Company”) will

operate as CorpAcq and intends to list on the New York Stock Exchange.

Based in Altrincham, England and founded in 2006, CorpAcq has

cultivated a leading reputation as a “preferred buyer” for founder-led small and medium-sized enterprises

(“SMEs”) based on its founder-friendly, management empowered value proposition and focus on investing for long-term

performance. Through a disciplined approach, CorpAcq has acquired and built a diversified portfolio of

well-established businesses in the UK with strong asset bases, high barrier to entry business models, profitable growth, free cash

flow generation and experienced management teams who typically remain in-place after acquisition. As of the end of July 2023,

CorpAcq's portfolio consists of 41 businesses. The average age of its existing portfolio of companies is greater than 30 years old

with at least one member of the pre-acquisition management teams still represented in 98% of the acquired companies. CorpAcq is one

of a small group of companies in the Northern European region that employ the compounder model of acquiring and holding small to

medium-sized businesses, at least one of which has grown to a portfolio size of more than 225 companies.

CorpAcq’s approach to maintaining autonomy within its businesses

and commitment to a perpetual ownership horizon has enabled it to purchase quality businesses at attractive single-digit multiples of

cash flow and generate strong returns on investment. CorpAcq management helps to professionalize each business it acquires and provide

a range of support functions that drive long-term operational improvements, growth, and sustainability. This acquisition strategy, supplemented

by the current portfolio of mature and stable companies, creates an opportunity for investors to own a differentiated platform with a

compelling combination of potential for earnings growth and strong risk-adjusted returns. Additionally, CorpAcq expects to initiate an

annual dividend policy following the close of the transaction that is supported by the underlying cash flow generated from the current

portfolio.

1

Adjusted EBITDA definition and reconciliation provided in the appendix.

Churchill Capital is a leader in listed equity growth vehicles. Churchill

Capital invests in, executes value-enhancement strategies for and provides other support for high-quality, entrepreneurial businesses

in the public markets. Its public equity growth vehicles have a track record of acquiring profitable, growing businesses of scale. Churchill

VII consummated its initial public offering in February 2021.

Simon Orange, Chairman and Founder of CorpAcq, said, “Today is

an exciting milestone in CorpAcq’s history and validation of our team, our tremendous growth and our approach of partnering closely

with and empowering portfolio companies to drive long-term performance. We are thrilled to partner with Churchill VII. With their team’s

deep M&A and capital markets expertise, track record of value-added investing in companies as well as an extensive relationship network,

we are confident that Churchill VII is the right partner to propel CorpAcq’s next phase of growth. As a public company, we believe

CorpAcq will be better positioned to accelerate organic growth, expand our acquisition pipeline deeper in the UK and deliver compounding

returns to shareholders, all while staying true to our ethos of fostering autonomy at our portfolio companies and investing over a long

time horizon.”

Michael Klein, Chairman and CEO of Churchill VII, said, “When

we launched Churchill VII, we wanted to identify a profitable, cash flow generating partner with strong management, a highly differentiated

business model and clear growth opportunities. We believe CorpAcq fits all our criteria and more with its proven acquisition and operating

strategy, established positioning in the UK SME space, track record of topline growth and profitability and talented management team.

With its meaningful financial returns, current industry positioning, substantial cash flow to support dividends and upside potential to

accelerate its acquisition pace in new markets, we believe the Company is a highly attractive opportunity for shareholders. We look forward

to working with Simon and the rest of CorpAcq’s management team as we position this business for future success.”

CorpAcq Founder and Chairman Simon Orange will continue to lead the

Company, along with Chief Executive Officer David Martin and the rest of CorpAcq’s seasoned leadership team.

Key CorpAcq Highlights

| · | Track Record of Revenue Growth, Profitability and Cash Flow Generation: Since its inception, CorpAcq has delivered meaningful

financial returns and sustained value over several economic cycles with prudent financial leverage. The Company has a record of organic

topline growth and cash flow generation with a disciplined, lower-risk acquisition strategy that has diversified and enhanced the CorpAcq

platform. From 2018 to 2022, CorpAcq reported a compound annual growth rate (CAGR) for revenue of 16%, with average organic growth outpacing

the UK GDP, and an adjusted EBITDA2 CAGR

of 17% during the same period. CorpAcq exited 2022 at a run-rate of $850 million revenue and adjusted EBITDA of $133 million3

and has added an additional $80 million of revenue and $12 million of subsidiary-level profit4

from acquisitions year to date. This strong performance has continued into 2023 with organic subsidiary-level profit growth increasing by 8% in the

first half of the year. |

2

Adjusted EBITDA definition and reconciliation provided in the appendix.

3

Sum of FY2022 Adj. EBITDA for CorpAcq and incremental subsidiary-level profit from 2022 acquisitions

4

Subsidiary-level profit is measured as earnings before interest, tax, depreciation and amortization and excludes management fees to CorpAcq.

| · | Diversified Portfolio Aligned with Favorable End-Markets and Risk Mitigation: Anchored by stable, mature UK SMEs across multiple

large industries, CorpAcq’s portfolio of 41 businesses creates diversification and helps contribute to overall portfolio resilience

through economic cycles. CorpAcq’s businesses have a long, well-established history of operating successfully and are aligned with

attractive industry trends in the UK with exposure to essential end-markets, providing a clear opportunity for organic growth to outperform

GDP. |

| · | “Preferred Buyer” Status Driven by Management-Empowered Value Proposition: CorpAcq offers an alternative equity

avenue for founders of SMEs who want to remain involved in their companies and empower existing management teams to accelerate business

performance while maintaining their brand, identification, and legacy. CorpAcq looks to be a strategic partner to these businesses, helping

to professionalize the operations and drive sustained operational improvements. This approach has allowed CorpAcq to become a “preferred

buyer” for profitable, well-established, founder-led SMEs in the UK by maintaining autonomy within the business through a decentralized

and scalable structure and holding the investment over a perpetual horizon. |

| · | Strong and Experienced Management Team: Led by Founder and Chairman Simon Orange and CEO David Martin, CorpAcq has a highly

qualified and long-tenured management team that has a demonstrated track record of success with its established M&A playbook and operating

business model. The leadership team brings together the necessary commercial knowledge, extensive networks and operational expertise to

drive successful acquisitions and value creation. |

| · | Attractive and Growing Acquisition Pipeline: With its strong reputation and proprietary sourcing channels, CorpAcq has a robust

pool of opportunities in its core UK market where there is a large total addressable market of more than 90,000 companies in key sectors

to CorpAcq, including residential and nonresidential construction, manufacturing, infrastructure, industrials, transportation and consumer.

In addition, the increased capital from the public markets and expertise from Churchill VII will provide CorpAcq the opportunity to scale

its business model to target larger transactions and operate in new geographies over the medium-term. |

| · | Compelling Profile for Compounding Returns for Investors: CorpAcq offers an opportunity for shareholders to own a growth platform

strategy that has generated high risk-adjusted returns at an attractive valuation. CorpAcq’s focus and discipline to acquire stable

and profitable businesses at attractive single-digit multiples of cash flow have led to strong returns on investment and historical double-digit

net income growth. In addition to strong earnings and revenue growth potential, CorpAcq is anticipated to have the capacity to deliver

a strong annual dividend yield with a more flexible capital structure. |

Summary of the Transaction

The transaction values CorpAcq at a pro forma enterprise value of $1.58

billion, providing an attractive entry point for Churchill VII shareholders with a discount to other leading European compounders. The

transaction is expected to deliver up to $592 million in gross proceeds from the cash held in Churchill VII’s trust account (assuming

no redemptions by Churchill VII shareholders). Upon completion of the transaction, CorpAcq expects to have up to approximately $199 million

in cash on its balance sheet, of which $129 million is coming from transaction proceeds, to improve liquidity and financial flexibility,

accelerate growth in its core UK market and expand its pipeline of acquisition opportunities. Assuming no redemptions, existing CorpAcq

shareholders will receive up to approximately $257 million in cash as part of the transaction and are expected to own approximately 46%

of the Company post-close (assuming no redemptions).

In connection with the transaction, Churchill VII’s sponsor has

elected to forfeit 15 million founder shares and unvest an additional 12.1 million shares to align with its shareholders and the long-term

value creation and performance of CorpAcq.

The transaction, which has been approved by the Boards of Directors

of CorpAcq and Churchill VII, is expected to close in late 2023 or early 2024 and is subject to approval by Churchill VII’s shareholders,

Churchill VII having available cash at closing of at least $350 million net of transaction fees and other customary closing conditions.

Additional information about the transaction, including a copy of

the merger agreement will be filed by Churchill VII in a Current Report on Form 8-K with the Securities and Exchange Commission (the

“SEC”) and available at www.sec.gov.

Advisors

Citigroup Global Markets Inc. served as capital markets advisor to

Churchill VII.

Duff & Phelps rendered a fairness opinion to the board of directors

of Churchill VII in connection with the proposed transaction.

Reed Smith LLP served as legal counsel to CorpAcq.

Weil, Gotshal & Manges LLP served as legal counsel to Churchill

VII.

Webcast Details

CorpAcq and Churchill VII will host a joint investor webcast to discuss

the transaction at 12:00 PM ET on August 1, 2023.

To listen to the prepared remarks via telephone, please use the following

information:

| Date: |

Tuesday, August 1, 2023 |

| Time: |

12:00 p.m. Eastern Time |

| U.S. dial-in number: |

1-877-407-0784 |

| International dial-in number: |

1-201-689-8560 |

A telephone replay will be available through August 15. The webcast

will be broadcast live and available for replay at https://viavid.webcasts.com/starthere.jsp?ei=1627767&tp_key=0892cef2a4.

A copy of the investor presentation can be found via CorpAcq's website at corpacq.com.

About CorpAcq Holdings Limited

CorpAcq is a corporate compounder founded in 2006 with deep commercial

experience and a diversified portfolio of 41 companies across more than seven industries. The company has a proven track record of unlocking

business potential, profitability and long-term growth for small and medium-sized enterprises (SMEs) through its established M&A playbook

and decentralized operational approach. Its leaders develop close relationships with management and shareholders to support them with

financial and strategic expertise and lean on existing management to utilize the strategies that made their business successful. The company

is headquartered in the United Kingdom.

About Churchill Capital Corp VII

Churchill Capital Corp VII was formed for the purpose of effecting

a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Forward-Looking Statements

This communication includes “forward looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

Forward looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are

not statements of historical matters. Churchill VII and CorpAcq have based these forward looking statements on each of its current expectations

and projections about future events. These forward looking statements include, but are not limited to, statements regarding estimates

and forecasts of financial and operational metrics. These statements are based on various assumptions, whether or not identified in this

communication, and on the current expectations of CorpAcq’s and Churchill VII’s management and are not predictions of actual

performance. Nothing in this communication should be regarded as a representation by any person that the forward looking statements set

forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved. These forward

looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor

as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult

or impossible to predict and may materially differ from assumptions. Many actual events and circumstances are beyond the control of Churchill

VII and CorpAcq. These forward looking statements are subject to known and unknown risks, uncertainties and assumptions about Churchill

VII and CorpAcq that may cause each of its actual results, levels of activity, performance or achievements to be materially different

from any future results, levels of activity, performance or achievements expressed or implied by such forward looking statements. Such

risks and uncertainties include changes in domestic and foreign business changes in the competitive environment in which CorpAcq operates;

CorpAcq's ability to manage its growth prospects, meet its operational and financial targets, and execute its strategy; the impact of

any economic disruptions, decreased market demand and other macroeconomic factors, including the effect of the COVID 19 pandemic, to CorpAcq's

business, projected results of operations, financial performance or other financial metrics; expectations as to future growth in demand

for CorpAcq's products and services; CorpAcq's ability to maintain and develop its IT systems or data storage, including the security

of its product offering, or anticipate, manage or adopt technological advances within its industry; CorpAcq's reliance on its senior management

team and key employees; risks related to liquidity, capital resources and capital expenditures; failure to comply with applicable laws

and regulations or changes in the regulatory environment in which CorpAcq operates; the outcome of any potential litigation, government

and regulatory proceedings, investigations and inquiries that CorpAcq may face; assumptions or analyses used for CorpAcq's forecasts proving

to be incorrect and causing its actual operating and financial results to be significantly below its forecasts; CorpAcq failing to maintain

its current level of acquisitions or an acquisition not occurring as planned and negatively affecting operating results; the inability

of the parties to successfully or timely consummate the proposed transactions, including the risk that any required regulatory approvals

are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected

benefits of the proposed transactions or that the approval of the shareholders of Churchill VII is not obtained; the risk that shareholders

of Churchill VII could elect to have their shares redeemed by Churchill VII, thus leaving the combined company insufficient cash to complete

the proposed transactions or grow its business; the outcome of any legal proceedings that may be instituted against CorpAcq or Churchill

VII following announcement of the proposed transactions; failure to realize the anticipated benefits of the proposed transactions; risks

relating to the uncertainty of the projected financial information with respect to CorpAcq; the effects of competition; changes in applicable

laws or regulations; the ability of CorpAcq to manage expenses and recruit and retain key employees; the ability of Churchill VII or the

combined company to issue equity or equity linked securities in connection with the proposed transactions or in the future; the outcome

of any potential litigation, government and regulatory proceedings, investigations and inquiries; the impact of the global COVID 19 pandemic

or any future pandemic on CorpAcq, Churchill VII, the combined company’s projected results of operations, financial performance

or other financial metrics, or on any of the foregoing risks; those factors discussed in Churchill VII’s Quarterly Reports filed

by Churchill VII with the SEC on Form 10-Q and the Annual Reports filed by Churchill VII with the SEC on Form 10-K, in each case, under

the heading “Risk Factors,” and other documents filed, or to be filed, with the SEC by Churchill VII. If any of these risks

materialize or CorpAcq’s or Churchill VII’s assumptions prove incorrect, actual results could differ materially from the results

implied by these forward looking statements. There may be additional risks that neither CorpAcq nor Churchill VII presently know or that

CorpAcq and Churchill VII currently believe are immaterial that could also cause actual results to differ materially from those contained

in the forward looking statements. In addition, forward looking statements reflect CorpAcq’s and Churchill VII’s expectations,

plans or forecasts of future events and views as of the date of this communication. CorpAcq and Churchill VII anticipate that subsequent

events and developments will cause CorpAcq’s and Churchill VII’s assessments to change. However, while CorpAcq and Churchill

VII may elect to update these forward looking statements at some point in the future, CorpAcq and Churchill VII specifically disclaim

any obligation to do so. These forward looking statements should not be relied upon as representing CorpAcq and Churchill VII’s

assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward

looking statements. An investment in CorpAcq or Churchill VII is not an investment in any of CorpAcq’s or Churchill VII’s

founders’ or sponsors’ past investments or companies or any funds affiliated with any of the foregoing. The historical results

of these investments are not indicative of future performance of CorpAcq or Churchill VII, which may differ materially from the performance

of past investments, companies or affiliated funds.

Non-GAAP Financial Measures

This communication includes Adjusted EBITDA, which is not presented

in accordance with UK GAAP. Adjusted EBITDA is not a measure of financial performance in accordance with UK GAAP or any other GAAP and

may exclude items that are significant in understanding and assessing CorpAcq’s financial results. Therefore, Adjusted EBITDA should

not be considered in isolation or as an alternative to net income or other measures of profitability or performance under UK GAAP or any

other GAAP. You should be aware that CorpAcq’s presentation of Adjusted EBITDA may not be comparable to similarly-titled measures

used by other companies.

CorpAcq believes Adjusted EBITDA provides useful information to management

and investors regarding certain financial and business trends relating to CorpAcq’s financial condition and results of operations.

CorpAcq believes that the use of Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results

and trends and in comparing CorpAcq’s financial measures with other similar companies, many of which present similar non-GAAP financial

measures to investors. Adjusted EBITDA is subject to inherent limitations as it reflects the exercise of judgments by management about

which expense and income are excluded or included in determining Adjusted EBITDA.

Use of Projections

This communication contains certain financial forecast information

of CorpAcq, including, but not limited to, estimated results for fiscal year 2023, including Adjusted EBITDA and the Company's long-term

business model. Such financial forecast information constitutes forward-looking information, and is for informational purposes only and

should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast

information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks

and uncertainties. See "Forward-Looking Statements“ above. Actual results may differ materially from the results contemplated

by the financial forecast information contained in this communication, and inclusion of such information in this communication should

not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. None of CorpAcq's or

Churchill's independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the

purpose of their inclusion in this communication, and, accordingly, neither of them have expressed an opinion or provided any other form

of assurance with respect thereto for the purpose of this communication. In addition, the analyses of the CorpAcq and Churchill contained

herein are not, and do not purport to be, appraisals of the securities, assets or business of CorpAcq or Churchill.

Additional Information and Where to Find It

In connection with the proposed transactions, CorpAcq or Churchill

VII (or an affiliate of CorpAcq) is expected to file a registration statement on Form F-4 or any other applicable form (the “Registration

Statement”) with the SEC, which will include preliminary and definitive proxy statements to be distributed to Churchill VII’s

shareholders in connection with Churchill VII’s solicitation for proxies for the vote by Churchill VII’s shareholders in connection

with the proposed transactions and other matters to be described in the Registration Statement, as well as the prospectus relating to

the offer of the securities to be issued to Churchill VII’s shareholders in connection with the completion of the proposed transactions.

After the Registration Statement has been filed and declared effective, Churchill VII will mail a definitive proxy statement/prospectus

and other relevant documents to its shareholders as of the record date established for voting on the proposed transactions. This communication

does not contain all the information that should be considered concerning the proposed transactions and is not intended to form the basis

of any investment decision or any other decision in respect of the proposed transactions. Before making any voting or other investment

decisions, Churchill VII’s shareholders and other interested persons are advised to read, once available, the preliminary proxy

statement/prospectus statement and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection

with Churchill VII’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things,

the proposed transactions, as well as other documents filed with the SEC by Churchill VII in connection with the proposed transactions,

as these documents will contain important information about CorpAcq, Churchill VII and the proposed transactions. Shareholders may obtain

a copy of the preliminary or definitive proxy statement/prospectus, once available, as well as other documents filed by Churchill VII

with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to Churchill Capital

Corp VII at 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

CorpAcq, Churchill VII, Churchill Sponsor VII LLC and their directors

and executive officers may be deemed participants in the solicitation of proxies from Churchill VII’s shareholders with respect

to the proposed transactions. A list of the names of Churchill VII’s directors and executive officers and a description of their

interests in Churchill VII is set forth in Churchill VII’s filings with the SEC (including Churchill VII’s prospectus related

to its initial public offering filed with the SEC on February 16, 2021 and Annual Reports filed by Churchill VII with the SEC on Form

10-K) and are available free of charge at the SEC’s website located at www.sec.gov, or by directing a written request to Churchill

Capital Corp VII at 640 Fifth Avenue, 12th Floor, New York, NY 10019. Additional information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests will be included in the definitive proxy statement/prospectus when it becomes

available. Shareholders, potential investors and other interested persons should read the definitive proxy statement/prospectus carefully

when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources

indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a proxy statement or solicitation of a proxy,

a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or

exemptions therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY

NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Media Contact

Christina Stenson / Michael Landau

Gladstone Place Partners

(212) 230-5930

Appendix

EBITDA

and Adjusted EBITDA Non-GAAP Reconciliation

(in

millions)

| | |

FY2018A | | |

FY2019A | | |

FY2020A | | |

FY2021A | | |

FY2022A | | |

FY2023E | |

| Net Income | |

$ | 2 | | |

$ | 12 | | |

$ | 0 | | |

$ | 22 | | |

$ | 25 | | |

$ | 35 | |

| Add back: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest Expense | |

| 29 | | |

| 33 | | |

| 34 | | |

| 33 | | |

| 36 | | |

| 48 | |

| Tax Expense | |

| 5 | | |

| 5 | | |

| 5 | | |

| 14 | | |

| 9 | | |

| 11 | |

| Other Adjustments | |

| (0 | ) | |

| (4 | ) | |

| (0 | ) | |

| 0 | | |

| - | | |

| - | |

| Depreciation & Amortization | |

| 35 | | |

| 40 | | |

| 44 | | |

| 49 | | |

| 54 | | |

| 58 | |

| EBITDA | |

$ | 70 | | |

$ | 86 | | |

$ | 83 | | |

$ | 117 | | |

$ | 124 | | |

$ | 152 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-Recurring Capital Raise Costs | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2 | | |

| - | |

| Non-Recurring Legal and Insurance Costs | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1 | | |

| - | |

| Subsidiary Share-Based Compensation | |

| - | | |

| - | | |

| 1 | | |

| 1 | | |

| 1 | | |

| - | |

| Adjusted EBITDA (1) | |

$ | 70 | | |

$ | 86 | | |

$ | 84 | | |

$ | 118 | | |

$ | 129 | | |

$ | 152 | |

Note: Financial information based on UK GAAP audits and has not been audited in accordance with PCAOB standards.

(1)

Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization adding back any one-time costs related to previous

capital raises and share-based deferred compensation

Exhibit 99.2

August 2023 Investor Presentation

2 About This Presentation This presentation is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential transaction (the “proposed transaction”) between CorpAcq Holdings Limited (“CorpAcq”) and Churchill Capital Corp VII (“Churchill”) and related transactions and for no other purpose . The information contained herein does not purport to be all inclusive and no representations or warranties, express or implied, are given in, or in respect of, this presentation or any other written or oral communication communicated to the recipient in the course of the recipient’s evaluation of CorpAcq and Churchill and their respective affiliates . The information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material . This presentation does not constitute ( i ) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Churchill, CorpAcq, or any of their respective affiliates . You should not construe the contents of this presentation as legal, tax, accounting or investment advice or a recommendation . You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision . The recipient shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment or decision to invest in CorpAcq or Churchill or their respective affiliates . To the fullest extent permitted by law, in no circumstances will CorpAcq, Churchill or any of their respective subsidiaries, interest holders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . In addition, this presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of CorpAcq, Churchill or the proposed transaction . Please refer to the definitive merger agreement and other related transaction documents, when available, for the full terms of the proposed transaction . The general explanations included in this presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs . The distribution of this presentation may also be restricted by law and persons into whose possession this presentation comes should inform themselves about and observe any such restrictions . The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the United States Securities Exchange Act of 1934 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10 b - 5 thereunder . Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . Churchill and CorpAcq have based these forward - looking statements on each of its current expectations and projections about future events . These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and operational metrics ;. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of CorpAcq’s and Churchill’s management and are not predictions of actual performance . Nothing in this presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and may materially differ from assumptions . Many actual events and circumstances are beyond the control of Churchill and CorpAcq . These forward - looking statements are subject to known and unknown risks, uncertainties and assumptions about Churchill and CorpAcq that may cause each of its actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward - looking statements . Such risks and uncertainties include changes in domestic and foreign business changes in the competitive environment in which CorpAcq operates ; CorpAcq's ability to manage its growth prospects, meet its operational and financial targets, and execute its strategy ; the impact of any economic disruptions, decreased market demand and other macroeconomic factors, including the effect of the COVID - 19 pandemic, to CorpAcq's business, projected results of operations, financial performance or other financial metrics ; expectations as to future growth in demand for CorpAcq's products and services ; CorpAcq's ability to maintain and develop its IT systems or data storage, including the security of its product offering, or anticipate, manage or adopt technological advances within its industry ; CorpAcq's reliance on its senior management team and key employees ; risks related to liquidity, capital resources and capital expenditures ; failure to comply with applicable laws and regulations or changes in the regulatory environment in which CorpAcq operates ; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries that CorpAcq may face ; assumptions or analyses used for CorpAcq's forecasts proving to be incorrect and causing its actual operating and financial results to be significantly below its forecasts ; CorpAcq failing to maintain its current level of acquisitions or an acquisition not occurring as planned and negatively affecting operating results ; the inability of the parties to successfully or timely consummate the proposed transaction, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transaction or that the approval of the shareholders of Churchill is not obtained ; the risk that shareholders of Churchill could elect to have their shares redeemed by Churchill, thus leaving the combined company insufficient cash to complete the transactions or grow its business ; the outcome of any legal proceedings that may be instituted against CorpAcq or Churchill following announcement of the proposed transaction ; failure to realize the anticipated benefits of the proposed transaction ; risks relating to the uncertainty of the projected financial information with respect to CorpAcq ; the effects of competition ; changes in applicable laws or regulations ; the ability of CorpAcq to manage expenses and recruit and retain key employees ; the ability of Churchill or the combined company to issue equity or equity - linked securities in connection with the proposed transaction or in the future ; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries ; and the impact of the global COVID - 19 pandemic or any future pandemic on CorpAcq, Churchill, the combined company’s projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks ; those factors discussed in Churchill’s Quarterly Reports filed by Churchill with the U . S . Securities and Exchange Commission (“SEC”) on Form 10 - Q and the Annual Reports filed by Churchill with the SEC on Form 10 - K, in each case, under the heading “Risk Factors,” as well as the factors summarized in this presentation under “Risk Factors” and other documents filed, or to be filed, with the SEC by Churchill . If any of these risks materialize or CorpAcq’s or Churchill’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that neither CorpAcq nor Churchill presently know or that CorpAcq and Churchill currently believe are immaterial that could also cause actual results to differ materially from those contained in the forward - looking statements . In addition, forward - looking statements reflect CorpAcq’s and Churchill’s expectations, plans or forecasts of future events and views as of the date of this presentation . CorpAcq and Churchill anticipate that subsequent events and developments will cause CorpAcq’s and Churchill’s assessments to change . However, while CorpAcq and Churchill may elect to update these forward - looking statements at some point in the future, CorpAcq and Churchill specifically disclaim any obligation to do so . These forward - looking statements should not be relied upon as representing CorpAcq and Churchill’s assessments as of any date subsequent to the date of this presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements . An investment in CorpAcq or Churchill is not an investment in any of CorpAcq’s or Churchill’s past investments or companies or any funds affiliated with any of the foregoing . The historical results of these investments are not indicative of future performance of CorpAcq or Churchill, which may differ materially from the performance of past investments, companies or affiliated funds .

3 Financial Information The financial information contained in this presentation has been taken from or prepared based on the historical financial statements of CorpAcq for the periods presented . CorpAcq’s historical financial information is prepared in accordance with the generally accepted accounting practice in the UK (“UK GAAP”) . Such information has not been audited in accordance with Public Company Accounting Oversight Board (“PCAOB”) standards . Neither Churchill nor CorpAcq can assure you that, had the financial statements been compliant with Regulation S - X under the United States Securities Act of 1933 , as amended (the “Securities Act”), and the regulations of the SEC promulgated thereunder or audited in accordance with PCAOB standards, there would not be differences and such differences could be material . An audit of CorpAcq’s financial statements in accordance with PCAOB standards is in process and will be included in the registration statement relating to the proposed transaction . Furthermore, all financial information included in this presentation subsequent to December 31 , 2022 is preliminary and unaudited . CorpAcq's independent auditor has not reviewed or performed any procedures on the preliminary, unaudited financial results included in this presentation . Accordingly there may be material differences between the presentation of the financial information included in the presentation and in the registration statement . Certain monetary amounts, percentages and other figures included in this presentation have been subject to rounding adjustments . Certain other amounts that appear in this presentation may not sum due to rounding . Non - GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with UK GAAP including, but not limited to, Adjusted EBITDA, Free Cash Flow, EBITDA Margin, ROIC and certain ratios and other metrics derived therefrom . These non - GAAP financial measures are not measures of financial performance in accordance with UK GAAP or any other GAAP and may exclude items that are significant in understanding and assessing CorpAcq’s financial results . Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under UK GAAP or any other GAAP . You should be aware that CorpAcq’s presentation of these measures may not be comparable to similarly - titled measures used by other companies . CorpAcq believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to CorpAcq’s financial condition and results of operations . CorpAcq believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing CorpAcq’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . These non - GAAP measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures . Industry and Market Data ; Trademarks This presentation also contains certain statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on other third - party or internal sources . This information involves many assumptions and limitations, and you are cautioned not to give undue weight to such information . None of CorpAcq, Churchill or any placement agent has independently verified the accuracy or completeness of the information contained in the industry publications and other publicly available information . Accordingly, none of CorpAcq, Churchill or any placement agent makes any representation as to the accuracy or completeness of that information nor does CorpAcq, Churchill or any placement agent undertake to update such information after the date of this presentation . In addition, this presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of CorpAcq or the proposed transaction . You should make your own evaluation of CorpAcq and of the relevance and adequacy of the information and should make such other investigations as you deem necessary . The information contained in the third party citations referenced in this presentation is not incorporated by reference into this presentation . This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are property of their respective owners . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, (c) or (r) symbols, but CorpAcq and Churchill will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights . Additional Information about the Proposed Transaction and Where to Find It In connection with the proposed transaction, CorpAcq or Churchill (or an affiliate of CorpAcq) is expected to file a registration statement on Form F - 4 or any other applicable form (the “Registration Statement”) with the SEC, which will include preliminary and definitive proxy statements to be distributed to Churchill’s shareholders in connection with Churchill’s solicitation for proxies for the vote by Churchill’s shareholders in connection with the proposed transaction and other matters to be described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Churchill’s shareholders in connection with the completion of the proposed transaction . After the Registration Statement has been filed and declared effective, Churchill will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders as of the record date established for voting on the proposed transaction . This presentation does not contain all the information that should be considered concerning the proposed transaction and is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction . Before making any voting or other investment decisions, Churchill’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus statement and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection with Churchill’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed transaction, as well as other documents filed with the SEC by Churchill in connection with the proposed transaction, as these documents will contain important information about CorpAcq, Churchill and the proposed transaction . Shareholders may obtain a copy of the preliminary or definitive proxy statement/prospectus, once available, as well as other documents filed by Churchill with the SEC, without charge, at the SEC’s website located at www . sec . gov or by directing a written request to Churchill Capital Corp VII . at 640 Fifth Avenue, 12 th Floor, New York, NY 10019 . About This Presentation

4 Participants in the Solicitation CorpAcq, Churchill, Churchill Sponsor VII LLC and their directors and executive officers may be deemed participants in the solicitation of proxies from Churchill’s shareholders with respect to the proposed transaction . A list of the names of Churchill’s directors and executive officers and a description of their interests in Churchill is set forth in Churchill’s filings with the SEC (including Churchill’s prospectus related to its initial public offering filed with the SEC on February 16 , 2021 and Annual Reports filed by Churchill with the SEC on Form 10 - K) and are available free of charge at the SEC’s website located at www . sec . gov, or by directing a written request to Churchill Capital Corp VII at 640 Fifth Avenue, 12 th Floor, New York, NY 10019 . Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the definitive proxy statement/prospectus when it becomes available . Shareholders, potential investors and other interested person should read the definitive proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions . You may obtain free copies of these documents from the sources indicated above . No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . This presentation is not, and under no circumstances is to be construed as, a proxy statement or solicitation of a proxy, a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or exemptions therefrom . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Risk Factors For a description of certain risks relating to CorpAcq, including its business and operations, and the proposed transaction, we refer you to “Risk Factors” at the end of this presentation . Use of Projections This presentation contains certain financial forecast information of CorpAcq, including, but not limited to, estimated results for fiscal year 2023 , including Adjusted EBITDA, revenue and gross margin, and the Company's long - term business model . Such financial forecast information constitutes forward - looking information, and is for informational purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . See "Forward - Looking Statements“ above and “Selected Risk Factors” at the end of this presentation . Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved . None of CorpAcq's or Churchill's independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and, accordingly, neither of them have expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation . In addition, the analyses of the CorpAcq and Churchill contained herein are not, and do not purport to be, appraisals of the securities, assets or business of CorpAcq or Churchill . About This Presentation

5 Simon Orange David Martin Michael Klein • Established CorpAcq in 2006 • Current role includes identifying and negotiating acquisitions in conjunction with CorpAcq partners and driving funding, strategic development and partnership • Has been involved in funding and managing businesses and has overseen the creation and growth of several ventures that have exited successfully • Also a Founder, Investor, and Director of BOL Foods (a company supplying food products to major retailers) • Joined CorpAcq as the Finance Director in 2007 and was appointed as Chief Executive Officer in 2011 • Leads all operational matters for CorpAcq and is actively involved with subsidiary businesses • Has had extensive involvement with the management and financial control of UK manufacturing businesses across numerous sectors • Prior to joining CorpAcq, held a number of key positions within Nestle UK, Frank Roberts & Sons, Volex, and GEC • Founder and CEO of Churchill I - VII which have completed four business combinations to date • Founder and managing partner of M. Klein and Company, which he founded in 2012 • Background in strategic advisory work was built during his 30+ year career, including more than two decades at Citi and its predecessors • Previously CEO of Citi’s institutional businesses, which had aggregate revenues of approximately $20 billion and 65,000 employees • Served as a private advisor to the Government of the United Kingdom in responding to the financial market crisis Founder & Chairman Chief Executive Officer Acquisitions & Investments Chairman and CEO CorpAcq Churchill • Joined CorpAcq in 2019 as Acquisitions Manager • Current role includes leading new business origination alongside structuring, negotiating, and executing acquisitions • Began career at Goldman Sachs followed by 11 years at Glencore, ultimately as Head of Sugar Trading Globally • Garnered commercial experience at Glencore managing a global physical and paper trading book as well as leading contract negotiations alongside complementary M&A activities Stuart Kissen Source: CorpAcq and Churchill Capital Corp VII Management. Today’s Presenters

6 1 2 3 4 5 6 CorpAcq to go public via a business combination with Churchill Capital Corp VII (NYSE: CVII) in a transaction anticipated to create a differentiated acquisition platform that offers a compelling combination of earnings growth and attractive risk - adjusted returns with a valuation of approximately 10x 2023E Adjusted EBITDA CorpAcq is a corporate compounder anchored by a diversified portfolio of 41 (1) small - to - medium sized enterprises (“SMEs”) (2) within the UK that are stable and profitable asset - rich businesses with a recent history of organic subsidiary - level profit growth (3) of 7% and total Adj. EBITDA (4) growth of 17% from 2018 – 2022 In partnership with Churchill Capital Corp VII, CorpAcq expects to be able to accelerate its successful platform strategy by increasing its capital deployment and acquisition pace Since 2006, CorpAcq has developed a track record as a “preferred buyer” for well - established, founder - led SMEs across the UK by maintaining autonomy within the businesses and investing for long - term performance This attractive transaction structure aligns interests between CorpAcq’s management team and shareholders of the post - closing combined company and offers the potential opportunity for the newly public company to pay a regular dividend from closing Business combination is expected to close in late 2023 / early 2024 resulting in the opportunity for Churchill Capital Corp VII investors to become CorpAcq shareholders (1) As of 7/31/2023. (2) SME defined by CorpAcq as business with 10 - 249 employees. (3 ) Organic growth is calculated as the aggregate growth of s ubsidiary - level profit , of subsidiaries that have been in the portfolio for at least one year beyond their year of initial acquisition. Subsidiary - level profit is measured as earnings before interest, tax, depreciation and amorti zation and excludes management fees to CorpAcq. (4) See appendix for definition of Adj. EBITDA and reconciliation to its most directly comparable GAAP metric. (5) Assumes sponsor to forfeit 15mm founder shares and unvest 7.4mm and 4.7mm founder shares at close that are subject to vesting share prices at or above $11.50 per share and $15.00 per sh are, respectively. 7 Strong shareholder alignment as sponsors are expected to forfeit and unvest more than 75% (5) of founder shares on day one with additional revesting and earn - in hurdles significantly above deal price CorpAcq to Go Public in Partnership With Churchill Capital VII

7 A diversified platform underpinned by a foundation of proven assets and supplemented by an acquisition engine that is expecte d t o drive shareholder returns Current Key Company Statistics (1) CorpAcq Engine For Value Creation Acquisition Engine Stable, Cash - Generative Companies Consistent and Accretive Acquisition Engine ~$25mm+ EBITDA acquired per year Stable Retained proven management team Profitable with ~15% EBITDA margin Accretive with +20% (2) returns on investment Source: CorpAcq Management. Note: Financials based on UK GAAP audits . Assumes USD:GBP exchange ratio of 1.286:1. (1) Company statistics are as of 7/31/2023 except for FY2022 Revenue. (2) Returns on investment for acquisitions are defined as operating income minus tax, interest and debt service divided by CorpAcq’s cash investment. Return metrics for target acquisition are based on se ven of CorpAcq’s recently completed acquisitions between 2019 - 2023. (3) CorpAcq sold 3 businesses (Regency, Vista, M&S) for more than 10x total cash invested. Acquisition Targets Self Funding Alcentra Capital / Asset Finance Goldman Sachs Pref Go Public CorpAcq’s Funding Path 41 Total Subsidiaries ~ $826mm FY2022 Revenue >3.5k Total Employees Across Subsidiaries >30 years Average Age of Subsidiaries >6 Average Number of Years in Portfolio Across Subsidiaries 45 Companies acquired 3 Sold at strong returns (3) 4 Management changes The CorpAcq Platform

8 CorpAcq’s Acquisition Structure Focuses on Lowering Risk and Driving Returns CorpAcq achieves consistently attractive returns on its deployed capital partially through its acquisition structures Acquisition Structure Benefits Acquisition Cost (Mid - Single Digits EV / EBITDA multiple) Entry to public markets can provide the potential for equity - linked compensation to help drive returns Illustrative Sample Acquisition Structure Ability to drive +20% (1) return on cash investment from Day 1 Status as a “preferred buyer” enables CorpAcq to purchase founder led SMEs for attractive multiples Immediate and growing free cash flow (2) for dividend Potential to add attractive returns on deployed capital Source: CorpAcq Management. (1) Return on cash investment for acquisitions is defined as operating income minus tax, interest and debt service divided by CorpAcq’s cash investment. Return metrics for target acquisition are based on seven of CorpAcq’s recently completed acquisitions between 2019 - 2023 and do not represent the performance of entire portfolio. Past performance is not indicative of f uture results. (2) Free cash flow is defined as cash flow from operations minus net CapEx. See reconciliation in appendix for definition of net CapEx. Acquisition Funding Sources ~25% ~50% Cash ~25% Debt (at Subsidiary Level) Performance - Linked Deferred Compensation