Current Report Filing (8-k)

September 28 2021 - 8:05AM

Edgar (US Regulatory)

0001620280

false

0001620280

2021-09-28

2021-09-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 28, 2021

Uniti Group Inc.

(Exact name of registrant as specified in its

charter)

|

Maryland

|

001-36708

|

46-5230630

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

10802 Executive Center Drive

Benton Building Suite 300

Little Rock, Arkansas

|

72211

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (501) 850-0820

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UNIT

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.04

|

Triggering Events That Accelerate or Increase a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement

|

The information set forth below in Item 8.01 of

this Current Report on Form 8-K with respect to the Redemption of the 2024 Senior Notes (each as defined below) is incorporated herein

by reference.

On September 28, 2021, Uniti Group Inc. (the

“Company,” “we,” “us,” or “our”) issued a press release to announce an offering of

senior notes (the “New Notes”) by its subsidiaries, Uniti Group LP, Uniti Fiber Holdings Inc., Uniti Group Finance 2019

Inc. and CSL Capital, LLC (the “Issuers”). The New Notes will be guaranteed on a senior unsecured basis by the Company

and by each of the Company’s subsidiaries (other than the Issuers) that guarantees indebtedness under the Company’s

senior secured credit facilities and the Company’s existing notes (except initially those subsidiaries that require regulatory

approval prior to guaranteeing the New Notes). The Issuers intend to use the net proceeds from the offering of the New Notes to fund

the redemption (the “Redemption”) in full of the outstanding $600 million aggregate principal amount of 7.125% senior

notes due 2024 (the “2024 Senior Notes”), including related premiums, fees and expenses in connection with the

foregoing. The Issuers will redeem the 2024 Senior Notes on December 15, 2021 (the “Redemption Date”) at a redemption

price of 101.781% of the principal amount of 2024 Senior Notes being redeemed plus accrued and unpaid interest, if any, to, but

excluding, the Redemption Date. The Issuers will use any remaining net proceeds to prepay settlement obligations under the

settlement agreement the Company entered into with Windstream Holdings, Inc. (together with Windstream Holdings II, LLC, its

successor in interest, and its subsidiaries, “Windstream”) in connection with Windstream’s emergence from

bankruptcy. The notice of redemption issued today for the 2024 Senior Notes is conditioned upon completion of one or more debt

financings in an aggregate principal amount of at least $700 million. This Current Report on Form 8-K does not constitute a notice

of redemption with respect to the 2024 Senior Notes.

The New Notes will not be registered under the

Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and may not be offered or sold in

the United States absent registration or an applicable exemption from registration under the Securities Act or any applicable state securities

laws. The New Notes will be offered only to persons reasonably believed to be qualified institutional buyers under Rule 144A under the

Securities Act and outside the United States in compliance with Regulation S under the Securities Act. A copy of the press release is

attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: September 28, 2021

|

UNITI GROUP INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Daniel L. Heard

|

|

|

|

|

Name:

|

|

Daniel L. Heard

|

|

|

|

|

Title:

|

|

Executive Vice President - General Counsel and Secretary

|

|

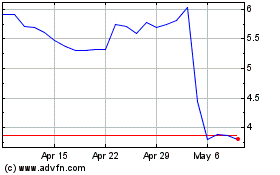

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Jul 2024 to Aug 2024

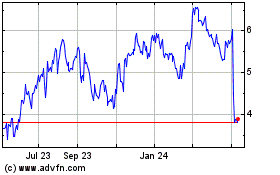

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Aug 2023 to Aug 2024