Current Report Filing (8-k)

November 03 2021 - 4:07PM

Edgar (US Regulatory)

false

0001293282

0001293282

2021-10-29

2021-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2021

TechTarget, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

1-33472

|

04-3483216

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

275 Grove Street,

Newton, MA

|

|

02466

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (617) 431-9200

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act.

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 per value per share

|

TTGT

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 29, 2021 (“Closing Date”), TechTarget, Inc. (the “Company”) entered into a Loan and Security Agreement (“Loan Agreement”) by and among the Company, the banks and other financial institutions or entities from time to time party thereto as lenders (each a “Lender” and, collectively, the “Lenders”), and Western Alliance Bank, as administrative agent and collateral agent for the Lenders (in such capacities, the “Administrative Agent”). The Loan Agreement provides for a two-year revolving credit facility in an aggregate principal amount not to exceed $75 million with a $5 million letter-of-credit sublimit (collectively, the “Revolving Line”). Terms used in this Item 1.01 and not defined herein shall have the meanings ascribed to them in the Loan Agreement, which is attached to this Form 8-K as Exhibit 10.1. The new Loan Agreement expires on October 29, 2023 and is currently undrawn. Borrowings under the Loan Agreement are prepayable at the Company’s option without premium or penalty. Amounts borrowed under the Loan Agreement may be repaid and reborrowed from time to time prior to the maturity date.

Each borrowing under the Loan Agreement will bear interest at a rate per annum equal to the applicable LIBOR Rate plus a margin based on the Company’s Consolidated Leverage Ratio from time to time between 2.75% and 2.00%. In addition, the Company has agreed to pay a facility fee payable to each Lender equal to 0.075% of such Lender’s commitment under the Revolving Line on the Closing Date and on each anniversary of the Closing Date. In addition, the Company has agreed to pay the Administrative Agent an unused line fee, per annum, payable monthly in arrears, in an amount equal to 0.075% of the daily unused portion of the Revolving Line, as determined by the Administrative Agent. The borrowings under the Loan Agreement are secured by a lien on substantially all of the assets of the Company, including a pledge of the stock of certain of its wholly-owned subsidiaries (limited, in the case of the stock of certain foreign subsidiaries of the Company, to no more than 65% of the capital stock of such subsidiaries).

The Loan Agreement contains customary representations and warranties, and affirmative and negative covenants and events of default applicable to the Company and its subsidiaries. Events of default, subject to grace periods in certain cases, which may cause repayment include: (1) failure to pay any obligation when due, (2) failure to comply with certain affirmative covenants and negative covenants, (3) failure to perform any other obligation required under the Loan Agreement and to cure such default within 30 days after the earlier of written notice from Administrative Agent or knowledge of a responsible officer of the Company, (4) the occurrence of a Material Adverse Effect, (5) the attachment or seizure of a material portion of the Company’s assets if such attachment or seizure is not removed, discharged or rescinded within 30 days after the Company receives notice thereof, (6) bankruptcy or insolvency of the Company, (7) default by the Company under any agreement (i) resulting in a right by a third party to accelerate indebtedness in an amount in excess of $5,000,000 or (ii) that would reasonably be expected to have a Material Adverse Effect, (8) entry of a final, uninsured judgment or judgments against the Company for the payment of money in an amount, individually or in the aggregate, of at least $5,000,000, (9) any material misrepresentation or material misstatement with respect to any warranty or representation set forth in the Loan Agreement or any other Loan Document, or (10) any agreement evidencing the subordination of any subordinated debt ceases to be in full force and effect, or the obligations under the Loan Agreement are subordinated or do not have the priority contemplated by Loan Agreement. The Loan Agreement also requires that, commencing with the first fiscal quarter ending after the Closing Date, the Company maintain a Consolidated Leverage Ratio of no greater than 4.75 to 1.00 for any fiscal quarter ending thereafter.

The foregoing description of the Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Loan Agreement, which is filed as Exhibit 10.1, and incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

On November 3, 2021, TechTarget, Inc. (the “Company”) disclosed its results for the quarter and three (3) months ended September 30, 2021 in its Shareholder Letter, which is posted on the Investor Relations section of its website at www.techtarget.com. The Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in Item 2.02 of this Form 8-K (including Exhibit 99.1) is furnished in accordance with SEC Release No. 33-8216 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation by reference language in such filing, except as expressly set forth by specific reference in such a filing.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following Exhibit 99.1 relating to Item 2.02 shall be deemed to be furnished, and not filed:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

TechTarget, Inc.

|

|

|

|

|

|

|

Date: November 3, 2021

|

|

By:

|

/s/ Daniel Noreck

|

|

|

|

|

Daniel Noreck

|

|

|

|

|

Chief Financial Officer and Treasurer

|

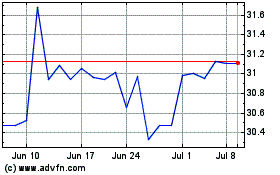

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From May 2024 to Jun 2024

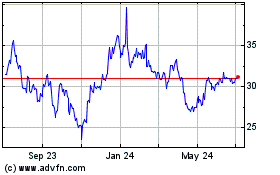

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jun 2023 to Jun 2024