NanoVibronix, Inc., (NASDAQ: NAOV), a healthcare

device company that produces the UroShield® and PainShield® Surface

Acoustic Wave (SAW) Portable Ultrasonic Therapeutic Devices, today

reported its financial results for the quarter ended June 30, 2021

and provided a business update.

Financial and Business

Highlights

- Revenue increased 18% to $318,000,

which included the first shipment of products to Ultra Pain

Products, Inc. (UPPI) under its amended contract which extended

terms and increased minimum purchase requirements to $8 million

over three years

- Launched OTC pain management

device, PainShield RELIEF

- Submitted request to CMS for

reimbursement code(s) for UroShield and PainShield Plus

- Received registration approval for

UroShield from Therapeutic Goods Administration (TGA) in

Australia

- Balance sheet remains strong with

$5.7 million in cash and $0 long-term debt as of June 30, 2021

“We made great strides in the first half of

2021, accelerating our progress towards full commercialization of

our products with expanded distribution, clearance of regulatory

approvals, the launch of PainShield Plus and the planned launch of

PainShield RELIEF, which is expected to be available

over-the-counter, significantly expanding our addressable market,”

stated Brian Murphy, CEO of NanoVibronix. “Our entire product

portfolio has been redesigned to improve appearance, functionality

and efficiency, and we have submitted patent applications to

protect our intellectual property, both for our existing brands and

technology as well as products under development. Our robust

business model is comprised of innovative products that are

clearing regulatory approvals, a high-quality manufacturing partner

and global distribution channels. Importantly, we believe that we

are operating in a market environment of increasing demand and that

we can continue to grow.”

Murphy continued, “The demand we are

experiencing exceeds our supply across all of the markets we serve

including commercial, insurance and the Veterans Administration

(VA). This demand, combined with the energy of our distributors to

bring our products to market, reinforces our optimism for continued

growth. Given our growing backlog of orders and the submissions we

are making for regulatory approval in new markets, we are actively

searching for additional manufacturers for our products and are

currently engaged with additional contract manufacturers located in

the United Kingdom, Israel, the United States and Mexico to expand

output.”

Murphy continued, “Another development that we

are energized by is our planned entry into the over-the-counter

market with the launch of PainShield RELIEF, a derivative of our

prescription PainShield that we plan to be available without a

clinician’s prescription. Opening availability of our pain

management device to the mass market should greatly expand our

revenue potential and provide us with the opportunity to scale and

leverage our manufacturing and distribution infrastructures.”

“We are aggressively pursuing a reimbursement

code from the Centers for Medicare and Medicaid (CMS), which once

approved should make the devices more broadly available to millions

of Medicare beneficiaries,” added Murphy. “We recently completed

the application process with CMS to receive a reimbursement code

for our UroShield and PainShield Plus devices and have been granted

approval and reimbursement at favorable rates from the Federal

Supply Schedule. We are progressing in this realm as expeditiously

as possible and are encouraged by the trajectory of our

efforts.”

Murphy concluded, “Our balance sheet remains

strong, and we are adequately funded for growth and execution of

our strategic plans. With $5.7 million in cash at the end of the

second quarter and zero debt, we have the capacity to ramp

manufacturing as orders accelerate while continuing to invest in

product development and expand our sales channels.”

Second Quarter 2021 Financial

Summary

Revenues were $318,000 for the second quarter of

2021, up 18% compared with $269,000 for the second quarter of 2020.

The increase was primarily due to increased sales of PainShield

devices to the company’s distributors.

Gross profit was $208,000, or 65% of revenue, in

the second quarter of 2021 compared with $38,000, or 14% of

revenue, in the 2020 period. The increases in gross profit and

gross margin were primarily driven by increased sales of products

to distributors at higher margins and the absence of special

discounts in the 2021 period.

Total operating expenses were $1.2 million in

the second quarter of 2021 compared with $1.5 million in the prior

year period. The decrease was primarily due to a decrease in

general and administrative expense resulting from the inclusion of

a non-recurring settlement with a contractor in the year ago

period, partially offset by an increase in expense in the current

period for fees related to a lawsuit, expenses related to the

company’s efforts to ratify its prior over issuances of common

stock and an increase in salary expense in the 2021 period compared

to the year ago period when salaries were reduced due to the

furlough of staff at the start of the COVID-19 pandemic. The

decreases in general and administrative expenses were partially

offset by an increase in research and development expense and

selling and marketing expense, primarily salary related as the

prior period benefited from the furlough of staff.

Net loss was $216,000, or $(0.01) per basic and

diluted share, compared with a loss of $1.5 million or $(0.20) per

basic and diluted share for the previous quarter. Second quarter

2021 results include a change in fair value of derivative

liabilities resulting in a non-cash gain of $706,000.

About NanoVibronix, Inc.

NanoVibronix, Inc. (NASDAQ: NAOV) is a medical

device company headquartered in Elmsford, New York, with research

and development in Nesher, Israel, focused on developing medical

devices utilizing its patented low intensity surface acoustic wave

(SAW) technology. The proprietary technology allows for the

creation of low-frequency ultrasound waves that can be utilized for

a variety of medical applications, including for disruption of

biofilms and bacterial colonization, as well as for pain relief.

The devices can be administered at home without the assistance of

medical professionals. The Company’s primary products include

PainShield® and UroShield®, which are portable devices suitable for

administration at home without assistance of medical professionals.

Additional information about NanoVibronix is available at:

www.nanovibronix.com.

Forward-looking Statements

This press release contains “forward-looking

statements.” Such statements may be preceded by the words

“intends,” “may,” “will,” “plans,” “expects,” “anticipates,”

“projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,”

“potential” or similar words. Forward-looking statements are not

guarantees of future performance, are based on certain assumptions

and are subject to various known and unknown risks and

uncertainties, many of which are beyond the Company’s control, and

cannot be predicted or quantified; consequently, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Such risks and uncertainties include,

without limitation, risks and uncertainties associated with: (i)

the geographic, social and economic impact of COVID-19 on the

Company’s ability to conduct its business and raise capital in the

future when needed, (ii) market acceptance of our existing and new

products or lengthy product delays in key markets; (iii) negative

or unreliable clinical trial results; (iv) inability to secure

regulatory approvals for the sale of our products; (v) intense

competition in the medical device industry from much larger,

multinational companies; (vi) product liability claims; (vii)

product malfunctions; (viii) our limited manufacturing capabilities

and reliance on subcontractor assistance; (ix) insufficient or

inadequate reimbursements by governmental and/or other third party

payers for our products; (x) our ability to successfully obtain and

maintain intellectual property protection covering our products;

(xi) legislative or regulatory reform impacting the healthcare

system in the U.S. or in foreign jurisdictions; (xii) our reliance

on single suppliers for certain product components, (xiii) the need

to raise additional capital to meet our future business

requirements and obligations, given the fact that such capital may

not be available, or may be costly, dilutive or difficult to

obtain; (xiv) our conducting business in foreign jurisdictions

exposing us to additional challenges, such as foreign currency

exchange rate fluctuations, logistical and communications

challenges, the burden and cost of compliance with foreign laws,

and political and/or economic instabilities in specific

jurisdictions; and (xv) market and other conditions. More detailed

information about the Company and the risk factors that may affect

the realization of forward looking statements is set forth in the

Company’s filings with the Securities and Exchange Commission

(SEC), including the Company’s Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q. Investors and security holders are

urged to read these documents free of charge on the SEC’s web site

at: http://www.sec.gov. The Company assumes no obligation to

publicly update or revise its forward-looking statements as a

result of new information, future events, or otherwise, except as

required by law.

-- Tables Follow –

NanoVibronix,

Inc.Condensed Consolidated Balance Sheets

(Unaudited)(Amounts in thousands, except share and

per share data)

| |

|

|

|

|

|

| |

June 30, 2021 |

|

|

December 31, 2020 |

|

|

ASSETS: |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,672 |

|

|

$ |

7,142 |

|

|

Restricted cash |

|

- |

|

|

|

391 |

|

|

Trade receivables |

|

36 |

|

|

|

25 |

|

|

Other accounts receivable and prepaid expenses |

|

671 |

|

|

|

267 |

|

|

Inventory |

|

205 |

|

|

|

145 |

|

| Total current assets |

|

6,584 |

|

|

|

7,970 |

|

| |

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

Fixed assets, net |

|

5 |

|

|

|

4 |

|

|

Other assets |

|

23 |

|

|

|

25 |

|

|

Severance pay fund |

|

198 |

|

|

|

199 |

|

|

Operating lease right-of-use assets, net |

|

22 |

|

|

|

31 |

|

|

Total non-current assets |

|

248 |

|

|

|

259 |

|

|

Total assets |

$ |

6,832 |

|

|

$ |

8,229 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Trade payables |

$ |

181 |

|

|

$ |

144 |

|

|

Other accounts payable and accrued expenses |

|

147 |

|

|

|

488 |

|

|

Deferred revenues |

|

53 |

|

|

|

- |

|

|

Shares issued in excess of authorized |

|

- |

|

|

|

2,257 |

|

|

Operating lease liabilities - current |

|

10 |

|

|

|

13 |

|

|

Total current liabilities |

|

391 |

|

|

|

2,902 |

|

| |

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

Accrued severance pay |

$ |

241 |

|

|

|

245 |

|

|

Deferred licensing income |

|

176 |

|

|

|

199 |

|

|

Derivative liabilities |

|

1,848 |

|

|

|

2,471 |

|

|

Operating lease liabilities, non-current |

|

12 |

|

|

|

18 |

|

|

Total liabilities |

|

2,668 |

|

|

|

5,835 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 9) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

Series C Preferred stock of $0.001 par value - Authorized:

3,000,000 shares at June 30, 2021 and December 31, 2020; Issued and

outstanding: 666,667 at June 30, 2021 and December 31, 2020 |

|

1 |

|

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

Series D Preferred stock of $0.001 par value - Authorized: 506

shares at June 30, 2021 and December 31, 2020; Issued and

outstanding: 153 at June 30, 2021 and December 31, 2020 |

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

Series E Preferred stock of $0.001 par value - Authorized:

1,999,494 shares at June 30, 2021 and December 31, 2020,

respectively; Issued and outstanding: 875,000 at June 30, 2021 and

December 31, 2020 |

|

1 |

|

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

Common stock of $0.001 par value - Authorized: 24,109,635 shares at

June 30, 2021 and December 31, 2020; Issued and outstanding:

24,109,634 and 21,246,523 shares at June 30, 2021 and December 31,

2020, respectively |

|

24 |

|

|

|

22 |

|

| |

|

|

|

|

|

|

|

| Additional paid in

capital |

|

51,867 |

|

|

|

44,959 |

|

| Accumulated other

comprehensive income |

|

59 |

|

|

|

66 |

|

| Accumulated deficit |

|

(47,788 |

) |

|

|

(42,655 |

) |

|

Total stockholders’ equity |

|

4,164 |

|

|

|

2,394 |

|

|

Total liabilities and stockholders’ equity |

$ |

6,832 |

|

|

$ |

8,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NanoVibronix,

Inc.Condensed Consolidated Statements of

Operations (Unaudited)(Amounts in thousands except

share and per share data)

| |

|

|

|

|

|

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

318 |

|

|

$ |

269 |

|

|

$ |

421 |

|

|

$ |

383 |

|

|

Cost of revenues |

|

110 |

|

|

|

231 |

|

|

|

136 |

|

|

|

294 |

|

|

Gross profit |

|

208 |

|

|

|

38 |

|

|

|

285 |

|

|

|

89 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

64 |

|

|

|

16 |

|

|

|

128 |

|

|

|

63 |

|

|

Selling and marketing |

|

296 |

|

|

|

180 |

|

|

|

607 |

|

|

|

434 |

|

|

General and administrative |

|

839 |

|

|

|

1,310 |

|

|

|

1,855 |

|

|

|

1,967 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

1,199 |

|

|

|

1,506 |

|

|

|

2,590 |

|

|

|

2,464 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

(991 |

) |

|

|

(1,468 |

) |

|

|

(2,305 |

) |

|

|

(2,375 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income (expense), net |

|

1 |

|

|

|

(5 |

) |

|

|

(6 |

) |

|

|

(10 |

) |

|

Change in fair value of derivative liabilities |

|

706 |

|

|

|

- |

|

|

|

(1,242 |

) |

|

|

- |

|

|

Gain on purchase of warrants |

|

64 |

|

|

|

- |

|

|

|

64 |

|

|

|

- |

|

|

Warrant modification expense |

|

- |

|

|

|

- |

|

|

|

(1,627 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before taxes on

income |

|

(220 |

) |

|

|

(1,473 |

) |

|

|

(5,116 |

) |

|

|

(2,385 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit / (expense) |

|

4 |

|

|

|

(4 |

) |

|

|

(17 |

) |

|

|

(13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(216 |

) |

|

$ |

(1,477 |

) |

|

$ |

(5,133 |

) |

|

$ |

(2,398 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss

available for holders of common stock, Series C Preferred Stock and

Series D Preferred Stock |

$ |

(0.01 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.33 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

24,776,302 |

|

|

|

7,252,510 |

|

|

|

24,476,551 |

|

|

|

7,279,708 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Contacts:

Brett Maas, Managing Principal, Hayden IR,

LLCbrett@haydenir.com(646) 536-7331

SOURCE: NanoVibronix, Inc.

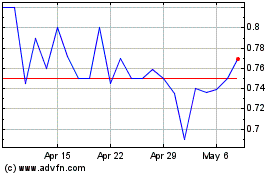

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From May 2024 to Jun 2024

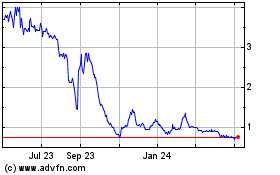

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jun 2023 to Jun 2024