Current Report Filing (8-k)

January 18 2022 - 7:20AM

Edgar (US Regulatory)

HAIN CELESTIAL GROUP INC false 0000910406 0000910406 2022-01-14 2022-01-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 14, 2022

THE HAIN CELESTIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-22818

|

|

22-3240619

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1111 Marcus Avenue, Lake Success, NY 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 587-5000

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $.01 per share

|

|

HAIN

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On January 18, 2022, The Hain Celestial Group, Inc. (the “Company”) issued a press release announcing a Chief Financial Officer transition. The press release also provided a preliminary financial update for the second quarter of fiscal year 2022. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information contained in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Appointment of New Chief Financial Officer

The Company’s Board of Directors (the “Board”) has appointed Chris Bellairs as Executive Vice President and Chief Financial Officer, effective as of the close of business on February 4, 2022. Mr. Bellairs will succeed the Company’s current Executive Vice President and Chief Financial Officer, Javier H. Idrovo.

Mr. Bellairs, age 61, served as Chief Financial Officer of Stone Brewing, a California-based craft brewery with nationwide and international distribution, from September 2018 to September 2020 with responsibility for the company’s financial organization. Prior to that he was an independent dairy consultant from October 2017 to August 2018. Prior to that he served as Executive Vice President and Chief Financial Officer of Dean Foods Company, a food and beverage company, from March 2013 to September 2017 with responsibility for the company’s financial organization. Prior to becoming Executive Vice President and Chief Financial Officer, he served in various capacities with Dean Foods including as Chief Financial Officer of the Fresh Dairy Direct Division from 2012 to 2013 and as Chief Financial Officer, Supply Chain from 2008 to 2011. Mr. Bellairs worked at PepsiCo, Inc., a global food and beverage company, from 1996 to 2004, where he most recently served as Vice President and Chief Financial Officer for the Foodservice and Vending division and led the financial integration of the Quaker Oats, Gatorade and Tropicana brands. Prior to joining PepsiCo, he worked at The Procter & Gamble Company in various finance management roles. He has also served as a divisional Chief Financial Officer at Expedia, Inc. and Iron Mountain Incorporated and in a senior leadership role at The University of Notre Dame. Mr. Bellairs was an intelligence officer in the U.S. Army for six years.

In connection with Mr. Bellairs’ appointment, the Company and Mr. Bellairs entered into an Offer Letter (the “Offer Letter”) that provides for an annual base salary of $550,000. Mr. Bellairs will be eligible to receive annual incentive awards under the Company’s Annual Incentive Plan (“AIP”), with a target AIP award for fiscal year 2022 of 85% of his annual base salary, prorated based on his start date with the Company. Mr. Bellairs’ minimum payout under his AIP award for fiscal year 2022 will be his target award amount, prorated based on his start date with the Company. Mr. Bellairs will also be eligible to receive awards under the Company’s Long-Term Incentive Program (“LTIP”). His award for fiscal year 2022, under the Company’s 2022-2024 LTIP, will have a target value of $1,000,000 prorated to reflect the number of months he is employed during fiscal year 2022. The 2022-2024 LTIP award will consist of:

|

|

•

|

|

An award of Restricted Share Units (“RSUs”), representing 50% of the 2022-2024 LTIP award value, vesting in three (3) equal annual installments on each of November 18, 2022, 2023 and 2024, subject to continued employment with the Company through each vesting date. Vesting of the RSUs will accelerate upon any death, disability or termination without cause within twelve (12) months following a change in control, and will accelerate on a prorated basis upon any other termination without cause within the first eighteen (18) months following Mr. Bellairs’ start date with the Company.

|

|

|

•

|

|

Awards of Performance Share Units (“PSUs”), representing 50% of the 2022-2024 LTIP award value, with two-thirds (2/3) of the PSUs tied to relative total shareholder return ranking within the S&P Food & Beverage Select Industry Index, and one-third (1/3) of the PSUs tied to absolute total shareholder return goals, under the terms of the 2022-2024 LTIP. The number of PSUs that vest, if any, may vary from 0% to 200% of the target number of PSUs, and is based on performance over the three (3) year performance period from November 18, 2021 through November 17, 2024. The time vesting requirement will be satisfied on November 17, 2024.

|

Pursuant to the terms of the Offer Letter, if the Company terminates Mr. Bellairs’ employment without cause, as determined by the Compensation Committee of the Board in good faith, Mr. Bellairs will be entitled to receive severance in an amount equal to one (1) times his base salary in effect at the time of termination and one (1) times his target annual incentive award under the AIP for the year in which the termination occurs, payable over twelve (12) months following termination.

Mr. Bellairs will receive a Change in Control Agreement on the Company’s standard form, providing for severance if his employment is terminated without Cause or for Good Reason (as those terms are defined in the agreement) within twelve (12) months following a Change in Control (as defined in the agreement). In that event, the amount of severance would be two (2) times the sum of Mr. Bellairs’ base salary and target annual incentive award under the AIP, payable over two (2) years following termination, subject to the execution of a release and certain other conditions.

Departure of Current Chief Financial Officer

On January 14, 2022, Javier H. Idrovo informed the Company of his intention to resign from his position as Executive Vice President and Chief Financial Officer to pursue another opportunity. Mr. Idrovo will continue to serve as Executive Vice President and Chief Financial Officer until February 4, 2022, to assist with the transition of his responsibilities and to participate in the Company’s upcoming conference call to discuss its second quarter fiscal year 2022 financial results.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 18, 2022

|

|

|

|

|

THE HAIN CELESTIAL GROUP, INC.

|

|

|

|

|

By:

|

|

/s/ Kristy M. Meringolo

|

|

Name:

|

|

Kristy M. Meringolo

|

|

Title:

|

|

EVP, General Counsel and Corporate Secretary

|

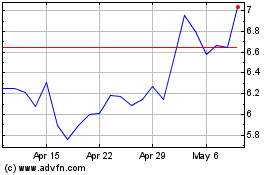

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From May 2024 to Jun 2024

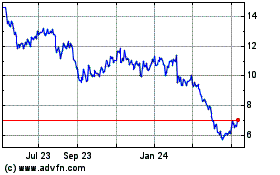

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Jun 2023 to Jun 2024