Current Report Filing (8-k)

December 13 2021 - 8:38AM

Edgar (US Regulatory)

0000910406false00009104062021-12-132021-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2021

————————————

THE HAIN CELESTIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

————————————

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

0-22818

|

22-3240619

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1111 Marcus Avenue, Lake Success, NY 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 587-5000

Former name or former address, if changed since last report: N/A

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

|

HAIN

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On December 13, 2021, The Hain Celestial Group, Inc. (the “Company,” “we” and “our”) issued a press release announcing its entry into an agreement to acquire the producer and marketer of the ParmCrisps® and Thinsters® brands.

The Company expects the acquisition to close by the end of calendar year 2021, subject to customary closing conditions, including the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. The words “believe,” “expect,” “anticipate,” “may,” “should,” “plan,” “intend,” “potential,” “will” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include, among other things, our beliefs or expectations relating to corporate acquisitions and our future performance, results of operations and financial condition.

Risks and uncertainties that may cause actual results to differ materially from forward-looking statements include: the ability to satisfy the conditions to the closing of the contemplated acquisition, which may include conditions outside of our control such as regulatory approvals; our ability to successfully integrate and realize the benefits of the contemplated acquisition; challenges and uncertainty resulting from the impact of competition; challenges and uncertainty resulting from the COVID-19 pandemic; our ability to manage our supply chain effectively; disruption of operations at our manufacturing facilities; reliance on independent contract manufacturers; changes to consumer preferences; customer concentration; reliance on independent distributors; the availability of organic ingredients; risks associated with our international sales and operations; risks associated with outsourcing arrangements; our ability to execute our cost reduction initiatives and related strategic initiatives; our reliance on independent certification for a number of our products; the reputation of our Company and our brands; our ability to use and protect trademarks; general economic conditions; input cost inflation; the United Kingdom’s exit from the European Union; cybersecurity incidents; disruptions to information technology systems; the impact of climate change; liabilities, claims or regulatory change with respect to environmental matters; potential liability if our products cause illness or physical harm; the highly regulated environment in which we operate; pending and future litigation; compliance with data privacy laws; compliance with our credit agreement; the discontinuation of LIBOR; concentration in the ownership of our common stock; our ability to issue preferred stock; the adequacy of our insurance coverage; impairments in the carrying value of goodwill or other intangible assets; and other risks and matters described in our most recent Annual Report on Form 10-K and our other filings from time to time with the U.S. Securities and Exchange Commission.

We undertake no obligation to update forward-looking statements to reflect actual results or changes in assumptions or circumstances, except as required by applicable law.

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 13, 2021

|

|

|

|

|

|

|

|

THE HAIN CELESTIAL GROUP, INC.

|

|

|

|

By:

|

/s/ Kristy M. Meringolo

|

|

Name:

|

Kristy M. Meringolo

|

|

Title:

|

EVP, General Counsel and Corporate Secretary

|

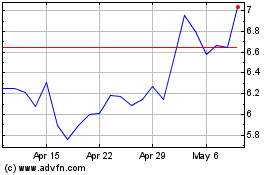

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From May 2024 to Jun 2024

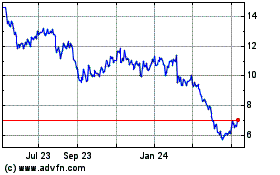

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Jun 2023 to Jun 2024