Marie Brizard Wine & Spirits: financial information for the

third quarter 2020

Charenton-le-Pont,

28th October 2020

Financial Information for the third

quarter 2020

- Sales1 for the first nine

months of 2020 up +3.9% at €126.8m (excluding Poland and

Moncigale)

> An activity driven by bulk sales and the

positive effects of the change in distribution model

in the United States which enjoyed strong growth over the first

nine months of 2020

> A WEMEA

cluster impacted by the health crisis

- Third-quarter Sales (excluding Poland and

Moncigale) of €40.0m, down -2.4%

> Branded

Business (-9.5%) impacted by a highly promotional French market

this quarter, persistent

difficulties on the HoReCa segment in Europe (West and East) due to

Covid-19 and the on-going

value-driven strategy

> Slight

deceleration in the United States after a strong first half

year

- Uncertainty about the rest of the year due to

changes in health measures in some countries

NB: All sales growth figures mentioned in this

press release are at constant exchange rates and on a like-for-like

basis, unless otherwise stated.

Marie Brizard Wine &

Spirits (Euronext: MBWS) is today releasing its quarterly

business information for its activity up to 30th September 2020. In

applying IFRS 5 relating to "entities sold and held for sale", the

scope of consolidation has been restated following the definitive

disposal of operations in Poland communicated on October 23rd and

the announced signing of the sale of Moncigale communicated on

October 14th which are therefore considered as sold at September

30th 2020 according to the accounting standard IFRS 5. Quarterly

performance before the application of IFRS 5 is presented in the

appendix.

9 Months 2020

|

|

In €m |

Q3 YTD 2019 |

Organic Growth |

Currency Impact |

Q3 YTD 2020 |

Organic Growth at C.C. |

Growth |

| |

|

|

|

|

|

|

|

|

Branded Business |

107.1 |

-6.2 |

-0.5 |

100.5 |

-5.8% |

-6.2% |

|

|

WEMEA |

73.4 |

-7.3 |

0.0 |

66.1 |

-10.0% |

-10.0% |

|

| |

France1 |

59.8 |

-3.1 |

0.0 |

56.8 |

-5.1% |

-5.1% |

|

| |

Rest of cluster |

13.5 |

-4.3 |

0.0 |

9.3 |

-31.5% |

-31.4% |

|

|

Central & Eastern Europe |

19.0 |

-1.7 |

0.0 |

17.3 |

-9.0% |

-9.0% |

|

| |

Poland1 |

0,0 |

0.0 |

0.0 |

0.0 |

0.0% |

0.0% |

|

| |

Rest of cluster |

19.0 |

-1.7 |

0.0 |

17.3 |

-9.0% |

-9.0% |

|

|

Americas |

12.9 |

2.7 |

-0.5 |

15.0 |

20.8% |

16.9% |

|

|

Asia Pacific |

1.9 |

0.2 |

0.0 |

2.1 |

8.9% |

8.9% |

|

|

Other Businesses |

15.5 |

10.9 |

0.0 |

26.4 |

70.7% |

70.7% |

|

|

|

TOTAL MBWS (1) |

122.6 |

4.8 |

-0.5 |

126.8 |

3.9% |

3.5% |

|

3rd Quarter 2020

|

|

In €m |

Q3 2019 |

Organic Growth |

Currency Impact |

Q3 2020 |

Organic Growth at C.C. |

Growth |

| |

|

|

|

|

|

|

|

|

Branded Business |

37.1 |

-3.5 |

-0.6 |

32.9 |

-9.5% |

-11.1% |

|

|

WEMEA |

24.8 |

-2.5 |

0.0 |

22.3 |

-10.0% |

-10.0% |

|

| |

France1 |

20.4 |

-2.1 |

0.0 |

18.2 |

-10.5% |

-10.5% |

|

| |

Rest of cluster |

4.4 |

-0.4 |

0.0 |

4.1 |

-8.1% |

-8.0% |

|

|

Central & Eastern Europe |

6.9 |

-0.9 |

0.0 |

6.0 |

-13.2% |

-13.2% |

|

| |

Poland1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0% |

0.0% |

|

| |

Rest of cluster |

6.9 |

-0.9 |

0.0 |

6.0 |

-13.2% |

-13.2% |

|

|

Americas |

4.5 |

-0.1 |

-0.6 |

3.8 |

-1.6% |

-15.0% |

|

|

Asia Pacific |

0.9 |

0.0 |

0.0 |

0.8 |

-4.7% |

-4.7% |

|

|

Other Businesses |

4.5 |

2.5 |

0.0 |

7.1 |

55.7% |

55.7% |

|

|

|

TOTAL MBWS (1) |

41.6 |

-1.0 |

-0.6 |

40.0 |

-2.4% |

-3.8% |

|

[1] Application of IFRS 5 "Entities held for

sale": restatement of the scope of consolidation relating to the

sale of the activities in Poland and Moncigale considered sold at

30 September 2020.

WEMEA: a quarter that reflects the value

strategy and the difficult environment in the HoReCa

segment

At end-September 2020, the cluster WEMEA's sales

amounted to €66.1 million, down -10.0% compared with 2019, with a

third quarter down -10,0% at €22.3 million.

In France, revenue for the third quarter of 2020

amounted to €18.2 million, down -10.5% compared with the same

period in 2019. The Group had to deal with a highly promotional and

competitive spirits market where its marketing initiatives were

limited, in accordance with its strategy of enhancing the value of

its portfolio. Sales in the HoReCa segment were further impacted by

the health crisis. In this context, the William Peel brand shows

some resilience.

Revenue in the rest of the cluster amounted to

€4.1 million in the third quarter of 2020, down -8.1% when compared

with the same period in 2019. This decrease, less pronounced than

in H1 (-44%), includes a slight business recovery in Western Europe

and Africa thanks to the reopening of retail markets. The Iberian

region, whose activity had deteriorated sharply as a result of the

closures and halt in activity in the HoReCa segment in the first

half of the year, continues to suffer but to a lesser extent in

this quarter. The Scandinavian countries, still under pressure in

the domestic retail market, suffered the negative effects of

lockdown which were not offset by marketing actions.

Central and Eastern Europe (CEE): impact

of the strategy favouring profitable volumes

Revenue for the first nine months of 2020 for

the CEE cluster amounted to €17.3 million, down -9.0%, following a

third quarter of €6.0 million, down -13.2% compared with the third

quarter of 2019. During this quarter, activities were impacted by a

decline in volumes and sales in Lithuania, due to the termination

of non-profitable commercial contracts and the ongoing

reorganisation of the portfolio focused on profitable ranges. This

was not fully offset by the good export performance for spirits

from Bulgaria.

Americas: slight deceleration in the

United States after strong growth in the first half of the

year

At the end of September 2020, revenue for the

Americas cluster reached €15.0 million, up 20.8% compared with the

first nine months of 2019.

The third-quarter 2020 revenue amounted to €3.8

million for the cluster, a -1.6% decrease after recording a very

robust first half in the United States driven by the start of the

new distribution partnership with Sazerac at the beginning of the

year and better off-Trade performance in the second quarter. The

latter continued in the third quarter, albeit with a less

favourable price-mix effect.

The good performances recorded in Brazil this

quarter is the result of the commercial strategy implemented with

the launch of a local brand, the introduction of new COFEPP brands

and a positive price effect.

Asia-Pacific

Over the first nine months of 2020, revenue in

the Asia-Pacific region amounted to €2.1 million, reflecting a

slowdown in the third quarter. Due to the global health context,

the Group has suspended the implementation of projects to

revitalise this cluster for the year 2020.

Other Activities

Driven by bulk alcohol sales in Lithuania,

revenue from Other Activities grew very strongly over the first

nine months of 2020. Revenue grew, but at a slower pace over the

third quarter of 2020, at €7.1m.

Activities sold or held for

sale

- Polish activities: business in Poland experienced a sharp

decline during the third quarter, with sales (€5.9 million) down

-35.7% due to a still highly competitive commercial situation, to

the continuing impact of the pandemic on traditional distribution

and cash & carry channels, and to our proactive policy of

focusing on sales profitability. Over the quarter, bulk demand

weakened in Poland due to high levels of disinfectant product

inventories and new offers from a number of producers.

- Moncigale: despite an improvement in net sales prices, the Wine

business posted a sharp drop in revenue this quarter as the

difficulties experienced for several years in the Wine Based

Flavoured Drink segment affected Fruits & Wines. In a highly

competitive market, the Private Label activity in France

experienced a sharp decline in sales in the 3rd quarter 2020.

Outlook

As indicated on 30th September 2020, the

difficulties linked to Covid-19 will continue over the second part

of the year and could prove to be more restrictive again in the

coming weeks. Given the decisive weight of the fourth quarter in

its business, the Group does not yet have sufficient visibility and

remains cautious about the outlook for the year.

Financial calendar

Extraordinary General Meeting on 30th November 2020.

About Marie Brizard Wine & Spirits

Marie Brizard Wine & Spirits is a Group of

wines and spirits based in Europe and the United States. Marie

Brizard Wine & Spirits stands out for its expertise, a

combination of brands with a long tradition and a resolutely

innovative spirit. From the birth of the Maison Marie Brizard in

1755 to the launch of Fruits and Wine in 2010, the Marie Brizard

Wine & Spirits Group has developed its brands in a spirit of

modernity while respecting its origins. Marie Brizard Wine &

Spirits' commitment is to offer its customers brands of confidence,

daring and full of flavours and experiences. The Group now has a

rich portfolio of leading brands in their market segments,

including William Peel, Sobieski, Fruits and Wine, Marie Brizard

and Cognac Gauthier.Marie Brizard Wine & Spirits is listed on

Compartment B of Euronext Paris (FR0000060873 - MBWS) and is part

of the EnterNext PEA-PME 150 index

|

ContactImage Sept Claire Doligez

– Flore Largercdoligez@image7.fr / flarger@image7.frTél : +33 1 53

70 74 70 |

APPENDIX

Revenue at 30 September 2020 before

application of IFRS 5relating to "entities sold or

held for sale".

9 Months 2020

|

|

In €m |

Q3 YTD 2019 |

Organic Growth |

Currency Impact |

Q3 YTD 2020 |

Organic Growth at C.C. |

Growth |

| |

|

|

|

|

|

|

|

|

Branded Business |

138.8 |

-17.7 |

-1.0 |

120.0 |

-12.8% |

-13.5% |

|

WEMEA |

80.1 |

-12.2 |

0.0 |

67.9 |

-15.2% |

-15.2% |

| |

France |

66.6 |

-7.9 |

0.0 |

58.6 |

-11.9% |

-11.9% |

| |

Rest of cluster |

13.5 |

-4.3 |

0.0 |

9.3 |

-31.5% |

-31.4% |

|

Central & Eastern Europe |

43.9 |

-8.4 |

-0.5 |

35.0 |

-19.1% |

-20.2% |

| |

Poland |

24.9 |

-6.7 |

-0.5 |

17.7 |

-26.8% |

-28.8% |

| |

Rest of cluster |

19.0 |

-1.7 |

0.0 |

17.3 |

-9.0% |

-9.0% |

|

Americas |

12.9 |

2.7 |

-0.5 |

15.0 |

20.8% |

16.9% |

|

Asia Pacific |

1.9 |

0.2 |

0.0 |

2.1 |

8.9% |

8.9% |

|

Other Businesses |

65.9 |

9.4 |

0.0 |

75.3 |

14.3% |

14.3% |

| |

Sobieski Trade |

0.0 |

0.0 |

0.0 |

0.0 |

0.0% |

0.0% |

|

|

Private Labels |

65.9 |

9.4 |

0.0 |

75.3 |

14.3% |

14.3% |

|

|

TOTAL MBWS |

204.7 |

-8.3 |

-1.0 |

195.4 |

-4.1% |

-4.5% |

3rd Quarter 2020

|

|

In €m |

Q3 2019 |

Organic Growth |

Currency Impact |

Q3 2020 |

Organic Growth at C.C. |

Growth |

| |

|

|

|

|

|

|

|

|

Branded Business |

48.3 |

-8.1 |

-0.8 |

39.5 |

-16.7% |

-18.4% |

|

WEMEA |

26.5 |

-3.6 |

0.0 |

22.9 |

-13.7% |

-13.7% |

| |

France |

22.1 |

-3.3 |

0.0 |

18.8 |

-14.9% |

-14.9% |

| |

Rest of cluster |

4.4 |

-0.4 |

0.0 |

4.1 |

-8.1% |

-8.0% |

|

Central & Eastern Europe |

16.5 |

-4.3 |

-0.2 |

12.0 |

-26.3% |

-27.5% |

| |

Poland |

9.6 |

-3.4 |

-0.2 |

5.9 |

-35.7% |

-37.8% |

| |

Rest of cluster |

6.9 |

-0,9 |

0.0 |

6.0 |

-13.2% |

-13.2% |

|

America |

4.5 |

-0.1 |

-0.6 |

3.8 |

-1.6% |

-15.0% |

|

Asia Pacific |

0.9 |

0.0 |

0.0 |

0.8 |

0.0% |

0.0% |

|

Other Businesses |

21.6 |

-1.3 |

0,2 |

20.5 |

-6.1% |

-5.2% |

| |

Sobieski Trade |

0.0 |

0.0 |

0.0 |

0.0 |

0.0% |

0.0% |

|

|

MDD |

21.6 |

-1.3 |

0.2 |

20.5 |

-6.1% |

-5.2% |

|

|

TOTAL MBWS |

70.0 |

-9.4 |

-0.6 |

60.0 |

-13.4% |

-14.3% |

1 Application of IFRS 5 "Entities held for

sale": restatement of the scope of consolidation relating to the

sale of the activities in Poland and Moncigale considered sold at

30 September 2020.

- MBWS_PR_Q3SALES_EN_2020OCTOBER28

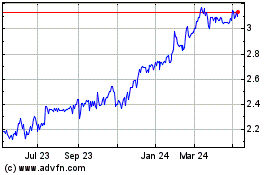

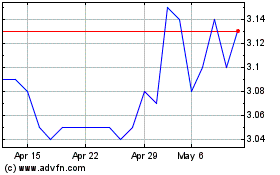

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From May 2024 to Jun 2024

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Jun 2023 to Jun 2024