Central Securities Depositories Looking To Blockchain

February 27 2019 - 2:00PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

February 27, 2019 -- ADVFN Crypto NewsWire -- A small group of

central securities depositories (CSDs) in Europe and Asia are

considering how they might collaborate on a new infrastructure to

custody digital assets. These financial institutions are making a

seemingly complete reversal from what the majority of the rest of

the financial industry is doing. Where most attention is paid to

how investments can be made in Bitcoin without actually holding the

currency, these organizations are looking to store the coin itself.

In this way, their function as a business remains parallel to what

they were created for in the late 1980s and early 1990s.

“A new world of tokenized assets

and blockchain is coming. It will probably disrupt our role as

CSDs. The whole group decided we will be focusing on tokenized

assets, not just blockchain but on real digital assets.” - Artem

Duvanov, head of innovation at the National Settlement Depository

(NSD) of the Moscow Exchange Group

The stock market boomed in the

1970s and 1980s. Because of this, the antiquated physical paper

based shareholder systems were beginning to fail. Central

Securities Depositories emerged to solve the problem. These

financial institutions focus solely on holding stocks, bonds and

securities in certificated or uncertificated (dematerialized) form

in one spot, rather than the certificates of ownership needing to

be physically transferred when a stock market purchase and sale is

made. This is now all done electronically, which vastly improved

efficiency of 5the process. However, blockchain technology will

likely take this further.

Similarities to

Cryptocurrencies and Blockchain

The primary functions of CSD run

parallel to many of the strengths being seen with Bitcoin and the

blockchain technology field that emerged from it:

-

Safekeeping Securities

-

Deposit and withdrawal through

relationships with the transfer agent and/or issuers, along with

the underwriting process or listing of new issues in a

market.

-

Dividend, interest, and principal

processing, as well as corporate actions including proxy voting

Payment to transfer agents, and issuers involved in these

processes

-

Securities lending and borrowing,

matching, and repo settlement, or ISIN assistance.

-

Pledge - Central depositories

provide pledging of share and securities. Every country is required

to provide legal framework to protect the interest of the pledger

and pledgee.

In almost all of these situations,

use of cryptocurrencies or a blockchain network would automate the

process further, with completely integrated authentication and

transparency of the transfers themselves.

The group was formed last year as

the International Securities Services Association (ISSA), and in

that time the founding group of 15 has doubled to 30. They have set

a deadline for a prototype platform to present at the annual SIBOS

conference in London in October.

By: BGN Editorial Staff

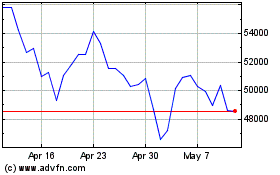

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From May 2024 to Jun 2024

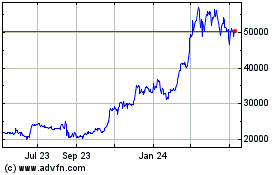

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles