Bushveld Minerals Limited Admission to AIM of AfriTin Mining Limited (9873V)

November 09 2017 - 2:01AM

UK Regulatory

TIDMBMN

RNS Number : 9873V

Bushveld Minerals Limited

09 November 2017

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

9 November 2017

Bushveld Minerals Limited

("Bushveld" or the "Company")

Admission to AIM of AfriTin Mining Limited

Bushveld Minerals Limited (AIM: BMN), a diversified mineral

development company with a portfolio of vanadium, tin, coal assets

and other interests in Southern Africa, is pleased to announce the

admission of AfriTin Mining Limited's ("AfriTin Mining") Ordinary

Shares (AfriTin Mining Shares) to trading on the AIM market of the

London Stock Exchange. Dealings in AfriTin will commence at 8.00 am

today.

Anthony Viljoen will become the Chief Executive Officer of

AfriTin Mining and as such will stand down as an executive director

at Bushveld with immediate effect. However, he will remain on the

board of the Company as a non-executive director.

Upon Admission to AIM, Bushveld will own a total of 51,995,342

AfriTin Mining Shares, representing 17.48 per cent of the issued

share capital of AfriTin Mining, which at the issue price of 3.9p,

is valued at approximately GBP2.0 million. A further 24.39 per cent

of the issued share capital of AfriTin Mining will be distributed

to the Bushveld shareholders on the register as at the close of

business on 08 November 2017.

AfriTin Mining's Admission Document is available on the

company's website: www.afritinmining.com

Fortune Mojapelo, CEO of Bushveld Minerals, said: "With this

milestone, we have fulfilled our promise to shareholders to develop

the necessary critical-mass for a stand-alone tin company with a

near-term production profile and a perfect opportunity to grow into

the African tin champion. This is the culmination of significant

work done over the years.

"We are delighted to have AfriTin listed on the AIM Market. As a

substantial and committed shareholder, Bushveld will remain

supportive of AfriTin. Congratulations to Anthony and his team; we

wish them well for the future."

Enquiries: info@bushveldminerals.com

Bushveld Minerals +27 (0) 11 268 6555

Fortune Mojapelo

SP Angel Corporate Finance

LLP +44 (0) 20 3470 0470

Nominated Adviser & Joint

Broker

Ewan Leggat

Beaufort Securities +44 (0) 20 7382 8300

Joint Broker

Jon Belliss

Blytheweigh

Financial PR

Tim Blythe / Nick Elwes +44 (0) 207 138 3204

Gabriella von Ille +27 (0) 711 121 907

Notes to editors

Bushveld Minerals is an AIM listed mineral project development

company with a portfolio of vanadium, tin and coal assets in

Southern Africa, including interest in a vanadium-producing

operation.

The Company's flagship platform, the vanadium platform, includes

the Mokopane Vanadium Project, the Brits Vanadium Project, and an

interest in Bushveld Vametco Alloys primary vanadium mining and

processing company. The coal platform comprises the wholly-owned

Imaloto Coal Project, which is being developed as one of

Madagascar's leading independent power producers. The Company's tin

interest is held through its shareholding in AIM listed AfriTin

Mining Limited.

Bushveld's vision is to become a significant, low-cost,

integrated, primary vanadium producer through owned low-cost,

high-grade assets. This incorporates development and promotion of

the role of vanadium in the growing global energy storage market

through Bushveld Energy, the Company's energy storage solutions

provider. Whilst the demand for vanadium remains largely anchored

in a slow growing steel industry, Bushveld Minerals believes there

is strong potential for an imminent, significant, global vanadium

demand surge from the fast-growing energy storage market,

particularly through the use and adoption of Vanadium Redox Flow

Batteries.

The Company's approach to project development recognises that

whilst attractive project economics are imperative, they are

insufficient to secure capital to bring them to account. A clear

path to production with a visible timeframe, low capex requirements

and scalability are important factors in retaining an attractive

exit option. This philosophy is core to the Company's strategy in

developing projects.

Detailed information on the Company and progress to date can be

accessed on the website: www.bushveldminerals.com

- ENDS -

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCOKFDDKBDBCDK

(END) Dow Jones Newswires

November 09, 2017 02:01 ET (07:01 GMT)

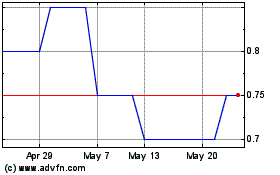

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From May 2024 to Jun 2024

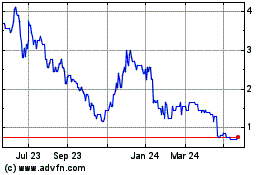

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024