TIDMTOM

RNS Number : 3690Q

TomCo Energy PLC

28 June 2022

28 June 2022

TomCo Energy plc

("TomCo", the "Company" or the "Group")

Unaudited interim results for the six-month period ended 31

March 2022

TomCo Energy plc (AIM: TOM), the US operating oil development

group focused on using innovative technology to unlock

unconventional hydrocarbon resources, announces its unaudited

interim results for the six-month period ended 31 March 2022 (the

"Period").

Highlights

-- Acquisition of an initial 10% interest in Tar Sands Holdings II LLC (" TSHII")

-- TSHII reserves report received from Netherland, Sewell & Associates, Inc.

-- A number of agreements entered into with certain third

parties to seek to enhance the potential value that can be

generated from the TSHII site and provide income for the

Company

-- Placing completed in January 2022, raising gross proceeds of

GBP1.25 million, to fund the drilling of three exploration wells

and cover corporate expenses, particularly in relation to

Greenfield Energy LLC's shorter-term plans

-- Drilling of three exploration wells on the TSHII site

completed post the Period end with initial results meeting the

Company's expectations

-- Appointment of Zac Phillips as a Non-Executive Director of

the Company, with Richard Horsman stepping down from the Board

Chairman's Statement

Operational

I am very pleased with the progress made during the Period as

the Company's primary focus remains on its wholly owned subsidiary,

Greenfield Energy LLC ("Greenfield") and its near-term potential

production plans at the Tar Sands Holdings II LLC ("TSHII") site in

the Uinta Basin, Utah, United States. As announced on 9 June 2021,

TomCo, via Greenfield, entered into an agreement to acquire up to

100% of the ownership and membership rights and interests in TSHII

(the "Membership Interests").

On 16 November 2021, we were pleased to report that Greenfield

had exercised its option to acquire an initial 10% of the

Membership Interests for a total cash consideration of US$2

million, of which US$500,000 was satisfied by crediting the

deposits paid previously. Following this acquisition, Greenfield

retains an exclusive option, at its sole discretion, to acquire the

remaining 90% of the Membership Interests for certain additional

cash consideration up to 31 December 2022, as detailed in the

Company's announcement of 9 June 2021.

Alongside the acquisition of the initial 10% of the Membership

Interests, a newly incorporated subsidiary of Greenfield was

granted a lease over approximately 320 acres of the 760-acre site

owned by TSHII (the "Lease Area"), for a nominal consideration and

annual rental of US$320, together with a 12% net sales royalty per

barrel of conventional oil and gas produced and removed from the

Lease Area. The lease provides Greenfield's subsidiary with the

exclusive right to explore, drill, and mine for, and extract,

store, and remove oil, gas, hydrocarbons, and other associated

substances on and from the Lease Area. In addition, it affords the

right, inter alia, to erect, construct and use such plant and

equipment and infrastructure as required. The lease is for an

initial term of 10 years and will continue thereafter for so long

as any oil, gas or other hydrocarbons are being produced from the

Lease Area or drilling operations are being prosecuted or as the

parties may agree.

The US$1.5 million balance of the consideration for the initial

10% of the Membership Interests paid by Greenfield, was financed by

way of an unsecured US$1.5 million loan from Valkor Oil & Gas

LLC ("Valkor") to Greenfield (the "Loan"). Such Loan is repayable

by Greenfield via a number of potential means and although

originally scheduled to be repaid on or before 30 May 2022, the

repayment date has subsequently been extended to on or before 31

July 2022.

Greenfield is engaged in ongoing discussions regarding possible

funding options, including a due diligence exercise with a

potential funder, to potentially achieve the ultimate acquisition

of 100% of the Membership Interests, as well as the drilling of

several production oil wells and the planned first 5,000 barrels of

oil per day production plant, whilst progressing other preparatory

work. However, there can be no certainty that Greenfield can secure

the requisite funding or the permitting required for such

wells.

TSHII Reserves Report

On 13 January 2022, we were pleased to announce the findings of

an independent report commissioned from Netherland, Sewell &

Associates, Inc. ("NSAI") estimating the proved (1P), proved plus

probable (2P), and proved plus probable plus possible (3P) oil

reserves, associated marketable sand volumes, and future net

revenue, as of 31 December 2021 in respect of a 100 per cent.

interest in a potential commercial scale project situated on the

mining properties comprising the TSHII site.

NSAI estimated 1P oil reserves of 22.8 million barrels of oil

("bbls"), 2P oil reserves of 33.6 million bbls and 3P oil reserves

of 44.3 million bbls. NSAI further estimated associated volumes of

marketable sand at 22.8 million tonnes (1P), 41.2 million tonnes

(2P) and 59.8 million tonnes (3P). Total estimated undiscounted

future net revenues (as outlined in the Company's announcement of

13 January 2022) ranged from US$942 million based on 1P reserves,

to approximately US$2.5 billion based on 3P reserves in respect of

a gross 100% interest in TSHII. Estimated discounted future net

revenues attributable to TomCo's current 10 per cent. interest in

TSHII ranged from approximately US$30.5 million based on 1P

reserves, to approximately US$57.6 million based on 3P

reserves.

TSHII Drilling

During the Period, Greenfield's wholly owned subsidiary, AC Oil

LLC, secured the permits required from the Utah Division of Oil,

Gas and Mining to drill three exploration wells on the TSHII site

and post the Period end on 31 May 2022, we reported that the

drilling of these three exploration wells had been completed.

Initial results met with the Company's expectations and the full

results of this drill programme are currently being independently

assessed by NSAI with a view to updating its initial TSHII reserves

report in the coming months.

Additionally, Greenfield continues to progress the requisite

permitting for its planned production well programme on the TSHII

site following recent changes to the relevant permit legislation.

The Company currently anticipates that the necessary permits will

be secured in time for drilling to commence in Q3 2022, assuming

the requisite funding has been obtained beforehand, with initial

production expected to occur in Q4 2022. The number of wells to be

permitted has been increased from an initially planned five to

seven.

Third Party Agreements in relation to TSHII site

Alongside the TSHII exploration well drill programme and ongoing

funding discussions, Greenfield and TSHII entered into several

agreements with certain third parties during the Period, designed

to enhance the potential value that can be generated from the TSHII

site and provide income for the Company.

TSHII entered into a 10-year lease with a tenant starting from 1

March 2022, covering an existing refinery on the TSHII site that is

not required for Greenfield's future plans and was previously

scheduled to be demolished should Greenfield eventually acquire

100% of TSHII. The tenant intends to develop a 10,000 barrels of

oil per day refinery on the site and under the terms of the lease

has two years in which to do so without potentially forfeiting the

lease. The lease requires the tenant to pay TSHII US$10,000 per

month by way of rent, together with a further payment of US$3 for

every barrel of produced hydrocarbons.

Vivakor Inc ("Vivakor") entered into a renewed lease with TSHII

covering approximately three acres of land for a term of five

years, with an option to extend for a further five years, effective

from 9 March 2022, to, inter alia, accommodate Vivakor's storage

needs and planned plant operations at the TSHII site. It is

Vivakor's intention, with the assistance of Greenfield, to develop

and enhance a pre-existing oil sands processing plant on the leased

land. Such an upgraded plant, to be operated by Vivakor, would be

designed to produce at least 1,000 barrels of oil per day or

equivalent tonnage of asphalt cement. Under the lease agreement,

TSHII shall supply Vivakor with such quantity of oil sands as

Vivakor determines each month, at a set minimum saturation quality,

with a maximum supply of 2,000 tons per day. Vivakor will cover the

cost of mining the oil sands and will pay TSHII US$3 per ton of oil

sands processed by way of rental for the Lease. Vivakor paid a

US$30,000 advance against future rental payments on signing of the

Lease.

Additionally, Greenfield entered into a Memorandum of

Understanding ("MoU") with Vivakor covering a proposed professional

services agreement for the potential supply of certain operating

and engineering services, including sand treatment and oil

upscaling to Vivakor. In exchange for its services in respect of

the enhancement of Vivakor's plant, Greenfield would be entitled to

receive 50% of the net revenues received by Vivakor for any

post-processed sand material from the plant sold through offtake

agreements procured by Greenfield. The MoU includes a binding

five-year exclusivity period for agreeing and entering into any

definitive agreements.

Greenfield also entered into an agreement with Heavy Sweet Oil

LLC ("Heavy Sweet Oil"), a US based oil and gas company, to assist

it with permitting and government relations in respect of their

planned drilling programme adjacent to the D Tract of the TSHII

site. Should Heavy Sweet Oil progress to producing oil it is

anticipated that some of the supporting infrastructure for their

operations would be located on the TSHII site. Such assistance is

being provided alongside Greenfield's own work to progress its

plans for the TSHII site. Heavy Sweet Oil are paying TomCo

US$10,000 per month for its services, with the agreement backdated

to start from 1 January 2022.

TurboShale

In January 2022, the Company acquired the residual 20% interest

in TurboShale Inc ("TurboShale") not previously held by the

Company, for US$15,000. Accordingly, TurboShale is now a wholly

owned subsidiary of the Company. Amongst other assets, TurboShale

owns two 25KW Radio Frequency generators currently valued by TomCo

at over US$500,000 and which could be utilised on the TSHII site.

However, the Company continues to evaluate its future strategy for

TurboShale, which is not currently a strategic priority for the

Company.

Board Changes

On 24 January 2022, Zac Phillips was appointed as a

Non-Executive Director of the Company. Zac had previously been, and

continues to be, engaged by TomCo, through his company, Oil &

Gas Advisors Limited, to provide advice in respect of a number of

financing initiatives.

Zac has over 22 years' experience in the oil and gas sector, and

of finance, working for companies such as BP, Chevron, DB

Petroleum, Merrill Lynch and ING Barings, where he undertook

finance or finance related roles. He is an expert in the valuation

of oil and gas exploration and production assets at all stages of

the cycle. Previously, Zac was the CFO for Dubai World's oil &

gas business (DB Petroleum), with responsibility for risk

management, valuation and authoring of investment proposals. Zac

has an Honours Degree in Chemical Engineering and a PhD in Chemical

Engineering. He is a member of the Society of Petroleum Engineers,

Institute of Chemical Engineers, American Association of Petroleum

Geologists and the Association of International Petroleum

Negotiators.

At the same time, Richard Horsman resigned as a Non-Executive

Director of the Company in order to focus on his other business

interests. I would like to thank Richard for his contribution to

the Company and we wish him well in his future endeavours.

Funding

On 24 January 2022, the Company raised gross proceeds of GBP1.25

million via the placing of 250,000,000 new ordinary shares at 0.50

pence per share (the "Placing"). The Placing was undertaken to,

inter alia, provide funds to further progress Greenfield's

shorter-term plans in relation to the TSHII site. The net proceeds

of the Placing are currently expected to provide sufficient funding

to cover the Company's corporate operating expenses through to Q1

2023, and satisfied the costs associated with drilling the

abovementioned three exploration wells on the TSHII site.

The net proceeds are also being utilised to cover the Company's

expenses in relation to an ongoing due diligence exercise in order

to secure potential funding of up to US$145 million for Greenfield.

Whilst there is no certainty that such funding arrangements will be

satisfactorily concluded, or as to the terms of any such funding,

such non-equity financing, if secured, would enable Greenfield to

acquire the remaining 90% of the Membership Interests in TSHII and

cover the currently estimated construction costs of an initial

5,000 barrels per day oil production plant and the requisite

associated supporting infrastructure to enable the future mining of

oil baring sands at the TSHII site.

Additionally, on 23 November 2021 the Company received

GBP210,000 through the exercise of broker warrants to subscribe for

46,666,666 new ordinary shares at a price of 0.45 pence per share.

This related to warrants issued as part of the Company's placing,

announced on 16 November 2020.

Summary

Our continued focus is on progressing our plans for Greenfield

and unlocking the significant potential we see in the TSHII

site.

Greenfield is engaged in ongoing discussions regarding possible

funding options to potentially achieve the ultimate acquisition of

100% of the TSHII Membership Interests, as well as the proposed

drilling of a number of production oil wells and future

construction of the planned first 5,000 barrels of oil per day

production plant, whilst progressing other preparatory work. Whilst

there can be no certainty that Greenfield can secure the requisite

funding or the further permitting required for such wells, I am

optimistic, based on discussions with potential funders to date,

that the required funding to implement our plans can be secured in

due course.

These continue to be very exciting times for TomCo as we look to

realise Greenfield's significant long term potential.

Malcolm Groat

Non-Executive Chairman

Enquiries :

TomCo Energy plc

Malcolm Groat (Chairman) / John Potter (CEO) +44 (0)20 3823 3635

Strand Hanson Limited (Nominated Adviser)

James Harris / Matthew Chandler +44 (0)20 7409 3494

Novum Securities Limited (Broker)

Jon Belliss / Colin Rowbury +44 (0)20 7399 9402

IFC Advisory Limited (Financial PR)

Tim Metcalfe / Florence Chandler +44 (0)20 3934 6630

For further information, please visit www.tomcoenergy.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

Condensed consolidated statement of comprehensive income

For the six-month period ended 31 March 2022

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 30 September

31 March 31 March

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

----------------------------------------- ----- ----------- ----------- -------------

Revenue 23 - -

----------------------------------------- ----- ----------- ----------- -------------

Cost of sales - - -

----------------------------------------- ----- ----------- ----------- -------------

Gross profit/(loss) 23 - -

Administrative expenses 3 (637) (738) (1,528)

Impairment losses - - (8,679)

----------------------------------------- ----- ----------- ----------- -------------

Operating loss (614) (738) (10,207)

Finance income/(costs) (64) - -

Share of loss of joint venture - (39) (84)

----------------------------------------- ----- ----------- ----------- -------------

Loss on ordinary activities before

taxation (678) (777) (10,291)

Taxation - - -

----------------------------------------- ----- ----------- ----------- -------------

Loss from continuing operations (678) (777) (10,291)

Loss for the period/year attributable

to :

Equity shareholders of the parent (678) (739) (10,017)

Non-controlling interests - (38) (274)

----------------------------------------- ----- ----------- ----------- -------------

(678) (777) (10,291)

----------------------------------------- ----- ----------- ----------- -------------

Items that may be reclassified subsequently to

profit or loss

Exchange differences on translation

of foreign operations

Other comprehensive income for the year attributable

to:

Equity shareholders of the parent (1) (598) (507)

Non-controlling interests (11) 13 4

Other comprehensive income (12) (585) (503)

Total comprehensive loss attributable

to :

Equity shareholders of the parent (679) (1,337) (10,524)

Non-controlling interests (11) (25) (270)

----------------------------------------- ----- ----------- ----------- -------------

(690) (1,362) (10,794)

----------------------------------------- ----- ----------- ----------- -------------

Loss per share attributable to the equity shareholders

of the parent

------------------------------------------------------------- ----------- -------------

Basic & Diluted Loss per share (pence) 4 (0.04) (0.06) (0.76)

----------------------------------------- ----- ----------- ----------- -------------

Condensed consolidated statement of financial position

As at 31 March 2022

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

31 March 31 March 30 September

2022 2021 2021

Note GBP'000 GBP'000 GBP'000

----------------------------------- ---- ----------- ------------ ---------------

Assets

Non-current assets

Intangible assets 5 3.989 8,192 3,947

Property, plant and equipment - 382 -

Investment in joint venture - 1,859 -

Financial assets 6 1,523 - -

Other receivables 26 24 25

----------------------------------- ---- ----------- ------------ ---------------

5,538 10,457 3,972

----------------------------------- ---- ----------- ------------ ---------------

Current assets

Trade and other receivables 115 138 104

Other financial assets 6 - - 371

Cash and cash equivalents 1,124 2,250 726

----------------------------------- ---- ----------- ------------ ---------------

1,239 2,388 1,201

----------------------------------- ---- ----------- ------------ ---------------

Total Assets 6,777 12,845 5,173

----------------------------------- ---- ----------- ------------ ---------------

Liabilities

Current liabilities

Loans (1,208) - -

Trade and other payables (384) (228) (808)

(1,592) (228) (808)

----------------------------------- ---- ----------- ------------ ---------------

Net current (liabilities)/assets (353) 2,160 393

----------------------------------- ---- ----------- ------------ ---------------

Total liabilities (1,592) (228) (808)

----------------------------------- ---- ----------- ------------ ---------------

Total Net Assets 5,185 12,617 4,365

----------------------------------- ---- ----------- ------------ ---------------

Shareholders' equity

Share capital - - -

Share premium 32,527 30,271 31,142

Warrant reserve 8 2,145 3,466 2,579

Translation reserve (231) (316) (225)

Retained deficit (29,256) (20,606) (28,688)

----------------------------------- ---- ----------- ------------ ---------------

Equity attributable to owners

of the parent 5,185 12,815 4,808

Non-controlling interests - (198) (443)

----------------------------------- ---- ----------- ------------ ---------------

Total Equity 5,185 12,617 4,365

----------------------------------- ---- ----------- ------------ ---------------

The above financial information was approved and authorised for

issue by the Board of Directors on 27 June 2022 and was signed on

its behalf by:

J Potter

Director

Condensed consolidated statement of changes in equity

For the six months ended 31 March 2022

Share Share Warrant Translation Retained Non-controlling Total

capital premium reserve reserve deficit Total interest equity

----------------------- -----

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ----- -------- -------- -------- ----------- -------- ------- --------------- -------

At 30 September

2020 (audited) - 29,222 1,288 282 (19,887) 10,905 (173) 10,732

-------- -------- -------- ----------- -------- ------- --------------- -------

Loss for the period - - - - (739) (739) (38) (777)

Comprehensive income

for the period - - - (598) - (598) 13 (585)

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Total comprehensive

loss for the period - - - (598) (739) (1,337) (25) (1,362)

Issue of shares

(net of costs) - 1,049 2,178 - - 3,227 - 3,227

Share based payment

charge - - - 20 20 - 20

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

At 31 March 2021

(unaudited) - 30,271 3,466 (316) (20,606) 12,815 (198) 12,617

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Loss for the period - - - - (9,278) (9,278) (236) (9,514)

Comprehensive income

for the period - - - 91 - 91 (9) 82

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Total comprehensive

income for the perio (9,278

d - - - 91 ) (9,187) (245) (9,432)

Issue of shares

(net of costs) - 871 (872) - - (1) - (1)

Expiry of warrants - - (15) - 15 - - -

Share based payment

charge - - - - 1,181 1,181 - 1,181

At 30 September

2021 (audited) - 31,142 2,579 (225) (28,688) 4,808 (443) 4,365

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Loss for the period - - - - (678) (678) - (678)

Comprehensive loss

for the period - - - (1) - (1) (11) (12)

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Total comprehensive

loss for the period - - - (1) (678) (679) (11) (690)

Issue of shares

(net of costs) - 1,385 - - - 1,385 - 1,385

Purchase of non-controlling

interest - - - (5) (460) (465) 454 (11)

Exercise of warrants - - (140) - 140 - - -

Expiry of warrants - - (294) - 294 - - -

Share-based payment

charge - - - - 136 136 - 136

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

At 31 March 2022

(unaudited) - 32,527 2,145 (231) (29,256) 5,185 - 5,185

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share capital Amount subscribed for share capital at nominal value,

together with transfers to share premium upon redenomination

of the shares to nil par value.

Share premium Amount subscribed for share capital in excess of nominal

value, together with transfers from share capital

upon redenomination of the shares to nil par value.

Warrant reserve Amounts credited to equity in respect of warrants

to acquire ordinary shares in the Company.

Translation reserve Amounts debited or credited to equity arising from

translating the results of subsidiary entities whose

functional currency is not sterling.

Retained deficit Cumulative net gains and losses recognised in the

consolidated statement of comprehensive income.

Non-Controlling Amounts attributable to the non-controlling interest

Interests in TurboShale Inc.

Condensed consolidated statement of cash flows

For the period ended 31 March 2022

Unaudited Unaudited Audited

Six months Six months Year ended

ended 31 ended 31 30 September

March 2022 March 2021 2021

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ---- ----------- ------------------ -------------

Cash flows from operating activities

Loss after tax (678) (777) (10,291)

Finance costs 64 - -

Amortisation of intangible fixed

assets - 3 6

Impairment losses - - 8,679

Share-based payment charge 136 20 135

Unrealised foreign exchange (gains)/

losses (121) 172 67

Share of loss of joint venture - 39 84

(Increase)/decrease in trade and

other receivables (11) (20) 22

(Decrease)/increase in trade and

other payables 49 13 63

------------------------------------------- ---- ----------- ------------------ -------------

Cash used in operations (561) (550) (1,235)

Interest received/(paid) - - -

Net cash outflows from operating

activities (561) (550) (1,235)

Cash flows from investing activities

Investment in intangibles 5 (411) - (2)

Purchase of financial assets 6 (1,115) - (219)

Investment in joint venture - (761) (1,502)

Purchase of non-controlling interest (11) - -

Cash acquired on acquisition of

control of joint venture - - 124

Net cash used in investing activities (1,537) (761) (1,599)

------------------------------------------- ---- ----------- ------------------ -------------

Cash flows from financing activities

Issue of share capital 1,460 3,500 3,500

Costs of share issue (75) (273) (274)

Receipt of loans 1,111 - -

Net cash generated from financing

activities 2,496 3,227 3,226

------------------------------------------- ---- ----------- ------------------ -------------

Net increase in cash and cash

equivalents 398 1,916 392

Cash and cash equivalents at beginning

of financial period 726 334 334

------------------------------------------- ---- ----------- ------------------ -------------

Foreign currency translation differences - - -

------------------------------------------- ---- ----------- ------------------ -------------

Cash and cash equivalents at end

of financial period 1,124 2,250 726

------------------------------------------- ---- ----------- ------------------ -------------

UNAUDITED NOTES FORMING PART OF THE CONDENSED CONSOLIDATED

INTERIM FINANCIAL STATEMENTS

For the six months ended 31 March 2022

1. Accounting Policies

Basis of Preparation

The unaudited condensed consolidated interim financial

statements of TomCo Energy plc ("TomCo" or the "Company") for the

six months ended 31 March 2022, comprise the Company and its

subsidiaries (together referred to as the "Group").

The unaudited condensed interim financial information for the

Group has been prepared using the recognition and measurement

requirements of International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board ("IASB") as adopted for use in the EU, with the

exception of IAS 34 Interim Financial Reporting that is not

mandatory for companies quoted on the AIM market of the London

Stock Exchange. The unaudited condensed interim financial

information has been prepared using the accounting policies which

will be applied in the Group's statutory financial information for

the year ending 30 September 2022.

There were no new standards, interpretations and amendments to

published standards effective in the period which had a significant

impact on the Group.

Going concern

As at 27June 2022, the Group had cash reserves of approximately

GBP610k, and an outstanding loan due to Valkor of approximately

GBP1.23 million (US$1.5 million) principal amount.

The Directors have prepared a Group cash flow forecast for the

period to 30 June 2023. The forecast, which includes committed

capital expenditure as at the date of this interim report,

indicates that the Group will need to raise additional finance in

order to continue as a going concern. The cash flow forecast

assumes, amongst other things, the following:

-- that either the Valkor Loan of US$1.5 million, which is due

for repayment by 31 July 2022, is further extended by mutual

agreement, which would lead to an increase in financing costs, or

is alternatively settled by the grant of a production share over

the production wells planned to be drilled on leased land now

occupied by the Group under arrangements concluded during the

reporting period; and

-- that the potential payment, which is due in respect of the

TSHII option, if exercised, by 31 December 2022 of US$16,250,000

requires sufficient additional funding to be raised prior to

December 2022 otherwise the option will lapse. Should the option

lapse because sufficient funding cannot be secured then the Group's

current business plan would be curtailed but, in the Board's view,

the Group would remain a going concern subject to the occurrence of

any other currently unforeseen events.

It is possible that rather than further extend the term or grant

a production share, the Group may wish to refinance the Valkor Loan

and that additional capital expenditure beyond that committed as at

the date of this interim report will be necessary prior to February

2023 in order to maximise the opportunities presented by, in

particular, Greenfield. Any such refinancing or additional

expenditure would be subject to funding, in whole or in part, via

additional debt or equity or a combination of both.

The Directors note that in light of both the lingering effects

of COVID-19 and the ongoing war in Ukraine there remains

considerable uncertainty concerning the global economy and that oil

prices continue to be volatile, albeit reaching higher levels of

late, which may have implications in respect of securing additional

funding when required, either for the Group's day-to-day operations

or possible additional capital expenditure.

The cash reserves currently held by the Group are insufficient

to fund ongoing overhead costs for the entire forecast period to 30

June 2023. However, based on a history of successfully raising

funds, the Directors have a reasonable expectation that the Group

can raise additional funds, when necessary, albeit there is no

guarantee that adequate funds will be available at that time.

All of these conditions represent a material uncertainty which

may cast significant doubt over the Group's ability to continue as

a going concern and, therefore, that it may be unable to realise

its assets and discharge its liabilities in the normal course of

business. Whilst acknowledging this material uncertainty, the

Directors remain confident of raising additional funds when

required and therefore the Directors consider it appropriate to

prepare the unaudited condensed consolidated interim financial

statements on a going concern basis. The unaudited condensed

consolidated interim financial statements do not include the

adjustments that would result if the Group was unable to continue

as a going concern.

2. Financial reporting period

The unaudited condensed interim financial information

incorporates comparative figures for the unaudited six-month

interim period to 31 March 2021, and the audited financial year

ended 30 September 2021. The six-month financial information to 31

March 2022 is neither audited nor reviewed. The Directors consider

the unaudited condensed interim financial information for the

period to be a fair representation of the financial position,

results from operations and cash flows for the period in conformity

with the generally accepted accounting principles consistently

applied.

The financial information contained in this unaudited interim

report does not constitute statutory accounts as defined by the

Isle of Man Companies Act 2006. It does not include all disclosures

that would otherwise be required in a complete set of financial

statements and should be read in conjunction with the 2021 Annual

Report and Financial Statements. The comparatives for the full year

ended 30 September 2021 are not the Group's full statutory accounts

for that year. The auditors' report on those accounts was

unqualified.

3. Operating Loss

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2022 2021 2021

GBP'000 GBP'000 GBP'000

------------------------------------------------ ----------- ----------- -------------

The following items have been charged in arriving at operating loss:

Directors' remuneration 234 160 271

Share-based payment charges 136 20 132

Auditors' remuneration 22 16 43

Operating leases for land and buildings-short

term assets 12 4 10

------------------------------------------------ ----------- ----------- -------------

4. Loss per share

Basic loss per share is calculated by dividing the losses

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period concerned.

Reconciliations of the losses and weighted average number of shares

used in the calculations are set out below.

Weighted average Per share

Losses number of shares amount

Six months ended 31 March 2022 GBP'000 Pence

---------------------------------------- --------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (678) 1,573,769,286 (0.04)

---------------------------------------- --------- ------------------ ----------

Weighted average Per share

Losses number of shares amount

Six months ended 31 March 2021 GBP'000 Pence

---------------------------------------- --------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (739) 1,193,585,125 (0.06)

---------------------------------------- --------- ------------------ ----------

Weighted average Per share

Losses number of shares amount

Year ended 30 September 2021 GBP'000 Pence

---------------------------------------- --------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (10,017) 1,323,206,884 (0.76)

---------------------------------------- --------- ------------------ ----------

5. Intangible assets

Oil & Gas Exploration Oil & Gas Oil &Gas

and development Patents and Development

licences patent applications expenditure Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------------------- -------------------- ------------ ---------

Cost, net of impairment and amortisation

At 30 September 2020 (audited) 8,819 15 - 8,834

Additions - - - -

Translation differences

and amortisation (638) (4) - (642)

--------------------------------- --------------------- -------------------- ------------ ---------

At 31 March 2021 (unaudited) 8,181 11 - 8,192

Additions 2 - - 2

Acquisition of subsidiary - - 3,875 3,875

Impairment (8,287) (6) - (8,293)

Translation differences

and amortisation 104 (5) 72 171

--------------------------------- --------------------- -------------------- ------------ ---------

At 30 September 2021 (audited) - - 3,947 3,947

Additions 139 - 272 411

Adjustment to previously

recognised asset - - (482) (482)

Translation differences

and amortisation 3 - 110 113

--------------------------------- --------------------- -------------------- ------------ ---------

At 31 March 2022 (unaudited) 142 - 3,847 3,989

--------------------------------- --------------------- -------------------- ------------ ---------

Net book value

At 31 March 2022 (unaudited) 142 - 3,847 3,989

--------------------------------- --------------------- -------------------- ------------ ---------

At 30 September 2021 (audited) - - 3,947 3,947

--------------------------------- --------------------- -------------------- ------------ ---------

At 31 March 2021 (unaudited) 8,181 11 - 8,192

--------------------------------- --------------------- -------------------- ------------ ---------

A newly formed wholly owned subsidiary of Greenfield, AC Oil

LLC, has entered into a 10-year lease from 15 November 2021 to

explore for oil, gas, hydrocarbons and all associated substances

over a 320-acre site in Uinta County, Utah, USA owned by Tar Sands

Holdings II LLC.

The directors have reassessed the value of intangibles and

liabilities owned and owed by Greenfield at acquisition during the

year ended 30 September 2021 and have reduced the value of both by

GBP482,000.

6. Financial asset

GBP'000

----------------------------------------- ------------------

At 31 March 2021 -

On acquisition of subsidiary 146

Additions 219

Other comprehensive income-translation

differences 6

------------------------------------------- ------------------

At 30 September 2021 (audited) 371

Additions 1,115

Other comprehensive income-translation

differences 37

------------------------------------------- ------------------

At 31 March 2022 1,523

------------------------------------------- ------------------

In November 2021, Greenfield completed the purchase of a 10%

ownership interest in Tar Sands Holdings II LLC ("TSHII"). The

investment is carried at cost. The Group has an option to purchase

the remaining 90% interest in TSHII by 31 December 2022 for

US$16.25 million. The option is recorded at its cost of nil on the

basis that there is no reliable fair value for this instrument.

7. Share Capital

31 March 31 March 30 September

2022 2021 2021

unaudited Unaudited audited

Number of Number of Number of

shares shares shares

--------------------------- -------------- -------------- --------------

Issued and fully paid

Number of ordinary shares

of no-par value 1,748,078,678 1,451,412,012 1,451,412,012

--------------------------- -------------- -------------- --------------

8. Warrants

31 March 31 March 30 September

2022 2021 2021

unaudited Unaudited Audited

--------------------------- ------------- -------------- -------------

Outstanding (number) 5 84,552,350 1,041,457,112 704,575,640

Exercisable (number) 5 84,552,350 1,041,457,112 704,575,640

Weighted average exercise

price (pence) 0. 9 1.0 0.9

--------------------------- ------------- -------------- -------------

9. Post balance sheet events

On 31 May 2022, the Company announced that the terms of the

unsecured US$1.5 million Loan obtained by Greenfield from Valkor in

connection with its acquisition of the initial 10% of the

Membership Interests in TSHII had been varied in order to extend

the repayment date to on or before 30 June 2022.

In addition, further to the Company's announcements of 10

February and 10 March 2022, on the same date the Company reported

that the drilling of the three exploration wells on the TSHII site

has been completed with initial results meeting with the Company's

expectations. The results of the drill programme were being

assessed by NSAI with a view to it providing an update to its

initial TSHII reserves report, as announced by the Company on 13

January 2022, in the coming months.

Additionally, Greenfield was progressing the requisite

permitting for its planned production well programme on the TSHII

site following recent changes to the relevant permit legislation.

The Company anticipated that the necessary permits will be secured

in time for drilling of the wells to commence in Q3 2022, assuming

the requisite funding has been secured, with initial production

then expected in Q4 2022. The number of wells to be permitted had

been increased from five to seven.

On 28 June 2022, the Company announced that the terms of the

abovementioned Loan from Valkor had been further varied in order to

extend the repayment date to on or before 31 July 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKOBBOBKDBAB

(END) Dow Jones Newswires

June 28, 2022 02:00 ET (06:00 GMT)

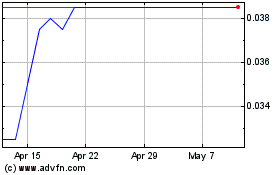

Tomco Energy (LSE:TOM)

Historical Stock Chart

From May 2024 to Jun 2024

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Jun 2023 to Jun 2024