TIDMSRC

RNS Number : 0194Z

SigmaRoc PLC

12 September 2022

12 September 2022

(EPIC: SRC / Market: AIM / Sector: Construction Materials)

SIGMAROC PLC

('SigmaRoc', the 'Company' or the 'Group')

Interim Results

SigmaRoc plc, the AIM listed buy-and-build quarried materials

group, is pleased to announce its unaudited interim results for the

six months ended 30 June 2022.

Highlights

Financial highlights

30 June 2022 30 June 2021 Change

Revenue GBP247.1m GBP84.8m 191.5%

Underlying EBITDA GBP47.6m GBP15.2m 212.2%

Underlying profit before tax GBP29.1m GBP8.7m 233.7%

Underlying EPS 3.61p 2.68p 34.7%

Cash and cash equivalents GBP46.4m GBP19.9m 132.9%

Underlying results are stated before acquisition related

expenses, certain finance costs, redundancy and reorganisation

costs, impairments, amortisation of acquisition intangibles and

share option expense. References to an underlying profit measure

throughout this Annual Report are defined on this basis. Pro-forma

financial information is presented on a like-for-like basis

adjusting for impact of any acquisitions or non-recurring

events.

Financial highlights

-- Strong first half of 2022, demonstrating the effectiveness of the Group's diversified model

-- Revenue of GBP247m, 17% ahead of prior year on a pro-forma basis

-- EBITDA of GBP47.6m, 6% ahead of prior year on a pro-forma

basis reflecting pass through and management of inflationary cost

increases

-- Underlying operating cash generation of GBP22 million, with

leverage within the Group's target range

Strategic highlights

-- Ongoing focus on efficiency with further improvement

initiatives implemented across the portfolio

-- Continued very strong momentum in uptake of our Greenbloc,

ultra-low carbon products technology, with roll out across our

concrete ranges and new capacity investment

-- Acquisitions of Johnston and RightCast completed in the first half

-- Published maiden ESG report with net-zero target set for 2040

-- Creation of quicklime division at Nordkalk based on strong technical competencies

-- Joint venture agreement signed with ArcelorMittal post period end

Outlook

-- H2 trading started well, benefitting from the Group's diversification

-- Demand remains good for both housing and infrastructure, as

well as for industrial minerals

-- Continue to focus on inflationary cost management,

particularly energy, with further operational improvement

initiatives to be implemented

-- The Board is cognisant of the macro-economic backdrop, but

the Group is well placed to make further financial and strategic

progress in H2

-- The long term potential remains exciting, with significant

opportunities to extend our geographical reach and product offering

across a range of markets for high quality construction materials

and industrial minerals

David Barrett, Executive Chairman, commented:

"I am extremely pleased with the performance of the Group

considering the challenges faced in the last six months.

Furthermore, Johnston Quarry Group and RightCast are excellent

additions to the Group and fit the SigmaRoc model well. The Group

remains well positioned for growth and evolution in the coming

months and years, as clearly demonstrated by the very exciting

development with ArcelorMittal. "

Max Vermorken, CEO, commented:

"Amidst a new set of challenges in the first half of the year,

the Group once again demonstrates its drive and agility. We closed

the first six months of 2022 well on track while successfully

managing inflationary pressures across the Group, the industrial

action in Finland and the consequences of the Ukraine conflict.

Our focus for the second half remains on numerous strategic

projects including our industry leading ESG commitments and our

partnership with ArcelorMittal for green quicklime, while

continuing to look for further opportunities to grow."

The full text of the interim statement is set out below,

together with detailed financial results, and will be available on

the Company's website at www.sigmaroc.com.

An investor and analyst call will take place at 8.00 a.m. today.

To participate in the results call, please register your interest

via the following links:

URL:

https://us06web.zoom.us/webinar/register/WN_kiNoUHiWT0uEE_3l4R5Cvw

Should you wish to ask questions of management, there will be an

online Q&A facility to log any questions. It may not be

possible for all questions to be heard during the call.

Any large investor or analyst wishing to arrange a one to one

call with the Company, should contact ir@sigmaroc.com or one of the

Company's Joint Brokers via the relevant contact details below.

Information on the Company is available on its website at

www.sigmaroc.com.

Enquiries:

SigmaRoc plc Tel: +44 (0) 207

Max Vermorken 002 1080

Liberum Capital (Co-Broker and Nominated Tel: +44 (0) 203

Adviser) 100 2000

Neil Patel / Jamie Richards / Ben Cryer

Peel Hunt (Co-Broker) Tel: +44 (0) 20 7418

Mike Bell / Ed Allsopp 8900

Investor Relations Tel: +44 (0) 207

Dean Masefield 002 1080

ir@sigmaroc.com

EXECUTIVE STATEMENT

When COVID-19 hit, our business model showed its inherent

flexibility and our teams their drive and agility. 2022 produced

new challenges and yet again our agility and flexibility showed its

true value. We closed the first half of 2022 well on track with

market expectations. Our central team was able to find savings and

efficiency gains to compensate for unexpected breakdowns and union

strikes. Our commercial teams locally were able to deal with

inflationary cost pressures, leveraging the strategic location of

our footprint and our customer relationships. Our operators were

able to react with agility to an increasingly challenging energy

market, production requirements and customer demand. We are pleased

that the quality of our operators, the inherent diversification in

our model and our strong local market positions have demonstrated

their true value in a time of rapid changes and multiple

challenges.

The Group reported underlying revenue of GBP247.1 million,

representing a 191.5% year-on-year increase, and an underlying

EBITDA of GBP47.6 million, being an uplift of 212.2% year-on-year.

Underlying profit before tax was GBP29.1 million and underlying EPS

was 3.61p representing a 34.7% improvement year-on-year. Revenue

and underlying EBITDA have increased primarily due to the inclusion

of Nordkalk which was acquired in August 2021, together with the

additions of Johnston and RightCast. On a pro-forma adjusted basis

revenue and EBITDA grew by 18% and 6%, respectively, in the first

half.

The strong trading performance and continuation of careful and

effective cash management strategies has led to a strong cash

position at 30 June 2022 of GBP46.4 million. Whilst the Group has

continued its investment led growth strategy with the acquisitions

of Johnston and RightCast, for a total initial consideration of

GBP38 million, the Group's Adjusted Leverage Ratio at 30 June 2022

had reduced to 2.24x, which is within our long term target

range.

Operating performance

The majority of Group businesses performed ahead of the Board's

expectations during the first half of 2022, which enabled the

Company to offset the impact of the union strike at our leading

pulp and paper customer in the first quarter.

In the Channel Islands phasing of significant construction

projects created a modest decline in demand early in the year, but

with residential development still buoyant in Jersey, and with

rising confidence in Guernsey, targets for the half year were

exceeded. The residential sector is expected to remain strong and,

with more favourable project phasing coming through in H2, we

anticipate good sales volumes through the rest of the year.

PPG continued its strong performance, with demand consistent

across the period and cost increases passed-on through regular

price increases. Allen Concrete continued its strong volume trend

from 2021, Poundfield had a slightly subdued start to the year but

closed the period with a very busy bespoke projects division and

CCP operated at close to maximum capacity, with additional shifts

added to meet the rising demand.

Our rebranded England & Wales platform traded well after

recovering from a challenging start at Harries and the inclusion of

Johnston from February. Revenue for Harries was strong throughout

the period, but margin performance was impacted in January and

February as a result of equipment issues which increased

maintenance and plant hire costs. This has been recovered by

improved margins through a combination of premium aggregate product

sales and operating cost efficiencies. At Johnston construction

aggregate demand from Lincolnshire quarries was subdued as large

infrastructure projects were delayed but this was offset by strong

demand for agricultural lime.

Dimension Stone had a particularly strong first half in 2022,

with an exceptionally strong order book translating into high

volumes. Inflationary input cost pressure was mitigated by regular

price increases and we further benefitted from very good

electricity generation from a new solar panel installation.

Our Benelux platform had mixed results but overall performed in

line with expectations. B-Mix had a very strong first half of the

year with volumes ahead of budget translating into good EBITDA

growth. Cuvelier was in line with expectations and GduH behind due

to offtake volumes not being adhered to, which will correct in H2

2022 through a contractual take-or-pay mechanism.

Nordkalk faced particularly challenging conditions in the early

part of the year, including:

-- The Russian invasion of Ukraine displacing three employees and their families;

-- Significant energy cost increases and concern over supply arrangements;

-- Union strike at UPM in Finland which persisted for almost 4 months; and

-- Unexpected plant shutdown at customer, SSAB, in January.

Through active collaboration between SigmaRoc technical teams

and the regional teams within Nordkalk, many of the challenges were

met head-on. Further savings were found across the Group and

Nordkalk's commercial teams were able to manage the inflationary

pressure well through a combination of hedging and dynamic pricing.

The impact from customer interruptions was successfully mitigated

through the implementation of cost saving programmes across the

Group combined with catchup demand through the remainder of the

period. The challenges of the Ukraine conflict should also not be

forgotten. Nordkalk staff in Poland were very active in assisting

our Ukrainian staff and their families to relocate to safety when

possible, with those who had to remain in Ukraine being located

near the Polish border. As a result, Nordkalk had a good first half

of 2022 in ways beyond the purely financial.

Safety

The Group has continued to progress and improve its safety

culture across the first half of 2022 by focusing on 3 key areas:

1. Structure & Compliance by ensuring corrective actions are

properly closed out and on time; 2. Proactive Prevention by

focusing on each businesses' 3-5 core risks; 3. Learn & Improve

through thorough investigations and timely communication. We are

pleased to report a 21% period-on-period reduction in incident

frequency rate; no increase in harm frequency rate and a 277%

period-on-period increase in near hit, hazard and risk reporting.

With the addition of two new businesses during the period the Group

has leveraged its established health & safety tools and

procedures, including the internally developed safety management

system HighVizz which has helped increase reporting, decrease

incidents and improve safety awareness and culture.

Invest, improve, integrate, innovate

At the end of January 2022, the Group acquired Johnston for an

initial cash consideration of GBP35.5 million. Johnston is a

specialist quarried materials supplier producing construction

aggregates and premium quality building stone, as well as

agricultural lime for soil improvement. Its aggregate products are

typically used in infrastructure projects, with its unique

Cotswolds Ironstone and Bath Stone used in specified high end

housing and architectural applications. The business currently

operates five active quarries and mines and two separate processing

sites located across the south-west of England, Oxfordshire and

Lincolnshire. Johnston has access to 86 million tonnes of freehold

and leasehold reserves and resources giving JQG an average life of

mine of over 40 years.

For the 12 months to 30 September 2021, Johnston reported

revenue of GBP14.7 million, generating EBITDA of GBP5.9 million and

profit before tax of GBP3.6 million. The acquisition was funded

from the Group's existing resources, including the assumption of

approximately GBP10 million in borrowings comprising long term debt

and plant hire contracts.

In April 2022, the Group acquired RightCast for an initial cash

consideration of GBP2.55 million with a further GBP0.45 million

deferred consideration payable in 12 months subject to certain

conditions. RightCast is a precast concrete producer specialising

in the production of concrete stair flights and landings.

For the 12 months ended 31 October 2021, RightCast reported

revenue of GBP3.1 million, generating EBITDA of GBP0.6 million and

profit after tax of GBP0.5 million. The acquisition was funded from

the Group's existing resources and RightCast has been integrated

into the PPG platform. RightCast brought with it a strong pipeline

of work, well established team and complimentary product offering

to PPG.

The market reaction to Greenbloc has surpassed our expectations.

We have invested significantly in our own manufacturing facilities

to keep pace with demand, while the PPG platform has also acquired

and developed additional UK sites to facilitate the development and

manufacture of ultra-low carbon construction products that go

beyond concrete blocks.

From the start of this year every product currently manufactured

by SigmaRoc's PPG platform is now available in a cement-free

ultra-low carbon option. From September 2022 we expect up to 50% of

all products produced by the PPG Platform to fall under the

Greenbloc brand.

Our strategic collaboration agreement with Marshalls, which was

established on the back of our leadership in the market with

Greenbloc, has accelerated during the first half of 2022. We have

multiple workstreams focusing on pushing existing technologies to

their limits while also developing new manufacturing techniques.

Together with Marshalls, we remain committed to improving how

concrete is specified within the build environment and reducing its

carbon footprint significantly.

In the Channel Islands all ready-mix concrete and concrete

products are now offered with a low carbon cement blend option, and

the ultra-low carbon offering for ready-mix concrete is gathering

traction in the market.

Organic development

Development of the 2 million tonne quarry extension in Jersey,

which was consented in 2021, has progressed well, with sales of

product from the extended area already underway. In Guernsey, the

planning application to develop the new quarry resource at Chouet

is expected to be determined in autumn 2022, with extraction

anticipated to commence early next year.

In Poland, a new limestone deposit was opened, with planned

reserve extensions expected to add a total of 35 million tonnes to

the Group's reserves and resources.

In Belgium, quarry extension works are on track at Soignies with

construction of the new road around the extension area progressing

well, which should enable excavations of overburden in Q4'22.

Furthermore, work is nearly complete on the construction of our

first mainland Europe precast production facility in Belgium with

first products expected off the production line in September

2022.

Environmental, Social and Governance (ESG)

In April 2022 the Group published its first ESG report which

contains extended detail on its Environmental, Social and

Governance policies and initiatives, as well as a detailed roadmap

to net-zero. The report provides further detail on a large number

of initiatives already in place across the Group to manage its

energy use and sourcing, as well as accelerate its successful track

record in innovation to both meet demanding ESG targets and further

enhance competitiveness. In summary of the ESG report, we aim

to:

-- provide option for 100% of manufactured products to utilise

waste/recycled materials by 2025;

-- utilise 100% of production materials by 2027;

-- be free of fossil fuel use by 2032; and

-- achieve net-zero by 2040.

No other operator in the lime sector has committed to these

targets and no other building materials producer is presently able

to offer certified products with ultra-low carbon credentials

totally free of cement, across the entire range of its

products.

More specifically, in Belgium feasibility studies to further

increase green energy sourcing have been initiated. These include

new wind installations and further increases of solar capacity on

site at Soignies.

In West Wales Harries contributed to a successful

"nappy-enhanced" asphalt trial, whereby 2.4km of roadway was

surfaced using asphalt that contained recycled nappies. The fibres

from the nappies improve binding of bitumen with aggregate,

resulting in a more durable road surface which is expected to

remain in situ for up to 20 years while also providing reduced road

noise.

As part of our commitment to employees as well has their

families and the communities they love and work in, West Wales held

a Family Fun Day w ith over 200 people attending . This was an

opportunity for everyone to come together, have fun and relax as

well as raise money for local charities with additional support

from other local businesses.

Furthering our governance initiatives, we are pleased to advise

that Julie Kuenzel has been appointed as Company Secretary with

immediate effect. Julie holds a Bachelor of Commerce Degree, is a

Chartered Accountant and working toward membership with the

Chartered Governance Institute UK & Ireland. Julie has over 20

years' experience working in a wide range of industries in senior

management positions. More recently, Julie has been focussed on

providing financial and corporate governance advice to listed

companies. Julie replaces Westend Corporate, who remain as the

Group's financial accountants. Julie bolsters the Group's already

strong corporate governance function and will report to the Board

on all compliance related matters.

In April 2022, Axelle Henry joined the Board as an independent

NED. Ms Henry brings significant financial skill to the Group given

her role as CFO of a major investment fund and also adds fresh

perspective to the Board with her knowledge of sectors which are

more brand and innovation oriented.

To support both our businesses and our communities, we are

continuing to develop our working relationships with the military

and military employment charities and are registered with the

Career Transition Partnership. We will help facilitate resettlement

and transition from military to civilian life as well as support

civilian spouses and partners of serving and ex-Forces personnel on

their journey into employment.

Across all our platforms, our business model of local business

for local communities ensures that we continue to integrate into

the areas we work, supporting both other local businesses,

projects, and communities.

Corporate

Our 2021 annual results were released in March 2022 and in April

2022 we held our Annual General Meeting with all resolutions being

passed.

Outlook

Trading in the early part of H2 2022 has started well, with the

Group benefitting from its broad end market and geographical

diversification. Demand remains good both for housing and

infrastructure, as well as for industrial minerals. The Group has

successfully dealt with various supply chain and inflationary

headwinds in H1 2022 and has continued to do so into H2 2022, with

particular focus on energy costs and continuous operational

improvement initiatives.

Looking further ahead, we maintain our focus on a number of

important strategic projects identified in the FY21 annual report,

including our ambitious ESG commitments, continuing our disciplined

investment strategy and pursuing organic growth and margin

improvement through expansion of our markets and sales

networks.

We continue to see significant opportunity to extend our

geographical reach and product offering across a range of markets

for high quality construction materials and industrial minerals.

The Group remains well placed to continue its growth and

development while actively managing a challenging macro landscape

and horizon.

David Barrett Max Vermorken Garth Palmer

Executive Chairman Chief Executive Officer Chief Financial Officer

9 September 2022

CONSOLIDATED INCOME STATEMENT

6 months to 30 June 2022 6 months to 30 June 2021

Unaudited Unaudited

Non-underlying* Non-underlying*

Underlying (Note 8) Total Underlying (Note 8) Total

Continued GBP'000

operations Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------ ---------- --------------- --------- ----------- --------------- --------

Revenue 6 247,067 - 247,067 84,760 - 84,760

---------- --------------- --------- ----------- --------------- --------

Cost of sales 7 (193,918) - (193,918) (61,585) - (61,585)

Profit from

operations 53,149 - 53,149 23,175 - 23,175

---------- --------------- --------- ----------- --------------- --------

Administrative

expenses 7 (21,410) (9,766) (31,176) (13,117) (2,398) (15,515)

Net finance

(expense)/income (3,349) (764) (4,113) (1,306) - (1,306)

Other net

(losses)/gains 576 (9) 567 46 822 868

Foreign Exchange 157 - 157 (89) - (89)

Profit/(loss)

before tax 29,123 (10,539) 18,584 8,709 (1,576) 7,133

---------- --------------- --------- ----------- --------------- --------

Tax expense (5,206) - (5,206) (1,236) - (1,236)

Profit/(loss) 23,917 (10,539) 13,378 7,473 (1,576) 5,897

---------- --------------- --------- ----------- --------------- --------

Profit/(loss)

attributable to:

Owners of the

parent 23,067 (10,539) 12,528 7,467 (1,571) 5,895

Non-controlling

interests 850 - 850 6 (4) 2

---------- --------------- ---------

23,917 (10,539) 13,378 7,473 (1,576) 5,897

---------- --------------- --------- ----------- --------------- --------

Basic earnings

per share

attributable

to owners of the

parent

(expressed

in pence per

share) 15 3.61 (1.65) 1.96 2.68 (0.56) 2.12

---------- --------------- --------- ----------- --------------- --------

Diluted earnings

per share

attributable

to owners of the

parent

(expressed

in pence per

share) 15 3.46 (1.58) 1.88 2.45 (0.52) 1.93

---------- --------------- --------- ----------- --------------- --------

* Non-underlying items represent acquisition related expenses,

restructuring costs, certain finance costs, share option expense

and amortisation of acquired intangibles. See Note 8 for more

information.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to 30 June to 30 June

2022 2021

Unaudited Unaudited

Note GBP'000 GBP'000

------------------------------------------------ ---- ----------- -----------

Profit for the year 13,378 5,897

----------- -----------

Other comprehensive income:

Items that will or may be reclassified to

profit or loss:

Currency exchange (losses) / gains 11,306 (3,074)

Cash flow hedges - effective portion of changes

in fair value 11,678 -

Remeasurement of the net defined benefits

liability 13 -

22,997 (3,074)

----------- -----------

Total comprehensive income 36,375 2,823

----------- -----------

Total comprehensive income attributable to:

Owners of the parent 35,518 2,822

Non-controlling interests 12 857 1

----------- -----------

Total comprehensive income for the period 36,375 2,823

----------- -----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Company number: 05204176

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

--------------------------------- ----- ---------- ---------- -----------

Non-current assets

Property, plant and equipment 9 277,364 147,109 256,436

Intangible assets 10 355,222 51,181 306,436

Investment in equity-accounted

associate 11 528 - 524

Investment in joint ventures 11 5,283 - 5,134

Derivative financial assets 11,989 - 870

Other receivables 4,879 12 4,759

Deferred tax asset 3,915 956 3,129

659,180 199,258 577,288

---------- ---------- -----------

Current assets

Trade and other receivables 94,097 30,828 73,254

Inventories 56,028 14,792 44,530

Cash and cash equivalents 46,427 19,937 69,916

Derivative financial assets 10,180 174 4,327

206,732 65,731 192,027

---------- ---------- -----------

Total assets 865,912 264,989 769,315

---------- ---------- -----------

Current liabilities

Trade and other payables 119,933 48,511 98,213

Derivative financial liabilities 1,372 - 737

Provisions 4,982 - 4,024

Current tax payable 3,811 1,158 3,934

Borrowings 13 30,021 5,235 21,723

160,119 54,904 128,631

---------- ---------- -----------

Non-current liabilities

Borrowings 13 13 233,363 67,546 212,199

Employee benefit liabilities 1,575 - 1,589

Derivative financial liabilities 1,057 - -

Deferred tax liabilities 9,710 3,917 5,190

Provisions 5,094 5,391 6,151

Other payables 4,484 5,100 4,401

---------- ---------- -----------

255,283 81,954 229,530

---------- ---------- -----------

Total Liabilities 415,102 136,858 358,161

---------- ---------- -----------

Net assets 450,510 128,131 411,154

---------- ---------- -----------

Equity attributable to owners

of the parent

Share capital 14 6,382 2,799 6,379

Share premium 14 400,022 107,893 399,897

Share option reserve 9,307 807 3,104

Other reserves 12,797 473 (11,236)

Retained earnings 12,781 14,924 2,116

Equity attributable to owners

of the parent 441,289 126,896 400,260

Non-controlling interest 12 9,221 1,235 10,894

---------- ---------- -----------

Total Equity 450,510 128,131 411,154

---------- ---------- -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Non-controlling

Share Share option Other Retained interest

capital premium reserve reserves earnings Total Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------ ------- ------- ------- -------- -------- --------- ----------------- ---------

Balance as at 1

January

2021 2,788 107,418 847 3,293 9,218 123,564 - 123,564

------- ------- ------- -------- -------- --------- ----------------- ---------

Profit for the

period - - - - 5,895 5,895 2 5,897

Currency translation

differences - - - (3,073) - (3,073) (1) (3,074)

Total comprehensive

income for the

period - - - (3,073) 5,895 2,822 1 2,823

------- ------- ------- -------- -------- --------- ----------------- ---------

Contributions by

and distributions

to owners

Issue of ordinary

shares 11 475 - - - 486 1,234 1,721

Share option charge - - 24 - - 24 - 24

Exercise of share

options - - (64) - 64 - - -

Movement in equity - - - 253 (253) - - -

Total contributions

by and

distributions

to owners 11 475 (40) 253 (190) 510 1,234 1,744

------- ------- ------- -------- -------- --------- ----------------- ---------

Balance as at 30

June 2021 2,799 107,893 807 473 14,924 126,896 1,235 128,131

------- ------- ------- -------- -------- --------- ----------------- ---------

Balance as at 1

January

2022 6,379 399,897 3,104 (11,236) 2,116 400,260 10,894 411,154

------- ------- ------- -------- -------- --------- ----------------- ---------

Profit for the

period - - - - 12,528 12,528 850 13,378

------- ------- ------- -------- -------- --------- ----------------- ---------

Currency translation

differences - - - 11,299 - 11,299 7 11,306

Other comprehensive

income - - - 11,691 - 11,691 - 11,691

------- ------- ------- -------- -------- --------- ----------------- ---------

Total comprehensive

income for the

period - - - 22,990 12,528 35,518 857 36,375

------- ------- ------- -------- -------- --------- ----------------- ---------

Contributions by

and distributions

to owners

Issue of ordinary

shares 14 3 125 - - - 128 - 128

Share option charge - - 6,380 - - 6,380 - 6,380

Exercise of share

options - - (177) - 177 - - -

Dividends - - - - (1,686) (1,686) (2,530) (4,216)

Movement in equity - - - 1,043 (354) 689 - 689

------- ------- ------- -------- -------- --------- ----------------- ---------

Total contributions

by and

distributions

to owners 3 125 6,203 1,043 (1,863) 5,511 (2,530) 2,981

------- ------- ------- -------- -------- --------- ----------------- ---------

Balance as at 30

June 2022 6,382 400,022 9,307 12,797 12,781 441,289 9,221 450,510

------- ------- ------- -------- -------- --------- ----------------- ---------

CASH FLOW STATEMENTS

6 months 6 months

to 30 June to 30 June

2022 2021

Unaudited Unaudited

Note GBP'000 GBP'000

------------------------------------------------ ---- ----------- -----------

Cash flows from operating activities

Profit 13,378 5,897

Adjustments for:

Depreciation and amortisation 15,830 6,076

Share option expense 6,597 23

Loss/(gain) on sale of property, plant and

equipment (358) 79

Net finance costs 4,113 1,306

Other non-cash adjustments 407 (858)

Net tax paid (1,441) 549

Share of earnings from associates (201) -

Increase in trade and other receivables (13,325) (5,096)

Increase in inventories (8,501) (1,163)

(Decrease)/increase in trade and other payables 3,383 (1,026)

Decrease in provisions (539) (596)

Net cash flows from operating activities 19,343 5,191

----------- -----------

Investing activities

Purchase of property, plant and equipment 9 (15,063) (4,119)

Cash paid for acquisition of subsidiaries

(net of cash acquired) (36,648) (9,856)

Sale of property plant and equipment 779 1

Purchase of intangible assets 10 (535) -

Financial derivatives 302 -

Interest received 2,959 -

Net cash used in investing activities (48,206) (13,974)

----------- -----------

Financing activities

Proceeds from share issue 128 1,721

Finance costs (6,714) (705)

Proceeds from borrowings 28,901 4,444

Repayment of borrowings (16,257) (4,124)

Dividends paid (1,686) -

----------- -----------

Net cash generated from financing activities 4,372 1,336

----------- -----------

Net increase in cash and cash equivalents (24,491) (7,447)

Cash and cash equivalents at beginning of

period 69,916 27,452

Exchange (losses)/gains on cash 1,002 (68)

Cash and cash equivalents and end of period 46,427 19,937

----------- -----------

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

The principal activity of SigmaRoc plc (the 'Company') is to

make investments and/or acquire projects in the construction

materials sector and through its subsidiaries (together the

'Group') is the production of high-quality aggregates and supply of

value-added construction materials. The Company's shares are

admitted to trading on the AIM market of the London Stock Exchange

('AIM'). The Company is incorporated and domiciled in the United

Kingdom.

The address of its registered office is Suite 1, 15 Ingestre

Place, London, W1F 0DU.

2. Basis of preparation

The interim financial statements have been prepared in

accordance with IAS 34 - Interim Financial Reporting, as adopted by

the UK. The interim financial statements have been prepared

applying the accounting policies and presentation that were applied

in the annual financial statements for the year ended 31 December

2021. The condensed interim financial stat ements should be read in

conjunction with the annual financial statements for the year ended

31 December 2021.

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS) as adopted by

the UK.

Statutory financial statements for the period ended 31 December

2021 were approved by the Board of Directors on 23 March 2022 and

delivered to the Registrar of Companies. The report of the auditors

on those financial statements was unqualified. The comparative

financial information for the interim period ended 30 June 2021 and

year ended 31 December 2021 is for the Group only.

Going concern

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Company and Group to continue in

operational existence for the foreseeable future and that,

therefore, it is appropriate to adopt the going concern basis in

preparing the condensed interim financial statements for the period

ended 30 June 2022.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Company's

2021 Annual Report and Financial Statements, a copy of which is

available on the Company's website: www.sigmaroc.com . The key

financial risks are liquidity risk, credit risk, interest rate risk

and fair value estimation.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in Note 4 of the Company's 2021 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

Foreign Currencies

a) Functional and Presentation Currency

Items included in the Financial Statements are measured using

the currency of the primary economic environment in which the

entity operates (the 'functional currency'). The Financial

Statements are presented in Pounds Sterling, rounded to the nearest

pound, which is the Group's functional currency.

b) Transactions and Balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where such items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in the Income Statement. Foreign exchange gains and

losses that relate to borrowings and cash and cash equivalents are

presented in the Income Statement within 'finance income or costs.

All other foreign exchange gains and losses are presented in the

Income Statement within 'Other net gains/(losses)'.

Translation differences on non-monetary financial assets and

liabilities such as equities held at fair value through profit or

loss are recognised in profit or loss as part of the fair value

gain or loss. Translation differences on non-monetary financial

assets measured at fair value, such as equities classified as

available for sale, are included in other comprehensive income.

c) Group companies

The results and financial position of all the Group entities

(none of which has the currency of a hyperinflationary economy)

that have a functional currency different from the presentation

currency are translated into the presentation currency as

follows:

-- assets and liabilities for each period end date presented are

translated at the period-end closing rate;

-- income and expenses for each Income Statement are translated

at average exchange rates (unless this average is not a reasonable

approximation of the cumulative effect of the rates prevailing on

the transaction dates, in which case income and expenses are

translated at the dates of the transactions); and

-- all resulting exchange differences are recognised in other comprehensive income.

On consolidation, exchange differences arising from the

translation of the net investment in foreign entities, and of

monetary items receivable from foreign subsidiaries for which

settlement is neither planned nor likely to occur in the

foreseeable future, are taken to other comprehensive income. When a

foreign operation is sold, such exchange differences are recognised

in the Income Statement as part of the gain or loss on sale.

3. Accounting policies

Except as described below, the same accounting policies,

presentation and methods of computation have been followed in these

condensed interim financial statements as were applied in the

preparation of the company's annual financial statements for the

year ended 31 December 2021, except for the impact of the adoption

of the Standards and interpretations described in para 3.1

below:

3.1. Changes in accounting policy and disclosures

(a) Accounting developments during 2022

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 30 June 2022 but did

not result in any material changes to the financial statements of

the Group or Company.

(b) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standard Impact on initial application Effective date

--------- ------------------------------ ---------------

IAS 12 Income taxes 1 January 2023

------------------------------ ---------------

IFRS 17 Insurance contracts 1 January 2023

------------------------------ ---------------

IAS 8 Accounting estimates 1 January 2023

------------------------------ ---------------

IAS 1 Classification of Liabilities 1 January 2023

as Current or Non-Current.

------------------------------ ---------------

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

the Group's results or shareholders' funds.

4. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 June 2022 (2021: nil).

5. Segment Information

Management has determined the operating segments based on

reports reviewed by the Board of Directors that are used to make

strategic decisions. During the periods presented the Group had

interests in four key geographical segments, being the United

Kingdom, Channel Islands, Belgium and Northern Europe. Activities

in the United Kingdom, Channel Islands, Belgium and Northern Europe

relate to the production and sale of construction material products

and services .

6 months to 30 June 2022

-----------------------------------------------------

United Channel Belgium Northern Total

Kingdom Islands Europe

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- ------- -------- ------------

Revenue 51,343 15,021 43,224 137,479 247,067

---------- ---------- ------- -------- ------------

Profit from operations per

reportable segment 12,093 5,085 11,865 24,106 53,149

---------- ---------- ------- -------- ------------

Additions to non-current

assets 57,501 (401) (2,191) 26,984 81,893

Reportable segment assets 180,906 49,787 116,653 518,566 865,912

Reportable segment liabilities 280,673 5,500 30,015 99,214 415,102

---------- ---------- ------- -------- ------------

6 months to 30 June 2021

United Channel Belgium Total

Kingdom Islands

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- -------- ------- -------

Revenue 35,225 14,367 35,168 84,760

-------- -------- ------- -------

Profit from operations per reportable

segment 7,433 5,016 10,726 23,175

-------- -------- ------- -------

Additions to non-current assets 290 (874) 4,812 4,228

Reportable segment assets 105,919 47,254 111,816 264,989

Reportable segment liabilities 76,767 4,981 55,110 136,858

-------- -------- ------- -------

6. Revenue

Consolidated

---------------------

6 months 6 months

to 30 June to 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

---------------------------------------------- ------------- -----------

Upstream products 28,009 11,383

Value added products 191,046 64,332

Value added services 23,171 6,832

Other 4,842 2,213

247,067 84,760

------------- -----------

Upstream products revenue relates to the sale of aggregates and

cement. Value added products is the sale of finished goods that

have undertaken a manufacturing process within each of the

subsidiaries. Value added services consists of the transportation,

installation and contracting services provided.

All revenues from upstream and value added products relate to

products for which revenue is recognised at a point in time as the

product is transferred to the customer. Value added services

revenues are accounted for as products and services for which

revenue is recognised over time.

Whilst the Group has contract revenue, this amount is not deemed

to be material under IFRS 15.

7. Expenses by nature

6 months 6 months

to 30 June to 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

-------------------------------------- ----------- -----------

Cost of sales

Raw materials and production 92,942 22,592

Distribution and selling expenses 19,654 3,850

Employee benefit expenses 46,614 18,801

Maintenance expense 10,196 3,627

Plant hire expense 3,008 2,627

Depreciation and amortisation expense 15,091 5,221

Other costs of sale 6,413 4,867

Total cost of sales 193,918 61,585

----------- -----------

Administrative expenses

Operational admin expenses 19,666 12,421

Corporate admin expenses 11,510 3,094

Total administrative expenses 31,176 15,515

----------- -----------

Depreciation and amortisation expense is a combination of

property, plant and equipment depreciation and amortisation of

intangible assets.

8. Non-underlying items

As required by IFRS 3 - Business Combinations, acquisition costs

have been expensed as incurred. Additionally, the Group incurred

costs associated with obtaining debt financing, including advisory

fees to restructure the Group to satisfy lender requirements.

6 months 6 months

to 30 June to 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------- ----------- -----------

Acquisition related expenses 1,849 349

Restructuring expenses 801 396

Share options expense 6,696 23

Amortisation of acquired intangibles 739 808

Other non-underlying 454 -

10,539 1,576

----------- -----------

Acquisition related expenses include costs relating to the due

diligence of prospective pipeline acquisitions and other direct

costs associated with merger & acquisition activity including

accounting fees, legal fees and other consulting fees.

Amortisation of acquired assets are non-cash items which distort

the underlying performance of the businesses acquired.

Restructuring expenses include advisory fees, additional legal

fees relating to the refinancing and redundancy costs.

Share option expense is the fair value of the share options

issued and or vested during the period.

Other non-underlying costs include COVID-19 related costs,

professional adviser fees and other associated costs.

9. Property, plant and equipment

Office Land Land Plant Furniture Construction

equipment and minerals and buildings and machinery and vehicles in progress Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ---------- ------------- -------------- -------------- ------------- ------------ --------

Cost

As at 1 January

2021 4,225 104,379 45,948 98,498 24,537 1,247 278,834

---------- ------------- -------------- -------------- ------------- ------------ --------

Acquired through

acquisition of

subsidiary 213 - 179 7,672 4,146 - 12,210

Fair value

adjustments - - - 633 (383) (250) -

Additions 165 183 1,899 1,600 234 37 4,118

Disposals - (14) - (66) (103) - (183)

Forex (110) (162) (1,067) (2,906) (41) - (4,286)

As at 30 June

2021 4,493 104,386 46,959 105,431 28,390 1,034 290,693

---------- ------------- -------------- -------------- ------------- ------------ --------

Acquired through

acquisition of

subsidiary - 81,482 70,443 185,753 - 10,667 348,345

Transfer between

classes - - 1,149 133 - (1,282) -

Fair value

adjustments - 3,433 1,539 - - - 4,972

Additions 198 3,141 1,869 8,344 2,060 2,824 18,436

Disposals - (177) (592) (7,698) (5,905) - (14,372)

Forex (97) (2,298) (134) (2,045) 50 - -4,524

---------- ------------- -------------- -------------- ------------- ------------ --------

As at 31 December

2021 4,594 189,967 121,233 289,918 24,595 13,243 643,550

---------- ------------- -------------- -------------- ------------- ------------ --------

Acquired through

acquisition of

subsidiary 159 9,248 994 10,931 251 1,730 23,313

Transfer between

classes - - - 364 - (364) -

Fair value

adjustment - - (68) - 2,192 - 2,124

Additions 106 2,303 1,176 8,084 423 2,971 15,063

Disposals (5) -- - (1,254) (112) - (1,371)

Forex 93 2,742 975 2,206 201 (46) 6,171

---------- ------------- -------------- -------------- ------------- ------------ --------

As at 30 June

2022 4,947 204,260 124,310 310,249 27,550 17,534 688,850

---------- ------------- -------------- -------------- ------------- ------------ --------

Depreciation

As at 1 January

2021 3,817 11,373 25,085 76,738 17,030 - 134,043

---------- ------------- -------------- -------------- ------------- ------------ --------

Acquired through

acquisition of

subsidiary 152 - 131 4,194 3,201 - 7,678

Charge for the

year 120 1,489 773 1,843 1,139 - 5,364

Transfer between

classes - - - 316 (316) -

Disposals - - - - (103) - (103)

Forex (111) (102) (1,028) (1,728) (429) - (3,398)

---------- -------------

As at 30 June

2021 3,978 12,760 24,961 81,363 20,522 - 143,584

---------- ------------- -------------- -------------- ------------- ------------ --------

Acquired through

acquisition of

subsidiary - 57,487 40,796 145,316 - - 243,599

Charge for the

year 148 907 2,649 8,195 496 - 12,395

Disposals - - (592) (7,298) (2,984) - (10,874)

Impairment - - 380 684 - - 1,064

Forex (85) (980) 198 (1,979) 192 - (2,654)

As at 31 December

2021 4,041 70,174 68,392 226,281 18,226 - 387,114

---------- ------------- -------------- -------------- ------------- ------------ --------

Acquired through

acquisition of

subsidiary 78 1,947 68 4,140 53 - 6,286

Charge for the

year 102 1,157 3,207 8,847 1,477 - 14,790

Disposals (3) - - (888) (58) - (949)

Forex 89 2,500 (380) 1,884 152 - 4,245

---------- ------------- -------------- -------------- ------------- ------------ --------

As at 30 June

2022 4,307 75,778 71,287 240,264 19,850 - 411,486

---------- ------------- -------------- -------------- ------------- ------------ --------

Net book value

---------- ------------- -------------- -------------- ------------- ------------ --------

As at 30 June

2021 515 91,626 21,998 24,068 7,868 1,034 147,109

---------- ------------- -------------- -------------- ------------- ------------ --------

As at 31 December

2021 553 119,793 52,841 63,637 6,369 13,243 256,436

As at 30 June

2022 640 128,482 53,023 69,985 7,700 17,534 277,364

---------- ------------- -------------- -------------- ------------- ------------ --------

10. Intangible assets

Consolidated

Customer Intellectual Research Other

Goodwill Relations property & Development Branding Intangibles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- ---------- ------------ -------------- -------- ------------ ----------

Cost & net book

value

As at 1 January

2021 39,966 3,333 471 1,236 3,398 400 48,804

Additions - - - - - - -

Additions through

business combination 5,494 - - - - - 5,494

Amortisation - (259) (42) (332) (80) - (713)

Forex (2,241) - - (163) - - (2,404)

As at 30 June 2021 43,219 3,074 429 741 3,318 400 51,181

-------- ---------- ------------ -------------- -------- ------------ ----------

As at 1 January

2022 293,438 2,816 386 571 3,238 5,986 306,436

-------- ---------- ------------ -------------- -------- ------------ ----------

Additions - - - 4 - 531 535

Additions through

business combination 41,496 - - - - 41,496

Amortisation - (258) (42) (54) (80) (607) (1,041)

Forex 7,647 - - 4 - 145 7,796

-------- ---------- ------------ -------------- -------- ------------ ----------

As at 30 June 2022 342,581 2,558 344 525 3,158 6,055 355,222

-------- ---------- ------------ -------------- -------- ------------ ----------

The intangible asset classes are:

- Goodwill is the excess of the consideration transferred and

the acquisition date fair value of any previous equity interest in

the acquired over the fair value of the net identifiable

assets.

- Customer relations is the value attributed to the key customer lists and relationships.

- Intellectual property is the patents owned by the Group.

- Research and development is the acquiring of new technical

knowledge and trying to improve existing processes or products or;

developing new processes or products.

- Branding is the value attributed to the established company brand.

- Other intangibles consist of capitalised development costs for

assets produced that assist in the operations of the Group and

incur revenue.

Amortisation of intangible assets is included in cost of sales

on the Income Statement. Development costs have been capitalised in

accordance with the requirements of IAS 38 and are therefore not

treated, for dividend purposes, as a realised loss.

The Purchase Price Allocation ('PPA') exercise for B-Mix has

commenced but is still subject to finalisation.

Impairment tests for goodwill

Goodwill arising on business combinations is not amortised but

is reviewed for impairment on an annual basis, or more frequently

if there are indications that the goodwill may be impaired.

Goodwill is allocated to groups of cash generating units according

to the level at which management monitor that goodwill, which is at

the level of operating segments.

The primary operating segments are considered to be Ronez in the

Channel Islands, Topcrete, Poundfield, CCP, Rightcast, GD Harries

and Johnston Quarry Group in the UK, CDH, Stone, GDH, B-Mix and

Casters in Belgium and Nordkalk in Finland, Sweden and Poland.

Key assumptions

The key assumptions used in performing the impairment review are

set out below:

Cash flow projections

Cash flow projections for each operating segment are derived

from the annual budget approved by the Board for 2022 and the

three-year plan to 2023 and 2025. The key assumptions on which

budgets and forecasts are based include sales volumes, product mix

and operating costs. These cash flows are then extrapolated forward

for a further 17 years, with the total period of 20 years

reflecting the long-term nature of the underlying assets. Budgeted

cash flows are based on past experience and forecast future trading

conditions.

Long-term growth rates

Cash flow projections are prudently based on 2 per cent. and

therefore provides plenty of headroom.

Discount rate

Forecast cash flows for each operating segment have been

discounted at rates of 8 per cent which was calculated by an

external expert based on market participants' cost of capital and

adjusted to reflect factors specific to each operating segment.

Sensitivity

The Group has applied sensitivities to assess whether any

reasonable possible changes in assumptions could cause an

impairment that would be material to these consolidated Financial

Statements. This demonstrated that a 1% increase in the discount

rate would not cause an impairment and the annual growth rate is

assumed to be 2%.

The Directors have therefore concluded that no impairment to

goodwill is necessary.

11. Investment in Equity Accounted Associates & Joint Ventures

Nordkalk has a joint venture agreement with Franzefoss Minerals

AS, to build a lime kiln located in Norway which was entered into

on 5 August 2004. NorFraKalk AS is the only joint agreement in

which the Group participates.

The Group has one non-material local associate in Pargas, Pargas

Hyreshus Ab.

30 June 2022 30 June 2021

Unaudited Unaudited

GBP'000 GBP'000

-------------------------- ------------ ------------

Interests in associates 528 -

Interest in joint venture 5,283 -

------------ ------------

5,811 -

------------ ------------

Proportion of

ownership interest

held

---------------------------------------------------- -------- ----------------------

30 June 30 June

2022 2021

Name Country of incorporation Unaudited Unaudited

------------------------- --------------------------- ---------------- ------------

NorFraKalk AS Norway 50% -

------------------------- ------------------------------- ------------ ------------

Summarised financial information

30 June 30 June

2022 2021

Unaudited Unaudited

NorFraKalk AS - Cost and net book value GBP'000 GBP'000

---------------------------------------- ---------- ----------

Current assets 10,960 -

Non-current assets 9,867 -

Current liabilities 4,199 -

Non-current liabilities 5,488 -

---------- ----------

30,514 -

---------- ----------

6 months 6 months

to 30 June to 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

-------------------------------------------- ----------- -----------

Revenues 10,559 -

Profit after tax from continuing operations 478 -

----------- -----------

12. Non-controlling interests

6 months 6 months

to 30 to 30

June 2022 June 2021

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------------- ---------- ----------

As at 1 January 10,894 -

Shares issued to non-controlling interest - 1,234

Non-controlling interests share of profit in the

period 850 1

Dividends paid (2,530)

Foreign exchange movement 7

---------- ----------

As at 30 June 9,221 1,235

---------- ----------

13. Borrowings

30 June 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

---------------------------------------------- ------------- ----------

Non-current liabilities

Santander term facility 211,320 59,456

Bank Loans 65 634

Finance lease liabilities 21,978 7,456

-------- ----------

233,363 67,546

-------- ----------

Current liabilities

Santander term facility 16,000 -

Bank loans 6,962 2,298

Finance lease liabilities 7,059 2,937

-------- ----------

30,021 5,235

-------- ----------

In July 2021, the Group entered into a new Syndicated Senior

Credit Facility of up to GBP305 million (the 'Credit Facility') led

by Santander UK and including several major UK and European banks.

The Credit Facility, which comprises a GBP205 million committed

term facility, a GBP100 million revolving facility commitment and a

further GBP100 million accordion option. This new facility replaces

all previously existing bank loans within the Group.

The Credit Facility is secured by a floating charge over the

assets of SigmaFin Limited, Carrieres du Hainaut and Nordkalk and

is secured by a combination of debentures, security interest

agreements, pledges and floating rate charges over the assets of

SigmaRoc plc, SigmaFin Limited, B-Mix, Carrieres du Hainaut and

Nordkalk. Interest is charged at a rate between 1.85% and 3.35%

above SONIA ('Interest Margin'), based on the calculation of the

adjusted leverage ratio for the relevant period. For the period

ending 30 June 2022 the Interest Margin was 2.60%.

The carrying amounts and fair value of the non-current

borrowings are:

Carrying amount

and fair value

----------------------

30 June 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

---------------------------------------------- ---------- ----------

Santander term facility (net of establishment

fees) 211,320 59,456

Bank loans 65 2,931

Finance lease liabilities 21,978 10,394

---------- ----------

233,363 72,781

---------- ----------

14. Share capital and share premium

Number Ordinary Share premium

of shares shares Total

GBP GBP GBP

------------------------- ----------- -------- ------------- -------

Issued and fully paid

As at 1 January 2021 278,739,186 2,787 107,418 110,205

----------- -------- ------------- -------

Exercise of options

and warrants - 30 April

2021 1,059,346 11 456 467

Exercise of warrants

- 13 May 2021 78,044 1 19 20

----------- -------- ------------- -------

As at 30 June 2021 279,876,576 2,799 107,893 110,692

Issue of new shares

- 31 August 2021 (1) 307,762,653 3,059 249,772 252,831

Issue of new shares

- 31 August 2021 50,276,521 521 42,232 42,753

----------- -------- ------------- -------

As at 31 December

2021 637,915,750 6,379 399,897 406,276

----------- -------- ------------- -------

As at 1 January 2022 637,915,750 6,379 399,897 406,276

4 January 2022 330,594 3 125 128

As at 30 June 2022 638,246,344 6,382 400,022 406,404

----------- -------- ------------- -------

(1) Includes issue costs of GBP8,748,365

On 4 January 2022, the Company issued and allotted 304,580 new

Ordinary Shares at a price of 40 pence per share as an exercise of

options. On this same day the Company issued and allotted 26,014.

new Ordinary Shares at a price of 25 pence per share as an exercise

of options.

15. Earnings per share

The calculation of the total basic earnings per share of 1.96

pence (2021: 2.12 pence) is calculated by dividing the profit

attributable to shareholders of GBP13,378 million (2021: GBP5,897

million) by the weighted average number of ordinary shares of

638,240,865 (2021: 279,125,771) in issue during the period.

Diluted earnings per share of 1.88 pence (2021: 1.93 pence) is

calculated by dividing the profit attributable to shareholders of

GBP13,378 million (2021: GBP5,897,070 ) by the weighted average

number of ordinary shares in issue during the period plus the

weighted average number of share options and warrants to subscribe

for ordinary shares in the Company, which together total

667,404,450 (2021: 304,541,876).

Details of share options that could potentially dilute earnings

per share in future periods are disclosed in the notes to the

Group's Annual Report and Financial Statements for the year ended

31 December 2021 .

16. Fair value of financial assets and liabilities measured at amortised costs

The following table shows the carrying amounts and fair values

of the financial assets and liabilities, including their levels in

the fair value hierarchy. It does not include fair value

information for financial assets and financial liabilities not

measures at fair value if the carrying amount is a reasonable

approximation of fair value.

Items where the carrying amount equates to the fair value are

categorised to three levels:

-- Level 1 inputs are quoted prices (unadjusted) in active

markets for identical assets or liabilities that the entity can

access at the measurement date

-- Level 2 inputs are inputs other than quoted prices included

within Level 1 that are observable for the asset or liability,

either directly or indirectly

-- Level 3 inputs are unobservable inputs for the asset or liability.

Carrying Amount Fair value

------------------------------------------------------ ---

Financial

Fair Fair Fair asset

value value value at Other

- Hedging through through amortised financial Level Level

instruments P&L OCI cost liabilities Total 1 2 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------------ ------- ------- --------- ----------- ------- ------- ------- ------------

Forward exchange

contracts - 1,138 - - - 1,138 - 1,138 1,138

CO(2) emission

hedge - 126 - - - 126 126 - 126

Electricity

hedges 20,905 - - - - 20,905 20,905 - 20,905

----------- ------- ------- --------- ----------- ------- ------- ------- ------------

Financials assets not measured at fair value

Trade and

other receivables

(excl.

Derivatives) - - - 94,097 - 94,097 - - -

Cash and

cash equivalents - - - 46,427 - 46,427 - - -

Financial liabilities measured at fair value

Forward exchange

contracts 219 - - - - 219 - 219 219

CO(2) emission

hedge 126 - - - - 126 126 - 126

Electricity

hedges 2,084 - - - - 2,084 2,084 - 2,084

----------- ------- ------- --------- ----------- ------- ------- ------- ------------

Financial liabilities not measured at fair value

Loans - - - - 234,347 234,347 - - -

Finance lease

liability - - - - 29,037 29,037 - - -

Trade and

other payables

(excl.

derivative) - - - - 124,120 124,120 - - -

----------- ------- ------- --------- ----------- ------- ------- ------- ------------

17. Business combination

Johnston Quarry Group

On 1 February 2022, the Group acquired 100 per cent. of the

share capital of Johnston Quarry Group Limited ('JQG') for a cash

consideration of GBP35.5 million (being GBP35.5 million less

adjustments for various obligations assumed by the Group as part of

the acquisition). JQG is registered and incorporated in England.

JQG is a high-quality producer of construction aggregates, building

stone and agricultural lime.

The following table summarises the consideration paid for JQG

and the values of the assets and equity assumed at the acquisition

date.

Total consideration GBP'000

----------------------- -------

Net cash consideration 35,050

Deferred consideration 8,500

43,550

-------

Recognised amounts of assets and liabilities acquired GBP'000

------------------------------------------------------- ---------

Cash and cash equivalents 1,587

Trade and other receivables 2,160

Inventories 1,533

Property, plant & equipment 16,897

Trade and other payables (5,685)

Borrowings (10,795)

Provisions (325)

Income tax payable (350)

Deferred tax liability (826)

---------

Total identifiable net assets 4,197

---------

Goodwill 39,354

---------

Total consideration 43,550

---------

RightCast Limited

On 27 April 2022, the Group acquired 100 per cent. of the share

capital of RightCast Limited ('RightCast') and its subsidiaries for

a cash consideration of GBP2.55 million. RightCast is registered

and incorporated in England. RightCast is a precast company

specialising in the design, manufacture, supply and installation of

bespoke precast concrete products.

The following table summarises the consideration paid for

RightCast and the values of the assets and equity assumed at the

acquisition date.

Total consideration GBP'000

----------------------- -------

Cash 2,550

Deferred consideration 747

-------

3,297

-------

Recognised amounts of assets and liabilities acquired GBP'000

------------------------------------------------------ -------

Cash and cash equivalents 15

Trade and other receivables 1,153

Inventories 462

Property, plant & equipment 75

Trade and other payables (474)

Income tax payable (57)

Deferred tax liability (19)

Total identifiable net assets 1,155

-------

Goodwill (refer to note 10 ) 2,142

-------

Total consideration 3,297

-------

18. Related party transactions

Loans with Group Undertakings

Amounts receivable/(payable) as a result of loans granted

to/(from) subsidiary undertakings are as follows:

Company

----------------------

30 June 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------ ---------- ----------

Ronez Limited (19,728) (15,468)

SigmaGsy Limited (6,763) (5,455)

SigmaFin Limited 20,146 (6,584)

Topcrete Limited (9,494) (8,678)

Poundfield Products (Group) Limited 5,251 5,863

Foelfach Stone Limited 466 457

CCP Building Products Limited 5,396 5,786

Carrières du Hainaut SCA 16,388 (4,861)

GDH (Holdings) Limited 9,838 1,484

B-Mix Beton NV 517 -

Stone Holdings SA 376 368

Nordkalk Oy Ab 73,939 -

Johnston Quarry Group 10,451 -

106,783 (27,088)

---------- ----------

Loans granted to or from subsidiaries are unsecured, have

interest charged at 2% and are repayable in Pounds Sterling on

demand from the Company.

All intra Group transactions are eliminated on

consolidation.

Other Transactions

During the period, there were no related party transactions.

19. Events after the reporting date

On 12 September 2022 the Company announced it had entered into a

joint venture agreement with ArcelorMittal Global Holdings S.L.R.

to develop quicklime production for use in steel production and

other applications.

20. Approval of interim financial statements

The condensed interim financial statements were approved by the

Board of Directors on 9 September 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUPGBUPPGRG

(END) Dow Jones Newswires

September 12, 2022 02:01 ET (06:01 GMT)

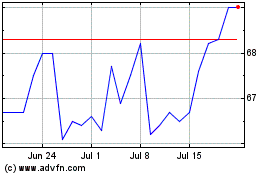

Sigmaroc (LSE:SRC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sigmaroc (LSE:SRC)

Historical Stock Chart

From Sep 2023 to Sep 2024