SigmaRoc PLC Acquisition of Johnston Quarry Group (2535X)

January 04 2022 - 2:00AM

UK Regulatory

TIDMSRC

RNS Number : 2535X

SigmaRoc PLC

04 January 2022

4 January 2022

(EPIC: SRC / Market: AIM / Sector: Construction Materials)

SIGMAROC PLC

( ' SigmaRoc ', the 'Group' or the 'Company')

Acquisition of Johnston Quarry Group

SigmaRoc plc (AIM: SRC), the AIM quoted quarried materials

group, is pleased to announce the acquisition of Johnston Quarry

Group Limited ('JQG') and Guiting Quarry Limited for an initial

cash consideration of GBP35.5m (the 'Acquisition') from Nicholas

Johnston, Giantflow Limited and Flowgiant Limited (the

'Sellers').

JQG is a specialist quarried materials supplier producing

construction aggregates and premium quality building stone, as well

as agricultural lime for soil improvement. Its aggregate products

are typically used in infrastructure projects, with its unique

Cotswolds Ironstone and Bath Stone used in specified high end

housing applications. The business operates eight quarries and two

separate processing sites located across the South West,

Oxfordshire and Lincolnshire. JQG has access to 86 million tonnes

of freehold and leasehold reserves and resources giving JQG an

average life of mine of over 40 years.

For the 12 months to 30 September 2021, JQG reported revenue of

GBP14.7m, generating EBITDA of GBP5.9m and GBP3.6m profit before

tax. As at 30 September 2021, JQG had gross assets of GBP22.1m and

net assets of GBP6.9m primarily in land, mineral reserves and plant

and machines. The Acquisition, which will be immediately enhancing

to SigmaRoc's underlying earnings, is expected to complete in the

next few weeks, following the satisfaction of certain completion

conditions. On completion of the Acquisition, Nicholas Johnston,

JQG's founder, will remain available in an advisory capacity as

required for smooth integration. The Acquisition consideration will

be funded from the Group's existing resources, including the

assumption of up to GBP6m of JQG's long term debt and up to GBP3.6m

in plant hire contracts.

As part of the Acquisition, SigmaRoc has also conditionally

agreed to purchase from the Sellers two further quarries, together

with additional mineral reserves, for a total potential

consideration of GBP14.5m. These additional sites have a

strategically attractive location relative to JQG and will increase

the business' footprint and market access. The consideration for

the acquisition of these additional sites is payable in three

phases, upon the delivery of each of the two quarries and the

delivery of the mineral reserves with planning permission. The

Group expects these additional transactions to complete between H2

- 2022 and H2 - 2024.

David Barrett, Chairman of SigmaRoc, commented:

"Johnston Quarry Group fits the SigmaRoc model well and I

believe the benefits gained will be mutual. As a Group, we have

focussed on building a portfolio of high quality stand-alone

businesses, to which we can add value through our improvement and

integration efforts, while maintaining those aspects of each which

are unique and successful. We look forward to welcoming the JQG

team to SigmaRoc and see significant potential to create value in

this business over time."

Max Vermorken, CEO of SigmaRoc, commented:

"Firstly, we welcome the JQG staff to SigmaRoc and look forward

to supporting them in growing and developing their very successful

business. JQG is high quality quarrying group, with an attractive

geographic footprint and a product range which offers both

architectural and environmental benefits over alternatives. The

Acquisition extends our footprint significantly in several key

markets within the UK, while offering the opportunity for further

improvement and platform based synergies."

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European (Withdrawal) Act

2018.

Information on the Company is available on its website,

www.sigmaroc.com .

SigmaRoc plc Tel: +44 (0) 207

Max Vermorken 002 1080

Strand Hanson Limited (Nominated and Financial Tel: +44(0) 207 409

Adviser) 3494

James Spinney / James Dance / Rob Patrick

Liberum Capital (Co-Broker) Tel: +44 (0) 203

Neil Patel / Jamie Richards / Ben Cryer 100 2000

Peel Hunt (Co-Broker) Tel: +44 (0) 20 7418

Mike Bell / Ed Allsopp 8900

Investor Relations Tel: +44 (0) 207

Dean Masefield / Florian Werner 002 1080

ir@sigmaroc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAAFDEANAEAA

(END) Dow Jones Newswires

January 04, 2022 02:00 ET (07:00 GMT)

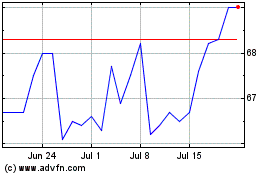

Sigmaroc (LSE:SRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sigmaroc (LSE:SRC)

Historical Stock Chart

From Apr 2023 to Apr 2024