RNS Number:6979E

Mountview Estates PLC

05 December 2002

CHAIRMAN'S STATEMENT

I have much pleasure in presenting the unaudited Accounts for the six months

ended on 30 September 2002. Profit on ordinary activities before taxation has

risen from #8,942,260 to #10,260,221, which is an increase of 14.7%, and which

has been derived from a smaller equity share capital. The substantial rise in

earnings per share from 136.2 pence to 183.9 pence is an increase of 35.0%. From

this base it is very reasonable to expect satisfactory results for the full

year.

This time last year we were all fearful of the after-effects of 11 September,

but interest rates have been kept lower for longer than was generally expected.

This helped avert the most feared economic consequences and, indeed, kept the

housing market very buoyant, but it is this buoyancy which is now perceived as a

problem. Whilst other sectors of the economy need low, or even lower interest

rates, the increased supply of cheap money threatens to fuel the rise in house

prices at an unsustainable pace.

Caution must be the watchword, but strong cash flow has helped us manage our

increased borrowings and replenish our stocks. Although there has been no single

outstanding purchase, there has been a steady flow of good buying and this

underpins our future profits. Despite our debt being high by our historic

standards, strong sales figures have enabled us to make our loan repayments with

comfort, make the very necessary reinvestment and maintain our policy of

steadily increasing dividends. To this end the interim dividend is increased

from 36 pence per share to 40 pence per share. A decision in respect of any

increase in the final dividend will be taken in the light of the final results

for the year ending 31 March 2003.

The buy-back is working well for every single shareholder and it is so much more

rewarding for management to be able to focus on the long term growth of the

Company without being distracted by a rival company, which had a substantial

shareholding and whose objectives did not accord with those of the Board. The

35.0% increase in earnings per share for the six months to 30 September 2002

gives a very sound base on which to build results for the year ending 31 March

2003 and the Board are confident of riding out the economic turbulence that may

impact in the next few years.

The interim dividend of 40 pence per share will be payable on 31 March 2003 to

shareholders on the register on 28 February 2003.

Consolidated Profit and Loss Account (unaudited).

Half Year Half Year Full Year

ended ended ended

30.09.2002 30.09.2001 31.03.2002

# # #

Turnover 21,726,006 17,838,646 40,289,432

Cost of Sales (8,227,978) (6,153,004) (14,828,704)

Gross Profit 13,498,028 11,685,642 25,460,728

Administrative Expenses (1,524,556) (1,341,376) (2,402,125)

Operating Profit 11,973,472 10,344,266 23,058,603

Interest Payable (1,713,251) (1,402,006) (2,983,334)

Profit on ordinary activities 10,260,221 8,942,260 20,075,269

before taxation

Tax on ordinary activities (3,091,357) (2,695,969) (6,013,113)

Profit on ordinary activities 7,168,864 6,246,291 14,062,156

after taxation

Dividends (1,559,606) (1,403,645) (3,275,172)

Retained Profit for the period 5,609,258 4,842,646 10,786,984

Earnings per Share 183.9p 136.2.p 325.1p

Consolidated Balance Sheet (unaudited)

As at As at As at

30.09.2002 30.09.2001 31.03.2002

# # #

Fixed Assets

Intangible assets 132,905 221,511 177,208

Tangible Assets 29,191,336 25,819,481 29,120,348

29,324,241 26,040,992 29,297,556

Current Assets

Stocks 136,311,131 130,002,697 130,314,220

Debtors:

due within one year 559,115 218,301 1,435,246

Cash at Bank and in hand 83,377 77,091 519,442

136,953,623 130,298,089 132,268,908

Creditors: amounts failing due (33,720,757) (29,909,158) (32,438,615)

Within one year

Net Current Assets 103,232,866 100,388,931 99,830,293

Total Assets less Current 132,557,107 126,429,923 129,127,849

Liabilities

Creditors: Amounts failing due

After more than one year (31,254,000) (22,000,000) (33,434,000)

101,303,107 104,429,923 95,693,849

Capital and Reserves

Called up share capital 194,951 229,354 194,951

Revaluation Reserve 8,248,484 5,846,215 8,248,484

Capital Redemption Reserve 55,049 20,646 55,049

Capital Reserve 24,660 24,660 24,660

Other Reserves 56,000 56,000 56,000

Profit and Loss Account 92,723,963 98,253,048 87,114,705

101,303,107 104,429,923 95,693,849

Consolidated Cash Flow

Statement

Half year ended Half year ended Full Year ended

30.09.2002 30.09.2001 30.03.2002

Cash inflow(outflow) from 6,469,811 (12,930,405) (1,799,501)

operating activities

Returns on Investment and (1,691,401) (1,390,098) (2,849,343)

servicing

of finance

Taxation (3,212,207) (2,495,718) (6,280,853)

Capital expenditure and (131,560) (552,727) (1,537,553)

financial investment

Equity dividend paid (1,873,774) (2,201,796) (3,364,738)

Cash ( outflow)/ inflow before (439,131) (19,570,744) (15,831,988)

use of liquid

resources and financing

Financing (2,180,000) 20,070,000 10,421,320

(Decrease)Increase in cash flow (2,619,131) 499,256 (5,410,668)

for the period

Reconciliation of Net Cash flow

movement

in Net Debt

(Decrease/Increase in cash in (2,619,131) 499,256 (5,410,668)

the period

Change in Net Debt resulting (2,619,131) 499,256 (5,410,668)

from Cash Flow

Cash Inflow/(Outflow) from the

Decrease

(Increase) in debt 2,180,000 (20,070,000) (27,504,000)

Net debt at the beginning of (58,038,982) (25,124,314) (25,124,314)

the period

Net debt at the end of the (58,478,113) (44,695,058) (58,038,982)

period

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FSLSUISESELE

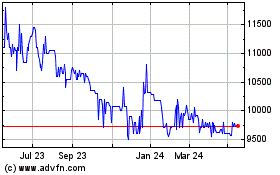

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Jun 2024 to Jul 2024

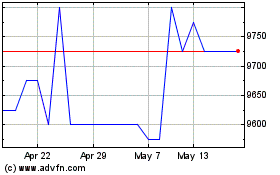

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Jul 2023 to Jul 2024