Molins PLC - Interim Results

September 03 1997 - 3:32AM

UK Regulatory

RNS No 3924t

MOLINS PLC

3rd September 1997

1997 INTERIM RESULTS

Molins PLC, the international specialist engineering company, announces its

results for the six months ended 30 June 1997.

1997 1996

Half Year Half Year

Turnover #125.4m #147.2m

______________ ______________

Operating profit (before exceptional items) #8.2m #16.0m

Exceptional items

- Langston #(13.4)m -

- Rationalisation costs #(1.5)m #(2.0)m

Interest #(1.0)m #(0.4)m

____________ ____________

(Loss)/profit before taxation #(7.7)m #13.6m

____________ ____________

Earnings per share (before exceptional items) 14.2p 33.7p

(Loss)/earnings per share (18.2)p 29.9p

Dividend per share 6.5p 6.5p

Chief Executive, Peter Harrisson, commented:

"Clearly this is a very disappointing set of results reflecting difficult

trading conditions in our major markets coupled with the exceptional charges

at Langston. Although the outlook is for substantially lower second half

profits this year compared with last, the balance sheet remains strong and we

are taking action to improve profitability in a changing market environment".

Enquiries: Peter Harrisson, Chief Executive

Peter Grant, Group Finance Director

Tel: 0171 638 9571

Chairman's statement

Results

The Group's results for the six months ended 30 June 1997 are very

disappointing and reflect in particular the outcome of the investigation into

the accounting irregularities at Langston. When the findings from the

investigation were announced early in July, shareholders were made aware that

the exceptional charge in respect of Langston would take the Group into loss

for the first half. The full results are now available and confirm that the

Group incurred a loss before tax of #7.7m after charging exceptional costs of

#14.9m (including #13.4m in respect of Langston).

The gradual decline in order intake for tobacco and corrugated board

machinery from the record levels of more than a year ago began to affect the

Group's trading performance in the first half of the current year. Sales of

tobacco machinery in the first half were lower than a year ago and sales of

corrugated board machinery remained depressed. Packaging machinery sales were

substantially higher, reflecting the acquisition of Langen. It became

increasingly apparent that the strength of sterling had eroded the Group=s

competitive position at a time when demand in some of its main markets was

slowing. Group profit before tax before exceptional items was only #7.2m,

against #15.6m for the first half of last year. Earnings per share before

exceptional items of 14.2p compared with 33.7p a year ago. After an

exceptional charge equivalent to 32.4p per share the loss per share was

18.2p.

Shareholders' funds were #98.2m at 30 June 1997 (1996: #119.6m) following the

acquisition of Langen in November 1996 and net debt amounted to #16.6m (1996:

net cash of #1.4m). Net cash inflow from operating activities in the first

half was #6.4m (1996: #9.3m).

Dividend

The Directors have declared an interim dividend of 6.5p per share (1996:

6.5p) which is more than twice covered by earnings before exceptional items.

This is payable on 30 October 1997 to shareholders on the register on 19

September 1997.

Langston Investigation

The results of the investigation into the accounting irregularities at

Langston were announced early in July. In summary, the investigation

concluded that profits had been overstated over a number of years to the

aggregate sum of US$20.8m (#12.2m) before tax and US$14.8m (#8.7m) after tax.

The impact on the reported results for 1996 was less than #3.0m (#1.9m after

tax) against reported profits of #33.4m (#24.9m after tax). The total

adjustment, together with the related investigation costs of #1.2m (#1.0m

after tax), has been accounted for as an exceptional charge.

Tobacco Machinery

Tobacco Machinery reported sales of #78.9m for the six months to 30 June 1997

(1996: #88.0m) and an operating profit before exceptional items of #7.7m

(1996: #11.6m). The order backlog for original equipment at the beginning of

the current year, whilst substantially lower than the record of a year

earlier, was sufficient to maintain satisfactory levels of production

throughout the first half. However, invoiced sales were some #5m lower than

expected because shipments to the Far East were affected by delays in

receiving letters of credit. Operating results for the first half suffered

accordingly.

As previously announced, weak demand caused losses at the Brazilian

operation, prompting a restructuring to reduce costs, for which an

exceptional charge of #1.5m is included in the half year's results. Steady

progress has been made in most of the other areas of Tobacco Machinery, with

the spares activities performing particularly well.

Corrugated Board Machinery

Corrugated Board Machinery=s sales of #31.3m in the first half (1996: #51.7m)

were much lower than those of a year earlier, when Langston benefited from a

substantial order backlog built up at the top of the cycle. In the downturn,

weaker demand throughout the whole of the industry put margins under pressure

and resulted in an operating loss before exceptional items of #0.9m for the

six months to 30 June 1997, against last year=s reported profit before

exceptional items of #3.6m.

The investigation of the accounting irregularities at Langston inevitably

caused a significant distraction, affecting both operational management and

marketing activities. Decisive action was taken to replace the management

and the new team is now established.

Packaging Machinery

Packaging Machinery reported sales of #15.2m in the first half (1996: #7.5m)

and an operating profit of #1.4m (1996: #0.8m), and continues to grow in

importance as an integral part of the Group.

Sandiacre achieved satisfactorily higher volumes in the first half, although

margins were affected by the strength of sterling. Langen had a slow start

to the year but by June the order book had returned to more normal levels.

Further development work continued on tea bagging machines and other projects

in collaboration with major multi-nationals.

Outlook

When the trading update accompanying the announcement of the results of the

Langston investigation was released early in July, the Group was looking for

the second half results to be broadly comparable with those achieved in the

second half of 1996. However, further discussions with major customers

regarding the delays in shipment referred to above have cast a different

light upon the pattern of demand for tobacco machinery in Far Eastern

markets. In summary, a slowing of the flow of orders for original equipment

seems bound to reduce levels of activity in the second half. Spares volumes

have not been affected, but production schedules for original equipment will

need to be adjusted and further action is being taken to reduce costs. In

the changed circumstances, even though the problems at Langston are largely

behind us and the packaging machinery operations continue to make steady

progress, the outlook must now be for substantially lower operating profits

in the second half of the year when compared with the second half of 1996.

Looking further forward, with a strong balance sheet and an internationally

recognised portfolio of products, the Group is in a sound position to weather

its current difficulties and resume growth in future years.

J C Orr

Chairman

3 September 1997

Group profit and loss account

6 months to

30 June 6 months 6 months 6 months 12

1997 to months

before 30 June to 30 to 30 to 31

1997 June June Dec

excep- excep- 1997 1996 1996

tional tional

items items total

#m #m #m #m #m

Note 2

Turnover 125.4 - 125.4 147.2 306.2

_____ _____ _____ _____ _____

Operating (loss)/profit 8.2 (14.9) (6.7) 14.0 34.4

Net interest payable (1.0) - (1.0) (0.4) (1.0)

_____ _____ _____ _____ _____

(Loss)/profit on ordinary 7.2 (14.9) (7.7) 13.6 33.4

activities before taxation

Taxation (2.3) 3.7 1.4 (3.4) (8.5)

_____ _____ _____ _____ _____

(Loss)/profit for the period 4.9 (11.2) (6.3) 10.2 24.9

Dividends (including non- (2.3) - (2.3) (2.2) (7.6)

equity)

_____ _____ _____ _____ _____

Retained (loss)/profit 2.6 (11.2) (8.6) 8.0 17.3

for the period _____ _____ _____ _____ _____

Earnings per ordinary share 14.2p - 14.2p 33.7p 81.0p

(before exceptional items)

(Loss)/earnings per ordinary 14.2p (32.4)p (18.2)p 29.9p 72.8p

share

Dividend per ordinary share 6.5p - 6.5p 6.5p 22.0p

_____ ______ _____ _____ _____

Reconciliation of movements in shareholders' funds

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

1997 1996 1996

#m #m #m

Opening shareholders' funds 105.9 111.4 111.4

_____ _____ _____

(Loss)/profit for the period (6.3) 10.2 24.9

Dividends (2.3) (2.2) (7.6)

Goodwill adjustment - - (19.8)

Other recognised gains and losses for the 0.9 0.1 (6.5)

period

New share capital - 0.1 3.5

_____ _____ _____

Net (reductions)/additions to (7.7) 8.2 (5.5)

shareholders' funds

_____ _____ _____

Closing shareholders' funds 98.2 119.6 105.9

_____ _____ _____

Group balance sheet

1997 1996 1996

#m #m #m

Fixed assets

Tangible assets 54.1 56.1 54.7

Investments 1.3 0.4 1.2

_____ _____ _____

55.4 56.5 55.9

_____ _____ _____

Current assets

Stocks 79.7 84.0 78.1

Debtors - due within one year 59.7 58.5 66.0

Debtors - due after more than one year 14.3 13.8 13.9

Cash at bank and in hand 8.5 17.1 9.8

_____ _____ _____

162.2 173.4 167.8

Creditors - amounts falling due within

one year

Borrowings (14.0) (2.9) (16.3)

Other creditors (85.2) (85.4) (84.1)

Proposed dividend (2.3) (2.2) (5.4)

_____ _____ _____

(101.5) (90.5) (105.8)

Net current assets 60.7 82.9 62.0

Total assets less current liabilities 116.1 139.4 117.9

Creditors - amounts falling due after

more than one year

Borrowings (11.1) (12.8) (5.2)

Other creditors (0.8) (0.3) (0.9)

_____ _____ _____

(11.9) (13.1) (6.1)

Provisions for liabilities and charges (5.8) (6.7) (5.7)

_____ _____ _____

Net assets 98.4 119.6 106.1

_____ _____ _____

Capital and reserves

Called up share capital 9.5 9.4 9.5

Share premium account 21.0 19.8 21.0

Revaluation reserve 18.3 21.6 17.8

Profit and loss account 49.4 68.8 57.6

_____ _____ _____

Shareholders' funds (including 98.2 119.6 105.9

non-equity interests)

Minority interests 0.2 - 0.2

____ ____ ____

98.4 119.6 106.1

_____ _____ _____

Group cash flow statement

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

1997 1996 1996

#m #m #m

Operating (loss)/profit (6.7) 14.0 34.4

Exceptional items 14.9 2.0 3.9

Depreciation 3.6 3.2 6.6

Working capital (5.4) (9.6) (17.0)

Other - (0.3) (0.3)

____ ____ ____

Net cash inflow from operating activities 6.4 9.3 27.6

Interest paid (net) (0.9) (0.4) (1.1)

Dividends paid (5.4) (4.8) (7.1)

Tax paid (1.7) (3.7) (8.2)

Investment in joint venture (0.1) - (1.0)

Purchase of subsidiary/acquisition costs (0.2) - (19.5)

Capital expenditure (net) (2.9) (5.9) (9.6)

____ ____ ____

Net cash outflow before use of liquid

resources and financing (4.8) (5.5) (18.9)

____ ____ ____

Management of liquid resources - 2.7 6.5

Financing

Issue of ordinary share capital - 0.1 1.4

Increase/(decrease) in loans and

finance lease obligations 3.0 (0.1) (1.5)

____ ____ ____

Net cash inflow/(outflow) from financing 3.0 - (0.1)

____ ____ ____

Decrease in cash in the period (1.8) (2.8) (12.5)

____ ____ ____

Closing net (borrowings)/cash (16.6) 1.4 (11.7)

____ ____ ____

Notes

1 Segmental information

Turnover Operating (loss)/profit

------------------- ---------------------------

6 months 6 months 12 months 6 months 6 months 12 months

to 30 to 30 to 31 Dec to 30 to 30 to 31 Dec

June June June June

1997 1996 1996 1997 1996 1996

#m #m #m #m #m #m

By activity

Tobacco 78.9 88.0 183.2 7.7 11.6 28.4

Corrugated 31.3 51.7 101.6 (0.9) 3.6 6.6

Board

Packaging 15.2 7.5 21.4 1.4 0.8 3.3

____ ____ ____ ____ ____ ____

125.4 147.2 306.2 8.2 16.0 38.3

Exceptional - - - (14.9) (2.0) (3.9)

items

____ ____ ____ ____ ____ ____

125.4 147.2 306.2 (6.7) 14.0 34.4

____ ____ ____ ____ ____ ____

The exceptional items for 1997 comprise #1.5m cost of restructuring in

Brazil (Tobacco Machinery division) and #13.4m in respect of accounting

irregularities at The Langston Corporation. These irregularities had the

effect of overstating profits of the Corrugated Board Machinery division

over a number of years to 31 December 1996. This adjustment comprises US

$20.8m (#12.2m) before tax and US $14.8m (#8.7m) after tax together with

related investigation costs of #1.2m (#1.0m after tax). The exceptional

items in 1996 comprised rationalisation costs in the Corrugated Board

Machinery division (full year: #2.9m, half year: #2.0m) and in the

Tobacco Machinery division (full year: #1.0m, half year: nil). The

exceptional items for 1996 are now shown separately in the segmental

analysis.

3 The interim financial statements have been prepared on the basis of the

accounting policies set out in the Group's 1996 statutory accounts.

4 The financial information for the half year has not been audited,

although the auditors have carried out a review.

5 The results for the full year 1996 are not the Group's statutory accounts

but have been extracted from the Group's full accounts for that year

which have been filed with the Registrar of Companies. The 1996 accounts

received an auditors' report which was not qualified and did not contain

a statement under section 237 (2) or (3) of the Companies Act 1985.

6 The preference dividend paid on 30 June 1997 amounted to #18,900 (1996:

#18,900).

The cost of the interim dividend of 6.5p per ordinary share for the six

months to 30 June 1997 will amount to #2,328,000.

8 Overseas tax included in taxation in the profit and loss account

comprises a #0.8m charge against the result before exceptional items, and

a #3.7m credit in respect of exceptional items (6 months to 30 June 1996

- #1.4m charge, year to 31 December 1996 - #3.1m charge).

9 Earnings per ordinary share are based upon the profit after taxation less

the preference dividend and on a weighted average of 34,603,489 shares in

issue during the period (1996: 34,104,180).

10 In 1996 the Group changed its accounting policy regarding the

translation of overseas earnings and now uses an average rate

rather than the closing rate. The directors believe that the

new treatment more fairly reflects the results and cash flows

as they arise throughout the year. The effects are not

material in either the current or prior periods and therefore

comparative figures have not been restated.

Copies of the report are being sent to all shareholders. Further copies, and

copies of the 1996 Annual Report and Accounts, are available from the

Company's registered office: 11 Tanners Drive, Blakelands, Milton Keynes

MK14 5LU.

END

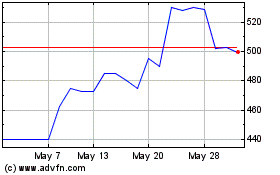

Mpac (LSE:MPAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2023 to Jul 2024