Molins PLC - Trading Statement, etc

July 08 1997 - 3:31AM

UK Regulatory

RNS No 800j

MOLINS PLC

8th July 1997

LANGSTON INVESTIGATION AND GROUP TRADING UPDATE

Langston Investigation

On 23 April 1997 the Board of Molins PLC ('Molins') announced that it had

identified certain accounting irregularities at The Langston Corporation

('Langston'), Molins' wholly-owned corrugated board machinery subsidiary in

the USA. It also announced that it had instructed Price Waterhouse LLP to

work with KPMG Audit Plc, the Group's auditors, to conduct an immediate

investigation and to report on the precise nature of the irregularities and

their financial effect. The investigation is now complete and its main

conclusions are as follows:

(i) a large number of irregularities, most of which were individually

quite small, accumulated over a number of years into an overstatement

of net assets at 31 December 1996 of #8.7m (compared with reported

consolidated net assets of the Group of #106.1m);

(ii) the irregularities related mainly to the overvaluation of inventory,

the deferral of costs and provisions, and the overstatement of

debtors;

(iii) no evidence has been uncovered of any misappropriation of Langston's

assets;

(iv) certain accounting practices were deployed at Langston in the United

States at various times which resulted in incorrect accounts, were

contrary to Group policy and were concealed from Group management.

The announcement of 23 April included a preliminary indication of the net

financial effect of the irregularities of #4.4m, which was based on

information available at that time. The final outcome is larger as the

range, number and complexity of the irregularities was greater than a

preliminary assessment could reveal, especially in the areas of inventory

evaluation and the treatment of costs and provisions.

Owing to the large number of transactions involved, the Board believes that

the cost of allocating the adjustments precisely between the years would

outweigh the benefit. However, KPMG Audit Plc agrees that the overstatement

of profit in 1996 was less than #3m (net of tax: #1.9m), against reported

Group profits of #33.4m (net of tax: #24.9m).

The total adjustment, which amounts to US$20.8m (#12.2m) before tax, and

US$14.8m (#8.7m) net of tax, will, together with related investigation costs,

be treated as an exceptional charge in the Group's 1997 accounts.

Commenting on the outcome of the investigation, the Chief Executive of

Molins, Mr Peter Harrisson, said:

"We acted decisively to replace the management and conduct an independent

investigation as soon as the irregularities at Langston came to our

attention. We have now received a comprehensive report from Price Waterhouse

LLP, which has enabled us to quantify the financial effects and identify

measures which will be implemented to prevent any recurrence."

Group Trading Update

Tobacco Machinery

The tobacco machinery division started the current year with a more normal

order book compared with the exceptionally strong position at the beginning

of 1996. Although order intake for original equipment has been slow in

recent months, the immediate outlook is more encouraging. Levels of activity

were satisfactory throughout the first half with the exception of Molins do

Brasil. Weak demand has taken this operation into loss and prompted

restructuring to reduce costs, incurring a one off charge of #1.5m. Progress

has been made elsewhere, but the negative factors in Brazil mean that the

division's contribution to operating profits in the first half is likely to

be somewhat less than the #11.6m reported for the first half of 1996.

Corrugated Board Machinery

The Langston business has inevitably been distracted during the process of

the investigations. However, orders have continued to be received at a fair

rate when considered against the background of weak market conditions. Sales

in the first half were substantially lower than in the comparable period of

1996, which benefited from a much higher opening order book, while margins

continued to be under pressure as is usual at this stage of the cycle.

Against this background, the corrugated board machinery division seems set to

report a small operating loss (before the exceptional item arising from the

Langston investigation) as compared with the reported, but now known to be

overstated, profit of #1.6m for the first half of last year.

Packaging Machinery

Sandiacre achieved satisfactorily higher volumes in the first half, although

margins were affected by the strength of sterling. Langen had a slow start

to the year, but an increasing order book, especially in the main Canadian

operation, is encouraging. The packaging machinery division should achieve a

rather higher operating profit in the first half of 1997 than the #0.8m

reported a year ago.

Group

For the first half of the year, Group profit before tax (before the

exceptional item) is likely to be significantly lower than the somewhat

overstated #13.6m reported a year ago, reflecting not only the reversal in

Langston's results but also the costs of restructuring in Brazil. After the

exceptional charge in respect of Langston, the Group will report a pre-tax

loss for the first half. Despite this, the balance sheet remains strong and

the Directors expect to declare a maintained interim dividend of 6.5p per

share.

Looking forward, prospects for the tobacco machinery division in the second

half are satisfactory. With progress anticipated in the packaging machinery

division, and some recovery expected in the corrugated board machinery

division, the Group is looking for the second half results to be broadly

comparable with those achieved in the second half of 1996.

The interim results will be announced early in September.

Enquiries: Mr Peter Harrisson (Chief Executive)

Mr Peter Grant (Group Finance Director)

Tel: 0171 638 9571

Date: 8 July 1997

END

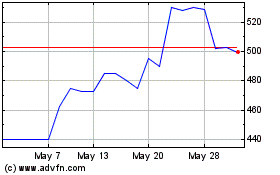

Mpac (LSE:MPAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2023 to Jul 2024