TIDMLSE

RNS Number : 2691K

London Stock Exchange Group PLC

21 April 2020

21 April 2020

LONDON STOCK EXCHANGE GROUP plc

TRADING STATEMENT

INCLUDING REVENUES AND KPIs FOR THE THREE MONTHSED

31 MARCH 2020 (Q1)

-- Good Q1 performance against unprecedented market backdrop

-- Q1 total income up 13% year-on-year to GBP615 million, driven

by increased equity trading in Capital Markets and higher clearing

activity across listed and OTC products leading to higher NTI in

Post Trade

-- Resources focused on ensuring strong operational resilience

across the Group's systemically important market infrastructure

platforms and services; Group employees working almost entirely on

a remote basis across all locations

-- Integration planning for Refinitiv transaction progressing

well: CFIUS approval received and anti-trust filings prepared in

multiple jurisdictions; remain committed to achieving completion in

H2 2020

Q1 summary:

-- Information Services: revenues up 7% to GBP215 million - with

8% growth at FTSE Russell. Good growth in both subscription and

asset-based revenues, the latter reflecting growth in ETF AUM in

prior quarter; ETF AUM fell sharply at the end of Q1, reflecting

market turbulence in March

-- Post Trade: income up 17% to GBP271 million, with 11% growth

in LCH revenue, with strong listed and OTC clearing activity,

including record volumes in SwapClear. Good clearing volumes at

CC&G drove a 15% revenue increase. Increased clearing activity

drove higher cash margin, with consequent stronger NTI, up 39% in

LCH and 10% in CC&G

-- Capital Markets: revenues up 15% to GBP112 million,

principally reflecting higher equity secondary markets activity in

London and Milan

-- Technology Services: revenues unchanged at GBP14 million

Update on the Refinitiv transaction

The Group continues to make good progress on planning for the

integration of Refinitiv. A number of workstreams on business

structure and opportunities, including synergy realisation, are

well developed, and the Integration Management Office has been

expanded to bring additional resource to the Group.

The Group also continues to make progress with merger control,

foreign investment and financial regulatory filings. US foreign

investment clearance has been received from CFIUS. Merger control

clearance has been received from Botswana, Japan, Kenya and

Ukraine, and merger control reviews have commenced in several other

jurisdictions. As disclosed last month, the European Commission has

requested a delay to submission of filings by merger parties

generally; the Group continues to work constructively with the

European Commission case team and will file as soon as it is

possible to do so. The Group is committed to completion of the

transaction in H2 2020.

Comment on Q1 and outlook:

LSEG recognises the significant impact of the coronavirus

Covid-19 global pandemic on its employees, customers and other

stakeholders. Employee health and wellbeing has been a key focus.

The vast majority of our employees have been working remotely, and

we continue to adapt our technology and working practices to this

changing environment. LSEG is in regular contact with public health

authorities, governments and stakeholders around the world and will

continue to adjust our response as needed.

As a systemically important financial markets infrastructure

business, LSEG places a high priority on its responsibility to

ensure the orderly functioning of markets and continuity of

services for its customers and other stakeholders. During this

unprecedented period, the Group has prioritised operational

resilience across the Group's Capital Markets, Information Services

and Post Trade businesses.

In light of current circumstances, LSEG regularly assesses the

strength of its balance sheet and stress-tests its liquidity

positions under various market scenarios. The Group strongly

believes it has sufficient cash resources and access to liquidity

to maintain continuity of business and has no need to materially

adjust any its operations or incur significant additional costs. As

at 31 March 2020, the Group had committed facility headroom of over

GBP600 million available for general corporate purposes. Reflecting

the strong 2019 results and ongoing financial strength, the Group

intends to pay its final dividend in relation to the 2019 financial

year, subject to shareholder approval at today's AGM.

While the Group has performed well in Q1, it is too early to

comment specifically on the impact of the coronavirus pandemic on

the outlook for LSEG and its customers for the remainder of the

year. The Group believes the longer-term drivers of growth in each

of its business lines remain intact.

David Schwimmer, CEO said:

"The Group has delivered a good financial performance and strong

operational resilience during this unprecedented period. We have

had a focus on ensuring orderly functioning of markets and

continuity of service to customers across our businesses."

"A key priority has been the health and wellbeing of our

employees around the world. The vast majority of our colleagues are

working remotely as a key element of our business continuity

measures. I've been impressed by their adaptability, resiliency and

commitment to continue to support our customers. Although market

conditions are likely to remain challenging in the coming period,

we believe the Group is financially strong and has the necessary

resources to continue to operate effectively in this

environment."

Further information is available from:

Gavin Sullivan/Lucie Holloway

-

London Stock Exchange Media +44 (0) 20 7797 1222

Group plc Paul Froud - Investor Relations +44 (0) 20 7797 3322

The Group will host a conference call for analysts and investors

today, Tuesday 21 April at 08:30am (UK time). On the call will be

David Schwimmer (CEO), David Warren (CFO) and Paul Froud (Group

Head of Investor Relations).

To access the telephone conference call please pre-register

using the following link and instructions below:

http://emea.directeventreg.com/registration/5831128

-- Please register in advance of the conference using the link

above . Upon registering with your full name, company name and

email address, you will be provided with participant dial-in

numbers, Direct Event passcode and unique registrant ID

-- In the 10 minutes prior to the call start time, you will need

to use the conference access information provided in the email

received at the point of registering

Note: Due to regional restrictions some participants may receive

operator assistance when joining this conference call and will not

be automatically connected.

For further information, please call the Group's Investor

Relations team on

+44 (0) 20 7797 3322.

Q1 Revenue Summary

Revenues for three months ended 31 March 2020, referring to

continuing operations, with comparatives against performance for

the same period last year, are provided below. Growth rates for Q1

performance are also expressed on an organic and constant currency

basis. All figures are unaudited.

Organic

and

Three months ended constant

31 March currency

---------------------

2020 2019 Variance variance(1)

Continuing operations: GBPm GBPm % %

Revenue

Information Services 215 201 7% 6%

Post Trade 192 172 12% 13%

Capital Markets 112 97 15% 16%

Technology 14 14 - -

Other 2 2 - -

----------------------------- ---------- --------- --------- ------------

Total revenue 535 486 10% 10%

Net treasury income through

CCP businesses 79 59 34% 34%

Other income 1 1 - -

---------- --------- ------------

Total income 615 546 13% 13%

----------------------------- ---------- --------- --------- ------------

Cost of sales (60) (56) 8% 9%

---------- ---------

Gross profit 555 490 13% 13%

----------------------------- ---------- --------- --------- ------------

(1) Organic growth is calculated in respect of businesses owned

for at least the full 3 months in either period and excludes Beyond

Ratings. The Group's principal foreign exchange exposure arises

from translating and revaluing its foreign currency earnings,

assets and liabilities into LSEG's reporting currency of

Sterling

The Euro weakened by 1% against Sterling compared with the same

period last year while the US $ strengthened by 2%. To illustrate

our exposure to movements in exchange rates, a EUR0.05 change in

the average euro:sterling rate would have resulted in a change to

continuing operations total income of cGBP8 million for Q1, while a

US$0.05 move would have resulted in a cGBP7 million change.

More detailed revenues by segment are provided in tables

below:

Information Services

Organic

and

Three months ended constant

31 March currency

---------------------

2020 2019 Variance variance(1)

GBPm GBPm % %

Revenue

Index - Subscription 105 99 6% 6%

Index - Asset based 58 52 12% 9%

FTSE Russell 163 151 8% 7%

---------------------------- ---------- --------- --------- ------------

Real time data 25 24 3% 4%

Other information services 27 26 2% 1%

Total revenue 215 201 7% 6%

---------------------------- ---------- --------- --------- ------------

Cost of sales (17) (17) - -

---------- ---------

Gross profit 198 184 7% 6%

---------------------------- ---------- --------- --------- ------------

(1) Removal of Beyond Ratings from Other information services

(acquired June 2019)

Note: UnaVista previously reported in Other information services

is now reported in Post Trade, historical comparators have been

adjusted to reflect this

Post Trade

Three months ended Constant

31 March currency

---------------------

2020 2019 Variance variance

GBPm GBPm % %

Revenue

OTC - SwapClear, Forex &

CDSClear 82 76 8% 9%

Non OTC - Fixed income,

Cash equities & Listed derivatives 41 34 21% 22%

Other 26 24 7% 7%

Total LCH revenue 149 134 11% 12%

------------------------------------- ---------- --------- --------- ---------

Clearing 12 11 15% 17%

Settlement, Custody & other 15 14 6% 7%

Total Post Trade Italy revenue 27 25 10% 12%

------------------------------------- ---------- --------- --------- ---------

UnaVista 16 13 22% 22%

Total revenue 192 172 12% 13%

------------------------------------- ---------- --------- --------- ---------

LCH - Net treasury income 67 48 39% 39%

CC&G - Net treasury income 12 11 10% 12%

Total income 271 231 17% 18%

------------------------------------- ---------- --------- --------- ---------

Cost of sales (39) (35) 14% 15%

---------- ---------

Gross profit 232 196 18% 19%

------------------------------------- ---------- --------- --------- ---------

Capital Markets

Three months ended Constant

31 March currency

---------------------

2020 2019 Variance variance

GBPm GBPm % %

Revenue

Primary Markets 32 28 13% 14%

Secondary Markets - Equities 49 37 33% 33%

Secondary Markets - Fixed

income, derivatives and

other 31 32 (3%) (2%)

Total revenue 112 97 15% 16%

------------------------------ ---------- --------- --------- ---------

Cost of sales (1) (1) - -

---------- ---------

Gross profit 111 96 16% 17%

------------------------------ ---------- --------- --------- ---------

Technology Services

Three months ended Constant

31 March currency

---------------------

2020 2019 Variance variance

GBPm GBPm % %

Total revenue 14 14 - -

--------------- ---------- --------- --------- ---------

Cost of sales (2) (2) - -

---------- --------- --------- ---------

Gross profit 12 12 - -

--------------- ---------- --------- --------- ---------

Basis of Preparation

Results for the period ended 31 March 2019 have been translated

into sterling using the average exchange rates for the period.

Constant currency growth rates have been calculated by translating

prior period results at the average exchange rate for the current

period.

Average rate Average rate

Closing rate Closing rate

3 months ended at 3 months ended at

31 March 2020 31 March 2020 31 March 2019 31 March 2019

GBP : EUR 1.16 1.12 1.15 1.16

GBP : USD 1.28 1.24 1.30 1.30

--------------- -------------- --------------- --------------

Appendix - Key performance indicators

Information Services

As at

31 March Variance

-----------------

2020 2019 %

ETF assets under management

benchmarked ($bn)

FTSE 359 398 (10%)

Russell Indexes 224 256 (13%)

----------------------------- ---------

Total 583 654 (11%)

----------------------------- ------- -------- ---------

Terminals

UK 64,000 67,000 (4%)

Borsa Italiana Professional

Terminals 98,000 105,000 (7%)

Note: FTSE ETF assets under management benchmarked KPI has been

rebased to remove previously reported active ETFs. The previous

year comparator has also been adjusted, with a change of $15

billion

Post Trade - LCH

Three months ended

31 March Variance

---------------------

2020 2019 %

LCH OTC derivatives

SwapClear

IRS notional cleared ($tn) 402 318 26%

SwapClear members 123 119 3%

Client trades ('000) 565 411 37%

CDSClear

Notional cleared (EURbn) 776 352 120%

CDSClear members 26 26 -

ForexClear

Notional value cleared

($bn) 5,405 4,311 25%

ForexClear members 34 34 -

LCH Non-OTC

Fixed income - Nominal

value (EURtn) 51.6 52.4 (2%)

Listed derivatives contracts

(m) 104.2 72.8 43%

Cash equities trades (m) 558 362 54%

LCH average cash collateral

(EURbn) 115.9 91.1 27%

Note: CDSClear notional cleared and LCH Non-OTC volumes have

been rebased to count both sides of each cleared trade. This aligns

with how activity is reported on LCH's website. The previous year

comparator has also been adjusted

Post Trade - Italy

Three months ended

31 March Variance

---------------------

2020 2019 %

CC&G Clearing

Contracts (m) 38.9 25.0 56%

Initial margin held (average

EURbn) 14.3 13.7 4%

Monte Titoli

Settlement instructions

(trades m) 13.8 10.7 29%

Custody assets under management

(average EURtn) 3.34 3.29 2%

Capital Markets - Primary

Markets

Three months ended

31 March Variance

---------------------

2020 2019 %

New Issues

UK Main Market, PSM &

SFM 12 10 20%

UK AIM 6 5 20%

Borsa Italiana 1 7 (86%)

----------

Total 19 22 (14%)

--------------------------- ---------- --------- ---------

Money Raised (GBPbn)

UK New 0.4 0.5 (20%)

UK Further 2.3 3.0 (23%)

Borsa Italiana new and

further - - -

Total (GBPbn) 2.7 3.5 (23%)

--------------------------- ---------- --------- ---------

Capital Markets - Secondary Markets

Three months ended

31 March Variance

---------------------

Equity 2020 2019 %

Totals for period

UK value traded (GBPbn) 390 294 33%

Borsa Italiana (no of

trades m) 27.3 15.6 75%

Turquoise value traded

(EURbn) 166 163 2%

SETS Yield (basis points) 0.68 0.68 -

Average daily

UK value traded (GBPbn) 6.1 4.7 30%

Borsa Italiana (no of

trades '000) 427 248 72%

Turquoise value traded

(EURbn) 2.6 2.6 -

Derivatives

Contracts (m) 9.2 9.1 1%

Fixed Income

MTS cash and BondVision

(EURbn) 786 836 (6%)

MTS money markets (EURbn

term adjusted) 30,829 28,809 7%

Note: The Q1 2019 number of derivative contracts includes 0.8

million from LSE Derivatives. This service no longer accepted new

trades from November 2019

Total Income - Quarterly

2019 2020

GBP millions Q1 Q2 Q3 Q4 2019 Q1

----- ----- ----- ----- ------ -----

Index - Subscription 99 104 108 107 418 105

Index - Asset based 52 60 61 58 231 58

FTSE Russell 151 164 169 165 649 163

Real time data 24 24 24 25 97 25

Other information 26 27 27 29 109 27

---------------------------------------

Information Services 201 215 220 219 855 215

OTC - SwapClear, ForexClear &

CDSClear 76 72 80 79 307 82

Non OTC - Fixed income, Cash equities

& Listed derivatives 34 35 36 35 140 41

Other 24 25 28 26 103 26

--------------------------------------- ----- ----- ----- ----- ------ -----

Post Trade Services - LCH 134 132 144 140 550 149

Clearing 11 11 11 10 43 12

Settlement, Custody & other 14 15 16 15 60 15

--------------------------------------- ----- ----- ----- ----- ------ -----

Post Trade Services - CC&G and

MT 25 26 27 25 103 27

UnaVista 13 12 10 12 47 16

------

Post Trade 172 170 181 177 700 192

Primary Markets 28 62 30 31 151 32

Secondary Markets - Equities 37 37 39 38 151 49

Secondary Markets - Fixed income,

derivatives & other 32 30 33 29 124 31

--------------------------------------- ----- ----- ----- ----- ------ -----

Capital Markets 97 129 102 98 426 112

Technology 14 16 16 20 66 14

Other 2 2 2 3 9 2

Total Revenue 486 532 521 517 2,056 535

Net treasury income through CCP:

LCH 48 48 53 57 206 67

CC&G 11 13 12 13 49 12

Other income 1 1 1 - 3 1

Total income 546 594 587 587 2,314 615

--------------------------------------- ----- ----- ----- ----- ------ -----

Cost of sales (56) (53) (58) (43) (210) (60)

Gross profit 490 541 529 544 2,104 555

--------------------------------------- ----- ----- ----- ----- ------ -----

Note: UnaVista previously reported in Other information services

is now reported in Post Trade, historical comparators have been

adjusted to reflect this

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPPUWCCUPUPGU

(END) Dow Jones Newswires

April 21, 2020 02:00 ET (06:00 GMT)

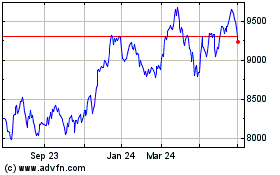

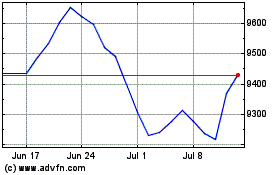

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024