JZ Capital Ptnrs Ltd Notice of EGM

May 29 2019 - 2:00AM

UK Regulatory

TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

Notice of Extraordinary General Meeting

and

Recommended Proposals in respect of:

Buy Back Authorities relating to a Tender Offer (or a series of Tender Offers)

and resultant Off-Market Acquisitions

and

The Company's proposed investments in Spruceview Capital Partners

29 May 2019

Unless otherwise defined herein, capitalised terms used in this document have

the meanings given to them in the circular published by the Company dated 29

May 2019 (the "Circular").

Notice of Extraordinary General Meeting

Notice is hereby given that the Extraordinary General Meeting ("EGM") of the

Company will be held at the offices of Northern Trust International Fund

Administration Services (Guernsey) Limited, Trafalgar Court, Les Banques, St

Peter Port, Guernsey GY1 3QL, Channel Islands at 1.15 p.m. on 27 June 2019 (or

as soon thereafter as the annual general meeting of the Company convened for

the same day and place has been concluded or adjourned).

The purpose of the EGM is to consider and, if thought fit, approve the

Company's proposed: (i) return of capital to Ordinary Shareholders by way of a

Tender Offer (or a series of Tender Offers) and resultant Off-Market

Acquisitions in respect of the Company's Ordinary Shares (the "Buy Back

Proposal"), and (ii) investments in Spruceview Capital Partners jointly with

David W. Zalaznick and John (Jay) W. Jordan II (together, the JZAI Founders who

are the founders and principals of Jordan/Zalaznick Advisers, Inc., the

Company's investment adviser) (or their respective affiliates) which would be

considered a Related Party Transaction of the Company under Chapter 11 of the

Listing Rules (with which the Company voluntarily complies and insofar as the

Listing Rules are applicable to the Company by virtue of its voluntary

compliance) ("Spruceview Capital Partners") (the "Spruceview Proposal" and

together with the Buy Back Proposal, the "Proposals") and as more fully

described below.

Buy Back Proposal

As announced by the Company on 8 May 2019, among other strategic initiatives,

the Company intends to return, by way of a Tender Offer (or a series of Tender

Offers), approximately US$100 million of capital to Ordinary Shareholders at a

maximum discount to net asset value of 5 per cent.

The Buy Back Authorities which the Company is requesting as part of the Buy

Back Proposal are intended to allow the Company to return capital to Ordinary

Shareholders by way of a Tender Offer (or a series of Tender Offers) and

resultant Off-Market Acquisitions in respect of the Company's Ordinary Shares.

The Tender Offers are intended to be generated from the proceeds of

realisations that are planned for this calendar year and the next. As announced

on 8 May, the Company also intends to use certain of the proceeds from such

realisations to reduce the Company's debt by approximately US$100 million

during the same period.

As the Tender Offers are intended to take place over the course of this

calendar year and the next, the Board may request further approvals from

Ordinary Shareholders for the same purpose in the future.

The Buy Back Authorities needed to effect Tender Offers are being sought in the

form of:

a. a general authority to make Market Acquisitions of Ordinary Shares by way

of a Tender Offer (or a series of Tender Offers) (being the Market

Acquisition Authority); and

b. an authority to make Off-Market Acquisitions of Ordinary Shares as a result

of any Market Acquisitions of Ordinary Shares made by way of any Tender

Offers (being the Off-Market Acquisition Authority),

in each case, as set out and described in further detail below.

Market Acquisition Authority

The Market Acquisition Authority will give the Company authority to make Market

Acquisitions of Ordinary Shares by way of a Tender Offer (or a series of Tender

Offers).

The maximum number of Ordinary Shares which may be purchased under the Market

Acquisition Authority is 12,091,959 Ordinary Shares representing approximately

14.99 per cent. of the Ordinary Shares in issue as at 28 May 2019.

The minimum and maximum prices that may be paid for each Ordinary Share

purchased pursuant to the Market Acquisition Authority will be 95 per cent. and

100 per cent. respectively of the Company's net asset value (before dividends)

per Ordinary Share by reference to the Company's most recently announced net

asset value announced via a Regulatory Information Service prior to the

announcement of any Tender Offer. Such minimum and maximum prices are to be

adjusted for any disposal or buy back of Shares to the extent not taken into

account in such most recently announced net asset value figure translated into

sterling by reference to the exchange rate quoted by Bloomberg as at market

close on the tender closing date in respect of any Tender Offer.

Off-Market Acquisition Authority

The Off-Market Acquisition Authority will give the Company authority to make

Off-Market Acquisitions of Ordinary Shares as a result of any Market

Acquisitions of Ordinary Shares made by way of any Tender Offers.

The Off-Market Acquisitions are to be made under the Off-Market Acquisition

Authority in pursuance of the terms of a contract included in the Company's

Articles of Incorporation and as prescribed by an arrangement included within

the Articles referred to as the CFC Buy Back Arrangement. The CFC Buy Back

Arrangement applies in circumstances where the Company makes acquisitions of

its Ordinary Shares pursuant to a Market Acquisition Authority including in the

case of a Tender Offer. Shareholders are reminded that the purpose of any

Off-Market Acquisitions and the CFC Buy Back Arrangement is to allow the

Company to make acquisitions of its Ordinary Shares in a way that reduces the

risk of the Company being or becoming a Controlled Foreign Corporation.

The price that each large US Ordinary Shareholder to whom the CFC Buy Back

Arrangement applies will be entitled to receive (and that will be paid by the

Company) for each Ordinary Share acquired by the Company under the CFC Buy Back

Arrangement is the CFC Buy Back Arrangement Price. The CFC Buy Back Arrangement

Price is the volume weighted average price payable per Ordinary Share agreed to

be purchased by the Company on the relevant trading day pursuant to a Market

Acquisition Authority. The CFC Buy Back Arrangement Price is therefore expected

to be the same as the price per Ordinary Share described above at which the

Company's Ordinary Shares are bought back pursuant to the Market Acquisition

Authority.

Further details of the CFC Buy Back Arrangement are included in the Circular of

the Company published in connection with the Proposals as well as a separate

circular published by the Company dated 20 April 2017.

Each of the Buy Back Authorities are proposed in addition to any subsisting

authorities of the Company to buy back the Company's Shares including any buy

back authorities that may be granted by Ordinary Shareholders at the Company's

forthcoming Annual General Meeting to be held on 27 June 2019. If granted by

Ordinary Shareholders, the Buy Back Authorities will expire at the conclusion

of any extraordinary general meeting of the Company to renew them or on 27

December 2020, whichever is the earlier.

The details of any Tender Offer, including the eligibility of those Ordinary

Shareholders entitled to participate, how certain Ordinary Shareholders may

participate and the Tender Offer terms and conditions, will be sent to

Shareholders by separate shareholder circular(s) at the time the Company

decides to undertake a Tender Offer under the Market Acquisition Authority if

granted by Ordinary Shareholders.

Spruceview Proposal

As mentioned above, the Company is also proposing to make further investments

jointly with the JZAI Founders (or their respective affiliates) in Spruceview

Capital Partners which includes its affiliated funds from time to time, and in

particular CERPI. The joint investment is intended to be used for both

Spruceview Capital Partners' general corporate purposes and investments in its

affiliated funds from time to time, and in particular CERPI. CERPI is an

investment fund established and managed by Spruceview Capital Partners for its

client, a Mexican retirement fund administrator.

Spruceview Capital Partners, a portfolio investment of the Company in which it

has made previous joint investments with the JZAI Founders (or their respective

affiliates), is an asset management business in the United States and aims to

address the demand from corporate pensions, endowments, family offices and

foundations for fiduciary management services through an Outsourced Chief

Investment Officer model as well as specific products per asset class.

Spruceview has developed significant client relationships by creating

particularised strategies and funds for its targeted client base, including in

Canada and Mexico. In 2018, Spruceview launched a US middle market private

equity fund-of-funds and continues to provide investment oversight to a

European private credit fund-of-funds and portfolios for family office clients.

Also in 2018, Spruceview expanded its mandate with an international packaged

foods company to provide investment oversight to the pension funds of its

Mexican subsidiary, in addition to those of its Canadian subsidiary, which

Spruceview has advised since 2016. As mentioned above, Spruceview Capital

Partners also established CERPI for its client, a Mexican retirement fund

administrator. As the general partner of CERPI, Spruceview Capital Partners was

required to make co-investments in CERPI. These investments were permitted to

be made by various affiliates of Spruceview Capital Partners, including the

Company and the JZAI Founders.

As also mentioned above, the Company has made previous joint investments in

Spruceview Capital Partners with the JZAI Founder (or their respective

affiliates), of US$30 million in total (with US$30 million also being

contributed by the JZAI Founders (or their respective affiliates)).

Shareholders should also note, in March 2019 the Company further increased its

investment together with the JZAI Founders (or their respective affiliates) in

Spruceview Capital Partners by an additional US$1.475 million from the Company

(with a further US$1.475 million to be contributed by the JZAI Founders (or

their respective affiliates)). This increase was considered by the Company not

to be a material change to the terms of the existing shareholder approval and,

therefore, Ordinary Shareholder approval was not obtained for such increase.

All of the Company's increased investment of US$1.475 million, has been used to

support Spruceview Capital Partner's share of the above mentioned co-investment

in CERPI.

The Company is now proposing to invest a further US$15 million (with a further

US$15 million to be contributed by the JZAI Founders (or their respective

affiliates)) in Spruceview Capital Partners which includes its affiliated funds

from time to time, and in particular CERPI. As with the previous joint

investments in Spruceview Capital Partners, the proposed joint investment will

be on the same terms and conditions as between the Company and the JZAI

Founders, being 50:50 economically, but with certain structural features

intended to afford each side appropriate US tax protections. The joint

investment is intended to be used for Spruceview Capital Partners' general

corporate purposes and investments in its affiliated funds from time to time,

and in particular to support Spruceview Capital Partners' share of any further

co-investment required in CERPI.

The Company's proposed investments in Spruceview Capital Partners, being a

material change to the terms of the existing shareholder approval, would be

considered a Related Party Transaction under Chapter 11 of the Listing Rules

(with which the Company voluntarily complies and insofar as the Listing Rules

are applicable to the Company by virtue of its voluntary compliance).

Jordan/Zalaznick Advisers, Inc. ("JZAI") is the Company's investment adviser

and, under the Listing Rules, would therefore be considered a Related Party of

the Company. As founders and principals of JZAI, the JZAI Founders are

associates of JZAI and would also be considered Related Parties of the Company.

In addition, each of the JZAI Founders are substantial shareholders of the

Company as they are each entitled to exercise or to control the exercise of 10

per cent. or more of the votes able to be casted at a general meeting of the

Company. As such, each of the JZAI Founders are considered to be Related

Parties of the Company on this basis as well. The Company's proposed

investments in Spruceview Capital Partners which involves the JZAI Founders as

Related Parties of the Company would be considered to be arrangements whereby

the Company and its Related Parties invest in or provide finance to another

undertaking or asset. Accordingly, the JZAI Founders as Related Parties and the

Spruceview Proposal as arrangements between them would be considered a Related

Party Transaction under Chapter 11 of the Listing Rules, insofar as the Listing

Rules are applicable to the Company by virtue of its voluntary compliance with

the same.

As such, the Spruceview Proposal, as a Related Party Transaction of the

Company, requires approval of Ordinary Shareholders for the Company to invest

together with the JZAI Founders in Spruceview Capital Partners.

Notice of EGM and Shareholder Circular

Further details of both Proposals are included in the Notice convening the EGM

and the Circular of the Company published in connection with the Proposals.

The Notice convening the EGM is being distributed to members of the Company and

will shortly be uploaded to the Company's website at www.jzcp.com. Copies of

the Circular the Company is posting to Shareholders are available for viewing,

during normal business hours, at the registered office of the Company at

Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL and will shortly

be available for viewing at www.morningstar.co.uk/uk/nsm. The notice convening

the EGM is also included within the Circular.

For further information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

May 29, 2019 02:00 ET (06:00 GMT)

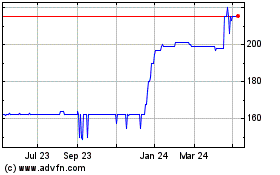

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

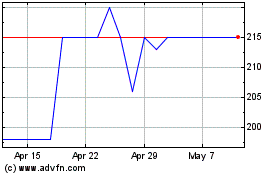

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jul 2023 to Jul 2024