Lloyd's Insurer Apollo Syndicate to Exit Adani's Carmichael Coal Mine

October 28 2020 - 12:42PM

Dow Jones News

By Dieter Holger

Apollo Syndicate Management Ltd., which is part of the Lloyd's

of London insurance market, doesn't plan to keep underwriting the

construction of Adani Mining Pty. Ltd.'s Carmichael coal mine in

Australia, joining other insurers that have backed away from one of

the world's biggest coal projects amid pressure from

environmentalists and dim long-term prospects for coal.

Julian Cusack, chair of the board of directors at Apollo

Syndicate, told nonprofit Market Forces that Apollo Syndicate was

underwriting "one construction liability policy" for Adani's mine

but that policy terminates September 2021 and the firm won't

provide anymore insurance, including for the project's port and

rail extension, according to emails reviewed by The Wall Street

Journal.

"We will not participate in any further insurance policies for

risks associated with this project," he said. Mr. Cusack confirmed

to the Journal that he wrote the email, but didn't provide

additional comment.

The Stop Adani environmentalist campaign said that Apollo

Syndicate is the 27th insurer and 17th Lloyd's of London insurer to

rule out the mine. Lloyd's of London, the world's oldest insurance

market, said in 2018 that it would divest from coal but doesn't

have a coal policy for underwriters like Apollo Syndicate that are

part of its market. Lloyd's of London didn't immediately respond to

a request for comment.

Many big European insurers, including Swiss Re AG and Zurich

Insurance Group AG, have said they would stop backing coal

projects.

Indian conglomerate Adani didn't immediately respond to a

request for comment.

Adani's Carmichael coal mine under construction in Queensland,

Australia, has drawn fire from environmentalists after authorities

greenlighted the project last year. As of early 2020, the mine has

already drawn more than $1 billion in contracts and will produce

some 10 million metric tons of coal a year when finished, according

to Adani's website.

"The Carmichael mine, through mining taxes and royalties, will

generate billions of dollars for government in its first 30 years

of operation. This money will help to build new schools, hospitals

and roads for Queensland," according to Adani's website.

Pablo Brait, the campaigner at Market Forces who exchanged

emails with Apollo Syndicate's Mr. Cusack, said he hopes more

insurers will follow and that Adani needs to explain to investors,

bankers and contractors how it plans to insure the mine in the

future.

"With the mainstream insurers and now the Lloyd's market turning

their backs, how will it deal with the significant risks that

running a massive coal mine, rail line and port entail," he

said.

Write to Dieter Holger at dieter.holger@wsj.com;

@dieterholger

(END) Dow Jones Newswires

October 28, 2020 12:27 ET (16:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

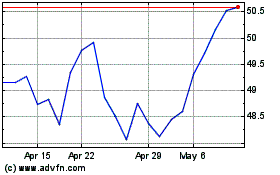

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Oct 2024 to Nov 2024

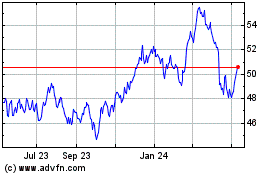

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Nov 2023 to Nov 2024