Zurich Insurance, Generali Both Post Losses But Investors React Differently

May 12 2016 - 9:20AM

Dow Jones News

By John Letzing and Giovanni Legorano

Two of Europe's biggest insurers posted sharp declines in

first-quarter profit on Thursday. But while investors looked beyond

Zurich Insurance Group AG's shortfall, they punished Italy's

Assicurazioni Generali SpA.

One reason for the reaction was that Mario Greco, Zurich

Insurance's new chief executive as of March--and, until recently,

the head at Generali--was able to point to a recent improvement at

the embattled Swiss company's largest business, and ongoing

cost-cutting efforts, while signaling plans for a significant brand

revamp.

Generali however issued a report that highlighted difficulties

many insurers have encountered, as they scramble for investment

returns in a world of low and negative interest rates.

Zurich Insurance said its first-quarter net profit fell 28%

compared with the same period last year, to $875 million. Analysts

had expected a profit of $728 million.

The company's biggest unit, general insurance, reported a

decline in gross written premiums compared with last year's period.

But profitability at the unit improved significantly in the

quarter, compared with its overall result for 2015. The overall

return on the insurer's investments also ticked up slightly.

Shares of Zurich Insurance rose more than 6%.

Daniel Bischof, an analyst at Helvea Baader Bank, said the

results show Zurich Insurance "heading in the right direction."

While the benefits of cost-cutting efforts aren't yet clear, the

analyst said, indications are that "they're working hard on that."

The company has flagged plans to cut up to 8,000 jobs by the end of

2018.

Generali, which bid farewell to Mr. Greco in January, reported

that its first-quarter profit fell 14% compared with the same

period last year, to EUR588 million ($671.6 million). The insurer

cited the impact of ultralow interest rates on its investments, and

said it is under pressure to find new ways to cut costs.

"We are carrying out a thorough analysis to understand where we

can generate additional profitability," said Generali Chief

Financial Officer Alberto Minali.

Shares of Generali fell by about 3%.

The insurance industry has been mired in a difficult period, due

in part to the low, and sometimes negative, interest rates that

have dogged insurers' ability to turn the premiums that they earn

into profitable investments.

Generali, which was presenting its first results under Chief

Executive Philippe Donnet, who took over in March, is betting on a

big commercial push in Europe, Asia and Latin America to improve

its cash flow. In the first quarter, Generali's life-insurance

business posted an 8.1% decline in operating income to EUR756

million. The company's property and casualty business reported that

operating income was virtually flat, at EUR498 million.

Generali, which does much of its business in the eurozone, where

central bank policy makers have implemented negative interest

rates, said it has tried to favor a portfolio of policies that are

less sensitive to low rates, and which absorb less capital at its

life insurance business.

Investment returns at the company's life business declined 18%

compared with the same period last year, Generali said, while

returns at the property and casualty unit were down 14%. The

Italian insurer said it couldn't repeat the gains made in the

quarter last year, which had been particularly strong.

Zurich Insurance, which is based in a country that also has

negative interest rate policies but operates around the globe, said

it managed to improve its total return on investments to 2.7% in

the quarter, from 2.6% in the same period last year.

The Swiss company's mainstay business of general insurance

reported a combined ratio for the first quarter of 97.7%--an

improvement over the 103.6% reported for all of 2015. The combined

ratio is a measure of how much is paid on claims and costs for each

dollar earned, and a ratio of less than 100% means that an

underwriting business is profitable.

Troubles at the general insurance business have undercut the

firm's financial results in recent quarters, and hampered its

ability to pursue a takeover last year of U.K.-based RSA Insurance

Group PLC. That acquisition bid was called off last September.

Zurich Insurance said on Tuesday that improvement at the general

insurance business should continue. "We expect performance to

strengthen further as the year progresses," said Chief Financial

Officer George Quinn.

Write to John Letzing at john.letzing@wsj.com and Giovanni

Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

May 12, 2016 09:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

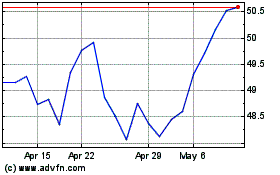

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Oct 2024 to Nov 2024

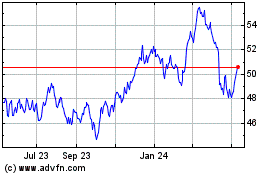

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Nov 2023 to Nov 2024