Tesco to Buy Food Wholesaler Booker for $4.7 Billion -- 2nd Update

January 27 2017 - 7:18AM

Dow Jones News

By Ian Walker

LONDON-- Tesco PLC's Friday agreement to buy Booker Group PLC

for GBP3.7 billion ($4.66 billion) combines the U.K.'s largest

retailer with its largest food wholesaler, in a surprise deal that

the supermarket chain expects to bring major cost savings.

Tesco shares were up 8.5% on the news in morning trading in

London, while Booker gained 16%.

Tesco billed the acquisition--its largest ever in the U.K.--as

catapulting it from the country's biggest supermarket chain to its

biggest food business, giving the grocer access to the market for

eating out, worth an estimated GBP85 billion a year.

The supermarket chain will gain access to Booker's more than one

million customers--which it serves through delivery and

cash-and-carry--including restaurants, pubs, movie theaters and

convenience stores. It said British consumers would see more fresh

food available at more outlets while its customers would have

access to 8,000 more locations to pick up their click-and-collect

orders.

The deal is Tesco's first acquisition under Chief Executive Dave

Lewis, a former Unilever PLC executive who took the helm in 2014 as

Tesco was struggling through an accounting scandal and losing

market share to newly aggressive discounters Aldi and Lidl.

Mr. Lewis has since been focused on turning around Tesco's U.K.

performance by cutting prices, adjusting its range and improving

customer service. Far from being in acquisition mode, Tesco

retrenched from a variety of businesses and big markets as it

worked to improve its performance at home. The supermarket chain

sold garden-center chain Dobbies, coffee chain Harris + Hoole and

Giraffe restaurants, among other noncore businesses, and sold its

Turkey and South Korea units.

Friday's deal--along with the announcement that Tesco will

restart paying dividends in fiscal 2018, after suspending them for

the past two years--was seen by some analysts as a sign that the

once-troubled grocer has turned a corner. But others noted that

stiff pricing competition and sluggish revenue growth had

translated into an urgent need for retailers to cut costs,

motivating Tesco's acquisition of Booker.

"We read this as a clearly a defensive move in an increasingly

tough U.K. trading environment," said Société Générale analyst

Arnaud Joly.

The deal wasn't without controversy. Mr. Lewis admitted that the

abrupt resignation of its senior independent director, Richard

Cousins, earlier this month was motivated by Mr. Cousins's

reservations about the acquisition.

Tesco and Booker first began talking about working together a

year ago, according to Mr. Lewis, who knew Booker CEO Charles

Wilson from his time at Unilever. The companies eventually decided

that a Tesco acquisition of Booker was the best way to tap growth

opportunities. Mr. Wilson will join Tesco's board and executive

committee once the deal closes.

The acquisition will need approval from the U.K. Competition and

Markets Authority, which likely will require some convenience-store

closures. The companies have an estimated 10% share of the U.K.

convenience market. Shore Capital analyst Clive Black said the

regulator could make closing the deal difficult.

Booker shareholders will get 0.861 new Tesco shares and 42.6

pence in cash for each share held, giving them about a 16% share of

the combined company. Tesco said the cash-and-share deal would

deliver at least GBP175 million of cost savings, partly through

procurement and distribution. Revenue synergies will be at least

GBP25 million a year.

Ian Walker contributed to this article.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

January 27, 2017 07:03 ET (12:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

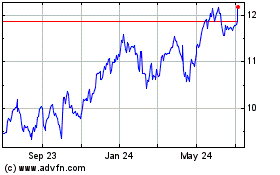

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From May 2024 to Jun 2024

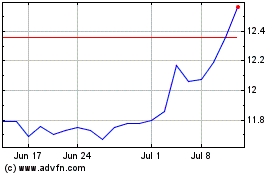

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Jun 2023 to Jun 2024