U.

S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

|

[

X]

|

|

QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

|

|

|

|

For

the quarterly period ended December 31, 2009

|

|

|

|

|

|

[ ]

|

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from ___________ to _____________

MEXUS

GOLD US

|

Nevada

|

|

000-52413

|

|

20-4092640

|

|

(State

or other jurisdiction

|

|

(Commission

File Number)

|

|

(IRS

Employer

|

|

of

Incorporation)

|

|

|

|

Identification

Number)

|

|

|

|

1805

N. Carson Street, #150

|

|

|

|

|

|

Carson

City, NV 89701

|

|

|

|

|

|

(Address

of principal executive offices)

|

|

|

|

|

|

|

|

|

|

|

|

(916)

776 2166

|

|

|

|

|

|

(Issuer’s

Telephone Number)

|

|

|

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past

12 months (or for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes

X

No

___

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange

Act.

|

Large

accelerated filer [ ]

|

|

Accelerated

filer [ ]

|

|

Non-accelerated

filer [ ]

(Do

not check if smaller reporting company)

|

|

Smaller

reporting company [

X

]

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Check

whether the registrant filed all documents and reports required to be filed by

Section 12, 13, or 15(d) of the Exchange Act of 1934 after the distribution of

securities under a plan confirmed by a court.

APPLICABLE

ONLY TO CORPORATE ISSUERS

State the

number of shares outstanding of each of the issuer’s classes of common equity,

as of the latest practicable date: As of December 31,

2009, there were 122,541,333 shares of our common stock were issued

and outstanding.

PART

I

ITEM 1.

FINANCIAL

STATEMENTS

|

MEXUS

GOLD US

|

|

|

|

|

|

|

Page

|

|

|

|

|

Condensed

Balance Sheets at December 31, 2009 (unaudited) and March 31,

2009

|

F-2

|

|

|

|

|

Condensed

and Unaudited Statements of Operations for the nine months ended December

31, 2009 and 2008 and the three months ended December 31, 2009 and

2008

|

F-3

|

|

|

|

|

Condensed

and Unaudited Statement of Changes in Shareholders' Deficit for the nine

months ended December 31, 2009

|

F-4

|

|

|

|

|

Condensed

and Unaudited Statements of Cash Flows for the nine months ended

December 31, 2009 and 2008

|

F-5

|

|

|

|

|

Notes

to Financial Statements

|

F-6

|

|

|

|

|

F-1

|

|

|

MEXUS GOLD US

|

|

|

|

|

|

CONDENSED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31,

|

|

March

31,

|

|

|

|

|

|

2009

|

|

2009

|

|

|

|

|

|

(Unaudited)

|

|

(Derived

from

|

|

|

|

|

|

|

|

Audited

|

|

|

|

|

|

|

|

Statements)

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

assets:

|

|

|

|

|

|

|

Cash

|

$

|

10,685

|

$

|

3,478

|

|

|

Due

from related party (Note 3)

|

|

0

|

|

4,347

|

|

|

Inventory

|

|

0

|

|

10,230

|

|

|

|

Total

current assets

|

|

10,685

|

|

18,055

|

|

|

|

|

|

|

|

|

|

Fixed

assets:

|

|

|

|

|

|

|

Property

and equipment, net of depreciation

|

|

49,570

|

|

0

|

|

|

|

Total

fixed assets

|

|

49,570

|

|

0

|

|

|

|

|

|

|

|

|

|

Other

assets:

|

|

|

|

|

|

|

Idle

Equipment (Note 6)

|

|

64,237

|

|

0

|

|

|

Deferred

Costs

|

|

81,000

|

|

0

|

|

|

|

|

|

145,237

|

|

0

|

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

$

|

205,492

|

$

|

18,055

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

liabilities:

|

|

|

|

|

|

|

Accounts

payable

|

$

|

961

|

$

|

750

|

|

|

Accounts

payable to related party (Note 3)

|

|

9,600

|

|

8,400

|

|

|

Sales

tax payable

|

|

318

|

|

288

|

|

|

Loans

payable to related party (Note 3)

|

|

6,149

|

|

38,462

|

|

|

Note

payable

|

|

17,500

|

|

475,000

|

|

|

Capitalized

lease-current portion

|

|

24,225

|

|

0

|

|

|

Deferred

Gain on equipment sale

|

|

44,640

|

|

0

|

|

|

|

Total

current liabilities

|

|

103,392

|

|

522,900

|

|

|

|

|

|

|

|

|

|

Longterm

liabilities:

|

|

|

|

|

|

|

Capitalized

lease obligations- longterm

|

|

25,775

|

|

0

|

|

|

|

|

|

25,775

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES

|

$

|

129,168

|

|

522,900

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS'

DEFICIT (Note 4)

|

|

|

|

|

|

|

Preferred

stock, 10,000,000 shares authorized, no par value,

|

|

|

|

|

|

|

|

-0-

shares issued and outstanding

|

|

—

|

|

—

|

|

|

Common

stock, 500,000,000 shares authorized, no par value,

|

|

|

|

|

|

|

|

136,505,000

shares issued and outstanding as at March 31, 2009

|

|

|

|

|

|

|

|

122,541,333

shares issued and outstanding as at December 31, 2009

(Unaudited)

|

|

|

Additonal

Paid In Capital

|

|

557,355

|

|

0

|

|

|

Retained

deficit

|

|

(603,572)

|

|

(512,280)

|

|

|

|

|

|

|

|

|

|

TOTAL

STOCKHOLDERS' DEFICIT

|

|

76,324

|

|

(504,845)

|

|

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$

|

205,492

|

$

|

18,055

|

|

|

|

|

|

|

|

|

|

See notes to the accompanying condensed, unaudited

financial statements

|

|

|

|

|

|

F-2

|

|

|

|

|

|

|

|

MEXUS GOLD US

|

|

|

|

|

|

|

|

|

|

CONDENSED AND UNAUDITED STATEMENTS OF

OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine

Months ended

December 31

|

|

Three

Months ended

December 31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

Sales

|

$

|

10,043

|

$

|

17,698

|

$

|

0

|

$

|

6,210

|

|

Total

revenues

|

|

10,043

|

|

17,698

|

|

0

|

|

6,210

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

Cost

of Goods Sold

|

|

18,199

|

|

11,929

|

|

8,493

|

|

4,060

|

|

|

General

and administrative

|

|

84,387

|

|

17,372

|

|

75,748

|

|

8,485

|

|

|

Compensation

expense (Notes 3 and 4)

|

|

109

|

|

18

|

|

0

|

|

6

|

|

Total

operating expenses

|

|

102,695

|

|

29,319

|

|

84,241

|

|

12,551

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

from operations

|

|

(92,652)

|

|

(11,621)

|

|

(84,241)

|

|

(6,341)

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain

on Sale of Equipment

|

|

1,360

|

|

0

|

|

1,360

|

|

0

|

|

|

|

|

1,360

|

|

0

|

|

1,360

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision

for Income Taxes (Note 5)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

LOSS

|

$

|

(91,292)

|

$

|

(11,621)

|

$

|

(82,881)

|

$

|

(6,341)

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

loss per common share

|

$

|

(0.00)

|

$

|

(0.00)

|

$

|

(0.00)

|

$

|

(0.00)

|

|

Diluted

loss per common share

|

$

|

(0.00)

|

$

|

(0.00)

|

$

|

(0.00)

|

$

|

(0.00)

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average common shares outstanding - Basic

|

80,991,778

|

|

136,494,000

|

|

Weighted

average common shares outstanding - Diluted

|

80,991,778

|

|

136,494,000

|

|

|

|

|

|

|

|

|

|

|

|

|

See notes to the accompanying condensed, unaudited

financial statements

F-3

|

|

MEXUS GOLD US

|

|

|

|

|

|

|

|

|

|

STATEMENT OF CHANGES IN STOCKHOLDERS' DEFICIT

UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

Common

Stock

|

|

Additonal

|

Retained

|

Stockholders'

|

|

|

Shares

|

|

Amount

|

Paid

In Capital

|

Deficit

|

|

Deficit

|

|

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Balance

at March 31, 2009

|

136,505,000

|

$

|

7,435

|

$

|

|

(512,280)

|

$

|

(504,845)

|

|

|

|

|

|

|

|

|

|

|

|

Shares

issued for convertible note

|

42,500,000

|

|

42,500

|

|

42,500

|

|

|

85,000

|

|

|

|

|

|

|

|

|

|

|

|

Shares

canceled due to forgiven note

|

(129,025,000)

|

|

|

|

411,102

|

|

|

411,102

|

|

|

|

|

|

|

|

|

|

|

|

Shares

issued for services

|

109,000

|

|

109

|

|

|

|

|

109

|

|

|

|

|

|

|

|

|

|

|

|

Shares

issued for equipment purchase

|

40,000,000

|

|

40,000

|

|

|

|

|

40,000

|

|

|

|

|

|

|

|

|

|

|

|

Shares

issued for S-8 consulting

|

11,000,000

|

|

11,000

|

|

|

|

|

11,000

|

|

|

|

|

|

|

|

|

|

|

|

Shares

issued for cash

|

1,202,333

|

|

1,247

|

|

103,753

|

|

|

105,000

|

|

|

|

|

|

|

|

|

|

|

|

Shares

issued for options

|

20,250,000

|

|

20,250

|

|

|

|

|

20,250

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss for the nine months ended

|

|

|

|

|

|

|

|

December

31, 2009 (unaudited)

|

|

|

|

|

|

(91,292)

|

|

(91,292)

|

|

|

|

|

|

|

|

|

|

|

|

Balance

at December 31, 2009 (unaudited)

|

122,541,333

|

$

|

122,541

|

$

|

557,355

|

(603,572)

|

$

|

76,324

|

|

|

|

|

|

|

|

|

|

|

|

See notes to the accompanying condensed, unaudited

financial statements

|

|

F-4

|

|

|

|

|

|

|

|

|

|

MEXUS GOLD US

|

|

|

|

|

|

CONDENSED AND UNAUDITED STATEMENTS OF CASH

FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months

Ended

December 31

|

|

|

|

|

2009

|

|

2008

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

Net

loss

|

$

|

(91,292)

|

$

|

(11,621)

|

|

|

Adjustments

to reconcile net income to net cash

|

|

|

|

|

|

|

provided

by (used in) operating activities:

|

|

|

|

|

|

|

Depreciation

and amortization

|

|

1,790

|

|

0

|

|

|

Stock

based compensation

|

|

11,109

|

|

18

|

|

|

Payments

through the issuance of company stock:

|

|

|

|

|

|

Equipment

|

|

40,000

|

|

0

|

|

|

Option

to aquire Mexus Gold Ming S.A. de C.V.

|

|

|

|

|

|

|

and

mining leasehold properties

|

|

20,250

|

|

0

|

|

|

Gain

on sale of equipment

|

|

(46,000)

|

|

0

|

|

|

Changes

in operating assets and liabilities:

|

|

|

|

|

|

|

Equipment

|

|

0

|

|

(1,645)

|

|

|

Accounts

Receivable

|

|

(5,792)

|

|

0

|

|

|

Inventory

|

|

10,230

|

|

165

|

|

|

Accounts

payable and accrued expenses

|

|

8,649

|

|

2,034

|

|

|

|

|

|

|

|

|

NET

CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES

|

|

(51,056)

|

|

(11,049)

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

Equipment

purchases

|

|

(50,000)

|

|

(1,645)

|

|

|

Equipment

fabrication

|

|

(68,237)

|

|

0

|

|

|

Increase

in deferred costs

|

|

(81,000)

|

|

0

|

|

|

|

|

|

|

|

|

NET

CASH USED IN INVESTING ACTIVITIES

|

|

(199,237)

|

|

(1,645)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

Proceeds

from loan payable to officer

|

|

0

|

|

12,128

|

|

|

Proceeds

from loan payable

|

|

102,500

|

|

0

|

|

|

Proceeds

from issuance of common shares for cash

|

105,000

|

|

0

|

|

|

Proceeds

from sale and leaseback of equipment

|

|

50,000

|

|

0

|

|

|

|

|

|

|

|

|

NET

CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES

|

257,500

|

|

12,128

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

CHANGE IN CASH

|

|

7,207

|

|

(566)

|

|

|

|

|

|

|

|

|

CASH

BALANCES

|

|

|

|

|

|

|

Beginning

of period

|

|

3,478

|

|

2,327

|

|

|

End

of period

|

$

|

10,685

|

$

|

1,761

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION:

|

|

|

|

CASH

PAID DURING THE PERIOD FOR:

|

|

|

|

|

|

|

Interest

|

$

|

213

|

$

|

-

|

|

|

Income

taxes

|

$

|

-

|

$

|

-

|

|

|

|

|

|

|

|

|

See notes to the accompanying condensed, unaudited

financial statements

|

|

|

|

|

|

F-5

|

|

|

|

|

|

MEXUS

GOLD US

Notes

to Financial Statements

NOTE

1. BASIS

OF PRESENTATION

The

accompanying interim financial statements of Mexus Gold US (the “Company”) have

been prepared pursuant to the rules of the Securities and Exchange Commission

(the "SEC") for quarterly reports on Form 10-Q and do not include all of the

information and note disclosures required by generally accepted accounting

principles. These financial statements and notes herein are unaudited, but in

the opinion of management, include all the adjustments (consisting only of

normal recurring adjustments) necessary for a fair presentation of the Company’s

financial position, results of operations, and cash flows for the periods

presented. These financial statements should be read in conjunction with the

Company's audited financial statements and notes thereto included in the

Company’s Form 10-K for the period ended March 31, 2009 as filed with the SEC.

Interim operating results are not necessarily indicative of operating results

for any future interim period or for the full year.

NOTE

2. GOING

CONCERN

The

accompanying financial statements have been prepared on a going concern basis,

which contemplates the realization of assets and the satisfaction of liabilities

in the normal course of business. As shown in the accompanying

financial statements, the Company has a limited operating history and limited

funds. These factors, among others, may indicate that the Company

will be unable to continue as a going concern.

The

Company is dependent upon outside financing to continue operations. The

financial statements do not include any adjustments that might result from the

outcome of this uncertainty. It is management’s plans to raise

necessary funds via a private placement of its common stock to satisfy the

capital requirements of the Company’s business plan. There is no

assurance that the Company will be able to raise necessary funds, or that if it

is successful in raising the necessary funds, that the Company will successfully

operate its business plan.

The

financial statements do not include any adjustments relating to the

recoverability and classification of assets and/or liabilities that might be

necessary should the Company be unable to continue as a going concern. Our

continuation as a going concern is dependent upon our ability to meet our

obligations on a timely basis, and, ultimately to attain

profitability.

|

NOTE

3.

|

RELATED

PARTY TRANSACTIONS

|

On

September 4, 2009, the Company entered into a six month Rental Agreement with

Mexus Gold International, Inc., a Nevada corporation, to lease a Komatsu P38D

Dozer and a PC440 core drill at a rate of $3,850 per month, payable in advance

by the 5

th

day

of each month. Payment can be made in cash or in restricted shares of

common stock of the Company valued at $.08 per share. Mr. Paul D.

Thompson, our sole officer and director, owns a majority interest in Mexus Gold

International, Inc.

On

December 21, 2009, the Company issued 40 million restricted shares of its common

stock to Mexus Gold International, Inc. as payment for the following pieces of

mining equipment:

|

Equipment

|

|

Serial

Number

|

|

#

Shares

|

|

|

|

|

|

|

|

Komatsu

Dozer Drill

|

|

2NKCLL9X7FM327785

|

|

4,000,000

|

|

Cone

|

|

CONEP282S11709

|

|

22,000,000

|

|

Jaw

Crusher

|

|

JAW

P12X361209

|

|

8,000,000

|

|

Serge

Tank

|

|

PSTF96144

|

|

3,000,000

|

|

Hydraulic

Drum

|

|

HYDS12YD

|

|

3,000,000

|

The

equipment was valued at $40,000.00, or par value of $0.001 per

share.

Loans

Payable to Related Party

On March

31, 2008, the Company made a two year zero interest promissory note payable to

Phillip E. Koehnke, APC, our majority shareholder, in the amount of

$17,687.70.

On

September 2, 2009, Phillip E. Koehnke agreed to forgive all but $17,685.70 of

notes due to him and cancel 129,025,000 shares of common stock held by him in

exchange for a payment of $85,000. The forgiveness of the debt

resulted in a $411,102 gain, which has been recorded as additional paid-in

capital because the transaction occurred with a related party.

Effective

September 30, 2009, the Company entered into an asset purchase agreement with

Phillip E. Koehnke, whereby the Company sold its retail sports apparel sales

assets, as presented on its balance sheet for the period ended September 30,

2009, in exchange for cancelation of the $17,687.70 two year promissory note

held by Mr. Koehnke.

On August

21, 2009, the Company made a one year zero interest convertible promissory note

payable to Taurus Gold, Inc. in the amount of $85,000. The note was

convertible into restricted shares of the Company’s common stock at any time up

to the maturity date at a conversion rate of $.002 (see Note 4).

On

September 30, 2009, the Company made a two year zero interest promissory note

payable to Phillip E. Koehnke, APC, our former majority shareholder in the

amount $6,038. This is the only remaining note balance to this related party

since the Asset Purchase Agreement was executed.

On

October 15, 2009 the company made a Demand Note Agreement with Paul Thompson Sr.

in the amount of $10,000.00 with an interest rate of 8%.

Issuances

of Securities

On or

about September 30, 2009 the Company issued 109,000 restricted shares of its

common stock to Susie Johnson, the Company’s President, as payment for

services.

On

October 20, 2009, the Company entered into a 180 day option agreement with Mexus

Gold Mining, S.A. de C.V. pursuant to which the Company acquired the right to

acquire 99% of the capital stock of Mexus Gold Mining, S.A. The

option price was 20 million restricted shares of the Company’s common stock and

the exercise price is 20 million restricted shares of the Company’s common

stock.

Accounts

Payable

The

Company had a payable balance due to G.K.’s Gym, Inc., a related party owned by

the parents of Phillip E. Koehnke, as of December 31, 2009. At December

31, 2009, the Company owed $9,600 to G.K.’s Gym, Inc. for rent.

Equipment

Lease

On

December 9, 2009 the Company entered into a 24 month lease agreement with

Francis and Alice Stadelman, Trustees of the Stadelman Revocable Living Trust,

for equipment. The equipment is one Komatsu Dozer Driller with serial

number 2NKCLL9X7FM327785.

Future

minimum lease payments required under the arrangement are as

follows:

|

|

|

Amount

|

|

|

|

|

|

For

the year ended March 31, 2010, minimum lease payments:

|

$

|

0

|

|

|

|

|

|

For

the year ended March 31, 2011, minimum lease payments:

|

$

|

37,500

|

|

|

|

|

|

For

the year ended March 31, 2012 minimum lease payments:

|

|

12,500

|

|

|

|

|

|

Total

future minimum lease payments:

|

$

|

50,000

|

|

|

|

|

Legal

Services

|

|

Legal

counsel to the Company is a firm controlled by our former majority

shareholder.

|

|

NOTE

4.

|

STOCKHOLDERS’

DEFICIT

|

The

stockholders’ equity section of the Company contains the following classes of

capital stock as of December 31, 2009:

Preferred

stock, no par value; 10,000,000 shares authorized, zero (0) shares issued and

outstanding.

Common

stock, no par value; 500,000,000 shares authorized: 122,541,333 shares issued

and outstanding.

Common

Stock Transactions

On or

about September 30, 2009 the Company issued 109,000 restricted shares of its

common stock to Susie Johnson, the Company’s President, as payment for services

rendered during the three months ended September 30, 2009. The

transaction was recorded at par value, or $109.

On

October 16, 2009, the Company acquired an eight (8) month option, with a six (6)

month extension, to purchase certain patented and unpatented mining claims

situated in Esmeralda County, Nevada, United States. The option price

was 250,000 restricted shares of the Company’s common stock. The

exercise price of the option is five million dollars ($5,000,000) payable in

installments of both cash and restricted shares of the Company’s common

stock

On

October 20, 2009, the Company entered into a 180 day option agreement with Mexus

Gold Mining, S.A. de C.V. pursuant to which the Company acquired the right to

acquire 99% of the capital stock of Mexus Gold Mining, S.A. The

option price was 20 million restricted shares of the Company’s common stock and

the exercise price is 20 million restricted shares of the Company’s common

stock. The agreement is conditioned upon Mexus Gold Mining, S.A. de

C.V. obtaining an audit of its financial records by public accountants

acceptable to the standards required for financial reporting purposes in the

United States of America. On February 11, 2010, the Company issued 20

million restricted shares of the Company’s common stock as the exercise price of

the option.

On

November 11, 2009, the Company issued 416,667 restricted shares of common stock

to an accredited investor for $25,000.00, or $ 0.06 per share.

On

December 9, 2009 the company issued shares in exchange for cash in the amount of

833,333 shares for $50,000.00, or $0.06 per share.

On

December 14, 2009 the company issued 11,000,000 shares of S8 stock for

consulting with a value of $.001 per share.

On

December 21, 2009, the Company issued 375,000 restricted shares of common stock

to an accredited investor for $30,000.00, or $0.08 per share.

The

issuance of securities described above were deemed to be exempt from

registration under the Securities Act in reliance on Section 4(2) of the

Securities Act of 1933 and Regulation D as transactions by an issuer not

involving any public offering. The recipients of securities in each

such transaction represented their intention to acquire the securities for

investment only and not with a view to or for sale in connection with any

distribution thereof, and appropriate legends were affixed to the share

certificates and other instruments issued in such transactions. The sales of

these securities were made without general solicitation or

advertising.

The

Company intends to use the proceeds from sale of the securities for the purchase

of equipment for mining operations, mining machinery, supplies and payroll for

operations, professional fees, and working capital.

There

were no underwritten offerings employed in connection with any of the

transactions set forth above.

Preferred

Stock Transactions

None

The

Company records its income taxes in accordance with SFAS No. 109, “Accounting

for Income Taxes”. The Company incurred net operating losses during

all periods presented through December 31, 2009 resulting in a

deferred tax asset, which was fully allowed for; therefore, the net benefit and

expense resulted in $-0- income taxes.

|

|

The

following mining equipment is currently being fabricated and modified by

the Company and is not presently in

use.

|

|

|

Cone

1709

|

|

|

Crusher

|

|

|

Hopper

|

|

|

Hydraulic

Drum 12YD

|

|

|

Jaw

Crusher 1209

|

|

|

Serge

Tank 6144

|

On

October 1, 2009, the Company changed its name to Mexus Gold US, re-domiciled to

the State of Nevada and changed the par value of its common stock to

$0.001.

Effective

September 30, 2009, the Company discontinued its retail sports apparel sales

business and began its mining operations as follows:

On

October 16, 2009, the Company acquired an eight (8) month option, with a six (6)

month extension, to purchase certain patented and unpatented mining claims

situated in Esmeralda County, Nevada, United States. The option price

was 250,000 restricted shares of the Company’s common stock. The

exercise price of the option is five million dollars ($5,000,000) payable in

installments of both cash and restricted shares of the Company’s common

stock.

On

October 20, 2009, the Company entered into a 180 day option agreement with Mexus

Gold Mining, S.A. de C.V. pursuant to which the Company acquired the right to

acquire 99% of the capital stock of Mexus Gold Mining, S.A. The

option price is 20 million restricted shares of the Company’s common stock and

the exercise price is 20 million restricted shares of the Company’s common

stock. The agreement is conditioned upon Mexus Gold Mining, S.A. de

C.V. obtaining an audit of its financial records by public accountants

acceptable to the standards required for financial reporting purposes in the

United States of America. The term of the option may be extended by

the Company for such reasonable time as is required by Mexus Gold Mining, S.A.

de C.V. to complete its audit.

Mexus

Gold Mining, S.A. de C.V. represents that it owns or has claim to certain lands

which are either patented land ownership or concession agreements in the State

of Sonora, Mexico. In addition, Mexus Gold Mining, S.A. de C.V. owns

equipment suitable for exploring for precious mineral deposits or extracting and

processing mineral ores for the purpose of sale of such refined product, and has

agreed to maintain the equipment in good working order and free of any lien,

assessment or claim of indebtedness of any kind or nature.

F-6

ITEM

2. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION OR

PLAN OF OPERATIONS

The

following discussion and analysis should be read in conjunction with our

unaudited consolidated financial statements and related notes included in this

report. The statements contained in this report that are not historic in nature,

particularly those that utilize terminology such as “may,” “will,” “should,”

“expects,” “anticipates,” “estimates,” “believes,” or “plans” or comparable

terminology are forward-looking statements based on current expectations and

assumptions.

Various

risks and uncertainties could cause actual results to differ materially from

those expressed in forward-looking statements.

The

forward-looking events discussed in this report, the documents to which we refer

you and other statements made from time to time by us or our representatives,

may not occur, and actual events and results may differ materially and are

subject to risks, uncertainties and assumptions about us. For these statements,

we claim the protection of the “bespeaks caution” doctrine. All forward-looking

statements in this document are based on information currently available to us

as of the date of this report, and we assume no obligation to update any

forward-looking statements. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause the actual results to

differ materially from any future results, performance or achievements expressed

or implied by such forward-looking statements.

The

Company

Mexus Gold US is a development stage

mining company engaged in the evaluation, acquisition, exploration and

advancement of gold, silver and copper projects in the State of Sonora, Mexico

and the Western United States. Mexus Gold US is dedicated to protect

the environment, provide employment and education opportunities for the

communities that it operates in.

Our President and CEO, Paul Thompson,

brings over 40 years experience in mining and mining development to Mexus Gold

US. Mr. Thompson is currently recruiting additional management personnel for its

Mexico, Nevada, and submarine Cable Recovery operations to assist in growing the

company.

Our

executive offices are located at, 1805 N. Carson Street, #150, Carson City,

Nevada 89701. Our telephone number is (916) 776 2166

.

We were

originally incorporated under the laws of the State of Colorado on June 22,

1990, as U.S.A. Connection, Inc. On October 28, 2005, we changed our

name to Action Fashions, Ltd. On October 28, 2009, we changed our

domicile to Nevada and changed our name to Mexus Gold US to better reflect our

new business operations. Our fiscal year end is March 31

st

.

Business

Strategy

The

Company has the following mining operations:

On

September 4, 2009, the Company entered into a six month Rental Agreement with

Mexus Gold International, Inc., a Nevada corporation, to lease a Komatsu P38D

Doyer and a PC440 core drill at a rate of $3,850 per month, payable in advance

by the 5

th

day

of each month. Payment can be made in cash or in restricted shares of

common stock of the Company valued at $.08 per share.

On

September 21, 2009, the Company acquired an eight (8) month option, with a six

(6) month extension, to purchase certain patented and unpatented mining claims

situated in Esmeralda County, Nevada, United States. The option price

was 250,000 restricted shares of the Company’s common stock. The

exercise price of the option is five million dollars ($5,000,000) payable in

installments of both cash and restricted shares of the Company’s common

stock.

On

October 20, 2009, the Company entered into a 180 day option agreement with Mexus

Gold Mining, S.A. de C.V. pursuant to which the Company acquired the right to

acquire 99% of the capital stock of Mexus Gold Mining, S.A. The

option price is 20 million restricted shares of the Company’s common stock and

the exercise price is 20 million restricted shares of the Company’s common

stock. The agreement was conditioned upon Mexus Gold Mining, S.A. de

C.V. obtaining an audit of its financial records by public accountants

acceptable to the standards required for financial reporting purposes in the

United States of America. On February 1, 2010, Mexus Gold

Mining, S.A. de C.V. reported that it had obtained the audit of its financial

records and on February 11, 2010, the Company issued 20 million restricted

shares of the Company’s common stock as the exercise price of the

option.

Mexus

Gold Mining, S.A. de C.V. represents that it owns or has claim to certain lands

which are either patented land ownership or concession agreements in the State

of Sonora, Mexico. In addition, Mexus Gold Mining, S.A. de C.V. owns

equipment suitable for exploring for precious mineral deposits or extracting and

processing mineral ores for the purpose of sale of such refined product, and has

agreed to maintain the equipment in good working order and free of any lien,

assessment or claim of indebtedness of any kind or nature.

The current projects of the Company are

summarized as follows:

Ocho

Hermanos

The main feature is a sulfide zone

composed primarily of galena with some pyrite and arsenopyrite. Above this zone

there is an oxide zone composed of iron and lead oxides. Recent grab samples

taken indicate that values over 5,000 grams per ton of silver were encountered.

These samples may not reflect the average grade. However, grab sample results

indicate silver values over 3,000 grams per ton appear to be not unusual. Gold

in the samples ranged from 1 gram per ton to over 5 grams per ton.

370 Area

This zone is composed of a sedimentary

sequence (limestone, quartzite, shale) intruded by dacite and diorite as well as

rhyolite. The docite exhibits argillic alterations as well as silicification

(quartz veins). The entire area is well oxidized on the surface. This is an area

of classic disseminated low grade gold and silver mineralization. Surface grab

sample assays show 0.14 grams per ton to as high as 29.490 grams per ton gold.

This area is an important area for potentially defining an open pit heap leach

project.

El Scorpion Project

Area

This area has several shear zones and

veins which show copper and gold mineralization’s. Recent assays of a 84’ drill

hole shows 2,887 grams per ton to 1,139 grams per ton of copper and 3.971 grams

per ton to 0.072 grams per ton of gold. Another assay of rock sample from the

area shows greater than 10,000 grams per ton copper. This land form distribution

appears to be snonymous to the ideal porphyry deposit at Baja La Alumbrera,

Argentina.

Los

Laureles

Los Laureles is a vein type deposit

mainly gold with some silver and copper. Recent assays from grab samples show

gold values of 67.730 grams per ton gold, 38.4 grams per ton silver, 2,800 grams

per ton copper.

Nevada

Property

Mexus Gold US controls Nevada Pacific

Rim’s silver and gold property. The Pacific Rim property is located

in Esmeralda County, Nevada

.

C

onsisting of approximately 150 acres of patented mining claims with

water rights and 22 unpatented lode claims and two mill site claims. Management

believes this is a strong exploration target. To date, 51 holes have been

drilled on the patented lands. However, Mexus has not verified the

authenticity of any of these representations at this time.

Cable

Salvage

Mexus Gold US Cable Salvage. Operations

are expected to be concentrated from San Diego, CA to Alaska. It’s reported, but

not yet verified by Mexus to date, to contain in excess of 400,000,000 pounds of

salvageable copper.

Results

of Operations

For the nine months ended December 31,

2009, we had revenues of $10,043 compared to $17,698 for the nine months ended

December 31, 2008. For the three months ended December 31,

2009, we had revenues of zero ($0) compared to revenues of $6,210 for the three

months ended December 31, 2008. The $10,043 in revenues for the nine

months ended December 31, 2009, is related to our prior business of retail

apparel sales. We did not have any revenues for the three months

ended December 31, 2009. Our decrease in revenues for the three

months ended December 31, 2009, is due to the cessation of our retail apparel

business and the beginning of our mining operations.

For the three months ended December 31,

2009, we had total operating expenses of $84,241 and an operating loss of

($84,241) compared to total operating expenses of $12,551 and a loss from

operations of ($6,341) for the three months ended December 31,

2008. Our loss from operations increased greatly for this quarter due

to the costs general and administrative expenses associated with our new mining

business. We anticipate this loss from operations will continue until

such time as we start to receive revenues from mining operations.

Because

we have discontinued our retail apparel sales, and we have not received revenues

from mining operations, we have reported zero ($0) revenues for the for the

three months ended December 31, 2009. We do not expect to have any

revenues until we begin mining operations which we anticipate will begin within

the next nine months.

We

believe that we have sufficient available cash and available loans from our sole

officer and director to satisfy our working capital and capital expenditure

requirements during the next 12 months. There can be no assurance,

however, that cash and cash from loans will be sufficient to satisfy our working

capital and capital requirements for the next 12 months or beyond.

Liquidity

and Capital Resources

At December 31, 2009, we had cash of

$10,685 compared to $3,478 at March 31, 2009.

As of

December 31, 2009, our inventory decreased to $0 as a result of discontinuing

our apparel sales operations.

Our fixed

assets increased from zero ($0) from the previous quarter to $49,570 due to our

acquisition of mining equipment for the period ended December 31,

2009.

Our other

assets increased from zero ($0) from the previous quarter to $145,237 due to our

acquisition of mining properties.

Our

current liabilities decreased significantly from $522,900 as of March 31, 2009,

to $103,392, at December 31, 2009, due to forgiveness of debt by a related

party.

Future

Goals

During

this quarter, we have met our goals and acquired mining properties and minting

equipment. We are currently in the process of transporting equipment

and setting up mining operations in Mexico. We have also begun the

process of obtaining the necessary permits to begin our cable salvage

operations. In the next 12 months, our goal is to begin mining

operations in Mexico and to obtain the necessary permits to begin our cable

salvage operations. We intend to initially focus our mining efforts

in the State of Sonora Mexico.

Off-balance

Sheet Arrangements

We maintain no significant off-balance

sheet arrangements

Foreign

Currency Transactions

None.

Number

of total employees and number of full time employees.

We currently have six (6) full time

employees. We expect to increase the number of employees as we ramp

up our mining operations within the next 12 months. Mr. Paul D.

Thompson is our sole officer and director.

ITEM

3. QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We currently do not utilize sensitive

instruments subject market risk in our operations.

ITEM

4. CONTROLS

AND PROCEDURES

As required by Rule 13a-15 under the

Securities Exchange Act of 1934 (“Exchange Act”) we carried out an evaluation of

the effectiveness of the design and operation of our disclosure controls and

procedures as of September 30, 2008, being the date of our most recently

completed fiscal quarter. This evaluation was carried out under the supervision

and with the participation of our Chief Executive Officer/Chief Financial

Officer. Based upon that evaluation, our sole officer has concluded that our

disclosure controls and procedures were effective to ensure that information

required to be disclosed in our Exchange Act reports is recorded, processed,

summarized, and reported within the time periods specified in the Securities and

Exchange Commission’s rules and forms, and that such information is accumulated

and communicated to them to allow timely decisions regarding required

disclosure. There were not any changes in our internal control over financial

reporting during our most recent fiscal quarter that have materially affected,

or is reasonably likely to materially affect, our internal control over

financial reporting.

PART

II – OTHER INFORMATION

ITEM 1.

LEGAL PROCEEDINGS

None.

ITEM 2.

UNREGISTERED SALES OF EQUITY

SECURITIES AND USE OF PROCEEDS

On October 16, 2009, the Company issued

250,000 restricted shares of common stock as the purchase price of an eight (8)

month option, with a six (6) month extension, to purchase certain patented and

unpatented mining claims situated in Esmeralda County, Nevada, United

States.

On October 20, 2009, the Company

entered into a 180 day option agreement with Mexus Gold Mining, S.A. de C.V.

pursuant to which the Company acquired the right to acquire 99% of the capital

stock of Mexus Gold Mining, S.A. The Company issued 20 million

restricted shares as the purchase price of the option.

On November 11, 2009, the Company

issued 416,667 restricted shares of common stock to an accredited investor in

exchange for cash.

On December 9, 2009 the Company issued

833,333 restricted shares of common stock to an accredited investor in exchange

for cash.

On December 21, 2009, the Company

issued 40 million restricted shares of its common stock to Mexus Gold

International, Inc. as payment for the following pieces of mining

equipment:

|

Equipment

|

|

Serial

Number

|

|

#

Shares

|

|

|

|

|

|

|

|

Komatsu

Dozer Drill

|

|

2NKCLL9X7FM327785

|

|

4,000,000

|

|

Cone

|

|

CONEP282S11709

|

|

22,000,000

|

|

Jaw

Crusher

|

|

JAW

P12X361209

|

|

8,000,000

|

|

Serge

Tank

|

|

PSTF96144

|

|

3,000,000

|

|

Hydraulic

Drum

|

|

HYDS12YD

|

|

3,000,000

|

On December 23, 2009, the Company

issued 375,000 restricted shares of common stock to an accredited investor in

exchange for cash.

The issuance of securities described

above were deemed to be exempt from registration under the Securities Act in

reliance on Section 4(2) of the Securities Act of 1933 and Regulation D as

transactions by an issuer not involving any public offering. The

recipients of securities in each such transaction represented their intention to

acquire the securities for investment only and not with a view to or for sale in

connection with any distribution thereof, and appropriate legends were affixed

to the share certificates and other instruments issued in such transactions. The

sales of these securities were made without general solicitation or

advertising.

The Company intends to use the proceeds

from sale of the securities for the purchase of equipment for mining operations,

mining machinery, supplies and payroll for operations, professional fees, and

working capital.

There were no underwritten offerings

employed in connection with any of the transactions set forth

above.

ITEM 3.

DEFAULT UPON SENIOR

SECURITIES

None.

ITEM 4.

SUBMISSION OF MATTERS TO A VOTE OF

SECURITY HOLDERS

None.

ITEM 5.

OTHER INFORMATION

None.

ITEM

6. EXHIBITS

|

Exhibit

#

|

|

Description

|

|

|

|

|

|

3.1

|

|

Articles

of Incorporation filed with the Secretary of State of Colorado on June 22,

1990 (Filed as an exhibit to our registration statement on Form 10-SB

filed on January 24, 2007).

|

|

|

|

|

|

3.2

|

|

Articles

of Amendment to the Articles of Incorporation filed with the Secretary of

State of Colorado on October 17, 2006 (Filed as an exhibit to our

registration statement on Form 10-SB filed on January 24,

2007).

|

|

|

|

|

|

3.3

|

|

Articles

of Amendment to Articles of Incorporation filed with the Secretary of

State of the State of Colorado on January 25, 2007 (Filed as an exhibit to

our annual report on Form 10-KSB filed on June 29,

2007).

|

|

|

|

|

|

3.3

|

|

Amended

and Restated Bylaws dated December 30, 2005 (Filed as an exhibit to our

registration statement on Form 10-SB filed on January 24,

2007).

|

|

|

|

|

|

4.1

|

|

June

1, 2005, Promissory Note in the amount of $19,000 made by the Company to

G.K.’s Gym, Inc. as payment for assets (Filed as an exhibit to our

registration statement on Form 10-SB filed on January 24,

2007).

|

|

|

|

|

|

4.2

|

|

December

6, 2003, Convertible Promissory Note in the amount of $480,000 made by the

Company to Phillip E. Koehnke as payment under the terms of Mr. Koehnke’s

employment agreement with the Company (Filed as an exhibit to our

registration statement on Form 10-SB filed on January 24,

2007).

|

|

|

|

|

|

10.1

|

|

Employment

agreement dated December 6, 2003, between the Company and Phillip E.

Koehnke (Filed as an exhibit to our registration statement on Form 10-SB

filed on January 24, 2007).

|

|

|

|

|

|

10.2

|

|

June

1, 2005, Asset Purchase Agreement by and between the Company and G.K.’s

Gymnastics, Inc. (Filed as an exhibit to our registration statement on

Form 10-SB filed on January 24, 2007).

|

|

|

|

|

|

10.3

|

|

September

21, 2009, option agreement by and between the Company and Nevada Pacific

Rim (Filed as an exhibit to our quarterly report filed on form 10-Q A-1

filed on January 12, 2010).

|

|

|

|

|

|

10.4

|

|

October

20, 2009, option agreement by and between the Company and Mexus Gold

Mining S.A. de C.V. (Filed as an exhibit to our quarterly report filed on

form 10-Q A-1 filed on January 12, 2010).

|

|

|

|

|

|

14.1

|

|

Code

of Ethics (Filed as an exhibit to our annual report on Form 10-KSB filed

on June 29, 2007).

|

|

|

|

|

|

31.1

|

|

Certification pursuant

to Rule 13a-14(a) (Attached hereto).

|

|

|

|

|

|

32.1

|

|

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of

the Sarbanes-Oxley Act of 2002 (Attached

hereto).

|

|

Signatures

|

|

|

|

In

accordance with the requirements of the Exchange Act, the registrant

caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

March 19, 2010

|

|

/s/ Paul D. Thompson

|

|

Paul

D. Thompson

|

|

Chief

Executive Officer

Chief

Financial Officer

Principal

Accounting Officer

Director

|

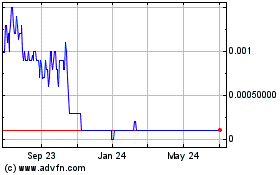

Mexus Gold US (CE) (USOTC:MXSG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mexus Gold US (CE) (USOTC:MXSG)

Historical Stock Chart

From Nov 2023 to Nov 2024