U.

S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K (A-1)

(Mark

One)

|

[

X

]

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended

March 31,

2009

|

[ ]

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ___________ to _____________

Commission

File Number:

000-52413

ACTION

FASHIONS, LTD.

(Name of

small business issuer as specified in its charter)

|

Nevada

|

20-4092640

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

1805

N. Carson Street, #150, Carson City, NV 89701

________________________________________________________________________

(Address

of principal executive offices, including zip

code)

|

Registrant’s

telephone number, including area

code:

(

858)

229-8116

Securities

registered pursuant to Section 12(b) of the

Act:

None

Securities

registered pursuant to Section 12(g) of the

Act:

common stock, no par

value

___________________

Indicate

by check mark whether the registrant is a well-known seasoned issuer, as defined

in Rule 405 of the Securities Act Yes [ ] No[

X

]

Indicate

by check mark whether the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes [ ] No [

X]

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past

12 months (or for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes [

X

] No

[ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment of this Form 10-K. Yes [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange

Act.

|

Large

accelerated filer [ ]

|

|

Accelerated

filer [ ]

|

|

Non-accelerated

filer [ ] (Do not check if smaller

reporting company)

|

|

Smaller

reporting company [

X

]

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

[ ] No [

X

]

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates on September 30, 2008, based upon the $0.00 per shares closing

price for our common stock on the OTC Bulletin Board was $0.00.

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate

by check mark whether the registrant filed all documents and reports required to

be filed by Section 12, 13, or 15(d) of the Exchange Act of 1934 after the

distribution of securities under a plan confirmed by a court. Yes

[ ] No [ ]

(APPLICABLE

ONLY TO CORPORATE REGISTRANTS)

Indicate

the number of shares outstanding of each of the issuer’s classes of common

stock, as of the latest practicable date: As of March 31,

2009, There were 136,505,000 shares of our common stock were issued

and outstanding.

DOCUMENTS

INCORPORATE BY REFERENCE

List

hereunder the following documents if incorporated by reference and the Part of

the Form 10-K (e.g., Part I, Part II, etc.) into which the document is

incorporated: (1) Any annual report to security holders; (2) Any proxy or

information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or

(c) under the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g., annual report to securities

holders for fiscal year ended December 24, 1980).

PART

I

Item

1. Business

Cautionary

Statement Concerning Forward-Looking Statements

The

following discussion and analysis should be read in conjunction with our audited

consolidated financial statements and related notes included in this

report. This report contains “forward-looking statements.” The

statements contained in this report that are not historic in nature,

particularly those that utilize terminology such as “may,” “will,” “should,”

“expects,” “anticipates,” “estimates,” “believes,” or “plans” or comparable

terminology are forward-looking statements based on current expectations and

assumptions.

Various

risks and uncertainties could cause actual results to differ materially from

those expressed in forward-looking statements. Factors that could

cause actual results to differ from expectations include, but are not limited

to, those set forth under the section “Risk Factors” set forth in this

report.

The

forward-looking events discussed in this report, the documents to which we refer

you and other statements made from time to time by us or our representatives,

may not occur, and actual events and results may differ materially and are

subject to risks, uncertainties and assumptions about us. For these

statements, we claim the protection of the “bespeaks caution”

doctrine. All forward-looking statements in this document are based

on information currently available to us as of the date of this report, and we

assume no obligation to update any forward-looking

statements. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause the actual results to

differ materially from any future results, performance or achievements expressed

or implied by such forward-looking statements.

The

Company

Action

Fashions, Ltd. is in the business of retail sports apparel sales. Our executive

offices are located at, P.O. Box 235472, Encinitas, California,

92024. Our telephone number is (858) 229-8116. Our retail

location is located at 2026 Lowe Street, Fort Collins, CO 80525.

We were

originally incorporated under the laws of the State of Colorado on June 22,

1990, as U.S.A. Connection, Inc. On June 1, 2005, we entered into an

arms length asset purchase agreement with G.K. Gymnastics, Inc. to purchase the

retail inventory of G.K. Gymnastics, Inc. for a total purchase price of $19,000

which was wholesale value of the goods purchased. The $19,000

purchase price was paid for with a five year, zero interest, $19,000 promissory

note. October 28, 2005, we filed Articles of Amendment with the

Colorado Secretary of State changing our name to Action Fashions, Ltd. to better

reflect our business operations. Our fiscal year end is March 31

st

.

The

Business

We are an

apparel company specializing in the retail sales of exercise, gymnastics, and

dance apparel including clothing, outfits, shoes and related

accessories. Our sole retail outlet is presently located within the

facilities of G.K. Gymnastics, Inc., a dance and gymnastics school/studio

located in Fort Collins, Colorado. By embedding our retail facility internally

at the school/studio we have been able to market to a captive audience of dance

and gymnastics students with minimal outside competition. Our goal is to expand

our retail outlet from the current location to multiple dance and gymnastics

schools throughout the country beginning with the State of

Colorado. Our auditors have expressed concern about our ability to

continue as a going concern.

Merchandise/Product

We focus on dance and gymnastics

clothing and accessories. These items are distinguished from normal women’s

apparel in that dance and gymnastics apparel must be comfortable and provide

freedom of movement. Dancers and gymnasts need clothes made from fabrics that

breathe, are quick drying and transport moisture away from the skin, to keep

them dry and comfortable during intense workouts and performances.

We currently maintain distribution,

consignment or similar wholesale supply relationships with the following

manufacturers of dance and gymnastics apparel. These relationships

allow us to buy products at wholesale, team and quantity discount

prices.

|

§

|

Capezio (Ballet Makers, Inc.)

-

Ballet Makers Incorporated is one of the leading manufactures of

clothing for the performer in dance, theater and recreation. For over 100

years, they have been committed to providing exceptional service to

customers with innovative, quality products and services, while

continuously advancing market research and technologies

(Source:

www.Capeziodance.com

).

|

|

§

|

Elite Sportswear GK

-

Elite Sportswear GK is a well recognized manufacturer of gymnastics

apparel around the world. Elite Sportswear is recognized around the globe

for superior quality, styling, and fit, and friendly, knowledgeable

customer service. With the release of ten catalogs a year and Custom

Design Services, Elite Sportswear offers more Workout and Team apparel

choices than anyone else. Since 2000, Elite Sportswear in affiliation with

Addidas America has been manufacturing the United States National, World,

and Olympic Team Apparel

(Source: www.gk-elitesportswear.com).

|

|

§

|

Tighe Industries

- Tighe

designs, manufactures, and markets garments designed for dance recitals,

gymnastics schools, cheerleaders, and drill teams. Tighe Industries,

located in York, Pennsylvania, is a company with a global focus. With

sales representatives in Japan, the United Kingdom, Ireland, Iceland and

Germany, Tighe has become a world leader in producing dance costumes and

gymnastics apparel. Olympic teams from around the world continue to

compete in garments designed and produced by Tighe associates. Specialized

lines like Curtain Call Spirit have made tremendous inroads into the world

of professional sports, outfitting cheerleading squads for teams like the

NBA’s Dallas Mavericks and Cleveland Cavaliers and the NFL’s Philadelphia

Eagles and Buffalo Bills. Tighe Industries has also provided the costumes

for the extravagant Orange and Sugar Bowl halftime shows

(Source: www.tighe.com).

|

|

§

|

Gibson, Inc.

- For over 30 years Gibson has provided Gymnastics,

Fitness, Dance and Stretch Apparel to individuals and public and private

institutions concerned about quality when purchasing athletic equipment

and supplies. Gibson is one of the largest manufacturers of innovative

dance and stretch clothing in the United States and a leading provider of

AAI American competitive gymnastics equipment. Gibson markets products to

Schools, Universities, private gym clubs, dance studios, Parks and

Recreation departments, YMCAs and individuals. Gibson manufactures and

sources equipment from around the world and throughout the U. S. in order

to provide customers with the best equipment and supplies available

(Source:

www.gibsongymnastics.com

).

|

|

§

|

Foxy’s Fitness Fashions

– Foxy's Fitness Fashions is a manufacturer and retailer of gymnastic

apparel which has been in the business for almost two decades. The company

specializes in design, specialty fabrics, quality and

fit. The company’s leotards are made in the USA and are

sized true to actual clothing sizes which makes for a better

fit. The company offers six different sizes for children and

five different sizes for adults. Foxy’s Fitness Fashions offers

a consignment program to us and other retailers (Source:

www.foxysfitnessfashions.com

).

|

We purchase our entire inventory from

the above suppliers and manufacturers. We do not own or operate any

manufacturing facilities. We believe that we have established

sufficient relationships with these suppliers and manufactures to meet our

ongoing and future inventory needs. We do not have long-term

contracts with the suppliers and manufactures and we transact business

principally on account on an order-by-order basis.

Business

Strategy

Our retail location is presently

located within the 30,000 square foot building of the G.K. Gymnastics, Inc.

dance and gymnastics school/studio in Fort Collins, Colorado. The G.K.

Gymnastics, Inc. facility has over 700 students, not including their other

family members. These students and their families serve as our

customer base.

Our retail location is situated near

the main entrance of the G. K. Gymnastics, Inc. facility and has its own

separate entrance. By embedding the retail facility internally at the

school/studio we are able to market to a captive audience of dance and

gymnastics students with minimal outside competition. We have found that the

relationship between our retail store and the school/studio has both increased

store sales and satisfied a consumer need for the studio/school and its

members. In addition, we believe that our relationship with the

school/studio gives us an advantage over our competitors because most sales

outlets for dance and gymnastics apparel exist in larger sporting goods stores,

department stores and a limited number of specialty athletic clothing stores. By

focusing our sales inside the school/studio we can target our market when the

customer enters and exits the school/facility and we believe we will be able to

compete more efficiently with larger retail competitors. By placing our store

front locations in areas of high target customer traffic with highly visible

product placement and creative store displays, we hope to attract an increased

customer sales base. Our staff are typically experienced dance and

gymnastics instructors that are usually familiar with the customer and

understand the customer’s needs.

We conduct limited marketing and

advertising utilizing the local Yellow Pages, various mailings and

fliers. We primarily rely upon our individual store displays,

embedded location and word-of-mouth to attract customers. Our product lines are

supported by visual merchandising, which consists of window displays, table

layouts and various promotions. This type of marketing is an important component

of our marketing and promotion strategies since our embedded location provides

significant target customer foot traffic.

We have

found that many schools and studios throughout the country already maintain

in-store retail sales departments. However, these “stores” are

usually poorly run, unorganized and not properly inventoried. Our

goal is to offer school/studio owners a profit center without the headache and

hassle of merchandizing, inventorying and returning products.

In addition to our existing location in

Fort Collins, Colorado, within the next 12 months, we plan to expand our

business into 2 to 4 new locations in existing gymnastics and dance schools and

studios in the state of Colorado.

Our goal

is to offer other gymnastic and dance schools a “pre-packaged” retail store

whereby we will design and construct small retail outlets within the

school/studio, supply the inventory on an ongoing basis and train the

school/studio’s existing staff to sell the products. We will split

the profits from the sales with the school/studios on a negotiated basis

pursuant to contractual agreements. The pre-packaged program that

will allow the studios and schools to offer their captive customers dance and

gymnastics apparel from within their existing facility without the cost and

burden of establishing the store, seeking vendors and/or purchasing large

amounts of inventory. We estimate the cost for each location to be

approximately $25,000 - $40,000 depending on the location, and plan on raising

the funds by a private placement of our securities.

Competitive

Business Conditions

The retail gymnastics and dance apparel

industry is competitive and highly fragmented with no standout industry leaders.

This type of apparel is usually sold though sporting goods stores, department

stores and a limited number of specialty athletic clothing stores. We believe

our target customers choose to purchase apparel based on the following factors:

style and fashion, fit and comfort, customer service, shopping convenience and

environment and value and we believe that we have advantages over our

competitors in meeting these needs. Specifically, by locating our store within

dance and gymnastics studios, we are able to make the sale immediately before or

after the customer participates in the activity in which the apparel is

used.

We experience the normal seasonal

pattern of the retail apparel industry with our peak sales occurring during the

Christmas, back-to-school and spring periods. In addition, we also experience

additional sales and interest increases in cyclical periods surrounding the

Summer Olympics. To keep merchandise fresh and fashionable, slow-moving

merchandise is marked down throughout the year.

Distribution

Methods of the Products

We currently market our products to a

limited captive market based on our current location. Products are sold on site

with little distribution and shipping costs. We project revenue increase from

future expansion by adding additional retail outlets in various target market

areas throughout the country. There is no assurance of the revenue

increase from future expansion or that expansion will occur at all.

General

Market

The gymnastics and dance markets

continue to grow each year in the United States. According to the website (

www.usa-gymnastics.org

)

of USA Gymnastics, the sole national governing body for the sport of artistic

and rhythmic gymnastics in the United States, USA Gymnastics currently maintains

a grass roots membership base of approximately 3,000,000 recreational gymnasts,

85,000 competitive gymnasts, 15,000 professional members and 4,000 gymnastic

clubs in throughout the United States. General public interest for

gymnastics has continued to maintain record highs over the last few years and

Gymnastics continues to be the most popularly viewed Olympic sport. Over 40

million households tuned into USA gymnastics telecasts on NBC Sports during the

2000 Olympic season. (Source:

www.usa-gymnastics.org

).

Dance studios and schools as well continue to maintain a significant presence.

The US Census Bureau’s 2002 Economic Census reported approximately 6,504 dance

schools in the United States.

Our

founder and majority shareholder, Phillip E. Koehnke holds 98% of the

outstanding shares and exercises control of the company.

Our founder and majority shareholder,

Phillip E. Koehnke, holds 98% of the outstanding shares and exercises control of

the company. Accordingly, our other shareholders will have little or

no control of the company.

Dependence

on One or a Few Major Customers

We are highly dependent on our customer

base derived from the location of our facility. By its nature, our competitive

advantage of our internal store location places us at the mercy of the

studios/schools where our facility is or will be located. In the

event the studio/school ceases operations or loses its facility, we may lose a

key retailer and major customer supplier.

Patents,

trademarks, licenses, franchises, concessions, royalty agreements or labor

contracts, including duration;

We do not have any designs which are

copyrighted, trademarked or patented.

Effect

of existing or probable governmental regulations on the business

The effects of existing or probable

government regulations on our business are minimal.

Research

and Development

We do not foresee any immediate future

research and development costs.

Costs

and effects of compliance with environmental laws

The expense of complying with

environmental regulations is of minimal consequence.

Number

of total employees and number of full time employees.

We have two part-time staff

workers. We do not have any full time employees and do not expect to

hire any new employees within the next 12 months. Ms. Susie Johnson is our sole

officer and director.

Item

1A. Risk Factors

An investment in our common stock

involves a high degree of risk. You should carefully consider the

following risk factors and the other information in this registration statement

before investing in our common stock. Our business and results of

operations could be seriously harmed by any of the following risks.

We

have a limited operating history and may not succeed.

We have a

limited operating history and may not succeed. Our plans and

businesses are “proposed” and “intended” but we may not be able to successfully

implement them. Our primary business purpose is the expansion of our

retail sports apparel sales business. We expect that unanticipated expenses,

problems, and technical difficulties will occur and that they will result in

material delays in the operation of our business. We may not obtain

sufficient capital or achieve a significant level of operations and, even if we

do, we may not be able to conduct such operations on a profitable

basis.

Our

majority shareholder, Phillip E. Koehnke, holds 98% of the outstanding shares

and exercises control of the company.

Our majority shareholder, Phillip E.

Koehnke, holds 98% of the outstanding shares and exercises control of the

company. Accordingly, our other shareholders will have little or no

control of the company.

We

may have insufficient funds to implement our expansion strategy.

Our expansion strategy will require

additional capital for, among other purposes, opening new and relocated stores,

renovating existing stores and entering new markets, including researching

existing and new real estate and consumer markets, lease costs, inventory,

property and equipment, integration of new stores and markets into company-wide

systems and programs and other costs associated with new store, renovated and

relocated store and market entry expenses and growth. If cash generated

internally is insufficient to fund capital requirements, or if funds are not

available, we will require additional debt or equity financing. Adequate

financing may not be available or, if available, may not be available on terms

satisfactory to us. If we fail to obtain sufficient additional capital in the

future, we could be forced to curtail our expansion, renovation and relocation

strategies by reducing or delaying capital expenditures relating to new stores,

renovated and relocated stores and new market entry, selling assets or

restructuring or refinancing our indebtedness. As a result, there can be no

assurance that we will be able to fund our current plans for the opening of new

stores, the expansion, renovation and relocation of existing stores or entry

into new markets

.

Customer

tastes and fashion trends are volatile and may prove difficult to respond

to.

Our success depends in part on our

ability to effectively predict and respond to changing fashion tastes and

consumer demands, and to translate market trends into appropriate, saleable

product offerings far in advance. If we are unable to successfully predict or

respond to changing styles or trends and misjudge the market for our products or

any new product lines, our sales will be lower and we may be faced with a

substantial amount of unsold inventory or missed opportunities. In response, we

may be forced to rely on additional markdowns or promotional sales to dispose of

excess, slow-moving inventory, which may have a material adverse effect on our

business, financial condition and results of operations.

Existing

and increased competition in the specialty retail apparel business may reduce

our net revenues, profits and market share.

The specialty retail apparel business

is highly competitive. Our retail segment competes against a wide variety of

small, independent specialty stores as well as department stores, national

specialty chains and catalog and Internet-based retailers. In addition, some of

our suppliers offer products directly to consumers. Many of our competitors are

considerably larger and have substantially greater financial, marketing and

other resources than we have. We cannot assure you that we will continue to be

able to compete successfully against existing or future competitors. Our

expansion into markets served by our competitors and entry of new competitors or

expansion of existing competitors into our markets could have a material adverse

effect on our business, financial condition and results of

operations.

A

downturn in the economy may affect consumer purchases of discretionary items and

could harm our operating results.

In general, our sales represent

discretionary spending by our customers. Discretionary spending on our products

is affected by many factors, including, among others:

|

§

|

general

business conditions;

|

|

§

|

the

availability of consumer credit;

|

|

§

|

the

number of new and second home

purchases;

|

|

§

|

unemployment

trends; and

|

|

§

|

other

matters that influence consumer confidence and

spending.

|

Purchases of discretionary items,

including the products we sell, could decline during periods when disposable

income is lower or during periods of actual or perceived unfavorable economic

conditions. If this occurs, our operating results could suffer.

If

we are unable to maintain the profitability of our existing store and profitably

open and operate new stores, we may not be able to adequately implement our

growth strategy, which may adversely affect our overall operating

results.

Our

planned growth depends, in part, on our ability to maintain the profitability of

our existing store and to open new stores. There can be no assurance, however,

that we will be able to identify and obtain favorable store sites, arrange

favorable leases for stores, obtain governmental and other third-party consents,

permits and licenses needed to expand or operate stores, construct or refurbish

stores, open stores in a timely manner, or hire, train and integrate qualified

sales associates in those stores. If we are unable to profitably open and

operate stores and maintain the profitability of our existing stores, we may not

be able to adequately implement our growth strategy, which may adversely affect

our overall operating results.

Requirements

associated with being a public company will require significant company

resources and management attention.

We have limited experience complying

with the reporting requirements of the Securities Exchange Act of 1934, or the

other rules and regulations of the SEC or any securities exchange relating to

public companies. We are working with independent legal, accounting and

financial advisors to identify those areas in which changes should be made to

our financial and management control systems to manage our growth and our

obligations as a public company. These areas include corporate governance,

corporate control, internal audit, disclosure controls and procedures and

financial reporting and accounting systems. We have made, and will continue to

make, changes in these and other areas, including our internal controls over

financial reporting. However, we cannot assure you that these and other measures

we may take will be sufficient to allow us to satisfy our obligations as a

public company on a timely basis.

In addition, compliance with reporting

and other requirements applicable to public companies such as Sarbanes Oxley

will create additional costs for us, will require the time and attention of

management and will require the

hiring of additional personnel and outside consultants. We cannot predict or

estimate the amount of the additional costs we may incur, the timing of such

costs or the degree of impact on our management's attention to these matters

will have on our business.

Our planned growth, if any,

together with our added obligations of being a public company may strain our

business infrastructure, which could adversely affect our operations and

financial condition.

If we grow, we will face the risk that

our existing resources and systems may be inadequate to support our growth. We

may also face new challenges, including an increase in information to be

processed by our management information systems and diversion of management

attention and resources away from existing operations and towards the opening of

new and relocated stores and new markets. Our current growth strategy will

require us to increase our management and other resources over the next few

years. In particular, heightened new standards with respect to internal

accounting and other controls, as well as other resource-intensive requirements

of being a public company, may further strain our business infrastructure. If we

are unable to manage our planned growth and maintain effective controls, systems

and procedures, we would be unable to efficiently operate and manage our

business and may experience errors or information lapses affecting our public

reporting, either of which could adversely effect our operations and financial

condition.

We depend on a number of suppliers

and any failure by any of them to supply us with products may impair our

inventory and adversely affect our ability to meet customer demands, which could

result in a decrease in net sales.

We typically do not maintain long-term

purchase contracts with suppliers, but instead operate principally on a purchase

order basis. Our current suppliers may not continue to sell products to us on

current terms or at all, and we may not be able to establish relationships with

new suppliers to ensure delivery of products in a timely manner or on terms

acceptable to us. We may not be able to acquire desired merchandise in

sufficient quantities on terms acceptable to us in the future. Our business

could also be adversely affected if there were delays in product shipments to us

due to freight difficulties, financial difficulties with our major suppliers,

delays due to the difficulties of our suppliers involving strikes or other

difficulties at their principal transport providers or otherwise. We are also

dependent on suppliers for assuring the quality of merchandise supplied to us.

Our inability to acquire suitable merchandise in the future or the loss of one

or more of our suppliers and our failure to replace them may harm our

relationship with our customers and our ability to attract new customers,

resulting in a decrease in net sales.

Costs

of legal matters and regulation could exceed estimates and adversely affect our

business.

We may become parties to a number of

legal and administrative proceedings involving matters pending in various courts

or agencies. These include proceedings associated with facilities

currently or previously owned, operated or leased by us and include claims for

personal injuries and property damages. It is not possible for us to

estimate reliably the amount and timing of all future expenditures related to

legal matters and other contingencies.

Any

projections used in this registration statement may not be accurate and our

actual performance may not match or approximate the projections.

Any and all projections and estimates

contained in this registration statement or otherwise prepared by us are based

on information and assumptions which management believes to be accurate;

however, they are mere projections and no assurance can be given that actual

performance will match or approximate the projections.

Our

estimates may prove to be inaccurate and future net cash flows are

uncertain. Any significant variance from these assumptions could

greatly affect our estimates.

Our estimates of both future sales and

the timing of development expenditures are uncertain and may prove to be

inaccurate. We also make certain assumptions regarding net cash flows

and operating costs that may prove incorrect when judged against our actual

experience. Any significant variance from these assumptions could

greatly affect our estimates of future net cash flows and our ability to borrow

under our credit facility.

We

require substantial capital requirements to finance our

operations. Our inability to obtain financing will adversely impact

our business.

We will require additional capital for

future operations. We plan to finance anticipated ongoing expenses

and capital requirements with funds generated from the following

sources:

|

§

|

cash

provided by operating activities;

|

|

§

|

available

cash and cash investments; and

|

|

§

|

capital

raised through debt and equity

offerings.

|

The uncertainties and risks associated

with future performance and revenues will ultimately determine our liquidity and

our ability to meet anticipated capital requirements. If declining

prices cause our anticipated revenues to decrease, we may be limited in our

ability to replace our inventory. As a result, our production and

revenues would decrease over time and may not be sufficient to satisfy our

projected capital expenditures. We may not be able to obtain

additional financing in such a circumstance.

Our

stock price could be extremely volatile and, as a result, you may not be able to

resell your shares at or above the price you paid for them.

Only recently has our stock been

trading in the public market. An active public market for our common

stock may not develop or be sustained. Further, the market price of

our common stock may decline below the price you paid for your

shares.

Among the factors that could affect our

stock price are:

|

§

|

industry

trends and the business success of our

vendors;

|

|

§

|

actual

or anticipated fluctuations in our quarterly financial and operating

results, including our comparable store

sales;

|

|

§

|

our

failure to meet the expectations of the investment community and changes

in investment community recommendations or estimates of our future

operating results;

|

|

§

|

strategic

moves by our competitors, such as product announcements or

acquisitions;

|

|

§

|

regulatory

developments;

|

|

§

|

general

market conditions;

|

|

§

|

other

domestic and international macroeconomic factors unrelated to our

performance; and

|

|

§

|

additions

or departures of key personnel.

|

The stock market has from time to time

experienced extreme volatility that has often been unrelated to the operating

performance of particular companies. These kinds of broad market fluctuations

may adversely affect the market price of our common stock.

In the past, following periods of

volatility in the market price of a company's securities, securities class

action litigation has often been instituted. If a securities class action suit

is filed against us, we would incur substantial legal fees and our management's

attention and resources would be diverted from operating our business in order

to respond to the litigation.

Issuing preferred stock with

rights senior to those of our common stock could adversely affect holders of

common stock.

Our charter documents give our board of

directors the authority to issue series of preferred stock without a vote or

action by our stockholders. The board also has the authority to

determine the terms of preferred stock, including price, preferences and voting

rights. The rights granted to holders of preferred stock may

adversely affect the rights of holders of our common stock. For

example, a series of preferred stock may be granted the right to receive a

liquidation preference – a pre-set distribution in the event of a liquidation –

that would reduce the amount available for distribution to holders of common

stock. In addition, the issuance of preferred stock could make it

more difficult for a third party to acquire a majority of our outstanding voting

stock. As a result, common stockholders could be prevented from

participating in transactions that would offer an optimal price for their

shares.

We

do not anticipate paying dividends on our capital stock in the foreseeable

future.

We do not anticipate paying any

dividends in the foreseeable future. We currently intend to retain our future

earnings, if any, to fund the growth of our business. In addition, the terms of

the instruments governing our existing debt and any future debt or credit

facility may preclude us from paying any dividends.

Item

1B. Unresolved Staff Comments.

None.

Item

2. Properties

Real Property

At present, we do not own any

property. Our retail operation is located in a leased facility. We

have local access to all commercial freight systems. The current retail facility

is approximately 300 square feet. This facility contains both the

administrative/sales offices and retail floor sections. The current

lease runs until May 31, 2010. The retail facility is located at 2026 Lowe St,

Fort Collins, CO 80525. We lease this facility on a monthly basis for $200 per

month.

Item

3. Legal Proceedings

Currently,

we are not a party to any pending legal proceedings.

Item

4. Submission of Matters to a Vote of Security Holders

None.

PART

II

Item

5. Market for Registrant’s Common Equity and Related Stockholder

Matters and Issuer Purchases of Equity Securities.

Market

information

Our

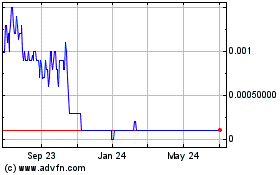

common stock only recently became quoted on the Over The Counter Bulletin Board

(OTC.BB AFSN). As of the date of this report we are unable to provide

any high and low bid information for our common stock for any quarter subject to

this report. Currently, there are 47,500,000 shares of our common

stock issuable upon conversion of outstanding convertible securities held in the

name of an affiliate and 1,456,000 shares of our common stock which can be sold

by non-affiliates pursuant to Rule 144 of the Securities Act.

Holders

We have approximately 37 holders of

record of our common stock.

Dividends

We have

not declared any cash dividends on any class of our securities and we do not

have any restrictions that currently limit, or are likely to limit, our ability

to pay dividends now or in the future.

Securities

authorized for issuance under equity compensation plans

We do not have any securities

authorized for issuance under equity compensation plans.

Item

6. Selected Financial Data.

As a smaller reporting company, we are

not required to provide the information required by this item.

Item

7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations

The

following discussion and analysis should be read in conjunction with our audited

consolidated financial statements and related notes included in this

registration statement. This registration statement contains

“forward-looking statements.” The statements contained in this report that are

not historic in nature, particularly those that utilize terminology such as

“may,” “will,” “should,” “expects,” “anticipates,” “estimates,” “believes,” or

“plans” or comparable terminology are forward-looking statements based on

current expectations and assumptions.

Various

risks and uncertainties could cause actual results to differ materially from

those expressed in forward-looking statements. Factors that could

cause actual results to differ from expectations include, but are not limited

to, those set forth under the section “Risk Factors” set forth in this

registration statement.

The

forward-looking events discussed in this registration statement, the documents

to which we refer you and other statements made from time to time by us or our

representatives, may not occur, and actual events and results may differ

materially and are subject to risks, uncertainties and assumptions about

us. For these statements, we claim the protection of the “bespeaks

caution” doctrine. All forward-looking statements in this document

are based on information currently available to us as of the date of this

report, and we assume no obligation to update any forward-looking

statements. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause the actual results to

differ materially from any future results, performance or achievements expressed

or implied by such forward-looking statements.

Critical

Accounting Policies

Our policy is to use the accrual method

of accounting to prepare and present financial statements, which conform to

generally accepted accounting principles. The company has elected a March 31,

year-end.

We consider all highly liquid

investments with maturities of three months or less when purchased, to be cash

equivalents.

Inventories are valued at the lower of

average cost (which approximates computation on a first-in, first-out basis) or

market (net realizable value or replacement cost).

Revenue is recognized at the time of

sale.

We account for income taxes under the

provisions of SFAS No. 109, “Accounting for Income Taxes”. SFAS 109

requires recognition of deferred tax liabilities and assets for the expected

future tax consequences of events that have been included in the financial

statements or tax returns. Under this method, deferred tax

liabilities and assets are determined based on the difference between the

financial statement and tax bases of assets and liabilities using enacted tax

rates in effect for the year in which the differences are expected to

reverse.

Results

of Operations

For the year ended March 31, 2009, we

had revenues of $22,065 compared to $20,367 for the year ended March 31,

2008. We attribute this slight increase in sales due to increased

enrolment in the gymnastics facility and the recent 2008 summer Olympics which

sparked greater interest in gymnastics in young children.

For the year ended March 31, 2009, we

had total operating expenses of $43,039 and an operating loss of ($20,974)

compared to total operating expenses of $114,820 and an operating loss of

($94,453) for the year ended March 31, 2008. The substantial decrease

in operating expenses for the year ended March 31, 2009, is

attributable to the expiration of the employment agreement with Mr. Koehnke,

thus reducing our quarterly operating expenses by $30,000. In

addition, we saw increased sales for the year.

Generally, our cost of goods, wholesale

prices and inventory have remained stable over the past 12 months.

As expected, our sales increase this

year primarily due to the 2008 summer Olympics in Beijing, China and the

increased enrolment in gymnastics students at the facility in which we are

located. Historically, national interest in the summer Olympics has

significantly increased enrolment in gymnastics schools throughout the United

States and we experienced this trend this summer. While summer

enrolment in the gymnastics school is generally down due to competing summer

activities available to children, this year, due to the summer Olympics,

enrolment in the gymnastics school remained stable which helped our

sales. We anticipate that our sales will increase through 2009 and

then level off or even drop slightly to the pre-Olympic levels.

Liquidity

and Capital Resources

At March 31, 2009, we had cash of

$3,478 compared to $2,327 at March 31, 2008.

Future

Goals

Since our inception, our goal has been

to expand our business into new locations. Our goal was to be a fully

reporting company with our shares of common stock trading in the public market

prior to the beginning of the 2008 summer Olympics. With the

increased interest in gymnastics following the summer Olympics, we believed that

this would be a catalyst to begin our expansion plan. However,

although we were successful in becoming a reporting company in a timely fashion,

we had continuing difficulties in filing our 211 application with FINRA and only

completed this process during the last month of our fiscal year. As

of March 2009, our common stock will be trading on the Over the

Counter Bulletin Board (OTC.BB AFSN)

Now that our common stock will be

trading in the public market, management is considering whether it remains a

valid business goal to continue with our original business plan and to seek

financing for our expansion goals whether it be through bank loans or a private

placement of our securities. Management is concerned that the

“window of opportunity” may have passed in regard to expanding in conjunction

with the summer Olympics and that the “window” will not occur for

another four years. Alternatively, management is not opposed to

changing directions with the business if suitable ideas or business partners

present themselves.

Assuming management goes forward with

our original business plan and we are successful in obtaining financing, we plan

on expanding into the Loveland, Colorado location during the second half of our

fiscal year and opening additional locations in Colorado

thereafter. The opening of additional locations is dependent upon

sufficient financing and the identification of suitable gymnastic/dance school

facilities. We anticipate that each new location will require

approximately $25,000 - $40,000 to open depending upon the

location.

Off-balance

Sheet Arrangements

We maintain no significant off-balance

sheet arrangements

Foreign

Currency Transactions

None.

I

tem 7A. Quantitative and

Qualitative Disclosures About Market Risk

We

currently do not utilize sensitive instruments subject market risk in our

operations.

Item

8. Financial Statements and Supplementary Data.

Our

financial statements and related explanatory notes can be found on the “F” Pages

at the end of this Report.

Item

9. Changes In and Disagreements With Accountants on Accounting and

Financial Disclosure.

None.

Item

9A. Controls and Procedures.

In

accordance with Rule 13a-15(b) of the Securities Exchange Act of 1934,as of the

end of the period covered by this Report on Form 10-K, our management

evaluated, with the participation of our principal executive and financial

officer, the effectiveness of the design and operation of the Company's

disclosure controls and procedures (as defined in Rule 13a-15(e) or Rule

15d-15(e) under the Exchange Act). Disclosure controls and procedures are

defined as those controls and other procedures of an issuer that are designed to

ensure that the information required to be disclosed by the issuer in the

reports it files or submits under the Act is recorded, processed, summarized and

reported, within the time periods specified in the Commission's rules and forms.

Disclosure controls and procedures include, without limitation, controls and

procedures designed to ensure that information required to be disclosed by an

issuer in the reports that it files or submits under the Act is accumulated and

communicated to the issuer's management, including its principal executive

officer and principal financial officer, or persons performing similar

functions, as appropriate to allow timely decisions regarding required

disclosure. Based on their evaluation of these disclosure controls and

procedures, our chairman of the board and chief executive and financial officer

has concluded that the disclosure controls and procedures were effective as of

the date of such evaluation to ensure that material information relating to the

company, was made known to them by others within those entities, particularly

during the period in which this Annual Report on Form 10-K was being

prepared.

Item

9A(T). Controls and Procedures.

Our

management is responsible for establishing and maintaining adequate internal

control over financial reporting. The Company's internal control over financial

reporting has been designed to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting

principles generally accepted in the United States of America. The Company's

internal control over financial reporting includes policies and procedures that

pertain to the maintenance of records that, in reasonable detail, accurately and

fairly reflect transactions and dispositions of assets of the Company; provide

reasonable assurance that transactions are recorded as necessary to permit

preparation of financial statements in accordance with accounting principles

generally accepted in the United States of America, and that receipts and

expenditures are being made only in accordance with authorization of management

and directors of the Company; and provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use or

disposition of the Company's assets that could have a material effect on the

Company's financial statements.

Because

of its inherent limitations, internal control over financial reporting may not

prevent or detect misstatements. Therefore, even those systems determined to be

effective can provide only reasonable assurance with respect to financial

statement preparation and presentation. Projections of any evaluation of

effectiveness to future periods are subject to the risk that controls may become

inadequate because of changes in conditions, or that the degree of compliance

with the policies or procedures may deteriorate.

Management

assessed the effectiveness of the Company's internal control over financial

reporting at March 31, 2009. In making this assessment, management

used the criteria set forth by the Committee of Sponsoring Organizations of the

Treadway Commission ("COSO") in Internal Control--Integrated Framework. Based on

that assessment under those criteria, management has determined that, at March

31, 2009, the Company's internal control over financial reporting was

effective.

This

Annual Report on Form 10-K does not include an attestation report of the

Company's registered public accounting firm regarding internal control over

financial reporting. Management's report was not subject to attestation by the

Company's registered public accounting firm pursuant to temporary rules of the

SEC that permit the Company to provide only management's report in this annual

report.

Inherent

Limitations of Internal Controls

Our

internal control over financial reporting is designed to provide reasonable

assurance regarding the reliability of financial reporting and the preparation

of financial statements for external purposes in accordance with generally

accepted accounting principles. Our internal control over financial reporting

includes those policies and procedures that:

|

●

|

|

pertain

to the maintenance of records that, in reasonable detail, accurately and

fairly reflect the transactions and dispositions of our

assets;

|

|

●

|

|

provide

reasonable assurance that transactions are recorded as necessary to permit

preparation of financial statements in accordance with generally accepted

accounting principles, and that our receipts and expenditures are being

made only in accordance with authorizations of our management and

directors; and

|

|

●

|

|

provide

reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use, or disposition of our assets that could

have a material effect on the financial

statements.

|

Our

management does not expect that our internal controls will prevent or detect all

errors and all fraud. A control system, no matter how well designed and

operated, can provide only reasonable, not absolute, assurance that the

objectives of the control system are met. Further, the design of a control

system must reflect the fact that there are resource constraints, and the

benefits of controls must be considered relative to their costs. Because of the

inherent limitations in all control systems, no evaluation of internal controls

can provide absolute assurance that all control issues and instances of fraud,

if any, have been detected. Also, any evaluation of the effectiveness of

controls in future periods are subject to the risk that those internal controls

may become inadequate because of changes in business conditions, or that the

degree of compliance with the policies or procedures may

deteriorate.

Management

has not identified any change in the our internal control over financial

reporting indentified in connection with the its evaluation of our most recent

fiscal quarter that has materially affected, or is reasonably likely to

materially affect, our internal control over financial reporting.

Item

9B. Other Information.

None.

PART

III

|

Item

10.

|

Directors,

Executive Officers and Corporate

Governance.

|

The

following table sets forth, as of the date of this registration statement, the

name, age and position of our sole director/executive officer.

|

NAME

|

|

AGE

|

|

POSITION

|

|

|

|

|

|

|

|

Susie

L.G. Johnson

|

|

42

|

|

President,

Chief Executive Officer, Chief Financial Officer, Secretary, and

Director

|

The

background of our sole director/executive officer is as follows:

Susie

L.G. Johnson

Ms. Johnson is our President, Chief

Executive Officer and Secretary. Ms. Johnson’s career has been

focused on management. She served as a Production Control Analyst for

US Air in Reno and San Diego California for 9 years and thereafter managed a

cellular retail outlet in Kingsville, Texas. She is a licensed

cosmetologist and has owned and operated a sole proprietor hair salon business

since 2001.

Information

about our Board and its Committees.

Audit Committee

We currently do not have an audit

committee although we intend to create one as the need

arises. Currently, our Board of Directors serves as our audit

committee.

Compensation Committee

We currently do not have a compensation

committee although we intend to create one as the need

arises. Currently, our Board of Directors serves as our Compensation

Committee.

Advisory Board

We currently do not have an advisory

board although we intend to create one as the need arises.

Section

16(a) Beneficial Ownership Reporting Compliance

Section 16(a)

of the Securities Exchange Act of 1934, as amended, requires our directors,

executive officers, and stockholders holding more than 10% of our outstanding

common stock, to file with the Securities and Exchange Commission initial

reports of ownership and reports of changes in beneficial ownership of our

common stock. Executive officers, directors and greater-than-10%

stockholders are required by SEC regulations to furnish us with copies of all

Section 16(a) reports they file. To our knowledge, based solely

on review of the copies of such reports furnished to us for the period ended

March 31, 2009, the Section 16(a) reports required to be filed by our

executive officers, directors and greater-than-10% stockholders were filed on a

timely basis.

Code

of Ethics

Effective

February 22, 2006, our board of directors adopted the Action Fashions, Ltd. Code

of Business Conduct and Ethics. The board of directors believes that

our Code of Business Conduct and Ethics provides standards that are reasonably

designed to deter wrongdoing and to promote the following:

(1) honest and ethical conduct, including the

ethical handling of actual or apparent conflicts of interest between personal

and professional relationships;

(2) full,

fair, accurate, timely, and understandable disclosure in reports and documents

that we file with, or submits to, the Securities and Exchange Commission

; (3) compliance with applicable governmental

laws, rules and regulations;

the prompt

internal reporting of violations of the Code of Business Conduct and Ethics to

an appropriate person or persons; and

(4)

accountability for adherence to the Code of Business Conduct and

Ethics. We will provide a copy of our Code of Business Conduct and

Ethics by mail to any person without charge upon written request to us

at: P.O. Box 235472, Encinitas, CA 92024.

Item

11. Executive Compensation

The

following table sets forth the compensation paid to Ms. Susie L.G. Johnson, who

is our sole executive officer, for services rendered, and to be

rendered. No restricted stock awards, long-term incentive plan

payouts or other types of compensation, other than the compensation identified

in the chart below, were paid to Ms. Johnson during the fiscal years

presented.

|

Summary

Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity

|

|

Nonqualified

|

All

|

|

|

Name

and

|

|

|

|

|

|

|

|

|

|

|

|

Incentive

|

|

Deferred

|

Other

|

|

|

Principal

|

|

|

|

|

|

|

|

Stock

|

|

Option

|

|

Plan

|

|

Compensation

|

Compen

|

|

|

Position

|

|

Year

|

|

Salary

|

|

Bonus

|

|

Awards

|

|

Awards

|

|

Compensation

|

|

Earnings

|

-sation

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Susie

L.G. Johnson

|

|

2009

|

|

0

|

|

0

|

|

24,000

(1)

|

|

0

|

|

0

|

|

0

|

0

|

$24

(2)

|

|

President,

Chief Executive Officer, Chief Financial Officer, Secretary, and

Director

|

|

2008

|

|

0

|

|

0

|

|

6,000

(1)

|

|

0

|

|

0

|

|

0

|

0

|

$6

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Ms.

Johnson receives 2,000 restricted shares of our common stock for each month she

serves as an officer of the company.

(2) Based

upon restricted shares of our common stock issued annually at $.001 per

share.

Employment

Agreements

We currently do not have an employment

agreement with Ms. Johnson, our sole officer and director. Our board

of directors has authorized Ms. Johnson to be compensated for her services at a

rate of 2,000 restricted shares of our common stock for each month she serves as

an officer of the corporation.

Compensation

of Director

We

currently do not compensate our director. In the future, we may

compensate our current director or any additional directors for reasonable

out-of-pocket expenses in attending board of directors meetings and for

promoting our business. From time to time we may request certain

members of the board of directors to perform services on our

behalf. In such cases, we will compensate the directors for their

services at rates no more favorable than could be obtained from unaffiliated

parties.

Item

12. Security Ownership of Certain Beneficial Owners and

Management.

The

following table sets forth certain information regarding the beneficial

ownership of the 136,481,000 issued and outstanding shares of our common stock

as of March 31, 2009, by the following persons:

|

·

|

each

person who is known to be the beneficial owner of more than five percent

(5%) of our issued and outstanding shares of common

stock;

|

|

·

|

each

of our directors and executive officers;

and

|

|

·

|

All

of our Directors and Officers as a

group

|

|

Name

And Address

|

Number

Of Shares Beneficially Owned

|

Percentage

Owned

|

|

Phillip

E. Koehnke

(1)

|

135,025,000

|

98%

|

|

Susie

L.G. Johnson

(1)

|

30,000

|

*

|

|

|

|

|

|

All

Officers and Directors as Group

|

30,000

|

*

|

|

Total

|

135,055,000

|

98%

|

* Less

than 1%

(1) The

address is PO Box 235472, Encinitas, California 92024.

Beneficial

ownership is determined in accordance with the rules and regulations of the

SEC. The number of shares and the percentage beneficially owned by

each individual listed above include shares that are subject to options held by

that individual that are immediately exercisable or exercisable within 60 days

from the date of this registration statement and the number of shares and the

percentage beneficially owned by all officers and directors as a group includes

shares subject to options held by all officers and directors as a group that are

immediately exercisable or exercisable within 60 days from the date of this

registration statement.

Item

13. Certain Relationships and Related Transactions.

We have

not entered into any material transactions with related parties in the past two

years.

Transactions with

Promoters

None.

|

|

Item

14. Principal Accountant Fees and

Services.

|

Appointment

of Auditors

Our Board

of Directors selected Cordovano and Honeck, LLP as our auditors for the year

ended March 31, 2009.

Audit

Fees

Cordovano and Honeck, LLP billed us

$10,274 in audit fees during the year ended March 31, 2009 and $10,523 in audit

fees during the year ended March 31, 2008.

Audit-Related

Fees

We

did not pay any fees to Cordovano and Honeck, LLP for assurance and related

services that are not reported under Audit Fees above, during our fiscal years

ending March 31, 2009 and March 31, 2008.

Tax

and All Other Fees

We did not pay any fees to Cordovano

and Honeck, LLP for tax compliance, tax advice, tax planning or other work

during our fiscal years ending March 31, 2009 and March 31, 2008.

Pre-Approval

Policies and Procedures

We have

implemented pre-approval policies and procedures related to the provision of

audit and non-audit services. Under these procedures, our board of

directors pre-approves all services to be provided by Cordovano and Honeck, LLP,

and the estimated fees related to these services.

With

respect to the audit of our financial statements as of March 31, 2009, and for

the year then ended, none of the hours expended on Cordovano and Honeck, LLP’s

engagement to audit those financial statements were attributed to work by

persons other than Cordovano and Honeck, LLP’s full-time, permanent

employees.

Item

15. Exhibits, Financial Statement Schedules.

|

Statements

|

|

|

|

|

|

|

|

|

|

|

|

Report

of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

|

|

Balance

Sheets at March 31, 2009 and 2008

|

|

|

|

|

|

|

|

|

|

|

|

Statements

of Operations for the years ended March 31, 2009 and 2008

|

|

|

|

|

|

|

|

|

|

|

|

Statement

of Changes in Shareholders' Deficit for the years ended March 31, 2009 and

2008

|

|

|

|

|

|

|

|

Statements

of Cash Flows for the years ended March 31, 2009 and 2008

|

|

|

|

|

|

|

|

|

|

|

|

Notes

to Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

Schedules

|

|

|

|

|

|

|

|

|

|

|

|

All

schedules are omitted because they are not applicable or the required

information is shown in the Financial Statements or notes

thereto.

|

|

|

|

|

|

|

|

|

Exhibit

|

Form

|

Filing

|

Filed

with

|

|

Exhibits

|

#

|

Type

|

Date

|

This

Report

|

|

|

|

|

|

|

|

Articles

of Incorporation filed with the Secretary of State of Colorado on June 22,

1990

|

3.1

|

10-SB

|

1/24/2007

|

|

|

|

|

|

|

|

|

Articles

of Amendment to the Articles of Incorporation filed with the Secretary of

State of Colorado on October 17, 2006

|

3.2

|

10-SB

|

1/24/2007

|

|

|

|

|

|

|

|

|

Articles

of Amendment to Articles of Incorporation filed with the Secretary of

State of the State of Colorado on January 25, 2007

|

3.3

|

10KSB

|

6/29/2007

|

|

|

|

|

|

|

|

|

Amended

and Restated Bylaws dated December 30, 2005

|

3.3

|

10-SB

|

1/24/2007

|

|

|

|

|

|

|

|

|

Code

of Ethics

|

14.1

|

10-KSB

|

6/29/2007

|

|

|

|

|

|

|

|

|

Consent

of Experts

|

23.1

|

|

|

X

|

|

|

|

|

|

|

|

Certification

of Paul Thompson, pursuant to Rule 13a-14(a)

|

31.1

|

|

|

X

|

|

|

|

|

|

|

|

Certification

of Paul Thompson pursuant to 18 U.S.C Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

|

32.1

|

|

|

X

|

SIGNATURES

In accordance with Section 13 or 15(d)

of the Exchange Act, the registrant caused this report to be signed on its

behalf by the undersigned, thereto duly authorized.

|

ACTION

FASHIONS, LTD.

/s/

Paul D. Thompson

By: Paul

D. Thompson

Its: President

|

In

accordance with the Exchange Act, this report has been signed below by the

following persons on behalf of the registrant on the capacities and on the dates

indicated.

|

Signatures

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Paul D. Thompson

Paul

D. Thompson

|

|

Chief

Executive Officer, Chief Financial Officer and Principal Accounting

Officer

|

|

January

6, 2010

|

|

ACTION

FASHIONS, LTD.

|

|

|

|

|

|

|

Page

|

|

|

|

|

Report

of Independent Registered Public Accounting Firm:

|

F-2

|

|

|

|

|

Balance

Sheets for March 31, 2009 and 2008:

|

F-3

|

|

|

|

|

Statements

of Operations for the years ended March 31, 2009 and 2008:

|

F-4

|

|

|

|

|

Statement

of Changes in Shareholders' Deficit for the years ended March

31, 2009 and 2008:

|

F-5

|

|

|

|

|

Statement

of Cash Flows for the years ended March 31, 2009 and 2008:

|

F-6

|

|

|

|

|

Notes

to Financial Statements:

|

F-7

|

|

|

|

|

F-1

|

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Director and Shareholders

Action

Fashions, Ltd.:

We have

audited the balance sheets of Action Fashions, Ltd. as of March 31, 2009 and

2008, and the related statements of operations, changes in shareholders’ deficit

and cash flows for the years ended March 31, 2009 and 2008. These

financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on these

financial statements based on our audit.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require

that we plan and perform the audits to obtain reasonable assurance about whether

the financial statements are free of material misstatement. The

Company is not required to have, nor were we engaged to perform, an audit of its

internal control over financial reporting. Our audits included

consideration of internal control over financial reporting as a basis for

designing audit procedures that are appropriate in the circumstances, but not

for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no

such opinion. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements, assessing

the accounting principles used and significant estimates made by management, as

well as evaluating the overall financial statement presentation. We

believe that our audits provide a reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of Action Fashions, Ltd. as of March

31, 2009 and 2008, and the results of its operations and its cash flows for the

years ended March 31, 2009 and 2008 in conformity with accounting principles

generally accepted in the United States of America.

The

accompanying financial statements have been prepared assuming the Company will

continue as a going concern. As discussed in Note 2 to the financial

statements, the Company has a limited operating history, limited funds, and a

working capital deficit, which raises a substantial doubt about its ability to

continue as a going concern. Management’s plans in regard to these

matters are also described in Note 2. The financial statements do not

include any adjustments that might result from the outcome of this

uncertainty.

/s/ Cordovano and Honeck

LLP

Cordovano

and Honeck LLP

Englewood,

Colorado

June 22,

2009

|

ACTION

FASHIONS, LTD.

|

|

|

|

|

|

Balance

Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March

31, 2009

|

|

March

31, 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|