Current Report Filing (8-k)

March 06 2020 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 2, 2020

DSG

Global, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-53988

|

|

26-1134956

|

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

312

– 2630 Croydon Drive, Surrey, British Columbia, Canada

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (604) 575-3848

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbols(s)

|

|

Name

of each exchange on which registered

|

|

NA

|

|

|

|

|

Item

1.01. Entry into a Material Definitive Agreement

On March 2, 2020

DSG Global, Inc. (the “Company”) entered into an Advisory Services Agreement (the “Advisory Agreement”)

with Graj + Gustavsen, Inc. (“G+G”). Under the terms of this five-year Advisory Agreement, G+G has agreed to provide

the Company with strategic brand and business positioning, strategic marketing, concept development and ongoing strategic consulting

services. In consideration of the sevices to be rendered by G+G, the Company has agreed to (1) make a cash payment

in the amount of $350,000 payable in several tranches following the Company’s completion of future financings of the Company,

and monthly payments of $10,000 following the first twelve months of the engagement, and (2) issue a five-year warrant

to purchase 2,829,859 at an exercise price of $0.25 per share, upon the execution of the Advisory Agreement (the “First

Warrant”), and a five-year warrant to purchase such number of shares of the Company’s common stock that is equal to

10% of the Company’s shares of common stock calculated on a fully diluted basis as of the closing date of the future financing,

at an exercise price per share equal to the 80% of the price of the Company’s securities in such future financing less

the number of shares represented by the First Warrant. The warrants contains, among other provisions customary for the instruments

of this nature, provisions pertaining to cashless exercise, and two-year piggy-back registration rights which allows the holders

of the warrants to have the shares of the Company’s common stock underlying the warrants registered alongside other

registrable securities of the Company, subject to underwriter cutbacks in case of underwritten public offering(s) of the Company’s

securities, if any.

G+G

is an “accredited investor” (as defined in Regulation D under the Securities Act), and the Company issued the

securities in reliance upon an exemption from registration contained in Section 4(2) and Rule 506 under the Securities Act. There

were no discounts or brokerage fees associated with this transaction.

The Advisory Agreement

and the warrants contain certain additional provisions including mutual indemnity, confidentiality and other terms and

provisions that are customary for the instruments of this nature. The foregoing information is a summary of the Advisory

Agreement and the warrants described above, is not complete, and is qualified in its entirety by reference to the full text of

such documents, which are attached as exhibits to this Current Report on Form 8-K. Readers should review the Advisory Agreement

and the Form Warrant for a complete understanding of the terms and conditions of the transaction described above.

Item

3.02 Unregistered Sale of Equity Securities

The

Company hereby incorporates by reference the disclosure made in Item 1.01 above.

Item

9.01. Financial Statements and Exhibits

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

By:

|

/s/

Bob Silzer

|

|

|

Name:

|

Robert

Silzer Sr.

|

|

|

Title:

|

President,

CEO

|

|

|

|

|

|

Dated:

March 6, 2020

|

|

|

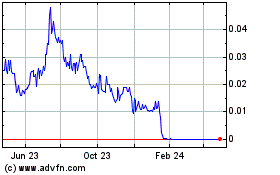

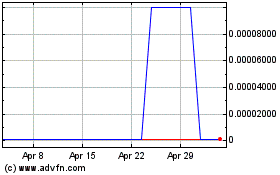

DSG Global (CE) (USOTC:DSGT)

Historical Stock Chart

From Aug 2024 to Sep 2024

DSG Global (CE) (USOTC:DSGT)

Historical Stock Chart

From Sep 2023 to Sep 2024