Centrica Shares Dive as Downbeat Guidance Fuels Dividend Fears

February 21 2019 - 11:26AM

Dow Jones News

--Centrica lowered its cash flow guidance hit by the U.K.

energy-price cap, prompting fears over the sustainability of its

dividend

--The owner of British Gas missed 2018 adjusted earnings

expectations

--Shares in the company fell sharply on the back of the news, on

track for their biggest percentage decline since November 2017

By Adria Calatayud

Shares of British Gas owner Centrica PLC (CNA.LN) fell Thursday

after the company lowered its cash flow guidance for 2019 and

missed 2018 adjusted earnings expectations, prompting fears over

its ability to sustain dividend.

The FTSE 100 utilities company said cash generation this year

will take a hit from the U.K.'s energy-price cap, and lower volumes

at its exploration and production as well as nuclear operations.

Centrica said it will step up its cost-reduction initiatives, with

plans to cut between 1,500 and 2,000 jobs, targeting savings of 250

million pounds ($326.3 million).

The company also intends to sell noncore units for up to GBP500

million, including the GBP230 million disposal of its Clockwork

home-services business in North America.

Centrica said adjusted operating cash flow will come in at

between GBP1.8 billion and GBP2.0 billion, below previous guidance

for the 2018-2020 period of GBP2.1 billion to GBP2.3 billion. In

2018, the company's adjusted operating cash flow rose 9% to GBP2.25

billion.

Centrica's lower cash-flow guidance led analysts to question

whether the company will be able maintain its full-year dividend at

the 12.0 pence a share it declared for 2018.

"Centrica is increasingly relying on cost cutting and disposals

to prop up the payment. Neither can continue forever," Hargreaves

Lansdown analyst George Salmon said.

Analysts at Citi noted that Centrica failed to reassure

investors on its dividend plans for this year, while its outlook

pointed to weaker adjusted earnings.

The company's adjusted earnings per share fell 10% to 11.2

pence, falling short of the company's guidance of 11.5 pence.

The company said it made a pretax profit of GBP575 million in

2018 compared with GBP137 million a year earlier on revenue that

increased 5.9% to GBP29.69 billion. In 2017, the company's profit

fell sharply due to exceptional charges.

"Centrica's financial performance in 2018 was mixed against a

challenging external backdrop," Centrica Chief Executive Iain Conn

said.

Shares at 1554 GMT were down 13% at 119.15 pence, on track for

their worst one-day percentage decline since November 2017, making

Centrica the biggest faller in the FTSE 100.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

February 21, 2019 11:11 ET (16:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

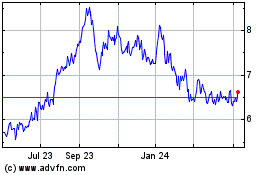

Centrica (PK) (USOTC:CPYYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

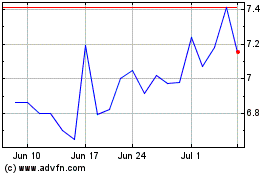

Centrica (PK) (USOTC:CPYYY)

Historical Stock Chart

From Apr 2023 to Apr 2024