|

|

|

UNITED

STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, DC 20549

|

|

|

|

SCHEDULE 14A

|

|

(RULE 14a-101)

|

|

|

|

PROXY STATEMENT

PURSUANT TO SECTION 14(a) OF THE SECURITIES

|

|

EXCHANGE ACT OF 1934

|

|

|

|

Filed by the Registrant [X]

|

|

|

|

Filed by a Party other than the

Registrant [ ]

|

|

|

|

|

Check the appropriate box:

|

|

|

|

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for the Use of the Commission Only (as permitted by Rule 14a-6 (e)(2))

|

|

[X]

|

Definitive

Proxy Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to Section 240.14a-12

|

|

CALIFORNIA FIRST LEASING CORPORATION

|

|

(Name of Registrant as Specified in

Its Charter)

|

|

_____________________________________________________

|

|

(Name of Person(s) Filing Proxy

Statement if other than Registrant)

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Payment of Filing Fee

(Check the appropriate box):

|

| |

|

|

|

|

|

|

|

|

|

|

|

[X]

|

No

fee required

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

[

]

|

Fee

computed on table below per Exchange Act Rules 14a-16 (i)(4) and 0-11.

|

| |

|

|

|

|

|

|

|

|

|

|

| |

(1)

|

Title

of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate

number of securities to which transaction applies:

|

| |

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule

|

| |

|

0-11

(Set forth the amount on which the filing fee is calculated and state how it

was determined):

|

| |

(4)

|

Proposed

maximum aggregate value of transaction:

|

| |

(5)

|

Total

fee paid:

|

| |

|

|

|

|

|

|

|

|

|

|

|

[

]

|

Fee

paid previously with preliminary materials.

|

| |

|

|

|

|

|

|

|

|

|

|

|

[

]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the

|

| |

filing

for which the offsetting fee was paid previously. Identify the previous

filing by registration

|

| |

statement

number, or the Form or Schedule and the date of its filing.

|

| |

|

|

|

|

|

|

|

|

|

|

| |

(1)

|

Amount

Previously Paid:

|

| |

(2)

|

Form,

Schedule or Registration No.:

|

| |

(3)

|

Filing

Party:

|

| |

(4)

|

Date

Filed

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

California First Leasing Corporation

‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗ |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON january 31, 2024

The Annual Meeting of Shareholders of California First Leasing Corporation will be held on Wednesday, January 31, 2024 at 10:00 a.m., Pacific Standard time.

The Annual Meeting will be held (i) to elect a Board of Directors for the ensuing year, and (ii) to transact such other business as may properly come before the Annual Meeting and at any and all adjournments thereof. At the Annual Meeting, the Board of Directors of the Company intends to present Patrick E. Paddon, Glen T. Tsuma, Michael H. Lowry, Harris Ravine, Danilo Cacciamatta and Robert W. Kelley as nominees for election to the Board of Directors.

Only shareholders of record on the books of the Company at the close of business on December 15, 2023, the record date with respect to this solicitation, will be entitled to notice of and to vote at the Annual Meeting and at any adjournment thereof.

All shareholders are cordially invited to attend the Annual Meeting in person. If you are unable to do so, please execute the enclosed proxy and return it in the enclosed addressed envelope, since a majority of the outstanding shares must be represented at the meeting in order to transact business. Your promptness in returning the proxy will assist in the expeditious and orderly processing of the proxies. If you return your proxy, you may nevertheless attend the Annual Meeting and vote your shares in person if you wish.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting

to be held on January 31, 2024

A copy of this Notice of Annual Meeting and the Proxy Statement are available on the Internet at www.calfirstlease.com/investor/.

By Order of the Board of Directors

Glen T. Tsuma

Secretary

Newport Beach, California

December 20, 2023

CALIFORNIA FIRST LEASING CORPORATION

5000 Birch Street, Suite 500

Newport Beach, CA 92660

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 31, 2024

PROXY STATEMENT

SOLICITATION OF PROXIES

GENERAL INFORMATION AND VOTING PROCEDURES

The accompanying proxy is solicited by the Board of Directors of California First Leasing Corporation (the "Company") for use at the Company's Annual Meeting of Shareholders to be held on Wednesday, January 31, 2024, 10:00 a.m. Pacific Standard Time, and at any and all adjournments thereof. All shares represented by each properly executed and unrevoked proxy received in time for the Annual Meeting will be voted in the manner specified therein. Where no specification is made on a properly executed and returned proxy, and unless otherwise indicated in this proxy statement, the shares will be voted FOR the election of all nominees for Directors named in the proxy. Any shareholder has the power to revoke his or her proxy at any time before the Annual Meeting. A proxy may be revoked by delivering a written notice of revocation to the Secretary of the Company, by a subsequent proxy executed by the person executing the proxy and presented to the Annual Meeting or by attendance at the Annual Meeting and voting by the person executing the proxy.

This Proxy Statement is being mailed to the Company's shareholders on or about December 22, 2023. The solicitation of proxies will be made by mail and expenses will be paid by the Company, and will include forwarding solicitation materials regarding the meeting to beneficial owners of the Company's Common Stock. The mailing address of the Company's principal executive office is 5000 Birch Street, Suite 500, Newport Beach, CA 92660.

Outstanding Shares and Voting Rights

Only holders of record of the 9,309,387 shares of the Company's Common Stock outstanding at the close of business on December 15, 2023, the record date with respect to this solicitation, will be entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. In order to constitute a quorum for the conduct of business at the Annual Meeting, a majority of the outstanding shares of Common Stock of the Company entitled to vote at the meeting must be represented in person or by proxy at the Meeting. Shares represented by proxies that reflect abstentions or “broker non-votes” (shares held by a broker or nominee which are represented at the Meeting, but with respect to which the broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Abstentions are counted in tabulations of the votes cast on proposals presented to shareholders, and therefore will have the same effect as a negative vote, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved.

No shareholder will be entitled to cumulate votes (i.e., cast for any candidate for election to the Board of Directors, a number of votes greater than the number of the shareholder’s shares) unless the names of the candidate or candidates for whom votes will be cumulated have been placed in nomination prior to the voting and the shareholder has given notice at the meeting, prior to voting, of the shareholder's intention to cumulate votes. If any one shareholder has given such notice, all shareholders may cumulate their votes for candidates who have been nominated. If voting for directors is conducted by cumulative voting, each share will be entitled to a number of votes equal to the number of directors to be elected and the votes may be cast for a single candidate or may be distributed among two or more candidates in such proportions as the shareholder may determine. In the event of cumulative voting, the proxy holders intend to distribute the votes represented by the proxies solicited hereby in such proportions as they see fit. If the voting is not conducted by cumulative voting, each share will be entitled to one vote and the holders of the majority of the shares voting at the meeting will be able to elect all of the directors if they choose to do so. The candidates receiving the highest number of votes, up to the number of directors to be elected, will be elected. On all other matters, each share is entitled to one vote.

BENEFICIAL

OWNERSHIP OF PRINCIPAL SHAREHOLDERS, EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth certain

information as to the shares of the Common Stock beneficially owned as of

December 15, 2023 by the 1) Company's Executive Officers, 2) each member of the

Board of Directors, 3) all executive officers and directors as a group, and 4)

each person known by the Company to beneficially own 5% or more of the

outstanding stock.

| |

|

|

|

|

|

|

|

| |

|

|

Amount

of Common Stock

|

|

Percent

of Common Stock

|

|

Dollar

Range of Common

|

| |

Name of Beneficial Owners

|

|

Beneficially

Owned

|

|

Beneficially

Owned

|

|

Stock

Beneficially Owned

|

| |

Executive Officers

|

|

|

|

|

|

|

| |

Patrick E. Paddon

|

|

6,425,200

|

|

69.0%

|

|

Over

$100,000

|

| |

Glen T. Tsuma

|

|

1,344,422

|

|

14.4%

|

|

Over

$100,000

|

| |

S. Leslie Jewett

|

|

147,582

|

|

1.6%

|

|

Over

$100,000

|

| |

Independent Directors

|

|

|

|

|

|

|

| |

Michael H. Lowry

|

|

14,058

|

|

*

|

|

Over

$100,000

|

| |

Harris Ravine

|

|

14,200

|

|

*

|

|

Over

$100,000

|

| |

Danilo Cacciamatta

|

|

39,063

|

|

*

|

|

Over

$100,000

|

| |

Robert W. Kelley

|

|

4,061

|

|

*

|

|

$50,001

- $100,000

|

| |

Directors & Executive Officers (as group, 7)

|

|

7,988,586

|

|

85.8%

|

|

|

| |

|

|

|

|

|

|

|

| |

Over 5% Shareholders

|

|

|

|

|

|

|

| |

M3 Partners LP

|

|

605,490

|

|

6.5%

|

|

|

* Less than one

percent

ITEM 1

ELECTION OF DIRECTORS

Directors

are elected at each Annual Meeting of Shareholders and hold office until their

respective successors are duly elected and qualified. It is the intention of

the persons named in the enclosed form of proxy, unless the proxy specifies

otherwise, to vote the shares represented by the proxy FOR the election of the

nominees set forth below. Although it is anticipated that each nominee will be

available to serve as a director, should any nominee become unavailable to

serve, the proxies will be voted for such other person as may be designated by

the Company's Board of Directors.

Director

Nominees

The nominees for the

Board of Directors are set forth below. Certain information as of December 15,

2023 with respect to the nominees, including the number of shares of the

Company's Common Stock beneficially owned by each of them is previously set

forth under "Ownership of Principal Shareholders, Executive Officers and Directors.”

The address of each director and officer is c/o California First Leasing

Corporation, 5000 Birch Street, Suite 500, Newport Beach, CA 92660.

Interested Directors

Patrick

E. Paddon, age 72,

founded the Company in 1977, has served as the President and a Director of the

Company since its inception and has been Chief Executive Officer since 1990. From

October 2013 to February 2021, Mr. Paddon served as a director of California

First National Bank (“CalFirst Bank”), and served as Chief Executive Officer of

CalFirst Bank from October 2015 until it was sold in February 2021. Mr. Paddon

is the spouse of Ms. Jewett. Mr. Paddon is qualified to be a director and

Chairman of the Board based upon over forty-five years of leadership experience

with the Company and his extensive knowledge of its business, operations, investments

and resources.

Glen

T. Tsuma, age 71,

joined the Company in May 1981, has been Chief Operating Officer since August

1989 and Secretary since October 1991. From June 2011 to February 2021, Mr.

Tsuma was Vice Chairman of CalFirst Bank. Prior to joining the Company, he was

an audit manager with Arthur Young & Company. Mr. Tsuma’s over 40-year year

involvement with the Company and extensive knowledge of the business, investments,

customers, capabilities and resources qualify him to continue as a director.

Independent

Directors:

Michael

H. Lowry, age 79, was

elected to the Board of Directors in August 1992. From May 2011 to February

2021, Mr. Lowry also served as a director of CalFirst Bank. From 1994 until he

retired in December 2010, Mr. Lowry was a Managing Director of Nomura

Securities North America, LLC, an investment banking firm. Prior to joining

Nomura Securities, Mr. Lowry had been employed by the investment banking firm

of Bear Stearns & Co., Inc. from 1991 to 1993 and by the investment banking

firm of Kidder, Peabody & Co. Incorporated from 1970 to 1990. Mr. Lowry has

committed thirty years of service to the Board and is qualified to continue

based on this and his experience in various aspects of investment banking and

finance, including extensive knowledge and expertise related to capital and

investment markets, and working with Boards of Directors on transactional and

corporate governance matters.

Harris

Ravine, age 80, was

elected to the Board of Directors in February 1994, and served as Chairman of

the Board of CalFirst Bank from May 2001 to February 2021. Mr. Ravine was Chief

Operating Officer from March 2009 through June 2017 for Rocky Mountain Public

Broadcasting, Inc., the holder and operator of five public broadcasting

licenses in the State of Colorado. Prior to that, he was Managing Director with

The Ravine Group, an advisory services and investment firm. Mr. Ravine has been

a director of the Company for twenty-eight years and is qualified to continue

based on his service to the Company as well as his prior experience as chief

executive of a public company.

Danilo

Cacciamatta, age 77,

was elected to the Board of Directors in June 2001 and served as a director

of CalFirst Bank from May 2001 to February 2021. Mr. Cacciamatta was the Chief

Executive Officer of Cacciamatta Accountancy Corporation until May 2010, a

position he held for more than ten years. Mr. Cacciamatta’s years of experience

in public accounting, which included sixteen years with KPMG Peat Marwick,

brings important technical and financial expertise to the Board, including the

ability to understand and explain accounting, regulatory and tax matters. The

Board has determined that Mr. Cacciamatta qualifies as an “audit committee

financial expert” under SEC rules and regulations.

Robert

W. Kelley, age 85, was elected to the Board of Directors in December 2020 and

served as a director of CalFirst Bank from May 2001 to February 2021. From 1965

through 1995, Mr. Kelley was employed by the Office of the Comptroller of the

Currency (“OCC”) as Senior National Bank Examiner, including serving as Examiner-in-Charge

of the Los Angeles and Orange subregions. After retiring from the OCC, Mr.

Kelley served as an independent consultant to large and small financial

institutions. Mr. Kelley has a broad perspective based on his tenure on the Company’s

Board as well as his experience on commercial credit matters as a bank

regulator.

Executive Officer, not a director:

S.

Leslie Jewett, age 68, joined the Company in September 1991 as Vice President -

Finance. In April 1994, Ms. Jewett was named Chief Financial Officer of the

Company. From May 2001 to February 2021, Ms. Jewett served as a director of

CalFirst Bank, and from October 2011 thru October 2015 she also served as

President of CalFirst Bank. From 1981 to 1990, she held various positions in

the Corporate Finance group at Kidder, Peabody & Co. Incorporated. Ms.

Jewett has a BA from Swarthmore College and an MBA from Stanford University.

Ms. Jewett is the spouse of Mr. Paddon.

Corporate Governance Policies and Practices

The Company is an internally managed

non-diversified closed-end investment company registered under the Investment

Company Act of 1940, as amended (the “1940 Act”). With over 60% of the

Company’s Common Stock owned by Patrick Paddon, Chairman and Chief Executive

Officer, the Company is a “controlled company”. Notwithstanding such control,

four of the seven Directors, a majority, are considered to be “independent

directors” in accordance with guidelines established by the OTCQX Market and not “interested persons” as defined in

Section 2(a)(19) of the 1940 Act. No Independent Director has a material

relationship with the Company that would impair their independence from

management or otherwise compromise their ability to act as an Independent

Director. Based on the small size of the Board, long service and different

qualifications and contributions of the Independent Directors, the Company does

not have a lead independent director.

The position

of Chairman of the Board of Directors and Chief Executive Officer are both held

by Mr. Paddon. As founder of the Company and majority shareholder owning more

than 69% of the Company’s common stock, the Board of Directors believes this

leadership structure is appropriate for the Company. Mr. Paddon has extensive

knowledge of the Company’s strategy and challenges, operations and financial

condition, and is best situated to set agendas and lead discussions on matters

affecting the Company’s business. Based on his holdings in the Company’s common

stock and 46-year history of leadership, the Board believes Mr. Paddon’s

interests are consistent with the best interests of CFNB shareholders.

The Company’s management is responsible

for the day-to-day management of the lease and investment businesses and the

risks the Company faces, while the Board of Directors has overall

responsibility for risk oversight with a focus on the most significant risks

related to market, credit, liquidity and operations, as well as regulatory risk

and overall enterprise risk. The Board regularly engages in discussions of the

Company’s business and investment operations, receives financial reports that

inform its oversight of the Company at quarterly meetings, and receives interim

reports on an ad hoc basis between meeting that keep them informed. The Board

has established an Audit Committee.

Director Meetings

The Board of Directors holds regularly

scheduled quarterly meetings, with Audit Committee meetings occurring as

necessary. The Board of Directors met five times in person or by video

conference during the year ended June 30, 2023, with all directors in attendance

at each meeting.

Audit Committee and Independent Accountants

The Audit Committee of the Board of

Directors is made up of only the Independent Directors identified above. The

Board of Directors has determined that each Audit Committee member has sufficient

knowledge in financial and auditing matters to serve on the committee, and

further that Mr. Cacciamatta is an “audit committee financial expert” as

that term is defined in regulations issued by national securities exchanges and

the 1940 Act. The Audit Committee has responsibility for oversight of: (a) the

financial reports and other financial information provided by the Company to

any governmental or regulatory body, the public or other users thereof, (b) the

Company's systems of internal accounting and financial controls, (c) compliance

with rule 17f-2 of the 1940 Act, and (d) the annual audit of the Company's

financial statements. The Audit Committee has the sole authority and

responsibility for selecting the firm of independent public accountants to be

retained by the Company to perform the audit and certification of 1940 Act

compliance, and a shareholder vote on such selection is not required as long as

the audit committee is composed solely of independent directors. The Audit

Committee has authority to engage legal counsel or other experts or

consultants, as it deems appropriate to carry out its responsibilities. The

Board of Directors adopted an Audit Committee Charter in June 2000, amended it

in August 2002 and October 2004 and subsequently amended and restated it in May

2021. The Audit Committee met two times during fiscal 2023.

For the fiscal year ended

June 30, 2023, the Audit Committee recommended and a majority of the directors who were not

“interested persons” (as defined under the 1940 Act) retained the

independent registered public accounting firm Eide Bailly LLP to complete the

audit of the annual financial statements and certification of compliance with

the requirements of 17f-2 of the 1940 Act. Prior to the commencement of the audit,

the Audit Committee discussed with management and Eide Bailly the overall scope

and plans for the audit. Subsequent to the completion of the audit, the Audit

Committee discussed with Eide Bailly the results of their examination and had the

opportunity for a discussion without management present. In addition, the

Audit Committee discussed with Eide Bailly matters required to be discussed by

Statements on Auditing Standards No. 61, “Communication with Audit

Committees” as amended by Statement on Auditing Standards No. 90, “Audit

Committee Communications.” The Audit Committee has also received the written

disclosures from Eide Bailly meeting

applicable requirements for independent auditor communications with Audit

Committees concerning independence. The Audit

Committee discussed with Eide Bailly its independence from the Company and

management and considered the compatibility of non-audit services with the

independent auditors’ independence. A representative of Eide Bailly LLP is not

expected to be present at the meeting.

Communication with the Board of Directors

Stockholders who wish to communicate with the Board of Directors or one or more individual Directors may do so by writing to such Director or Directors at the Company’s corporate headquarters: c/o Corporate Secretary, California First Leasing Corporation, 5000 Birch Street, Suite 500, Newport Beach, California 92660. Stockholders and employees who wish to contact the Board of Directors or any member of the Audit Committee to report questionable accounting or auditing matters may do so anonymously by using the address above and addressing the communication to the Audit Committee, or by communicating by email to auditcommittee@calfirstlease.com. Any written request so received will be handled in accordance with procedures approved by the Board of Directors.

Transactions with Related Persons

Apart from service as an executive officer or on the Board of Directors, there are no additional relationships between the Company and any Related Person, nor are there any related party transactions between any Related Persons and the Company. A "Related Person" is any director or executive officer of the Company, any shareholder owning in excess of 5% of the total equity of the Company, and any "immediate family member" of any such person.

Officer and Director Compensation

The following table discloses compensation paid by the Company to the three highest-paid executive officers for the fiscal year ended June 30, 2023. No executive officer receives any incentive compensation related to the performance of the investment or lease portfolios. Each non-employee director is paid an annual retainer of $36,000 plus expenses for service on the Company’s Board. Directors who are employees of the Company do not receive any fees for their services as directors. There are no pension or retirement benefits accrued as part of expenses, or stock related compensation for any director or executive officer.

|

Name and Position |

Salary |

Other

Compensation (1) |

Total |

|

Patrick Paddon

President. Chief Executive Officer |

$180,000 |

$ |

8,191 |

$188,191 |

|

|

|

|

|

|

Glen T. Tsuma

Chief Operating Officer |

$180,000 |

$ |

5,975 |

$185,975 |

|

|

|

|

|

|

S. Leslie Jewett

Chief Financial Officer |

$216,539 |

$ |

4,500 |

$221,039 |

|

|

|

|

|

___

(1) Includes contribution under the Company's 401(k) Plan, certain professional fees, and club memberships.

The Company has not entered into any employment agreements with any executive officers and all officers are considered “at will” employees. The Company has no commitments for payments to be made or benefits provided in the event the employment of the executive officer is terminated.

Other Benefits

The Company’s executive officers are eligible to receive the same health benefits that are available to other employees and a contribution to their benefit premium that is the same as provided to other employees. The Company maintains a tax-qualified 401(k) Plan which provides for participation by all employees and non-discretionary matching contributions by the Company in an amount equal to 50% of an employee’s pretax contributions, subject to a maximum of $2,000. The only special benefits provided to executive officers include the payment of certain tax preparation fees (approved by the audit committee), and health club membership fees. All these costs are included in the column labeled "All Other Compensation" in the compensation table above.

The Company does not maintain or make contributions to a defined benefit plan for any employees. The Company indemnifies each of the executive officers to the fullest extent permitted under California law against expenses and, in certain cases, judgments, settlements or other payments incurred by the officer or director in suits brought by the Company, derivative actions brought by shareholders and suits brought by other third parties related to the officer’s or director’s service to the Company. The 1940 Act prohibits the protection of any officer or director against any liability arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

Section 16 Reports

Upon registering under the 1940 Act, the Company’s directors and officers and persons who beneficially own more than 10% of any class of our equity securities were again required to file with the SEC reports of ownership and changes in ownership of the Company’s common stock held by them. Based on our review of these reports, we believe that during the fiscal year ended June 30, 2023 and through December 15, 2023, all such reports that were required to be filed were filed on a timely basis.

ANNUAL REPORT

The Annual Report for the fiscal year ended June 30, 2023 was made available to shareholders and filed with the SEC in August 2023. The report contains important information about the Company, including its audited financial statements and statement of investments as of June 30, 2023. A copy of the annual report and additional details are available at www.CalFirstLease.com. A paper copy of the annual report is available by request to invest@calfirstlease.com or call 1(800) 496-4640; shareholders will not otherwise receive a paper copy. A shareholder can at any time elect to receive paper copies of future reports by contacting the Company pursuant to the foregoing sentence.

To minimize mailing costs, the Company may send a single copy of this proxy statement to any household at which two or more shareholders reside if they appear to be members of the same family. With this practice, however, each shareholder continues to receive a separate proxy card for voting. Any shareholder that desires to receive multiple copies of annual reports and proxy statements can communicate by email to invest@calfirstlease.com or should call Investor Relations at 949-255-0500.

PROPOSALS OF SHAREHOLDERS

All proposals of shareholders intended to be presented at the Company's 2024 Annual Meeting of Shareholders must be directed to the attention of and received by the Secretary of the Company at the address of the Company set forth on the first page of this Proxy Statement, before August 24, 2024. To be eligible to submit a proposal for inclusion in the Company’s proxy materials, a stockholder must be a holder of either: (1) at least $2,000 in market value or (2) 1% of the company’s shares of common stock entitled to be voted on the proposal, and must have held such shares for at least one year, and continue to hold those shares through the date of such annual meeting.

OTHER MATTERS

At the time of the preparation of this Proxy Statement, the Board of Directors knows of no other matters that will be acted upon at the Annual Meeting. If any other matters are properly presented for action at the Annual Meeting or any adjournment thereof, proxies will be voted with respect thereto in accordance with the best judgment and in the discretion of the proxy holders.

By Order of the Board of Directors

Glen T. Tsuma

Secretary

Newport Beach, California

December 20, 2023

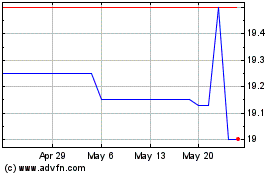

California First Leasing (QX) (USOTC:CFNB)

Historical Stock Chart

From Apr 2024 to May 2024

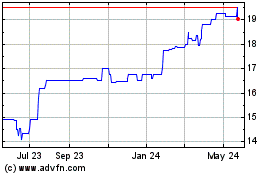

California First Leasing (QX) (USOTC:CFNB)

Historical Stock Chart

From May 2023 to May 2024