0000015847

BUTLER NATIONAL CORP

false

--04-30

Q1

2024

10,886

10,603

12,469

12,290

5

5

50,000,000

50,000,000

200,000

200,000

200,000

200,000

100

100

9.8

9.8

100

100

100

100

0

0

0

0

1,000

1,000

6

6

1,000

1,000

1,000

1,000

0

0

0

0

0.01

0.01

100,000,000

100,000,000

79,571,211

68,727,900

80,871,211

76,891,689

10,843,311

3,979,522

5

39

5

5

5

7

20

5

3

5

0

5

46

50

2

2

1

5

These shares of common stock were purchased through a private transaction

00000158472023-05-012023-07-31

xbrli:shares

00000158472023-09-14

iso4217:USD

00000158472023-07-31

00000158472023-04-30

iso4217:USDxbrli:shares

0000015847us-gaap:PreferredClassAMember2023-07-31

0000015847us-gaap:PreferredClassAMember2023-04-30

0000015847us-gaap:PreferredClassBMember2023-07-31

0000015847us-gaap:PreferredClassBMember2023-04-30

xbrli:pure

0000015847us-gaap:PreferredClassAMember2023-05-012023-07-31

0000015847us-gaap:PreferredClassAMember2022-05-012023-04-30

0000015847us-gaap:PreferredClassBMember2023-05-012023-07-31

0000015847us-gaap:PreferredClassBMember2022-05-012023-04-30

0000015847buks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:AerospaceProductsMember2022-05-012022-07-31

00000158472022-05-012022-07-31

0000015847us-gaap:CommonStockMember2022-04-30

0000015847us-gaap:AdditionalPaidInCapitalMember2022-04-30

0000015847us-gaap:TreasuryStockCommonMember2022-04-30

0000015847us-gaap:RetainedEarningsMember2022-04-30

0000015847us-gaap:ParentMember2022-04-30

0000015847us-gaap:CommonStockMember2022-05-012022-07-31

0000015847us-gaap:AdditionalPaidInCapitalMember2022-05-012022-07-31

0000015847us-gaap:TreasuryStockCommonMember2022-05-012022-07-31

0000015847us-gaap:RetainedEarningsMember2022-05-012022-07-31

0000015847us-gaap:ParentMember2022-05-012022-07-31

0000015847us-gaap:CommonStockMember2022-07-31

0000015847us-gaap:AdditionalPaidInCapitalMember2022-07-31

0000015847us-gaap:TreasuryStockCommonMember2022-07-31

0000015847us-gaap:RetainedEarningsMember2022-07-31

0000015847us-gaap:ParentMember2022-07-31

0000015847us-gaap:CommonStockMember2023-04-30

0000015847us-gaap:AdditionalPaidInCapitalMember2023-04-30

0000015847us-gaap:TreasuryStockCommonMember2023-04-30

0000015847us-gaap:RetainedEarningsMember2023-04-30

0000015847us-gaap:ParentMember2023-04-30

0000015847us-gaap:CommonStockMember2023-05-012023-07-31

0000015847us-gaap:AdditionalPaidInCapitalMember2023-05-012023-07-31

0000015847us-gaap:TreasuryStockCommonMember2023-05-012023-07-31

0000015847us-gaap:RetainedEarningsMember2023-05-012023-07-31

0000015847us-gaap:ParentMember2023-05-012023-07-31

0000015847us-gaap:CommonStockMember2023-07-31

0000015847us-gaap:AdditionalPaidInCapitalMember2023-07-31

0000015847us-gaap:TreasuryStockCommonMember2023-07-31

0000015847us-gaap:RetainedEarningsMember2023-07-31

0000015847us-gaap:ParentMember2023-07-31

00000158472022-04-30

00000158472022-07-31

utr:D

0000015847buks:ProfessionalServicesMembersrt:NorthAmericaMember2023-05-012023-07-31

0000015847buks:AerospaceProductsMembersrt:NorthAmericaMember2023-05-012023-07-31

0000015847srt:NorthAmericaMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMembersrt:NorthAmericaMember2022-05-012022-07-31

0000015847buks:AerospaceProductsMembersrt:NorthAmericaMember2022-05-012022-07-31

0000015847srt:NorthAmericaMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMembersrt:EuropeMember2023-05-012023-07-31

0000015847buks:AerospaceProductsMembersrt:EuropeMember2023-05-012023-07-31

0000015847srt:EuropeMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMembersrt:EuropeMember2022-05-012022-07-31

0000015847buks:AerospaceProductsMembersrt:EuropeMember2022-05-012022-07-31

0000015847srt:EuropeMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMemberbuks:OtherMember2023-05-012023-07-31

0000015847buks:AerospaceProductsMemberbuks:OtherMember2023-05-012023-07-31

0000015847buks:OtherMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMemberbuks:OtherMember2022-05-012022-07-31

0000015847buks:AerospaceProductsMemberbuks:OtherMember2022-05-012022-07-31

0000015847buks:OtherMember2022-05-012022-07-31

0000015847us-gaap:CasinoMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847us-gaap:CasinoMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847us-gaap:CasinoMember2023-05-012023-07-31

0000015847us-gaap:CasinoMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847us-gaap:CasinoMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847us-gaap:CasinoMember2022-05-012022-07-31

0000015847buks:SportsbookMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:SportsbookMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:SportsbookMember2023-05-012023-07-31

0000015847buks:SportsbookMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:SportsbookMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847buks:SportsbookMember2022-05-012022-07-31

0000015847buks:CasinoNongamingMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:CasinoNongamingMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:CasinoNongamingMember2023-05-012023-07-31

0000015847buks:CasinoNongamingMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:CasinoNongamingMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847buks:CasinoNongamingMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:AircraftModificationMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:AircraftModificationMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:AircraftModificationMember2023-05-012023-07-31

0000015847buks:AircraftModificationMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:AircraftModificationMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847buks:AircraftModificationMember2022-05-012022-07-31

0000015847buks:AircraftAvionicsMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:AircraftAvionicsMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:AircraftAvionicsMember2023-05-012023-07-31

0000015847buks:AircraftAvionicsMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:AircraftAvionicsMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847buks:AircraftAvionicsMember2022-05-012022-07-31

0000015847buks:SpecialMissionElectronicsMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847buks:SpecialMissionElectronicsMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847buks:SpecialMissionElectronicsMember2023-05-012023-07-31

0000015847buks:SpecialMissionElectronicsMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847buks:SpecialMissionElectronicsMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847buks:SpecialMissionElectronicsMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMemberbuks:PercentageOfCompletionContractsMember2023-05-012023-07-31

0000015847buks:AerospaceProductsMemberbuks:PercentageOfCompletionContractsMember2023-05-012023-07-31

0000015847buks:PercentageOfCompletionContractsMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMemberbuks:PercentageOfCompletionContractsMember2022-05-012022-07-31

0000015847buks:AerospaceProductsMemberbuks:PercentageOfCompletionContractsMember2022-05-012022-07-31

0000015847buks:PercentageOfCompletionContractsMember2022-05-012022-07-31

0000015847buks:ProfessionalServicesMemberus-gaap:TransferredAtPointInTimeMember2023-05-012023-07-31

0000015847buks:AerospaceProductsMemberus-gaap:TransferredAtPointInTimeMember2023-05-012023-07-31

0000015847us-gaap:TransferredAtPointInTimeMember2023-05-012023-07-31

0000015847buks:ProfessionalServicesMemberus-gaap:TransferredAtPointInTimeMember2022-05-012022-07-31

0000015847buks:AerospaceProductsMemberus-gaap:TransferredAtPointInTimeMember2022-05-012022-07-31

0000015847us-gaap:TransferredAtPointInTimeMember2022-05-012022-07-31

utr:Y

0000015847us-gaap:LandMember2023-07-31

0000015847us-gaap:LandMember2023-04-30

0000015847us-gaap:BuildingAndBuildingImprovementsMember2023-07-31

0000015847us-gaap:BuildingAndBuildingImprovementsMember2023-04-30

0000015847buks:AircraftMember2023-07-31

0000015847buks:AircraftMember2023-04-30

0000015847us-gaap:MachineryAndEquipmentMember2023-07-31

0000015847us-gaap:MachineryAndEquipmentMember2023-04-30

0000015847us-gaap:FurnitureAndFixturesMember2023-07-31

0000015847us-gaap:FurnitureAndFixturesMember2023-04-30

0000015847us-gaap:LeaseholdImprovementsMember2023-07-31

0000015847us-gaap:LeaseholdImprovementsMember2023-04-30

0000015847buks:NotesCollateralizedByBHCMCsAssetsAndCompensationDueUnderStateManagementContractDueDecember2027Member2023-07-31

0000015847buks:NotesCollateralizedByBHCMCsAssetsAndCompensationDueUnderStateManagementContractDueDecember2027Member2023-05-012023-07-31

0000015847buks:NotesCollateralizedByBHCMCsAssetsAndCompensationDueUnderStateManagementContractDueOctober2026Member2023-07-31

0000015847buks:NotesCollateralizedByBHCMCsAssetsAndCompensationDueUnderStateManagementContractDueOctober2026Member2023-05-012023-07-31

0000015847buks:NoteOneCollateralizedByRealEstateDueMarch2029Member2023-07-31

0000015847buks:NoteTwoCollateralizedByRealEstateDueMarch2029Member2023-07-31

0000015847buks:PatriotsBankMemberbuks:NoteCollateralizedByAircraftSecurityAgreementMember2023-07-31

0000015847buks:NoteCollateralizedByEquipmentDueOctober2025Member2023-07-31

0000015847buks:KansasExpandedLotteryActContractPrivilegeMember2023-07-31

0000015847buks:GamingEquipmentMember2023-07-31

0000015847buks:JETAutopilotIntellectualPropertyMember2023-07-31

0000015847buks:OtherMiscellaneousLongtermAssetsMember2023-07-31

0000015847buks:ButlerNationalCorporation2016EquityIncentivePlanMember2016-11-30

0000015847us-gaap:RestrictedStockMemberbuks:ButlerNationalCorporation2016EquityIncentivePlanMember2019-04-122019-04-12

0000015847us-gaap:RestrictedStockMemberbuks:ButlerNationalCorporation2016EquityIncentivePlanMember2019-04-12

0000015847buks:ButlerNationalCorporation2016EquityIncentivePlanMember2019-04-122019-04-12

0000015847us-gaap:RestrictedStockMemberbuks:ButlerNationalCorporation2016EquityIncentivePlanMember2020-03-172020-03-17

0000015847us-gaap:RestrictedStockMemberbuks:ButlerNationalCorporation2016EquityIncentivePlanMember2020-03-17

0000015847buks:ButlerNationalCorporation2016EquityIncentivePlanMember2020-03-172020-03-17

0000015847buks:ButlerNationalCorporation2016EquityIncentivePlanMembersrt:DirectorMember2022-07-012022-07-31

0000015847buks:ButlerNationalCorporation2016EquityIncentivePlanMembersrt:DirectorMember2022-07-31

0000015847buks:ButlerNationalCorporation2016EquityIncentivePlanMember2023-05-012023-07-31

00000158472019-04-11

00000158472019-04-122022-04-30

00000158472022-05-012023-04-30

00000158472023-07-20

00000158472016-05-012022-04-30

00000158472022-08-012022-10-31

00000158472022-10-31

00000158472022-11-012023-01-31

00000158472023-01-31

00000158472023-02-012023-04-30

0000015847buks:IncreaseInProgramAuthorizationMember2023-07-31

00000158472016-05-012023-07-31

0000015847buks:CasinoHangarAndOfficeSpaceOneMember2023-07-31

0000015847buks:CasinoHangarAndOfficeSpaceTwoMember2023-07-31

0000015847buks:CasinoHangarAndOfficeSpaceThreeMember2023-07-31

0000015847buks:GamingMember2023-05-012023-07-31

0000015847us-gaap:ProductAndServiceOtherMember2023-05-012023-07-31

0000015847buks:GamingMember2022-05-012022-07-31

0000015847us-gaap:ProductAndServiceOtherMember2022-05-012022-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-05-012023-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-05-012022-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:AerospaceProductsMember2023-05-012023-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:AerospaceProductsMember2022-05-012022-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:ProfessionalServicesMember2023-05-012023-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:ProfessionalServicesMember2022-05-012022-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:TheFiveAerospaceCustomersMember2023-05-012023-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:TopCustomerMember2023-05-012023-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:NextTopFourCustomersMembersrt:MinimumMember2023-05-012023-07-31

0000015847us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbuks:NextTopFourCustomersMembersrt:MaximumMember2023-05-012023-07-31

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended July 31, 2023

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to _____________

Commission File Number 0-1678

BUTLER NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

| Kansas | | 41-0834293 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

One Aero Plaza, New Century, Kansas 66031

(Address of principal executive offices)(Zip Code)

Registrant's telephone number, including area code: (913) 829-4606

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock $.01 Par Value

(Title of Class)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files): Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☐ |

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes ☐ No ☒

The number of shares outstanding of the Registrant's Common Stock, $0.01 par value, as of September 14, 2023 was 68,727,900 shares.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BUTLER NATIONAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

As of July 31, 2023 and April 30, 2023

(in thousands except per share data)

| | | July 31, 2023 | | | April 30, 2023 | |

| | | (unaudited) | | | | | |

| ASSETS | | | | | | | | |

| CURRENT ASSETS: | | | | | | | | |

| Cash | | $ | 14,236 | | | $ | 21,997 | |

| Accounts receivable, net | | | 3,260 | | | | 3,793 | |

| Inventory, net | | | 9,047 | | | | 8,947 | |

| Contract asset | | | 3,169 | | | | 1,893 | |

| Prepaid expenses and other current assets | | | 2,066 | | | | 3,532 | |

| Total current assets | | | 31,778 | | | | 40,162 | |

| | | | | | | | | |

| LEASE RIGHT-TO-USE ASSET, net | | | 3,033 | | | | 3,081 | |

| | | | | | | | | |

| PROPERTY, PLANT AND EQUIPMENT, net | | | 58,335 | | | | 59,067 | |

| | | | | | | | | |

| SUPPLEMENTAL TYPE CERTIFICATES (net of accumulated amortization of $10,886 at July 31, 2023 and $10,603 at April 30, 2023) | | | 9,061 | | | | 8,722 | |

| | | | | | | | | |

| OTHER ASSETS: | | | | | | | | |

| Other assets (net of accumulated amortization of $12,469 at July 31, 2023 and $12,290 at April 30, 2023) | | | 1,320 | | | | 1,401 | |

| Deferred tax asset, net | | | 1,473 | | | | 1,473 | |

| Total other assets | | | 2,793 | | | | 2,874 | |

| Total assets | | $ | 105,000 | | | $ | 113,906 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | |

| Accounts payable | | $ | 4,168 | | | $ | 5,320 | |

| Current maturities of long-term debt | | | 4,815 | | | | 4,987 | |

| Current maturities of lease liability | | | 136 | | | | 145 | |

| Contract liability | | | 9,256 | | | | 6,031 | |

| Gaming facility mandated payment | | | 1,449 | | | | 1,730 | |

| Compensation and compensated absences | | | 1,543 | | | | 6,722 | |

| Income taxes payable | | | 493 | | | | 228 | |

| Other current liabilities | | | 350 | | | | 214 | |

| Total current liabilities | | | 22,210 | | | | 25,377 | |

| | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| Long-term debt, net of current maturities | | | 37,252 | | | | 38,418 | |

| Lease liability, net of current maturities | | | 3,322 | | | | 3,330 | |

| Total long-term liabilities | | | 40,574 | | | | 41,748 | |

| Total liabilities | | | 62,784 | | | | 67,125 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY: | | | | | | | | |

| Preferred stock, par value $5: Authorized 50,000,000 shares, all classes; Designated Classes A and B 200,000 shares; $100 Class A, 9.8%, cumulative if earned liquidation and redemption value $100, no shares issued and outstanding | | | - | | | | - | |

| $1,000 Class B, 6%, convertible cumulative, liquidation and redemption value $1,000, no shares issued and outstanding | | | - | | | | - | |

| Common stock, par value $.01: Authorized 100,000,000 shares, issued 79,571,211 shares, and outstanding 68,727,900 shares at July 31, 2023 and issued 80,871,211 shares, and outstanding 76,891,689 shares at April 30, 2023 | | | 795 | | | | 808 | |

| Capital contributed in excess of par | | | 13,411 | | | | 13,647 | |

| Treasury stock at cost, 10,843,311 shares at July 31, 2023 and 3,979,522 shares at April 30, 2023 | | | (7,173 | ) | | | (2,138 | ) |

| Retained earnings | | | 35,183 | | | | 34,464 | |

| Total stockholders' equity | | | 42,216 | | | | 46,781 | |

| Total liabilities and stockholders' equity | | $ | 105,000 | | | $ | 113,906 | |

See accompanying notes to condensed consolidated financial statements (unaudited)

BUTLER NATIONAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED July 31, 2023 AND 2022

(in thousands, except per share data)

(unaudited)

| | | THREE MONTHS ENDED | |

| | | July 31, | |

| | | 2023 | | | 2022 | |

| REVENUE: | | | | | | | | |

| Professional services | | $ | 9,041 | | | $ | 8,962 | |

| Aerospace products | | | 8,144 | | | | 6,342 | |

| Total revenues | | | 17,185 | | | | 15,304 | |

| | | | | | | | | |

| COSTS AND EXPENSES: | | | | | | | | |

| Cost of professional Services | | | 3,946 | | | | 3,623 | |

| Cost of aerospace products | | | 7,326 | | | | 4,827 | |

| Marketing and advertising | | | 1,278 | | | | 1,331 | |

| General, administrative and other | | | 3,498 | | | | 3,898 | |

| Total costs and expenses | | | 16,048 | | | | 13,679 | |

| | | | | | | | | |

| OPERATING INCOME | | | 1,137 | | | | 1,625 | |

| | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | |

| Interest expense | | | (639 | ) | | | (723 | ) |

| Gain on sale of airplanes | | | 440 | | | | - | |

| Gain on sale of building | | | - | | | | 69 | |

| Interest income | | | 47 | | | | - | |

| Total other expense | | | (152 | ) | | | (654 | ) |

| | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | 985 | | | | 971 | |

| | | | | | | | | |

| PROVISION FOR INCOME TAXES: | | | | | | | | |

| Provision for income taxes | | | 266 | | | | 260 | |

| Deferred income taxes | | | - | | | | 280 | |

| | | | | | | | | |

| NET INCOME | | $ | 719 | | | $ | 431 | |

| | | | | | | | | |

| BASIC EARNINGS PER COMMON SHARE | | $ | 0.01 | | | $ | 0.01 | |

| | | | | | | | | |

| WEIGHTED AVERAGE SHARES USED IN PER SHARE CALCULATION | | | 75,198,532 | | | | 76,456,284 | |

| | | | | | | | | |

| DILUTED EARNINGS PER COMMON SHARE | | $ | 0.01 | | | $ | 0.01 | |

| | | | | | | | | |

| WEIGHTED AVERAGE SHARES USED IN PER SHARE CALCULATION | | | 75,198,532 | | | | 76,456,284 | |

See accompanying notes to condensed consolidated financial statements (unaudited)

BUTLER NATIONAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

FOR THE three MONTHS ENDED July 31, 2023 AND 2022

(dollars in thousands) (unaudited)

| |

|

Shares of Common Stock |

|

|

Common Stock |

|

|

Capital Contributed in Excess of Par |

|

|

Shares of Treasury Stock |

|

|

Treasury Stock at Cost |

|

|

Retained Earnings |

|

|

Total Stock-holders’ Equity |

|

| Balance, April 30, 2022 |

|

|

80,348,572 |

|

|

$ |

803 |

|

|

$ |

12,160 |

|

|

|

3,890,426 |

|

|

$ |

(2,077 |

) |

|

$ |

29,948 |

|

|

$ |

40,834 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock repurchase |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,639 |

|

|

|

(2 |

) |

|

|

- |

|

|

|

(2 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock awarded to Director |

|

|

400,000 |

|

|

|

4 |

|

|

|

348 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

352 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred compensation, restricted stock |

|

|

(75,000 |

) |

|

|

- |

|

|

|

132 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

431 |

|

|

|

431 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, July 31, 2022 |

|

|

80,673,572 |

|

|

$ |

807 |

|

|

$ |

12,640 |

|

|

|

3,892,065 |

|

|

$ |

(2,079 |

) |

|

$ |

30,379 |

|

|

$ |

41,747 |

|

| |

|

Shares of Common Stock |

|

|

Common Stock |

|

|

Capital Contributed in Excess of Par |

|

|

Shares of Treasury Stock |

|

|

Treasury Stock at Cost |

|

|

Retained Earnings |

|

|

Total Stock-holders’ Equity |

|

| Balance, April 30, 2023 |

|

|

80,871,211 |

|

|

$ |

808 |

|

|

$ |

13,647 |

|

|

|

3,979,522 |

|

|

$ |

(2,138 |

) |

|

$ |

34,464 |

|

|

$ |

46,781 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock repurchase |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,863,789 |

|

|

|

(5,035 |

) |

|

|

- |

|

|

|

(5,035 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred compensation, restricted stock |

|

|

(1,300,000 |

) |

|

|

(13 |

) |

|

|

(236 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(249 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

719 |

|

|

|

719 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, July 31, 2023 |

|

|

79,571,211 |

|

|

$ |

795 |

|

|

$ |

13,411 |

|

|

|

10,843,311 |

|

|

$ |

(7,173 |

) |

|

$ |

35,183 |

|

|

$ |

42,216 |

|

See accompanying notes to condensed consolidated financial statements (unaudited)

BUTLER NATIONAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE three MONTHS ENDED July 31, 2023 AND 2022

(in thousands)

(unaudited)

| | | THREE MONTHS ENDED | |

| | | July 31, | |

| | | 2023 | | | 2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net income | | $ | 719 | | | $ | 431 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities | | | | | | | | |

| Depreciation and amortization | | | 1,423 | | | | 1,458 | |

| Stock awarded to director | | | - | | | | 352 | |

| Deferred income tax expense | | | - | | | | 280 | |

| Gain on sale of airplane | | | (440 | ) | | | - | |

| Gain on sale of building | | | - | | | | (69 | ) |

| Deferred compensation, restricted stock | | | (249 | ) | | | 132 | |

| | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | 533 | | | | 21 | |

| Inventory | | | (100 | ) | | | (449 | ) |

| Contract assets | | | (1,276 | ) | | | 326 | |

| Prepaid expenses and other assets | | | 1,466 | | | | (241 | ) |

| Accounts payable | | | (1,152 | ) | | | (37 | ) |

| Contract liability | | | 3,225 | | | | 3,344 | |

| Lease liability | | | 48 | | | | 45 | |

| Accrued liabilities | | | (5,179 | ) | | | (372 | ) |

| Gaming facility mandated payment | | | (281 | ) | | | (308 | ) |

| Income tax payable | | | 265 | | | | 260 | |

| Other liabilities | | | 136 | | | | 137 | |

| Net cash provided by (used in) operating activities | | | (862 | ) | | | 5,310 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Capital expenditures | | | (901 | ) | | | (1,797 | ) |

| Proceeds from sale of airplane | | | 440 | | | | - | |

| Proceeds from sale of building | | | - | | | | 164 | |

| Net cash used in investing activities | | | (461 | ) | | | (1,633 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Repayments of long-term debt | | | (1,338 | ) | | | (1,302 | ) |

| Repayments on right-to-use lease liability | | | (65 | ) | | | (64 | ) |

| Repurchase of common stock | | | (5,035 | ) | | | (2 | ) |

| Net cash used in financing activities | | | (6,438 | ) | | | (1,368 | ) |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH | | | (7,761 | ) | | | 2,309 | |

| | | | | | | | | |

| CASH, beginning of period | | | 21,997 | | | | 12,487 | |

| | | | | | | | | |

| CASH, end of period | | $ | 14,236 | | | $ | 14,796 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | | |

| Interest paid | | $ | 637 | | | $ | 713 | |

| Income taxes paid | | $ | - | | | $ | - | |

| | | | | | | | | |

| NON CASH INVESTING AND FINANCING ACTIVITY: | | | | | | | | |

| Lease right-of-use assets purchased | | $ | - | | | $ | 541 | |

| Lease liability for purchase of assets under lease | | $ | - | | | $ | 541 | |

See accompanying notes to condensed consolidated financial statements (unaudited)

BUTLER NATIONAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data)

(unaudited)

1. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Article 8 of Regulation S-X and do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these financial statements should be read in conjunction with the annual report on Form 10-K for the fiscal year ended April 30, 2023. In our opinion, all adjustments (consisting of normal recurring accruals) necessary for a fair presentation have been included. Operating results for the three months ended July 31, 2023 are not indicative of the results of operations that may be expected for the fiscal year ending April 30, 2024.

Certain reclassifications within the condensed financial statement captions have been made to maintain consistency in presentation between years. These reclassifications have no impact on the reported results of operations. Financial amounts are in thousands of dollars except per share amounts.

2. Net Income Per Share: Butler National Corporation (“the Company”) follows ASC 260 that requires the reporting of both basic and diluted earnings per share. Basic earnings per share is computed by dividing net income available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock. In accordance with ASC 260, any anti-dilutive effects on net earnings per share would be excluded.

3. Revenue Recognition: ASC Topic 606, “Revenue from Contracts with Customers”

Under ASC 606, revenue is recognized when a customer obtains control of promised services in an amount that reflects the consideration we expect to receive in exchange for those services. To achieve this core principal, the Company applies the following five steps:

| | 1) | Identify the contract, or contracts, with a customer |

| | A contract with a customer exists when (i) the Company enters into an enforceable contract with a customer that defines each party’s rights regarding the services to be transferred and identifies the payment terms related to these services, (ii) the contract has commercial substance and (iii) the Company determines that collection of substantially all consideration for services that are transferred is probable based on the customer’s intent and ability to pay the promised consideration. |

| | 2) | Identify the performance obligations in the contract |

| | At contract inception, an entity shall assess the goods or services promised in a contract with a customer and shall identify as a performance obligation each promise to transfer to the customer. Performance obligations promised in a contract are identified based on the services that will be transferred to the customer that are both capable of being distinct, whereby the customer can benefit from the service either on its own or together with other resources that are readily available from third parties or from the Company, and are distinct in the context of the contract, whereby the transfer of the services is separately identifiable from other promises in the contract. To the extent a contract includes multiple promised services, the Company must apply judgment to determine whether promised services are capable of being distinct and distinct in the context of the contract. If these criteria are not met the promised services are accounted for as a combined performance obligation. |

| | 3) | Determine the transaction price |

| | The transaction price is the amount that an entity allocates to the performance obligations identified in the contract and, therefore, represents the amount of revenue recognized as those performance obligations are satisfied. The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. |

| | 4) | Allocate the transaction price to the performance obligations in the contract |

| | Once a contract and associated performance obligations have been identified and the transaction price has been determined, ASC 606 requires an entity to allocate the transaction price to each performance obligation identified. This is generally done in proportion to the standalone selling prices of each performance obligation (i.e., on a relative standalone selling price basis). As a result, any discount within the contract generally is allocated proportionally to all of the separate performance obligations in the contract. The Company is applying the right to invoice practical expedient to recognize revenue. As a result, the entity bypasses the steps of determining the transaction price, allocating that transaction price and determining when to recognize revenue as it will recognize revenue as billed by multiplying the price assigned to the good or service, by the units. |

| | 5) | Recognize revenue when, or as, we satisfy a performance obligation |

| | Revenue is recognized when or as performance obligations are satisfied by transferring control of a promised good or service to a customer. Control transfers either over time or at a point in time. Revenue is recognized when control of the promised services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those services. |

| | Aircraft modifications are performed under fixed-price contracts unless modified with a change order. Significant payment terms are generally included in these contracts, requiring a 30% to 50% down payment on arrival of the aircraft and include milestone payments throughout the project. Typically, contracts are less than one year in duration. Revenue from fixed-priced contracts is recognized on the percentage-of-completion method, measured by the direct labor incurred compared to total estimated direct labor. Direct labor best represents the progress on a contract. |

| | Revenue from Aircraft Avionics and Special Mission Electronics are recognized when shipped. Payment for these Avionics products is due within 30 days of the invoice date after shipment. |

| | Regarding warranties and returns, our products are special order and are not suitable for return. Our products are unique upon installation and tested prior to their release to the customer and acceptance by the customer. In the rare event of a warranty claim, the claim is processed through the normal course of business and may include additional charges to the customer. In our opinion, any future warranty work would not be material to the consolidated financial statements. |

| | Gaming revenue is the gross gaming win as reported by the Kansas Lottery casino reporting systems, less the mandated payments by and for the State of Kansas. Electronic games-slots and table games revenue is the aggregate of gaming wins and losses. Liabilities are recognized for chips and "ticket-in, ticket-out" coupons in the customers' possession, and for accruals related to anticipated payout of progressive jackpots. Progressive gaming machines, which contain base jackpots that increase at a progressive rate based on the number of coins played, are deducted from revenue as the value of jackpots increase. Effective September 1, 2022, sports wagering became legal in the State of Kansas. The company is currently managing sports wagering through DraftKings sports wagering platform. The Company shares a percentage of the gross sports wagering win with its platform partner. Revenue from Gaming Management and other Corporate/Professional Services is recognized as the service is rendered. Food, beverage, and other revenue is recorded when the service is received and paid. |

4. Disaggregation of Revenue

In the following table, revenue is disaggregated by primary geographical market, major product line, and timing of revenue recognition.

| | | Three Months Ended July 31, 2023 | | | Three Months Ended July 31, 2022 | |

| | | Professional Services | | | Aerospace Products | | | Total | | | Professional Services | | | Aerospace Products | | | Total | |

| Geographical Markets | | | | | | | | | | | | | | | | | | | | | | | | |

| North America | | $ | 9,041 | | | $ | 6,951 | | | $ | 15,992 | | | $ | 8,962 | | | $ | 5,997 | | | $ | 14,959 | |

| Europe | | | - | | | | 952 | | | | 952 | | | | - | | | | 183 | | | | 183 | |

| Other | | | - | | | | 241 | | | | 241 | | | | - | | | | 162 | | | | 162 | |

| | | $ | 9,041 | | | $ | 8,144 | | | $ | 17,185 | | | $ | 8,962 | | | $ | 6,342 | | | $ | 15,304 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Major Product Lines | | | | | | | | | | | | | | | | | | | | | | | | |

| Casino Gaming Revenue | | $ | 7,198 | | | $ | - | | | $ | 7,198 | | | $ | 7,816 | | | $ | - | | | $ | 7,816 | |

| Sportsbook Revenue | | | 701 | | | | - | | | | 701 | | | | - | | | | - | | | | - | |

| Casino Non-Gaming Revenue | | | 1,090 | | | | - | | | | 1,090 | | | | 1,077 | | | | - | | | | 1,077 | |

| Professional Services | | | 52 | | | | - | | | | 52 | | | | 69 | | | | - | | | | 69 | |

| Aircraft Modification | | | - | | | | 5,483 | | | | 5,483 | | | | - | | | | 3,836 | | | | 3,836 | |

| Aircraft Avionics | | | - | | | | 744 | | | | 744 | | | | - | | | | 715 | | | | 715 | |

| Special Mission Electronics | | | - | | | | 1,917 | | | | 1,917 | | | | - | | | | 1,791 | | | | 1,791 | |

| | | $ | 9,041 | | | $ | 8,144 | | | $ | 17,185 | | | $ | 8,962 | | | $ | 6,342 | | | $ | 15,304 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Contract Types / Revenue Recognition Timing | | | | | | | | | | | | | | | | | | | | | | | | |

| Percentage of completion contracts | | $ | - | | | $ | 5,213 | | | $ | 5,213 | | | $ | - | | | $ | 3,251 | | | $ | 3,251 | |

| Goods or services transferred at a point of sale | | | 9,041 | | | | 2,931 | | | | 11,972 | | | | 8,962 | | | | 3,091 | | | | 12,053 | |

| | | $ | 9,041 | | | $ | 8,144 | | | $ | 17,185 | | | $ | 8,962 | | | $ | 6,342 | | | $ | 15,304 | |

5. Accounts receivable, net, contract asset and contract liability

Accounts Receivables, net, contract asset and contract liability were as follows (in thousands):

| | | July 31, | | | April 30, | |

| | | 2023 | | | 2023 | |

| Accounts Receivable, net | | $ | 3,260 | | | $ | 3,793 | |

| Contract Asset | | | 3,169 | | | | 1,893 | |

| Contract Liability | | | 9,256 | | | | 6,031 | |

Accounts receivable, net consist of $3,260 and $3,793 from customers as of July 31, 2023 and April 30, 2023, respectively. At July 31, 2023 and April 30, 2023, the allowance for doubtful accounts was $205 and $205, respectively.

Contract assets are net of progress payments and performance based payments from our customers totaling $3,169 and $1,893 as of July 31, 2023 and April 30, 2023. Contract assets increased $1,276 during the three months ended July 31, 2023, primarily due to the recognition of revenue related to the satisfaction or partial satisfaction of performance obligations during the three months ended July 31, 2023. There were no significant impairment losses related to our contract assets during the three months ended July 31, 2023. We expect to bill our customers for the majority of the July 31, 2023 contract assets during fiscal year end 2024.

Contract liabilities increased $3,225 during the three months ended July 31, 2023, primarily due to payments received in excess of the revenue recognized on these performance obligations.

6. Inventory

Inventories are priced at the lower of cost, determined on a first-in, first-out basis, or net realizable value. Inventories include material, labor and factory overhead required in the production of our products.

Inventory obsolescence is examined on a regular basis. When determining our estimate of obsolescence, we consider inventory that has been inactive for five years or longer and the probability of using that inventory in future production. The obsolete inventory generally consists of Falcon and Learjet parts and electrical components.

Inventory is comprised of the following, net of the estimate for obsolete inventory of $275 at July 31, 2023 and $275 at April 30, 2023.

| | | July 31, 2023 | | | April 30, 2023 | |

| Parts and raw material | | $ | 5,683 | | | $ | 5,704 | |

| Work in process | | | 3,305 | | | | 3,194 | |

| Finished goods | | | 59 | | | | 49 | |

| Total Inventory, net of allowance | | $ | 9,047 | | | $ | 8,947 | |

7. Property, Plant and Equipment

Property, plant and equipment is comprised of the following:

| | | July 31, 2023 | | | April 30, 2023 | |

| Land | | $ | 4,751 | | | $ | 4,751 | |

| Building and improvements | | | 47,867 | | | | 47,867 | |

| Aircraft | | | 7,193 | | | | 8,515 | |

| Machinery and equipment | | | 5,627 | | | | 5,547 | |

| Office furniture and fixtures | | | 14,054 | | | | 13,881 | |

| Leasehold improvements | | | 4,032 | | | | 4,032 | |

| | | | 83,524 | | | | 84,593 | |

| Accumulated depreciation | | | (25,189 | ) | | | (25,526 | ) |

| Total property, plant and equipment | | $ | 58,335 | | | $ | 59,067 | |

Property and Related Depreciation: Machinery and equipment are recorded at cost and depreciated over their estimated useful lives. Depreciation is provided on a straight-line basis.

| Description | | Estimated useful life |

| Building and improvements | | 39 years or the shorter of the estimated useful life of the asset or the underlying lease term |

| Aircraft | | 5 years |

| Machinery and equipment | | 5 years |

| Office furniture and fixtures | | 5 years |

| Leasehold improvements | | Shorter of the estimated useful life of the asset or the underlying lease term |

Maintenance and repairs are charged to expense as incurred. The cost and accumulated depreciation of assets retired are removed from the accounts and any resulting gains or losses are reflected as income or expense.

8. Use of Estimates:

The preparation of financial statements in conformity with generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Future events and their effects cannot be determined with certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results could differ from those estimates, and any such differences

may be material to our financial statements.

9. Research and Development:

We invested in research and development activities. The amount invested in the three months ended July 31, 2023 and 2022 was $828 million and $631, respectively.

10. Debt: At July 31, 2023 , the Company has a line of credit with Kansas State Bank in the form of a promissory note with an interest rate 8.4% totaling $2,000. The unused line at July 31, 2023 was $2,000. There were no advances made on the line of credit during the quarter ended July 31, 2023. The line of credit is due on demand and is secured by a first and second position on all assets of the Company.

One note with Academy Bank, N.A. for $30,274 secured by all of BHCMC's assets and compensation under the State management contract with an interest rate of 5.32% payable over seven years with an initial twenty-year amortization and a balloon payment of $19,250 in December 2027. The second note with Academy Bank, N.A. for $9,424 is secured by all of BHCMC's assets and compensation under the State management contract with an interest rate of 5.75% payable in full over five years. These notes contain a covenant to maintain a debt service coverage ratio of 1.3 to 1.0. These notes also contain a liquidity covenant requiring the Company to maintain an aggregate sum of $1.5 million of unrestricted cash. We are in compliance with these covenants at July 31, 2023.

At July 31, 2023, there was a note payable with Bank of America, N.A. with a balance of $907. The interest rate on this note is at SOFR plus 1.75%. The loan is secured by buildings and improvements having a net book value of $640. This note matures in March 2029.

At July 31, 2023, there is a note payable with Bank of America, N.A. with a balance of $416. The interest rate on this note is at SOFR plus 1.75%. This loan is secured by buildings and improvements with a net book value of $691. This note matures in March 2029.

At July 31, 2023, there was a note payable with Patriots Bank with an interest rate of 4.35% totaling $1,007. This loan is secured by aircraft security agreements with a net book value of $920. This note matures in March 2029.

At July 31, 2023, there is a note payable with an interest rate of 8.13% totaling $39 secured by equipment with a net book value of $39. This note matures in October 2025.

We are compliant with the covenants and obligations of each of our notes as of July 31, 2023, and September 14, 2023.

11. Other Assets:

Our other asset account includes assets of $5,500 related to the Kansas Expanded Lottery Act Management Contract privilege fee, $6,744 of gaming equipment we were required to pay for ownership by the State of Kansas Lottery, JET autopilot intellectual property of $1,417 and miscellaneous other assets of $128. BHCMC expects the $5,500 privilege fee to have a value over the remaining life of the initial Management Contract with the State of Kansas which will end in December 2024. The State of Kansas approved a renewal management contract and an amendment to the current management contract for our Professional Services company BNSC assumed by BHCMC. The renewal will take effect December 15, 2024, and continue to 2039, another 15 years. The Managers Certificate asset for use of gaming equipment is being amortized over a period of three years based on the estimated useful life of gaming equipment. The JET intellectual property is fully amortized.

12. Stock Options and Incentive Plans:

In November 2016, the shareholders approved and adopted the Butler National Corporation 2016 Equity Incentive Plan. The maximum number of shares of common stock that may be issued under the Plan is 12.5 million.

On April 12, 2019, the Company granted 2.5 million restricted shares to employees. These shares have voting rights at date of grant and become fully vested and nonforfeitable on April 11, 2024. The restricted shares were valued at $0.38 per share, for a total of $950. On March 17, 2020, the Company granted 5.0 million restricted shares to employees. These shares have voting rights at date of grant and become fully vested and non-forfeitable on March 16, 2025. The restricted shares were valued at $0.41 per share, for a total of $2.0 million. The deferred compensation related to these grants will be expensed on the financial statements over the five year vesting period.

In July 2022, the Company granted a board member 400,000 shares under the plan. These shares were fully vested and nonforfeitable on the date of grant. These shares were valued at $0.88 per share, for a total of $352. The compensation related to this grant was expensed in the current period. No other equity awards have been made under the plan.

For the three months ended July 31, 2023 the Company expensed $104 and received a net benefit from the forfeiture of shares of $353 for a net benefit of $249. For the three months ended July 31, 2022, the Company expensed $484.

| | | Number of Shares | | | Weighted Average Grant Date Fair Value | |

| Total shares issued | | | 7,900,000 | | | $ | 0.42 | |

| Forfeited, in prior periods | | | (100,000 | ) | | $ | 0.40 | |

| Forfeited, during the year ended April 30, 2023 | | | (875,000 | ) | | $ | 0.40 | |

| Forfeited, during the three months ended July 31, 2023 | | | (1,300,000 | ) | | $ | 0.40 | |

| Total | | | 5,625,000 | | | $ | 0.43 | |

13. Stock Repurchase Program:

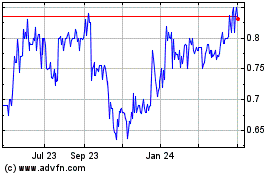

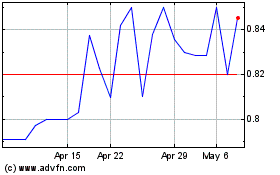

In July 2023, the Board of Directors approved an increase in the size of the Company's stock repurchase program from $4 million to $9 million. The program was established for the purpose of enabling Butler National Corporation (BNC) to flexibly repurchase its own shares in consideration of factors such as opportunities for strategic investment, BNC's financial condition and the price of its common stock as part of improving capital efficiency. The program is currently authorized through July 31, 2025.

The table below provides information with respect to common stock purchases by the Company through July 31, 2023.

| Period | | Total Number of Shares Purchased | | | Average Price Paid per Share | | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | | Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plans or Programs | |

| Shares purchased in prior periods | | | 3,290,426 | | | $ | 0.40 | | | | 3,290,426 | | | $ | 2,655 | |

| Quarter ended July 31, 2022 (a) | | | 1,639 | | | $ | 0.84 | | | | 1,639 | | | $ | 2,653 | |

| Quarter ended October 31, 2022 (a) | | | 150 | | | $ | 0.70 | | | | 150 | | | $ | 2,653 | |

| Quarter ended January 31, 2023 (a) | | | 85,307 | | | $ | 0.68 | | | | 85,307 | | | $ | 2,595 | |

| Quarter ended April 30, 2023 (a) | | | 2,000 | | | $ | 0.68 | | | | 2,000 | | | $ | 2,594 | |

| Increase in program authorization July 2023 | | | - | | | $ | - | | | | - | | | $ | 7,594 | |

| Quarter ended July 31, 2023 (a) | | | 6,863,789 | | | $ | 0.73 | | | | 6,863,789 | | | $ | 2,560 | |

| Total | | | 10,243,311 | | | $ | 0.63 | | | | 10,243,311 | | | | | |

| (a) | These shares of common stock were purchased through a private transaction |

14. Lease Right-to-Use:

We lease hangars and office space with initial lease terms of five, forty-six, and fifty years.

| | | July 31, 2023 | |

| Lease right-to-use assets | | $ | 3,781 | |

| Less accumulated depreciation | | | 748 | |

| Total | | $ | 3,033 | |

Future minimum lease payments for assets under finance leases at July 31, 2023 are as follows:

| 2024 | | $ | 252 | |

| 2025 | | | 114 | |

| 2026 | | | 116 | |

| 2027 | | | 119 | |

| 2028 | | | 121 | |

| Thereafter | | | 12,798 | |

| Total minimum lease payments | | | 13,520 | |

| Less amount representing interest | | | 10,062 | |

| Present value of net minimum lease payments | | | 3,458 | |

| Less current maturities of lease liability | | | 136 | |

| Lease liability, net of current maturities | | $ | 3,322 | |

Finance lease costs at July 31, 2023 and July 31, 2022 are as follows:

| | | July 31, 2023 | | | July 31, 2022 | |

| Finance lease cost: | | | | | | | | |

| Amortization of right-of-use assets | | $ | 47 | | | $ | 46 | |

| Interest on lease liabilities | | | 48 | | | | 45 | |

| Total finance lease cost | | $ | 95 | | | $ | 91 | |

| | | July 31, 2023 | | | July 31, 2022 | |

| Weighted average remaining lease term - Financing leases (in years) | | | 44 | | | | 45 | |

| Weighted average discount rate - Financing leases | | | 5.8 | % | | | 5.0 | % |

15. Segment Reporting and Sales by Major Customer:

Industry Segmentation

Current Activities - The Company focuses on two primary activities, Professional Services and Aerospace Products.

Aerospace Products:

Aircraft Modifications principally includes the modification of customer and company owned business-size aircraft for specific operations or special missions such as addition of aerial photography capabilities, mapping, search and rescue, and ISR modifications. We provide these services through our subsidiary, Avcon Industries, Inc. ("Aircraft Modifications" or "Avcon").

Special mission electronics principally includes the manufacture, sale, and service of electronics upgrades for classic weapon control systems used on civilian and military aircraft and vehicles. We provide the products through our subsidiary, Butler National Corporation - Tempe, Arizona.

Butler Avionics sells, installs and repairs aircraft avionics equipment (airplane radio equipment and flight control systems). These systems are flight display systems which include intuitive touchscreen controls with large display that enhance pilot situational awareness and give users unprecedented access to high-resolution terrain mapping, graphical flight planning, geo-referenced charting, traffic display, satellite weather and much more. Butler Avionics is also recognized nationwide for its troubleshooting and repair work particularly on autopilot systems.

Professional Services:

Butler National Service Corporation ("BNSC") provides management services to the Boot Hill Casino, a "state-owned casino".

BCS Design, Inc. provides licensed architectural services. These services include commercial and industrial building design.

| Three Months Ended July 31, 2023 | | Gaming | | | Aircraft Modification | | | Aircraft Avionics | | | Special Mission Electronics | | | Other | | | Total | |

| Revenues from customers | | $ | 8,989 | | | $ | 5,483 | | | $ | 744 | | | $ | 1,917 | | | $ | 52 | | | $ | 17,185 | |

| Interest expense | | | 556 | | | | 58 | | | | - | | | | 16 | | | | 9 | | | | 639 | |

| Depreciation and amortization | | | 648 | | | | 713 | | | | 3 | | | | 32 | | | | 27 | | | | 1,423 | |

| Operating income (loss) | | | 2,314 | | | | (793 | ) | | | (86 | ) | | | 721 | | | | (1,019 | ) | | | 1,137 | |

| Three Months Ended July 31, 2022 | | Gaming | | | Aircraft Modification | | | Aircraft Avionics | | | Special Mission Electronics | | | Other | | | Total | |

| Revenues from customers | | $ | 8,893 | | | $ | 3,836 | | | $ | 715 | | | $ | 1,791 | | | $ | 69 | | | $ | 15,304 | |

| Interest expense | | | 642 | | | | 66 | | | | - | | | | 7 | | | | 8 | | | | 723 | |

| Depreciation and amortization | | | 626 | | | | 740 | | | | 2 | | | | 39 | | | | 51 | | | | 1,458 | |

| Operating income (loss) | | | 2,642 | | | | 54 | | | | 48 | | | | 616 | | | | (1,735 | ) | | | 1,625 | |

Our Chief Operating Decision Maker (CODM) does not evaluate operating segments using asset or liability information.

Major Customers: Revenue from major customers (10 percent or more of consolidated revenue) were as follows:

| | | Three Months Ended July 31, 2023 | | | Three Months Ended July 31, 2022 | |

| Aerospace Products – two customers in the three months ended July 31, 2023, one customer in the three months ended July 31, 2022 | | | 23.8 | % | | | 11.7 | % |

| Professional Services | | | - | | | | - | |

In the three months ended July 31, 2023 the Company derived 33.8% of total revenue from five Aerospace customers. The top customer provided 12.9% of total revenue while the next top four customers ranged from 2.0% to 10.9%.

16. Subsequent Events:

The Company evaluated its July 31, 2023 financial statements for subsequent events through the filing date of this report. The Company is not aware of any subsequent events that would require recognition or disclosure in the consolidated financial statements.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

THROUGHOUT THIS ITEM 2 ALL NON TABULAR FINANCIAL RESULTS ARE PRESENTED IN THOUSANDS OF U.S. DOLLARS EXCEPT WHERE MILLIONS OF DOLLARS IS INDICATED.

Forward-Looking Statements

Statements made in this report, other reports and proxy statements filed with the Securities and Exchange Commission, communications to stockholders, press releases, and oral statements made by representatives of the Company that are not historical in nature, or that state the Company or management intentions, hopes, beliefs, expectations or predictions of the future, may constitute "forward-looking statements" within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements can often be identified by the use of forward-looking terminology, such as "could," "should," "will," "intended," "continue," "believe," "may," "expect," "hope," "anticipate," "goal," "forecast," "plan," "guidance" or "estimate" or the negative of these words, variations thereof or similar expressions. Forward-looking statements are not guarantees of future performance or results. They involve risks, uncertainties, and assumptions. It is important to note that any such performance and actual results, financial condition or business, could differ materially from those expressed in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in Item 1A (Risk Factors) of the Annual Report on Form 10-K for the fiscal year ended April 30, 2023, and elsewhere herein or in other reports filed with the SEC. Other unforeseen factors not identified herein could also have such an effect. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial condition or business over time.

The forward-looking statements in this report are only predictions and actual events or results may differ materially. In evaluating such statements, a number of risks, uncertainties and other factors could cause actual results, performance, financial condition, cash flows, prospects and opportunities to differ materially from those expressed in, or implied by, the forward-looking statements. These risks, uncertainties and other factors include those set forth in Item 1A (Risk Factors) of the Annual Report on Form 10-K for the fiscal year ended April 30, 2023, including the following factors:

| |

● |

customer concentration risk; |

| |

● |

dependence on government spending; |

| |

● |

industry specific business cycles; |

| |

● |

regulatory hurdles in the launch of new products; |

| |

● |

loss of key personnel; |

| |

● |

the geographic location of our casino; |

| |

● |

fixed-price contracts; |

| |

● |

international sales; |

| |

● |

future acquisitions; |

| |

● |

supply chain and labor issues; |

| |

● |

cyber security threats; |

| |

● |

fraud, theft and cheating at our casino; |

| |

● |

dependence on third-party platforms to offer sports wagering; |

| |

● |

outside factors influence the profitability of sports wagering; |

| |

● |

change of control restrictions; |

| |

● |

significant and expensive governmental regulation across our industries; |

| |

● |

failure by the corporation or its stockholders to maintain applicable gaming licenses; |

| |

● |

evolving political and legislative initiatives in gaming; |

| |

● |

extensive and increasing taxation of gaming revenues; |

| |

● |

changes in regulations of financial reporting; |

| |

● |

the stability of economic markets; |

| |

● |

potential impairment losses; |

| |

● |

marketability restrictions of our common stock; |

| |

● |

stock dilution; |

| |

● |

the possibility of a reverse-stock split; |

| |

● |

market competition by larger competitors; |

| |

● |

acts of terrorism and war; |

| |

● |

inclement weather and natural disasters; and |

| |

● |

rising inflation. |

Except as expressly required by the federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this report. Results of operations in any past period should not be considered indicative of the results to be expected for future periods. Fluctuations in operating results may also result in fluctuations in the price of the Company's common stock.

Investors should also be aware that while the Company, from time to time, communicates with securities analysts; it is against its policy to disclose any material non-public information or other confidential commercial information. Accordingly, shareholders should not assume that the Company agrees with any statement or report issued by any analyst irrespective of the content of the statement or report. Furthermore, the Company has a policy against issuing or confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of Butler National Corporation.

General

Butler National Corporation (“Butler National” the “Company”, “we”, “us”, or “our”) was incorporated in 1960. Our companies design, engineer, manufacture, sell, integrate, install, repair, modify, overhaul, service and distribute a broad portfolio of aerostructures, aircraft components, avionics, accessories, subassemblies and systems (“Aerospace Products”). We serve a broad, worldwide spectrum of the aviation industry, including owners and operators, of private, commercial, regional, business and government aircraft.

In addition, our companies provide management services in the gaming industry, which includes owning the land and building for the Boot Hill Casino and Resort in Dodge City, Kansas (“Professional Services”).

Products and Services

The Company has two operating segments for financial reporting purposes: (a) Aerospace Products, whose companies’ revenues are derived from system design, engineering, manufacturing, sale, distribution, integration, installation, repairing, modifying, overhauling and servicing of aerostructures, avionics, aircraft components, accessories, subassemblies and systems; and (b) Professional Services, whose companies provide professional management services in the gaming industry, sports wagering, and professional architectural services.

Aerospace Products. The Aerospace Products segment includes the manufacture, sale and service of structural modifications, electronic equipment, and systems and technologies enhancing aircraft. Additionally, we operate Federal Aviation Administration (the “FAA”) Repair Stations. Companies in Aerospace Products concentrate on Learjets, Beechcraft King Air, and Cessna turboprop aircraft.

Products. The aviation-related products that the companies within this group design, engineer, manufacture, integrate, install, repair and service include:

| ● |

Aerial mapping, search and rescue, and surveillance products |

● |

GARMIN GTN Global Position System Navigator with Communication Transceiver |

| |

|

|

|

| ● |

Aerodynamic enhancement products |

● |

J.E.T. autopilot products |

| |

|

|

|

| ● |

Standby instrument systems |

● |

Electrical systems and switching equipment |

| |

|

|

|

| ● |

Avcon stability enhancing fins |

● |

Rate gyroscopes |

| |

|

|

|

| ● |

ADS-B (transponder) systems |

● |

Replacement vertical accelerometers |

| |

|

|

|

| ● |

Cargo/sensor carrying pods and radomes |

● |

Provisions to allow carrying of external stores |

| |

|

|

|

| ● |

Electronic navigation instruments, radios and transponders |

● |

Attitude and heading reference systems |

Modifications. The companies in Aerospace Products have authority, pursuant to Federal Aviation Administration Supplemental Type Certificates (“STCs”) and Parts Manufacturer Approval (“PMA”), to build required parts and subassemblies and to make applicable installations. Companies in Aerospace Products perform modifications in the aviation industry including:

| ● |

Aerial photograph capabilities |

● |

Extended tip fuel tanks |

| |

|

|

|

| ● |

Aerodynamic improvements |

● |

Radar systems |

| |

|

|

|

| ● |

Avionics systems |

● |

ISR – Intelligence Surveillance Reconnaissance |

| |

|

|

|

| ● |

Cargo doors |

● |

Special mission modifications |

| |

|

|

|

| ● |

Extended nose and wing tip bays |

● |

Stability enhancements |

| |

|

|

|

| ● |

Extended doors |

● |

Traffic collision avoidance systems |

Special Mission Electronics. We supply defense-related, commercial off-the-shelf products to various commercial entities and government agencies and subcontractors in order to update or extend the useful life of aircraft with older components and technology. These products include:

| ● |

Cabling |

● |

HangFire Override Modules |

| |

|

|

|

| ● |

Electronic control systems |

● |

Test equipment |

| |

|

|

|

| ● |

Gun Control Units for Apache and Blackhawk helicopters |

● |

Gun Control Units for land and sea based military vehicles |

Professional Services. The Professional Services segment includes the management of a gaming and related dining and entertainment facility in Dodge City, Kansas. Boot Hill Casino and Resort features approximately 500 slot machines, 16 table games and a sportsbook. A Company in Professional Services also provide licensed architectural services, including commercial and industrial building design services.

Boot Hill. Butler National Service Corporation (“BNSC”), and BHCMC, LLC (“BHCMC”), companies in Professional Services, manage The Boot Hill Casino and Resort in Dodge City, Kansas (“Boot Hill”) pursuant to the Lottery Gaming Facility Management Contract, by and among BNSC, BHCMC and the Kansas Lottery, as subsequently amended (“Boot Hill Agreement”). As required by Kansas law, all games, gaming equipment and gaming operations, including sports wagering, at Boot Hill are owned and operated by the Kansas Lottery. On September 1, 2022, sports wagering became legal in the State of Kansas. The Company entered into a provider contract with DraftKings for interactive/mobile sports wagering. In addition to an online platform, the Company also features a DraftKings branded sports book at Boot Hill that opened on February 28, 2023.

Architectural Services. A Company in Professional Services provides licensed architectural, including commercial and industrial building design. The Company is in the process of winding down its architectural business.

Results Overview

The three months ended July 31, 2023 revenue increased 12% to $17.2 million compared to $15.3 million in the three months ended July 31, 2022. In the three months ended July 31, 2023 the professional services revenue was $9.0 million compared to $9.0 million in the three months ended July 31, 2022, an increase of 1%. In the three months ended July 31, 2023 the Aerospace Products revenue was $8.1 million compared to $6.3 million in the three months ended July 31, 2022, an increase of 28%.

The three months ended July 31, 2023 net income increased to $719 compared to a net income of $431 in the three months ended July 31, 2022. The three months ended July 31, 2023, operating income decreased to $1.1 million from an operating income of $1.6 million in the three months ended July 31, 2022.

RESULTS OF OPERATIONS

three months ended July 31, 2023 COMPARED TO three months ended July 31, 2022

| (dollars in thousands) |

|

Three Months Ended July 31, 2023 |

|

|

Percent of Total Revenue |

|

|

Three Months Ended July 31, 2022 |

|

|

Percent of Total Revenue |

|

|

Percent Change 2022-2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Professional Services |

|

$ |

9,041 |

|

|

|

53 |

% |

|

$ |

8,962 |

|

|

|

59 |

% |

|

|

1 |

% |

| Aerospace Products |

|

|

8,144 |

|

|

|

47 |

% |

|

|

6,342 |

|

|

|

41 |

% |

|

|

28 |

% |

| Total revenue |

|

|

17,185 |

|

|

|

100 |

% |

|

|

15,304 |

|

|

|

100 |

% |

|

|

12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of Professional Services |

|

|

3,946 |

|

|

|

23 |

% |

|

|

3,623 |

|

|

|

24 |

% |

|

|

9 |

% |

| Cost of Aerospace Products |

|

|

7,326 |

|

|

|

43 |

% |

|

|

4,827 |

|

|

|

31 |

% |

|

|

52 |

% |

| Marketing and advertising |

|

|

1,278 |

|

|

|

7 |

% |

|

|

1,331 |

|

|

|

9 |

% |

|

|

-4 |

% |

| General, administrative and other |

|

|

3,498 |

|

|

|

20 |

% |

|

|

3,898 |

|

|

|

25 |

% |

|

|

-10 |

% |

| Total costs and expenses |

|

|

16,048 |

|

|

|

93 |

% |

|

|

13,679 |

|

|

|

89 |

% |

|

|

17 |

% |

| Operating income |

|

$ |

1,137 |

|

|

|

7 |

% |

|

$ |

1,625 |

|

|

|

11 |

% |

|

|

-30 |

% |

Revenue:

Revenue increased 12% to $17.2 million in the three months ended July 31, 2023, compared to $15.3 million in the three months ended July 31, 2022. See "Operations by Segment" below for a discussion of the primary reasons for the increase in revenue.

| |

● |

Professional Services derives its revenue from (a) professional management services in the gaming industry through Butler National Service Corporation ("BNSC") and BHCMC, LLC ("BHCMC"), and (b) professional architectural, and management support services. Revenue from Professional Services increased 1% for the three months to $9.0 million at July 31, 2023 compared to $9.0 million at July 31, 2022. The new sports wagering platform brought in $701 of revenue that did not exist in first quarter of fiscal year 2023. Furthermore, casino gaming revenue decreased $618 due to a decrease in patron spend per visit. We believe this was primarily due to increased inflation and drought conditions in our primary market area causing a decrease in discretionary spending. |

| |

● |

Aerospace Products derives its revenue by designing, engineering, manufacturing, installing, servicing and repairing products for classic and current production aircraft. Aerospace Products revenue increased 28% for the three months to $8.1 million at July 31, 2023 compared to $6.3 million at July 31, 2022. The increase in revenue is mainly due to an increase in the aircraft modification business of $1.7 million. The development of new STC's and our marketing efforts for them in both domestic and international markets support this increase. |

Costs and expenses: