Current Report Filing (8-k)

March 26 2020 - 6:53AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 18, 2020

BIOXYTRAN, INC.

(Exact Name if Business Issuer as specified

in its Charter)

|

Nevada

|

|

001-35027

|

|

26-2797630

|

(State or other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

233 Needham Street,

Suite 300

Newton MA, 02464

(Address of principal executive offices,

including zip code)

(617) 494-1199

(Registrant’s telephone number including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 1 4a- 12 under the Exchange Act (17 CFR 240.1 4a- 12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 1 4d-2(b) under the Exchange Act (17 CFR 240.1 4d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 1 3e-4(c) under the Exchange Act (17 CFR 240.1 3e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Common Stock, par value $0.001

|

|

BIXT

|

|

OTCQB

|

Item 1.01. Entry Into a Material Definitive Agreement.

On March 18, 2020,

Bioxytran, Inc. (the “Company”) entered into a Securities Purchase Agreement (“PU SPA”) with Power Up Lending

Group LLC (“PU”) for the purchase of a Convertible Debenture in the aggregate principal amount of $64,900 (the “PU

Debenture”), carrying an interest rate of 8%, and due on February 18, 2021. The purchase price on the PU Debenture was $63,000

and carried due diligence and legal fees of $3,000 with the funds received by the Company on March 24, 2020.

The PU Debenture may

be converted at any time after 180 days from the issue date into shares of Company’s common stock, par value $.001 per share

(the “Common Stock”) at a price equal to Sixty Five percent (65%) of the lowest traded price (as reported by Bloomberg

LP) of the Common Stock for the twenty (20) Trading Days immediately preceding the date of the date of conversion of the Debentures,

subject to adjustment for certain penalties. The PU Debenture may be converted to up to a maximum of 4.99% of the issued and outstanding

Common Stock of the Company. The PU Debenture permits the Company to pre-pay its obligations at a premium prior to maturity.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a

Registrant

The

information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity

Securities

The

information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

By:

|

/s/ David Platt

|

|

|

Name:

|

Dr. David Platt

|

|

|

Title:

|

President and Chief Executive Officer

|

|

|

|

|

|

Dated: March 26, 2020

|

3

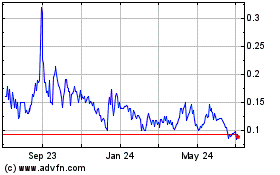

Bioxytran (QB) (USOTC:BIXT)

Historical Stock Chart

From Aug 2024 to Sep 2024

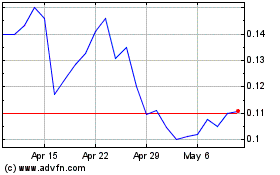

Bioxytran (QB) (USOTC:BIXT)

Historical Stock Chart

From Sep 2023 to Sep 2024