WNS (Holdings) Limited (NYSE: WNS), a leading provider of global

business process outsourcing (BPO) services, today announced

results for the fiscal second quarter 2009 ended September 30, 2008

and reaffirmed its profit guidance for fiscal 2009. Revenue for

fiscal second quarter 2009 at $149.8 million increased 29.6% over

the corresponding quarter in the prior fiscal year, while revenue

less repair payments at $109.0 million increased 52.0% over the

same quarter in the prior fiscal year. This growth in revenue less

repair payments for the fiscal quarter was primarily due to both

the strong organic growth in the global BPO business, and the

revenue contributions from Aviva Global Services Singapore Private

Limited (AGS) and Call 24/7 Limited, which WNS acquired in July

2008 and April 2008, respectively. �This was a strong quarter for

us as we successfully transitioned new client relationships and

completed the first phase of the AGS integration,� said Neeraj

Bhargava, Group Chief Executive Officer. �We also achieved the

milestone of exceeding $100 million in revenues less repair

payments for the first time, while improving our profitability. Our

strong performance in this difficult business environment clearly

positions us as a leader in the BPO industry.� Net income for

fiscal second quarter 2009 was $0.2 million as against a net loss

of $10.5 million during the corresponding quarter in the prior

fiscal year. The net loss during the fiscal second quarter 2008 was

due to the write off of goodwill and intangibles related to our

mortgage banking focused BPO business whereas the net income in the

current quarter was affected by amortization charges from the

acquisition of AGS during the quarter. Adjusted net income, or net

income excluding amortization and impairment of goodwill and

intangible assets, share-based compensation, and related fringe

benefit taxes, was $11.9 million, an increase of 47.6% over the

corresponding quarter in the prior year. The primary drivers of

this increase were our revenue growth, tight cost management, and

increased income from AGS. WNS also benefited from the revaluation

of US dollar-denominated assets, but this benefit was primarily

offset by the negative impact of foreign exchange losses from

hedging, a one-time tax associated with the AGS transaction, and

lower interest income. WNS recorded a basic income per ADS of $0.01

for fiscal second quarter 2009. Adjusted income per ADS, or basic

income per ADS excluding share-based compensation, related fringe

benefit taxes and amortization of intangible assets was $0.28 for

the quarter. �We have continued to tighten the management of our

operations and reduced non-operating costs, both of which have been

reflected in this quarter�s operating margins.� said Alok Misra,

Group Chief Financial Officer. �The AGS integration is on schedule

and we see additional opportunities to reduce capital expenditure

and increase operating leverage.� Financial Highlights: Fiscal

Second Quarter Ended September 30, 2008 Quarterly revenue of $149.8

million, up 29.6% from the corresponding quarter last year.

Quarterly revenue less repair payments of $109.0 million, up 52.0%

from the corresponding quarter last year. Quarterly net income of

$0.2 million against a net loss of $10.5 million from the

corresponding quarter last year. Quarterly adjusted net income (or,

net income excluding amortization and impairment of goodwill and

intangible assets, share-based compensation, and related fringe

benefit taxes) of $11.9 million, up 47.6% from the corresponding

quarter last year. Quarterly basic income per ADS of $0.01, up from

a basic loss per share of $0.25 for the corresponding quarter last

year. Quarterly adjusted basic income per ADS (or, basic income per

share excluding amortization and impairment of goodwill and

intangible assets, share-based compensation, and related fringe

benefit taxes) of $0.28, up from $0.19 for the corresponding

quarter last year. Reconciliations of non-GAAP financial measures

to GAAP operating results are included at the end of this release.

Key Organizational Developments In the past quarter, WNS announced

the following key developments to its business: The acquisition of

AGS, the business process offshoring company providing services to

Aviva, and an eight year and four month Master Services Agreement,

naming WNS as the long-term strategic BPO services provider to

Aviva's UK and Canadian businesses. The appointment of Karthik

Sarma as Chief People Officer, who will focus on attracting,

retaining and developing high quality talent for the WNS

organization. Fiscal 2009 Guidance WNS provided the following

guidance for the fiscal year ending March 31, 2009: Revenue less

repair payments is expected to be between $385 million and $400

million (down from the previously announced $425 million to $435

million). This assumes a USD to GBP range of 1.45 to 1.60. Net

income (excluding amortization and impairment of goodwill and

intangible assets, share-based compensation, and related fringe

benefit taxes) is still expected to remain between $46 million and

$49 million. �Our operating performance continues to be strong but

the recent strength of the dollar against the British Pound in

particular puts pressure on our non-US revenue and so we have

revised our revenue guidance accordingly. However, the dollar has

also strengthened considerably against the Indian Rupee and we have

hedges in place, which make us comfortable with our profit

guidance,� continued Misra. Conference Call WNS will host a

conference call on November 13, 2008 at 8 am (ET) to discuss the

company's quarterly results. To participate, callers can dial:

1-800-295-3991; international dial-in 617-614-3924; participant

passcode 1352836. A replay will also be made available online at

www.wnsgs.com for a period of three months beginning two hours

after the end of the call. About WNS WNS Holdings Ltd. [NYSE: WNS]

is a leading global business process outsourcing company. Deep

industry and business process knowledge, a partnership approach,

comprehensive service offering and a proven track record enables

WNS to deliver business value to some of the leading companies in

the world. WNS is passionate about building a market-leading

company valued by our clients, employees, business partners,

investors and communities. For more information, visit

www.wnsgs.com. About Non-GAAP Financial Measures For financial

statement reporting purposes, the company has two reportable

segments: WNS Global BPO and WNS Auto Claims BPO. In the auto

claims segment, which includes WNS Assistance and Chang Limited,

WNS provides claims-handling and accident-management services, in

which it arranges for automobile repairs through a network of

third-party repair centers. In its accident-management services,

WNS acts as the principal in dealings with the third-party repair

centers and clients. In order to provide accident-management

services, the Company arranges for the repair through a network of

repair centers. Repair costs are invoiced to customers. Amounts

invoiced to customers for repair costs paid to the automobile

repair centers are recognized as revenue. The Company uses revenue

less repair payments for �fault� repairs as a primary measure to

allocate resources and measure segment performance. Revenue less

repair payments is a non-GAAP measure which is calculated as

revenue less payments to repair centers. For �Non fault repairs,�

revenue including repair payments is used as a primary measure. As

the Company provides a consolidated suite of accident management

services including credit hire and credit repair for its �Non

fault� repairs business, the Company believes that measurement of

that line of business has to be on a basis that includes repair

payments in revenue. The Company believes that the presentation of

this non-GAAP measure in the segmental information provides useful

information for investors regarding the segment�s financial

performance. The presentation of this non-GAAP information is not

meant to be considered in isolation or as a substitute for the

Company�s financial results prepared in accordance with US GAAP.

Safe Harbor Statement under the provisions of the United States

Private Securities Litigation Reform Act of 1995 This news release

contains forward-looking statements, as defined in the safe harbor

provisions of the US Private Securities Litigation Reform Act of

1995. These statements involve a number of risks, uncertainties and

other factors that could cause actual results to differ materially

from�those that may be projected by these forward looking

statements. These risks and uncertainties include but are not

limited to technological innovation; telecommunications or

technology disruptions; future regulatory actions and conditions in

our operating areas; our dependence on a limited number of clients

in a limited number of industries; our ability to attract and

retain clients; our ability to expand our business or effectively

manage growth; our ability to hire and retain enough sufficiently

trained employees to support our operations; negative public

reaction in the US or the UK to offshore outsourcing; regulatory,

legislative and judicial developments; increasing competition in

the business process outsourcing industry; political or economic

instability in India, Sri Lanka and Jersey; worldwide economic and

business conditions, including a slowdown in the US and Indian

economies and in the sectors in which our clients are based and a

slowdown in the BPO and IT sectors world-wide; our ability to

successfully grow our revenues, expand our service offerings and

market shareand achieve accretive benefits from our acquisition of

Aviva Global Services Singapore Private Limited and our master

services agreement with Aviva Global Services (Management Services)

Private Limited; our ability to successfully consummate strategic

acquisitions, as well as other risks detailed in our reports filed

with the US Securities and Exchange Commission. These filings are

available at www.sec.gov. We may, from time to time, make

additional written and oral forward-looking statements, including

statements contained in our filings with the Securities and

Exchange Commission and our reports to shareholders. You are

cautioned not to place undue reliance on these forward-looking

statements, which reflect management�s current analysis of future

events. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. Reconciliation of revenue less repair

payments (non-GAAP) to revenue (GAAP) � Amount in thousands Three

months ended � � Six months ended September 30,2008 � September

30,2007 � � September 30,2008 � September 30,2007 � � � Revenue

less repair payments (Non-GAAP) $ 109,004 $ 71,736 $ 191,224 $

141,508 Add: Payments to repair centers 40,793 43,843 81,517 86,593

Revenue (GAAP) $ 149,797 $ 115,579 $ 272,741 $ 228,101

Reconciliation of cost of revenue (non-GAAP to GAAP) � Amount in

thousands Three months ended � � Six months ended September 30,2008

� September 30,2007 � � September 30,2008 � September 30,2007 � � �

Cost of revenue (Non-GAAP) $ 74,119 $ 48,625 $ 131,882 $ 96,081

Add: Payments to repair centers 40,793 43,843 81,517 86,593 Cost of

revenue (GAAP) $ 114,912 $ 92,469 $ 213,399 $ 182,674

Reconciliation of selling, general and administrative expense

(non-GAAP to GAAP) � Amount in thousands Three months ended � Six

months ended September 30,2008 � September 30,2007 � September

30,2008 � September 30,2007 � � Selling, general and administrative

expenses (excluding share-based compensation expense and FBT1

(Non-GAAP) $18,671 $16,981 $34,233 $30,713 Add: Share-based

compensation expense 2,471 1,175 4,736 2,164 Add: FBT1 162 627 531

627 Selling, general and administrative expenses (GAAP) $21,304

$18,783 $39,500 $33,504 1 FBT means the fringe benefit taxes on

options and restricted share units granted to employees under the

WNS 2002 Stock Incentive Plan and the WNS 2006 Incentive Award Plan

(as applicable) payable by WNS to the government of India.

Reconciliation of operating income (non-GAAP to GAAP) � Amount in

thousands Three months ended � � Six months ended September 30,2008

� September 30,2007 � � September 30,2008 � September 30,2007 � � �

Operating income (excluding amortization and impairment of goodwill

and intangible assets, share-based compensation and FBT2 (Non-GAAP)

$ 17,204 $ 6,873 $ 26,898 $ 15,972 Less: Amortization of intangible

assets 8,012 479 9,481 1,308 Less: Impairment of goodwill and

intangible assets � 15,465 � 15,465 Less: Share-based compensation

expense 3,461 1,918 6,525 3,423 Less: FBT1 162 627 531 627

Operating (loss) income (GAAP) $ 5,569 $ (11,616 ) $ 10,361 $

(4,850 ) Reconciliation of net income (non-GAAP to GAAP) � Amount

in thousands Three months ended � � Six months ended September

30,2008 � September 30,2007 � � September 30,2008 � September

30,2007 � � � Net income (excluding amortization and impairment of

goodwill and intangible assets, share-based compensation and FBT1)

(Non-GAAP) $ 11,862 $ 8,035 $ 20,104 $ 18,807 Less: Amortization of

intangible assets 8,012 479 9,481 1,308 Less: Impairment of

goodwill and intangible assets � 15,465 � 15,465 Less: Share-based

compensation expense 3,461 1,918 6,525 3,423 Less: FBT1 162 627 531

627 Net income (GAAP) $ 227 $ (10,454 ) $ 3,567 $ (2,015 ) 2 FBT

means the fringe benefit taxes on options and restricted share

units granted to employees under the WNS 2002 Stock Incentive Plan

and the WNS 2006 Incentive Award Plan (as applicable) payable by

WNS to the government of India. Reconciliation of Basic income per

ADS (non-GAAP to GAAP) Three months ended � � Six months ended

September 30,2008 � September 30,2007 � � September 30,2008 �

September 30,2007 � � � � Basic income per ADS (excluding

amortization and impairment of goodwill and intangible assets,

share-based compensation and FBT3 (Non-GAAP) $ 0.28 $ 0.19 $ 0.47 $

0.45 Less: Adjustments for amortization and impairment of goodwill

and intangible assets, share-based compensation and FBT1 0.27 0.44

0.39 0.50 Basic income per ADS (GAAP) $ 0.01 $ (0.25 ) $ 0.08 $

(0.05 ) Reconciliation of Diluted income per ADS (non-GAAP to GAAP)

Three months ended � � Six months ended September 30,2008 �

September 30,2007 � � September 30,2008 � September 30,2007 � � � �

Diluted income per ADS ( excluding amortization and impairment of

goodwill and intangible assets, share-based compensation and FBT1)

(Non-GAAP) $ 0.27 $ 0.19 $ 0.46 $ 0.44 Less: Adjustments for

amortization and impairment of goodwill and intangible assets,

share-based compensation and FBT1 0.26 0.44 0.38 0.49 Diluted

income/(loss) per ADS (GAAP) $ 0.01 $ (0.25 ) $ 0.08 $ (0.05 ) 3

FBT means the fringe benefit taxes on options and restricted share

units granted to employees under the WNS 2002 Stock Incentive Plan

and the WNS 2006 Incentive Award Plan (as applicable) payable by

WNS to the government of India. WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (Amounts in

thousands, except per share data) � Three months endedSeptember 30,

� Six months endedSeptember 30, � 2008 � � � 2007 � � � 2008 � � �

2007 � � � Revenue Third parties $ 148,925 $ 114,679 $ 270,961 $

226,487 Related parties � 872 � � � 899 � � � 1,780 � � � 1,614 �

149,797 115,578 272,741 228,101 Cost of revenue � 114,912 � � �

92,468 � � � 213,399 � � � 182,674 � Gross profit 34,885 23,110

59,342 45,427 Operating expenses Selling, general and

administrative expenses 21,304 18,782 39,500 33,504 Amortization of

intangible assets 8,012 479 9,481 1,308 Impairment of goodwill and

intangible assets � � � � � 15,465 � � � � � � � 15,465 � Operating

income (loss) 5,569 (11,616 ) 10,361 (4,850 ) Other income

(expense), net (275 ) 2,222 (1,788 ) 4,908 Interest expense �

(3,220 ) � � � � � � (3,367 ) � � � � Income (loss) before income

taxes 2,074 (9,394 ) 5,206 58 Provision for income taxes � (1,847 )

� � (1,060 ) � � (1,639 ) � � (2,073 ) Net income (loss) $ 227 � �

$ (10,454 ) � � 3,567 � � $ (2,015 ) � Basic (loss) income per

share $ 0.01 $ (0.25 ) $ 0.08 $ (0.05 ) Diluted income (loss) per

share $ 0.01 $ (0.25 ) $ 0.08 $ (0.05 ) � � � � WNS (HOLDINGS)

LIMITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in

thousands, except share and per share data) � September � � � �

March 31 � 2008 � � � 2008 (Unaudited) ASSETS Current assets: Cash

and cash equivalents $ 31, 328 $ 102,698 Bank deposits and

marketable securities � 8,074 Accounts receivable, net of allowance

of $2,107 and $1,741, respectively 86,418 47,302 Accounts

receivable � related parties 113 586 Funds held for clients 5,118

6,473 Employee receivables 1,963 1,179 Prepaid expenses 4,393 3,776

Prepaid income taxes 3,214 2,776 Deferred tax assets� current 538

618 Other current assets � � 17,550 � 8,596 Total current assets

150,635 182,078 Goodwill 96,596 87,470 Intangible assets, net

243,487 9,393 Property, plant and equipment, net 48,891 50,840

Deferred contract costs � non current 1,440 1,278 Foreign currency

derivative contracts � non current 779 � Deposits 7,646 7,391

Deferred tax assets � non current � 14,657 � 8,055 TOTAL ASSETS $

564,131 $ 346,505 � LIABILITIES AND SHAREHOLDERS� EQUITY Current

liabilities: Account payable $ 31,599 $ 15,562 Accounts payable �

related parties � 6 Long term debt � current 20,000 � Short term

line of credit 8,463 � Short term line of credit � related parties

6,336 � Accrued employee costs 24,108 26,848 Deferred revenue �

current 12,583 7,790 Income taxes payable 3,425 1,879 Deferred tax

liabilities � current 1,800 211 Accrual for earn-out payment �

33,699 Liability on outstanding derivative and interest swap

contracts �current 14,366 � Other current liabilities � 40,243 �

25,806 Total current liabilities 162,923 111,801 Long term debt �

non current 180,000 � Deferred revenue � non current 2,143 1,549

Deferred rent 3,662 2,627 Accrued pension liability 1,965 1,544

Deferred tax liabilities � non current 11,139 1,834 Liability on

outstanding derivative and interest swap contracts � non current �

3,214 � � � TOTAL LIABILITIES 365,046 119,355 Shareholders� equity:

Ordinary shares, $0.16 (10 pence) par value, authorized: 50,000,000

shares; Issued and outstanding: 42,569,239 and 42,363,100 shares,

respectively 6,662 6,622 Additional paid-in capital 176,155 167,459

Ordinary shares subscribed: Nil and 1,666 shares, respectively � 10

Retained earnings 42,472 38,839 Accumulated other comprehensive

income (loss) (26,204 ) 14,220 � Total shareholders� equity �

199,085 � 227,150 � TOTAL LIABILITIES AND SHAREHOLDERS� EQUITY $

564,131 $ 346,505

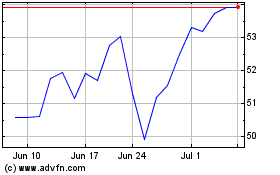

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024